Ethereum (ETH) News Today

Latest crypto news and price forecasts for ETH: Gate News brings together the latest updates, market analysis, and in-depth insights.

Vitalik Buterin Offloads Multiple Tokens, Ethereum Dominates Portfolio

Vitalik Buterin's recent small token sales highlight selective liquidity maneuvers, as 98% of his portfolio remains in Ethereum. His minor transactions reflect operational testing rather than market trends, emphasizing his focus on liquidity management.

CryptoFrontNews·1h ago

Ethereum Battles $3,000 Resistance Amid Weekend Choppiness

Ethereum is testing the $3,000 resistance level, with potential gains toward $3,120 if reclaimed. Failure to hold this level may lead to dips to $2,940–$2,750. Traders should proceed cautiously as the current sideways movement presents risks and opportunities.

ETH-0.54%

CryptoFrontNews·2h ago

What BitMine’s 4M ETH holdings mean for its stock valuation

Key takeaways

-------------

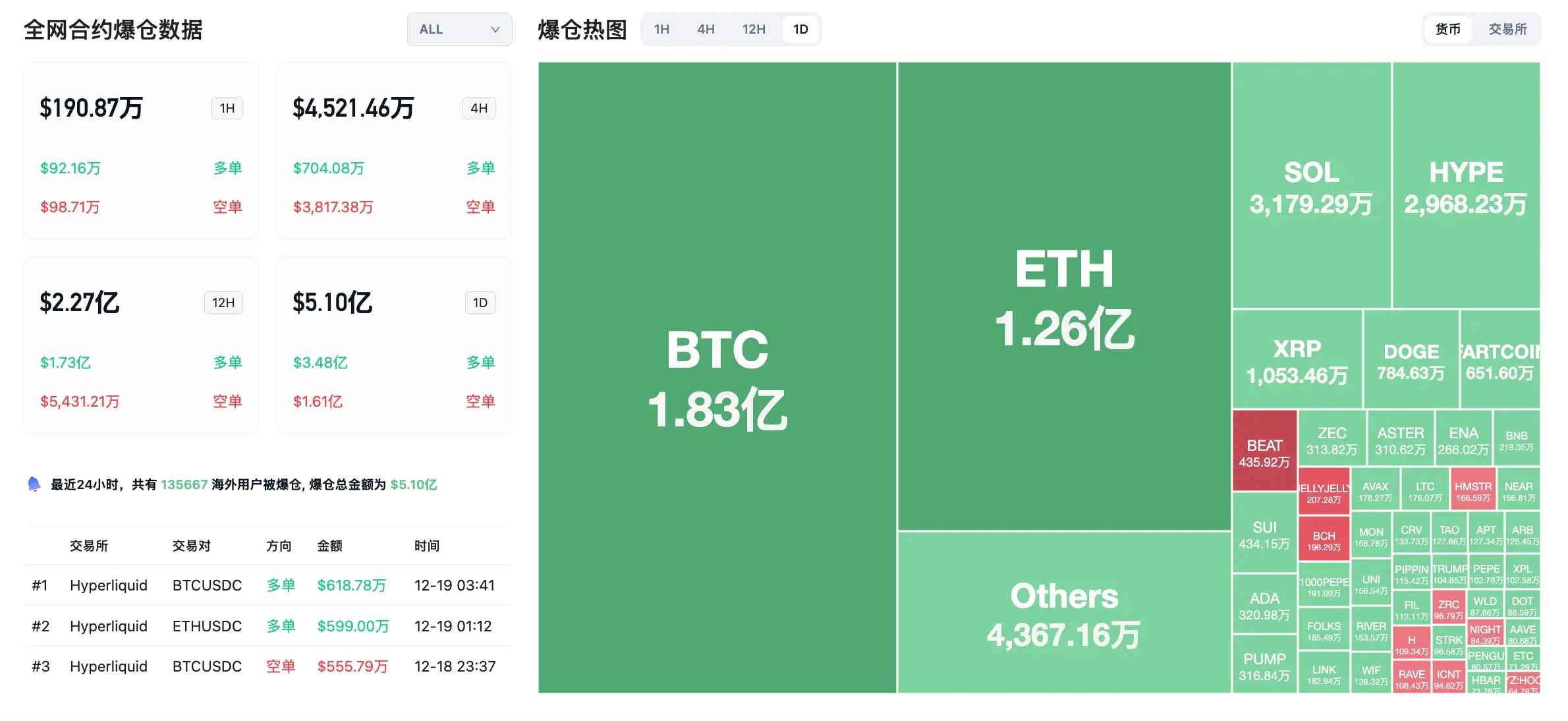

Large market participants are steadily reducing exposure, creating sustained selling pressure across Bitcoin, Ether and XRP.

Global macro tightening, including Bank of Japan rate-hike expectations and muted reactions to Fed cuts, is weighing on risk

Cointelegraph·6h ago

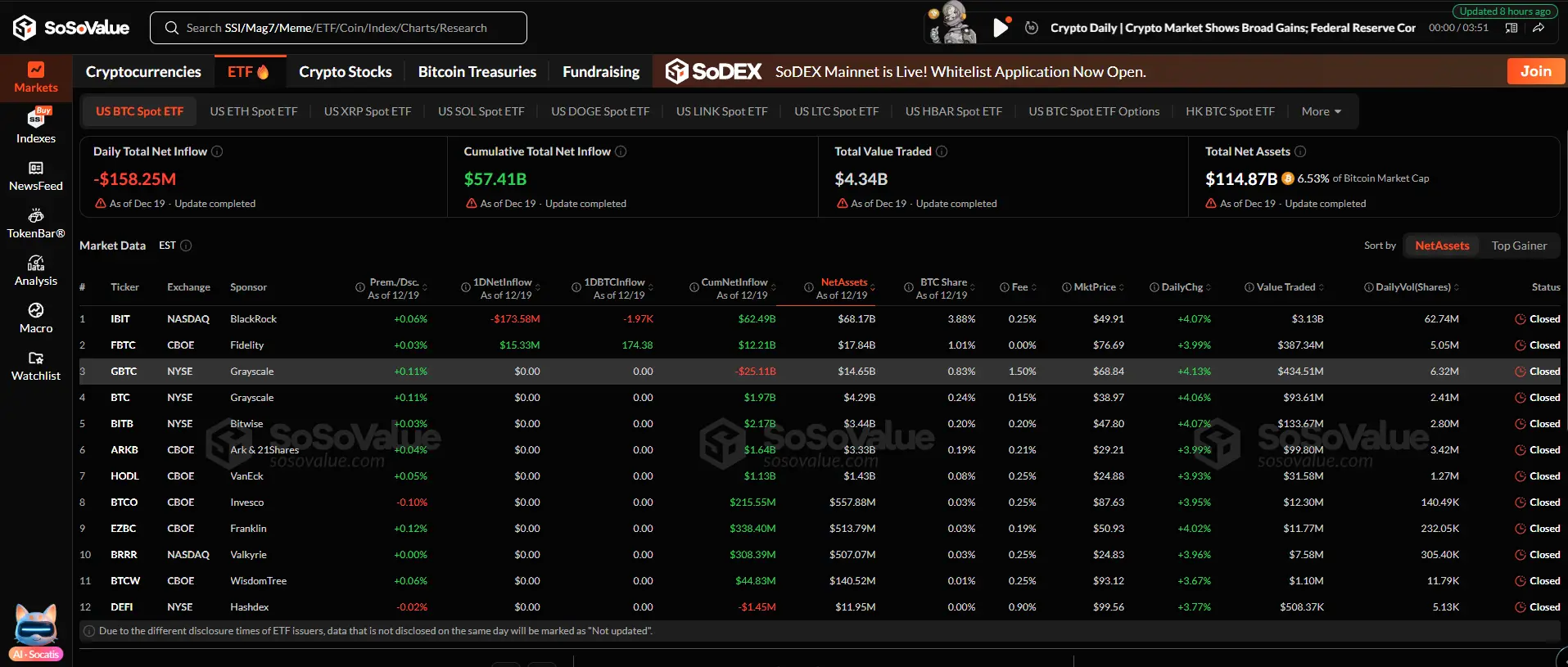

Ethereum ETFs extend 7-day outflow streak as ETH stalls below $3,000

Ethereum spot ETFs recorded $75.89 million in net outflows on December 19, extending the losing streak to seven consecutive trading days.

Summary

Ethereum ETFs posted $75.89M in outflows, extending the streak to seven days.

BlackRock's ETHA accounted for all redemptions while other ETH ETFs

Cryptonews·6h ago

Citi Forecasts Bitcoin Could Reach $143,000 and Ethereum $4,304 Within the Next 12 Months

Citi expects Bitcoin to rise to $143,000 and Ethereum to $4,304 in the next 12 months.

Clearer regulations and ETF inflows could support steady growth for Bitcoin and Ethereum.

Institutional activity and market trends may drive new all-time highs for major cryptocurrencies.

Citigroup

CryptoNewsLand·8h ago

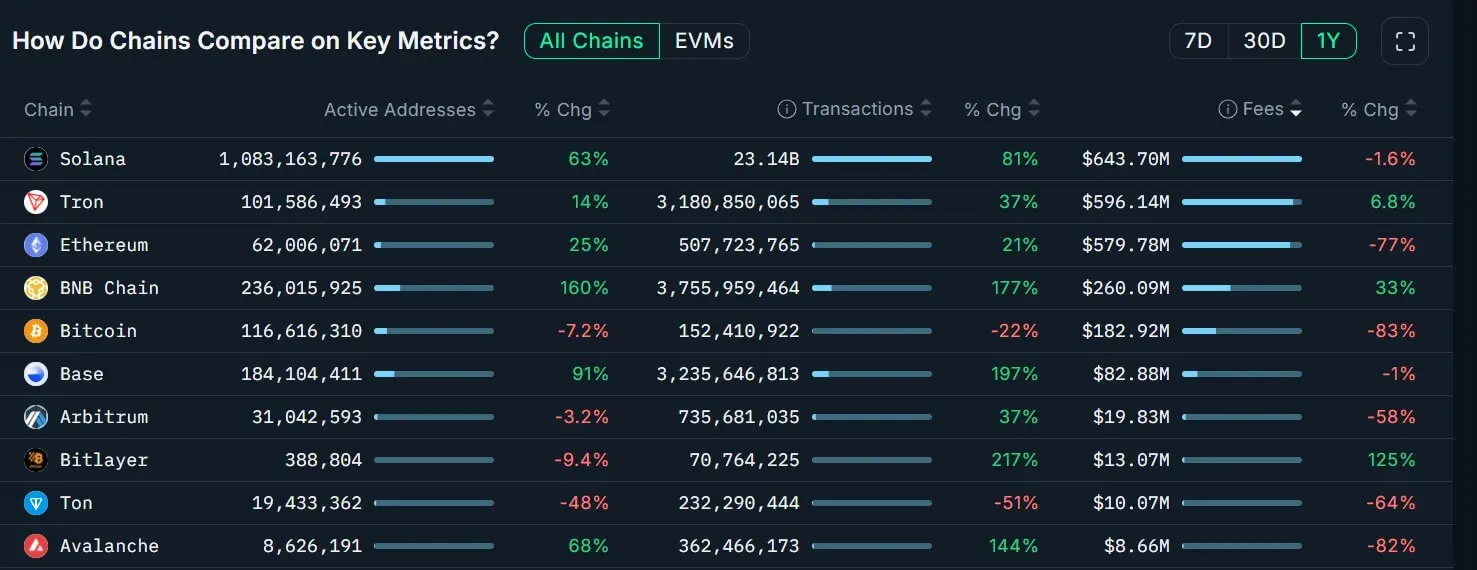

The Revenue Flippening Is Here: Solana (SOL) Set to Pass Ethereum (ETH)

A single chart can sometimes say more than a long debate. One recent image shared by CryptosRus put a spotlight on something that quietly built up over years. Solana revenue appears on track to surpass Ethereum annual revenue for the first time, and the numbers behind it are hard to ignore.

What s

CaptainAltcoin·10h ago

Ethereum outperforms Bitcoin even when the price remains below $3,000

Ethereum struggles to break the psychological resistance of $3,000 despite strong community support and a growing number of addresses. Positive on-chain data suggests potential for future recovery, but selling pressure remains a risk.

TapChiBitcoin·12h ago

Ethereum (ETH) To Make Rebound? This Key Pattern Formation Suggest So!

Date: Sun, Dec 14, 2025 | 12:30 PM GMT

The broader altcoin market has remained volatile over the past few weeks, with sharp intraday swings keeping traders cautious. Amid this uncertainty, Ethereum (ETH) is beginning to flash a technically s

ETH-0.54%

CoinsProbe·13h ago

Cryptocurrency ETFs are diverging: Bitcoin and Ethereum are losing capital, Solana and XRP are attracting funds

On December 19th, the spot cryptocurrency ETF market experienced mixed movements as capital continued to diverge significantly. The total net outflow from Bitcoin spot ETFs reached $158 million, indicating that profit-taking pressure remains present. Notably, only Fidelity's FBTC fund recorded a capital inflow of .

TapChiBitcoin·14h ago

Blue Fox Notes | Sweeping 3.86 million ETH relentlessly, where does Tom Lee's confidence come from?

From Tom Lee's multiple interviews, we can roughly see his long-term bullish outlook on Ethereum's core logic:

1. Ethereum is the future financial infrastructure's core settlement layer.

Ether not only serves as digital currency but also as the foundational infrastructure for building and operating DeFi, stablecoins, NFTs, on-chain markets, RWA, and more. Especially in the RWA sector, this will be the biggest narrative in the future. Wall Street is bringing trillions of assets (bonds/stocks, etc.) onto Ethereum. As the dominant settlement layer, this will generate substantial demand and drive up the value of Ether. Tokenization is not short-term speculation but a structural shift that will propel Ether into a bull market independent of Bitcoin.

2. Institutional adoption and ecosystem maturity.

Currently, approximately 4 million Bitcoin wallets worldwide hold assets exceeding $10,000, and similar amounts are held in stock/retirement accounts globally.

区块客·15h ago

NFT sales rise 12% to $67.7M, Ethereum sales spike 45%

According to CryptoSlam data, NFT sales volume has climbed by 12.03% to $67.76 million, up from last week's $64.95 million.

Summary

NFT sales rose 12% to $67.76M as buyers and sellers returned to the market.

Ethereum led NFT blockchains with $28.06M in sales, up over 45% week-on-week.

Cryptonews·15h ago

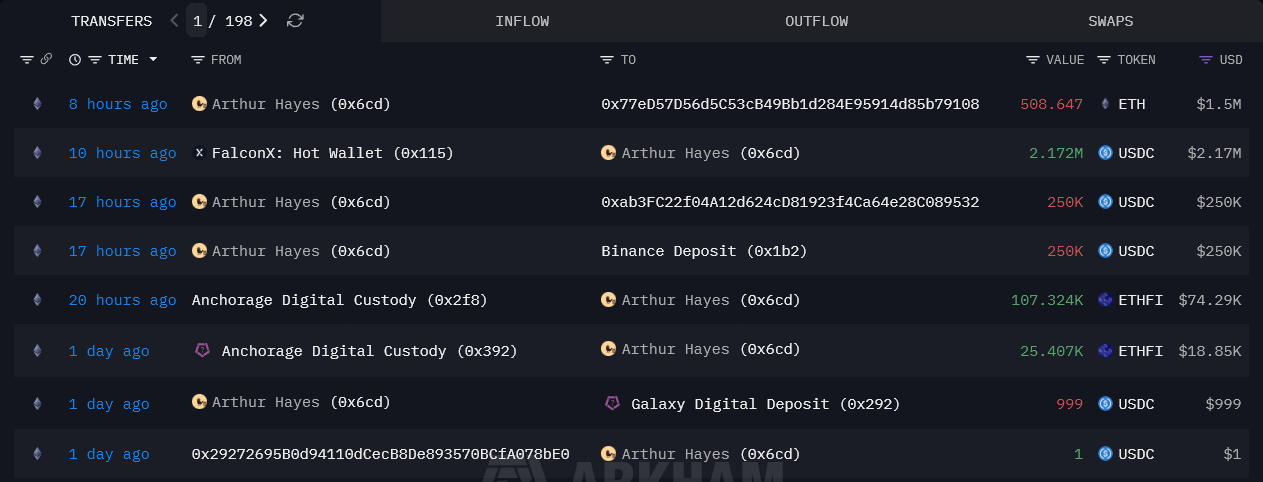

Did Arthur Hayes just sell 1.5 million dollars worth of Ethereum?

Arthur Hayes – one of the prominent figures in the cryptocurrency market – has just transferred 508,647 ETH, worth approximately $1.5 million, to Galaxy Digital. This move quickly drew the community's attention, sparking speculation that Hayes may be actively reducing his exposure to

ETH-0.54%

TapChiBitcoin·16h ago

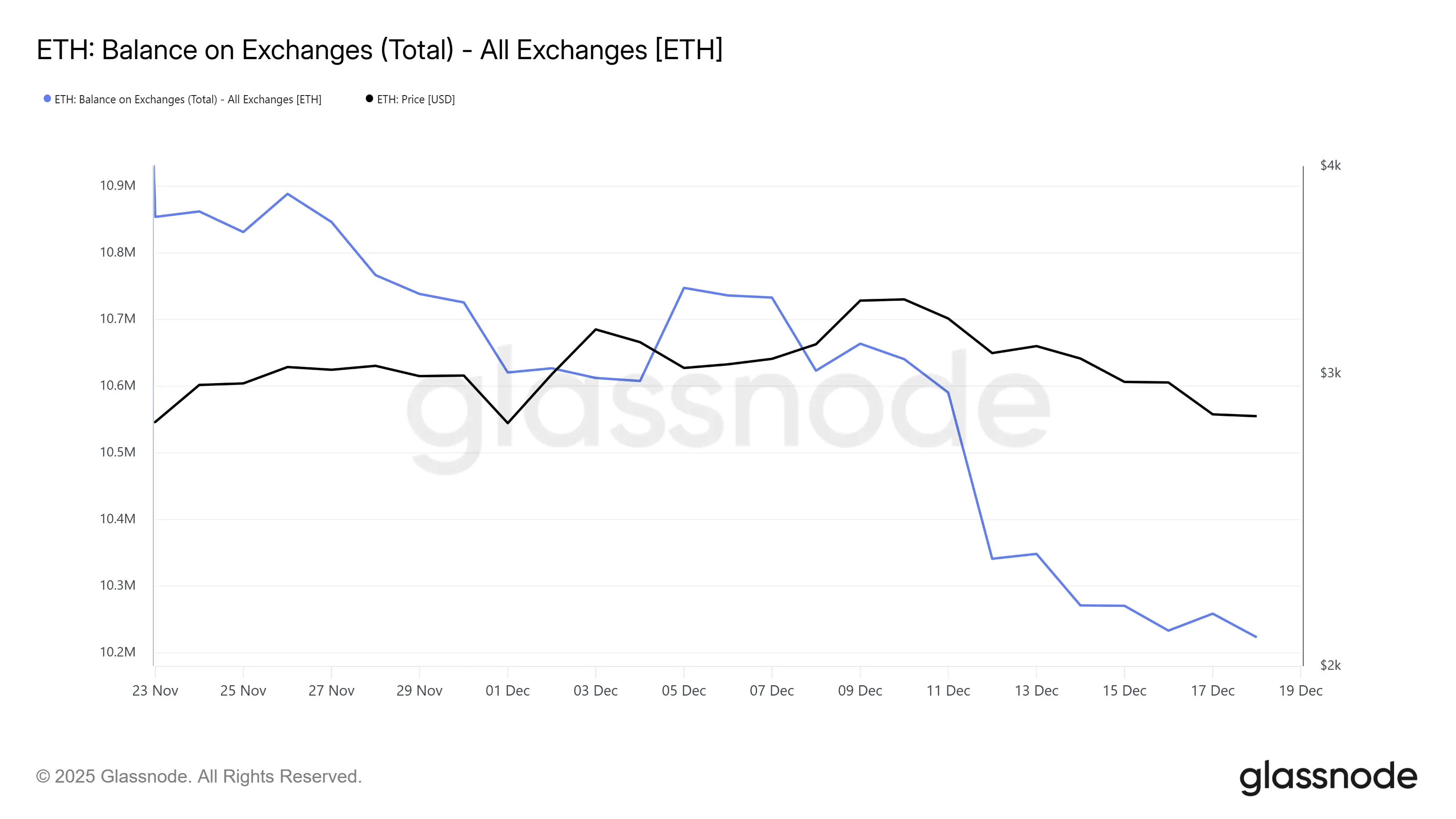

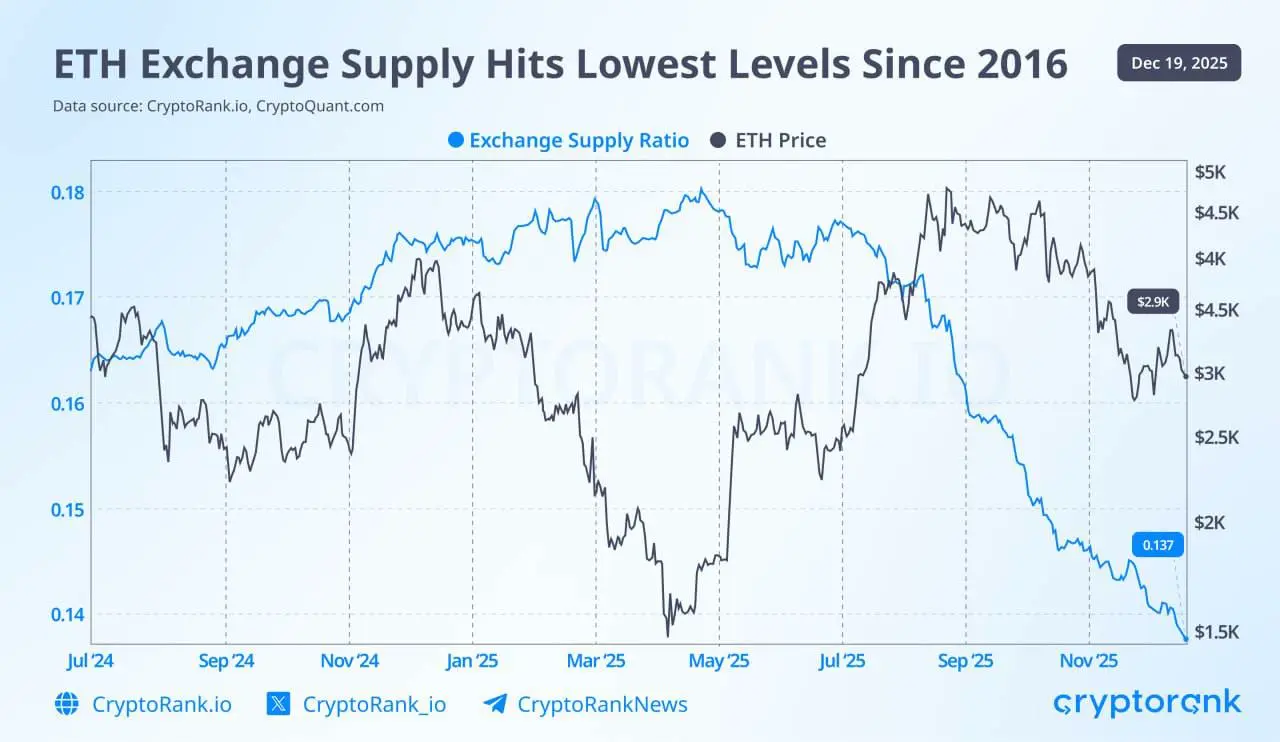

Ethereum balance on the (CEX) exchange drops to the lowest level since 2016

The amount of Ethereum held on centralized exchanges has dropped to its lowest since 2016, indicating a "bullish" trend. This decrease reduces short-term selling pressure, with more ETH being moved to long-term storage options, reflecting increased investor confidence in Ethereum's long-term prospects.

ETH-0.54%

TapChiBitcoin·18h ago

Ethereum must become simpler to achieve true trustlessness: Buterin

Vitalik Buterin emphasizes that the Ethereum blockchain must simplify its features to enhance user understanding and achieve true trustlessness. Current complexity leads to reliance on a small group of experts, contradicting the principle of trustlessness. Efforts are underway to make Ethereum more user-friendly, including educational programs and potential software upgrades.

Cointelegraph·12-19 18:55

ETH Network Adoption Soars Past Bitcoin as Leverage Washes Out

Ethereum has surpassed Bitcoin in network adoption, boasting 167 million wallets compared to Bitcoin's 57 million. High leverage ETH long positions are being liquidated amid market volatility, highlighting significant differences in user engagement and adoption rates between the two cryptocurrencies.

LiveBTCNews·12-19 17:50

Ethereum Slips Below Key Levels as Confidence Weakens Across Altcoins

Ethereum is currently in a downturn, trading between $2900 and $3300, despite a recent 29% growth over six months. Its potential for further gains exists if it surpasses resistance levels. Broader market skepticism affects investor confidence in altcoins.

CryptoDaily·12-19 17:42

Ethereum Eyes Major Upside Against Nasdaq Amid Bottoming Signal

ETH/Nasdaq ratio bottoms at 0.11, signaling potential rebound and mean reversion against tech stocks.

Macro factors like QE restart and cash stimulus may accelerate Ethereum’s outperformance vs Nasdaq.

SEC’s push for on-chain U.S. equities adds structural support, boosting ETH’s upside po

ETH-0.54%

CryptoFrontNews·12-19 16:11

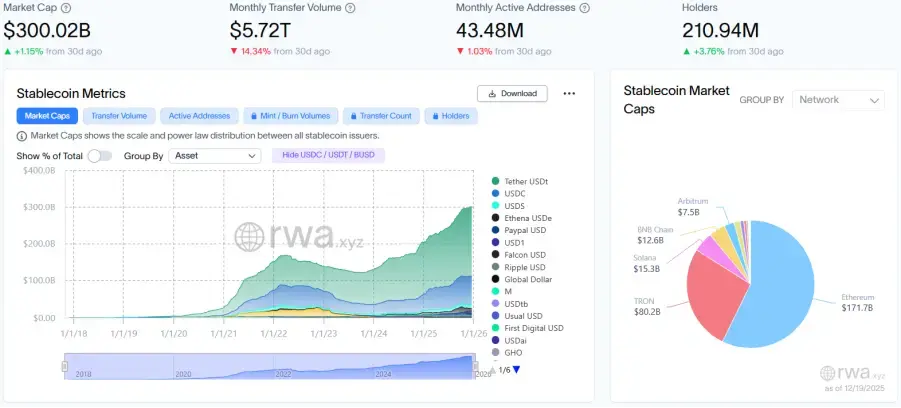

RWA Weekly: Coinbase announces the launch of prediction markets and tokenized stocks; Stablecoin U launches on BNB Chain and Ethereum

Highlights of this Issue

The weekly coverage period for this issue is from December 12, 2025, to December 19, 2025. This week, the total on-chain RWA market cap slightly increased to $18.9 billion, with the number of holders continuing to grow; stablecoin market cap surpassed $300 billion, but trading activity declined, indicating a market characterized by "stockpile sedimentation." The global regulatory framework is accelerating development, with China promoting digital RMB, and the US, Canada, and Hong Kong actively formulating rules for stablecoins and asset tokenization. Traditional financial institutions are further deepening their involvement: JPMorgan launched a tokenized fund on Ethereum and integrated JPM Coin into Base; Visa and Mastercard are expanding stablecoin payment and settlement services; DTCC is collaborating with Canton

PANews·12-19 13:04

Cardano repositions itself as a digital infrastructure, challenging the gap with Ethereum and Solana

Cardano is signaling a fundamental turning point, shifting from an academically focused research platform to a "operating system" model oriented towards commerce.

On December 17, the Intersect Product Committee released the Vision 2030 report, establishing a strict performance standard to redefine how the market

TapChiBitcoin·12-19 12:38

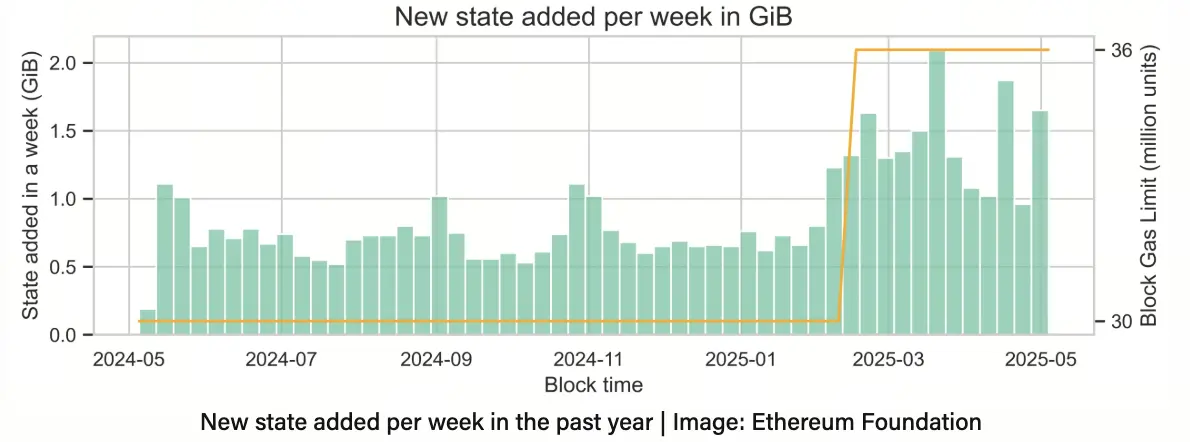

ETH Price Forecast: Ethereum Foundation proposes solutions ahead of the growing "state" pressure

The Stateless Consensus research team at the Ethereum Foundation (EF) states that the "state" (status) of the Ethereum network has grown significantly over the past year, following a series of upgrades aimed at improving scalability. In a blog post published on Tuesday, the Ethereum Foundation warns that the...

ETH-0.54%

TapChiBitcoin·12-19 12:06

Synthetix returns to Ethereum mainnet after 3 years: ‘We can run it back’

Perpetuals trading platform Synthetix is returning to Ethereum’s mainnet, with its founder arguing the network is now more than capable of supporting high-frequency financial applications after years of network congestion drove derivatives activity elsewhere.

“By the time perp DEXs became a

Cointelegraph·12-19 10:40

Ethereum (ETH) Testing Key Support – Will This Pattern Trigger a Rebound?

Date: Tue, Dec 16, 2025 | 02:00 PM GMT

The cryptocurrency market continues to face heavy selling pressure as the total crypto market capitalization slipped by 3.17% over the past 24 hours. This renewed wave of volatility dragged Ethereum

ETH-0.54%

CoinsProbe·12-19 10:37

Buterin Simplifies Ethereum Key to Achieve True Trustlessness

Ethereum Seeks to Simplify User Experience and Build Greater Trust

The Ethereum blockchain faces ongoing challenges in fostering true trustlessness, according to its co-founder Vitalik Buterin. While the network

ETH-0.54%

CryptoDaily·12-19 09:10

Devcon 8 in India: Racism Caused Ethereum to Make a Historic Announcement

_Devcon 8 is visiting Mumbai following the racist assault on the Indian developer in Argentina that created controversy on a worldwide platform. Ethereum Foundation declares Q4 2026 flagship occasion in India._

An Indian developer’s simple greeting on X became a flashpoint for global racism.

LiveBTCNews·12-19 09:01

Ethereum Eyes $10,000 by 2027 as Wyckoff Accumulation Phase Develops

_Ethereum mirrors Wyckoff accumulation as consolidation builds, signaling breakout momentum and a potential $10,000 target by 2027._

Ethereum is following the Wyckoff Accumulation Schematic, showing signs of a potential surge to $10,000 by 2027.

The price action indicates the cryptocurrency is

ETH-0.54%

LiveBTCNews·12-19 08:56

Ethereum (ETH) To Make Rebound? This Key Pattern Formation Suggest So!

Date: Sun, Dec 14, 2025 | 12:30 PM GMT

The broader altcoin market has remained volatile over the past few weeks, with sharp intraday swings keeping traders cautious. Amid this uncertainty, Ethereum (ETH) is beginning to flash a technically s

ETH-0.54%

CoinsProbe·12-19 08:44

Ethereum (ETH) Dips to Retest Key Breakout – Will It Bounce Back?

Date: Sat, Dec 13, 2025 | 05:58 PM GMT

The broader altcoin market has remained volatile over the past few weeks, with sharp swings keeping traders on edge. Amid this uncertainty, Ethereum ($ETH) is flashing a technically important signal.

ETH-0.54%

CoinsProbe·12-19 08:41

Blue Fox Notes | Sweeping 3.86 million ETH relentlessly, where does Tom Lee's confidence come from?

From Tom Lee's multiple interviews, we can roughly see his long-term bullish outlook on Ethereum's core logic:

1. Ethereum is the future financial infrastructure's core settlement layer.

Ether not only serves as digital currency but also as the foundational infrastructure for building and operating DeFi, stablecoins, NFTs, on-chain markets, RWA, and more. Especially in the RWA sector, this will be the biggest narrative in the future. Wall Street is bringing trillions of assets (bonds/stocks, etc.) onto Ethereum. As the dominant settlement layer, this will generate substantial demand and drive up the value of Ether. Tokenization is not short-term speculation but a structural shift that will propel Ether into a bull market independent of Bitcoin.

2. Institutional adoption and ecosystem maturity.

Currently, approximately 4 million Bitcoin wallets worldwide hold assets exceeding $10,000, and similar amounts are held in stock/retirement accounts globally.

区块客·12-19 07:16

Trading Moment: Japan's rate hike triggers, Bitcoin faces a critical test at $81,000, Ethereum's rebound is weak

Daily Market Highlights and Trend Analysis, produced by PANews.

1. Market Observation

Despite the US November CPI year-over-year unexpectedly dropping to 2.7%, with core CPI falling to 2.6%, hitting a new low since 2021, fueling market expectations of the Federal Reserve accelerating rate cuts, the reliability of this report has been widely questioned due to data collection disruptions caused by the government shutdown. The market wavers amid complex signals; on one hand, White House officials believe the Fed has "ample room to cut rates"; on the other hand, the Bank of Japan raised its benchmark interest rate to 0.75%, a 30-year high, continuing to tighten global liquidity. On the regulatory front, the CLARITY Act, aimed at clarifying rules for the crypto market, is expected to enter the Senate for review in January next year, bringing positive industry expectations. However, the financial markets are facing the largest-ever quarterly concentrated derivatives settlement, with approximately $7.1 trillion in risk exposure.

PANews·12-19 06:32

2026 Crypto King Competition: Bitcoin, Ethereum, XRP, who will win the next bull market?

On the eve of 2026, the crypto market has gradually entered a consolidation and maturity phase after reaching a new all-time high. Bitcoin, relying on the consensus of "digital gold," has repeatedly solidified its support around the $80,000 key level; Ethereum, benefiting from the Pectra upgrade and the landing of spot ETFs, has stabilized its ecosystem around $2,900; XRP, after making favorable progress in the US SEC lawsuit, is once again attracting institutional attention. This article will analyze the technical patterns, growth engines, and potential risks of the three core assets, and explore how the turning point in global liquidity and the formation of regulatory frameworks will shape the market landscape in 2026.

MarketWhisper·12-19 06:18

Bank of Japan Hikes Rates to a 30-Year High, but Bitcoin and Ethereum Stay Resilient

Date: Fri, Dec 19 2025 | 05:45 AM GMT

In a move that many had been anticipating for weeks, the Bank of Japan (BOJ) announced on December 19, 2025, that it was raising its key short-term interest rate by 25 basis points to 0.75%. This marks t

CoinsProbe·12-19 06:05

What Is $U Stablecoin by United Stables? New Unified Dollar on BNB Chain and Ethereum

United Stables officially launched its dollar-pegged stablecoin \$U on December 19, 2025, with dual-chain deployment on BNB Smart Chain (BSC) and Ethereum.

CryptopulseElite·12-19 05:58

"Major Chip Turnover" Nearing the End! K33 Analysis: Bitcoin is Expected to Return to Buyer Dominance by 2026

Long-term Bitcoin holders initiating and sustaining nearly two years of a selling wave seem to be finally coming to an end. According to a report released by research firm K33 Research, the structural selling pressure of Bitcoin is nearing exhaustion. As the market gradually stabilizes, it is optimistic that next year will see a shift back to buyer dominance.

Vetle Lunde, Head of Research at K33 Research, stated that starting from 2024, the number of long-term unspent transaction outputs (UTXOs), i.e., Bitcoin held for over two years without movement, continues to decline. During this period, approximately 1.6 million Bitcoins (worth about $138 billion at current prices) have re-entered circulation, indicating that the selling pressure from early holders is not a short-term phenomenon but a continuous release.

Vetle Lunde pointed out that such a large-scale change is certainly not merely due to wallet upgrades or technical adjustments, but a genuine shift.

ETH-0.54%

区块客·12-19 05:52

$3.16 billion in crypto options to be settled before Christmas. How will Bitcoin and Ethereum prices move?

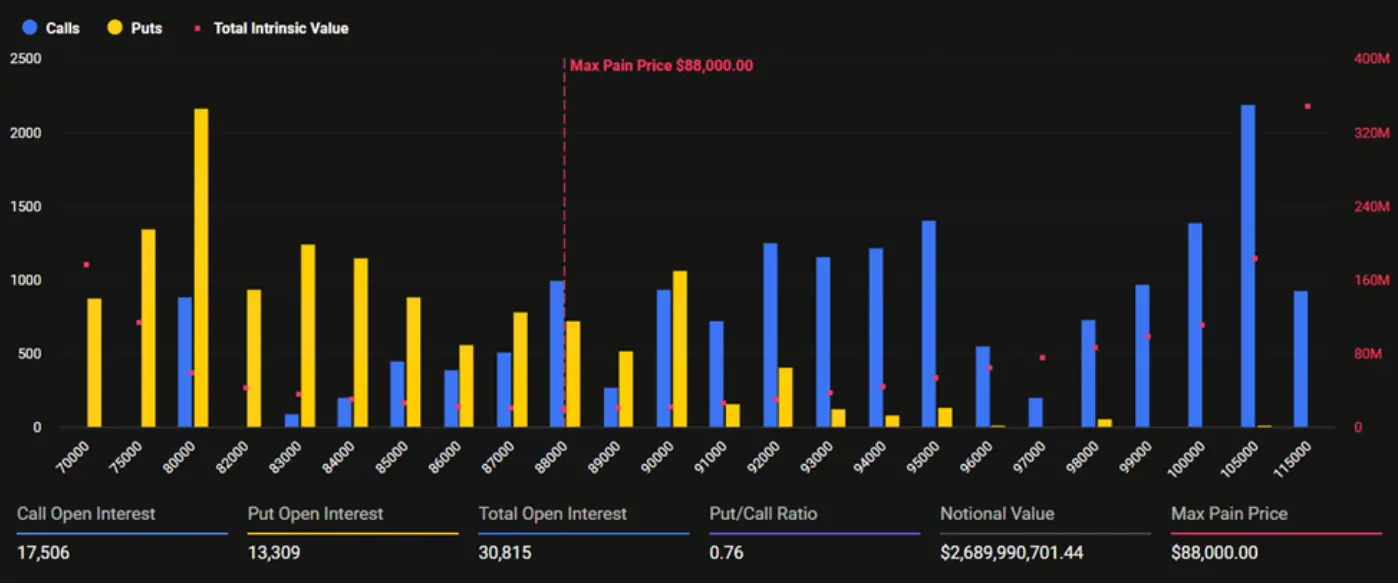

The cryptocurrency derivatives market is facing a critical year-end test. On December 19th at 08:00 UTC, approximately $3.16 billion worth of Bitcoin and Ethereum options will expire simultaneously on the Deribit exchange. This is the last major derivatives settlement before Christmas. Among them, Bitcoin options dominate with a notional value of up to $2.69 billion, with the current price close to the "maximum pain point" of $88,000; Ethereum options are valued at $473 million, with their "maximum pain point" at $3,100, which is significantly different from the current price. In the context of holiday liquidity being thin, this "annual report card" is testing the market's short-term balance and could serve as a trigger for pre-holiday volatility. Traders are holding their breath, waiting for the next clear market catalyst.

MarketWhisper·12-19 05:50

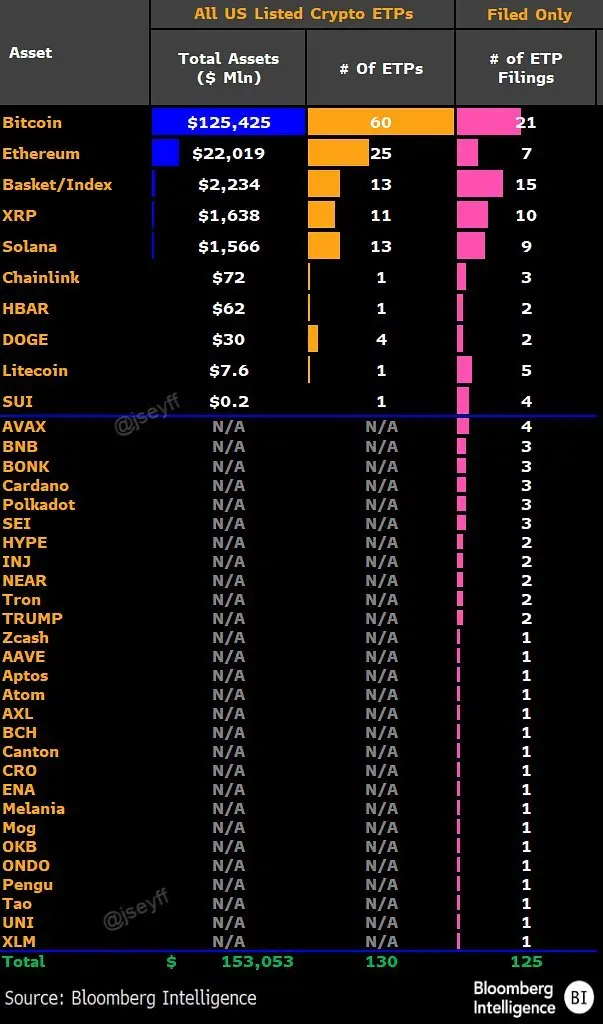

2026 Hundred-Index Crypto ETFs Coming! Bloomberg Warns: 2027 May See a Wave of Liquidations and Delistings

Bloomberg senior analyst warns that by 2026, over 100 Crypto ETF will be launched, but most may not survive past 2027 due to lack of funding. The market's "scattergun" strategy could trigger a new round of bubble burst.

MarketWhisper·12-19 05:38

What Is Ethereum's 'State Bloat' Problem? Foundation Researchers Propose Solutions to Ease Node Storage Burden

Ethereum Foundation researchers highlighted the growing challenge of "state bloat"—the exponential increase in data that full nodes must store and manage—as Ethereum's usage expands.

CryptopulseElite·12-19 05:36

Bankless 2026 Top 10 Predictions: Bitcoin volatility may be lower than Nvidia, Ethereum, and Solana await regulatory green light

Well-known crypto research platform Bankless recently released its top ten forward-looking predictions for the cryptocurrency space in 2026, outlining a future landscape characterized by institutionalization, regulatory breakthroughs, and market maturity. Key predictions include: Bitcoin is expected to break free from the traditional four-year cycle and reach new all-time highs, with its volatility potentially even lower than that of tech giant Nvidia; institutional demand for spot ETFs will absorb over 100% of new Bitcoin, Ethereum, and Solana issuance; and the passage of the key US crypto legislation, the Clarity Act, could serve as a decisive catalyst for the price surges of Ethereum and Solana. These predictions not only point to a leap in asset prices but also vividly depict the opportunities, challenges, and narrative shifts that will accompany the integration of cryptocurrencies into the global mainstream financial system.

MarketWhisper·12-19 05:13

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28