HenriqueCen

No content yet

HenriqueCen

"I know of no better life purpose than to perish in attempting the great and the impossible."― Friedrich Nietzsche

- Reward

- like

- Comment

- Repost

- Share

Everyone reads the bestsellers. If you consume the same information as the crowd, you’ll get the same results as the crowd.\n\nTo find an edge in the markets, you have to look where others aren\'t.\n\nRead what the majority ignores to see what the majority misses.

- Reward

- like

- Comment

- Repost

- Share

Maverick Capital is around the corner. Mathematical precision in sector investing!

- Reward

- like

- Comment

- Repost

- Share

Level 1 vs. Level 2 Thinking!

To find the winners, you have to move beyond the obvious.

First-Level Thinking (crowd)

"The earnings were good. Buy."

"The news is scary. Sell."

Result: You follow the herd and get average returns.

Second-Level Thinking (pros)

"The earnings were good, but were they better than I expected?"

"The news is scary, but is the price already beaten down and offers a margin of safety and good upside?"

You can always find value in where others got confused.

First-level thinkers react to the present.

Second-level thinkers anticipate the future. You need to be 3 steps ahead.

To find the winners, you have to move beyond the obvious.

First-Level Thinking (crowd)

"The earnings were good. Buy."

"The news is scary. Sell."

Result: You follow the herd and get average returns.

Second-Level Thinking (pros)

"The earnings were good, but were they better than I expected?"

"The news is scary, but is the price already beaten down and offers a margin of safety and good upside?"

You can always find value in where others got confused.

First-level thinkers react to the present.

Second-level thinkers anticipate the future. You need to be 3 steps ahead.

- Reward

- like

- Comment

- Repost

- Share

I just published my 23 contrarian predictions for 2026 markets.

• S&P 500 returns will disappoint

• 400+ IPOs coming (biggest year in decades)

• AI will improve by 50X this year

• Bitcoin won't hit $150k

• Many more scandalous predictions

I'm just living and breathing markets daily as a full-time investor

• S&P 500 returns will disappoint

• 400+ IPOs coming (biggest year in decades)

• AI will improve by 50X this year

• Bitcoin won't hit $150k

• Many more scandalous predictions

I'm just living and breathing markets daily as a full-time investor

BTC0,34%

- Reward

- like

- Comment

- Repost

- Share

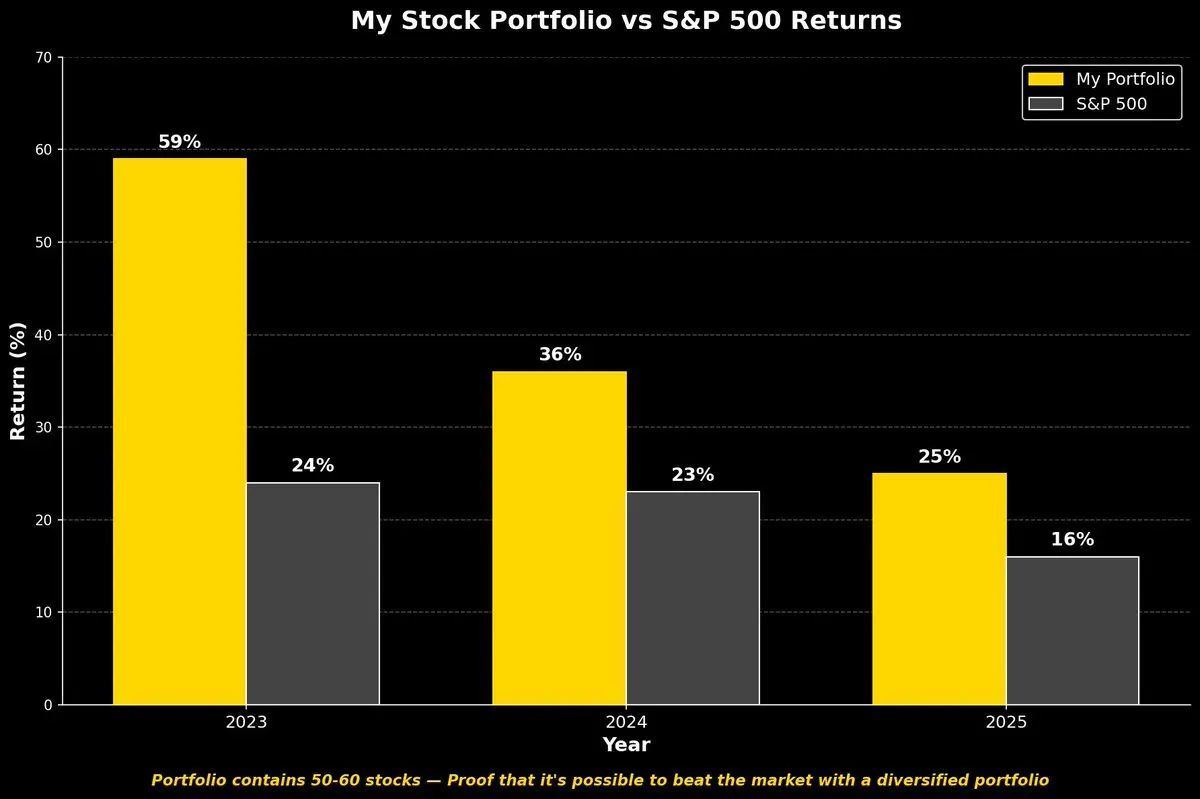

"You can't beat the market with a diversified portfolio."

I keep hearing this. But my stock portfolio tells a different story.

Here's my portfolio (50-60 stocks) vs S&P 500.

Diversification isn't the enemy of alpha. Poor stock selection is.

I keep hearing this. But my stock portfolio tells a different story.

Here's my portfolio (50-60 stocks) vs S&P 500.

Diversification isn't the enemy of alpha. Poor stock selection is.

- Reward

- like

- Comment

- Repost

- Share

"gold is a good hedge against inflation" is a cliché.

Gold went up 30x more than inflation.

Gold goes up because investors buy and investors buy because goes up.

This will soon end.

Gold went up 30x more than inflation.

Gold goes up because investors buy and investors buy because goes up.

This will soon end.

- Reward

- like

- Comment

- Repost

- Share

The market is already full of smart people and algorithms; if you see what they see, you have no edge.

To beat the market, you have to diverge from it. You have to be right when the crowd is wrong.

Different + Better = Second-Level Thinking.

To beat the market, you have to diverge from it. You have to be right when the crowd is wrong.

Different + Better = Second-Level Thinking.

- Reward

- like

- Comment

- Repost

- Share

My 23 predictions for 2026: It will be a market reset.

I'm pretty sure most of my predictions will be right.

❌ Gold: It’s going to underperform (and I explain why).

🤖 AI: We will see 50x improvements, but OpenAI won't announce AGI.

🍎 Apple: Tim Cook steps down.

🚀 Elon Musk: Becomes the first Trillionaire.

📉 S&P 500: Returns will slow, but the Russell 2000 is waking up.

🔔 400+ IPOs hit the market

💸 US Debt reaching $40T

Read my full analysis and roadmap here:

I'm pretty sure most of my predictions will be right.

❌ Gold: It’s going to underperform (and I explain why).

🤖 AI: We will see 50x improvements, but OpenAI won't announce AGI.

🍎 Apple: Tim Cook steps down.

🚀 Elon Musk: Becomes the first Trillionaire.

📉 S&P 500: Returns will slow, but the Russell 2000 is waking up.

🔔 400+ IPOs hit the market

💸 US Debt reaching $40T

Read my full analysis and roadmap here:

- Reward

- like

- Comment

- Repost

- Share

Who invested in this?

The Palantir $PLTR 3x leveraged ETF rose 28,000% in 3 years!

The Palantir $PLTR 3x leveraged ETF rose 28,000% in 3 years!

- Reward

- like

- Comment

- Repost

- Share

To win, you have to think differently.

In investing, there is a concept called "Second-Level Thinking." It is the difference between average returns and building crazy wealth.

First-level thinking is simplistic: "This company has a great product, I should buy it."

It is intuitive but because it’s obvious to everyone, there is no edge there.

Second-level thinking goes deeper and you need to ask uncomfortable questions:

"Everyone likes this product, but are expectations too high?"

"This news looks bad, but is the market reacting to noise is there a significant shift? what are people missing?"

If

In investing, there is a concept called "Second-Level Thinking." It is the difference between average returns and building crazy wealth.

First-level thinking is simplistic: "This company has a great product, I should buy it."

It is intuitive but because it’s obvious to everyone, there is no edge there.

Second-level thinking goes deeper and you need to ask uncomfortable questions:

"Everyone likes this product, but are expectations too high?"

"This news looks bad, but is the market reacting to noise is there a significant shift? what are people missing?"

If

- Reward

- like

- Comment

- Repost

- Share

Why most investors miss the big winners:

They lack SECOND-LEVEL thinking.

Level 1 Thinking

"This company has a cool product. AI is trendy. The stock will go up."

Everyone knows this. It’s already priced in. No significant upside.

Level 2 Thinking

"Everyone sees the cool product, everyone knows AI is trendy, but what else are they missing? Is the market selling off on short-term noise while ignoring long-term necessity?"

The goal is to find what the crowd has misunderstood. Be a contrarian.

They lack SECOND-LEVEL thinking.

Level 1 Thinking

"This company has a cool product. AI is trendy. The stock will go up."

Everyone knows this. It’s already priced in. No significant upside.

Level 2 Thinking

"Everyone sees the cool product, everyone knows AI is trendy, but what else are they missing? Is the market selling off on short-term noise while ignoring long-term necessity?"

The goal is to find what the crowd has misunderstood. Be a contrarian.

- Reward

- like

- Comment

- Repost

- Share

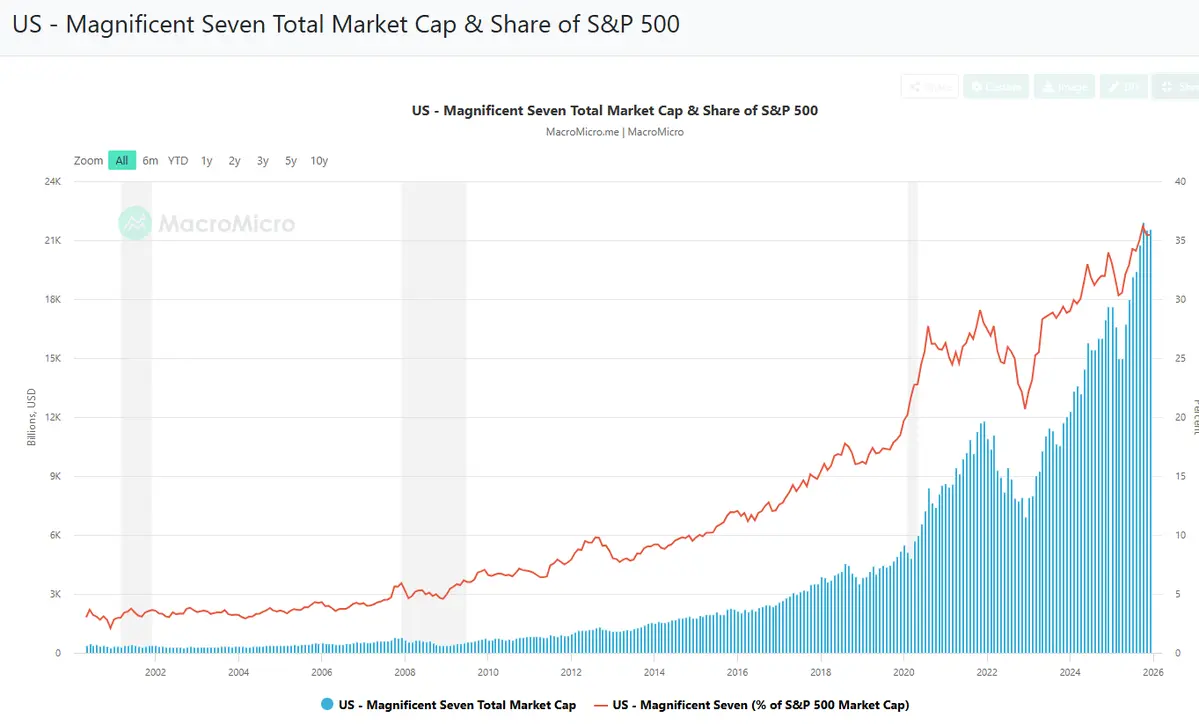

The S&P 500 is too concentrated in the MAG7. Here's where I'm going.

The S&P 500 is now a dangerous bet on just SEVEN tech giants. As of Jan 2026, the MAG 7 is 34.5% of the entire index. This is an ALL-TIME HIGH level of concentration that beats even the dot-com bubble peak!

That’s why I’m rotating a big chunk (potentially >50%) of my SSO position into URST, the 2x leveraged EQUAL-WEIGHT S&P 500 ETF.

In URST:

- Every stock gets ~0.2% weight

- MAG7 drops from 34% → just 1.4%

- Real exposure to the other 493 companies in healthcare, industrials, financials, etc., which might perform better next

The S&P 500 is now a dangerous bet on just SEVEN tech giants. As of Jan 2026, the MAG 7 is 34.5% of the entire index. This is an ALL-TIME HIGH level of concentration that beats even the dot-com bubble peak!

That’s why I’m rotating a big chunk (potentially >50%) of my SSO position into URST, the 2x leveraged EQUAL-WEIGHT S&P 500 ETF.

In URST:

- Every stock gets ~0.2% weight

- MAG7 drops from 34% → just 1.4%

- Real exposure to the other 493 companies in healthcare, industrials, financials, etc., which might perform better next

- Reward

- like

- Comment

- Repost

- Share

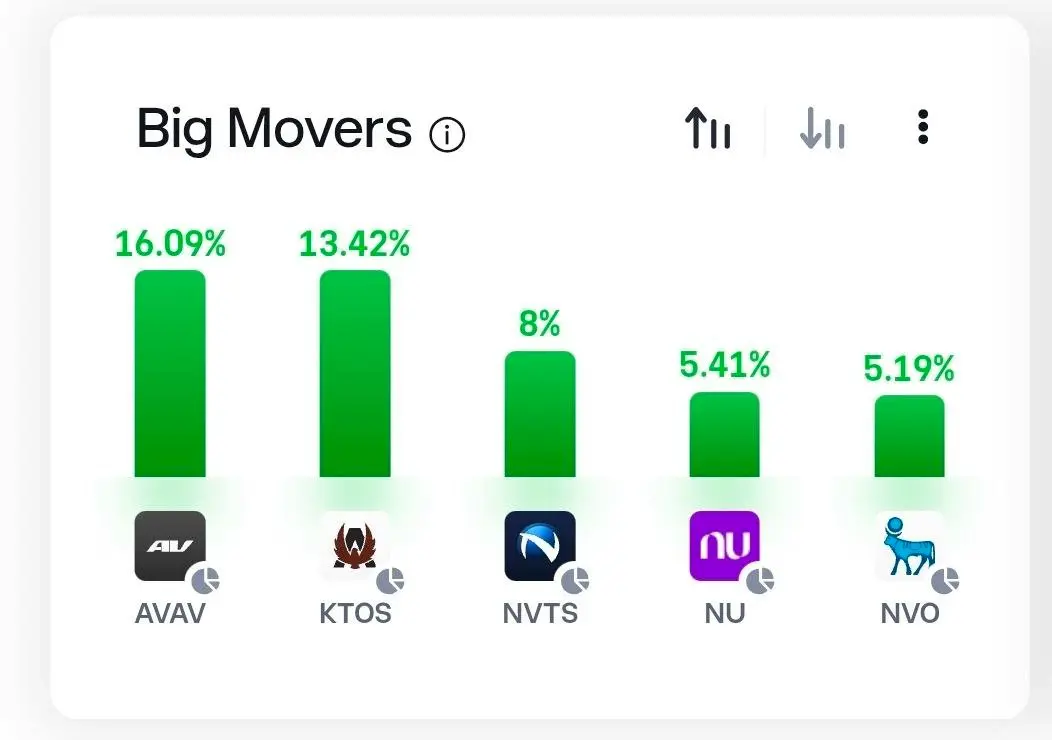

Investing in American defense stocks is investing in peace through strength.

Also, having some defense stocks, such as $AVAV and $KTOS, is a great insurance for times of international tension. $NU is also performing well as a LATAM bank.

Also, having some defense stocks, such as $AVAV and $KTOS, is a great insurance for times of international tension. $NU is also performing well as a LATAM bank.

- Reward

- like

- Comment

- Repost

- Share

Remember:

"The early bird gets the worm..."

But also:

"The second mouse gets the cheese."

Let narratives unfold.

Sometimes, being too early is just like being wrong.

"The early bird gets the worm..."

But also:

"The second mouse gets the cheese."

Let narratives unfold.

Sometimes, being too early is just like being wrong.

- Reward

- like

- Comment

- Repost

- Share