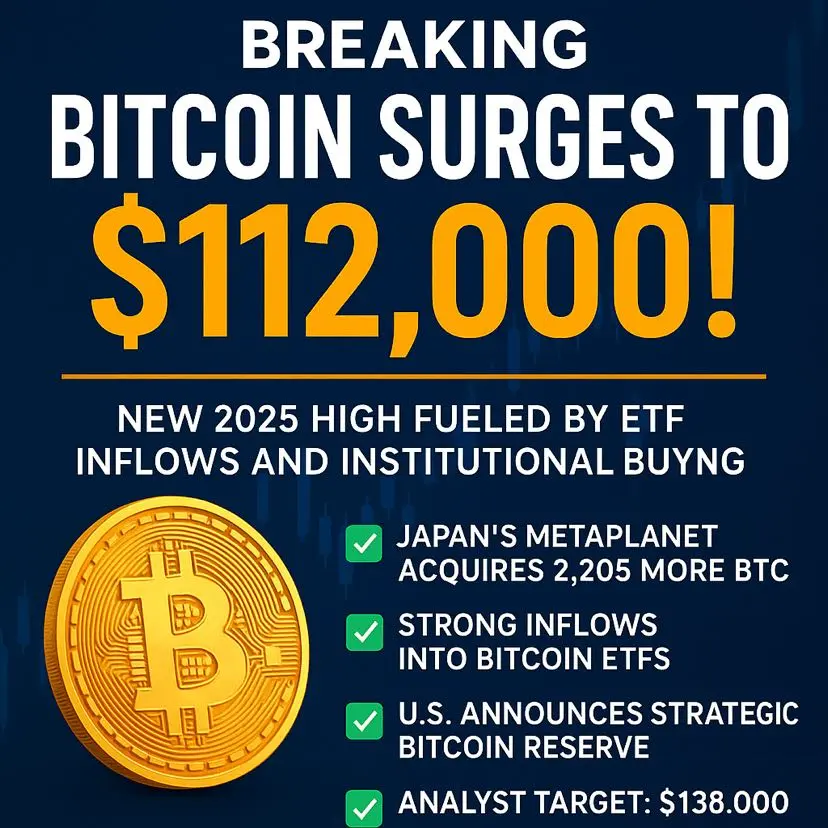

BREAKING: Bitcoin Surges to $112,000!

📈 New 2025 High Fueled by ETF Inflows and Institutional Buying

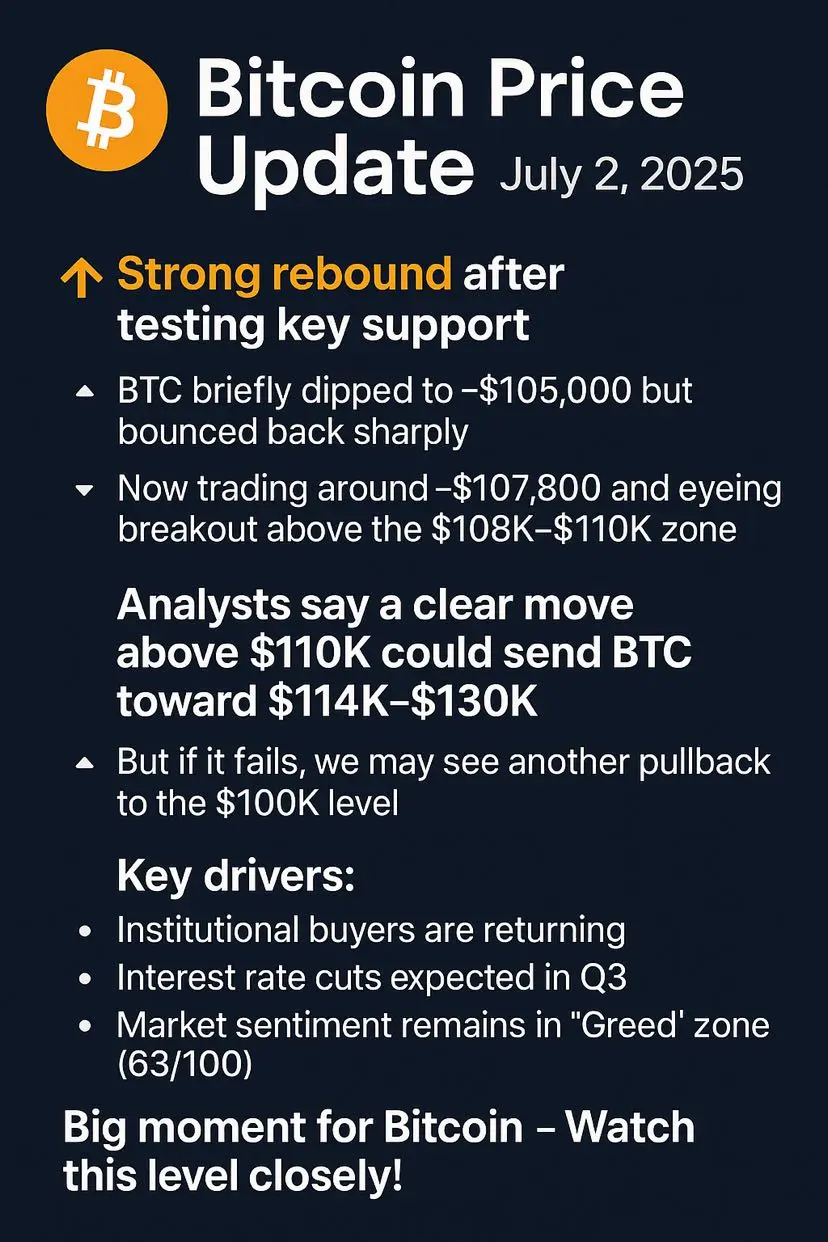

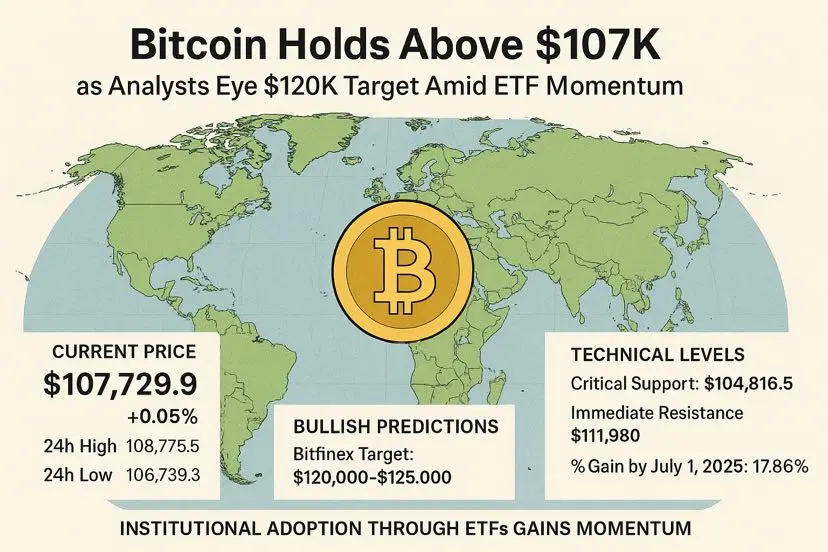

🪙 Latest BTC Price Update:

🔹 Intraday High: $111,748

🔹 Current Price: $111,201 (+2.4%)

🔹 Daily Low: $108,606

⸻

#BTC Hits New High #Gate xStocks Trading Share 🔍 Key Drivers Behind the Rally:

✅ Japan’s Metaplanet acquires 2,205 more BTC, now holding 15,555 BTC

✅ Strong inflows into Bitcoin ETFs – hitting record highs this year

✅ The U.S. announces a Strategic Bitcoin Reserve, pledging not to sell

✅ Growing view of BTC as a strategic asset on a global scale

⸻

📊 Analyst Outlook:

💥 Year-end