秦政闯天涯

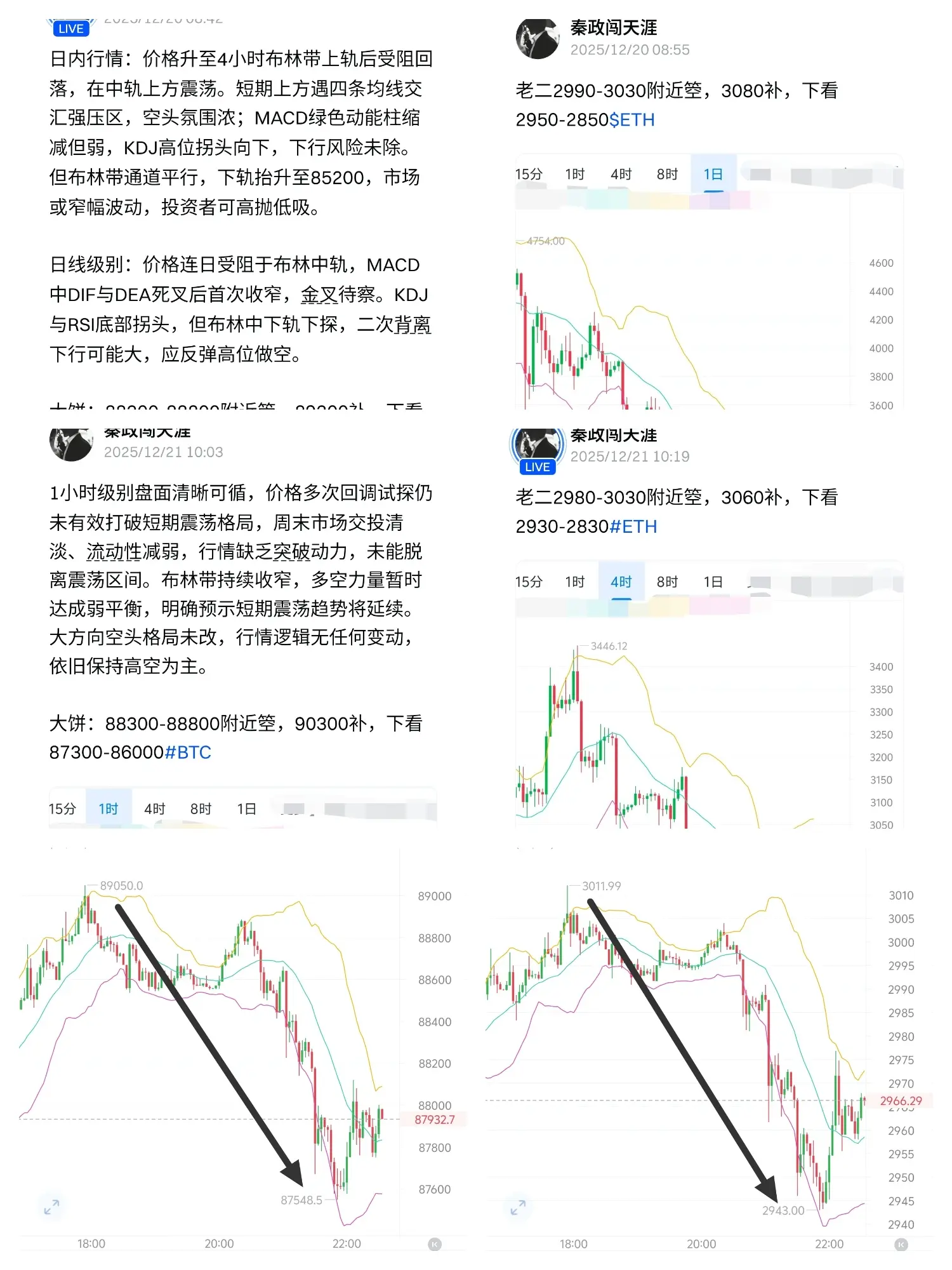

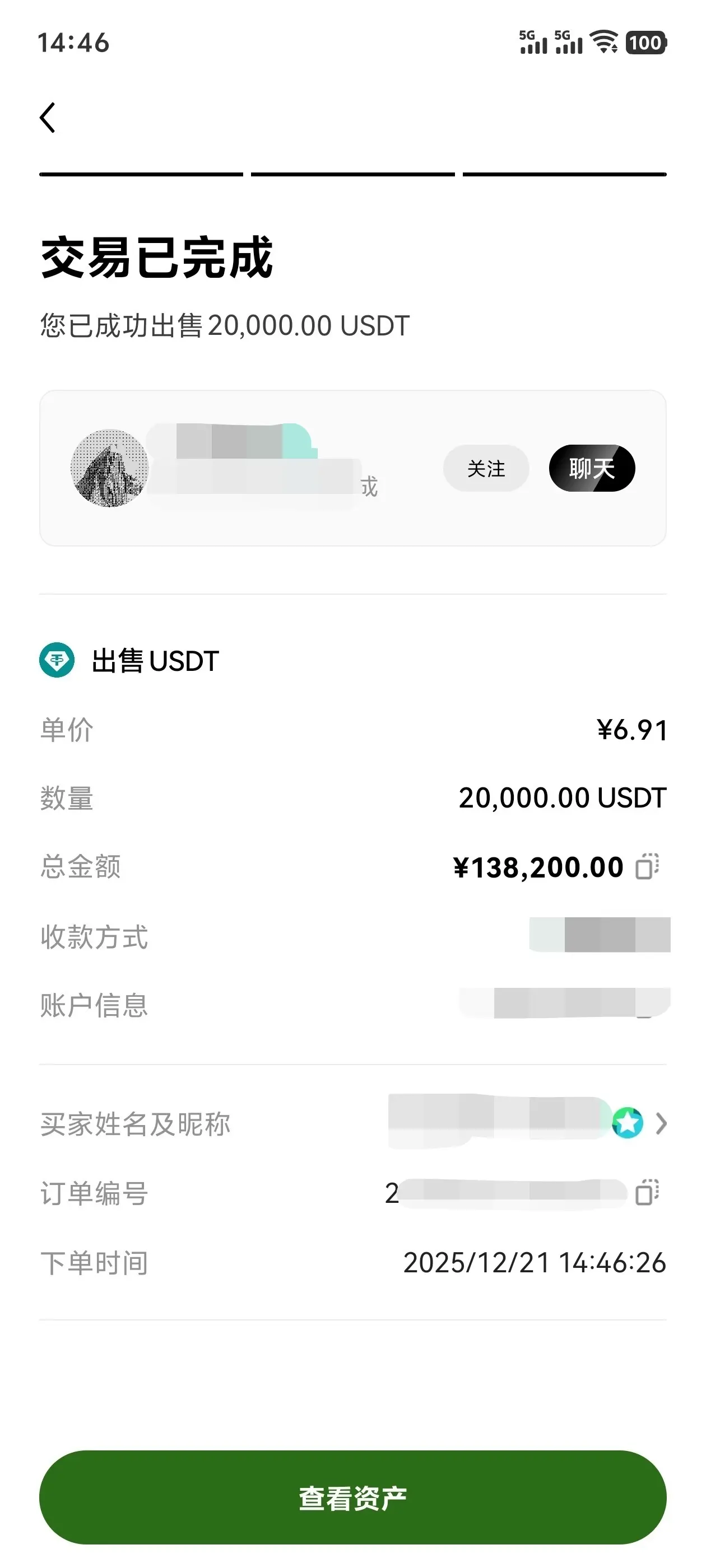

This week's 5-day public strategy hit all targets! BTC/ETH practical operation

Verification, strength is never just talk.

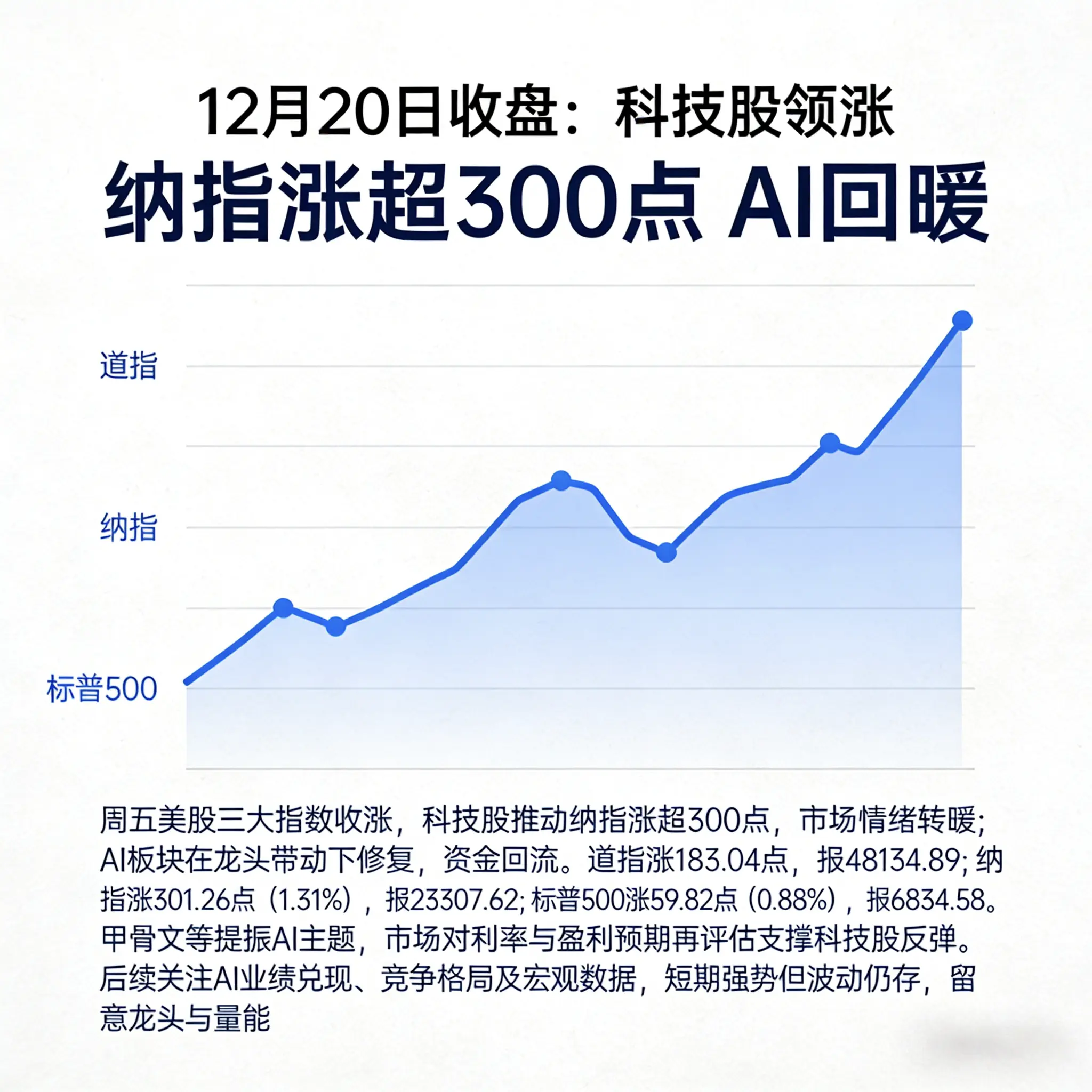

The market never pays for vague judgments, but crowns precise assessments—this week, BTC and ETH public strategies will be implemented in real-time for 5 days, with every entry signal, every support and resistance level, and every switch being perfectly verified on the table!

View OriginalVerification, strength is never just talk.

The market never pays for vague judgments, but crowns precise assessments—this week, BTC and ETH public strategies will be implemented in real-time for 5 days, with every entry signal, every support and resistance level, and every switch being perfectly verified on the table!