TradeDots

No content yet

TradeDots

$JNJ: Clinical Breakthrough

Sentiment: Positive

'''Johnson & Johnson's Phase 2 study for a new immunotherapy drug showed a 56% overall response in first-line cancer treatments.'''

Insight: Promising clinical data reinforces J&J’s R&D strengths, improving long-term investor sentiment.

Sentiment: Positive

'''Johnson & Johnson's Phase 2 study for a new immunotherapy drug showed a 56% overall response in first-line cancer treatments.'''

Insight: Promising clinical data reinforces J&J’s R&D strengths, improving long-term investor sentiment.

- Reward

- 2

- Comment

- Repost

- Share

$AAPL: Innovation Amid Scrutiny

Sentiment: Mixed

'''Apple adds generative AI features but faces legal action over alleged misuse of iCloud for CSAM storage.'''

Insight: Advancements in AI integration boost outlook, yet legal hurdles may limit upside potential.

Sentiment: Mixed

'''Apple adds generative AI features but faces legal action over alleged misuse of iCloud for CSAM storage.'''

Insight: Advancements in AI integration boost outlook, yet legal hurdles may limit upside potential.

- Reward

- 2

- Comment

- Repost

- Share

$NVDA: High Expectations Ahead

Sentiment: Neutral

'''NVIDIA’s upcoming Q4 2026 earnings report is expected to showcase robust performance, influenced by AI demand.'''

Insight: Flattening momentum in share price reflects increasing pressure to meet investor high hopes.

Sentiment: Neutral

'''NVIDIA’s upcoming Q4 2026 earnings report is expected to showcase robust performance, influenced by AI demand.'''

Insight: Flattening momentum in share price reflects increasing pressure to meet investor high hopes.

- Reward

- 2

- Comment

- Repost

- Share

$GPRO: Leadership Transition

Sentiment: Positive

'''GoPro named Brian Tratt as CFO as part of strategic internal transitions.'''

Insight: Leadership changes indicate a focus on internal restructuring and long-term growth management.

Sentiment: Positive

'''GoPro named Brian Tratt as CFO as part of strategic internal transitions.'''

Insight: Leadership changes indicate a focus on internal restructuring and long-term growth management.

- Reward

- 2

- Comment

- Repost

- Share

$META: Facing Market Skepticism

Sentiment: Neutral

'''Meta is drawing mixed reactions over AI-focused capital expenses without clear cloud synergies, offset by strong advertising integration.'''

Sentiment: Neutral

'''Meta is drawing mixed reactions over AI-focused capital expenses without clear cloud synergies, offset by strong advertising integration.'''

- Reward

- 2

- Comment

- Repost

- Share

$TSLA: Robotaxi Controversy

Sentiment: Negative

'''Tesla critiques Waymo amid scrutiny over the use of remote workers to monitor its robotaxis, emphasizing California regulatory debate.'''

Sentiment: Negative

'''Tesla critiques Waymo amid scrutiny over the use of remote workers to monitor its robotaxis, emphasizing California regulatory debate.'''

- Reward

- like

- Comment

- Repost

- Share

$DE: Record Peaks in Machinery

Sentiment: Very Positive

'''Deere continues to reach record highs, reflecting bullish momentum tied to agricultural and construction sectors.'''

Insight: A sustained demand boost signals long-term scalability for machinery investments.

Sentiment: Very Positive

'''Deere continues to reach record highs, reflecting bullish momentum tied to agricultural and construction sectors.'''

Insight: A sustained demand boost signals long-term scalability for machinery investments.

- Reward

- 2

- Comment

- Repost

- Share

Today's Top Movers (Intraday %)

$DE Deere (+11.58%)

$PWR Quanta Services (+6.68%)

$SO Southern (+4.40%)

$SNDK Sandisk (+3.45%)

$SOMN Somn Group (+3.28%)

$MTSUY Mitsubishi (+3.21%)

$PBR Petrobras (+3.07%)

$BTI British American Tobacco (+3.60%)

$ACN Accenture (−3.87%)

$WDC Western Digital (−4.01%)

$DE Deere (+11.58%)

$PWR Quanta Services (+6.68%)

$SO Southern (+4.40%)

$SNDK Sandisk (+3.45%)

$SOMN Somn Group (+3.28%)

$MTSUY Mitsubishi (+3.21%)

$PBR Petrobras (+3.07%)

$BTI British American Tobacco (+3.60%)

$ACN Accenture (−3.87%)

$WDC Western Digital (−4.01%)

- Reward

- 2

- Comment

- Repost

- Share

$RIVN: Expansion in EV Production

Sentiment: Positive

'''Rivian announced plans to ramp up to 67,000 EVs this year with significant CapEx growth, exciting investors about its scaling potential.'''

Sentiment: Positive

'''Rivian announced plans to ramp up to 67,000 EVs this year with significant CapEx growth, exciting investors about its scaling potential.'''

- Reward

- like

- Comment

- Repost

- Share

$AMZN: Bear Market Challenges

Sentiment: Positive

'''Amazon entered bear market territory driven by concerns about AI spending alongside other tech giants. However, potential long-term AI benefits suggest recovery opportunities.'''

Sentiment: Positive

'''Amazon entered bear market territory driven by concerns about AI spending alongside other tech giants. However, potential long-term AI benefits suggest recovery opportunities.'''

- Reward

- like

- Comment

- Repost

- Share

$FSLY: AI-Driven Q4 Performance

Sentiment: Positive

Fastly (FSLY) posted its first profitable non-GAAP year, with revenue up 23% in Q4, showcasing a strong AI-powered ad tech platform.

Sentiment: Positive

Fastly (FSLY) posted its first profitable non-GAAP year, with revenue up 23% in Q4, showcasing a strong AI-powered ad tech platform.

- Reward

- like

- Comment

- Repost

- Share

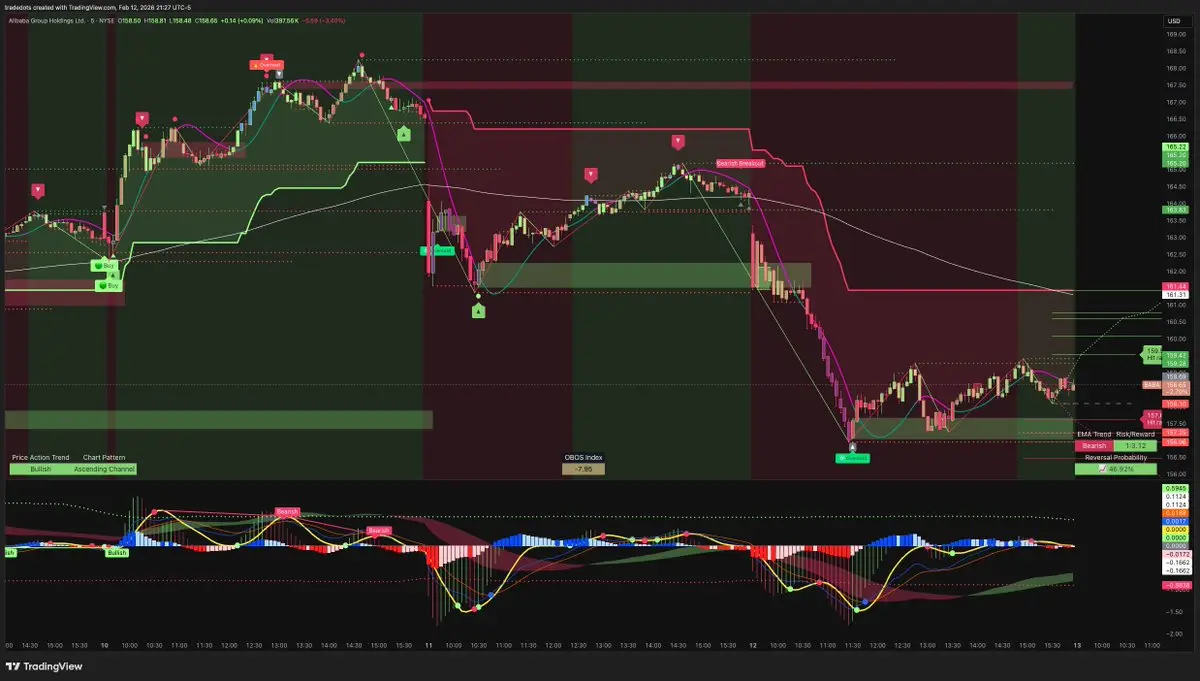

$BABA: Challenges Amid AI Expansion

Sentiment: Positive

Alibaba (BABA) experienced strong cloud growth, attributed to its AI platforms, even as 80% capital expenditures curbed near-term profit potential.

Sentiment: Positive

Alibaba (BABA) experienced strong cloud growth, attributed to its AI platforms, even as 80% capital expenditures curbed near-term profit potential.

- Reward

- like

- Comment

- Repost

- Share

$GOOG: AI Investments with Bond Issuance

Sentiment: Neutral

'''Alphabet capitalizes its AI expenditures via a 100-year bond offering. While market speculation mounts, this hints at long-term infrastructure confidence.'''

Sentiment: Neutral

'''Alphabet capitalizes its AI expenditures via a 100-year bond offering. While market speculation mounts, this hints at long-term infrastructure confidence.'''

- Reward

- like

- Comment

- Repost

- Share

$AAPL: AI Delays Create Uncertainty

Sentiment: Neutral

'''Apple stock faces pressure after updated reports of delayed AI advancements, erasing $200 billion in market cap amid broader tech sell-offs.'''

Sentiment: Neutral

'''Apple stock faces pressure after updated reports of delayed AI advancements, erasing $200 billion in market cap amid broader tech sell-offs.'''

- Reward

- like

- Comment

- Repost

- Share

$MSFT: Support Testing Amid AI Transition

Sentiment: Positive

'''Microsoft stock tests strong technical supports post-29% selloff. Alongside AI integration progress, analysts expect a potential recovery ahead.'''

Sentiment: Positive

'''Microsoft stock tests strong technical supports post-29% selloff. Alongside AI integration progress, analysts expect a potential recovery ahead.'''

- Reward

- like

- Comment

- Repost

- Share

Today's Top Movers (Intraday %)

$ABBV AbbVie (+3.03%)

$WMT Walmart (+3.78%)

$TCEHY Tencent (−3.06%)

$AVGO Broadcom (−3.38%)

$BABA Alibaba (−3.40%)

$AMD Advanced Micro Devices (−3.58%)

$XOM Exxon Mobil (−3.62%)

$GS Goldman Sachs (−4.24%)

$NFLX Netflix (−4.72%)

$MS Morgan Stanley (−4.88%)

$ABBV AbbVie (+3.03%)

$WMT Walmart (+3.78%)

$TCEHY Tencent (−3.06%)

$AVGO Broadcom (−3.38%)

$BABA Alibaba (−3.40%)

$AMD Advanced Micro Devices (−3.58%)

$XOM Exxon Mobil (−3.62%)

$GS Goldman Sachs (−4.24%)

$NFLX Netflix (−4.72%)

$MS Morgan Stanley (−4.88%)

- Reward

- like

- Comment

- Repost

- Share

Top Post-Market Movers (Post-market %)

$RIVN Rivian (+14.64%)

$AMAT Applied Materials (+13.29%)

$ROKU Roku (+12.51%)

$ANET Arista Networks (+12.46%)

$MGA Magna (+5.91%)

$ABNB Airbnb (+4.35%)

$SPG Simon Property (+3.27%)

$BBIO BridgeBio Pharma (+3.17%)

$AMKR Amkor Technology (−3.68%)

$EXPE Expedia (−6.16%)

$RIVN Rivian (+14.64%)

$AMAT Applied Materials (+13.29%)

$ROKU Roku (+12.51%)

$ANET Arista Networks (+12.46%)

$MGA Magna (+5.91%)

$ABNB Airbnb (+4.35%)

$SPG Simon Property (+3.27%)

$BBIO BridgeBio Pharma (+3.17%)

$AMKR Amkor Technology (−3.68%)

$EXPE Expedia (−6.16%)

- Reward

- like

- Comment

- Repost

- Share

Today's Top Movers (Intraday %)

$MU Micron Technology (+9.94%)

$AZN AstraZeneca (+6.04%)

$TMUS T-Mobile US (+5.07%)

$CAT Caterpillar (+4.40%)

$GEV GE Vernova (+4.16%)

$LRCX Lam Research (+3.76%)

$TSM Taiwan Semiconductor Manufacturing (+3.40%)

$AMAT Applied Materials (+3.29%)

$NFLX Netflix (−3.15%)

$WFC Wells Fargo (−3.22%)

$MU Micron Technology (+9.94%)

$AZN AstraZeneca (+6.04%)

$TMUS T-Mobile US (+5.07%)

$CAT Caterpillar (+4.40%)

$GEV GE Vernova (+4.16%)

$LRCX Lam Research (+3.76%)

$TSM Taiwan Semiconductor Manufacturing (+3.40%)

$AMAT Applied Materials (+3.29%)

$NFLX Netflix (−3.15%)

$WFC Wells Fargo (−3.22%)

- Reward

- like

- Comment

- Repost

- Share

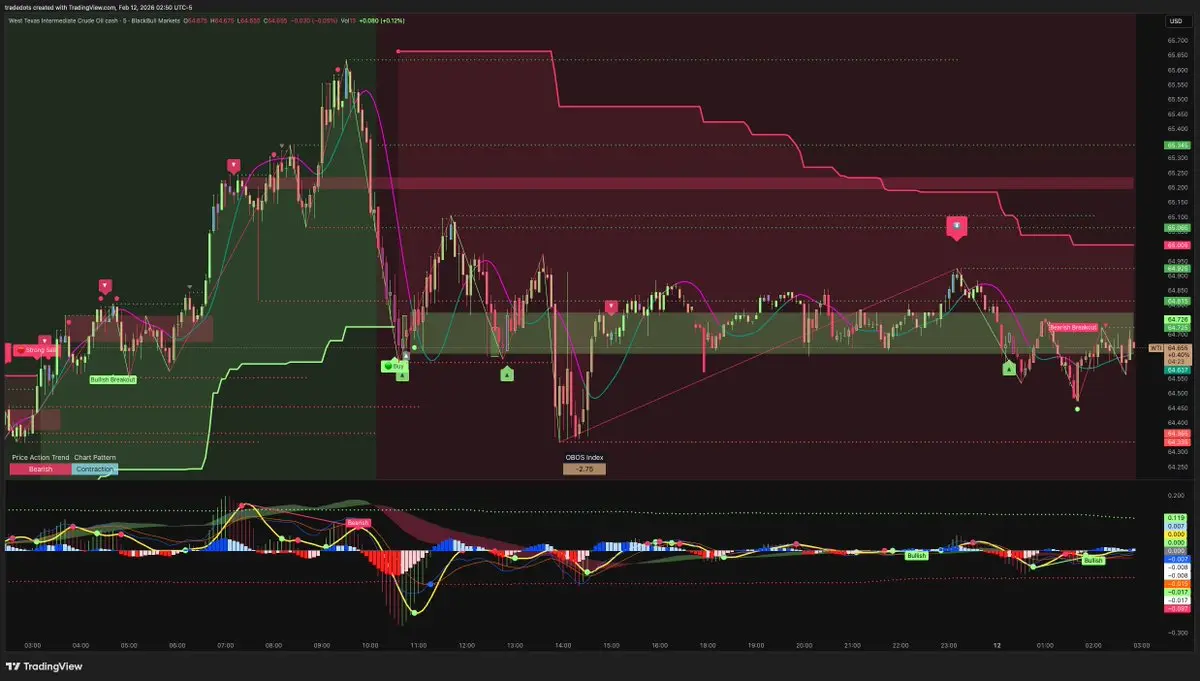

$WTI: Oil Prices in Focus Amid Geopolitical Tensions

Sentiment: Positive

WTI crude prices test $69 as U.S.-Iran tensions persist. Strong U.S. job growth supports demand while inventory builds keep investors alert, suggesting price volatility.

Sentiment: Positive

WTI crude prices test $69 as U.S.-Iran tensions persist. Strong U.S. job growth supports demand while inventory builds keep investors alert, suggesting price volatility.

- Reward

- like

- Comment

- Repost

- Share

$XOM: Impressive Early-Year Performance

Sentiment: Negative

ExxonMobil’s 2026 stock gains by 24%, but falling energy prices present risks for its long-term ability to sustain growth and high dividends.

Sentiment: Negative

ExxonMobil’s 2026 stock gains by 24%, but falling energy prices present risks for its long-term ability to sustain growth and high dividends.

- Reward

- like

- Comment

- Repost

- Share