Morgan Stanley applies for dual ETFs! Bitcoin and Solana predicted to attract 150 billion annually

Morgan Stanley applies for Bitcoin and Solana ETFs with the SEC, with SOL including staking features. On Monday, Bitcoin ETF net inflows reached a record high of $697 million, with Bloomberg analysts forecasting annual inflows of up to $150 billion. Morgan Stanley only opened recommendations for crypto ETFs in October last year, now launching its own products under a BYOA strategy.

Morgan Stanley’s 180-Degree Shift from Ban to Issuance

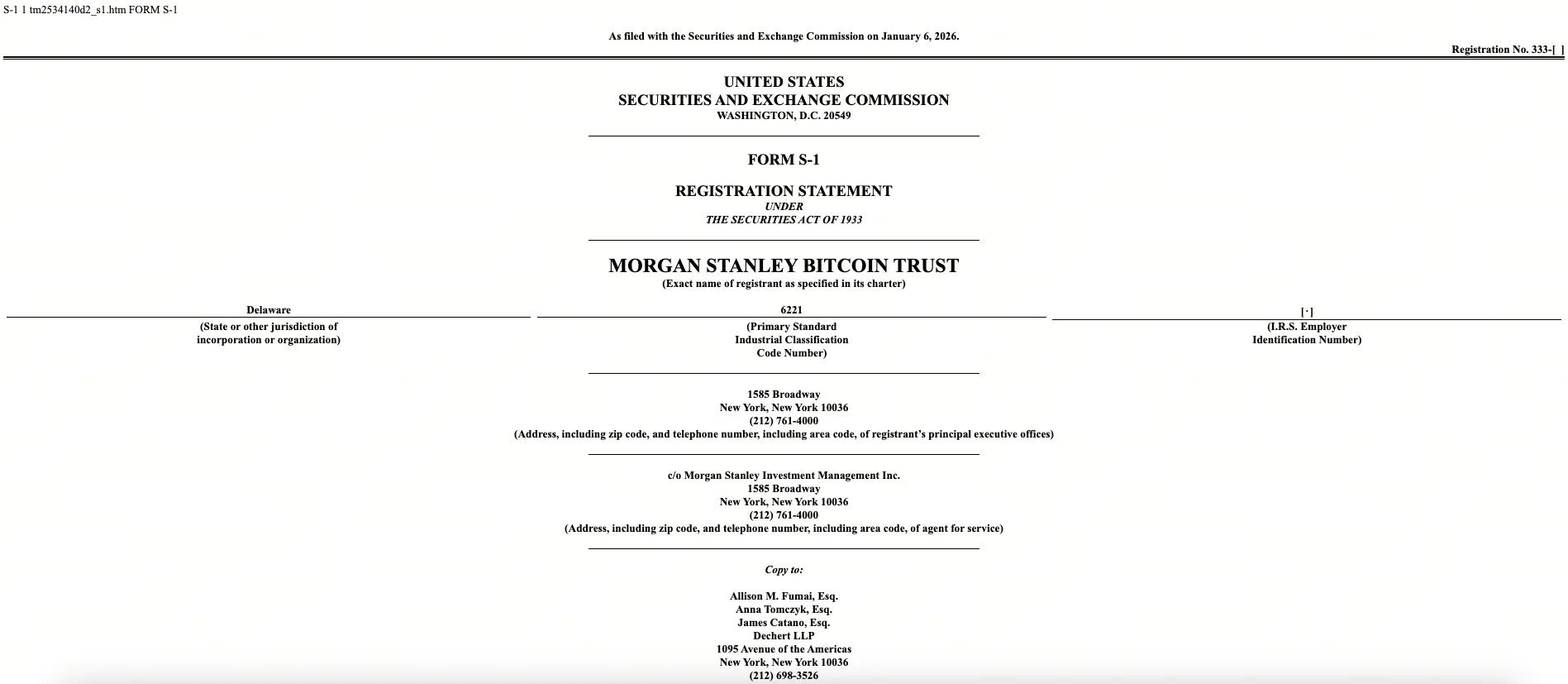

Morgan Stanley has submitted an S-1 registration statement to the U.S. Securities and Exchange Commission, planning to launch spot Bitcoin and Solana ETFs, marking a deeper entry into the regulated cryptocurrency product space. The Wall Street giant has filed applications for Bitcoin trust funds and Solana trust funds, with the proposed Solana fund including staking features.

Until recently, Morgan Stanley’s financial advisors were prohibited from purchasing crypto ETFs for clients. But that changed last October. At that time, the firm suggested limiting crypto allocations to 4% within its most aggressive client portfolios, similar to practices at BlackRock and Fidelity. Just a few months later, Morgan Stanley upgraded from “distributor approval” to “self-issuer,” a rare speed of attitude shift among conservative Wall Street giants.

If approved, these applications will position Morgan Stanley alongside major spot crypto ETF issuers like BlackRock and Fidelity, reflecting the growing demand for mainstream investment products in digital assets. This comes as U.S. spot crypto ETF trading volume recently surpassed $2 trillion, with spot Bitcoin ETFs alone holding over $123.5 billion in assets.

Morgan Stanley’s filings coincide with a more crypto-friendly regulatory environment from the SEC, following President Trump’s return to office and the agency’s introduction of faster listing standards for crypto ETFs. This further consolidates the firm’s broader crypto strategy, including a proposed 4% cap on opportunity-based portfolio allocations and expanded crypto access for all client accounts, including retirement plans.

Morgan Stanley manages approximately 20 ETFs across brands like Calvert and Eaton Vance, but currently only two ETFs are issued under Morgan Stanley’s name, highlighting the rarity of such branding decisions. Issuing ETFs under its own brand entails higher reputational risk, as poor product performance could directly impact Morgan Stanley’s brand image.

Business Logic and Competitive Effects of the BYOA Strategy

Bloomberg senior ETF analyst Eric Balchunas calls this move “smart,” noting Morgan Stanley can leverage these funds to kickstart its BYOA (Bring Your Own Assets) ETF strategy, where large asset managers direct client funds into their own proprietary products rather than competing funds.

Nate Geraci, President of NovaDius Wealth, wrote on X: “Now they’ve also launched their own crypto ETF. Considering Morgan Stanley’s vast distribution network, this makes sense. Clearly, they see huge client demand for crypto ETFs.” With over $6 trillion in client assets and thousands of financial advisors, this distribution network, once fully promoting its own ETFs, could generate a staggering capital siphoning effect.

Balchunas tweeted on X: “This could prompt several other firms to launch their own branded Bitcoin ETFs—we’ll see.” This chain reaction might include Goldman Sachs, U.S. Bank, UBS, and other traditional financial giants. Once these institutions launch their own branded Bitcoin ETFs, market competition will intensify, but investors will benefit from more choices and lower fees.

Three Key Significances of Morgan Stanley’s Dual ETF Applications

Mainstream Recognition Upgrade: Sixth-largest U.S. bank issuing under its own brand, stronger trust than distribution

BYOA Customer Lock-in: Directing client funds into proprietary products, reducing flows to BlackRock and Fidelity

Solana Institutional Adoption: First major bank applying for a SOL ETF, marking Solana’s entry into institutional-grade assets

Predicted $150 Billion Annual Inflows Like a Lion

On Monday, U.S. spot Bitcoin ETF net inflows hit $697 million, the largest single-day inflow since October, as crypto market sentiment improved early 2026. This surge brought nearly $1.2 billion in two days, with broad demand across issuers, led by BlackRock’s IBIT ($660 million) and Fidelity’s FBTC ($279 million).

Bloomberg senior ETF analyst Eric Balchunas on X said that spot Bitcoin ETFs are “entering 2026 like a lion,” adding that the early inflow speed suggests that if momentum continues, about $150 billion could flow in annually. This forecast is based on annualizing the inflow rate of the past two days, though maintaining such a pace year-round is unlikely; even at half speed, it’s still an astonishing $75 billion.

Crypto analyst Rachael Lucas of BTC Markets said ETF re-accumulation reflects “cautiously optimistic attitudes among major asset allocators,” though medium-term outlooks still depend on macroeconomic and regulatory stability. Currently, ETF capital flows support crypto prices, as institutional investors are upgrading crypto from tactical to strategic assets—a core reason for ongoing capital inflows.

Bitwise Chief Information Officer Matt Hougan wrote on X: “Major institutions are fully投入 into crypto and see it as a key business priority.” Morgan Stanley’s application is just the beginning; giants like Goldman Sachs and JPMorgan may follow suit.

Related Articles

Here’s the XRP Price If Bitcoin Enters a Real 2026 Crypto Winter

Whale Alert Founder: BTC's potential profit level has fallen back to late 2023, possibly approaching a three-year profit cycle turning point

Bitcoin ETFs Record $127.65M Daily Outflow, Ethereum and Solana ETFs Show Mixed Performance

BTC 15-minute increase of 1.17%: Safe-haven funds flow back and futures leverage resonance drive the rebound