Diznifigo

No content yet

diznifigo

New Cardano deal opens a path to $80 billion in omnichain assets, but liquidity still isn’t guaranteed

By leveraging LayerZero’s cross-chain messaging, Cardano seeks to expand its DeFi ecosystem without altering its core architecture.

Cardano is aggressively expanding the types of tokens that can operate on its network and raise the ceiling for its decentralized finance ecosystem over the next 12 to 18 months.

On Feb. 12, the Charles Hoskinson-led blockchain announced it would integrate with LayerZero, a widely used cross-chain messaging system.

This move represents the single largest interope

By leveraging LayerZero’s cross-chain messaging, Cardano seeks to expand its DeFi ecosystem without altering its core architecture.

Cardano is aggressively expanding the types of tokens that can operate on its network and raise the ceiling for its decentralized finance ecosystem over the next 12 to 18 months.

On Feb. 12, the Charles Hoskinson-led blockchain announced it would integrate with LayerZero, a widely used cross-chain messaging system.

This move represents the single largest interope

- Reward

- like

- Comment

- Repost

- Share

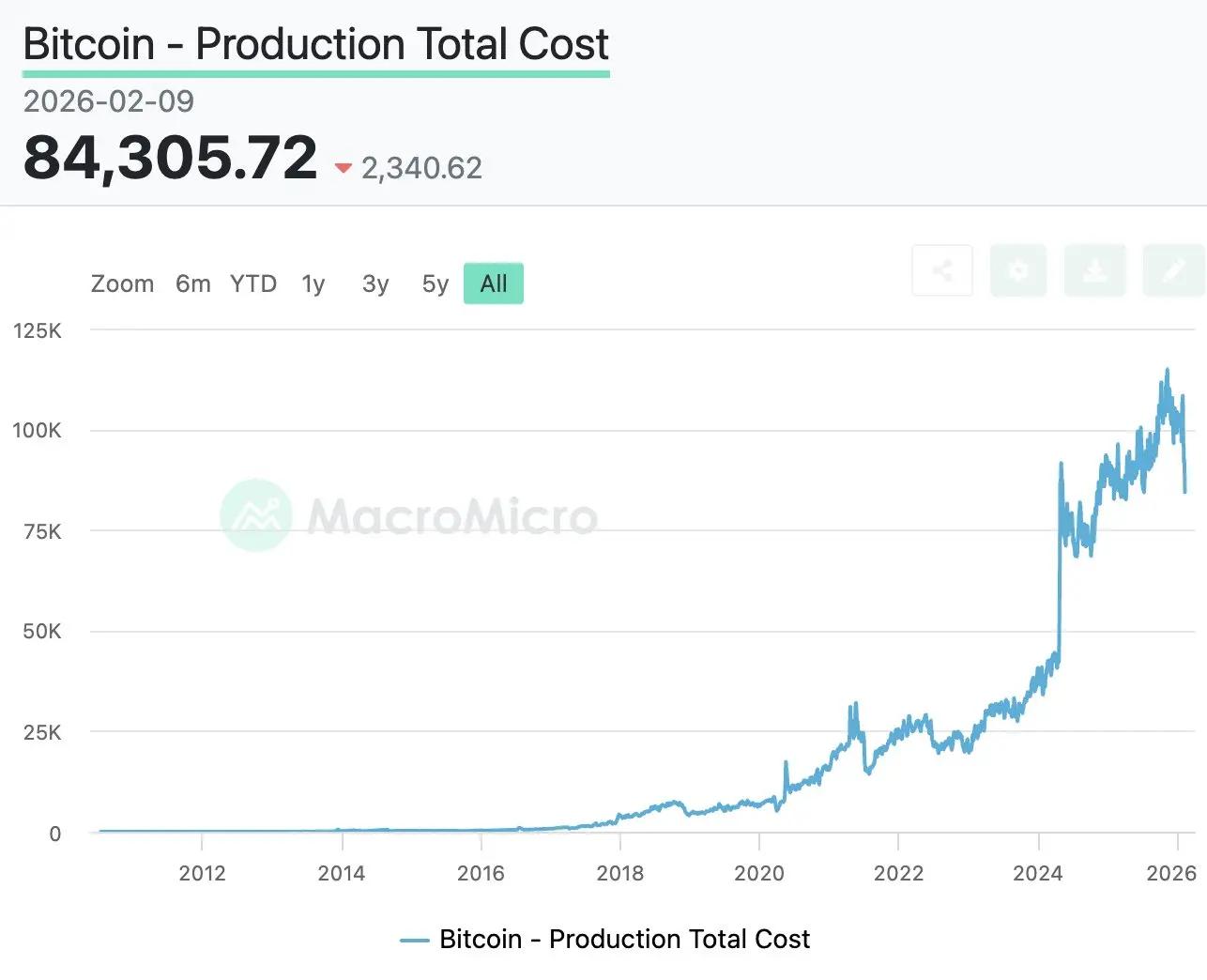

IT NOW COSTS AROUND $84,000 TO MINE 1 BITCOIN…

YET BTC IS TRADING AT $65,000.

LET THAT SINK IN.

Miners are producing coins at a loss.

History shows that when production costs sit above price for long, something eventually breaks — either inefficient miners capitulate… or price reprices.

Think carefully about what that usually means.

YET BTC IS TRADING AT $65,000.

LET THAT SINK IN.

Miners are producing coins at a loss.

History shows that when production costs sit above price for long, something eventually breaks — either inefficient miners capitulate… or price reprices.

Think carefully about what that usually means.

BTC4,83%

- Reward

- like

- Comment

- Repost

- Share

🚨WARNING: SOMETHING EXTREMELY BAD IS COMING!!

Bank of Japan is expected to hike rates to 1.00% in April, according to Bank of America.

Japan hasn’t been at 1.00% since the mid 1990s.

And if you think Japan has no impact on global markets

YOU ARE COMPLETELY WRONG.

Let me explain this in simple words.

The last time Japan was in this zone, the world was already getting hit.

In 1994, bonds got wrecked in the “Great Bond Massacre” about $1.5 TRILLION in bond market value got wiped out.

Then in early 1995, stress kept stacking.

And the yen went NUCLEAR.

On April 19, 1995, USD/JPY hit about 79.75

a

Bank of Japan is expected to hike rates to 1.00% in April, according to Bank of America.

Japan hasn’t been at 1.00% since the mid 1990s.

And if you think Japan has no impact on global markets

YOU ARE COMPLETELY WRONG.

Let me explain this in simple words.

The last time Japan was in this zone, the world was already getting hit.

In 1994, bonds got wrecked in the “Great Bond Massacre” about $1.5 TRILLION in bond market value got wiped out.

Then in early 1995, stress kept stacking.

And the yen went NUCLEAR.

On April 19, 1995, USD/JPY hit about 79.75

a

BTC4,83%

- Reward

- 3

- Comment

- Repost

- Share

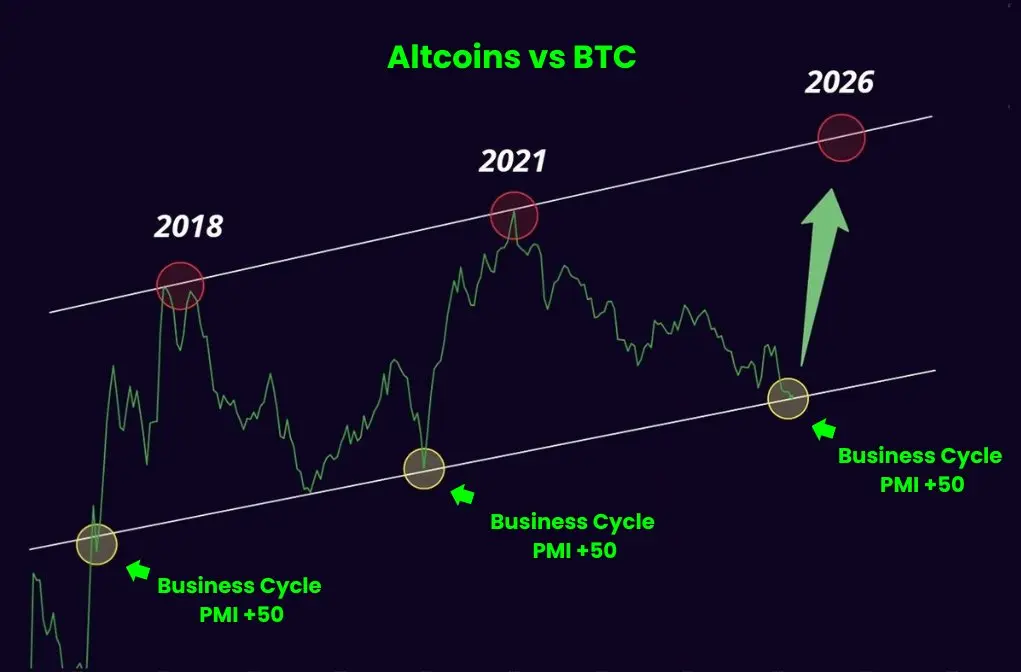

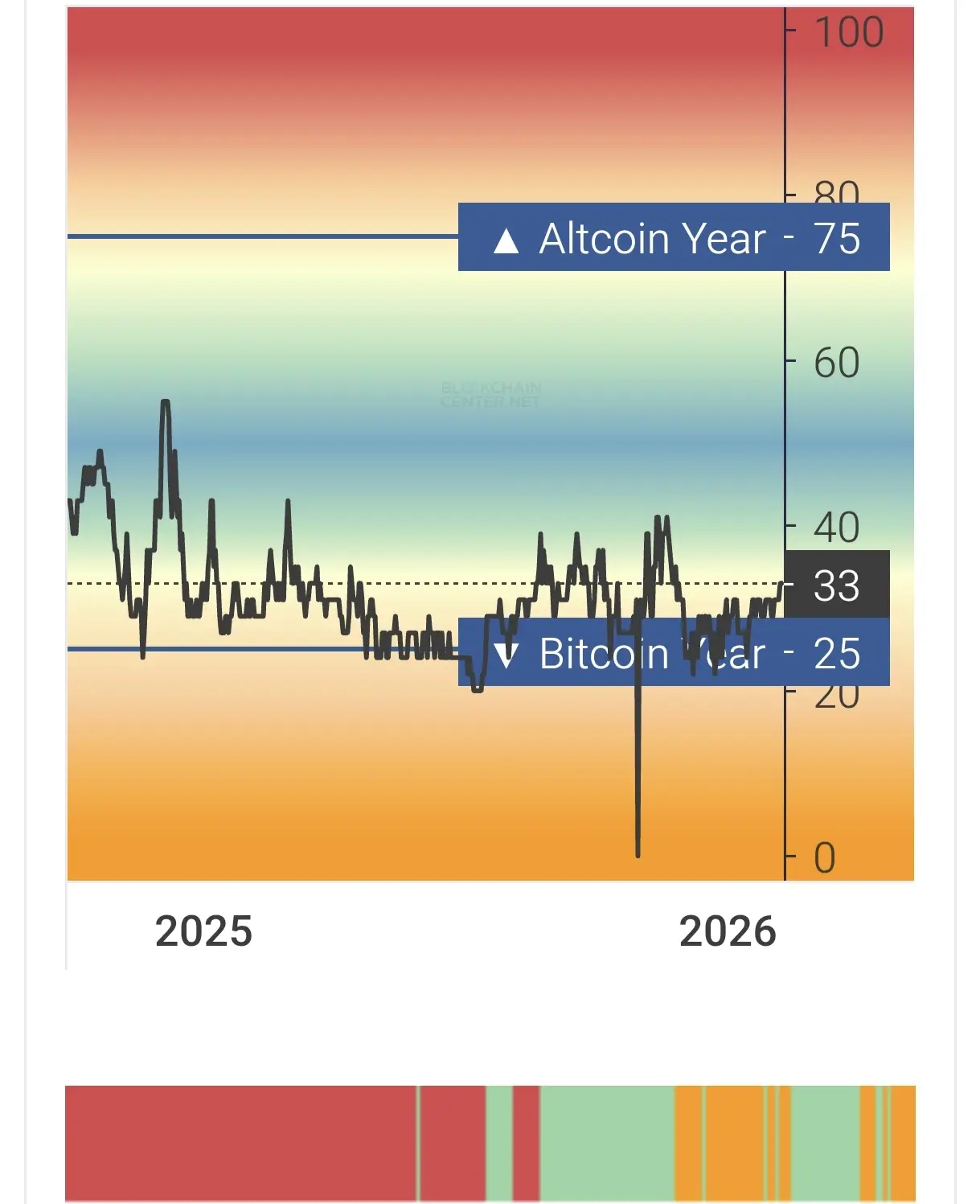

I don't think people understand how massive Alt Season 2026 is looking right now...

This pullback only magnifies the upside.

The key is Manufacturing PMI - and it just flipped back above 50.

First bullish print in ~4 years.

2016–2017:

Alts +1,000–4,000%

2020–2021:

Alts +800–3,000%

2026:

Lower entry.

Bigger move.

Rate cuts.

Regulatory clarity.

Liquidity returns.

While most disbelieve - the next wave of Crypto Millionaires do.

This pullback only magnifies the upside.

The key is Manufacturing PMI - and it just flipped back above 50.

First bullish print in ~4 years.

2016–2017:

Alts +1,000–4,000%

2020–2021:

Alts +800–3,000%

2026:

Lower entry.

Bigger move.

Rate cuts.

Regulatory clarity.

Liquidity returns.

While most disbelieve - the next wave of Crypto Millionaires do.

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 BILLIONAIRE ANTHONY SCARAMUCCI JUST BROKE THE BULL METER ON LIVE TV:

TRILLIONS OF DOLLARS ARE WAITING TO BUY BITCOIN, AND IT ALL STARTS TO FLOW IN WHEN MARKET STRUCTURE BILL PASSES.

“DEMOCRATS SAID IT WILL PASS”

THIS WILL BE THE BIGGEST CAPITAL INFLOW IN BITCOIN HISTORY 🚀

TRILLIONS OF DOLLARS ARE WAITING TO BUY BITCOIN, AND IT ALL STARTS TO FLOW IN WHEN MARKET STRUCTURE BILL PASSES.

“DEMOCRATS SAID IT WILL PASS”

THIS WILL BE THE BIGGEST CAPITAL INFLOW IN BITCOIN HISTORY 🚀

BTC4,83%

- Reward

- like

- 1

- Repost

- Share

GateUser-5a416c84 :

:

Selling in progress!🙏JACK YI’S TREND RESEARCH BUILT A MASSIVE $2.6B LEVERAGED ETH LONG AT AN AVERAGE PRICE OF $3,267.

OVER THE PAST WEEK, THEY WERE FORCED TO SELL $1.8B WORTH OF ETH AROUND $2,326 TO REPAY LOANS.

THEY NOW HOLD JUST $44M IN ETH — WITH TOTAL LOSSES AROUND $750M.

A BRUTAL REMINDER: LEVERAGE WORKS BOTH WAYS.

OVER THE PAST WEEK, THEY WERE FORCED TO SELL $1.8B WORTH OF ETH AROUND $2,326 TO REPAY LOANS.

THEY NOW HOLD JUST $44M IN ETH — WITH TOTAL LOSSES AROUND $750M.

A BRUTAL REMINDER: LEVERAGE WORKS BOTH WAYS.

ETH7,21%

- Reward

- like

- 1

- Repost

- Share

THE BIGGEST BULLRUN WE’VE EVER SEEN STARTS TODAY

sentiment is at all time lows as people have started to “accept” that the 4-year cycle is intact.

Fear and greed tapped 5 and is sitting at 8. RECORD LOWS.

RSI is also at RECORD LOWS.

While everyone is accepting that it’s over, quitting, and capitulating their bags at the bottom the institutions are secretly buying.

A rally is going to start and retail will miss it and FOMO back in at the highs.

Bookmark this post.

sentiment is at all time lows as people have started to “accept” that the 4-year cycle is intact.

Fear and greed tapped 5 and is sitting at 8. RECORD LOWS.

RSI is also at RECORD LOWS.

While everyone is accepting that it’s over, quitting, and capitulating their bags at the bottom the institutions are secretly buying.

A rally is going to start and retail will miss it and FOMO back in at the highs.

Bookmark this post.

- Reward

- like

- Comment

- Repost

- Share

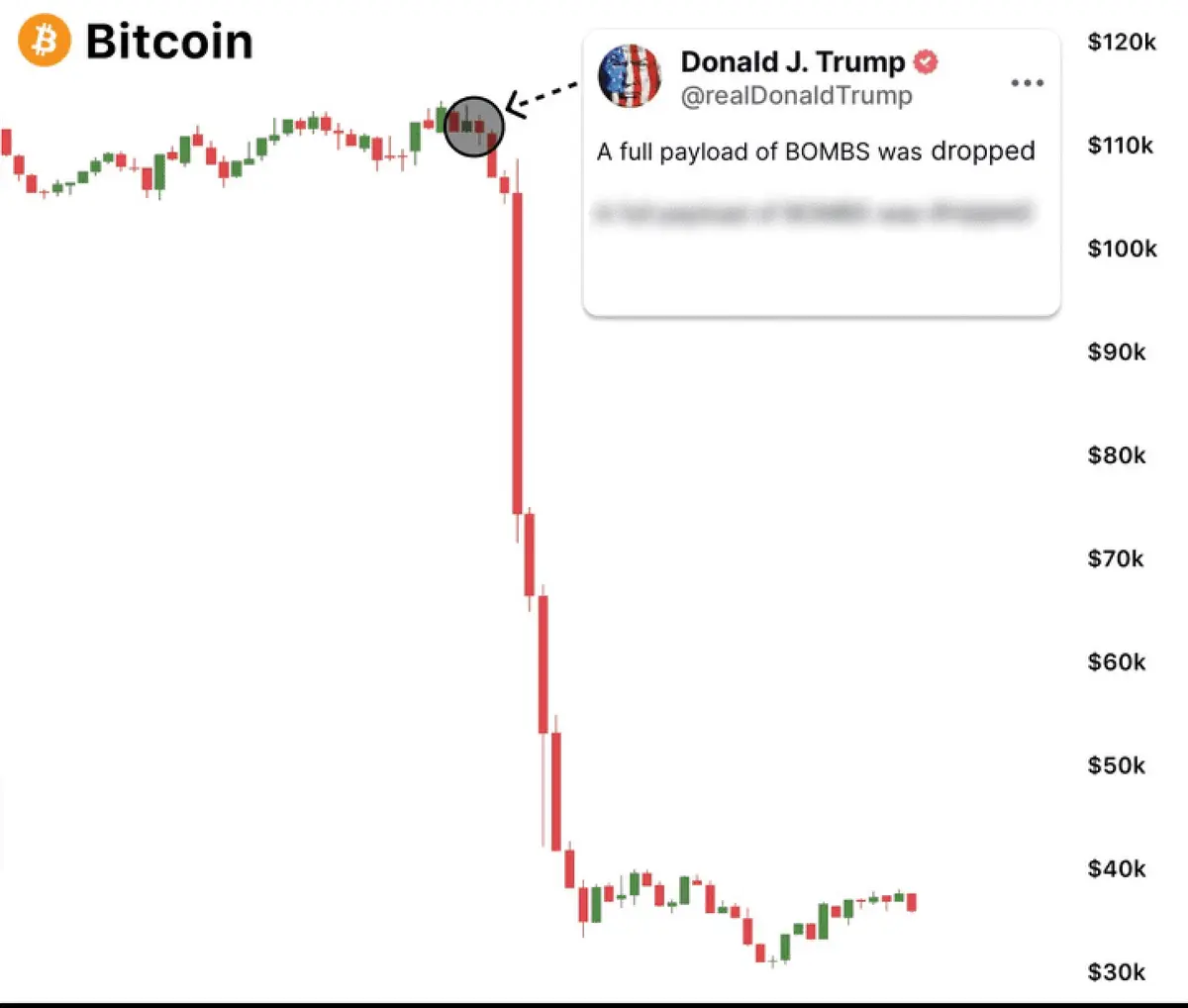

Geopolitics, Liquidity, and the Risk Ahead

Markets are already red and liquidity is thinning. This is just Phase One, not the bottom.

This current selloff isn’t fear; it’s sequence—BIG MONEY is dumping into thin liquidity now.

Liquidations are fueling moves: over $650M in positions wiped out in a few hours.

Large transfers to exchanges after spikes signal rapid risk-off dynamics.

Geopolitics could be the real catalyst.

A Trump escalation against Iran would press markets in multiple channels at once.

ENERGY, RATES, FX, and GLOBAL LIQUIDITY would all be impacted.

In a collision of geop

Markets are already red and liquidity is thinning. This is just Phase One, not the bottom.

This current selloff isn’t fear; it’s sequence—BIG MONEY is dumping into thin liquidity now.

Liquidations are fueling moves: over $650M in positions wiped out in a few hours.

Large transfers to exchanges after spikes signal rapid risk-off dynamics.

Geopolitics could be the real catalyst.

A Trump escalation against Iran would press markets in multiple channels at once.

ENERGY, RATES, FX, and GLOBAL LIQUIDITY would all be impacted.

In a collision of geop

- Reward

- like

- Comment

- Repost

- Share

BANK OF JAPAN WILL DUMP FOREIGN BONDS TODAY AT 6:50 PM ET.

LAST TIME, THEY SOLD $177 BILLION, MOSTLY US BONDS.

AFTER THE YEN INTERVENTION, THIS COULD BE $750 BILLION OR MORE.

THIS COULD BE REALLY BAD FOR MARKETS…

LAST TIME, THEY SOLD $177 BILLION, MOSTLY US BONDS.

AFTER THE YEN INTERVENTION, THIS COULD BE $750 BILLION OR MORE.

THIS COULD BE REALLY BAD FOR MARKETS…

- Reward

- like

- Comment

- Repost

- Share

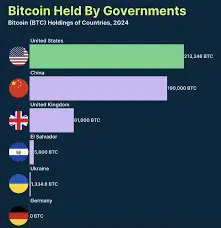

🇺🇸 THE BITCOIN ACT — MASSIVE SUPPLY SHOCK INCOMING

PROPOSED LEGISLATION REVEALS A LONG-TERM STRATEGY FOR THE U.S. TO ACCUMULATE UP TO 1,000,000 BTC.

THAT’S ~5% OF BITCOIN’S ENTIRE SUPPLY, PLANNED TO BE ACQUIRED GRADUALLY OVER THE NEXT 5 YEARS.

IF THIS MOVES FORWARD, IT’S NOT JUST BULLISH —

IT’S NATION-STATE LEVEL ADOPTION 🟠🚀

PROPOSED LEGISLATION REVEALS A LONG-TERM STRATEGY FOR THE U.S. TO ACCUMULATE UP TO 1,000,000 BTC.

THAT’S ~5% OF BITCOIN’S ENTIRE SUPPLY, PLANNED TO BE ACQUIRED GRADUALLY OVER THE NEXT 5 YEARS.

IF THIS MOVES FORWARD, IT’S NOT JUST BULLISH —

IT’S NATION-STATE LEVEL ADOPTION 🟠🚀

BTC4,83%

- Reward

- like

- Comment

- Repost

- Share

🚨 TOMORROW WILL BE INSANE

CME margin hikes are coming, for the second time in three days.

THEY ARE DESPERATE.

Starting Feb 2 (tomorrow), maintenance costs are going to skyrocket.

Check these insanity levels:

– Gold: +33%

– Silver: +36%

– Platinum: +25%

– Palladium: +14%

Don't let them fool you.

this isn't about managing volatility.

This screams that a major player is blowing up and they’re scrambling to protect the clearing firms.

The flush we saw on friday wasn't selling, it was a forced liquidation bloodbath. Get ready.

Btw, I think a huge market crash is coming in the next few months.

When

CME margin hikes are coming, for the second time in three days.

THEY ARE DESPERATE.

Starting Feb 2 (tomorrow), maintenance costs are going to skyrocket.

Check these insanity levels:

– Gold: +33%

– Silver: +36%

– Platinum: +25%

– Palladium: +14%

Don't let them fool you.

this isn't about managing volatility.

This screams that a major player is blowing up and they’re scrambling to protect the clearing firms.

The flush we saw on friday wasn't selling, it was a forced liquidation bloodbath. Get ready.

Btw, I think a huge market crash is coming in the next few months.

When

- Reward

- like

- Comment

- Repost

- Share

🚨 BUFFETT SOUNDS THE ALARM

WARREN BUFFETT SAYS HISTORY SHOWS ONE CLEAR PATTERN:

GOVERNMENTS EVENTUALLY ERODE THE VALUE OF THEIR OWN MONEY — AND WHAT HE’S SEEING IN U.S. POLICY RIGHT NOW MAKES HIM UNCOMFORTABLE.

WHEN EVEN THE MOST PATIENT INVESTOR STARTS POSITIONING FOR A SOFTER DOLLAR…

THAT’S NOT NOISE. THAT’S A SIGNAL. 👀

WARREN BUFFETT SAYS HISTORY SHOWS ONE CLEAR PATTERN:

GOVERNMENTS EVENTUALLY ERODE THE VALUE OF THEIR OWN MONEY — AND WHAT HE’S SEEING IN U.S. POLICY RIGHT NOW MAKES HIM UNCOMFORTABLE.

WHEN EVEN THE MOST PATIENT INVESTOR STARTS POSITIONING FOR A SOFTER DOLLAR…

THAT’S NOT NOISE. THAT’S A SIGNAL. 👀

- Reward

- 2

- 1

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊🚨CNBC reported: “Capital is flowing into #XRP for three major reasons.”

Global capital is pouring into XRPL following confirmation that Walmart — an $800B retail giant — is now integrated via RealFi. With Walmart handling over $650B in annual transaction volume, substantial payment flows could be routed through REAL on the XRP Ledger, potentially creating a powerful supply–demand imbalance.

REAL Token, built natively on the XRP Ledger, enables value transfer across a $654.39 trillion global market. A fixed supply combined with accelerating real-world adoption positions REAL for a possible sup

Global capital is pouring into XRPL following confirmation that Walmart — an $800B retail giant — is now integrated via RealFi. With Walmart handling over $650B in annual transaction volume, substantial payment flows could be routed through REAL on the XRP Ledger, potentially creating a powerful supply–demand imbalance.

REAL Token, built natively on the XRP Ledger, enables value transfer across a $654.39 trillion global market. A fixed supply combined with accelerating real-world adoption positions REAL for a possible sup

XRP7,33%

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊So in 72 hours we get:

• Trump speech

• Fed decision + Powell speech

• Tesla, Meta, and Microsoft earnings

• PPI inflation

• Apple earnings

• US government Shutdown deadline

If any of these goes against the market, red candles will be all over again.

• Trump speech

• Fed decision + Powell speech

• Tesla, Meta, and Microsoft earnings

• PPI inflation

• Apple earnings

• US government Shutdown deadline

If any of these goes against the market, red candles will be all over again.

- Reward

- like

- Comment

- Repost

- Share

YEN INTERVENTION COULD CRASH THE CRYPTO MARKET🚨

A few days ago, I talked about the Fed's possible "Yen Intervention."

This is planned to be done via USD devaluation, as a weak dollar is beneficial for the US government.

Now you must ask, Isn't a weak dollar bullish for BTC and alts?

Yes, but not in the short term.

We all know that weak Yen was a major liquidity source for decades.

If the Yen suddenly becomes stronger, investors will have to panic dump their assets.

This will be very similar to what happened in Q3 2024 when Yen pumped nearly 15% against the USD.

During that timeframe, BTC and

A few days ago, I talked about the Fed's possible "Yen Intervention."

This is planned to be done via USD devaluation, as a weak dollar is beneficial for the US government.

Now you must ask, Isn't a weak dollar bullish for BTC and alts?

Yes, but not in the short term.

We all know that weak Yen was a major liquidity source for decades.

If the Yen suddenly becomes stronger, investors will have to panic dump their assets.

This will be very similar to what happened in Q3 2024 when Yen pumped nearly 15% against the USD.

During that timeframe, BTC and

BTC4,83%

- Reward

- like

- Comment

- Repost

- Share

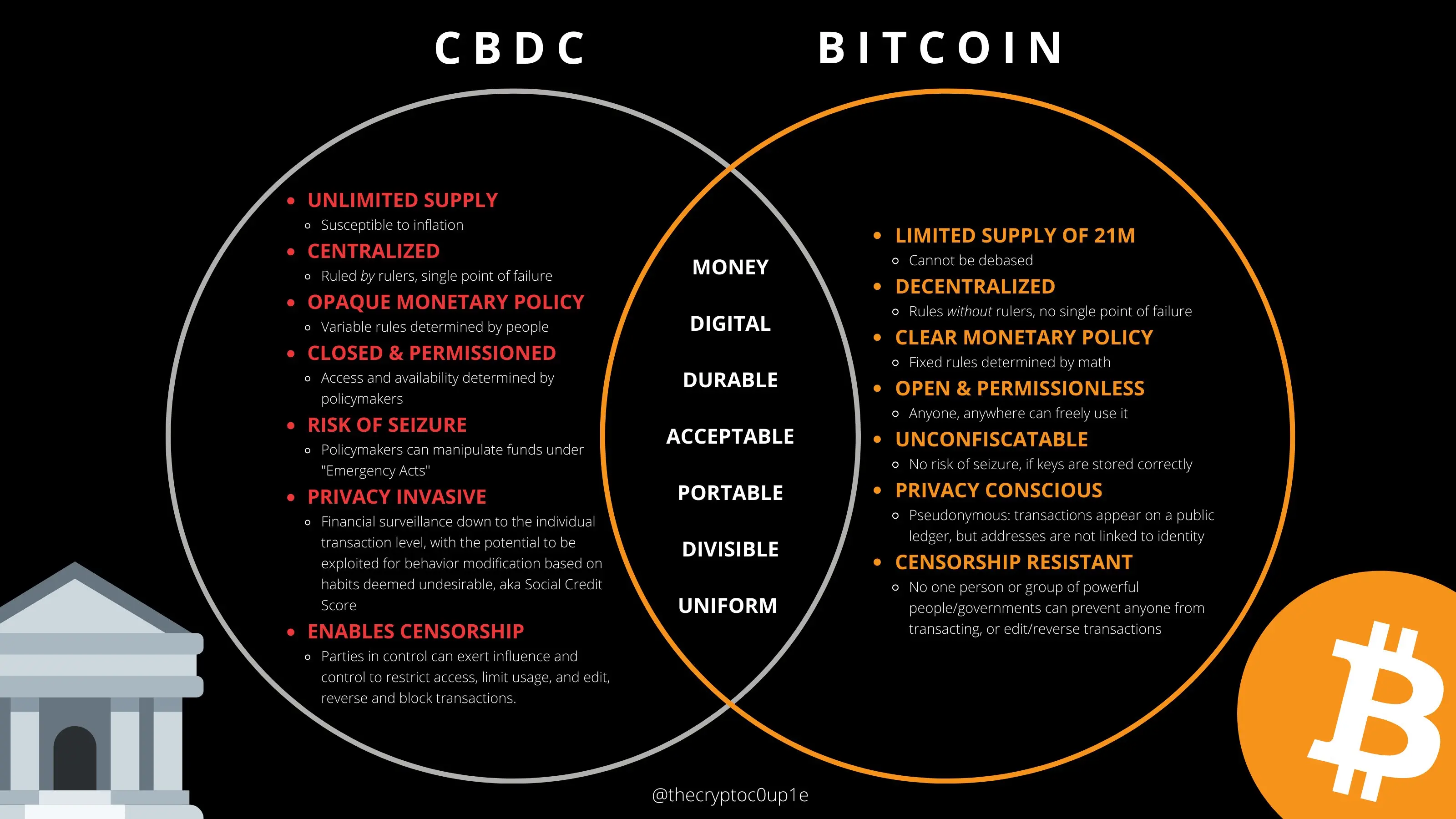

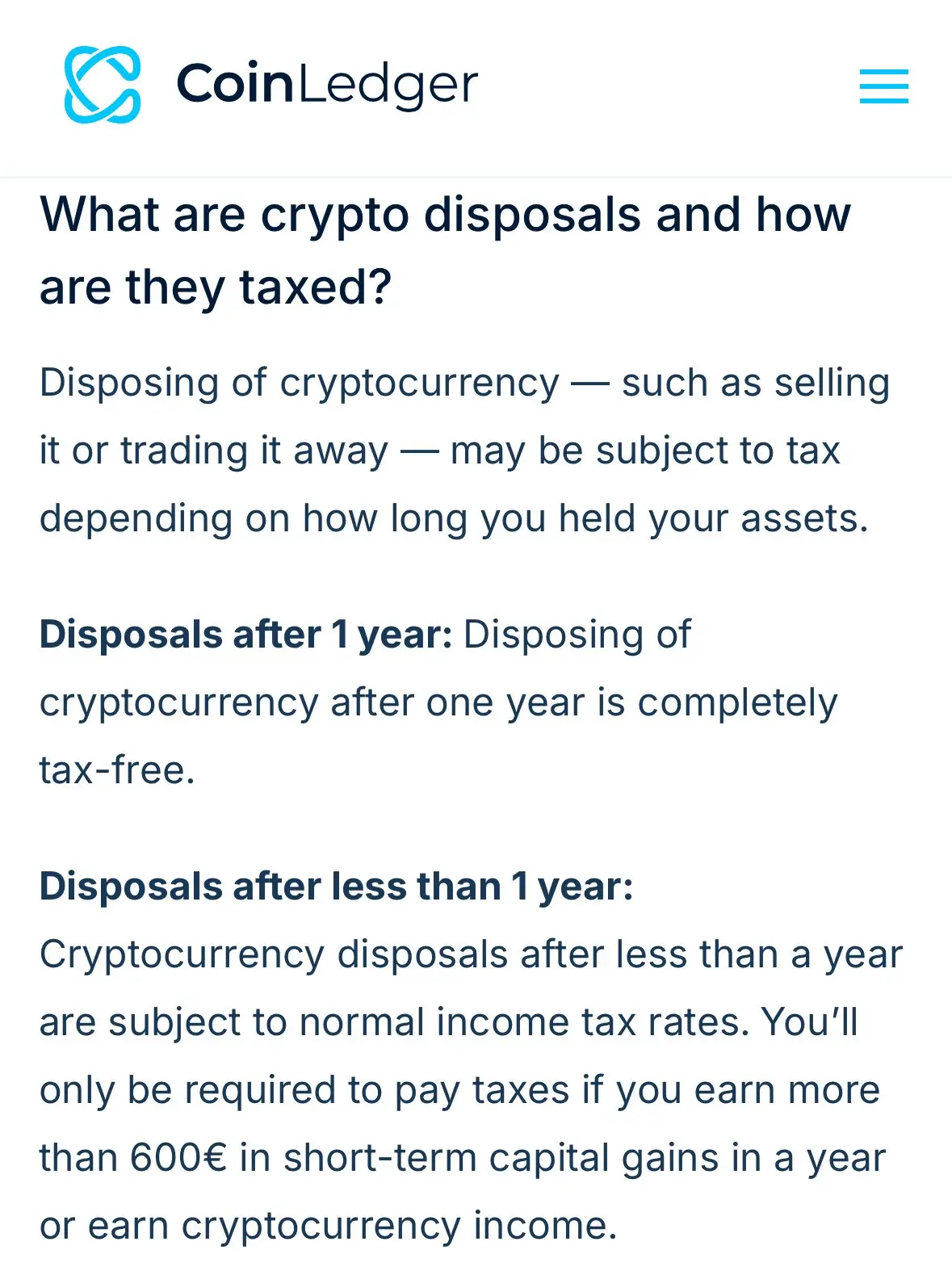

🚨BREAKING: Germany Confirms 0% Capital Gains Tax on $XRP (If You Hold 1+ Year) 🇩🇪💥

Germany treats crypto like private property, which means:

👉 Hold your $XRP for over 12 months = ZERO capital gains tax

👉 No minimum amount required

👉 Profit size doesn’t matter — 100% tax-free after one year

Short-term holders still pay income tax.

Tax haven for $XRP investors. 🤑🚀

Germany treats crypto like private property, which means:

👉 Hold your $XRP for over 12 months = ZERO capital gains tax

👉 No minimum amount required

👉 Profit size doesn’t matter — 100% tax-free after one year

Short-term holders still pay income tax.

Tax haven for $XRP investors. 🤑🚀

XRP7,33%

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More71.75K Popularity

3.51K Popularity

3.22K Popularity

50.7K Popularity

2.05K Popularity

Pin