2025 Cryptocurrency Market Trend Review: From Optimism to Collapse, Bitcoin's Annual Return is Negative

35m ago

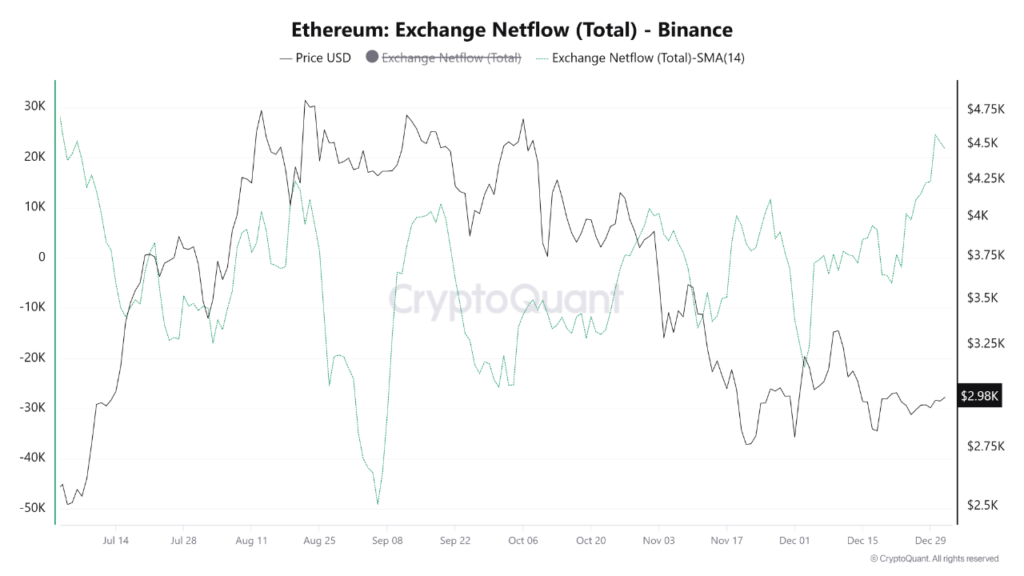

MICA Daily|Binance ETH inflow volume increases significantly, indicating potential selling pressure

2h ago

Trending Topics

View More17.93K Popularity

36.8K Popularity

48.83K Popularity

95.03K Popularity

3.54K Popularity

Hot Gate Fun

View More- MC:$3.55KHolders:10.00%

- MC:$3.56KHolders:10.00%

- MC:$3.61KHolders:20.00%

- MC:$3.85KHolders:21.29%

- MC:$3.54KHolders:10.00%

Pin

MICA Daily|Binance ETH inflow volume increases significantly, indicating potential selling pressure

According to CryptoQuant data, Binance’s Ethereum exchange net inflow (14-day moving average) continued to surge sharply after Christmas, reaching 245,000 ETH, which is more than the 140,000 ETH observed before Christmas. This marks the highest net inflow since early July. Positive net inflow indicates that the amount of ETH deposited into Binance exceeds the amount withdrawn. Such a surge suggests that investors are transferring large amounts of ETH from cold wallets to exchanges. From historical data, a significant increase in positive net inflow is usually positively correlated with rising selling pressure or high volatility. Currently, ETH’s price is consolidating just below $3,000, having recently pulled back from a high point. The $3,000 level has become a short-term resistance and an ideal price for fixed-amount selling. This influx of liquidity may imply two scenarios:

From historical data, a significant increase in positive net inflow is usually positively correlated with rising selling pressure or high volatility. Currently, ETH’s price is consolidating just below $3,000, having recently pulled back from a high point. The $3,000 level has become a short-term resistance and an ideal price for fixed-amount selling. This influx of liquidity may imply two scenarios: