📊 Institutional Bitcoin Strategy — Long‑Term Conviction or Tactical Adjustment?

In the latest market environment, data shows two very different behaviors between institutional investors and retail participants in Bitcoin (BTC):

1. Institutions Are Still Accumulating — Not Selling

Multiple on‑chain metrics and industry reports show that institutions continue to build Bitcoin exposure even as prices pull back:

Large holders and “whales” have been accumulating significant BTC amounts, reaching multi‑month highs in holdings.

Surveys indicate that about 80 % of institutions plan to buy more Bitcoin on price dips, reflecting confidence in long‑term value.

Major asset managers and institutional vehicles (like Bitcoin ETFs) have been consistent inflow sources, absorbing selling pressure and acting as core buyers.

What this means: Institutions are not panicking. Even when BTC prices decline, they are adding positions — a clear sign of long‑term strategic conviction, not short‑term tactical retreat.

2. The Driving Logic Behind Institutional Accumulation

Institutional behavior stems from structural and strategic rationales, not short‑term price moves:

🔹 Longer investment horizons:

Institutions use frameworks that extend across quarters and years, not daily price swings. This makes them treat temporarily weak markets as buying opportunities rather than sell signals.

🔹 Strategic allocation vs. speculation:

Today, many institutional strategies position Bitcoin as:

• A store of value or inflation hedge

• A portfolio diversifier with low correlation to traditional equities

• An asset held through regulated vehicles like spot ETFs that mirror traditional finance structures

🔹 ETF inflows continue despite price weakness:

Even in correction phases, net inflows into Bitcoin ETFs remain significant, showing trust in regulated, institutional channels for accumulation.

3. Divergence with Retail Behavior

A clear contrast is emerging:

📉 Retail investors tend to sell or stay sidelined during volatility, often reacting emotionally to losses or headlines — a classic behavioral pattern seen in previous cycles too.

📈 Institutions and whales tend to accumulate through downturns, treating dips not as danger zones but as entry points for long‑term positioning.

This divergence creates a supportive demand floor beneath the market even when prices fall, because institutional buying offsets retail selling.

4. Tactical Decisions Within a Strategic Framework

That doesn’t mean every institution follows the same playbook:

🔹 Some adjust timing and size:

Institutional allocations are not always linear — they may scale buying based on valuation models, volatility measures, macro outlook, or regulatory developments.

🔹 Risk management is key:

Institutions often use hedging, structured products, and staged allocation frameworks rather than all‑in lump purchases — meaning tactics adapt, but the long‑term thesis remains intact.

🧠 Bottom Line: Strategy or Tactic? The Answer Is Both.

Institutions are predominantly sticking to long‑term strategies when it comes to Bitcoin. This is evident from continued accumulation, growth of investment vehicles like ETFs, and surveys showing intent to buy on dips.

However, they are also adjusting tactical elements — such as

✔ pacing purchases over time

✔ managing risk through hedged products

✔ adapting to regulatory and macro signals

This layered approach reflects a mature investment philosophy:

long‑term commitment with disciplined, strategic execution.

📌 Why This Matters for BTC Markets

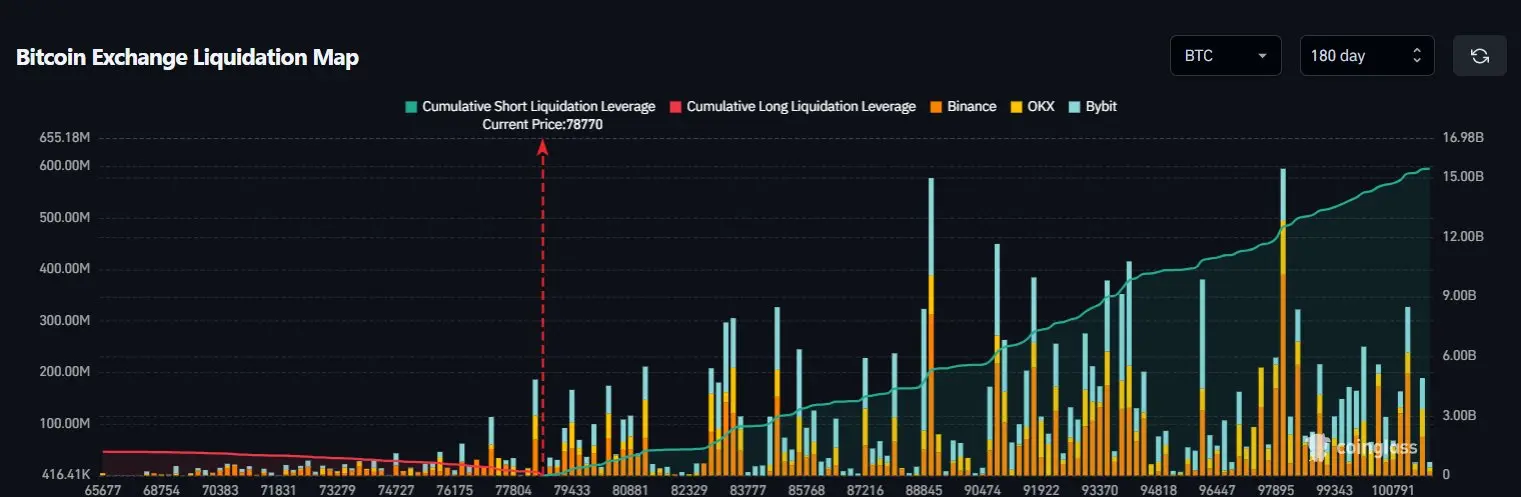

Reduced volatility over time: Institutions’ buy‑and‑hold behavior dampens extreme swings.

Stronger price support in downturns: Institutional demand absorbs selling pressure.

Shift from speculation to structural adoption: Bitcoin is increasingly seen as reserve asset or hedge, not just a trader’s instrument.

#InstitutionalHoldingsDebate

In the latest market environment, data shows two very different behaviors between institutional investors and retail participants in Bitcoin (BTC):

1. Institutions Are Still Accumulating — Not Selling

Multiple on‑chain metrics and industry reports show that institutions continue to build Bitcoin exposure even as prices pull back:

Large holders and “whales” have been accumulating significant BTC amounts, reaching multi‑month highs in holdings.

Surveys indicate that about 80 % of institutions plan to buy more Bitcoin on price dips, reflecting confidence in long‑term value.

Major asset managers and institutional vehicles (like Bitcoin ETFs) have been consistent inflow sources, absorbing selling pressure and acting as core buyers.

What this means: Institutions are not panicking. Even when BTC prices decline, they are adding positions — a clear sign of long‑term strategic conviction, not short‑term tactical retreat.

2. The Driving Logic Behind Institutional Accumulation

Institutional behavior stems from structural and strategic rationales, not short‑term price moves:

🔹 Longer investment horizons:

Institutions use frameworks that extend across quarters and years, not daily price swings. This makes them treat temporarily weak markets as buying opportunities rather than sell signals.

🔹 Strategic allocation vs. speculation:

Today, many institutional strategies position Bitcoin as:

• A store of value or inflation hedge

• A portfolio diversifier with low correlation to traditional equities

• An asset held through regulated vehicles like spot ETFs that mirror traditional finance structures

🔹 ETF inflows continue despite price weakness:

Even in correction phases, net inflows into Bitcoin ETFs remain significant, showing trust in regulated, institutional channels for accumulation.

3. Divergence with Retail Behavior

A clear contrast is emerging:

📉 Retail investors tend to sell or stay sidelined during volatility, often reacting emotionally to losses or headlines — a classic behavioral pattern seen in previous cycles too.

📈 Institutions and whales tend to accumulate through downturns, treating dips not as danger zones but as entry points for long‑term positioning.

This divergence creates a supportive demand floor beneath the market even when prices fall, because institutional buying offsets retail selling.

4. Tactical Decisions Within a Strategic Framework

That doesn’t mean every institution follows the same playbook:

🔹 Some adjust timing and size:

Institutional allocations are not always linear — they may scale buying based on valuation models, volatility measures, macro outlook, or regulatory developments.

🔹 Risk management is key:

Institutions often use hedging, structured products, and staged allocation frameworks rather than all‑in lump purchases — meaning tactics adapt, but the long‑term thesis remains intact.

🧠 Bottom Line: Strategy or Tactic? The Answer Is Both.

Institutions are predominantly sticking to long‑term strategies when it comes to Bitcoin. This is evident from continued accumulation, growth of investment vehicles like ETFs, and surveys showing intent to buy on dips.

However, they are also adjusting tactical elements — such as

✔ pacing purchases over time

✔ managing risk through hedged products

✔ adapting to regulatory and macro signals

This layered approach reflects a mature investment philosophy:

long‑term commitment with disciplined, strategic execution.

📌 Why This Matters for BTC Markets

Reduced volatility over time: Institutions’ buy‑and‑hold behavior dampens extreme swings.

Stronger price support in downturns: Institutional demand absorbs selling pressure.

Shift from speculation to structural adoption: Bitcoin is increasingly seen as reserve asset or hedge, not just a trader’s instrument.

#InstitutionalHoldingsDebate