Search results for "SHELL"

India’s ED targets decade-long crypto Ponzi in 21-location raid

India's ED raided 21 sites tied to 4th Bloc Consultants, alleging a decade-long fake crypto-platform Ponzi that laundered funds via wallets, shell firms, hawala and foreign accounts.

Summary

ED's Bengaluru office searched 21 premises in Karnataka, Maharashtra and Delhi under PMLA, targeting 4th

Cryptonews·2025-12-25 13:06

Tradoor suspected rug pull! Token plummets, team disappears, former employees owe wages, rumors of shell company sale emerge..

TON/BNB Ecosystem Perp Trading Platform Tradoor Rumored to Be a Victim of Malicious Rug Pull

(Background: From Sahara to Tradoor, a review of recent scam coin "fancy decline" tactics)

(Additional context: Bitcoin 70% of dark web trading volume suddenly evaporates: Abacus Market suspected of rug pull)

According to community insiders who leaked to Dongqu, the TON/BNB ecosystem Perp trading platform Tradoor is suspected of experiencing a team rug pull. The insider claims that Tradoor manipulated the self-issued token $TRADOOR through malicious trading, violently pumping and dumping, dropping from $2.4 to $0.7 within two weeks, then violently pumping again to $6.6 to attract buying interest.

> Tradoor

TRADOOR-12,53%

動區BlockTempo·2025-12-16 10:40

Taiwan Fully Bans Xiaohongshu for 1 Year! Government Reveals 3 Main Reasons: Zero Cybersecurity Compliance, Explosive Growth in Fraud, Refusal to Comply with Laws and Regulations

On December 4, the Criminal Investigation Bureau of the National Police Agency under Taiwan's Ministry of the Interior officially announced that, effective immediately, it has issued an "Internet domain name system discontinuation and access restriction" order for the Chinese social media platform "Xiaohongshu" (Little Red Book) APP and related websites, with the ban tentatively set for one year.

(Previous context: Nine Taiwanese companies and three women involved in the "Prince Group" scam empire! Laundering money with cryptocurrency and setting up shell companies in luxury residences.)

(Background supplement: A degree from a 985 university is not as valuable as 10,000 followers—Xiaohongshu is becoming a new hunting ground for cryptocurrency exchanges.)

On December 4, the Criminal Investigation Bureau of the National Police Agency under Taiwan's Ministry of the Interior officially announced that, effective immediately, it has issued an "Internet domain name system discontinuation and access restriction" order for the Chinese social media platform "Xiaohongshu" (Little Red Book) APP and related websites, with the ban tentatively set for one year.

Officials pointed out that this measure is based on Article of the Fraud Crime Prevention Act.

動區BlockTempo·2025-12-04 14:46

Brazil sentenced 14 people for using cryptocurrency and shell companies in a $95 million drug money laundering case.

A federal court in Brazil has sentenced 14 people for laundering more than 508 million reais (approximately 95 million USD) related to international drug trafficking and violent crimes, concluding a years-long investigation into a criminal network operating across multiple states. Two leaders each received sentences of more than

BTC1,21%

TapChiBitcoin·2025-12-03 01:01

Data: GLM falls over 10% in 24 hours, multiple tokens experience a rebound and then retreat.

According to Mars Finance news, Binance Spot data shows that the market has experienced significant fluctuations. GLM has fallen by 10.35% in 24 hours, while multiple tokens have shown a "high rebound and fall" state, with SUPER falling by 5.79% and 6.01%, MAV falling by 5.12%, and ANIME falling by 8.6%. Additionally, SCRT has hit a new low today, with a drop of 5.37%; SXP has reached a new low for the week, with a drop of 47.62%; SHELL and PHA have also hit new lows today, with drops of 6.25% and 8%, respectively.

GLM4,33%

MarsBitNews·2025-12-02 09:39

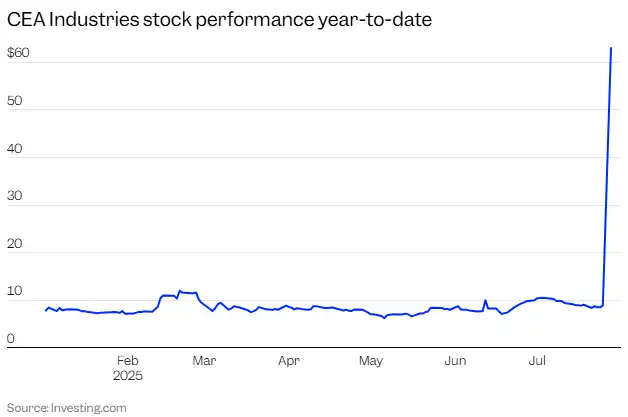

CZ plans to take over the troubled BNB reserve company and apply to replace the CEA board under the name YZi Labs.

The Zhao Changpeng family office YZi Labs launched a board takeover of CEA Industries, highlighting the conflict between encryption capital and traditional shell company governance (Background: CZ: The fall is not the end of the world! Time will go on! The community praises BNB and ASTAR for their resilience) (Additional background: Analyzing the four major impacts of "CZ being pardoned by Trump" on the market: BNB system迎來大浪潮) The festive lights on Wall Street have just been lit, but Nasdaq has already staged a power struggle. Binance founder Zhao Changpeng's family office YZi Labs submitted a proposal to the SEC on the 2nd, requesting the removal of CEA Industries (ticker

BNB0,95%

動區BlockTempo·2025-12-02 04:51

Data: LSK falls over 14% in 24 hours, PHA rises over 5%.

According to Mars Finance news, Binance Spot data shows that the market has experienced significant fluctuations. LSK has fallen by 14.68% in the last 24 hours, while PHA has risen by 5.88% and reached a new high today. In addition, LAZIO, PORTAL, and SOLV have all shown a "pullback" state, with 24-hour declines of 8.37%, 6.98%, and 11.52%, respectively. Among other tokens, VANRY has reached a new low today, while SAGA and SHELL have both hit new lows for the week, with declines of 13.87% and 6.07%, respectively.

MarsBitNews·2025-11-29 15:06

Calvin Ayre has been identified as a client behind the Wirecard 1.9 billion euro fraud case, affecting the Bitcoin SV ecosystem.

The German payment giant Wirecard AG collapsed in June 2020, revealing about 1.9 billion euros (approximately 2.19 billion dollars) in fraudulent Asian trust accounts, and investigations now identify billionaire Calvin Ayre as a key figure in this fraud case. Funds flowed into Ayre's gambling business through multiple international shell companies, while Ayre is a major backer of Bitcoin SV (BSV). This incident highlights the regulatory risks at the intersection of crypto assets and TradFi. Despite the exposure of the incident, BSV's price remained stable, trading at 20.91 dollars at the time of writing, with a slight pump of 1.37% over the past 24 hours. The market's reaction to the associated risks has been limited, but industry experts warn that such fraud could affect investors' trust in emerging assets.

MarketWhisper·2025-11-27 06:52

Vitalik Buterin's new look "Speaking out against FTX": Ethereum is the complete opposite of them, the meaning of Blockchain is that you don't need to trust anyone.

Vitalik Buterin criticized FTX at Devconnect, reiterating Ethereum's "impossible to be evil" trust framework and examining the real challenges of decentralization practices. (Background: Vitalik and the Ethereum Foundation issued a "Trustless Declaration": If decentralization is sacrificed, the blockchain is just an empty shell.) (Additional context: Vitalik warned that "ZK is not a panacea": defense against coercion needs to be complemented by multi-layer structures like MPC, FHE, TEE.) At the Devconnect conference in Buenos Aires, Argentina, in November, with the stage lights still on, Ethereum co-founder Vitalik Buterin pointed directly at the already bankrupt FTX, opening with the core question: Should the crypto world trust the centralized commitment of "do no evil" or build a decentralized mechanism of "impossible to be evil"? Vitalik appeared with a new look and strongly criticized FTX.

ETH1,33%

動區BlockTempo·2025-11-18 04:44

Hong Kong businessman charged with submitting fake investment advisory forms to the SEC for shell companies.

Hong Kong entrepreneur Guanhua "Michael" Su faces prosecution in the US for submitting fake investment advisory forms to the SEC. He and accomplices created fake financial consulting firms to deceive investors, resulting in $211 million in illicit gains before the scheme collapsed.

TapChiBitcoin·2025-11-15 10:33

Japan Exchange Group JPX plans to limit listed companies' encryption Holdings: Regulatory intervention to protect investors

In November 2025, according to Bloomberg, the Japan Exchange Group (JPX) is considering strengthening regulations on large-scale investments in cryptocurrency by listed companies, possibly extending the shell company listing ban to enterprises that shift their business focus to Digital Money Holdings. This motion arises from recent fluctuations in Crypto Assets that have caused investors to suffer substantial paper losses — Japan's largest Bitcoin Holdings company, Metaplanet, has fallen over 75% from its peak in mid-June, while Convano, which transformed from a nail salon, has also dropped about 60% since the end of August. Regulatory intervention aims to prevent listed companies from taking excessive risks and to maintain market stability.

MarketWhisper·2025-11-13 07:46

Spain arrests mastermind of $300 million cryptocurrency pyramid scheme

Spanish authorities have arrested Álvaro Romillo Castillo, known as "Cryptospain," for leading a $300 million cryptocurrency Ponzi scheme defrauding over 3,000 investors. His firm promised 20% annual returns while operating through a network of shell companies. The case has political implications due to alleged contributions to an extreme-right politician's campaign.

TapChiBitcoin·2025-11-08 00:09

How a $300 Million Crypto Scheme Linked a Crypto Kingpin to Spain’s Far Right

Spanish police arrested Álvaro Romillo Castillo, known as "Cryptospain," for leading a $300M pyramid scheme that deceived 3,000 investors.

Castillo's Madeira Invest Club posed as an exclusive fund in crypto and luxury assets but funneled money through offshore accounts and shell firms.

The

BeInCrypto·2025-11-07 21:54

SHELL Confirms Wedge Breakout As Market Watches $0.102 Support

SHELL/USDT has left a long-term downward trend wedge, and this is a prime change of direction in price movement.

The strength of the breakout is evidenced by the fact that the price of the asset is already retesting the support at $0.102 after having fallen 15.4 percent daily.

The next critical

SHELL1,88%

CryptoNewsLand·2025-11-05 19:34

BCH Group Launders 4.5 Billion NTD in Taiwan! "101 Building Gaming Empire" Wang Yutang Detained Pending Investigation

Prince Group of Cambodia involved in money laundering in Taiwan. Taipei District Prosecutors Office uncovered that the group established multiple shell companies, including Lian Fan, to purchase luxury homes and high-end cars to conceal illegal proceeds. On November 4, law enforcement conducted searches and detained 25 executives and employees of the group in Taiwan, seizing illegal funds amounting to 4.5 billion. Gu Shuwen, HR director of Tianxu Company, which is involved in illegal gambling and money laundering, was detained after questioning. On the 5th, Tianxu's responsible person Wang Yutang, along with Huang Jie and Shi Tingyu, who are on the US sanctions list, were sequentially transferred for further investigation.

MarketWhisper·2025-11-05 08:04

The US and UK besiege the BCH group, Singapore family office involved in the "Money Laundering Storm".

In October 2025, the US and UK jointly prosecuted and sanctioned Chen Zhi, the chairman of the Cambodian BCH Group, uncovering the largest cross-border Money Laundering network in Southeast Asia. The case revealed a hidden aspect of Singapore's "family office paradise"—Chen Zhi, using the Singapore family office DW Capital as the hub, achieved fund whitening and image laundering through family offices and shell companies, referred to by US media as "Singapore washing."

As a result, this case has also become a "stress test" for Singapore's financial system, exposing the "double-edged effect" of regulatory vacuum and high trust in Singapore's family office sector. Now, Singapore is accelerating the repair of its systems, speeding up approvals, and strengthening due diligence, seeking a new balance between "attracting genuine capital" and "rejecting gray funds."

Cross-border crackdown: Southeast Asia's largest scam network

On October 14, the United States and the United Kingdom acted in concert to sue and sanction Chen Zhi, the chairman of the Cambodian BCH Group, accusing him of leading cross-border.

BTC1,21%

金色财经_·2025-11-03 12:56

Data: FIL rose over 12%, ZK rose over 22%

According to Mars Finance news, the market has experienced significant fluctuations, based on Binance spot data. FIL has risen by 12.24% in 24 hours, and ZK has increased by 22.22%, reaching a new high today. Meanwhile, AR, ORDI, SHELL, AXL, and WIF also reached new highs today, with increases of 11.08%, 5.77%, 7%, 5.21%, and 5.19% respectively. In addition, ASR and YB are in a "bottoming out and recovering" state, with increases of 7.5% and 5.24% respectively.

MarsBitNews·2025-11-01 14:47

Data: DUSK rise over 7%, BAT rise over 9%

Recently, the market has seen significant fluctuations, with DUSK and BAT rising 7.78% and 9.32% to reach new highs, while DIA and MITO experienced declines of 7.03% and 8.59%, respectively. DASH fell slightly by 3.1%, and FIDA hit a weekly low with a drop of 7.41%. FLM and SHELL showed a recovery in performance, increasing by 5% and 9.37%, respectively.

MarsBitNews·2025-11-01 08:58

$SHELL Gains 28% After Key Technical Breakout – Can It Climb Higher?

MyShell's price has broken key resistance levels, indicating a bullish trend. Technical indicators show increasing buying pressure and investor confidence, reflected in rising market cap. A breakout has yielded significant profit potential, with analysts projecting further gains.

SHELL1,88%

CryptoFrontNews·2025-10-31 18:31

Shell (SHELL) Holds Support At $0.1062 While Testing Major Descending Trendline Resistance

SHELL is trading at $0.1127, marking a 6.7% 24-hour decline, yet remains above the key $0.1062 support level.

The token is testing a descending trendline, with $0.1243 acting as critical resistance for potential breakout confirmation.

SHELL gained 4.8% against BTC and 3.9% against ETH, showing

CryptoNewsLand·2025-10-31 17:36

Bitcoin Tumbles as Fears of an AI Bubble Drag Stocks Down

The digital asset dipped below $107K on Thursday as concerns over excess investment in AI by tech giants triggered a stock market selloff.

Bitcoin Slides as Anxiety Over an AI Bubble Roils Stock Markets

Alphabet and Meta will shell out roughly $93 and $72 billion, respectively, for artificial in

BTC1,21%

Coinpedia·2025-10-30 20:27

India Freezes $271M in Crypto as Forex Web Unravels Across Global Payment Loops

Indian authorities have unleashed a major financial strike, freezing crypto assets worth thousands of crores linked to illegal forex and crypto trades, as the dragnet tightens on global networks funneling funds through shell firms and offshore channels.

India Freezes $271M in Crypto Amid

Coinpedia·2025-10-22 03:34

Encryption reserve companies face obstacles! The three major stock exchanges in the Asia-Pacific region have strict listing controls, and MSCI recommends excluding DAT from the index.

According to Bloomberg, the three major stock exchanges in the Asia-Pacific region are cracking down on cryptocurrency hoarding tools disguised as publicly listed companies, including the strict regulation of digital asset financial company (DAT) in Hong Kong, India, and Australia. Additionally, the index company MSCI has also suggested excluding DAT from the index, putting Metaplanet, which is friendly towards DAT in Japan, in a difficult position.

The exchanges in Hong Kong, India, and Australia strictly regulate the listing of DAT.

Informed sources reveal that in recent months, the Hong Kong exchange has raised questions about the plans of at least five companies seeking to make digital asset financial strategies their core business. According to the regulations of the Hong Kong exchange, if a listed company's assets are primarily composed of cash or short-term investments, it will be classified as a "cash company" and its stocks may be suspended. This move aims to prevent shell companies from using their listing status to obtain funds.

The HKEX spokesperson rejected

ETH1,33%

ChainNewsAbmedia·2025-10-22 02:04

Continuous losses to profitability: Is it harder to replicate OSL's path under the new Web3 phase in Hong Kong?

Jessy, Golden Finance

On June 27, the OSL Group (0863.HK) announced its plan to acquire all shares of the payment company Banxa, with an investment of approximately HKD 486.7 million. On June 26, Hong Kong released the "Hong Kong Digital Asset Development Policy Declaration 2.0", which proposed four strategic directions centered around the "LEAP" framework, where P represents partnerships, emphasizing regional and international cooperation. The essence of OSL's acquisition of Banxa is also focused on the 45 licenses held by Banxa that support its business operations in these global locations, and it aligns with OSL's upcoming plans to vigorously develop PayFi.

According to the financial report information for 2024, the OSL Group achieved profitability in its first year of establishment. The exchange under the OSL Group, OSL, is Hong Kong's first licensed exchange. The earlier OSL Group was previously affiliated with Hong Kong shell king Gao Zhenshun.

金色财经_·2025-10-18 08:05

Nine Taiwanese companies and three women were involved in the "BCH Group" fraud empire! Using Crypto Assets for Money Laundering, shell companies were set up in luxury homes.

The United States and the United Kingdom launched a major strike against the Prince Group in Cambodia, exposing its "Pig-butchering scams" and money laundering schemes, confiscating $15 billion worth of Bitcoin assets. Shockingly, 9 companies and 3 women from Taiwan were implicated, with registered addresses pointing to the luxurious "Peace Garden" in Taipei. (Background: 127,000 Bitcoins confiscated! The U.S. targets the Southeast Asian "Pig-butchering Empire" Prince Group, simultaneously sanctioning the Huaiwang Group.) (Additional context: The New York Times reveals Cambodia's money laundering empire, the Huaiwang Group, the world's largest black gold money laundering operation.) On October 14, the U.S. and U.K. jointly initiated comprehensive sanctions against the Prince Group and its transnational criminal organization (TCO). The U.S. Department of Justice (DOJ) charged the founder of the Prince Group, Chen Zhi, and confiscated approximately $15 billion worth of Bitcoin.

BCH0,21%

動區BlockTempo·2025-10-16 11:55

The world's largest crypto asset seizure case: The US and UK join forces to combat Cambodia's "Pig-butchering scams" empire, freezing 127,000 Bitcoins!

U.S. federal prosecutors, the Treasury Department, and British authorities announced that they seized the largest amount of crypto assets in history during a joint operation against international online fraud, involving up to 127,000 Bitcoins. The operation targeted a multinational conglomerate in Cambodia—Prince Holding Group and its CEO Chen Zhi. Court documents show that the group is a highly sophisticated "Pig-butchering scams" and human trafficking network that laundered billions of dollars through hundreds of shell companies, crypto asset exchanges, and mining operations worldwide, while forcing thousands of victims to engage in fraudulent activities in Cambodian parks.

MarketWhisper·2025-10-15 01:16

Shiba Inu Price Forecast: Min & Max Targets for 2030, 2040, 2050

The cryptocurrency world is eager to know about the future of the Shiba Inu tokens and whether it’s going to finally be able to break past its current price threshold. The token has been living under a shell lately, unable to move beyond a certain price point. With the SHIB army aggressively

SHIB4,79%

TheBitTimesCom·2025-10-01 06:58

The legal reality of RWA Token: Why is the off-chain legal structure more important than on-chain code?

01 It all starts with a story: The abandoned buildings of Detroit and the disillusionment of ownership.

Imagine this scenario: a tenant living in an apartment in Detroit, with mold crawling up the walls and an eviction notice posted on the door. He was told that the building was part of a revolutionary blockchain project called RealT, aimed at democratizing real estate. But when the rent checks stopped cashing and the project came crashing down, he learned a painful lesson: when physical assets are poorly managed and legal ownership is tangled up in a mess of shell companies, the tokens in his digital wallet are worth nothing.

This story is not an isolated case; it is a concentrated manifestation of the early issues in the RWA (Real World Assets) industry. We were promised a true on-chain ownership, but the reality is that many RWA projects are built on unstable legal foundations [1]. The tokens you hold are, many times, merely a representation of rights to the underlying assets.

RWA1,55%

PANews·2025-09-26 00:07

Charlie Kirk shooting suspect apprehended: 22-year-old Tyler Robinson arrested.

Charlie Kirk was shot dead at Utah Valley University, and 22-year-old suspect Tyler Robinson has been arrested. Police found a sniper rifle related to the crime and shell casings engraved with strange writings, prompting an investigation into Robinson's changing political beliefs. Former President Trump has called for the death penalty, and the FBI is still investigating the motives and potential accomplices.

ChainNewsAbmedia·2025-09-12 16:33

Viewpoint: Multicoin, Jump, and DAT are undervalued

Why do we say that the new DAT bureau created by @multicoincap + @jump\_ + @galaxyhq might be underestimated by the market? Here are my personal thoughts:

1) Forward Industries, Inc. ( $FORD ) is a well-established company listed on Nasdaq, but it has a relatively small market capitalization, currently less than 60 million. With 1.71 million shares outstanding, after injecting new operational business through PIPE private equity financing, the burden of the original operating entity is not significant, so the subsequent constraints as a shell are minor.

2) @KyleSamani is like $BTC's @saylor and $ETH's @fundstrat, always a very dedicated evangelist for the technology and narrative of $SOL. This time at the DAT event, his individual...

金色财经_·2025-09-12 08:24

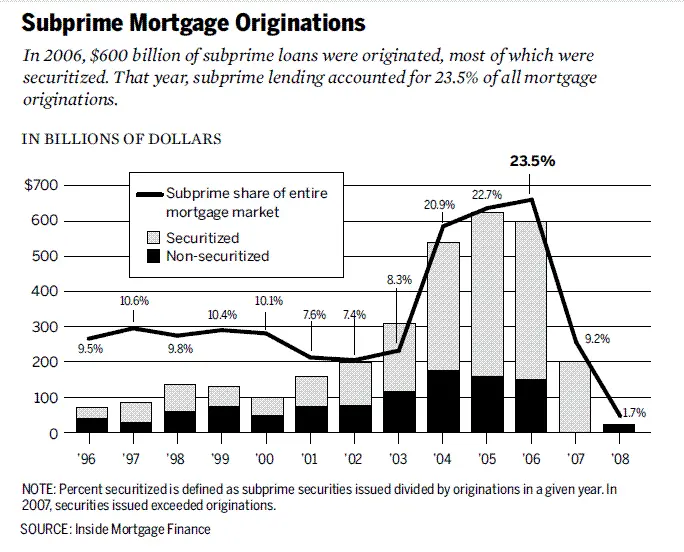

RWA Liquidity Paradox: Will the On-Chain of Billion-Dollar Slow Assets Repeat the Subprime Tragedy?

Author: Tristero Research

Compiled by: Felix, PANews

The slowest assets in the financial sector—loans, real estate, commodities—are being bundled into the fastest market ever. Tokenization promises liquidity, but what it truly creates is merely an illusion: a fully liquid shell encasing a core that lacks liquidity. This mismatch is the RWA liquidity paradox.

In just five years, tokenized RWA has evolved from a $85 million experiment to a $25 billion market, growing 245 times from 2020 to 2025, driven by institutional demand for yield, transparency, and balance sheet efficiency.

BlackRock has issued tokenized government bonds, and Figure Technologies has placed billions of dollars in private credit on-chain, starting from New Jersey.

RWA1,55%

PANews·2025-09-08 08:38

The liquidity paradox of RWA: tying slow assets to fast markets does not make them safer, but rather more dangerous...

Tokenizing illiquid assets from the real world on-chain promises to bring liquidity, yet it also reenacts the financial mismatches of 2008. This contradiction between a liquidity shell and an illiquid core may trigger a faster systemic collapse. This article is based on a piece by Tristero Research, organized, compiled, and written by Deep Tide TechFlow. (Previous context: Financial giant SBI partners with Chainlink: Advancing RWA tokenization in Japan with CCIP) (Background supplement: What does the ideal crypto world look like for "Letting Everything in Reality Go On-Chain" RWA public blockchain Plume?) Background introduction The slowest assets in finance—loans, buildings, commodities—are being tied to the fastest market in history. Tokenization promises liquidity, but in reality, it creates only an illusion: a shell of liquidity.

RWA1,55%

動區BlockTempo·2025-09-07 08:27

Coin-Stock Linkage: The New "Shell" of Web3 Projects

Written by: Lawyer Liu Zhengyao

In the past year, an increasing number of Web3 projects have begun to "step into" traditional financial markets. Instead of taking the slow lane of an IPO, they are opting for the capital shortcut of backdoor listings and mergers and acquisitions. Whether it is Conflux injecting core assets into the Hong Kong-listed company Leading Pharmaceutical, or Tron using the small-cap Nasdaq company SRM Entertainment to rebrand as "Tron Inc.,” and Sui pushing a U.S. stock company to allocate a massive amount of SUI tokens for treasury management, this round of cryptocurrency projects' "stock market paths" is worth a closer look.

The so-called "token-stock linkage" essentially refers to a new valuation realization method for Web3 projects leveraging traditional capital markets. On one side, there is a growing enthusiasm in the token market, while on the other side, the stock market is telling new stories based on themes, involving the project parties, listed companies, and funds in the secondary market.

TechubNews·2025-09-05 07:16

Coin-Stock Linkage: The New "Shell" of Web3 Projects

In the past year, more and more Web3 projects have begun to "enter" the TradFi market. Instead of taking the slow lane of IPOs, they are opting for the capital shortcut of shell mergers and acquisitions. Whether it is Conflux injecting core assets into the listed Hong Kong company Pioneer Pharma, or Tron using the small-cap Nasdaq company SRM Entertainment to change its name to "Tron Inc.", and Sui promoting the allocation of huge amounts of SUI Tokens by U.S. stock companies for treasury management, this round of crypto world projects' "stock market paths" is worth a closer look.

The so-called "coin-stock linkage" essentially refers to a new way of valuation realization for Web3 projects by leveraging traditional capital markets. On one side, the enthusiasm in the token market is heating up, while on the other side, the stock market is telling new stories by leveraging themes. Under the resonance of the project parties, listed companies, and funds in the secondary market, a synchronous surge in coin prices and stock prices occurs in a short period. Taking Tron as an example, it is a reverse merger.

金色财经_·2025-09-05 03:48

When slow assets meet a fast market, the liquidity paradox of RWA.

Written by: Tristero Research

Compiled by: Deep Tide TechFlow

Background Introduction

The slowest assets in the financial sector—loans, buildings, commodities—are being tied to the fastest markets in history. Tokenization promises liquidity, but what is actually created is merely an illusion: a shell of liquidity surrounding a non-liquid core. This mismatch is referred to as the "Real World Assets (RWA) Liquidity Paradox."

In just five years, RWA tokenization has transformed from an $85 million experiment into a $25 billion market, achieving a "245-fold growth between 2020 and 2025, mainly driven by institutional demand for yield, transparency, and balance sheet efficiency."

BlackRock has launched tokenized government bonds.

RWA1,55%

TechubNews·2025-09-05 02:41

When slow assets meet a fast market, the liquidity paradox of RWA.

Author: Tristero Research

Compiled by: Deep Tide TechFlow

Background Introduction

The slowest assets in finance—loans, buildings, commodities—are being tied to the fastest market in history. Tokenization promises liquidity, but what is actually created is merely an illusion: a shell of liquidity wrapping a non-liquid core. This mismatch is referred to as the "real world asset (RWA) liquidity paradox."

In just five years, RWA tokenization has surged from an $85 million experiment to a $25 billion market, achieving a "245-fold increase between 2020 and 2025, primarily driven by institutional demand for yield, transparency, and balance sheet efficiency."

BlackRock has launched tokenized government bonds, Figu

RWA1,55%

COINVOICE(链声)·2025-09-05 00:55

The Secret Unveiled by a Bunch of Grapes: RDA and RWA, Why Suddenly Exploding in Popularity?

Have you ever thought that one day houses, stocks, or even a bunch of grapes could become a type of digital token, like a "digital certificate," confirming rights and enabling efficient circulation on the Blockchain? Recently, the concept of these digital assets has suddenly exploded in popularity, becoming a hot topic in the finance and technology circles—this is RWA (Real World Assets on-chain) and RDA (Real Data Assets).

RWA is about putting real-world assets—houses, photovoltaic power stations, gold, agricultural products—into a digital shell through blockchain technology, forming programmable and transferable digital asset certificates. The transparency and traceability of blockchain make the rights confirmation and transfer of these assets more secure and efficient. For enterprises, it is like opening up a new financing channel: allowing assets with originally low liquidity to be revitalized, improving transaction efficiency, reducing intermediary costs, while attracting more investors.

Of course, opportunities and risks.

RWA1,55%

TechubNews·2025-08-29 11:23

Continuous losses to profitability: Is it harder to replicate OSL's path in Hong Kong's new Web3 phase?

Jessy, Golden Finance

On June 27, the OSL Group (0863.HK) revealed its plan to acquire all shares of the payment company Banxa, investing approximately 486.7 million HKD. On June 26, Hong Kong released the "Hong Kong Digital Asset Development Policy Declaration 2.0", which proposed four strategic directions centered around the "LEAP" framework, with P representing partnerships, emphasizing regional and international cooperation. The essence of OSL's acquisition of Banxa is also focused on Banxa holding 45 licenses that enable it to operate in these regions globally, which aligns with OSL's upcoming plans to vigorously develop PayFi.

According to the financial report information for 2024, OSL Group achieved its first year of profitability since its establishment. OSL, the exchange under OSL Group, is Hong Kong's first licensed exchange. Previously, OSL Group was affiliated with Hong Kong shell king, Gao Zhenshun.

SAAS16,91%

金色财经_·2025-08-29 04:33

SHELL Holds $37M Market Cap As Price Consolidates Within Defined Range

$SHELL trades at $0.1396 with 6.8% gains over the past seven days.

Support stands at $0.1298, resistance at $0.1412, guiding potential price action.

Market cap is $37 million, highlighting its small size in AI and Big Data tokens.

$SHELL has recently gained popularity within the cryptocurrency ma

SHELL1,88%

CryptoNewsLand·2025-08-28 16:34

Breaking News: Binance earns coins, Plasma USDT quota increased to 1 billion coins, 250 million coins were snapped up in 5 minutes.

(Background Supplement: Binance announces USDC lending promotion "4% annual interest," can the 12% savings promotion be arbitraged?) Binance has announced an increase in the total subscription limit for the Plasma fixed-term product to 1 billion USDT. Subscribing USDT will earn daily rewards in USDT, along with XPL rewards after TGE. The second batch quota (250 million USDT) opened for subscription at 17:00. However, it was fully subscribed in about 5 minutes. The subsequent quota of 500 million USDT will be announced separately. Related Reports: Binance Thailand CEO's Viewpoint: The encryption travel plan is very bold! Leading Thailand towards financial innovation. BNB continues to hit new highs + multiple institutions endorsement, is Binance also looking to go public by way of a shell? <Breaking News> Binance earns coin Plasma USDT quota raised to 1 billion, 250 million snapped up in 5 minutes.

動區BlockTempo·2025-08-22 10:36

RWA without Liquidity is just a digital shell — a life-and-death test for small and medium-sized enterprises.

The article discusses the challenges of Real World Assets (RWA) in terms of Liquidity, highlighting the issues faced by small and medium-sized enterprises and how to enhance the market operational efficiency of RWA by establishing value anchoring mechanisms and Liquidity frameworks. It suggests using professional RWA accelerators and smart contracts technology, through means such as asset splitting and protocol mechanisms, to provide Liquidity support for small and medium-sized enterprises, enabling effective circulation of assets.

RWA1,55%

TechubNews·2025-08-18 10:32

The story of "coin stocks" Who is footing the bill?

The stock market and the coin market, which used to look at each other with disdain, have finally progressed from being in court to being warm and affectionate.

A few years ago, when it came to the mainstream stock market's view on the coin market, it was perhaps hard to find a word of praise; even a neutral "let each take their own path" would be considered respectful. The force of action is mutual, and the coin market's rejection of the stock market is also visibly apparent. Most people in the coin circle believe that the lofty stock market has no merits either; it's all a zero-sum game—who is more noble than whom?

But as the year arrived, the two major groups unexpectedly went through the process of meeting, getting to know each other, and falling in love, quickly reaching the intersection of their interests. The crystallization of this love, the coin-stock, thus came into being.

Unlike the tokenization of US stocks to be moved onto the blockchain, coin stock enterprises successfully package tokens in the form of stocks, transforming into shell companies while still being fundamentally about capital narratives.

This time, it's not the people from the coin circle who are paying the bill, but

BTC1,21%

金色财经_·2025-08-13 12:19

Continuous losses to profitability: Is OSL's path hard to replicate in Hong Kong's new Web3 phase?

Jessy, Golden Finance

On June 27, OSL Group (0863.HK) revealed its plan to acquire all shares of payment company Banxa for approximately HKD 486.7 million. On June 26, Hong Kong issued the "Hong Kong Digital Asset Development Policy Declaration 2.0," which proposed four strategic directions centered around the "LEAP" framework, where P represents partnerships, emphasizing regional and international cooperation. The essence of OSL's acquisition of Banxa is also focused on the 45 licenses held by Banxa that support its operations in these global locations, and it aligns with OSL's upcoming plans to vigorously develop PayFi.

According to the financial report information for 2024, the OSL Group achieved profitability in its first year after establishment. The OSL exchange under the OSL Group is the first licensed exchange in Hong Kong, and the earlier OSL Group was formerly affiliated with Hong Kong's shell king, Gao Zhenshun.

SAAS16,91%

金色财经_·2025-08-11 07:34

BitBridge Capital is going public through a shell company with OTC code BTTL, aiming for a Nasdaq listing and betting on a Bitcoin treasury strategy.

BitBridge Capital Strategies announced the completion of a reverse merger with Green Mountain Merger Inc., expected to log in to the OTC market under the code BTTL by the end of Q3, and plans to transition to NAS. This Bitcoin-native enterprise emphasizes no traditional business burdens and focuses on expanding the Bitcoin economic ecosystem, with a core strategy of building a long-term Bitcoin reserve and financial products based on sound monetary principles. Its upcoming Bitcoin collateral loan product "Respect Loan" features long terms and low interest rates, aiming to avoid the fluctuation risks of encryption loans. CEO Paul Jaber declared that they will "bridge the gap between TradFi and the Bitcoin standard." This move comes at a time when the Bitcoin treasury strategy trend is facing scrutiny, with Galaxy Digital CEO Michael Novogratz warning that the industry may have "topped out," and competition will shift towards the scalability capabilities of existing enterprises.

BTC1,21%

MarketWhisper·2025-08-06 08:22

Alts micro-strategies' stock prices slump 50% Who is paying for the "fake" feast?

Jessy, Golden Finance

The "microstrategy" trend of altcoins will begin in May 2025.

Companies that mimic micro-strategies similar to altcoins like ETH, TRX, SOL, XRP, DOGE, and BNB are springing up like mushrooms after rain.

Unlike the strategy of purchasing Bitcoin through MicroStrategy's single issuance of convertible bonds, the operational pathway is roughly as follows: the stakeholders behind these altcoins buy a shell company on the US stock market and then announce the purchase of a certain token as a reserve. Both the stock price and the token price will experience a surge in the short term.

However, after a brief frenzy in stock prices, these altcoins' micro-strategies have all faced a decline in stock prices. For instance, the price of the Ethereum version of MicroStrategy, Sharplink, reached nearly $80 per share after the announcement, and now the stock price is less than $20 per share. Currently, the largest institution holding Ethereum, Bitmine, has seen its stock price on July 3.

金色财经_·2025-07-31 13:50

China cracks down on a $20 million Bitcoin Money Laundering case: Will Crypto Assets face stricter regulations in China?

China has long maintained a cautious and even restrictive attitude towards Crypto Assets, but recently, a significant piece of news has once again sparked market attention on its monetary policy direction. According to local reports, China has dismantled a Bitcoin Money Laundering group involved in a case amounting to 140 million RMB (approximately 19.3 million USD). The core figure in this case is a former employee of a video platform in Haidian District, who abused his power to transfer funds to offshore Crypto Assets exchanges through fake bonuses and shell companies, ultimately laundering the money into Bitcoin. This incident not only reveals new methods of digital asset Money Laundering but also raises concerns about whether China's stance on Crypto Assets will deteriorate as a result.

MarketWhisper·2025-07-31 09:36

Is Russia using the Kyrgyzstan encryption exchange to evade sanctions? The annual trading volume has surged to 4.2 billion USD, raising many questions.

A recent report by UK blockchain intelligence company TRM Labs reveals that Russian entities are using a network of cryptocurrency exchanges registered in Kyrgyzstan to circumvent international sanctions and procure dual-use materials for the Ukraine war. The investigation found that these exchanges exhibit characteristics of shell companies (reusing the same addresses/founders/contact information) and are linked to on-chain activities associated with the sanctioned Russian exchange Garantex. The report notes that since the outbreak of the Russia-Ukraine war in 2022, Kyrgyz crypto trading volume has skyrocketed from $59 million to $4.2 billion in the first seven months of 2024, with nearly 100% related to Russian activities. This article provides an in-depth analysis of the sanctions evasion operational model, on-chain evidence, and global regulatory response recommendations.

VSN1,65%

MarketWhisper·2025-07-30 05:45

The richest Chinese person manipulates the BNB treasury, and a nameless small-cap stock rises 600%.

On July 28, the long-rumored BNB treasury "Orthodox Army" finally landed in the hands of a small nicotine e-cigarette company named VAPE - this small-cap stock, which previously had a market capitalization of less than 10 million dollars, unexpectedly became the lucky recipient personally chosen by the richest Chinese.

The news was leaked in advance, causing the stock to surge over 1800%+ before the market opened. After the opening, the stock price jumped from Friday's closing price of 8.88 USD to an intraday high of 82.88 USD.

According to insiders who spoke to Rhythm BlockBeats, Binance's investment team began preparations for the acquisition of a shell company and private financing for the BNB treasury project as early as the beginning of July. Another insider indicated that to prevent the risk of "rat trading" before the shell resources were finalized, the team had simultaneously purchased multiple small shell companies in the U.S. stock market, only finalizing the target VAP at the last moment.

BNB0,95%

PANews·2025-07-29 11:21

Load More