Gate Plaza|3/9 Today’s Hot Topics: #国际油价突破100美元

🎁 Join the discussion and stand a chance to win 1 of 5 lucky draws for a $2,500 trading experience voucher!

Crude oil surged 25 overnight! WTI topped $114, and Brent broke through $110. Geopolitical tensions are tight, and the energy market is completely “crazy”! Did you catch this epic rally?

💬 This week’s hot topics:

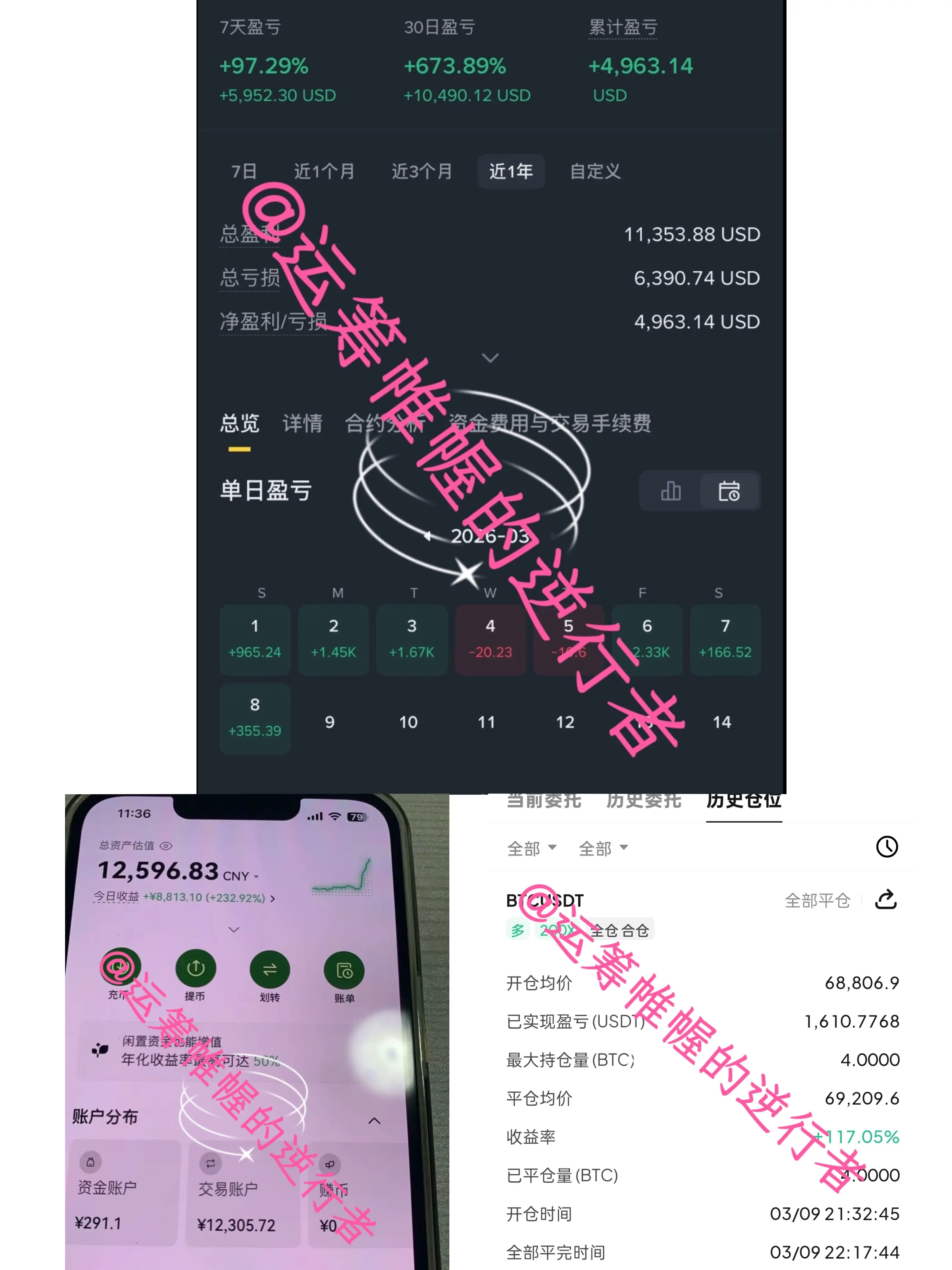

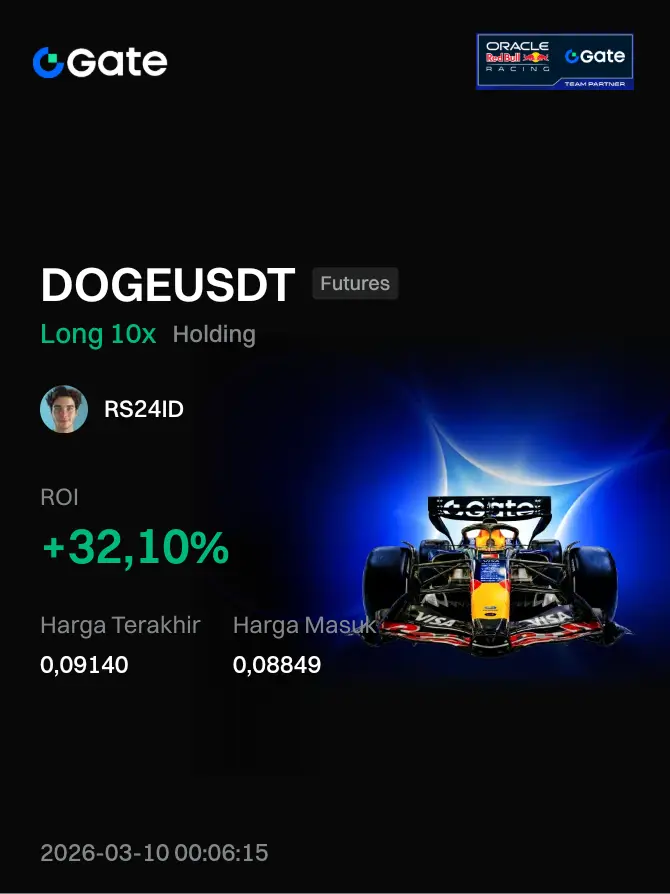

1️⃣ Show Your Gains: With this surge in crude oil, did you pre-position on Gate TradFi? Show off your results in the comments!

2️⃣ Discuss the Market: Where do you think the oil price ceiling is? Is now the time to “buy high” or “eat the dip”?

Share your views now and win great prizes 👉 https://www.gate.com/post

Gate TradFi, instantly seize crude oil opportunities 👉 https://www.gate.com/tradfi

📅 3/9 12:00 - 3/11 18:00 (UTC+8)

🎁 Join the discussion and stand a chance to win 1 of 5 lucky draws for a $2,500 trading experience voucher!

Crude oil surged 25 overnight! WTI topped $114, and Brent broke through $110. Geopolitical tensions are tight, and the energy market is completely “crazy”! Did you catch this epic rally?

💬 This week’s hot topics:

1️⃣ Show Your Gains: With this surge in crude oil, did you pre-position on Gate TradFi? Show off your results in the comments!

2️⃣ Discuss the Market: Where do you think the oil price ceiling is? Is now the time to “buy high” or “eat the dip”?

Share your views now and win great prizes 👉 https://www.gate.com/post

Gate TradFi, instantly seize crude oil opportunities 👉 https://www.gate.com/tradfi

📅 3/9 12:00 - 3/11 18:00 (UTC+8)