TAKD

No content yet

TAKD

- Reward

- like

- Comment

- Repost

- Share

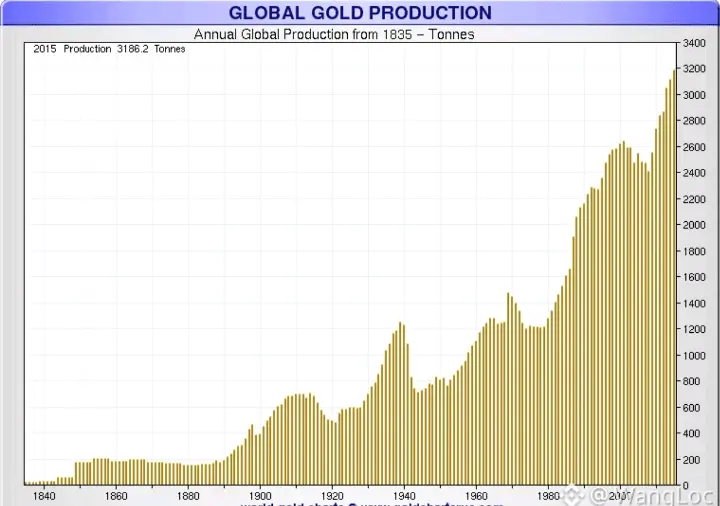

The real story with gold isn’t yesterday’s 9% drop. That’s noise. The uncomfortable truth is much bigger: over the long arc of history, gold has effectively fallen 99.987%.

That sounds impossible until you look at it through the right lens.

If humanity had stopped mining gold around 500 AD if the supply had truly been fixed an ounce of gold today wouldn’t be worth a few thousand dollars. It would be worth over $40 million. Not because demand would be radically different, but because supply would have remained absolutely capped.

But gold isn’t fixed in supply. It’s merely scarce. Every year, mo

That sounds impossible until you look at it through the right lens.

If humanity had stopped mining gold around 500 AD if the supply had truly been fixed an ounce of gold today wouldn’t be worth a few thousand dollars. It would be worth over $40 million. Not because demand would be radically different, but because supply would have remained absolutely capped.

But gold isn’t fixed in supply. It’s merely scarce. Every year, mo

XAUT-2,06%

- Reward

- 1

- Comment

- Repost

- Share

#CryptoMarketPullback Silver ($XAG) plunged 32% to $77, erasing nearly $2.4 trillion from its market value.

- Reward

- like

- Comment

- Repost

- Share

Silver ($XAG) plunged 32% to $77, erasing nearly $2.4 trillion from its market value.#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback #PreciousMetalsPullBack $BTC $GT

- Reward

- like

- Comment

- Repost

- Share

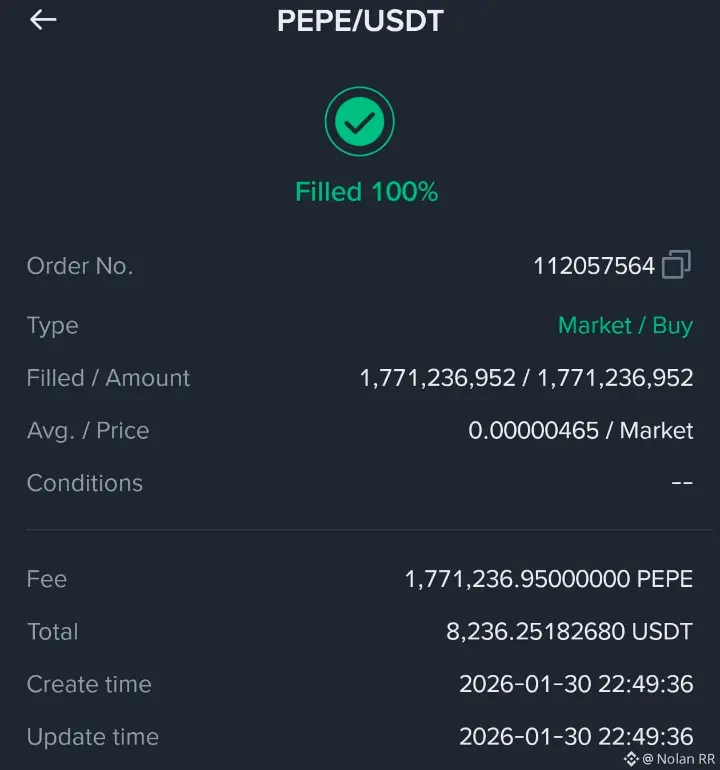

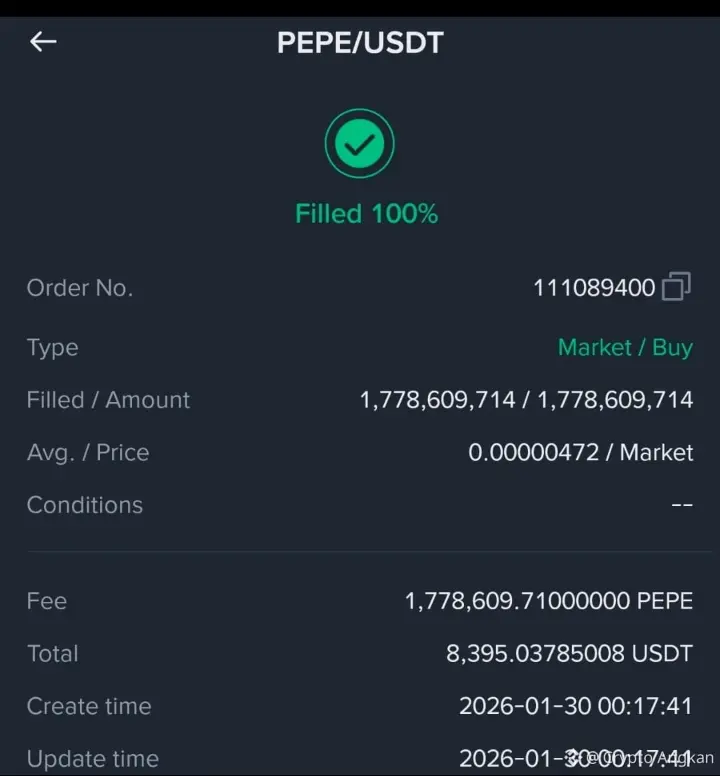

"Just secured another 1.77B $PEPE ✅ Market buy completed 💪

Big players are moving in early… the next leg up could be massive 📈🐸

Stay alert $PEPE pump season could ignite at any moment!"

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback #PreciousMetalsPullBack

$BTC $ETH $XRP

Big players are moving in early… the next leg up could be massive 📈🐸

Stay alert $PEPE pump season could ignite at any moment!"

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback #PreciousMetalsPullBack

$BTC $ETH $XRP

- Reward

- like

- Comment

- Repost

- Share

Key Takeaways

Bitcoin is on track for a sixth consecutive month of underperformance against gold, a streak not seen since 2019–2020. The bitcoin-to-gold ratio, which measures how much gold is equivalent to one BTC, rebounded to around 16.3 after briefly dipping to 15.5, as gold and silver fell more sharply than bitcoin over the past 24 hours. A potential bottom in the ratio may not necessarily indicate bitcoin strength; it could instead reflect gold’s continued underperformance relative to bitcoin.

Bitcoin (BTC) appears set to finish January underperforming gold for the sixth straight month, a

Bitcoin is on track for a sixth consecutive month of underperformance against gold, a streak not seen since 2019–2020. The bitcoin-to-gold ratio, which measures how much gold is equivalent to one BTC, rebounded to around 16.3 after briefly dipping to 15.5, as gold and silver fell more sharply than bitcoin over the past 24 hours. A potential bottom in the ratio may not necessarily indicate bitcoin strength; it could instead reflect gold’s continued underperformance relative to bitcoin.

Bitcoin (BTC) appears set to finish January underperforming gold for the sixth straight month, a

MC:$3.2KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

Market Overview

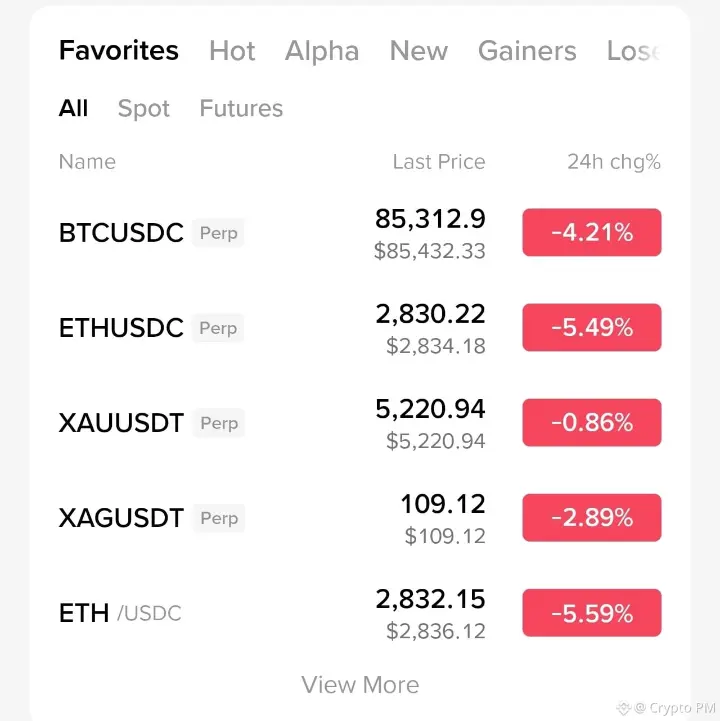

Bitcoin and Ether extended their recent losses as the cryptocurrency market continued to decline on Friday, following a sharp selloff on Thursday. Precious metals, including silver and gold, also fell, contributing to broader market weakness, while the U.S. dollar strengthened.

Crypto liquidations reached $1.8 billion, and bitcoin dominance slipped as investors rotated into higher-risk altcoins. Overnight, bitcoin (BTC) dropped 2.7% and ether (ETH) fell 3.5%, adding to Thursday’s steep declines.

Silver tumbled 20% from Thursday’s record high of $121, trading around $96, while g

Bitcoin and Ether extended their recent losses as the cryptocurrency market continued to decline on Friday, following a sharp selloff on Thursday. Precious metals, including silver and gold, also fell, contributing to broader market weakness, while the U.S. dollar strengthened.

Crypto liquidations reached $1.8 billion, and bitcoin dominance slipped as investors rotated into higher-risk altcoins. Overnight, bitcoin (BTC) dropped 2.7% and ether (ETH) fell 3.5%, adding to Thursday’s steep declines.

Silver tumbled 20% from Thursday’s record high of $121, trading around $96, while g

MC:$3.19KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

I am reading a Crypto Daybook article about a rough day in the crypto markets, with major cryptocurrencies entering “plunge protection” mode. The article, dated January 30, 2026, notes DOGE is down 0.40% and KMNO down 0.028%.

What type of post would you like me to help you create? For example:

A social media post commenting on this crypto news

An analysis or summary of the market situation

A post tailored for a specific platform (Twitter, LinkedIn, etc.)

What type of post would you like me to help you create? For example:

A social media post commenting on this crypto news

An analysis or summary of the market situation

A post tailored for a specific platform (Twitter, LinkedIn, etc.)

- Reward

- like

- Comment

- Repost

- Share

Major market moves in precious metals: Gold, silver, and copper have taken significant hits, triggering a $120M exodus from blockchain-based metal tokens.

While Bitcoin continues to strengthen its position as an independent risk asset, traditional metals face headwinds. This divergence highlights the evolving relationship between digital and physical stores of value.

What's your take on metals vs. crypto in 2026?

While Bitcoin continues to strengthen its position as an independent risk asset, traditional metals face headwinds. This divergence highlights the evolving relationship between digital and physical stores of value.

What's your take on metals vs. crypto in 2026?

BTC-8,7%

- Reward

- like

- Comment

- Repost

- Share

What to Know

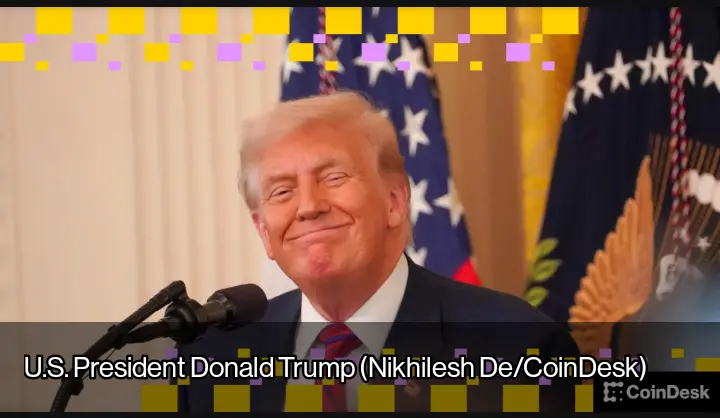

President Donald Trump has nominated Kevin Warsh to serve as the next chair of the Federal Reserve, confirming his choice on Friday to succeed Jerome Powell when Powell’s term concludes in May.

Warsh previously served on the Federal Reserve’s Board of Governors from 2006 to 2011, becoming the youngest person ever to hold that position. He was widely seen as the frontrunner for the role, a development that may have contributed to Bitcoin (BTC) dipping to nearly $81,000 late Thursday as betting markets priced in the likelihood of his nomination.

Warsh has experience in the cryptocur

President Donald Trump has nominated Kevin Warsh to serve as the next chair of the Federal Reserve, confirming his choice on Friday to succeed Jerome Powell when Powell’s term concludes in May.

Warsh previously served on the Federal Reserve’s Board of Governors from 2006 to 2011, becoming the youngest person ever to hold that position. He was widely seen as the frontrunner for the role, a development that may have contributed to Bitcoin (BTC) dipping to nearly $81,000 late Thursday as betting markets priced in the likelihood of his nomination.

Warsh has experience in the cryptocur

- Reward

- 1

- 1

- Repost

- Share

MrAltoid :

:

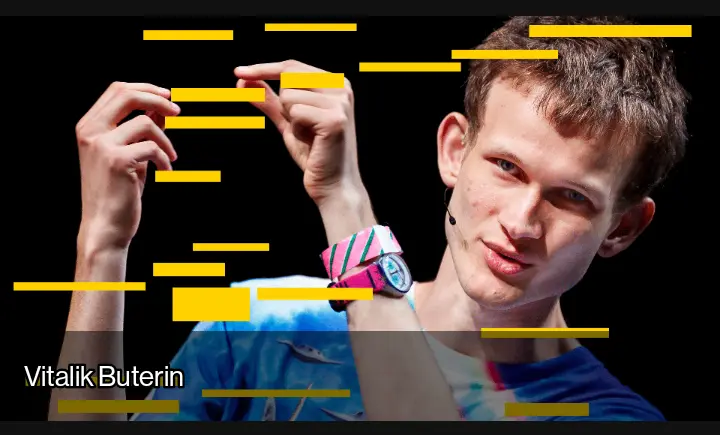

This is great news for us traders. Thanks for the updateI came across a finance article reporting that Vitalik Buterin plans to allocate $43 million to Ethereum development. The piece notes that the Ethereum co-founder will withdraw these funds to support “full-stack openness and verifiability” as the Ethereum Foundation revises its spending priorities.

What type of post would you like to create? For example:

A social media update sharing this news

An analysis or commentary piece

A post tailored for a specific platform (LinkedIn, X/Twitter, etc.)

Something else entirely

Let me know the style and platform, and I can help you craft it!#PreciousMetals

What type of post would you like to create? For example:

A social media update sharing this news

An analysis or commentary piece

A post tailored for a specific platform (LinkedIn, X/Twitter, etc.)

Something else entirely

Let me know the style and platform, and I can help you craft it!#PreciousMetals

ETH-10,02%

- Reward

- 1

- Comment

- Repost

- Share

Bought $1.7 Billion $PEPE

Now I'm thinking i'll be millionaire soon😅

Will i become a Billionaire in 2030⁉️

$PIEVERSE $10 soon🚀#PreciousMetalsPullBack

$PEPE

Now I'm thinking i'll be millionaire soon😅

Will i become a Billionaire in 2030⁉️

$PIEVERSE $10 soon🚀#PreciousMetalsPullBack

$PEPE

PEPE-10,59%

- Reward

- 1

- Comment

- Repost

- Share

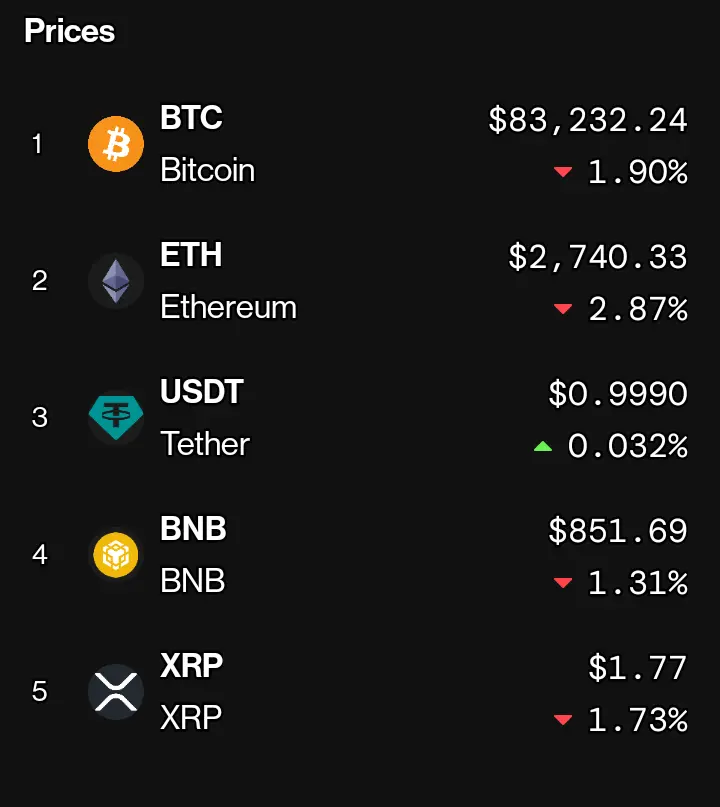

📊 Crypto Market Update

Bitcoin (BTC) trading at $83,232.24 📉 -1.90%

Ethereum (ETH) at $2,740.33 📉 -2.87%

Tether (USDT) stable at $0.9990 📈 +0.032%

BNB at $851.69 📉 -1.31%

XRP at $1.77 📉 -1.73%

Markets showing some red today with most major cryptocurrencies experiencing minor pullbacks. USDT holding steady near peg.

#Crypto #Bitcoin #Ethereum

Bitcoin (BTC) trading at $83,232.24 📉 -1.90%

Ethereum (ETH) at $2,740.33 📉 -2.87%

Tether (USDT) stable at $0.9990 📈 +0.032%

BNB at $851.69 📉 -1.31%

XRP at $1.77 📉 -1.73%

Markets showing some red today with most major cryptocurrencies experiencing minor pullbacks. USDT holding steady near peg.

#Crypto #Bitcoin #Ethereum

- Reward

- 3

- Comment

- Repost

- Share

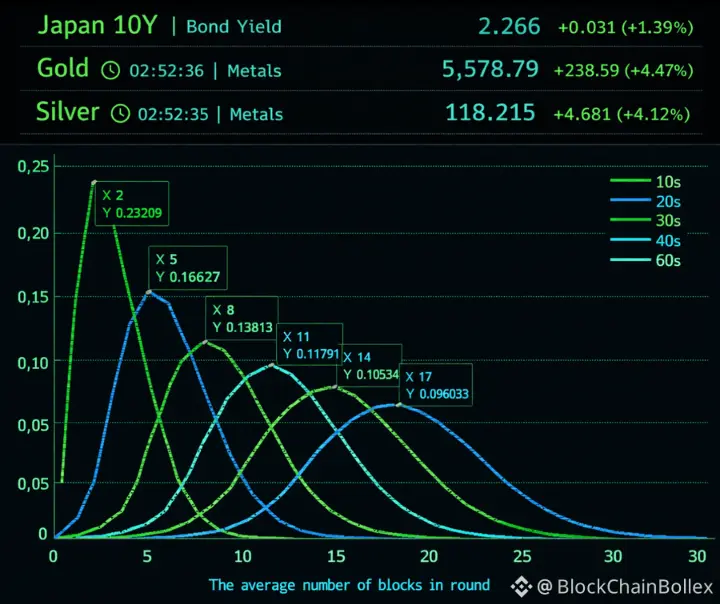

⚠️ This Is Extremely Risky Read Carefully

If you hold stocks, crypto, or commodities, you need to pay attention. We’re seeing warning signs similar to those before 2000, 2007, and 2019.

Three major red flags are flashing simultaneously:

Japan 10Y bond yield at record highs

Gold at all-time highs

Silver at all-time highs

This is not a bullish signal it’s the system showing stress.

What it means:

Japan bonds: Japan has been the world’s source of cheap money. When yields rise, easy money vanishes. Less cheap money = leveraged positions start breaking.

Gold: Prices surge when trust is eroding. T

If you hold stocks, crypto, or commodities, you need to pay attention. We’re seeing warning signs similar to those before 2000, 2007, and 2019.

Three major red flags are flashing simultaneously:

Japan 10Y bond yield at record highs

Gold at all-time highs

Silver at all-time highs

This is not a bullish signal it’s the system showing stress.

What it means:

Japan bonds: Japan has been the world’s source of cheap money. When yields rise, easy money vanishes. Less cheap money = leveraged positions start breaking.

Gold: Prices surge when trust is eroding. T

- Reward

- 2

- 2

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

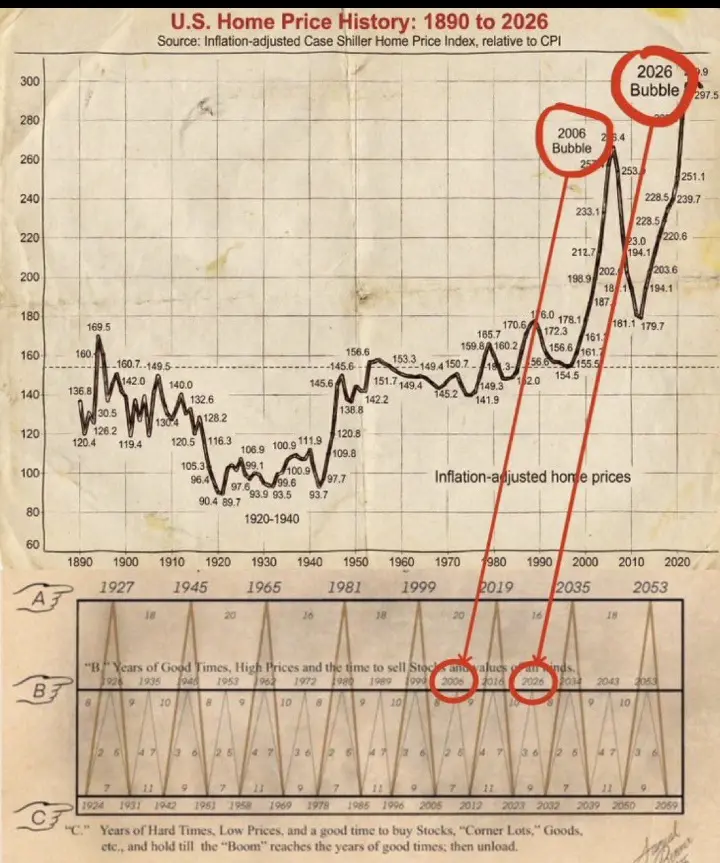

DON’T BUY A HOUSE THIS YEAR UNLESS YOU’RE ALREADY WEALTHY

If you’re not sitting on serious money, rent.

Yes, rent.

Buying a home in this environment is how ordinary people trap themselves in long-term financial stagnation.

If you’re aiming for your first home, the smart move is to wait for a real correction something on the scale of 2008.

I’ve watched every boom and bust: the 2008 collapse, the 2020 frenzy, and everything since. Look at the data. The last housing bubble peaked around 266 in 2006. If you believe today’s market is “stable,” you’re not early you’re late.

This market isn’t healt

If you’re not sitting on serious money, rent.

Yes, rent.

Buying a home in this environment is how ordinary people trap themselves in long-term financial stagnation.

If you’re aiming for your first home, the smart move is to wait for a real correction something on the scale of 2008.

I’ve watched every boom and bust: the 2008 collapse, the 2020 frenzy, and everything since. Look at the data. The last housing bubble peaked around 266 in 2006. If you believe today’s market is “stable,” you’re not early you’re late.

This market isn’t healt

- Reward

- 1

- Comment

- Repost

- Share

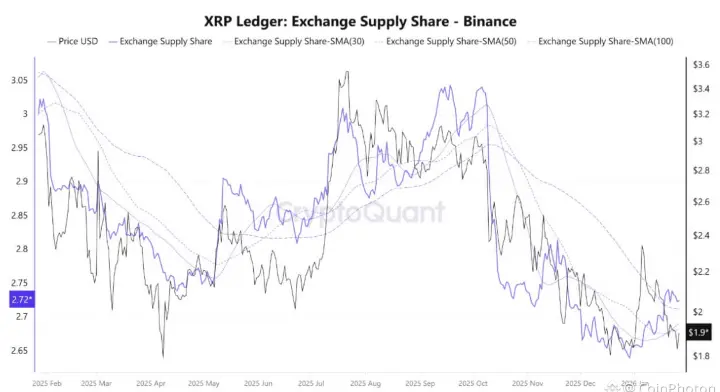

XRP opened 2026 moving mostly sideways below the $2 mark, though on-chain metrics reveal accumulating interest from large holders. Since the start of the year, 42 new wallets holding at least 1 million XRP have emerged, indicating that whales are taking advantage of the subdued price to build their positions.

From a technical standpoint, XRP still appears vulnerable. The price remains well under its 200-day moving average, and risk-adjusted indicators such as the Sharpe Ratio continue to signal a low-reward, range-bound market. Momentum indicators also lean more toward consolidation than any d

From a technical standpoint, XRP still appears vulnerable. The price remains well under its 200-day moving average, and risk-adjusted indicators such as the Sharpe Ratio continue to signal a low-reward, range-bound market. Momentum indicators also lean more toward consolidation than any d

- Reward

- 1

- Comment

- Repost

- Share

Gold up? BTC drops.

Gold down? BTC still drops.

Silver rises? ETH sinks.

Silver falls? ETH also sinks.

Bottom line:

No matter what traditional markets do, BTC and ETH just dump.

Right now the market logic feels like:

“If you’re in crypto, you’re meant to suffer.”

#GateLiveMiningProgramPublicBeta #GoldBreaks$5,500 #SEConTokenizedSecurities #MiddleEastTensionsEscalate

$BTC $GT $ETH

Gold down? BTC still drops.

Silver rises? ETH sinks.

Silver falls? ETH also sinks.

Bottom line:

No matter what traditional markets do, BTC and ETH just dump.

Right now the market logic feels like:

“If you’re in crypto, you’re meant to suffer.”

#GateLiveMiningProgramPublicBeta #GoldBreaks$5,500 #SEConTokenizedSecurities #MiddleEastTensionsEscalate

$BTC $GT $ETH

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More98.01K Popularity

14.7K Popularity

386.42K Popularity

2.9K Popularity

1.2K Popularity

Pin