GateUser-373e0984

No content yet

GateUser-373e0984

Just read the Federal Reserve meeting minutes. The impression from this meeting is that the Fed is not debating whether to cut interest rates, but rather whether to do it now or wait a bit longer.

Most officials agree on the direction, but lack enough confidence that inflation has truly safely retreated, so the December rate cut is more about risk management than a clear judgment of economic weakening.

Those supporting a pause worry about inflation stickiness and the risk of policy signals being misinterpreted, while those supporting a rate cut are more concerned about a sudden deterioration i

View OriginalMost officials agree on the direction, but lack enough confidence that inflation has truly safely retreated, so the December rate cut is more about risk management than a clear judgment of economic weakening.

Those supporting a pause worry about inflation stickiness and the risk of policy signals being misinterpreted, while those supporting a rate cut are more concerned about a sudden deterioration i

- Reward

- like

- Comment

- Repost

- Share

5% Wealth Tax Could Become the Tipping Point for California's Innovation Outflow

California's plan to introduce a billionaire tax law in 2026 may seem like a tax increase, but it actually raises a bigger question: when wealth continues to concentrate among a few, should the government use more aggressive means to redistribute resources?

Under the proposal, individuals with a net worth exceeding $1 billion will be taxed 5% on their wealth to fund healthcare and state aid. However, what truly provoked strong backlash from the crypto industry is not the tax rate itself, but the method of taxation

View OriginalCalifornia's plan to introduce a billionaire tax law in 2026 may seem like a tax increase, but it actually raises a bigger question: when wealth continues to concentrate among a few, should the government use more aggressive means to redistribute resources?

Under the proposal, individuals with a net worth exceeding $1 billion will be taxed 5% on their wealth to fund healthcare and state aid. However, what truly provoked strong backlash from the crypto industry is not the tax rate itself, but the method of taxation

- Reward

- like

- Comment

- Repost

- Share

From Outside the System to Inside the System: Russia's True Attitude Toward Cryptocurrency

The Moscow Exchange (MOEX) and the Saint Petersburg Exchange (SPB) have both expressed support for the central bank's cryptocurrency regulatory plan, and explicitly stated that trading can directly commence once the relevant regulations come into effect in 2026.

This is not a test or a slogan, but a very typical case of institutional readiness being in place, with only legal confirmation remaining. Both exchanges have confirmed that their technical infrastructure is already in place, indicating that this

View OriginalThe Moscow Exchange (MOEX) and the Saint Petersburg Exchange (SPB) have both expressed support for the central bank's cryptocurrency regulatory plan, and explicitly stated that trading can directly commence once the relevant regulations come into effect in 2026.

This is not a test or a slogan, but a very typical case of institutional readiness being in place, with only legal confirmation remaining. Both exchanges have confirmed that their technical infrastructure is already in place, indicating that this

- Reward

- like

- Comment

- Repost

- Share

In recent years, Crypto Assets have been widely used but seldom discussed in Africa. The real demand has long existed, but regulatory oversight has been lacking, causing the industry to remain in a gray area. Ghana's choice this time is essentially an acknowledgment of reality.

The Ghanaian Parliament has officially passed the "Virtual Asset Service Provider Bill", marking a key turning point where Crypto Assets are no longer considered an unregulated underground activity, but are explicitly incorporated into the country's financial system as a legitimate business.

Whether individuals

View OriginalThe Ghanaian Parliament has officially passed the "Virtual Asset Service Provider Bill", marking a key turning point where Crypto Assets are no longer considered an unregulated underground activity, but are explicitly incorporated into the country's financial system as a legitimate business.

Whether individuals

- Reward

- like

- Comment

- Repost

- Share

Today I saw that the German payment provider DECTA mentioned that with the full implementation of the European "Markets in Crypto-Assets Regulation" (MiCA) in 2026, the euro-pegged stablecoin market may face a critical turning point.

I can't help but feel that euro stablecoins have been really stifled in recent years. It's not that they can't be developed; it's that there's nowhere to use them. Banks are hesitant to adopt, payment institutions dare not touch them, and project teams spend every day drawing cross-border payment plans in PPTs, while in reality, even exchanging euros isn't smooth.

View OriginalI can't help but feel that euro stablecoins have been really stifled in recent years. It's not that they can't be developed; it's that there's nowhere to use them. Banks are hesitant to adopt, payment institutions dare not touch them, and project teams spend every day drawing cross-border payment plans in PPTs, while in reality, even exchanging euros isn't smooth.

- Reward

- 1

- Comment

- Repost

- Share

The U.S. Congress is urging the SEC to include cryptocurrencies like Bitcoin in 401(k) retirement plans.

It's important to note that 401(k) is America's most conservative and mainstream retirement tool, where people save a little, and companies contribute a bit, expecting more pension benefits in the future. Now, some are suggesting that retirement funds could also allocate some assets to Bitcoin and other digital assets.

The legislators pushing this matter have written a letter to SEC Chairman Paul Atkins, emphasizing that current securities regulations are outdated and overly restrictive, wh

It's important to note that 401(k) is America's most conservative and mainstream retirement tool, where people save a little, and companies contribute a bit, expecting more pension benefits in the future. Now, some are suggesting that retirement funds could also allocate some assets to Bitcoin and other digital assets.

The legislators pushing this matter have written a letter to SEC Chairman Paul Atkins, emphasizing that current securities regulations are outdated and overly restrictive, wh

BTC1,61%

- Reward

- 1

- Comment

- Repost

- Share

Breaking: The Trump Gold Card has officially gone on sale, and the U.S. government will begin accepting applications from December 10. Personal applicants need to invest $1 million, businesses $2 million, plus a $15,000 processing fee, and there is also an announcement of a $5 million Platinum Card.

There are several noteworthy points about this so-called Trump Gold Card and Platinum Card plan:

1. Regardless of the name, the core logic is quite simple: exchange higher amounts for faster, more direct U.S. residency. The amounts are higher than traditional EB-5 investments and offer quicker proc

View OriginalThere are several noteworthy points about this so-called Trump Gold Card and Platinum Card plan:

1. Regardless of the name, the core logic is quite simple: exchange higher amounts for faster, more direct U.S. residency. The amounts are higher than traditional EB-5 investments and offer quicker proc

- Reward

- like

- Comment

- Repost

- Share

UK FCA Moves to Overhaul Investment Environment

The UK Financial Conduct Authority (FCA) has released a set of new discussion and consultation papers, claiming to enhance investment culture, but in reality, it's restructuring the UK's crypto investment system.

The FCA is one of the highest-level financial regulatory bodies in the UK, directly overseeing financial markets, investment products, and the conduct of licensed institutions. It sits at the top of the regulatory framework in the UK's financial system, with all enterprises involved in financial services falling under its watch.

Regulato

View OriginalThe UK Financial Conduct Authority (FCA) has released a set of new discussion and consultation papers, claiming to enhance investment culture, but in reality, it's restructuring the UK's crypto investment system.

The FCA is one of the highest-level financial regulatory bodies in the UK, directly overseeing financial markets, investment products, and the conduct of licensed institutions. It sits at the top of the regulatory framework in the UK's financial system, with all enterprises involved in financial services falling under its watch.

Regulato

- Reward

- 12

- 1

- Repost

- Share

CyberpunkDanny :

:

stability is what we needItaly Launches Comprehensive Crypto Risk Review: A New Era of Global Regulatory Alignment

Italy’s Ministry of Economy and Finance has taken the initiative to conduct a systematic assessment of the risks faced by domestic retail investors in the crypto sector.

Leading the effort is the Macroprudential Policy Committee, comprised of the central bank governor, insurance and pension regulators, and senior officials from the finance ministry—essentially, a full national risk radar.

Their conclusion is straightforward: as the interconnection between crypto assets and traditional finance deepens, and

View OriginalItaly’s Ministry of Economy and Finance has taken the initiative to conduct a systematic assessment of the risks faced by domestic retail investors in the crypto sector.

Leading the effort is the Macroprudential Policy Committee, comprised of the central bank governor, insurance and pension regulators, and senior officials from the finance ministry—essentially, a full national risk radar.

Their conclusion is straightforward: as the interconnection between crypto assets and traditional finance deepens, and

- Reward

- like

- Comment

- Repost

- Share

Is anyone interested in claiming this unowned asset together 😂

View Original- Reward

- like

- Comment

- Repost

- Share

Malaysia’s crackdown on illegal mining has escalated—crypto miners stealing electricity have even resorted to using bird sounds to mask their operations.

Recently, Malaysia has ramped up enforcement against illegal Bitcoin mining, shifting from routine law enforcement to a full-scale crackdown.

The reason is simple: according to official data, electricity theft for mining has caused nearly $1 billion in losses over the past few years. Power authorities, grid companies, and energy regulators have all been forced to act together.

This time, the operation is clearly not the old approach of just k

Recently, Malaysia has ramped up enforcement against illegal Bitcoin mining, shifting from routine law enforcement to a full-scale crackdown.

The reason is simple: according to official data, electricity theft for mining has caused nearly $1 billion in losses over the past few years. Power authorities, grid companies, and energy regulators have all been forced to act together.

This time, the operation is clearly not the old approach of just k

BTC1,61%

- Reward

- like

- Comment

- Repost

- Share

Key Data Missing, ADP to Set the Tone for Tonight's Market Sentiment

The US November ADP Non-Farm Employment Change will be released tonight at 21:15, and this data carries much more weight than usual.

Next week is the Fed’s FOMC meeting, but both the official non-farm payroll and inflation data are missing this time, essentially turning off the two most important guiding lights for the market.

In this information vacuum, the ADP report has almost become the Fed’s only window into the labor market's temperature, so the market can only focus closely on this single indicator to speculate about n

View OriginalThe US November ADP Non-Farm Employment Change will be released tonight at 21:15, and this data carries much more weight than usual.

Next week is the Fed’s FOMC meeting, but both the official non-farm payroll and inflation data are missing this time, essentially turning off the two most important guiding lights for the market.

In this information vacuum, the ADP report has almost become the Fed’s only window into the labor market's temperature, so the market can only focus closely on this single indicator to speculate about n

- Reward

- like

- Comment

- Repost

- Share

The FDIC in the United States will launch a regulatory proposal for stablecoins, marking the entry of the crypto market into a formal era.

The U.S. regulators have really started to take action this time. FDIC Acting Chairman Travis Hill explicitly stated in his congressional testimony that the first batch of regulatory proposals for stablecoin issuers will be launched in December, which is a key step for the implementation of the GENIUS Act.

In the future, if you want to issue stablecoins, you must go through the formal federal approval process, rather than randomly opening a company and clai

View OriginalThe U.S. regulators have really started to take action this time. FDIC Acting Chairman Travis Hill explicitly stated in his congressional testimony that the first batch of regulatory proposals for stablecoin issuers will be launched in December, which is a key step for the implementation of the GENIUS Act.

In the future, if you want to issue stablecoins, you must go through the formal federal approval process, rather than randomly opening a company and clai

- Reward

- like

- Comment

- Repost

- Share

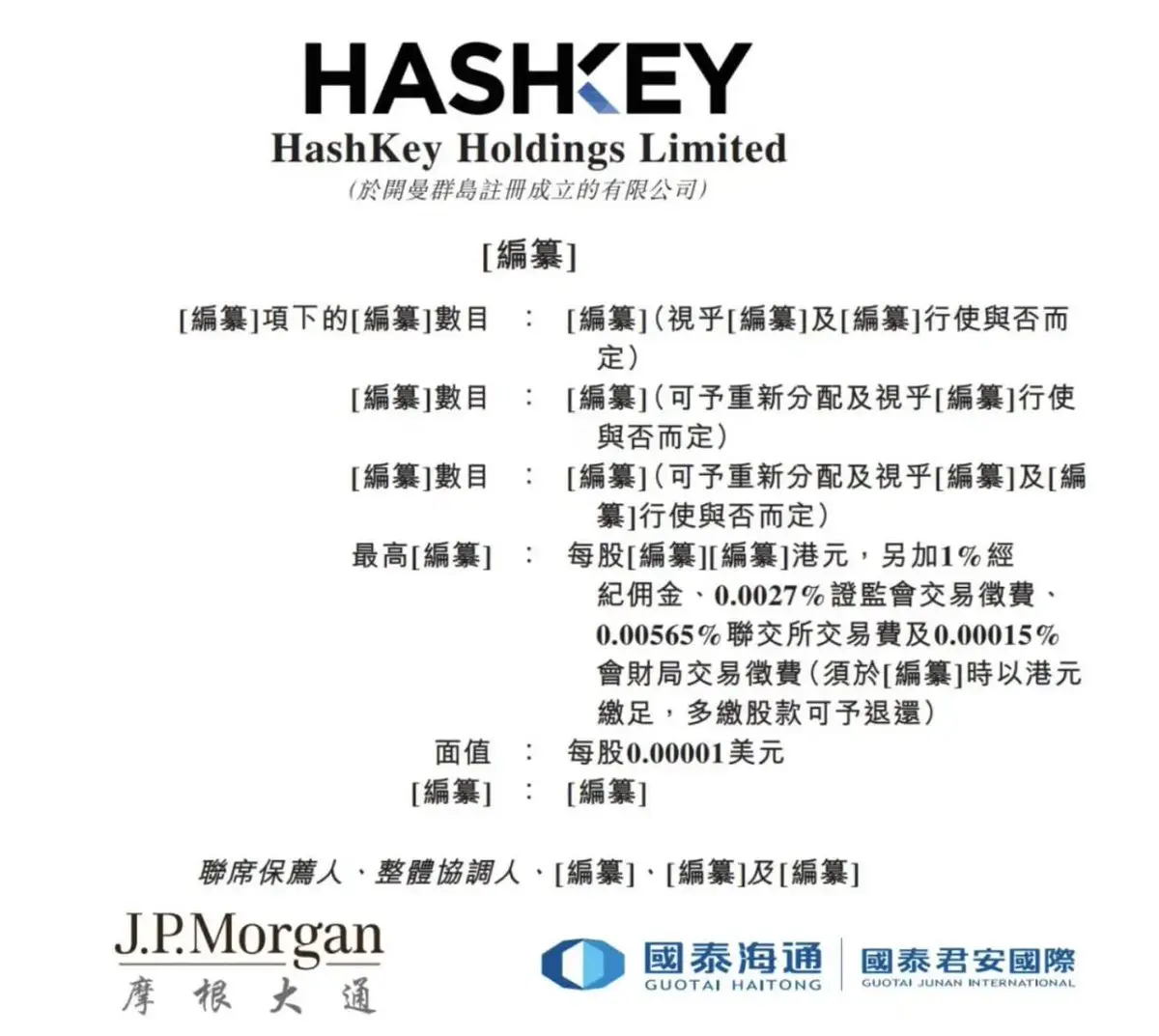

HashKey through hearing: encryption regular army formally knocks on the mainstream Capital Market

HashKey Holdings Limited, registered in the Cayman Islands and deeply rooted in Hong Kong for a long time, has passed the hearing of the Hong Kong Stock Exchange. Behind it are traditional financial giants such as JPMorgan, Cathay Securities, and Guotai Junan International serving as sponsors. This lineup itself indicates one thing: the regular army of the encryption industry is truly entering the sight of mainstream finance.

The information set after the hearing has been released, but from the co

View OriginalHashKey Holdings Limited, registered in the Cayman Islands and deeply rooted in Hong Kong for a long time, has passed the hearing of the Hong Kong Stock Exchange. Behind it are traditional financial giants such as JPMorgan, Cathay Securities, and Guotai Junan International serving as sponsors. This lineup itself indicates one thing: the regular army of the encryption industry is truly entering the sight of mainstream finance.

The information set after the hearing has been released, but from the co

- Reward

- like

- Comment

- Repost

- Share

The Central Bank convened a conference again this time to name Virtual Money, with a high standard: the Public Security, the Cyberspace Administration, the Supreme Court, and the Supreme Procuratorate all attended.

The core idea is actually very straightforward. Recently, the market has gained momentum, speculation has risen, funds are in disarray, and there have been more illegal incidents. Therefore, regulators need to clarify their stance once again. The domestic policy on Virtual Money remains prohibitive and has not changed, nor will it suddenly shift.

This time, stablecoins were specific

The core idea is actually very straightforward. Recently, the market has gained momentum, speculation has risen, funds are in disarray, and there have been more illegal incidents. Therefore, regulators need to clarify their stance once again. The domestic policy on Virtual Money remains prohibitive and has not changed, nor will it suddenly shift.

This time, stablecoins were specific

USDC-0,08%

- Reward

- like

- Comment

- Repost

- Share

MemeMax has recently become quite popular in the community, not because it released a new Meme, but because it is clearly attempting to reorganize the entire Meme ecosystem.

To be honest, everyone understands the current Meme market: rush to run, pre-embed, black pressure, instant rise and instant smash, newcomers rely on luck, while old players rely on reflexes. The entire ecosystem looks lively, but in reality, it is a complete mess.

Many projects cool down in less than three days; it's not about Meme, it's about life. What MemeMax is doing is quite straightforward. It aims to reduce

View OriginalTo be honest, everyone understands the current Meme market: rush to run, pre-embed, black pressure, instant rise and instant smash, newcomers rely on luck, while old players rely on reflexes. The entire ecosystem looks lively, but in reality, it is a complete mess.

Many projects cool down in less than three days; it's not about Meme, it's about life. What MemeMax is doing is quite straightforward. It aims to reduce

- Reward

- 2

- Comment

- Repost

- Share

WEMADE collaborates with CertiK to promote the globalization of the Korean won stablecoin.

Today, WEMADE officially launched the Global Korean Won Stablecoin Alliance GAKS in Singapore in collaboration with industry giants such as CertiK, Chainalysis, and SentBe.

It's not just about issuing a stablecoin; it's about directly launching a dedicated mainnet, StableNet, that covers the entire process from issuance, auditing, and regulation to cross-border payments.

CertiK conducts security audits, node verification, and on-chain monitoring, essentially taking over the underlying security of

Today, WEMADE officially launched the Global Korean Won Stablecoin Alliance GAKS in Singapore in collaboration with industry giants such as CertiK, Chainalysis, and SentBe.

It's not just about issuing a stablecoin; it's about directly launching a dedicated mainnet, StableNet, that covers the entire process from issuance, auditing, and regulation to cross-border payments.

CertiK conducts security audits, node verification, and on-chain monitoring, essentially taking over the underlying security of

View Original

- Reward

- like

- Comment

- Repost

- Share

Australia Takes Action: The Encryption Industry Moves from Wild Paths to Financial-Level Regulation

If you've been in the mixed chain for a while, you must know that Australia's regulations have been more talk than action for many years. As a result, this week, Treasurer Jim Chalmers and Minister for Financial Services Daniel Mulino directly presented a "2025 Digital Asset Framework Bill" to Parliament, clearly indicating a readiness for long-term governance.

This core change consists of three points:

1. Bring cryptocurrency exchanges and custodial services into the financial services

View OriginalIf you've been in the mixed chain for a while, you must know that Australia's regulations have been more talk than action for many years. As a result, this week, Treasurer Jim Chalmers and Minister for Financial Services Daniel Mulino directly presented a "2025 Digital Asset Framework Bill" to Parliament, clearly indicating a readiness for long-term governance.

This core change consists of three points:

1. Bring cryptocurrency exchanges and custodial services into the financial services

- Reward

- like

- Comment

- Repost

- Share

Robinhood has teamed up with the quantitative giant SIG (Susquehanna International Group) to prepare to establish a new futures and derivatives trading exchange, and they will also handle clearing themselves.

According to official statements, the joint venture Robinhood is the major shareholder and will also purchase MIAXdx (a CFTC-authorized futures exchange) along with the clearinghouse and swap execution facility held by MIAX. MIAX itself will retain a 10% equity stake. SIG will be responsible for supporting the market on the opening day, and in the future, more liquidity partners will be i

View OriginalAccording to official statements, the joint venture Robinhood is the major shareholder and will also purchase MIAXdx (a CFTC-authorized futures exchange) along with the clearinghouse and swap execution facility held by MIAX. MIAX itself will retain a 10% equity stake. SIG will be responsible for supporting the market on the opening day, and in the future, more liquidity partners will be i

- Reward

- like

- Comment

- Repost

- Share

The Japan FSA is going to take action again.

The Japanese regulatory authorities have sent another signal that in the future, cryptocurrency exchanges cannot just say that our assets are safe; they must also prepare a reserve fund of real cash for compensation. If something goes wrong, you need to be able to pay up.

Although Japan has long required exchanges to keep users' coins in cold wallets, it has not specifically required them to set aside a sum of money to deal with unexpected losses from hacks, system failures, and other incidents. In the past, everyone assumed they would deal with

View OriginalThe Japanese regulatory authorities have sent another signal that in the future, cryptocurrency exchanges cannot just say that our assets are safe; they must also prepare a reserve fund of real cash for compensation. If something goes wrong, you need to be able to pay up.

Although Japan has long required exchanges to keep users' coins in cold wallets, it has not specifically required them to set aside a sum of money to deal with unexpected losses from hacks, system failures, and other incidents. In the past, everyone assumed they would deal with

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More18.84K Popularity

45.86K Popularity

56.95K Popularity

89.77K Popularity

3.87K Popularity

Pin