Search results for "NET"

Bitcoin ETFs Slip Into Outflows as Ethereum, XRP and Solana Gain Momentum

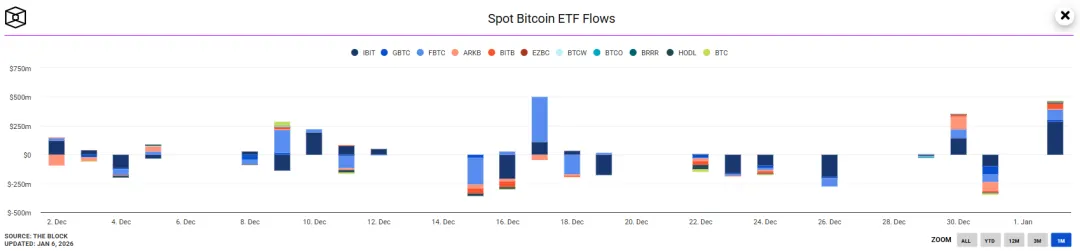

• Bitcoin ETF flows reversed on Jan. 6 after a strong early 2026 start.

• BlackRock’s IBIT remained the only Bitcoin ETF with net inflows.

• Ethereum, XRP, and Solana ETFs continued attracting institutional capital.

Bitcoin ETF flows shifted negative on Jan. 6, ending a brief streak of str

CryptoFrontNews·7h ago

$1.06 Billion in Days: Ethereum Just Flashed Crucial Market Signal - U.Today

Ethereum experienced significant net outflows of $1.06 billion this week, indicating potential accumulation. Major entities are staking ETH for long-term positioning. Despite recent price fluctuations, Ethereum's updates aim to improve transaction efficiency.

UToday·20h ago

Is TON a savior or a source of risk? The emerging concerns behind Telegram's rapid growth

Author: Zen, PANews

Telegram recently once again came into the spotlight due to a piece of financial information directed at investors: revenue is on the rise, but net profit has turned downward. The key variable here is not user growth slowing down, but the downward price movement of TON, which has "penetrated" asset-side fluctuations into the profit and loss statement.

Selling over 450 million USD worth of TON tokens has led the outside world to re-examine the利益关系与边界 of Telegram and the TON ecosystem.

Due to the low price of TON, Telegram's revenue surged sharply but still resulted in net losses

According to FT reports, in the first half of 2025, Telegram achieved a significant increase in revenue. Unaudited financial statements show that the company's revenue in the first half of the year reached 870 million USD, a 65% increase year-on-year, significantly surpassing the 525 million USD in the first half of 2024;

TON-0,5%

区块客·20h ago

Mike Novogratz Warns Crypto Treasury Firms on Shareholder Value

Galaxy Digital's CEO Mike Novogratz warns that cryptocurrency treasury companies must evolve from passive asset holders to operational businesses to avoid significant discounts to net asset value. He emphasizes the need for clear narratives and strategies to provide real shareholder value.

ICOHOIDER·01-09 11:56

Bitcoin Slides Toward $90,000 After Rejection at Key Resistance

Bitcoin is trading lower on Friday, drifting toward the $90,000 level after failing to break through a key resistance zone. The pullback follows weakening institutional demand, as US-listed spot Bitcoin exchange-traded funds have recorded net outflows this week. At the same time, on-chain data

ICOHOIDER·01-09 11:50

How to find the next 100x coin using TVL trading volume? Three key strategies for DeFi data mining

On-chain data is real-time, transparent, and tamper-proof. TVL measures the total value locked but is easily affected by token prices and should be combined with USD net inflow. Trading volume tracks DEX and perpetual contracts, with market share changes being more important than absolute values. Open interest indicates liquidity. Fees are paid by users, while revenue remains with the protocol. Three steps: focus on continuous growth, track stock and flow, consider token unlocks.

HYPE-3,85%

MarketWhisper·01-09 05:23

XAI losses are expanding alongside investments, Musk: Ultimately to support the operation of humanoid robot Optimus

According to internal documents reviewed by Bloomberg, Musk's xAI further expanded its losses in Q3 2025. As data center construction, AI talent recruitment, and software development accelerate across the board, xAI is rapidly depleting the company's cash reserves. However, company executives still emphasized during investor meetings that xAI's long-term goal is to develop an AI system capable of "self-operation," which will become the core brain of the humanoid robot Optimus in the future.

Losses Continue to Widen, Cash Outflows Rapidly Increase

Internal financial documents show that in Q3 2025 ( as of September ), xAI posted a net loss of $1.46 billion, higher than the $1 billion in Q1. In the first nine months, cash expenditures have reached $7.8 billion, reflecting the company's ongoing expansion in data center construction, AI hardware and software development, and high-level talent recruitment, burning cash.

ChainNewsAbmedia·01-09 04:33

XRP ETF ends eight consecutive weeks of inflows, with a first-time net outflow of $40 million

The US spot XRP exchange-traded fund (ETF) experienced a noticeable correction after maintaining net capital inflows for eight consecutive weeks. According to market data platform SoSoValue, on January 7, the US spot XRP ETF saw approximately $40 million in net outflows, officially ending a nearly continuous upward capital trend since its listing in mid-November last year. This also adds a variable to the recently relatively stable cryptocurrency ETF market.

Single Fund as the Main Cause of Outflows

Further analysis of capital flows reveals that the net outflow was almost entirely due to a single product. The TOXR fund issued by 21Shares saw as much as $47.25 million in redemptions on that day, becoming the key factor in turning the overall data negative. In comparison, other issuers performed relatively stably, including Canary,

ChainNewsAbmedia·01-09 03:26

XRP Today News: Despite ETF Outflows, Why Does the $3 Target Remain Resilient?

Entering 2026, XRP experienced a strong start but has recently come under pressure due to a net outflow of $40.8 million in the US spot ETF market for the first time in a single day. The price has been declining for three consecutive days, testing the key psychological support level of $2.0. However, short-term fluctuations have not reversed institutional optimism for its long-term prospects. On one hand, the steady progress of the Market Structure Act on Capitol Hill provides a potential decisive policy boost for the entire crypto industry; on the other hand, the actual application demand for XRP in cross-border payments and other fields continues to grow. Analysts believe that if the $2.0 level can be maintained, XRP's medium-term (4-8 weeks) target still points to $3.0, and the long-term (8-12 weeks) target could even reach the previous high of $3.66.

MarketWhisper·01-09 03:00

Bitcoin ETFs Experience Huge Withdrawals As the Crypto Market Experiences Turbulence

The cryptocurrency investment market experienced a significant shift as US spot Bitcoin exchange-traded funds (ETFs) recorded their largest single-day net outflow since inception on January 7. Data from SoSoValue reveals a staggering $486 million exit from these investment vehicles, highlighting the

BlockChainReporter·01-08 15:04

XRP ETFs log first outflow after 36‑day inflow streak, SoSoValue data shows

U.S. spot XRP ETFs saw their first net outflow on Jan. 7 after 36 days of inflows, raising concerns about potential shifts in institutional demand. The outflow, while notable, is small compared to overall inflows. Future trends remain uncertain.

XRP-0,23%

Cryptonews·01-08 14:06

"A steel coin falling from the sky belongs to him"—Uncovering the crimes and downfall of Cambodia's "Crown Prince" Chen Zhi

Writing by: Fish CoolFish

"There is a saying in Cambodia: if a coin falls from the sky, it must belong to the Taizi Group." Netizens in Cambodia expressed this way. This may be an exaggeration, but it is enough for us to glimpse the power of the Taizi Group in Cambodia.

However, with the heavy blows from multiple countries, this "house of cards" built on bones and fraud has collapsed suddenly.

On January 7, according to the Cambodia-China Times, Taizi Group boss Chen Zhi was arrested in Cambodia and has been deported back to China to undergo investigation by relevant authorities. This "business prodigy," who once frequented luxury car fleets, had a private jet at home, and even bought Picasso paintings for money laundering, ultimately could not escape the law's net.

Just last October, the U.S. Department of Justice accused Chen Zhi of orchestrating online scams, causing billions of dollars in losses to victims worldwide, and announced the seizure of assets worth over 140

BTC0,27%

PANews·01-08 12:41

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

The US Bitcoin Spot ETF saw a massive capital inflow yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts attribute the recent capital outflows primarily to

BTC0,27%

区块客·01-08 11:30

Ethereum spot ETF experienced a net outflow of $98.45 million after 3 trading days of inflow

The US Ethereum spot ETF market turned to net outflows after three trading days, with short-term supply and demand experiencing another fluctuation.

According to SoSoValue data, as of January 7 (local time), the US Ethereum spot ETF market experienced a single-day net outflow of $98.45 million.

After three consecutive trading days of capital inflows on the 2nd ($174.43 million), 5th ($168.13 million), and 6th ($114.74 million), the trend reversed to net outflows on that day. As short-term buying momentum slowed, the total net inflow amounted to $12.69 billion.

Looking at the fund flows of each ETF on that day, only Franklin EZET recorded a net inflow of $2.38 million. On the other hand, six ETFs experienced net outflows: ▲ Grayscale ETHE (–$52.05 million), ▲ Fidelity FETH (–$13.29 million), ▲ Grayscale ETH (–$130...

TechubNews·01-08 08:34

Gate Research Institute: Cryptocurrency Market Fluctuations and Consolidation | Aave Horizon RWA Market Net Deposits Surpass $600 Million

Cryptocurrency Asset Overview

BTC (-2.13% | Current Price 90,887 USDT)

BTC entered a consolidation phase after a sharp rise and pullback on the 1-hour chart. The price found support around $91,000, with a short-term attempt to recover towards MA5 and MA10, but overall it remains trading around MA30.

GateResearch·01-08 07:35

Prince Group Chen Zhi: From Net Cafe Dropout to Billion-Dollar Fraud Empire – The Dramatic Fall in 2026

Prince Group Chen Zhi, the enigmatic founder and chairman of Cambodia's Prince Group, was arrested in Cambodia and extradited to China on January 7, 2026, marking the collapse of one of Southeast Asia's most notorious alleged fraud networks.

BTC0,27%

CryptopulseElite·01-08 06:12

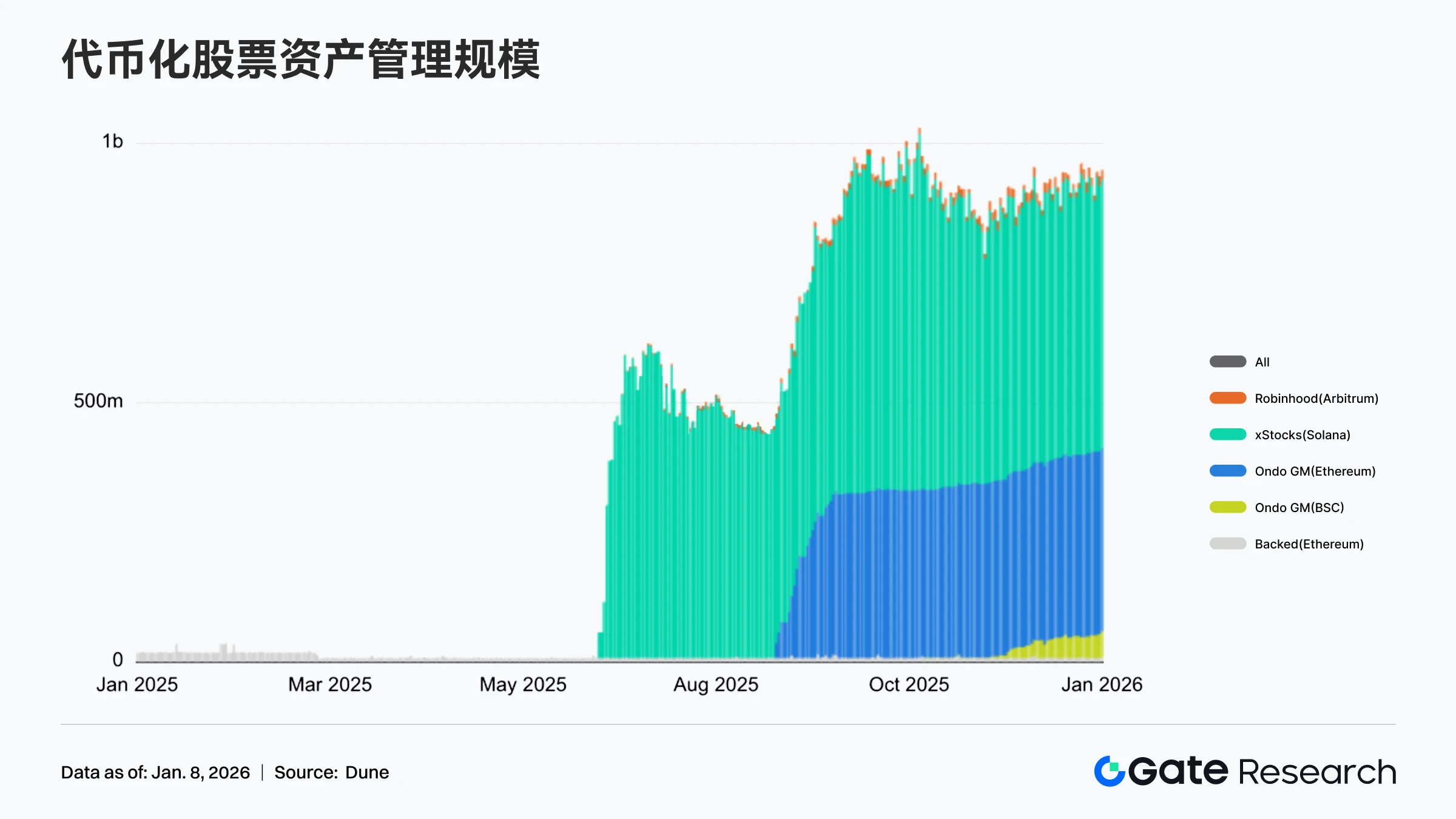

Gate Research Institute: Tokenized Stock AUM Surpasses $1 Billion | Nike Liquidates NFT Business Assets

Summary

BTC and ETH maintain oscillation and recovery, with the trend yet to be confirmed. Funds are shifting preference towards low-volatility and mid-to-long-term narrative assets.

Aave Horizon RWA market net deposits have surpassed $600 million, with institutional funds continuously entering.

Tokenized stock asset management scale has exceeded $1 billion, with on-chain securities accelerating expansion.

Nike sold RTFKT, completing a phased liquidation of its Web3 business attempt.

Polymarket introduces real estate prediction trading, accelerating coverage of real economic variables.

CONX, APT, and STRK will unlock approximately $25.23 million, $21.26 million, and $11.10 million worth of tokens respectively over the next 7 days.

Market Analysis

Market Commentary

BTC Market — After a spike and pullback on the 1-hour chart, BTC entered a consolidation phase, with the price

GateResearch·01-08 05:40

WisdomTree exits XRP ETF competition! Four companies share a 1.25 billion market pie

WisdomTree withdraws its spot XRP ETF application under SEC Rule 477, citing a current decision not to proceed with the issuance. The filing was submitted in December 2024 and no shares have been sold. The remaining four issuers in the XRP ETF market have received a net inflow of $1.25 billion since November. Canary, Bitwise, Franklin Templeton, and Grayscale will have exclusive access to the market.

MarketWhisper·01-08 05:15

2026 New Year's Day Crash Insider! Wintermute Dumps 2654 Bitcoins Triggering a Sell-Off

During the 2026 New Year's period, market maker Wintermute deposited a net of 2654 BTC into the exchange during the thinnest liquidity period, choosing late-night hours in Europe and America when liquidity was truly vacuumed, causing Bitcoin to drop from 92,000 to 88,000. The community questioned market manipulation, but the CEO claimed it was inventory management. Wintermute has been involved in continuous controversies recently, transferring 700 million before the liquidation in October 2025.

BTC0,27%

MarketWhisper·01-08 04:11

Visa's crypto credit card annual spending soars by 525%, crypto payments迎来 "pragmatism" turning point

According to on-chain data dashboard statistics from Dune Analytics, the net consumption of crypto credit cards associated with Visa in 2025 skyrocketed from approximately $14.6 million at the beginning of the year to $91.3 million at the end of the year, an increase of 525%.

Behind this astonishing growth, the widespread adoption of stablecoins and the emergence of innovative banking applications on high-performance public chains like Solana are key driving forces. It marks a shift in cryptocurrency from speculative assets and digital gold to "digital cash" that can be used in daily life, and mainstream adoption may have reached a critical point. Despite short-term market fluctuations, this trend provides fundamental support for Bitcoin, Ethereum, and the entire payment network beyond price.

MarketWhisper·01-08 02:53

KOSPI Composite Stock Price Index breaks through 4600 points during trading... Samsung Electronics and SK Hynix lead the charge to "reach a new all-time high"

KOSPI( on the Korea Composite Stock Price Index, on January 7, 2026, was driven by a rally in U.S. tech stocks, breaking through the 4,600-point mark for the first time during trading, then fluctuating repeatedly, and finally closing at 4,551.06 points, once again setting a new record for the highest closing price.

This rise is interpreted as benefiting from the major U.S. stock indices rallying last night after major tech companies announced artificial intelligence)AI( investment plans. Especially at the world's largest electronics trade show "CES 2026" held in Las Vegas, Nevada, NVIDIA CEO expressed an optimistic outlook on the memory semiconductor industry, which pushed the Philadelphia Semiconductor Index up for three consecutive days, directly boosting the prices of semiconductor-related stocks in South Korea.

Foreign investors net bought approximately 12.516 trillion won on the Korea Exchange, leading the index higher. Notably, Samsung Electronics' stock price broke through 140,000 won per share during trading for the first time, SK

TechubNews·01-07 15:28

BlackRock absorbs selling as U.S. Bitcoin ETFs slip into first 2026 outflow

U.S. spot Bitcoin ETFs experienced their first net outflow of 2026, led by withdrawals from Fidelity and Grayscale, despite BlackRock's iShares Bitcoin Trust seeing inflows. Institutional interest remains, with Morgan Stanley planning new Bitcoin and Solana ETFs.

Cryptonews·01-07 13:06

Bitcoin spot ETF attracts nearly $700 million, marking the largest single-day net inflow in 3 months

The cryptocurrency market in 2026 is off to a strong start, with Bitcoin spot ETFs attracting $697 million, reaching the highest record in nearly a year, indicating that institutional investors are returning to the market. In two days, inflows exceeded $1.16 billion, and risk appetite has rebounded. Ethereum spot ETFs also performed well, attracting $168 million. Market sentiment has improved, but retail investors remain cautious.

区块客·01-07 12:31

PancakeSwap Records Another Month of CAKE Supply Reduction

PancakeSwap continued its deflationary trend in December 2025, with a net burn of 1,785,740 CAKE tokens, reducing total supply by 0.512%. This trend, driven by farming rewards and trading fees, strengthens token economics and reflects a commitment to sustainable supply management.

CAKE2,48%

ICOHOIDER·01-07 11:20

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

The US Bitcoin Spot ETF saw a massive capital inflow yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts attribute the recent capital outflows primarily to

BTC0,27%

区块客·01-07 11:15

Dogecoin ETFs Net Inflow Turns Positive in Early 2026, Fueling 30% Price Rebound

Dogecoin ETFs net inflow has flipped decisively positive to start 2026, recording $2.3 million on January 2 alone and continued accumulation in subsequent sessions, reversing months of stagnation.

DOGE-0,4%

CryptopulseElite·01-07 09:51

Bitcoin Today News: Trump Seizes Venezuela's Oil, Is BTC Hedging Demand Taking Off?

Bitcoin is consolidating today around $92,800. Trump announced that Venezuela will transfer 30 million to 50 million barrels of oil. The ETF recorded a net inflow of $471 million on January 2, the largest since December. The Crypto Fear & Greed Index rebounded to 49 points, reaching a new high in October.

MarketWhisper·01-07 08:05

[Korean Stock Market Closing] Korea Composite Stock Price Index closes higher for the 4th consecutive day… Foreign investors net buy 1.2 trillion KRW, semiconductor and transportation equipment stocks perform strongly

The Korean stock market, driven by optimistic expectations for the AI industry and foreign capital inflows, has risen for four consecutive days to 4,551.06 points on the KOSPI. Despite some Asian stock markets declining due to the impact of China-Japan trade frictions, the transportation and semiconductor sectors performed strongly. The KOSDAQ index declined for two consecutive days, mainly due to selling pressure on machinery and electrical electronics stocks. The Korean won against the US dollar remains strong, and international oil prices have fallen. The US stock market rose, while the Japanese and Hong Kong markets declined.

TechubNews·01-07 07:35

XRP surges 25% at the start of the year, outperforming Bitcoin; four key reasons why it becomes the "hottest trading" in 2026

The beginning of 2026 saw a significant sector rotation in the cryptocurrency market. Ripple's payment token XRP surged by 25% in the first week of the year, outperforming Bitcoin's 6% increase and Ethereum's 10% rise during the same period. CNBC hosts called it the "hottest crypto trading of the year." Behind this strong performance are multiple positive factors, including continuous net inflows into spot ETFs, improvements in on-chain fundamentals, positive social sentiment, and Ripple's ongoing global partnerships and regulatory progress.

Meanwhile, the recent massive funding received by Elon Musk's xAI company is drawing significant market attention and capital toward the artificial intelligence sector, further highlighting the unique appeal of "traditional giants" like XRP, which possess clear practical value and regulatory progress, in the current market environment.

MarketWhisper·01-07 06:09

[Spot ETF] XRP·SOL continuous inflow for 6 consecutive trading days, DOGE·LTC·HBAR stagnate

In the US altcoin spot ETF market, XRP and Solana continue their streak of inflows, while Dogecoin, Litecoin, and Hedera show stagnant capital.

According to SosoValue, as of January 6 (local time), the US XRP spot ETF market experienced a total daily net inflow of $19.12 million.

Since December 29, it has maintained inflows for six consecutive trading days, with the total net inflow expanding to $1.25 billion.

▲Franklin XRPZ ($7.35 million) ▲Canary XRPC ($6.49 million) ▲Bitwise XRP ($3.54 million) ▲Grayscale GXRP ($1.75 million) confirmed net inflows, while ▲21Shares TOXR showed no change in capital flow.

The total trading volume was $58.92 million, and the total net asset size of XRP spot ETFs reached 16

TechubNews·01-07 05:06

XRP Today's News: Market Structure Bill Vote Imminent! XRP Bullish Structure Remains Steady, Returning to $3 Could Be Just Around the Corner?

As the U.S. Senate Banking Committee is scheduled to review and vote on the key Digital Asset Market Structure Bill on January 15, 2026, the XRP market is holding its breath. Driven by optimistic expectations, XRP's price surged to $2.4154 on January 6, reaching a new high since November last year, followed by a slight correction due to profit-taking. Despite short-term volatility, XRP spot ETF continues to see strong capital inflows — with a net inflow of $1.25 billion since listing, far surpassing the Bitcoin ETF during the same period — along with positive fundamentals supporting a medium-term bullish outlook. Market attention is focused on upward targets of $3.0 and even $3.66.

MarketWhisper·01-07 03:24

Telegram revenue soars 65% to $870 million! Toncoin becomes the engine, $500 million bond freeze casts a shadow

According to unaudited financial statements obtained from the UK Financial Times, the crypto communication giant Telegram's revenue soared to $870 million in the first half of 2025, a year-on-year increase of 65%. Among them, approximately $300 million in revenue comes from an "exclusive agreement" closely related to the ecosystem cryptocurrency Toncoin, marking a profound reshaping of its revenue structure by crypto business.

However, behind the impressive revenue is an embarrassing net loss of $222 million, mainly due to the impairment of the held Toncoin. Meanwhile, about $500 million in corporate bonds have been frozen at the Central Securities Depository of Russia due to Western sanctions against Russia, casting a geopolitical shadow over Telegram's financial prospects and IPO plans.

TON-0,5%

MarketWhisper·01-07 02:35

Bloomberg: Discord has secretly filed for an IPO, teaming up with Goldman Sachs and Morgan Stanley to rush for a U.S. stock listing

Popular social app Discord has secretly submitted an S-1 to go public, collaborating with Goldman Sachs and JPMorgan Chase to accelerate the IPO.

(Background: Elon Musk's net worth approaches $750 billion, the first in history! Court restores sky-high compensation, SpaceX IPO sparks imagination)

(Additional background: Tether reiterates: We will return to the US market! Targeting institutional clients, but not following Circle's IPO)

Bloomberg citing sources reports that popular social software Discord has secretly filed an IPO application with the U.S. Securities and Exchange Commission (SEC), expected to list on the US stock market this year. People familiar with the matter told Bloomberg that Goldman Sachs (Goldman Sachs) and JPMorgan Chase

動區BlockTempo·01-07 02:25

$697 million in a single day massive inflow! Bitcoin ETF sees its strongest institutional buying in three months

The beginning of 2026 has seen a "good start" for US spot Bitcoin ETFs, with a single-day net inflow of up to $6.972 billion on Monday, January 5th, marking a three-month high since October 7, 2025. In the first two trading days of 2026, the net inflow of funds into such products has approached $1.2 billion, coinciding with Bitcoin's price rebounding from around $87,000 to above $94,000.

Historical data shows that prolonged ETF outflows often coincide with local market bottoms, and the current shift from negative to positive fund flows, combined with the rebound of the Coinbase premium index, indicates that the market's "capitulation selling" phase may have ended. Institutional reallocation is injecting strong momentum into the market.

MarketWhisper·01-07 01:46

Smart money flows in! Decoding the three main drivers behind BTC's rebound

Author: Yuan Shan Insights

Data sources: Farside Investors, SoSoValue, Federal Reserve H.4.1 Report, CryptoQuant

On the first trading day of 2026, the BTC ETF saw a net inflow of $471 million in a single day.

What does this number mean?

In November and December, the total net outflow of spot BTC ETFs was approximately $4.57 billion; among them, December alone saw a net outflow of about $1.09 billion.

Many people are frantically cutting losses above 93K, while institutions bought back about one-tenth in just one day on January 2.

At the same time, the following events occurred:

- The Federal Reserve's balance sheet increased by approximately $59.4 billion week-over-week (WALCL: as of 12/31, it was $6.6406 trillion, an increase of about $59.4 billion since 12/24)

- A new giant whale's holdings surpassed 100,000 BTC ($12 billion)

- BTC from 8

PANews·01-07 01:32

Global M2 remains strong at $115.9 trillion... Market indicators simultaneously signal stability

The global M2 supply continues to grow amid a mild recovery, and the Bitcoin market shows signs of stability after adjustments. Despite short-term fluctuations, the liquidity foundation remains solid, and long-term holders remain active. Meanwhile, net inflows in the ETF market are significant, indicating recovery signals.

TechubNews·01-07 00:54

Morgan Stanley applies for dual ETFs! Bitcoin and Solana predicted to attract 150 billion annually

Morgan Stanley applies to the SEC for Bitcoin and Solana ETFs, with SOL featuring staking functionality. On Monday, Bitcoin ETF net inflows reached a record high of $697 million, and Bloomberg analysts forecast annual inflows of $150 billion. Morgan Stanley only opened recommendations for crypto ETFs in October last year, and now it is issuing its own with a BYOA strategy.

MarketWhisper·01-07 00:47

KOSPI breaks through the 4,500-point mark for the first time, mainly driven by individual investors... SK Hynix and Samsung Electronics' stock prices hit record highs again.

South Korea's KOSPI( Composite Stock Price Index closed above 4,500 points for the first time in history on January 6, 2026. Driven by a large-scale buying force from individual investors, the index turned to an upward trend during trading, and the stock market's momentum showed a clear upward trend, jumping over 100 points in just one day.

On that day, the KOSPI index closed at 4,525.48 points, up 67.96 points)1.52%( from the previous trading day. Although it opened lower and briefly fell below 4,400 points in the morning, the market atmosphere changed dramatically in the afternoon, and the gains widened. After breaking through 4,300 points on the 2nd of this month, it broke through 4,400 points the day before, and just a day later, it again reached the high of 4,500 points. This indicates that the market's upward momentum is rapidly spreading.

Leading the market are individual investors. On that day, at the Korea Securities Exchange, individual investors net bought as much as 5,963 billion won, driving the index. In contrast, foreign investors and institutional investors

TechubNews·01-06 14:58

ETF net assets surpass 300 trillion KRW… Retail investor assets surge towards KOSPI high rebound trend

KOSPI, South Korea's Composite Stock Price Index, first surpassed the 4,500-point mark, while the net asset scale of domestic listed index funds(ETF) market first exceeded 300 trillion Korean won. This is interpreted as a result of investor influx driven by a strong stock market and the diversification of ETF products.

According to the Financial Investment Association, as of January 5, 2026, the total net assets of domestic ETFs amounted to 303.5794 trillion Korean won. Considering that the net assets on the previous day, January 4, were 298.2461 trillion Korean won, this means an increase of over 5 trillion Korean won in just one day. The direct background is that the KOSPI index closed 67.96 points higher than the previous trading day, reaching 4,525.48 points, setting a new record high.

ETFs are "passively" managed products that fully track specific stock price indices and do not have dedicated fund managers actively adjusting the investment portfolio. Because they are similar to stocks

TechubNews·01-06 14:25

SK Hynix hits a new all-time high... surpassing 720,000 KRW driven by individual net buying

On January 6th, SK Hynix's stock price rose by over 4%, reclaiming the 700,000 KRW mark. In the afternoon, the stock reached a new high, and investor expectations for semiconductor stocks surged. The Korea Composite Stock Price Index increased by 1.52%, with a significant net buy-in from individual investors, despite large-scale selling by foreign and institutional investors, which had a positive impact on market sentiment.

TechubNews·01-06 13:52

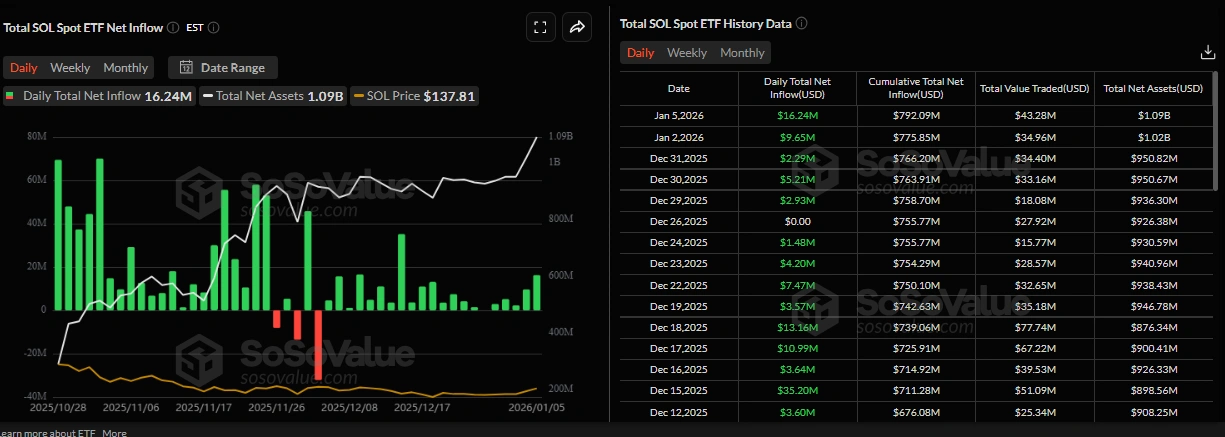

Solana (SOL) price heads towards higher levels thanks to accelerated ETF inflows

The price of Solana (SOL) continues to extend its upward momentum and surpasses the $137 mark at the time of writing on Tuesday, up more than 7% in the previous week. Institutional demand for SOL remains strong as spot ETF funds recorded a net inflow of over $16 million on Monday, marking a significant inflow tr

SOL-1,43%

TapChiBitcoin·01-06 13:10

ETF Clients Buy $46.10 Million Worth of XRP, Bringing Total ETF-Held Net Assets to $1.65 Billion

ETF clients buy $46.10 million worth of XRP.

This brings the value of the total ETF-held net assets to $1.65 billion.

XRP ETF interest boosts overall interest in altcoin ETFs.

Expectations for the price of XRP to hit new ATH prices in 2026 continue to grow stronger and several market

CryptoNewsLand·01-06 12:41

Bitcoin spot ETF attracts nearly $700 million, marking the largest single-day net inflow in 3 months

The cryptocurrency market in 2026 is off to a strong start, with Bitcoin spot ETFs attracting $697 million, reaching the highest record in nearly a year, indicating that institutional investors are returning to the market. In two days, inflows exceeded $1.16 billion, and risk appetite has rebounded. Ethereum spot ETFs also performed well, attracting $168 million. Market sentiment has improved, but retail investors remain cautious.

区块客·01-06 12:30

Secondary Market Daily Report 20260106

Market Trends

The cryptocurrency market currently exhibits a volatile and oscillating pattern, with clear differences in bullish and bearish views. On the macro level, fluctuations in U.S. oil export policies are indirectly affecting Bitcoin's safe-haven narrative; within the industry, although regulatory pressure and volatility risks coexist, the continuous net inflow into Bitcoin ETFs indicates that long-term institutional funds remain resilient. In the short term, the market is focused on the key battle zone for BTC between $94,000 and $100,000, with high volatility, so caution is advised.

Mainstream Coins

BTC

Has short-term bullish trading opportunities. Recent price movements are related to the adjustment of U.S. policies towards Venezuela's oil; the continued inflow into BTC ETFs also supports the market. Currently, focus should be on the $94,000 support level; if it stabilizes, the highly correlated BCH may show stronger breakout potential after surpassing the $700 resistance.

ETH

Fundamentals remain stable

Biteye·01-06 10:53

Telegram's $500 million Russian bonds frozen, Western sanctions hinder IPO

Telegram's revenue in the first half of 2025 saw a significant increase, but a $500 million Russian bond was frozen due to sanctions, coupled with a decline in Toncoin's price, leading to net losses and delaying the IPO schedule.

(Background recap: Telegram founder announces the launch of "AI Computing Power Network Cocoon": capable of mining TON with GPU, 100% private computation)

(Additional background: Bloomberg: Telegram founder Pavel Durov regains freedom! France lifts travel ban, ending 15 months of mobility restrictions)

Table of Contents

$500 million bond stuck in Moscow

Toncoin volatility erodes profits

Hundred-person team and compliance challenges

IPO schedule delayed again

The latest financial report from messaging platform Telegram reveals a contradiction: revenue

動區BlockTempo·01-06 08:59

Gate Research Institute: Solana ETF Achieves Largest Single-Day Net Inflow | Giza's AI Agent Asset Management Scale Exceeds $40 Million

Cryptocurrency Market Overview

BTC (+1.17% | Current price 93,921 USDT): The daily chart shows that Bitcoin has broken above the medium- to long-term downtrend channel. The MACD green bars continue to rise, and the RSI is moving higher, releasing a somewhat positive technical signal, indicating that the price still has room for further upward movement. Currently, BTC is testing the resistance at around $93,400, a level that coincides closely with a previous high-volume trading zone. If this resistance is broken effectively, it could open the way to test the $100,000 mark. The liquidation heatmap indicates that recent major liquidation clusters are concentrated below the current price, especially in the $85,000–87,000 range, suggesting that leveraged long positions are relatively concentrated. In contrast, liquidity above is more dispersed, implying that before the market continues to rise, some time is still needed for momentum to build. The recent slow upward movement has already cleared some short

GateResearch·01-06 08:05

XRP News: After a 31% weekly increase, buying pressure continues; Ripple bank license rumors add fuel to the fire?

At the beginning of 2026, Ripple (XRP) performed strongly, with its price soaring 31% over the past week, reaching a high of $2.39. Its gains temporarily surpassed Bitcoin and Ethereum, and its market capitalization jumped to the fourth position. Behind this robust performance are the combined effects of exchange reserves hitting an 8-year low, continuous large net inflows into spot ETFs, and active technical breakthroughs.

Meanwhile, rumors about "Ripple having obtained a US National Trust Bank license" have spread widely. Although not yet officially confirmed, they have sparked great enthusiasm within the community. This article will analyze the sources of XRP's current upward momentum, interpret the substantive impact of regulatory developments, and look ahead to its market prospects in the coming weeks.

MarketWhisper·01-06 07:04

Ethereum spot ETF net inflow of $168.13 million... cumulative total has increased to $12.67 billion

The US Ethereum spot ETF market continues its net inflow trend.

According to SoSoValue data, on January 5 local time, the US Ethereum spot ETF market achieved a single-day net inflow of $168.13 million.

Following the previous trading day (January 2, net inflow of $174.43 million), funds have maintained inflows for two consecutive days, with the total net inflow expanding to $12.67 billion.

On that day, capital inflows were concentrated in large products. ▲BlackRock ETHA ($102.9 million) ▲Grayscale Mini ETH ($22.34 million) ▲Fidelity FETH ($21.83 million) ▲Bitwise ETHW ($19.73 million) ▲Grayscale ETHE ($1.32 million), a total of 5 ETFs confirmed net inflows, while the other 4 products saw no change in fund flow.

The total transaction volume recorded $2.24 billion, similar to the level of the previous trading day ($2.28 billion).

TechubNews·01-06 06:40

Yesterday, the US Ethereum spot ETF had a total net inflow of approximately $168 million, marking the second consecutive day of net inflows.

According to Techub News, yesterday the total net inflow of the US Ethereum spot ETF was approximately $168 million, marking two consecutive days of increase. Among them, BlackRock ETF ETHA had a net inflow of about $102 million, Fidelity ETF FETH had a net inflow of approximately $21.83 million, and several other ETFs had no capital inflow or outflow.

TechubNews·01-06 05:48

Solana Today's News: Spot ETF demand surges, SOL price breaks $137

As of January 6, Solana broke through $137, gaining 7% for the week. Spot ETF inflows on Monday reached $16.24 million, a new high since mid-December, with total net assets surpassing $1 billion. Stablecoin supply rebounded to $15.32 billion, with a clear buyer-dominated trend. Technically, it broke out of the wedge pattern and stabilized above the 50-day EMA, with RSI rising to 63, targeting $150.61.

MarketWhisper·01-06 05:43

Load More