Search results for "DL"

A roundup of 6 key dates in U.S. cryptocurrency policy in 2026

Author: Aleks Gilbert, DL News

Translation: Wu Shuo

The past year, the United States experienced a crypto policy revolution.

In less than a year of his second term, President Donald Trump appointed industry-friendly regulators who ended investigations into crypto companies, made it easier for banks to hold crypto assets, and also facilitated asset management firms in launching crypto-related ETFs.

Under Trump's push, lawmakers passed landmark legislation on stablecoins and made significant progress in market structure legislation.

After these victories became facts, it’s natural to wonder whether 2026 will still be an important year for crypto policy.

The short answer is: yes.

So, without further ado, here are some key dates for US crypto policy in 2026.

January

January is destined to be a month of events

PANews·01-03 00:01

Bybit executive Yoyee Wang: Efficient custody and regulatory clarity are key for institutional adoption of Crypto Assets.

Yoyee Wang, Head of the Institutional Division at the crypto assets exchange Bybit, pointed out the three key factors for institutional investors entering the digital asset space at the summit in Abu Dhabi.

(Previous summary: Interpretation of Bybit x DL Research "2025 Global Crypto Assets Ranking Report": Compliance and demand become mainstream, financial sovereignty moves on-chain)

(Background Supplement: Bybit was selected by BeInCrypto as one of the "Best Centralized Exchanges" and "Best Exchange in Latin America" in the 100 Awards.)

Table of Contents

Custody, Risk, and Capital Efficiency

The regulatory clarity of the United Arab Emirates

Tokenization of real-world assets

Institutional Participation Beyond Asset Exposure

_*This article is a promotional piece written and provided by Bybit, and does not represent the position of the Blockchain District, nor is it investment advice or a purchase.

RWA0,99%

動區BlockTempo·2025-12-23 06:05

Interpreting Bybit x DL Research's "2025 Global Cryptocurrency Ranking Report": Compliance and Demand Become Mainstream, Financial Sovereign Chain On-Chain

Institutionalization and practicality are reshaping market drivers. The capital flows previously driven by narratives, leverage, and short-term speculation are being replaced by "verifiable utilities" such as compliant frameworks, custody and market-making mechanisms, ETF products, stablecoin settlements, and tokenized assets. Let's make a simple, understandable, yet profound interpretation of the "2025 Global Cryptocurrency Ranking Report" jointly released by Bybit and DL Research.

(Background recap: Bybit was awarded the "Best Centralized Exchange" and "Best Exchange in Latin America" by BeInCrypto's Top 100 awards)

(Additional background: Ben Zhou predicts that within five years, the distinction between "traditional finance and crypto" will disappear: Bybit is building a clear, efficient, and most trusted trading ecosystem)

Table of Contents

The Silent Shift of Global Financial Power

Seeing Through Data

DL-1,26%

動區BlockTempo·2025-12-19 13:53

Bybit Unveils 2025 Global Crypto Rankings Report

Bybit and DL Research have released the World Crypto Rankings 2025, an analysis of crypto adoption across 79 countries. The report highlights the rise of stablecoins, global tokenization, and the rapid normalization of onchain payrolls.

New World Crypto Rankings by Bybit Shows Adoption Trends

Byb

Coinpedia·2025-12-12 06:33

Singapore tops Bybit crypto adoption index as U.S. slips from first

Bybit's World Crypto Rankings put Singapore first for crypto adoption, with Vietnam, Hong Kong and other Asia-Pacific markets surging as RWA, local stablecoins and crypto payrolls grow

Summary

Bybit and DL Research rank Singapore first out of 79 countries on 28 metrics spanning regulation,

IN0,87%

Cryptonews·2025-12-10 12:00

Putin's aide calls for inclusion of cryptocurrencies in Russia's balance of payments accounting

According to TechFlow, on December 4, DL News reported that Maxim Oreshkin, a senior aide to Russian President Putin, stated that cryptocurrencies should be included in Russia's balance of payments accounting and referred to crypto mining as an "undervalued export industry." Oreshkin pointed out: "Cryptocurrencies are a form of money supply, and Russian companies can and indeed do use cryptocurrencies to pay for imports, which also affects the fiat currency market." Data shows that Russia accounts for nearly 16% of global Bitcoin hash power, second only to the United States. Oleg Ogiyenko, CEO of Moscow blockchain consulting firm Via Numeri, said that cryptocurrency mining "has already played an important role in the Russian economy," with Russian companies investing over $1.3 billion in data centers, grid connections, power generation, and mining hardware. The Russian central bank and Ministry of Finance have agreed to legalize cryptocurrency payments as

BTC-0,28%

DeepFlowTech·2025-12-04 04:28

Russian prosecutors seek to seize nearly $30 million in assets from former investigator involved in WEX "cryptocurrency bribery" case

Mars Finance News: According to DL News, Russian prosecutors are seeking to confiscate a large amount of luxury assets from fugitive secret service official Georgy Satyukov. He is accused of accepting $184 million worth of Bitcoin and $30 million worth of Ethereum as bribes from the operators of the now-defunct WEX cryptocurrency exchange. Investigators have identified $29.6 million worth of assets related to Satyukov's alleged bribery. Prosecutors claim that Satyukov used the illicit funds to purchase 13 Russian apartments, several non-residential properties in St. Petersburg, a villa in the UAE, and a million-dollar property in Saratov registered under his brother's name. In addition, the investigation found that he owns two Porsche Cayenne Turbos, seven Patek Philippe watches, and other jewelry with a total value of over $1.3 million. His family bank accounts still contain

MarsBitNews·2025-12-03 17:18

Research Report: The DeFi Market Is Beginning to Price Based on Fundamentals, But It Will Take Months to Materialize

According to TechFlow, on December 3, DL News reported that Berlin-based venture capital firm Greenfield released research showing that the decentralized finance (DeFi) market is beginning to be priced based on fundamentals, but this process will take several months to become apparent.

The research pointed out that three key indicators—protocol fees, total value locked (TVL), and revenue—explain valuation changes better than other variables. Models based on these indicators generally outperform analytical models that track the performance of Bitcoin and Ethereum, as well as models that include social sentiment.

Greenfield partner Felix

DeepFlowTech·2025-12-03 09:03

DL Holdings’ Interim Net Profit Surges Over 25-Fold as Digital Finance Strategy Accelerates Implementation

Media OutReach NewswireThe Group recorded a net profit of HK$202 million, representing a 2,511% increase compared with the same period last year; revenue from principal operations reached HK$118 million, up 43% year-on-year; and other income reached HK$194 million, an increase of 528% over the same

DL-1,26%

AsiaTokenFund·2025-11-28 07:55

DL announces half-year positive profit alert up 20x to HK$220M

Media OutReach Newswire It is expected to record a profit of approximately HK$180 million to HK$220 million, compared with a net profit of about HK$7.7 million for the same period last year — representing an increase of over 20 times (approximately 2,107%–2,757%), far exceeding market

BTC-0,28%

AsiaTokenFund·2025-11-10 07:12

DL & Antalpha US$100M Gold, US$100M Bitcoin Plan

Media OutReach Newswire covers tokenised gold assets and Bitcoin mining infrastructure On the gold-asset side, DL Holdings is in the process of delivering the initial US$5 million investment in Tether Gold (XAU₮) and plans to further acquire and distribute up to US$100 million in XAU₮ over the

AsiaTokenFund·2025-10-17 03:22

Belo Horizonte crowned Brazil’s ‘Bitcoin capital’ as DL Holdings grows in Paraguay

These are the most significant crypto developments in Latin America this week, from Brazil’s bold move to establish Belo Horizonte as a national Bitcoin hub to DL Holdings’ multimillion-dollar mining expansion in Paraguay and Oman, indicating the region’s growing influence in the global digital

BitcoinInsider·2025-10-04 13:42

DL Holdings spent 41 million USD to buy Bitcoin mining machines, aiming to lead Hong Kong.

DL Holdings has spent 41.1 million USD to purchase 2,995 Antminer S21 Bitcoin mining machines from Bitmain for deployment in Oman and Paraguay, raising the total mining fleet to 5,195 machines with a capacity of 2.1 EH/s.

The company stated that the goal is to become the largest listed Bitcoin mining stock in Hong Kong within two years.

BTC-0,28%

TapChiBitcoin·2025-09-30 02:09

DL Invests HK$320M with BITMAIN to Break Hashrate Barriers

Media OutReach Newswire This collaboration marks a key step in DL’s strategic layout for digital-asset businesses, advancing from “asset allocation” to “hashrate infrastructure + cash-flow generation” through industrialized operations. Together with the previous purchase of 2,200 mining machines, DL

BTC-0,28%

AsiaTokenFund·2025-09-29 14:28

DL Holdings will participate in Bitcoin mining through a convertible bond agreement.

DL Holdings Group Limited ( is listed in Hong Kong ) in collaboration with Fortune Peak Limited to expand into Bitcoin mining, marking its first major step into the digital asset infrastructure. The company plans to issue convertible bonds worth 21.85 million USD to purchase 2,200 S21XP HYD mining machines with a total

BTC-0,28%

TapChiBitcoin·2025-09-16 13:52

Why VC investments into crypto are seen to hit $25bn in 2025

Venture capital investors will back crypto startups to the tune of $25 billion in 2025.

That’s according to Michael Martin, director at Ava Labs’ incubator Codebase, who said a perfect storm of bullish signals will incentivise investors to back crypto companies.

He told DL News that factors like C

YahooFinance·2025-08-08 12:27

DL Holdings Share Placement to Raise HK$653M for Blockchain Push

DL Holdings Group aims to raise HK$653.3 million through share placements to support blockchain initiatives. Following the announcement, the stock price experienced a notable decline, shedding significant value across multiple time frames. In 2024, the company recorded mixed financial results with substantial revenue from various sectors.

IN0,87%

TodayqNews·2025-08-07 13:45

Solana’s $6bn ‘dark’ exchanges make trading more efficient — but at a cost

HumidiFi, an exchange on the Solana network, processed nearly $3 billion in trades last week and made up some 15% of the blockchain’s entire trading volume.

There’s just one problem. The identity of the project’s creator is a mystery.

Two people involved in running rival exchanges told DL News the

YahooFinance·2025-08-07 11:06

The Jito plan aims to create subDAOs to promote protocol development.

According to Mars Finance, the Solana ecosystem's liquid staking protocol Jito is currently creating a new subDAO aimed at promoting the development of the protocol and enhancing the value of its governance token JTO. According to a proposal written by Jito's governance lead Nick Almond, this subDAO will refine and implement new strategies such as token buybacks, yield subsidies, and fee-switch treasury, to support the price of JTO token. (DL

JTO-0,02%

MarsBitNews·2025-07-14 13:15

Public companies following MicroStrategy face skepticism, and financing to buy Bitcoin may become a high-risk move.

Author: Pedro Solimano, DL News

Compiled by: Felix, PANews

It all started with MicroStrategy. Nowadays, it seems that a new listed company announces it is hoarding Bitcoin or other cryptocurrencies every week.

But there is a problem here: investors are willing to give these companies a high valuation premium just because they buy Bitcoin.

What will happen if their stocks do not rise as a result?

Taking the Japanese company Metaplanet as an example, it has replicated Michael Saylor's Bitcoin frenzy at MicroStrategy.

BTC-0,28%

TechubNews·2025-06-03 03:22

According to Techub News and DL News reports, Jarrod M. Patten, a director at Strategy (formerly MicroStrategy), recently sold $5.2 million worth of Class A shares and plans to continue selling $300,000 this week. Patten's selling occurred between April 22 and May 14, conducted in multiple transactions, during which the company's stock price rebounded significantly after a sharp decline in the first quarter, rising over 20%.

TechubNews·2025-05-16 06:03

According to a report by DL News on May 16, Deep Tide TechFlow news states that documents from the U.S. Securities and Exchange Commission (SEC) show that Jarrod M. Patten, a board member of Strategy (formerly MicroStrategy), sold $5.2 million worth of Class A shares in less than a month and plans to sell another $300,000 worth of stock this week.

Strategy is currently the largest publicly traded company holder of Bitcoin, holding Bitcoin worth over $58 billion. The company's stock price rose by more than 20% from April 22 to May 14, reaching a new high of $421.61 this week.

BTC-0,28%

DeepFlowTech·2025-05-16 04:31

CoinVoice has recently learned that, according to DL News, Jarrod Patten, a director at Strategy (formerly MicroStrategy), has recently reduced his holdings of Class A shares by $5.2 million and plans to continue selling $300,000 this week. The reduction occurred when the company's stock price hit a new high for the year at $421.61, and after the latest news was announced, the stock price fell 3% to $403. Data shows that Patten has been reducing his holdings in batches since April 22, during which the stock price has risen over 20%. Currently, more than 130 companies have followed Strategy's Bitcoin holdings strategy.

BTC-0,28%

CoinVoice·2025-05-16 03:37

Trump's tariff policy may delay encryption companies' IPOs, Circle reassesses its listing plan.

According to Mars Finance news on April 8, DL News reported that former U.S. President Trump proposed a policy to impose a 60% tariff on Chinese goods, raising concerns in the market about economic uncertainty, which has led to a slowdown in the IPO process for cryptocurrency companies. The stablecoin USDC issuer Circle has reconsidered its listing strategy. Industry insiders say that the increasing political risks may affect the financing plans of crypto enterprises, and the market is closely monitoring the impact of the November election results on the industry.

MarsBitNews·2025-04-07 19:14

Memes, stable coins, and stock market bubbles are intertwined, becoming the potential detonation point of new systemic risks in the cryptocurrency world.

0x news reported that on February 18th, DL News released a message stating that Wolfgang Münchau, co-founder and director of Eurointelligence, and financial columnist, pointed out in his latest analysis that the market is currently facing a dangerous bubble state, and Cryptocurrency may become the catalyst for the next financial crisis.

The article mentioned three major risk factors:

The market valuation of Meme coins has reached 800 billion US dollars, with Dogecoin accounting for about half of the market value and TRUMP coin reaching a market value of 38 billion US dollars. Münchau emphasizes that unlike collateralized debt obligations (CDOs) during the 2008 financial crisis, Meme coins completely lack a rational basis and rely entirely on influence to drive them. Although its scale is not yet sufficient to threaten the global financial system, it has already caused a stir in markets such as Argentina.

0x资讯·2025-02-18 15:27

Where will AI and encryption go in 2025? Six experts share their thoughts.

Author: E. Johansson, L. Kelly, DL News; Translation: Tao Zhu, Golden Finance

As artificial intelligence becomes headline news, experts say that incorporating cryptocurrency into it will accelerate this trend.

Popular cryptocurrencies related to artificial intelligence have surged by 160%, approaching $55 billion in value by 2024. Meanwhile, investors have poured hundreds of millions of dollars into projects utilizing artificial intelligence and blockchain technology.

Market observers have reason to be optimistic about this trend: researchers estimate that by 2030, this combination will add an additional $20 trillion to the global economy.

We asked industry experts what they expect from the intersection of artificial intelligence and cryptocurrencies in 2025.

Mark Beylin, Boost VC

VC-1,52%

金色财经_·2025-01-03 04:04

Experts Forecast the Significant Growth of Cryptocurrency in 2025

2025 is shaping up to be a transformative period for the cryptocurrency market, as regulatory clarity, technological advancements, and institutional acceptance converge to drive growth. Deep insights gathered by DL News from industry leaders in asset management companies, banks, and financial institutions suggest that the market is poised for significant expansion.

Blotienso·2025-01-02 05:51

What is the trend of encryption VC in 2025? What do professionals in the industry say?

Authors: E. Johansson, L. Kelly, DL News; Translation: Tao Zhu, Golden Finance

Venture capital will make a strong comeback in 2025.

This is the statement of venture capital firms and market observers interviewed before the new year.

What will drive the market up? How much capital do investors hope to invest?

Mike Giampapa, General Partner of Galaxy Ventures

Mike Giampapa, General Partner at Galaxy Ventures

With the establishment of the most supportive administrative and legislative departments for cryptocurrencies in the history of the United States, it is difficult to overstate the potential impact this may have on the cryptocurrency industry.

With more favorable

金色财经_·2024-12-27 02:48

What are MicroStrategy's 1637 employees actually doing?

Author: Ben Weiss, DL News; Translation: Deng Tong, Jinse Caijing

MicroStrategy wants investors to know that it is hoarding Bitcoin.

MicroStrategy announced that the title of its first quarter earnings report is: "Currently holding 214,400 bitcoins."

In the second quarter, the announcement was: "Currently holding 226,500 bitcoins."

And the founder and chairman of the company, Michael Saylor, seems to have done almost nothing on X except flattery to the world's largest cryptocurrency.

"Bitcoin is a group of network bees serving the goddess of wisdom, feeding on the fire of truth," his X-profile featured post said.

But MicroStrategy is not just buying Bitcoin. It owns 1,637

金色财经_·2024-12-12 07:36

The support of Central Banks in various countries for CBDC in cross-border payments has decreased by 31% since last year.

CoinVoice has learned that interest in using Central Bank Digital Money to enhance cross-border payments is waning among central banks worldwide, according to DL News. According to OMFIF's 2024 Payment Future Survey, instant payment systems are becoming the preferred solution. Currently, only 13% of respondents consider CBDC networks as the most promising approach, down from 31% last year.

CoinVoice·2024-12-02 04:23

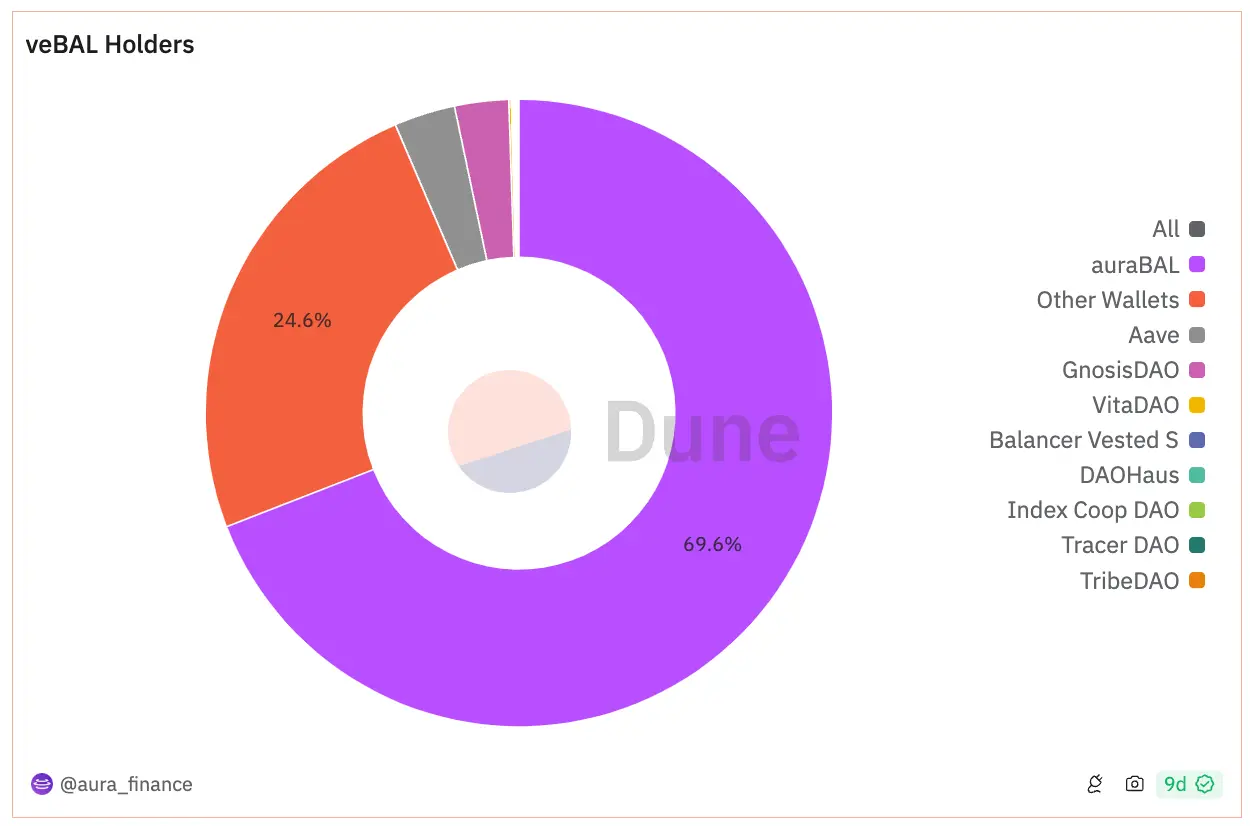

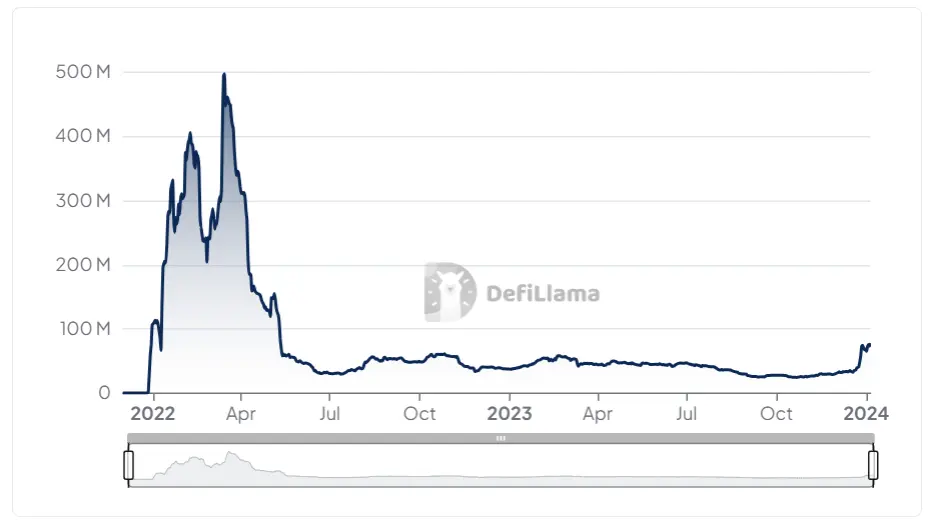

Decentralized Finance income market interpretation: Pendle TVLbig pump10 times, Convex lock-up amount rise17.5%

In the DL earnings category, there are over 500 protocols, with a total TVL of 79.5 billion US dollars at present.

星球日报·2024-07-31 07:13

Will Ethereum price break $5000 in June? What do institutional analysts think?

Original title: Ethereum to $ 5,000? Nine experts on how the ETF approval will impact prices

Original author: Eric Johansson, DL News

Original compilation: Ismay, BlockBeats

Editor's note: With the approval of the Spot Ethereum ETF in the United States, the market's enthusiasm for Ethereum has soared. Industry experts have predicted that the price of Ethereum will usher in a new round of pump. Galaxy, FRNT Financial, CCData, OKX, Consensys

ETH2,03%

星球日报·2024-06-04 03:03

Co-founder of Ethereum: Potential approval of ETF will lead to supply tightening.

Ethereum co-founder and CEO of blockchain technology company ConsenSys, Joseph Lubin, said that the potential approval of a spot Ethereum ETF by the U.S. Securities and Exchange Commission (SEC) could significantly restrict the supply of Ether (ETH). This development is expected to be a watershed moment for Ethereum.

Joseph Lubin's viewpoint

In an exclusive interview with DL News, Lubin predicts that the approval of spot Ethereum ETF will trigger a significant institutional demand. Considering many institutions have already started their cryptocurrency investment journey through spot Bitcoin ETF, Ethereum naturally becomes an important asset for diversification investment.

Lubin said, "Purchasing Ethereum through these ETFs will bring considerable natural demand accumulation."

奔跑财经·2024-05-23 04:31

Opinion: Bitcoin ETFs Will Hit These Three Crypto Stocks Hard

> A Bitcoin victory could ultimately be detrimental to crypto stocks like Coinbase, Marathon Digital, and MicroStrategy.

Written by: Tom Carreras, DL News

Compiled by: Luccy, BlockBeats

Editor's note: The launch of the Bitcoin ETF marked a new milestone in cryptocurrency investment, with Bitcoin rising 6% that day and breaking through the $49,000 mark. But analysts at Maple Finance and North Rock Digital pointed out that this victory may have an adverse impact on some cryptocurrency-related stocks, such as Coinbase, Marathon Digital and MicroStrategy.

ForesightNews·2024-01-15 00:33

TVL grew by US$600 million in two weeks, surpassing Base. What are the "hidden problems" behind Metis's rapid growth?

> The surge in Metis TVL is mostly attributed to the token rally and the Grants program.

Written by: Aleks Gilbert, DL News

Compiled by: Felix, PANews

Main points

The value of cryptocurrencies bridged to Metis was around $700 million in the past week, surpassing popular competitors such as zkSync and Base

The development of Metis’ DeFi ecosystem is much slower

Metis boom comes after announcement of new Grants scheme

Since December 20, Metis network TVL has increased 7 times, ranking third among Ethereum Layer 2 networks. But the seemingly rapid growth of TVL is not because users are eager to try it.

ForesightNews·2024-01-05 07:57

From team-building vacations to brutal dismissals Uncover the inside story of Polkadot's layoffs comparable to The Hunger Games

Written by Inbar Preiss, Inbar Preiss, DL News; Compiled: Pine Snow, Golden Finance

Parity's employees were asked to attend a company retreat after being fired.

Employees point out that company executives pay themselves handsomely.

A Parity spokesperson called the situation a "challenging step" for the company.

A week before Polkadot parent company Parity Technologies traveled to the Mediterranean island of Mallorca for its annual team-building getaway, its 385 employees received the shocking news: the company would lay off most of them.

However, several employees noted that departing employees are still expected to attend a team-building event at the Iberostar Cala Domingos Beach Resort Oct. 9-13 because flights have already been booked.

Parity ...

币小白_·2023-10-19 01:59

From team-building vacations to brutal dismissals revealing the inside story of Polkata's layoffs

Written by Inbar Preiss, Inbar Preiss, DL News; Compiled: Pine Snow, Golden Finance

Parity's employees were asked to attend a company retreat after being fired.

Employees point out that company executives pay themselves handsomely.

A Parity spokesperson called the situation a "challenging step" for the company.

A week before Polkadot parent company Parity Technologies traveled to the Mediterranean island of Mallorca for its annual team-building getaway, its 385 employees received the shocking news: the company would lay off most of them.

However, several employees noted that departing employees are still expected to attend a team-building event at the Iberostar Cala Domingos Beach Resort Oct. 9-13 because flights have already been booked.

Parity ...

金色财经_·2023-10-19 01:46

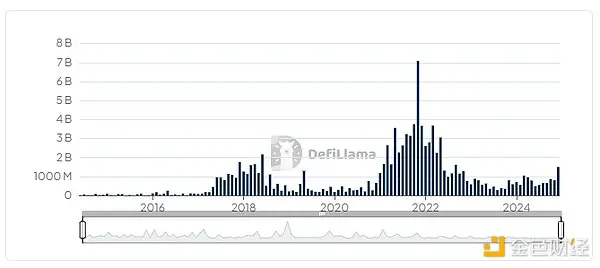

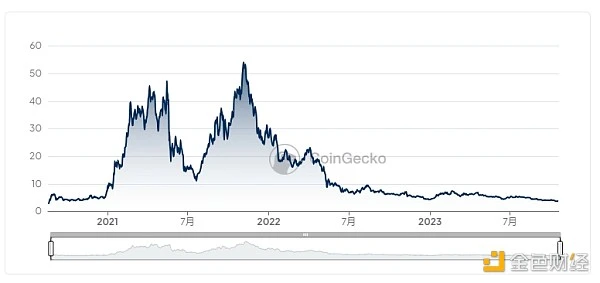

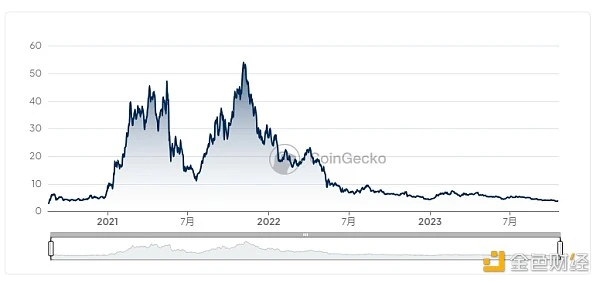

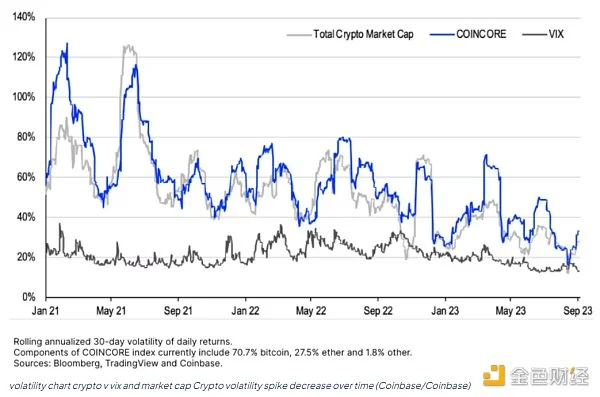

New lows in trading volume and declining volatility explain the grim current situation of the crypto market

Author: Tyler Pearson & Adam Morgan McCarthy, DL News

Compiled by: Felix, PANews

After a blowout 2022, crypto market sentiment is in the doldrums, characterized by declining trading volumes and a lack of liquidity.

How serious is it?

To help make sense of it all, this article provides three charts that explain the current state of the industry.

Spot trading volume hits 2019 low

In 2023, cryptocurrency spot trading volume continued to decline. Volume hit multi-year lows in May and then hit multi-year lows again in August.

According to crypto research and analytics firm CCData, trading volume on centralized exchanges last month was just $475 billion, a drop of nearly 8%. The company said this was the lowest spot trading volume since March 2019. ...

金色财经_·2023-09-18 01:04

Over 70% of SOL is pledged. Why did Solana fail to take off with liquidity staking?

Written by: Aleks Gilbert, DL News Compiled by: Felix, PANews

Liquidity staking is the largest sub-track of Ethereum, accounting for the largest proportion, and on other blockchains, the share of collateral used in DeFi protocols is growing rapidly.

In the Solana ecosystem, developers and investors also hope the same.

Ethereum, Solana, and other blockchains that rely on Proof-of-Stake technology have users lock (or stake) their tokens to achieve a certain amount of income.

These tokens are required for the complex but critical work of ordering and validating transactions on a blockchain using proof-of-stake technology.

Although the staking tokens are effectively locked, the liquidity staking protocol issues redeemable derivative tokens at a 1:1 ratio, allowing users to take advantage of the blockchain’s staking yield (5% for Ethereum and 7% for Solana ), while using them for...

金色财经_·2023-09-08 04:50

Stake.com remains strong after $40 million loss

Stake.com, the largest online casino and sports betting platform for cryptocurrency, was hacked on Monday, resulting in a loss of approximately US$41 million. These transactions included $16 million in Ethereum and stablecoins such as USDT, USDC, and DAI, followed by $25 million in withdrawals of MATIC and BNB tokens. Since the whole incident did not involve any complex chain activities, but only a simple transfer, many blockchain security experts said that the reason might be the leakage of the private key of the hot wallet of the platform, but its co-founder Edward Craven was in the However, DL News stated in an interview that the vulnerability was not caused by hackers controlling their private keys.

Craven told DL News on Tuesday: "The private key was not compromised, but the attacker was able to make several unauthorized transactions from our hot wallet...

金色财经_·2023-09-06 10:26

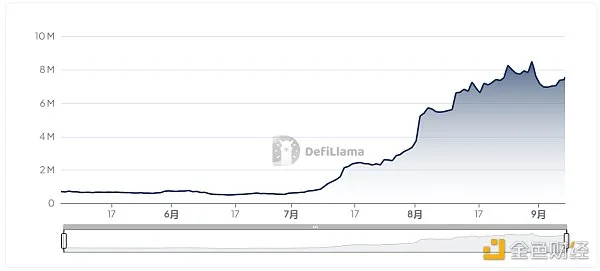

Why did the increase in DAI deposit rate to 8% split the MakerDAO community?

Author: Tim Craig, DL News; Source: dlnews; Compiler: Felix, PANews

DeFi users have flocked to DAI after MakerDAO increased the yield on its stablecoin earlier this month. Since the community raised the DAI yield to 8% on August 6, DAI’s market capitalization (the circulating supply of stablecoins pegged to the U.S. dollar) has increased by 25% to $5.2 billion. While some members of the DAO behind Maker applauded the increase in yields, others disagreed.

PaperImperium, a MakerDAO community member and GFX Labs governance liaison, said: “This move will only allow the whale to continue to drain the treasury.”

But the rise in DAI yields has had a wider impact, with several other DeFi protocols also benefiting from the rise.

origin

The split began in August...

金色财经_·2023-09-04 03:20

Tether Suspends Omni Minting Signals Bitcoin Comeback

Author: Osato Avan-Nomayo, DL News Compiler: Shan Ouba, Golden Finance

Tether has stopped offering the USDT stablecoin on the Omni Bitcoin meta layer.

The USDT issuer blamed its decision on a lack of users on the Omni layer.

Tether said it plans to support a new Bitcoin scalability layer called RGB.

Tether announced Thursday that it has stopped issuing the dollar-pegged USDT stablecoin on the Omni, Kusama and Bitcoin Cash SLP networks. USDT users on these affected platforms have one year to transfer funds to other supported networks, the announcement added. Tether ceasing to use USDT on Omni makes some sense because Tether's relationship with Omni...

金色财经_·2023-08-21 09:24

Tracking Do Kwon Funds: Terra's Crash Has Early Signs in 2019

Cryptocurrency fugitive Do Kwon has been evading Interpol for months. A South Korean professor followed, tracking the Terraform Labs CEO's every move. "I'm really fascinated by his address and on-chain data," Jaewoo Cho, a blockchain expert and assistant professor at Seoul National University, told DL News. It's kind of like "drawing a portrait. You're getting to know him."

Why track down the Korean co-founder of Terraform Labs in Singapore for almost a year? "I just like it... Tracking information (Doxxing) is my hobby." Jaewoo Cho is not the only one who wants to know Kwon's whereabouts. Terraform is in the midst of a May meltdown of its algorithmic stablecoin, TerraUSD. …

金色财经_·2023-06-20 03:43

The founder of Curve, who swallowed coins to buy luxury houses, was jointly sued by three major crypto VCs

Original Author: 0xmin Compilation: Deep Tide TechFlow

The encryption world needs more judges. After the SEC sued Binance, encryption VCs also started their litigation journey.

According to DL News, recently, three well-known crypto VCs, ParaFi, Framework Ventures and 1kx sued Curve founder Michael Egorov in San Francisco for commercial fraud.

You may be familiar with this name. Recently, Michael Egorov and his wife Anna Egorov spent $41 million to buy Avon Court, a mansion in Melbourne, setting a record for the highest single property transaction in Victoria during the year. In March last year, the Egorovs were also 18...

金色财经_·2023-06-10 01:48

Load More