Win1688888888

No content yet

People often misunderstand Platonic love as "asexual," thinking it is a form of deficiency or helplessness.

This is a huge mistake. In fact, it is a kind of "luxury" with an extremely high threshold.

The essence of desire is "possession" and "devouring." When you yearn to have someone, you are often not loving the person themselves, but the function they can fulfill to fill your emptiness. At this moment, they are the object of your desire.

Only by removing the interference of possessiveness can you truly see the other person as an independent subject with a soul. This is not asceticism;

View OriginalThis is a huge mistake. In fact, it is a kind of "luxury" with an extremely high threshold.

The essence of desire is "possession" and "devouring." When you yearn to have someone, you are often not loving the person themselves, but the function they can fulfill to fill your emptiness. At this moment, they are the object of your desire.

Only by removing the interference of possessiveness can you truly see the other person as an independent subject with a soul. This is not asceticism;

- Reward

- like

- Comment

- Repost

- Share

Basic cognition is addition: learn more indicators, read more news, listen to more messages. The result is brain overload and decision paralysis.

Advanced cognition is subtraction: eliminate noise, block emotions, and focus on first principles.

The bad habits you need to iterate away from:

1. Trying to explain every fluctuation.

2. Believing in a perfect prediction system.

3. Holding on tightly during losses, but unable to hold during profits.

Investing is like sculpture. You don't need to add anything; you just need to chip away at the parts that don't belong to "rationality." What remains is

View OriginalAdvanced cognition is subtraction: eliminate noise, block emotions, and focus on first principles.

The bad habits you need to iterate away from:

1. Trying to explain every fluctuation.

2. Believing in a perfect prediction system.

3. Holding on tightly during losses, but unable to hold during profits.

Investing is like sculpture. You don't need to add anything; you just need to chip away at the parts that don't belong to "rationality." What remains is

- Reward

- like

- Comment

- Repost

- Share

In any complex systems engineering, the quality of the system's output is always limited by the accuracy of its input data. If a person's social media feed is filled with redundant noise and low-entropy emotions, then their cognitive processing unit will be greatly wasted. I realize that passively accepting algorithmic feeds is essentially overdrawing on my cognitive bandwidth.

I am executing a long-term "Social Graph Reconstruction Plan." I am looking for individuals who have unique signal sources in their respective fields—whether it's the underlying operational architecture, the asymmetric

View OriginalI am executing a long-term "Social Graph Reconstruction Plan." I am looking for individuals who have unique signal sources in their respective fields—whether it's the underlying operational architecture, the asymmetric

- Reward

- like

- Comment

- Repost

- Share

99% of "side jobs" will only be an accelerator to bankruptcy by 2026.

Most people think they are starting a business, but in reality, they are just picking up coins while a steamroller approaches from behind.

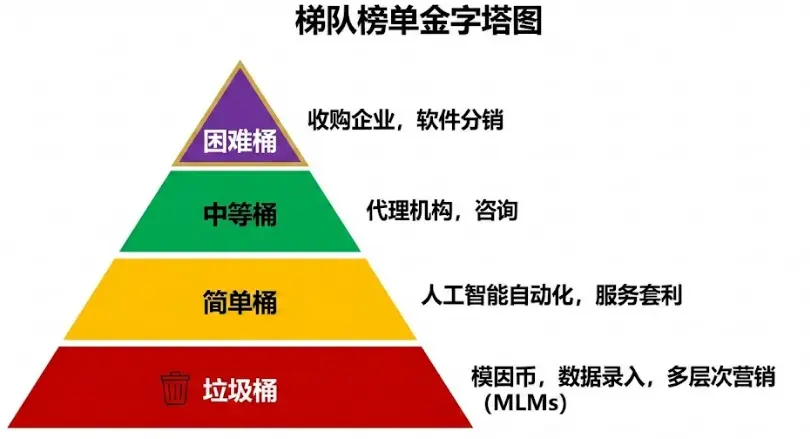

Dan Martell categorizes all the money-making methods in 2026 into 4 levels. The scariest thing is not "hard mode," but being trapped in "trash mode" and mistaking it for opportunity.

This is the brutal truth about wealth distribution over the next 3 years.

1. Trash Bin

The projects here are very obvious: extremely low difficulty, negative returns. Essentially, it's fighting Moore's Law wi

View OriginalMost people think they are starting a business, but in reality, they are just picking up coins while a steamroller approaches from behind.

Dan Martell categorizes all the money-making methods in 2026 into 4 levels. The scariest thing is not "hard mode," but being trapped in "trash mode" and mistaking it for opportunity.

This is the brutal truth about wealth distribution over the next 3 years.

1. Trash Bin

The projects here are very obvious: extremely low difficulty, negative returns. Essentially, it's fighting Moore's Law wi

- Reward

- like

- Comment

- Repost

- Share

A 50% loss requires a 100% increase to break even. A 90% loss requires a 900% increase to break even.

Preventing large drawdowns is more important than catching ten-bagger stocks.

Many so-called "stock gods" are just leveraging in a bull market. When the tide goes out, they are the first to disappear.

Simple hedging doesn't require complex derivatives:

1. Negatively correlated assets (stocks fall, government bonds/gold rise)

2. Sufficient cash reserves (that's your option)

3. Never fully commit

It's not just about how sharp your spear is, but also how thick your shield is. In this game, defens

View OriginalPreventing large drawdowns is more important than catching ten-bagger stocks.

Many so-called "stock gods" are just leveraging in a bull market. When the tide goes out, they are the first to disappear.

Simple hedging doesn't require complex derivatives:

1. Negatively correlated assets (stocks fall, government bonds/gold rise)

2. Sufficient cash reserves (that's your option)

3. Never fully commit

It's not just about how sharp your spear is, but also how thick your shield is. In this game, defens

- Reward

- like

- Comment

- Repost

- Share

The best growth environment is having a group of like-minded peers who can give you a sense of "cognitive pressure." One's perspective is ultimately limited, but by establishing high-quality connections, we can use each other's viewpoints as mirrors to discover blind spots that we might have overlooked.

I am looking for partners who are dissatisfied with the status quo, have a clear blueprint for the future, and possess extreme execution capabilities. I hope that our connection is not just a simple increase in numbers, but a deep alignment on "growth possibilities." I long to see your explorat

View OriginalI am looking for partners who are dissatisfied with the status quo, have a clear blueprint for the future, and possess extreme execution capabilities. I hope that our connection is not just a simple increase in numbers, but a deep alignment on "growth possibilities." I long to see your explorat

- Reward

- like

- Comment

- Repost

- Share

"Survival in high-stakes markets is proof of strength. But to grow, one must stay in sync with others who have been tested by fire. In the spirit of Taleb, I’m looking for those with 'Skin in the Game.'

I’m clearing out the noise to focus on builders and survivors. I want to connect with the action-oriented: those who have lost and learned, who debug at 3 AM, and who find logic where others see only mist.

If you’re building your moat or preparing for the next move, reach out. This isn't just networking—it’s about finding a reference frame for the next cycle and achieving a breakthrough in pers

I’m clearing out the noise to focus on builders and survivors. I want to connect with the action-oriented: those who have lost and learned, who debug at 3 AM, and who find logic where others see only mist.

If you’re building your moat or preparing for the next move, reach out. This isn't just networking—it’s about finding a reference frame for the next cycle and achieving a breakthrough in pers

- Reward

- like

- Comment

- Repost

- Share

In any market filled with competition, survival itself is a testament to strength. But long-term progress cannot rely solely on solitary vigilance; it also requires maintaining a resonance with those souls who have been tempered by the same fierce fire in the arena. As Nassim Nicholas Taleb said, we should seek out those who embody the spirit of “risk sharing.”

I have decided to clear out the noise of empty talk and complaints, and focus my vision on true builders and survivors. I yearn to connect with those who have experienced losses and pain but have never stopped thinking; those who debug

View OriginalI have decided to clear out the noise of empty talk and complaints, and focus my vision on true builders and survivors. I yearn to connect with those who have experienced losses and pain but have never stopped thinking; those who debug

- Reward

- like

- Comment

- Repost

- Share

The "honest person" who is always ready to help and never complains was optimized yesterday. Conversely, the "troublemaker" who often causes trouble and even dares to slam the table with superiors is not only steady as Mount Tai but also received the highest performance rating.

The honest person is so aggrieved that their hands tremble: "I did the work of three people, all the dirty and tiring jobs are covered by me. Why should I be treated like this?"

It's harsh, but the logic is simple: You are here to do the work, and he is here to settle accounts.

No matter how exquisite your PPT is, it’s

View OriginalThe honest person is so aggrieved that their hands tremble: "I did the work of three people, all the dirty and tiring jobs are covered by me. Why should I be treated like this?"

It's harsh, but the logic is simple: You are here to do the work, and he is here to settle accounts.

No matter how exquisite your PPT is, it’s

- Reward

- like

- Comment

- Repost

- Share

An individual's growth boundary is often limited by the density of information they are exposed to daily. If our social media is filled with fragmented emotions, then our cognitive bandwidth will be greatly wasted. I am planning a deep and systematic upgrade of my information flow.

I hope to reconstruct my timeline into a high-frequency, precise, and forward-looking think tank. I am looking for those who have deep expertise in their respective fields, can provide differentiated insights, and are continuously breaking through in practical applications. I don't want to passively wait for algorit

View OriginalI hope to reconstruct my timeline into a high-frequency, precise, and forward-looking think tank. I am looking for those who have deep expertise in their respective fields, can provide differentiated insights, and are continuously breaking through in practical applications. I don't want to passively wait for algorit

- Reward

- like

- Comment

- Repost

- Share

Self-study without friends leads to narrow knowledge and limited horizons. In the current cycle, any attempt to go it alone has significant limitations. True breakthroughs often occur at the intersection of different perspectives.

I initiated this initiative to build a distributed intelligent network. I am looking for friends who seek logic in code, hone human nature through trading, and express truth through creation. We don't necessarily have to be in the same track, but we need to share a similar pace of evolution and a common underlying operating system.

Please leave your field or recent d

View OriginalI initiated this initiative to build a distributed intelligent network. I am looking for friends who seek logic in code, hone human nature through trading, and express truth through creation. We don't necessarily have to be in the same track, but we need to share a similar pace of evolution and a common underlying operating system.

Please leave your field or recent d

- Reward

- like

- Comment

- Repost

- Share

The only shortcut to progress is to immerse yourself in the most radical and smartest groups. I am consciously tuning my social energy field, eliminating noise that dampens my fighting spirit, and introducing more aggressive and constructive signals.

I hope my homepage is no longer a fragmented pile of information, but a strategic game of minds among intelligent people. I long to see real combat insights, hardcore technical breakdowns, and the coldest market analysis.

If you consider yourself a continuous builder, please let me know through interaction. I will carefully screen every like-minde

View OriginalI hope my homepage is no longer a fragmented pile of information, but a strategic game of minds among intelligent people. I long to see real combat insights, hardcore technical breakdowns, and the coldest market analysis.

If you consider yourself a continuous builder, please let me know through interaction. I will carefully screen every like-minde

- Reward

- like

- Comment

- Repost

- Share

Investing is not about who has a higher IQ. Investing is about who can tolerate boredom better.

If you find investing very exciting, then you are probably gambling. True compound interest occurs the moment you stop trading frequently.

Ordinary people die from:

· Chasing hot topics

· Frequent portfolio switching

· Trying to predict tomorrow

Experts win by:

· Admitting ignorance

· Mechanical execution

· Long-term holding

Most people don't want "financial freedom," but rather "getting something for nothing." But the market only rewards one type of person: those who can delay gratification.

View OriginalIf you find investing very exciting, then you are probably gambling. True compound interest occurs the moment you stop trading frequently.

Ordinary people die from:

· Chasing hot topics

· Frequent portfolio switching

· Trying to predict tomorrow

Experts win by:

· Admitting ignorance

· Mechanical execution

· Long-term holding

Most people don't want "financial freedom," but rather "getting something for nothing." But the market only rewards one type of person: those who can delay gratification.

- Reward

- like

- Comment

- Repost

- Share

When you are extremely eager to make progress, the whole world will make way for you. But the prerequisite is that you must stand in a field filled with upward energy. I am actively breaking down the walls of my thinking to connect with those hardcore individuals who dare to explore uncharted territories and say no to mediocrity.

I have always believed that outstanding people are like stars scattered everywhere. Through connection, we can form a vast network of collaboration. I don't want to be just an onlooker here; I want to deeply participate in the growth process of every fellow traveler.

View OriginalI have always believed that outstanding people are like stars scattered everywhere. Through connection, we can form a vast network of collaboration. I don't want to be just an onlooker here; I want to deeply participate in the growth process of every fellow traveler.

- Reward

- like

- Comment

- Repost

- Share

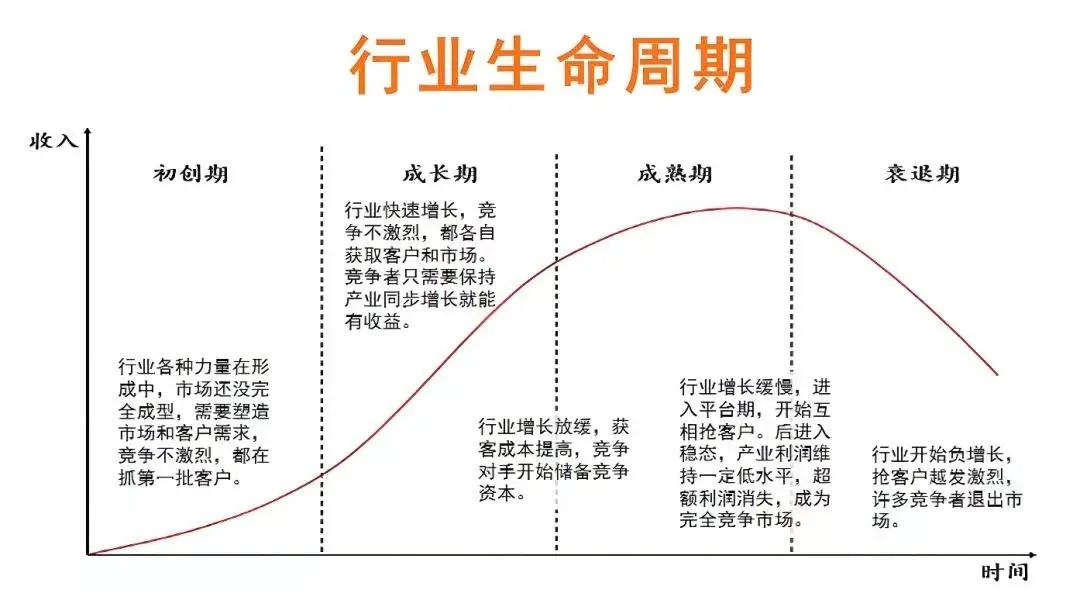

Wall Street is in a state of extreme fear over the "AI Bubble" burst. But Gene Munster has just presented an counterintuitive conclusion: it’s 1995 (the dawn of the internet), not 1999 (the eve of the crash).

This is not a gamble driven by hype, but a "Pascal’s Wager" for survival. Giants must spend money because the cost of not doing so is death.

Below is the underlying strategic logic and asset revaluation guide for the 2026 market.

1. Pascal’s Wager: Why Capex Must Surge by 50%

Many people don’t understand why Meta and Google are frantically buying GPUs. It’s not because they are confident

View OriginalThis is not a gamble driven by hype, but a "Pascal’s Wager" for survival. Giants must spend money because the cost of not doing so is death.

Below is the underlying strategic logic and asset revaluation guide for the 2026 market.

1. Pascal’s Wager: Why Capex Must Surge by 50%

Many people don’t understand why Meta and Google are frantically buying GPUs. It’s not because they are confident

- Reward

- like

- Comment

- Repost

- Share

Seeing an acquaintance jump into a fire pit, is your first reaction to pull them out? Then you're not far from bad luck either.

The logic of ordinary people: I'm doing this for your good, afraid you'll be scammed, afraid you'll take a detour, trying to use your limited experience to interfere with others' karma.

The logic of the person involved: If you block me, you're blocking my way to wealth, can't stand to see me do well; only when he truly falls headlong and bloodied will he realize that it's society's blow, not your foresight.

Once, a friend insisted on going all-in on a low-quality proj

View OriginalThe logic of ordinary people: I'm doing this for your good, afraid you'll be scammed, afraid you'll take a detour, trying to use your limited experience to interfere with others' karma.

The logic of the person involved: If you block me, you're blocking my way to wealth, can't stand to see me do well; only when he truly falls headlong and bloodied will he realize that it's society's blow, not your foresight.

Once, a friend insisted on going all-in on a low-quality proj

- Reward

- like

- Comment

- Repost

- Share

Lone travelers may go fast, but only collective travelers can reach the distant horizon. On the path to excellence, the most valuable thing is not resources, but the kind of cognitive feedback that can instantly synchronize.

I am consciously optimizing my digital social structure, eliminating ineffective noise, and introducing more vibrant signals. I yearn to connect with souls who dare to step out of their comfort zones, face real-world challenges, and always maintain a humble learning attitude.

If you consider yourself a person who is continuously striving forward, and if you also wish for y

View OriginalI am consciously optimizing my digital social structure, eliminating ineffective noise, and introducing more vibrant signals. I yearn to connect with souls who dare to step out of their comfort zones, face real-world challenges, and always maintain a humble learning attitude.

If you consider yourself a person who is continuously striving forward, and if you also wish for y

- Reward

- like

- Comment

- Repost

- Share

The lone traveler moves swiftly, while the companion walks a long road. To better break through current bottlenecks, I have decided to reorganize my social network and find friends who share the same ambitions for the future.

I hope my timeline is no longer filled with useless information, but rather with the thoughts and feedback of strivers. If you are currently giving your all, you are welcome to join my follow list. I will pay attention to every interaction and maintain long-term and close connections with like-minded individuals.

View OriginalI hope my timeline is no longer filled with useless information, but rather with the thoughts and feedback of strivers. If you are currently giving your all, you are welcome to join my follow list. I will pay attention to every interaction and maintain long-term and close connections with like-minded individuals.

- Reward

- like

- Comment

- Repost

- Share

The vast majority of investors cannot distinguish between a "good company" and a "good investment."

This is why the money you make in a bull market can evaporate out of thin air in a bear market. AI is turning business into a "negative-sum game"—this is not alarmism, but mathematics inevitability.

Here are 6 cold truths about survival, shorting bubbles, and cycle management.

1. Price Supremacy: Even garbage is golden if the price is right

The fundamental principle of investing has been completely forgotten. Great companies combined with the wrong price lead to disaster. Conversely, companies a

View OriginalThis is why the money you make in a bull market can evaporate out of thin air in a bear market. AI is turning business into a "negative-sum game"—this is not alarmism, but mathematics inevitability.

Here are 6 cold truths about survival, shorting bubbles, and cycle management.

1. Price Supremacy: Even garbage is golden if the price is right

The fundamental principle of investing has been completely forgotten. Great companies combined with the wrong price lead to disaster. Conversely, companies a

- Reward

- like

- Comment

- Repost

- Share

X Algorithm has been fully open-sourced, no longer a black box.

According to the most hardcore logic disclosed by Elon Musk in January 2026: Likes are vanity, retweets are nuclear bombs.

If you still believe in “daily updates” and don’t understand the permutations of the 20x weight factors, you are being systematically wiped out at 100 times the speed.

We are in the most transparent yet most brutal “computing power game” era in X’s history. When open-source code every 4 weeks becomes the norm, mediocre creators will become completely invisible due to their inability to penetrate the “funnel” m

View OriginalAccording to the most hardcore logic disclosed by Elon Musk in January 2026: Likes are vanity, retweets are nuclear bombs.

If you still believe in “daily updates” and don’t understand the permutations of the 20x weight factors, you are being systematically wiped out at 100 times the speed.

We are in the most transparent yet most brutal “computing power game” era in X’s history. When open-source code every 4 weeks becomes the norm, mediocre creators will become completely invisible due to their inability to penetrate the “funnel” m

- Reward

- like

- Comment

- Repost

- Share