九米波段

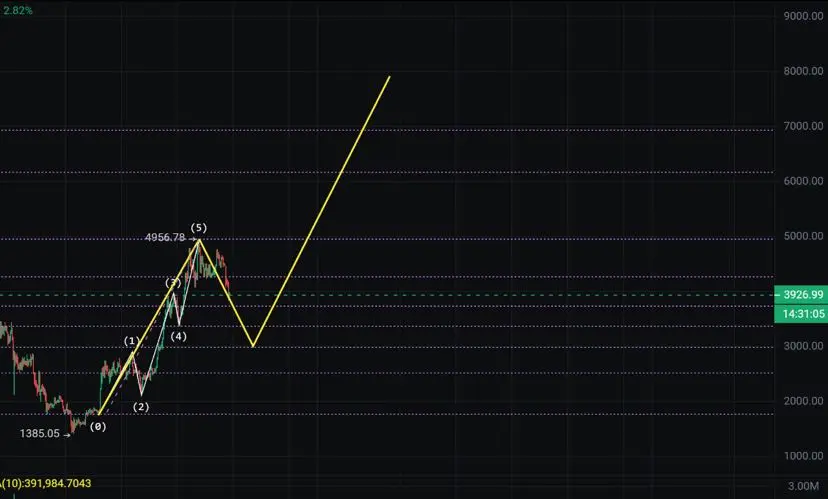

Short-term players in contracts should be the majority, right? If everyone can find a very good point in a small swing trading, you can follow my overall trend. The K-line forms minute by minute, hour by hour, and day by day. If you can't hold on, just reduce position and push for breakeven.

Treat contracts as investments and be clear about what level of trading you are engaged in. Don't think about the patterns with 5-minute K-lines; you can hold positions appropriately with significant tops and bottoms at the four-hour level.

Don't let contracts take over your life, and don't let contracts a

View OriginalTreat contracts as investments and be clear about what level of trading you are engaged in. Don't think about the patterns with 5-minute K-lines; you can hold positions appropriately with significant tops and bottoms at the four-hour level.

Don't let contracts take over your life, and don't let contracts a

[The user has shared his/her trading data. Go to the App to view more.]