Meta plans to split its artificial intelligence division into four small rollups, in order to improve organizational efficiency and accelerate product development. At the same time, employee roles may be laid off or adjusted, and some senior executives are expected to leave.#Institutions Hold 10M+ ETH #MicroStrategy Loosens Stock Rules #Show My Alpha Points

View Original# InstitutionsHold10M+ETH

16.68K

GateUser-e78067b2

Jinse Finance reported that documents from the U.S. Securities and Exchange Commission show that Robinhood's CFO (HOOD.O) Jason Warnick sold 100,000 shares of Class A common stock in the open market on August 15 at an average price of 110.929 Dollar per share.#Institutions Hold 10M+ ETH #MicroStrategy Loosens Stock Rules #Show My Alpha Points #PI #BTC

View Original

- Reward

- 1

- 1

- Repost

- Share

GateUser-e78067b2 :

:

The market is bullish 🐂- Reward

- like

- 2

- Repost

- Share

GateUser-e78067b2 :

:

Hold on tight 💪View More

#Institutions Hold 10M+ ETH

On the Brink of a New Era

As Ethereum celebrates its tenth anniversary, institutional investors are quietly but decisively stepping into the spotlight. No longer just a technology, ETH is now positioned as a strategic reserve asset, embraced by a wide spectrum of players—from Wall Street giants to Asian funds. As of today, institutions, ETFs, and public companies collectively hold over 10 million ETH, representing nearly $40 billion in market value.

Market Analysis: Institutional Flows Push ETH to New Heights

In recent months, Ethereum ETFs and institutional reser

On the Brink of a New Era

As Ethereum celebrates its tenth anniversary, institutional investors are quietly but decisively stepping into the spotlight. No longer just a technology, ETH is now positioned as a strategic reserve asset, embraced by a wide spectrum of players—from Wall Street giants to Asian funds. As of today, institutions, ETFs, and public companies collectively hold over 10 million ETH, representing nearly $40 billion in market value.

Market Analysis: Institutional Flows Push ETH to New Heights

In recent months, Ethereum ETFs and institutional reser

- Reward

- 61

- 12

- Repost

- Share

Asiftahsin :

:

Watching Closely 🔍View More

Jin10 data August 20: The data released by the Japanese Ministry of Finance on Wednesday showed that Japan's exports fell by 2.6% year-on-year in July, marking the third consecutive decline, while economists had predicted a decrease of 2.1%. Imports also dropped by 7.5% year-on-year in July, which is less than the economic forecasts that indicated a decline of 10.4%. As a result, Japan recorded a trade deficit of 1,175 billion yen ( equivalent to 79.55 million Dollar ), while a surplus of 1,962 billion yen was expected. #Institutions H# PI ##BTC old 10M+ ETH ##Show My Alpha Points #MicroStra

View Original

- Reward

- 1

- 1

- Repost

- Share

GateUser-e78067b2 :

:

The bullish market is at its peak 🐂Current BTC Market Dominance

Bitcoin’s dominance—its share of the entire cryptocurrency market capitalization—has been on a downward trajectory. Recently, it fell to around 59.5%, the lowest level in approximately 6.5 months .

Live market trackers show similar figures:

CoinCodex: ~58.93%

CoinMarketCap: ~59.1%

Gate.com: ~59.13%

So, conservatively, BTC dominance is hovering near ~59%.

---

What It Implies for the Market

Scenario Interpretation

BTC dominance ↓ (~59%) Capital is flowing into altcoins ("altseason" indicators are rising)

BTC dominance ↑ Investors prefer perceived stability of Bitc

Bitcoin’s dominance—its share of the entire cryptocurrency market capitalization—has been on a downward trajectory. Recently, it fell to around 59.5%, the lowest level in approximately 6.5 months .

Live market trackers show similar figures:

CoinCodex: ~58.93%

CoinMarketCap: ~59.1%

Gate.com: ~59.13%

So, conservatively, BTC dominance is hovering near ~59%.

---

What It Implies for the Market

Scenario Interpretation

BTC dominance ↓ (~59%) Capital is flowing into altcoins ("altseason" indicators are rising)

BTC dominance ↑ Investors prefer perceived stability of Bitc

- Reward

- 12

- Comment

- Repost

- Share

#Institutions Hold 10M+ ETH

Institutional investors now hold more than 10 million ETH. This figure makes me think: Ethereum has gained the trust not only of technology enthusiasts but also of major players.

From what I can see, this is a "accumulation signal". One of the strongest factors supporting the long-term value of ETH is institutional confidence. We saw this in BTC before, and now the same pattern is becoming apparent on the ETH side.

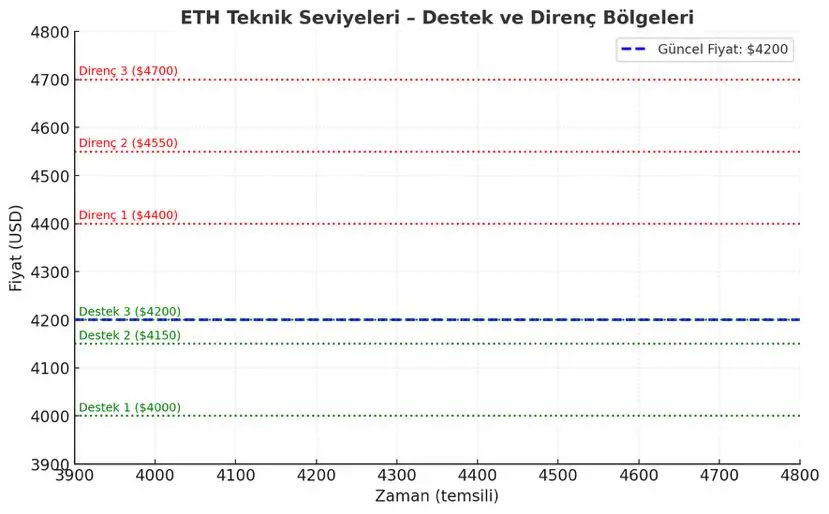

Technically speaking:

• Support zone: the $4,050 – $4,150 range still looks strong.

• Resistance zone: There is strong selling pressure around $4,350

Institutional investors now hold more than 10 million ETH. This figure makes me think: Ethereum has gained the trust not only of technology enthusiasts but also of major players.

From what I can see, this is a "accumulation signal". One of the strongest factors supporting the long-term value of ETH is institutional confidence. We saw this in BTC before, and now the same pattern is becoming apparent on the ETH side.

Technically speaking:

• Support zone: the $4,050 – $4,150 range still looks strong.

• Resistance zone: There is strong selling pressure around $4,350

ETH-0,36%

- Reward

- 27

- 11

- Repost

- Share

Ryakpanda :

:

Steadfast HODL💎View More

- Reward

- like

- Comment

- Repost

- Share

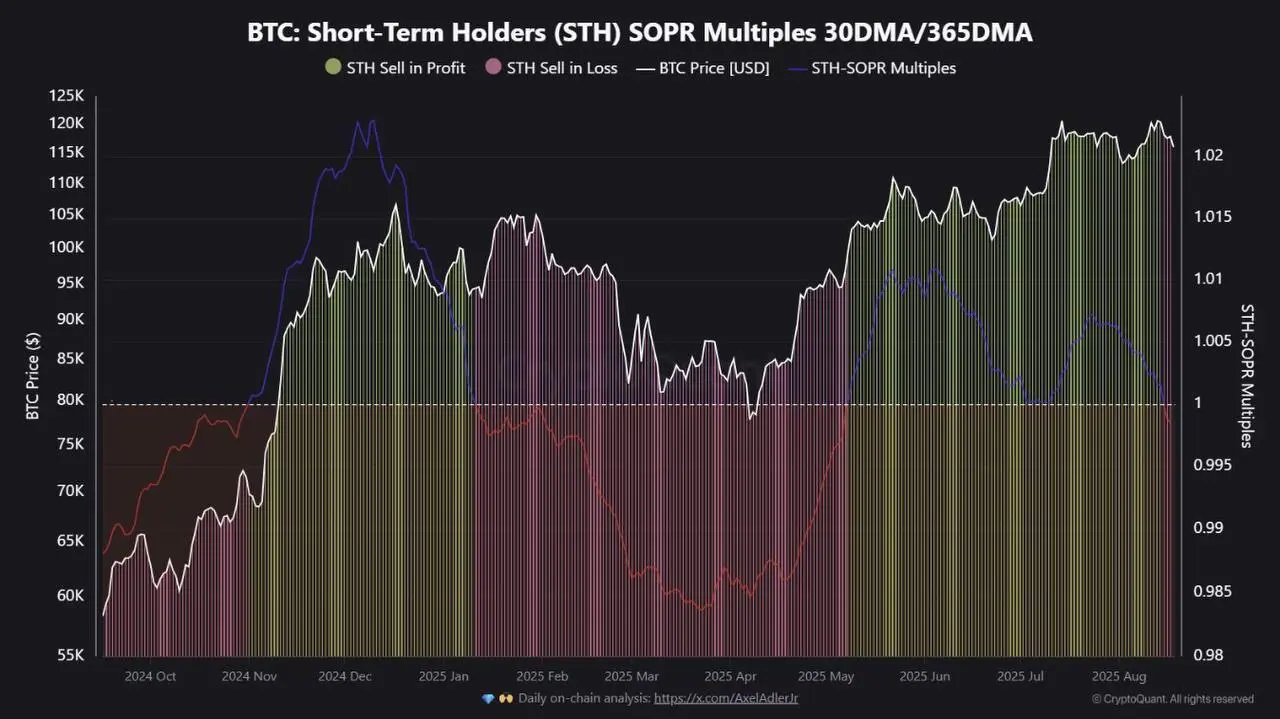

Bitcoin’s short-term holders are selling at a loss for the first time since January, signaling either a reset or weakening momentum.#Institutions Hold 10M+ ETH #Show My Alpha Points #MicroStrategy Loosens Stock Rules

- Reward

- 15

- 8

- Repost

- Share

DudasB :

:

Buy to earn 💎View More

Why It Matters:

Flexibility unlocked: On August 18, 2025, MicroStrategy (rebranded as Strategy Inc.) relaxed its longstanding restriction—now allowing stock issuance even when its market-to-Bitcoin net asset value (mNAV) ratio falls below 2.5×, reversing its previous pledge .

Strategic financing: This move gives the company greater agility to raise capital and continue buying Bitcoin, even as its stock premium narrows .

Aggressive acquisitions: In the past week, Strategy added 430 BTC (~$51 million), funded via its preferred-share and ATM equity programs .

Risks of dilution: Analysts caution t

Flexibility unlocked: On August 18, 2025, MicroStrategy (rebranded as Strategy Inc.) relaxed its longstanding restriction—now allowing stock issuance even when its market-to-Bitcoin net asset value (mNAV) ratio falls below 2.5×, reversing its previous pledge .

Strategic financing: This move gives the company greater agility to raise capital and continue buying Bitcoin, even as its stock premium narrows .

Aggressive acquisitions: In the past week, Strategy added 430 BTC (~$51 million), funded via its preferred-share and ATM equity programs .

Risks of dilution: Analysts caution t

- Reward

- 18

- 1

- Repost

- Share

📢 Gate Square Exclusive: #PUBLIC Creative Contest Is Now Live!

Join Gate Launchpool Round 297 — PublicAI (PUBLIC) and share your post on Gate Square for a chance to win from a 4,000 $PUBLIC prize pool

🎨 Event Period

Aug 18, 2025, 10:00 – Aug 22, 2025, 16:00 (UTC)

📌 How to Participate

Post original content on Gate Square related to PublicAI (PUBLIC) or the ongoing Launchpool event

Content must be at least 100 words (analysis, tutorials, creative graphics, reviews, etc.)

Add hashtag: #PUBLIC Creative Contest

Include screenshots of your Launchpool participation (e.g., staking record, re

Join Gate Launchpool Round 297 — PublicAI (PUBLIC) and share your post on Gate Square for a chance to win from a 4,000 $PUBLIC prize pool

🎨 Event Period

Aug 18, 2025, 10:00 – Aug 22, 2025, 16:00 (UTC)

📌 How to Participate

Post original content on Gate Square related to PublicAI (PUBLIC) or the ongoing Launchpool event

Content must be at least 100 words (analysis, tutorials, creative graphics, reviews, etc.)

Add hashtag: #PUBLIC Creative Contest

Include screenshots of your Launchpool participation (e.g., staking record, re

- Reward

- 4

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

19.76K Popularity

56.77K Popularity

65.43K Popularity

93.13K Popularity

4.07K Popularity

9.7K Popularity

172.55K Popularity

24.89K Popularity

89.71K Popularity

31.02K Popularity

218.02K Popularity

12.49K Popularity

13.62K Popularity

3.23K Popularity

231.48K Popularity

News

View MoreOverview of Major Whales: The bullish whales led by "BTC OG Insider Whale" have not adjusted their positions, while the "Shanzhai Air Force Leader" increased their LIT short position to $9.3 million.

3 h

The Farm2 community founded by AI16Z founder Shaw is about to launch the world's first 3D AI Agent

4 h

Solana founder Toly: Instead of buybacks, a long-term capital structure should be built through staking mechanisms

4 h

Deshare launches on-chain stock "IPO subscription" feature, unlocking a new way to participate in IPOs

4 h

Yili Hua: Before the 2026 big bull market, short sellers close early with small losses, and later close with huge and disastrous losses.

5 h

Pin