#FedRateCutComing

Navigating the Fed, Rate Cuts, and Market Implications in 2026

Introduction

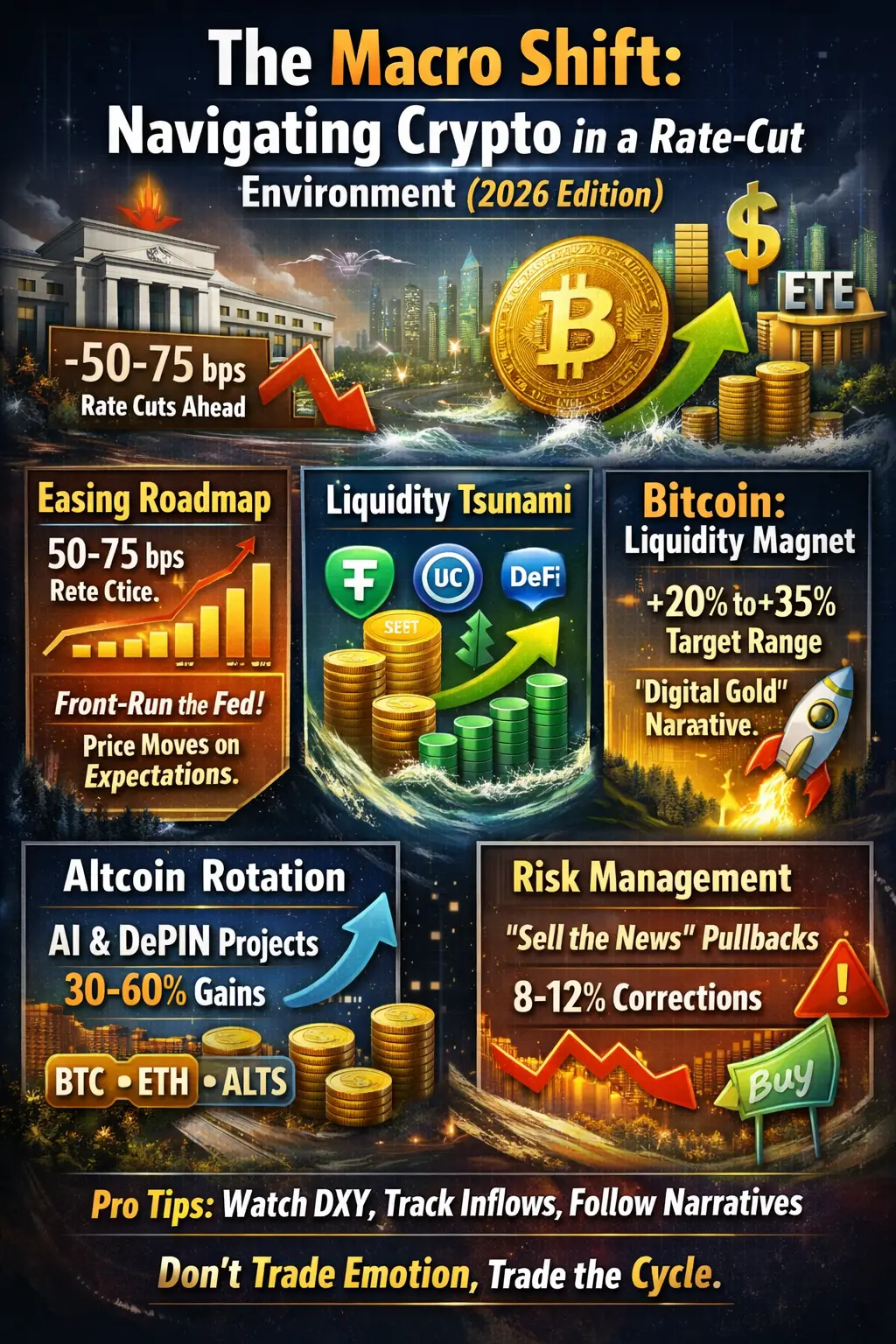

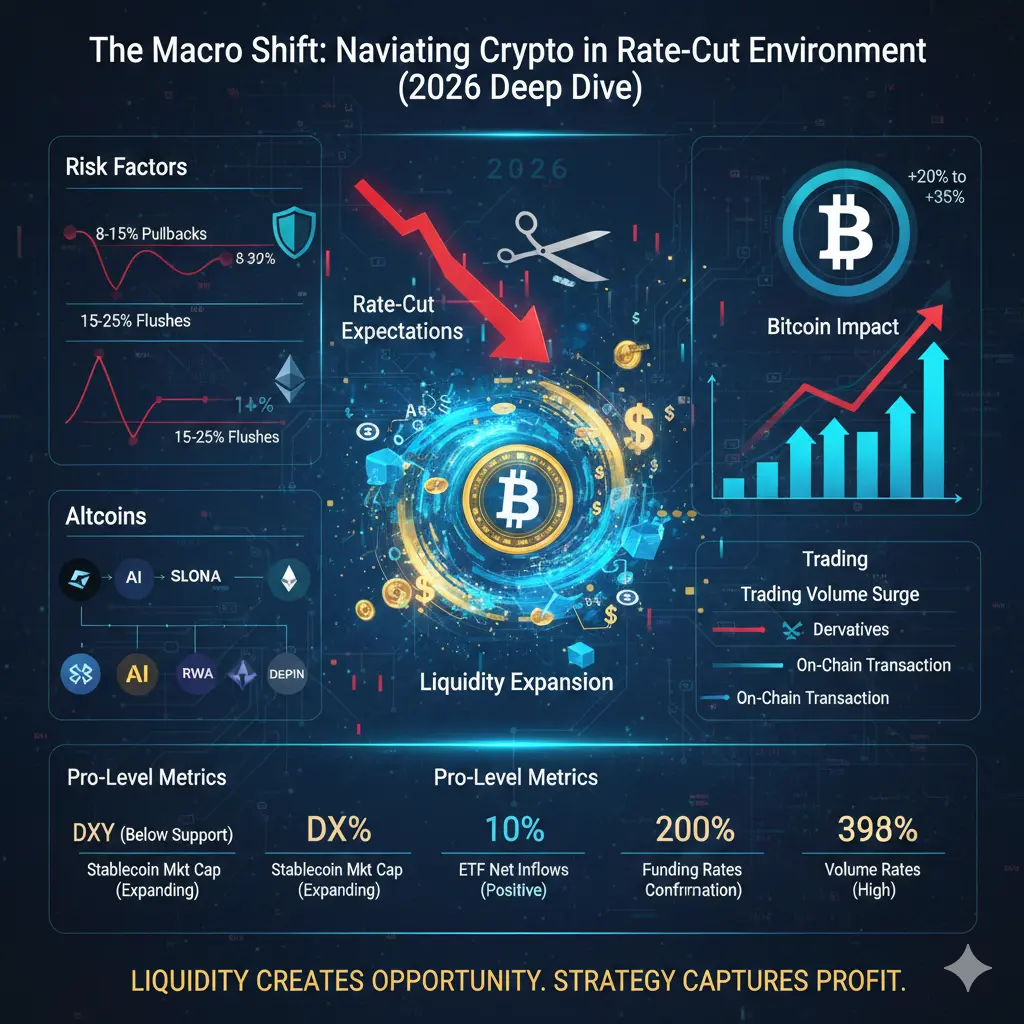

As we enter 2026, the Federal Reserve’s path has become a central focus for markets and investors. Jerome Powell’s term as Chair ends in May, and the upcoming selection of his successor is more than a political story — it is a critical macro event. With inflation above target in some sectors, growth slowing, and employment remaining resilient, the Fed faces a delicate balancing act. Its decisions on rate cuts, monetary policy, and communication will shape U.S. equities, bonds, and crypto markets for

Navigating the Fed, Rate Cuts, and Market Implications in 2026

Introduction

As we enter 2026, the Federal Reserve’s path has become a central focus for markets and investors. Jerome Powell’s term as Chair ends in May, and the upcoming selection of his successor is more than a political story — it is a critical macro event. With inflation above target in some sectors, growth slowing, and employment remaining resilient, the Fed faces a delicate balancing act. Its decisions on rate cuts, monetary policy, and communication will shape U.S. equities, bonds, and crypto markets for