Search results for "OWN"

Com2uS, cancels own shares worth 58.1 billion KRW... Shareholder return officially begins

Mobile game developer Com2uS announces the cancellation of approximately 646,000 treasury shares, accounting for about 5% of the company's total issued shares, to enhance shareholder value. This move is expected to reduce the number of outstanding shares and potentially have a positive impact on future stock prices. The company stated that it will continue to explore diversified shareholder return policies, demonstrating a willingness for long-term cooperation with shareholders.

TechubNews·8h ago

Morning Minute: Bitcoin Grinds Up Amidst Venezuela Conflict

_Morning Minute is a daily newsletter written by __Tyler Warner__. The analysis and opinions expressed are his own and do not necessarily reflect those of Decrypt. Subscribe to the Morning Minute __on Substack__._

GM!

Today’s top news:

Crypto majors see big green, up 6-9% YTD; BTC

Decrypt·12h ago

Stop gambling within the "Fortune" framework: Don't ask AI whether to buy or not, first talk to it about your thinking and current situation.

The article discusses how quick actions in response to problems can lead to misconceptions and emphasizes the importance of thinking before acting. By engaging in conversations with AI, individuals can identify their own strengths and establish an effective execution system framework. Reflection and summarization help to extract applicable decision-making models to enhance market responsiveness. Ultimately, understanding oneself and leveraging personal strengths are key to success.

PANews·15h ago

Europe to Trump: “We Won’t Repeal Our Rules” — The Tech Clash Escalates in 2026

Tensions between Brussels and Washington are heating up. The European Union has made it clear that it won’t bow to pressure from President Donald Trump’s administration and is determined to enforce its own digital rules — even if it risks triggering a trade conflict with the United States.

Brussels

Moon5labs·18h ago

1.34 Billion NFTs And No Buyers: Is Gaming The Only Thing Keeping The NFT Market Alive?

_NFT supply has hit 1.34B as sales plunge. Digital art fades, while gaming NFTs thrive through real utility and play-to-own adoption._

The NFT space is currently facing a harsh reality check. A new year has begun, and the total number of NFTs minted across all blockchains has surged to a

LiveBTCNews·01-03 16:50

If the strategy is truly good, why not make money yourself? Three papers reveal the harsh truth behind selling indicators.

In the world of cryptocurrency trading, many people often believe in specific "trading indicators." However, numerous studies have pointed out that most trading strategies claiming to have stable backtested profits are not necessarily proven effective by the market but are instead the survivors that were selected. It's like taking a hundred questions from last year's college entrance exam and scoring full marks; it doesn't mean you'll perform equally well on this year's exam. This is the "overfitting" trap of trading strategies. A more realistic question is, if a strategy truly performs so well, why not leverage it yourself instead of selling it externally or sharing it publicly?

After all, truly effective strategies are often limited by capacity; as capital increases, the advantage is often consumed by one's own trading behavior and market reactions.

Trading indicator developers often only showcase their best results to raise funds.

A paper published by the American Mathematical Society points out the bias in backtesting, revealing that under traditional backtesting frameworks, certain technical strategies can indeed generate significant positive results in historical data.

ChainNewsAbmedia·01-02 08:15

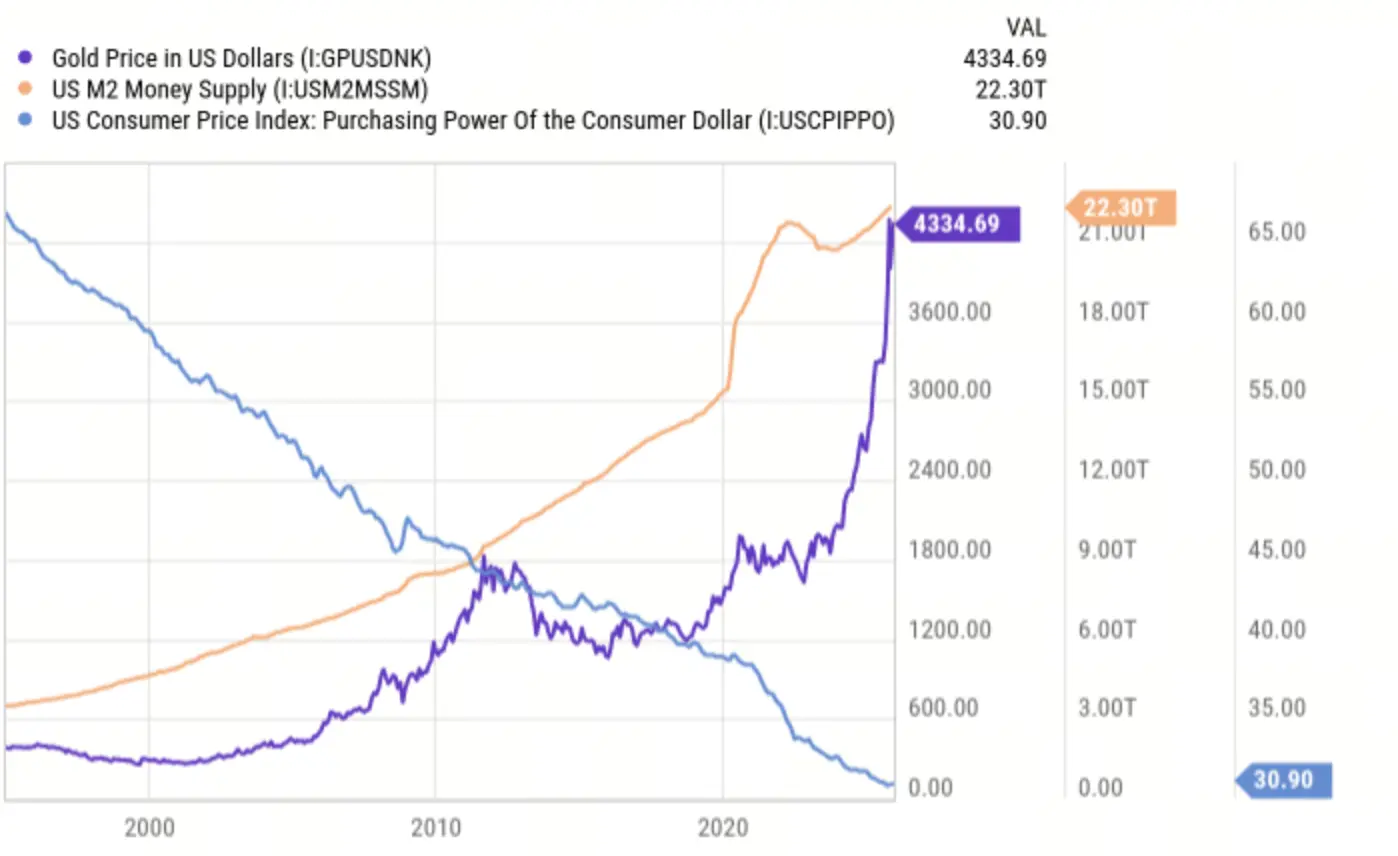

Why Gold Could Cross $5,000 in 2026 – And How Much You Should Own, Inspired by Ray Dalio

Gold has delivered an extraordinary 67% gain in 2025, far outpacing its long-term average annual return of ~8%. With persistent inflation, ballooning government debt, and geopolitical uncertainty, I predict gold will cross the $5,000 per ounce milestone in 2026.

CryptopulseElite·2025-12-31 08:17

Trump "Made in America" Delay! Trump Mobile $499 Gold Phone Delayed Again

Trump Mobile delays the $499 gold-colored phone "T1" originally scheduled for delivery by the end of the year. The company promised in June to manufacture in the United States to compete with Apple and Samsung, but supply chain analysts question its feasibility. Ironically, Trump is demanding Apple to produce in the U.S. and threatening a 25% tariff, yet his own company is unable to fulfill its promise.

MarketWhisper·2025-12-31 08:02

Vitalik may not have realized that transitioning Ethereum to PoS actually planted a financial "landmine"

After shifting consensus from PoW to PoS, $ETH now has staking yields, creating an "maturity mismatch" arbitrage opportunity between one's own LST liquid staking tokens and LRT liquidity re-mortgage tokens.

As a result, leveraging, cyclic lending, and maturity arbitrage of ETH staking yields have become the largest application scenarios for lending protocols like Aave, and also form one of the foundations of current on-chain DeFi.

That's right, the biggest application scenario for DeFi today is "arbitrage."

But don't panic, and don't be discouraged; traditional finance is the same.

The problem is, ETH's maturity mismatch hasn't brought additional liquidity or other value to the blockchain industry, or even to the Ethereum ecosystem itself, but only ongoing selling pressure. After all, institutions earning ETH staking yields will eventually cash out.

The selling pressure, ETH buying, and deflation form a micro

PANews·2025-12-31 04:17

ChatGPT Predicts the Best Cryptos to Buy in January (Hint: SOL and XRP Do Not Make the List)

January usually strips the market down to what actually matters. The noise fades, short-term trades lose appeal, and attention shifts to projects that can stand on their own.

This list is built with that mindset. No momentum chasing. No familiar large caps by default. Just three projects where

CaptainAltcoin·2025-12-30 14:35

【Madman on Trends】The market has become extremely quiet, and a trend reversal will occur very soon.

Madman says…

The market, whether in terms of sentiment or trading volume, has already reached an extremely quiet state. Mainstream coins like Bitcoin are stuck in a narrow range, sideways within a very small zone. This indicates that a trend reversal will occur soon (perhaps in early January). Based on the current trend, the probability of a downward spike is higher than a direct rise or fall. The strategy is to continue holding and wait for a new low to buy the dip.

The sharp rise in precious metals already indicates that inflation is on the way, so just wait for the water to come in 2026. As for everything else, let time do its work. Bitcoin will continue to prove its irreplaceable value and incomparable consensus advantage.

_Statement: This article only reflects the personal opinions of the author and does not represent the views or stance of Block. All content and opinions are for reference only and do not constitute investment advice. Investors should make their own decisions and trades. The author and Block will not be responsible for any direct or indirect losses resulting from investors' trading activities._

区块客·2025-12-30 09:21

Abu Dhabi giant IHC abandons building its own public chain and shifts to Ethereum Layer 2 to develop institutional-grade blockchain infrastructure.

Abu Dhabi, the capital of the United Arab Emirates, has once again made a major announcement in the blockchain industry. The UAE's largest corporate group with a market value of over $240 billion — International Holding Company (IHC), officially announced the abandonment of its original plan to develop its own Layer 1 blockchain, opting instead for an Ethereum-based Layer 2 solution. This shift was driven by the active promotion of the Ethereum developer community — especially the Lambda Class team. For the global blockchain industry, this move not only signifies institutional trust in Ethereum Layer 2 solutions but also marks an important step towards the Middle East region becoming a "blockchain financial center."

Embracing Layer 2: Security, scalability, and market trust become key factors

According to Ethereum core contributors

ChainNewsAbmedia·2025-12-30 07:43

I built a bot to "earn passive income" on Polymarket: Here's my setup logic

A developer shares how to build a Polymarket trading bot that captures BTC 15-minute market price fluctuations, turning $1,000 into $1,869 within a few days, with a backtested return of 86%. The article details the bot's construction logic, backtesting methods, and its limitations.

(Background: Leading prediction market Polymarket announces self-built L2, is Polygon's flagship gone?)

(Additional context: How to achieve an annualized 40% return through Polymarket arbitrage?)

Table of Contents

Bot Construction Logic

Backtesting

Limitations of Backtesting

Infrastructure

A few weeks ago, I decided to build my own Polymarket bot. The full version took me several weeks.

I am willing to invest

BTC0,78%

動區BlockTempo·2025-12-30 02:35

2026 Space Race Heats Up, Three Musk SpaceX Space Concept Stocks at a Glance

According to the latest video analysis released by (The Economist) on December 29, 2025, the world is rapidly moving into a new strategic phase. Entering 2026, space is no longer just infrastructure for communication, navigation, and observation, but is officially regarded by military planners around the world as one of the core domains of future warfare. Among them, several space-related concept stocks associated with Musk's SpaceX may become key points of observation.

War is shifting to space, and orbital capabilities are becoming the key to victory

The Economist points out that U.S. military planning has officially incorporated space into its core concept of future warfare. If conflicts with Russia or China occur in the future, the U.S. believes that maintaining operational capabilities in space will be a decisive factor in determining the outcome.

This not only includes protecting its own satellites but also encompasses the ability to counteract adversary space assets when necessary.

ChainNewsAbmedia·2025-12-29 10:04

A roundup of the absurd news in the crypto world in 2025: founders faking death, stablecoin companies issuing 300 trillion USD are just small cases

The extraordinary crypto market of 2025, from the US President issuing coins to epic liquidations, this article reviews the most outrageous and absurd moments of the year, including founders going missing, hackers getting hacked, fake death scams, and other laughable incidents.

(Previous summary: 2 million USD evaporated in 45 days: an OG's darkest moment and rebirth declaration)

(Additional background: Scam victims mocked by police "how are you still alive," mother and daughter devastated and took their own lives! Behind it is an old jewelry merchant laundering USDT)

Table of Contents

On TGE day, the founder went missing, claiming to have lost the main coin multi-signature in northern Myanmar

zkLend hacker mistakenly clicked on a phishing site, leading to a second theft of stolen funds, hacker requests cooperation with zkLend to recover the funds

Zerebro founder faked death and released a timed farewell letter

Previously stole project funds, Clanker partner revealed offline at a conference and dropped their vest

動區BlockTempo·2025-12-29 03:20

Bitcoin's "Ten Years of Sharpening the Sword": 278x Returns Outperform Gold, but the Furious Bull Market Is Now a Thing of the Past?

A century-long debate about store of value reached a new climax at the end of 2025: data shows that since 2015, Bitcoin's price has surged by 27,701%, while silver and gold have only increased by 405% and 283% respectively. However, after reaching a historic high of $125,100, Bitcoin has now retraced to around $87,800, a decline of about 30% from its peak this year. In the face of volatility, Bitwise Chief Investment Officer Matt Hougan proposed a compelling new narrative: Bitcoin's future will be a steady 10-year "gradual rise," rather than the past boom and bust cycles. This contest between "digital gold" and physical precious metals, along with the turning points in Bitcoin's own development stages, together define the core contradictions and future direction of the current market.

BTC0,78%

MarketWhisper·2025-12-29 01:39

What Are Intent-Based Transactions in DeFi

Introduction

Risk, volatility, uncertainty, liquidation are a few words that strike our minds when we talk about decentralized finance (DeFi). The innovation that claimed to liberate humanity from the shackles of conventional banking can be hazardous for users in its own way. Due to these very

BlockChainReporter·2025-12-27 14:34

3 altcoins could reach new ATHs in January 2026

As another year comes to a close, expectations for a strongly growing market in the coming year are spreading widely within the investor community. While Bitcoin often leads the rally of altcoins, some have established their own positions thanks to unique factors.

Coinphoton has

TapChiBitcoin·2025-12-27 02:04

The White House Power Expansion Proposal and the "Ultimate Puzzle" of US Cryptocurrency Tax Regulation

The IRS has submitted proposals for international standards on digital asset reporting and taxation to the White House, enabling access to cryptocurrency transaction information of taxpayers on overseas exchanges. This article will analyze the institutional background of the CARF framework, the evolution of the current US tax system, and the compliance implications for various market participants. The article is based on a piece by TaxDAO, organized, translated, and written by Foresight News.

(Previous summary: Why does the US embrace crypto? The answer may lie in the $37 trillion debt)

(Additional background: The most revenue-collecting US president in history, how the Trump family turned political influence into their own treasury)

Table of Contents

Introduction

1 White House reviews new regulations, targeting global crypto tax sources

2 CARF ushers in the global crypto tax "CRS 2.0" era

3 US crypto regulatory framework: gradually moving towards a

動區BlockTempo·2025-12-26 17:00

Memecoin – The Shameful Hall: The 10 Craziest Tokens of 2025

2025 begins with an incumbent president launching their own token just three days before the inauguration, and ends with the discovery that one of the most talked-about "resurgence stories" of the year is actually controlled by dozens of large wallets.

Between these two milestones, memecoin has transformed from a joke

TapChiBitcoin·2025-12-26 10:06

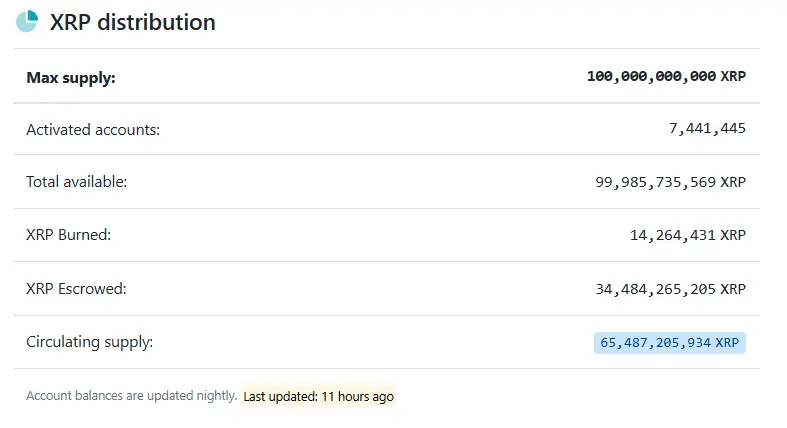

Expert Says 99% of People May Never Own 1 XRP: Here’s Why

An XRP community pundit has suggested that 99% of the global population may never be able to own up to 1 full XRP token.

Notably, XRP continues to face sharp market swings, yet some community figures see the current phase as a chance to buy at lower

XRP11,08%

TheCryptoBasic·2025-12-26 09:50

What are stablecoins? When will they be available in Taiwan? Can they be used to receive salaries?

Since the United States passed the GENIUS Act, which incorporates USD stablecoins into the financial system, various regions have begun evaluating their own national currency stablecoins. The Financial Supervisory Commission stated that if the Virtual Asset Management Regulations are successfully legislated, the New Taiwan Dollar stablecoin could officially launch as early as June or July 2026. What exactly is a stablecoin? Can it be used to receive salaries? How does it differ from Bitcoin? This article compiles comprehensive information to help you understand this financial tool that is about to change the payment ecosystem.

MarketWhisper·2025-12-25 06:22

Read Messari's 100,000-word report on 60 encryption trends for 2026 in 10 minutes.

This article summarizes from Messari's 100,000-word annual report, combining AI and human insights, and outlines the following 60 encryption trends for 2026.

1. If L1 does not have real growth, encryption money will increasingly flow towards Bitcoin.

2. ETH is currently still the "younger brother" of Bitcoin, not an independent leader. ETH has support from institutions and enterprises, and can earn alongside Bitcoin, but it is not yet fully able to stand on its own.

3. The correlation between ZEC and Bitcoin has dropped to 0.24, serving as a privacy hedge against Bitcoin.

4. Application-specific currencies (such as Virtuals Protocol, Zora) will become an emerging trend in 2026.

Take Virtuals Protocol as an example to introduce application-specific currency:

When a user creates an AI agent, a token exclusive to the agent will be issued.

PANews·2025-12-24 04:03

Behind the 30% fall in computing power: A guide to on-chain data verification for Bitcoin miner capitulation

As the Bitcoin network's computing power curve turns downward in early 2025, the market's interpretation instantly polarizes. On one side is the media's portrayal of a "Mining Farm winter" and a "Capitulation wave," while on the other side is the historical data presented by institutions, suggesting this could be a precursor to the market hitting bottom. Amidst this information vortex, technical practitioners possess a unique privilege — they do not have to choose which narrative to believe, but can bypass all intermediary interpretations and directly question the data itself. On-chain data is the most honest ledger Bitcoin leaves for validators; every fluctuation in hashrate and every miner's income and expenditure decision is solidified in the public blocks and transaction records. The following content discusses how to exercise this privilege. This is not another market perspective, but a methodology on how to build your own validation framework using code, transforming the vague "miner pressure" into clear, computable, and monitorable indicators, ultimately establishing clarity amidst the chaotic market noise.

BTC0,78%

TechubNews·2025-12-24 04:00

Don't waste every loss, the "Sisyphus Revelation" of the crypto market.

In 2025, the crypto market experienced severe fluctuations, causing many to incur heavy losses. This article explores how to turn losses into growth opportunities, establish a strict risk management system to avoid repeating past mistakes, and ultimately build one's own moat in the market. This article is derived from a piece written by thiccy and organized, translated, and authored by PANews.

(Previous summary: Michael Saylor is once again calling for Bitcoin to reach a million or ten million dollars: waiting for the day when Strategy controls 5% or 7% of the total BTC supply)

(Background information: Arthur Hayes predicts Bitcoin will bottom out and rebound in January: The Fed will implement a form of QE, I have

BTC0,78%

動區BlockTempo·2025-12-24 02:00

TaskOn Brings White Label Services and CEX Mode in Latest Update

TaskOn v2.7 introduces a customizable White Label service for Web3 projects, allowing brands full control under their own domains. The update enhances user experience, integrates CEX competitions, and includes improved Boost and Quest systems for better engagement.

BlockChainReporter·2025-12-23 23:04

"Balancer Hacked: Update on the $128 Million Case" Gnosis Chain announces the initiation of a Hard Fork to recover the stolen funds.

Gnosis Chain official X account announced the launch of a Hard Fork to recover the funds lost in the Balancer hack.

(Previous summary: Balancer issues a "final ultimatum" to the hacker with 96 hours to return the money: otherwise, all means will be used to find you)

(Background Information: Berachain: Victims of the "Balancer Hacking Incident" must check their own status and promptly retrieve ETH and BERA)

Less than a month after the major market crash on October 1011, the decentralized finance (DeFi) protocol Balancer V2 suffered a severe hacking attack in early November, where hackers exploited a rounding error in the precision of the protocol's Composable Stable Pools.

動區BlockTempo·2025-12-23 16:35

The leader of the prediction market, Polymarket, announced the establishment of its own L2. Is Polygon's ace gone?

The leader of the prediction market, Polymarket, announced that it will migrate from Polygon and launch an Ethereum Layer 2 network called POLY. This "breakup" reflects a re-evaluation of the underlying network following the rise of the Application Layer, as well as a microcosm of structural changes in the encryption industry.

(Previous context: Betting on "OpenAI releasing a new model" on Polymarket, the market questions the existence of insider arbitrage)

(Background information: Polymarket announces its return to the United States: approved by the CFTC, operating as a "designated contract market" intermediary trading platform)

Table of Contents

A "breakup" that is not unexpected.

Explicit and implicit economic contributions

Why now? The answer is not hard to guess.

A piece of news about the prediction market leader Polymarket has sparked

USDC-0,02%

動區BlockTempo·2025-12-23 14:50

When Tokyo Affects Bitcoin: Build Your Macro Fluctuation Warning System with Open Source AI

At the end of 2024, the Bitcoin market experienced a textbook-like macro shock. Under the expectation of interest rate hikes by the Central Bank of Japan, over a trillion dollars in "Yen Arbitrage Trading" began to Close Position globally, causing the price of Bitcoin to fall by more than 5% within 48 hours. This event revealed a profound change: Crypto Assets have become a part of the global Liquidity chain, and their price Fluctuation is increasingly driven by complex TradFi mechanisms. For developers and tech practitioners, waiting for traditional financial analysis has become outdated, while expensive professional terminals are out of reach. Fortunately, the maturity of current Open Source large language models and localized deployment technologies empowers us to build our own real-time AI-driven analysis engines. This article will detail how to start with hardware selection, choose and optimize a dedicated financial analysis model, and design a complete workflow capable of automatically processing news, interpreting data, and outputting structured risk warnings.

BTC0,78%

TechubNews·2025-12-23 09:42

Beyond Growth Metrics: How the Next Crypto Cycle Will Measure Exchanges by Trust and Resilience

By the time 2025 arrived, the crypto market had largely moved past its fixation on headline growth. User numbers, trading volumes, geographic expansion – these figures still matter, but they no longer impress on their own. For many market participants, especially those who lived through

LiveBTCNews·2025-12-23 09:10

Is the 4-year cycle of Bitcoin still in effect? Notable signals after halving

The number "4" has long been an iconic element in the cycles of the crypto market.

Historically, Bitcoin has often moved very closely with its own halving model. In each four-year cycle, the supply shock after halving has repeatedly become a factor.

BTC0,78%

TapChiBitcoin·2025-12-22 12:37

Latam Insights: Brazil's B3 to Issue Stablecoin, Libra's Launch Detailed

Welcome to Latam Insights, a compilation of the most relevant crypto news from Latin America over the past week. In this week’s edition, Brazil’s B3 stock exchange announces its own stablecoin, a whistleblower details Libra’s launch, and Nubank studies buying a bank.

Historic: Brazil’s B3 Stock

Coinpedia·2025-12-22 07:34

Blue Fox Notes | Recklessly sweeping up 3.86 million Ether, where does Tom Lee's confidence come from?

Tom Lee is optimistic about Ethereum, believing it will become the core settlement layer of future finance, driving up the value of Ether. He pointed out that institutional adoption is still in its early stages, and Ethereum has more practical utility than Bitcoin. He predicts that 2026 will be a big year for Ethereum and provides multiple price forecasts, emphasizing that investors should make their own decisions.

区块客·2025-12-22 07:26

Northern Data sells its Bitcoin mining business, regulatory documents reveal that the buyer is held by Tether executives.

The German listed company Northern Data sold its Bitcoin mining division Peak Mining in November last year, with the buyer being a British Virgin Islands company controlled by Tether executives, for an amount of approximately 200 million USD. This move marks Tether's integration of its Bitcoin mining business into its own holding company, which is interconnected with its major shareholder position in Rumble.

ChainNewsAbmedia·2025-12-22 04:33

Galaxy: Is the Universal L1 dead? You're wrong.

Source: Galaxy; Translated by: Golden Finance

In the past few weeks, there has been a constant stream of news about new "enterprise-level" blockchains designed for specific application scenarios. DTCC is tokenizing securities held at DTC on Canton. Stripe has launched a testnet for its payment-focused blockchain, Tempo. Robinhood is building its own L2 layer for storing real-world assets.

For crypto natives, these developments may trigger a familiar anxiety: the cypherpunk values that underpin cryptocurrencies are being diluted. The permissionless, generalized blockchains that facilitated the mainstream adoption of cryptocurrencies will be bypassed by existing regulated institutions with distribution channels and balance sheets.

If tokenization, real-world assets, and stablecoins are increasingly deployed on private or semi-permissioned tracks, what role does decentralized protocol have left? This is a

L1-0,32%

金色财经_·2025-12-22 04:12

The migration path of Binance's stablecoin landscape

Author: danny; Source: X, @agintender

In the world of cryptocurrency, what truly determines victory or defeat is never the code, but the game of liquidity, power, and regulation. The rise and fall of BUSD is not a tragic tale of a stablecoin, but a financial war about how exchanges attempt to "unify the world."

When BUSD was pushed onto the historical stage, it carried not only a narrative of compliance, but also Binance's ambition to reshape the stablecoin order through high-pressure tactics — by enforcing exchange rates and merging trading pairs, directly swallowing the depth of its competitors into its own ledger.

The "automatic conversion" of 2022 was a textbook-level blitzkrieg; while the regulatory iron fist of Valentine's Day 2023 caused this seemingly impeccable empire to collapse in an instant. The dual nature of BUSD, the shadow-like Binance-Peg, and the misalignment of regulatory boundaries together constitute its downfall.

金色财经_·2025-12-22 02:38

Why is Monero (XMR) Price Pumping Hard Today?

Monero has been quietly doing its own thing while the rest of the market chops around. On the daily chart, the XMR price keeps holding its structure, printing higher highs and higher lows, even when momentum across crypto fades.

At the time of the chart snapshot, Monero is trading near $452.96, s

CaptainAltcoin·2025-12-21 20:35

Blue Fox Notes | Sweeping 3.86 million Ether without hesitation, where does Tom Lee's confidence come from?

Tom Lee is optimistic about Ethereum, believing it will become the core settlement layer of future finance, driving up the value of Ether. He pointed out that institutional adoption is still in its early stages, and Ethereum has more practical utility than Bitcoin. He predicts that 2026 will be a big year for Ethereum and provides multiple price forecasts, emphasizing that investors should make their own decisions.

区块客·2025-12-21 07:26

CryptoQuant: Tom Lee loudly bullish! but was slapped in the face by his own fund Fundstrat due to a "bearish research stance"

Tom Lee strongly advocates for Bitcoin and Ethereum, but the Wall Street financial strategy fund Fundstrat he is backed by has released a very different report. The reasons for the two different scenarios are due to different risk control considerations.

(Background: When Ethereum fell below $2800, BitMine added an additional 30,000 ETH, holding over 3.3% of the supply)

(Additional background: Ondo Finance teamed up with LayerZero to launch a "Securities Cross-Chain Bridge": seamless transfer of tokenized stocks and ETFs, now supporting Ethereum and BSC)

Nicknamed "Crypto forever bullish," Tom Lee repeatedly announced in financial media interviews that Bitcoin and Ethereum would break their all-time highs by January 2026. However, the internal report from Fundstrat, where he works, shows a completely opposite outlook.

動區BlockTempo·2025-12-20 09:20

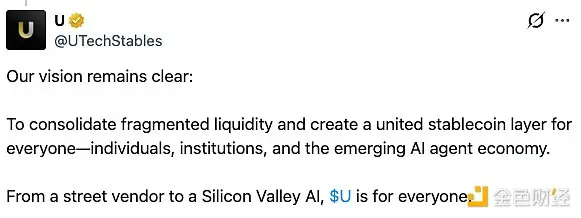

Binance Hegemony Rise and Fall: From BUSD's "Unified" Approach to $U's "Conquest" in the Stablecoin War

In the crypto world, what truly determines victory or defeat is never the code, but the game of liquidity, power, and regulation. The rise and fall of BUSD is not just a tragic story of a stablecoin, but a financial war over how exchanges attempt to "unify the world."

When BUSD was brought onto the stage of history, it carried not only a compliance narrative but also Binance's ambition to reshape the stablecoin order through heavy-handed tactics—by enforcing exchange rates and merging trading pairs, directly swallowing competitors' depth into its own ledger.

The 2022 "automatic conversion" was a textbook-level blitzkrieg; meanwhile, the regulatory iron fist on Valentine's Day 2023 caused this seemingly invincible empire to collapse in an instant. The twin BUSD, the shadow-like Binance-Peg, and the misalignment of regulatory boundaries together form its Achilles' heel.

But the story is not over yet.

From FDUSD

PANews·2025-12-19 12:08

The Hidden and Concerns Behind Web3 Super Unicorn Phantom

Author: Zhou, ChainCatcher

The crypto wallet market in 2025 is witnessing a brutal battle for market share.

As the meme coin craze subsides, high-frequency trading users are flocking to exchange-based wallets with lower fees and stronger incentives. In the face of the closed-loop ecosystem of exchanges, independent players' survival space is continuously shrinking.

Against this backdrop, Phantom's performance has attracted attention. Earlier this year, it raised $150 million, pushing its valuation to $3 billion. Since Q4, the project has launched its own stablecoin CASH, a prediction market platform, and a crypto debit card, attempting to find new growth points outside of trading business.

$3 billion valuation, from starting on Solana to multi-chain expansion

Looking back at Phantom's development history, in 2021, the Solana ecosystem just exploded, on-chain

SOL0,48%

金色财经_·2025-12-19 11:13

XRP News: ETF funds have been flowing in for 30 consecutive days, attracting $1.14 billion. Why does the XRP price remain weak?

As the US spot Bitcoin ETF continues to attract market attention, the spot XRP ETF is quietly reaching its own milestone. According to SoSoValue data, the US spot XRP ETF has achieved net capital inflows for 30 consecutive trading days, with total assets under management (AUM) surpassing $1.14 billion. Interestingly, the steady influx of funds contrasts sharply with XRP's recent price weakness, and this phenomenon of "buying the dip" is often seen as a sign of smart institutional investors making long-term positions. This article will analyze the flow of funds, leading products, and interpret the potential implications of this divergence for XRP's future trend.

MarketWhisper·2025-12-19 02:28

Charles Hoskinson: Trump Crypto Ventures Have Been 'Frustrating'—But Others Won't Talk About It

In brief

Charles Hoskinson believes Trump mishandled crypto policy by launching his own meme coin instead of focusing on policy.

He argued that Trump's actions turned crypto into a partisan issue and derailed bipartisan momentum in Congress.

Hoskinson said later disputes over a proposed U.S. cr

Decrypt·2025-12-18 22:09

New York Times: What Trump is hiding behind embracing Crypto

A series of crypto companies breaking industry boundaries have gone public, attracting investors and simultaneously pushing market risks to high levels. Over 250 listed companies are accumulating cryptocurrencies, with leveraged borrowing expanding. Deregulation and the Trump family’s business empire are intertwined, transmitting crypto market risks throughout the entire financial system. This article is based on a piece by The New York Times, compiled, edited, and written by Foresight News.

(Previous summary: Trump ventures into clean energy! TMTG announces full stock merger with TAE Technologies to create a "nuclear power plant," DJT jumps 22%)

(Additional background: The most money-raising US president in history, how the Trump family turns political influence into their own treasury)

Table of Contents

Capital Frenzy: An Out-of-Control Crypto Gamble

Flash Crash Horror:

TRUMP1,56%

動區BlockTempo·2025-12-18 13:15

Morning Minute: Robinhood Pushes Deeper Into Prediction Markets

Decrypt's Art, Fashion, and Entertainment Hub.

Discover SCENE

Morning Minute is a daily newsletter written by Tyler Warner . The analysis and opinions expressed are his own and do not necessarily reflect those of Decrypt. Subscribe to the Morning Minute on Substack .

GM!

Today's top news:

Decrypt·2025-12-18 13:12

The drama of "clearing incentives" before TGE is playing out again: How should Web3 practitioners protect their own tokens?

Original Authors: Huang Wenjing, Chen Haoyang

Everything happens on the eve of TGE

In the world of Web3, the most dramatic moments often occur in the weeks leading up to the project's TGE (Token Generation Event).

Mankun has recently received numerous inquiries from employees of crypto projects: complaints about project teams reclaiming token options at TGE, dismissing core team members, and so on. Such phenomena are quite common:

Developers working diligently for months, about to launch their tokens, suddenly lose all incentives due to "organizational adjustments";

Early advisors who were promised "token rewards and co-investment shares," only to be told after the project's popularity surged that "the model is not finalized" and "compliance is pending approval," causing repeated delays;

Others refer to the clear statement in the white paper about a "10% team incentive pool," but when the vesting period arrives, they are told it’s due to "performance not met" or "triggering non-compete clauses."

PANews·2025-12-18 05:06

Trump invests 120 million USD in a big gamble: WLFI allocates 5% of national treasury tokens to expand USD1 stablecoin market share

Trump family-supported World Liberty Financial (WLFI) proposes to allocate 5% of the national treasury funds (about $120 million) to promote its own stablecoin USD1 in response to fierce market competition. However, community voting results are divided, with opposition voices prevailing. WLFI hopes to attract liquidity through subsidy strategies, but concerns about its long-term effectiveness and regulatory risks still exist. This proposal will test its political influence and trustworthiness.

動區BlockTempo·2025-12-18 03:10

Amazon reportedly plans to invest hundreds of millions of dollars in OpenAI, heavily promoting its own chips Trainium to challenge NVIDIA's dominance

OpenAI is reportedly planning to raise funds at a valuation of $750 billion, with Amazon potentially investing over $10 billion to deepen collaboration on Trainium chips.

(Background: The third anniversary of ChatGPT: The end of the large model war, where is the true moat?)

(Additional context: ChatGPT launches group chat: up to 20 people can chat simultaneously, Taiwan gets early access (two-step activation))

According to The Information, OpenAI is in talks with Amazon for a new round of hundreds of millions of dollars in funding, with a valuation reaching $750 billion (about NT$24 trillion). If the deal is finalized, this company will remain one of the highest-valued private companies globally.

Valuation jumps three levels

Just two months ago, OpenAI was valued at $5,000

動區BlockTempo·2025-12-18 02:50

Securitize announces the launch of an "on-chain" stock trading marketplace in Q1 next year: real listed company equity will be tokenized on the blockchain, and users can also participate in DeFi interactions.

Asset tokenization platform Securitize announces that it will launch a product called "Stocks on Securitize" in the first quarter of 2026. The company claims this is the world's first fully compliant, fully on-chain trading platform for real listed company stocks, aiming to bring traditional financial markets closer to Web3 infrastructure, allowing investors to directly own and trade shares of truly public listed companies via blockchain.

(Background: What are the future and risks of financial asset tokenization? An in-depth analysis of RWA in a 73-page report by global securities regulators)

(Additional background: Huili Securities partners with Securitize Japan to issue tokenized securities! Allowing retail investors to participate in Sony's film "The Island")

Asset tokenization platform Securitize announced today (17) via the X platform that it will launch in 20

動區BlockTempo·2025-12-17 14:00

Load More