EagleEye

BOJ Tightening, Yen Liquidity & Crypto Risk Allocation Is the Yen Carry Trade Unwind Back on the Table?

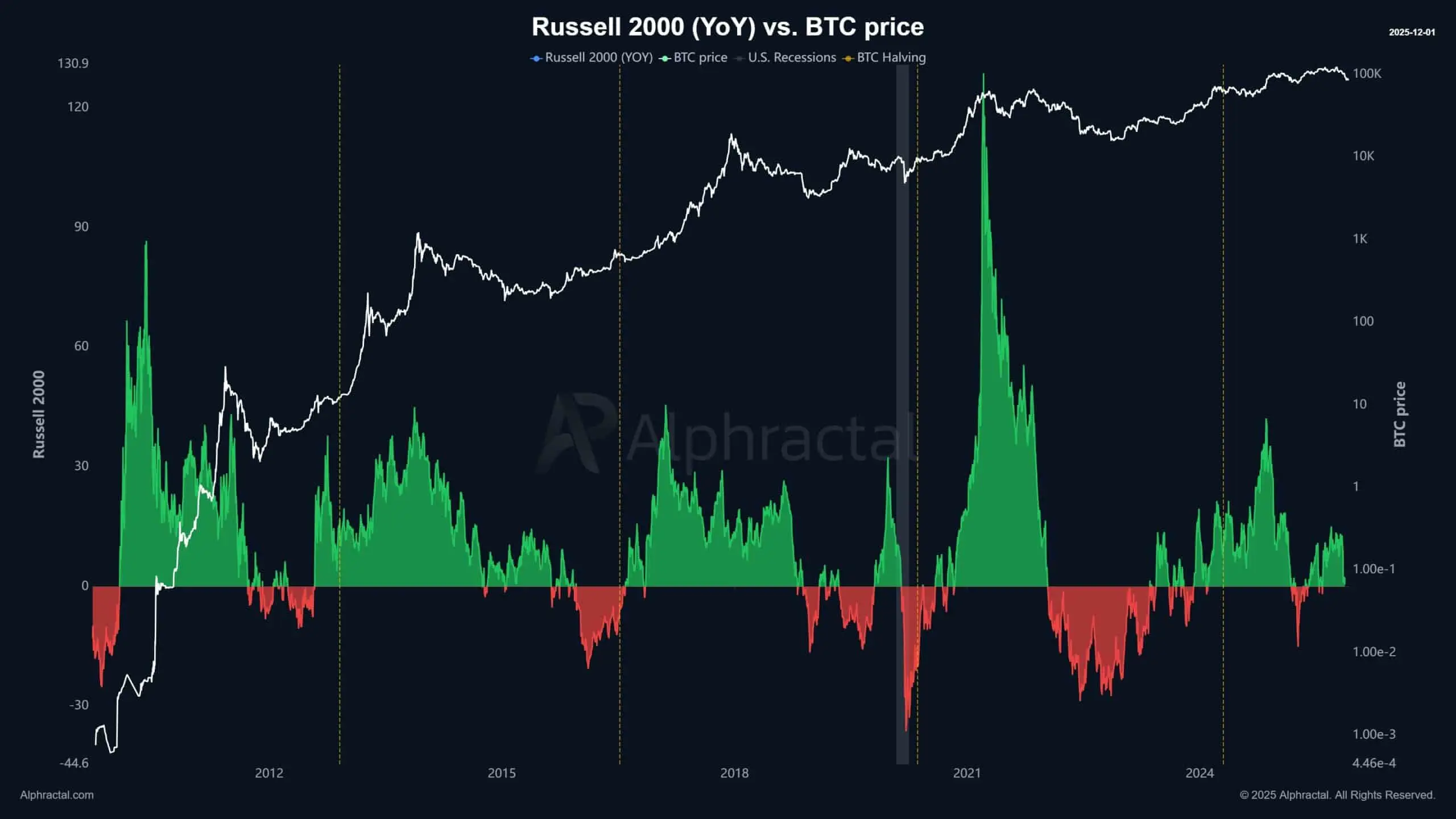

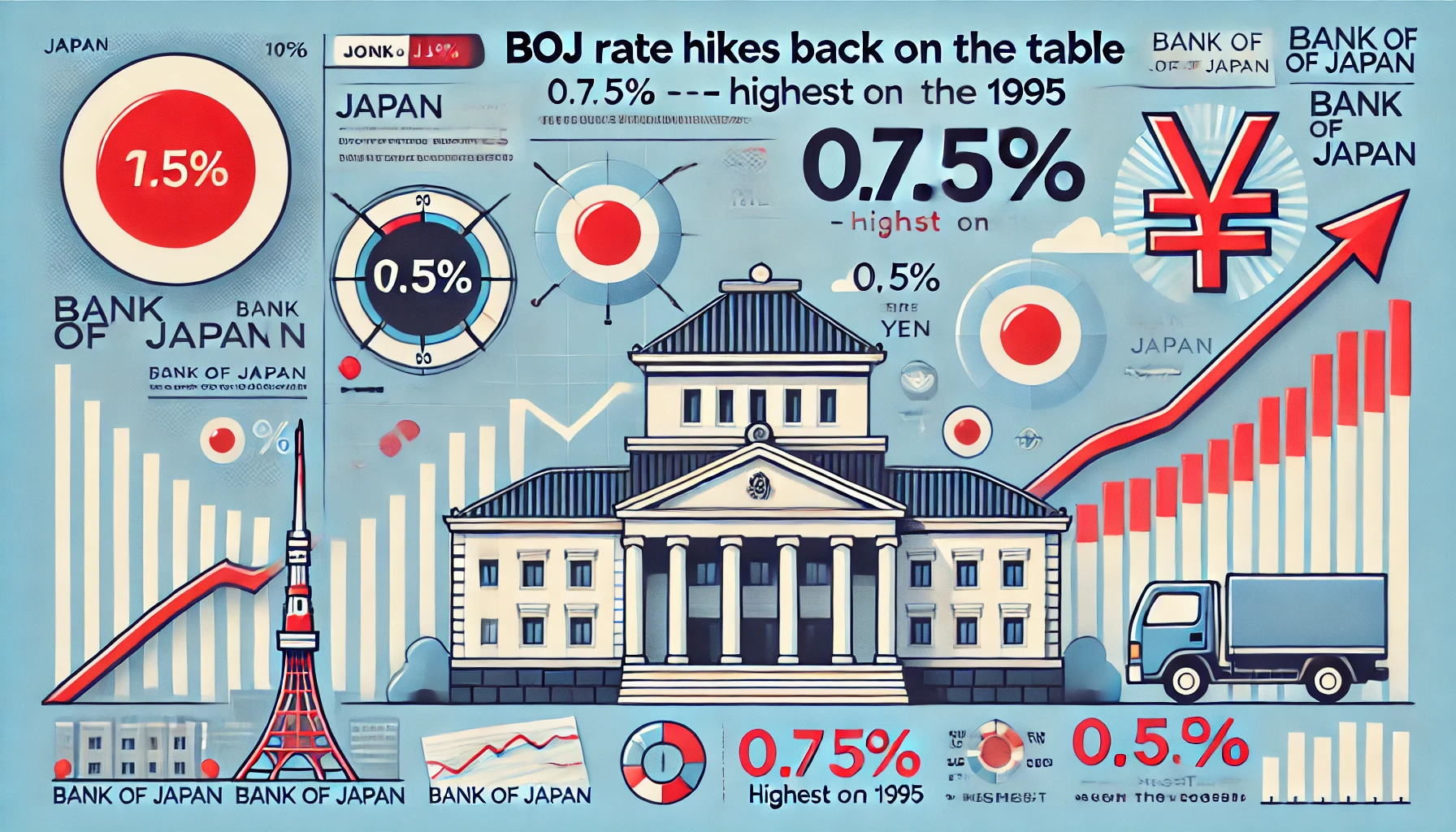

JPMorgan’s expectation that the Bank of Japan could hike rates twice in 2025, with policy rates potentially reaching ~1.25% by end-2026, may look modest in isolation. But in a global system built on decades of cheap yen funding, this shift carries outsized implications for cross-asset risk allocation including crypto.

This isn’t just about Japan. It’s about global liquidity plumbing.

Why the Yen Matters More Than Its GDP Share

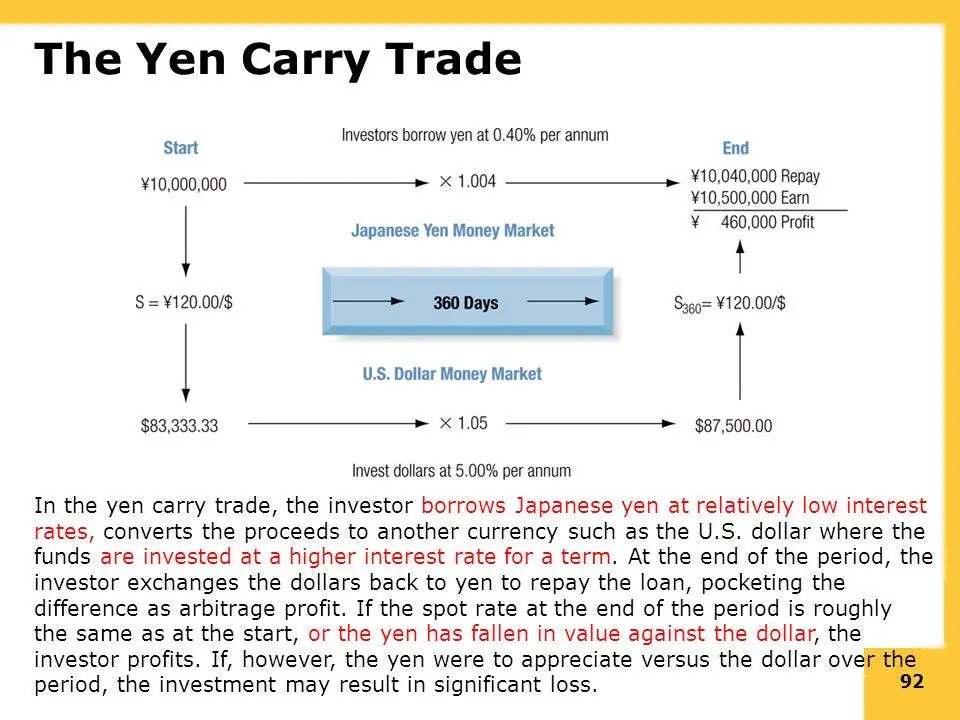

For years, the Japanese yen has functioned as one of the world’

JPMorgan’s expectation that the Bank of Japan could hike rates twice in 2025, with policy rates potentially reaching ~1.25% by end-2026, may look modest in isolation. But in a global system built on decades of cheap yen funding, this shift carries outsized implications for cross-asset risk allocation including crypto.

This isn’t just about Japan. It’s about global liquidity plumbing.

Why the Yen Matters More Than Its GDP Share

For years, the Japanese yen has functioned as one of the world’

BTC-2,92%