Will China open up to cryptocurrency in the future???

In the 1980s, a large number of young men and women convicted of "hooliganism" were executed. Looking back now, most of what was considered "hooliganism" at that time wouldn't even qualify as a minor offense today.

Times are progressing, society is developing, and most new things that are rejected at the current stage of development will be accepted and vigorously developed in the future.

The survival space of cryptocurrency comes from the need for secure and efficient transactions, as well as the development needs of the global dark web economy. It has an absolute space for survival and development, and it cannot be resisted by the power of a single country.

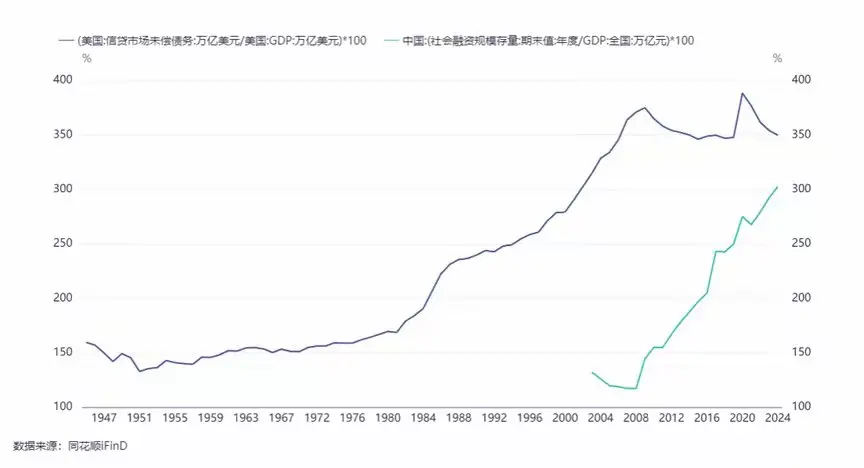

Currently, our resistance to cryptocurrency mainly stems from the fact that it increases capital outflow pressure. During an economic downturn, counter-cyclical credit expansion leads to rapid asset inflation. Under capital controls, domestic asset prices are much higher than overseas, creating a pressure differential for capital outflow that requires a long period to resolve. During this process, rapid development of cryptocurrency is equivalent to poking a hole directly in the domestic asset bubble, accelerating the collapse of the asset bubble, and affecting financial security, which is why it is strictly prohibited.

After the domestic asset bubble is fully deflated and the levels of domestic and overseas assets are balanced, there will no longer be capital outflow pressure. At that point, the internationalization of the RMB can be formally advanced, and in line with global trends, the ban on cryptocurrency may be lifted.

Currently, China may have reached a key inflection point in 2021, hitting the limit of debt-driven economic growth and entering what Richard Koo calls a "balance sheet recession." In this cycle, continued debt-driven growth will only have a negative impact on the economy. If debt-driven growth ceases, debt defaults will increase and asset values will continue to fall, a process that will persist until both the debt and asset bubbles are fully deflated.

This cycle is quite lengthy. After Japan's 1991 crash, it took households and businesses until around 2006 to repair their balance sheets. China’s repair cycle is compounded by the global economic downturn, accelerating population decline, and supply chain shifts caused by the trade war. This makes the repair process even longer. Therefore, for a long time to come, cryptocurrency will continue to be severely suppressed.