Tom_Tucker

No content yet

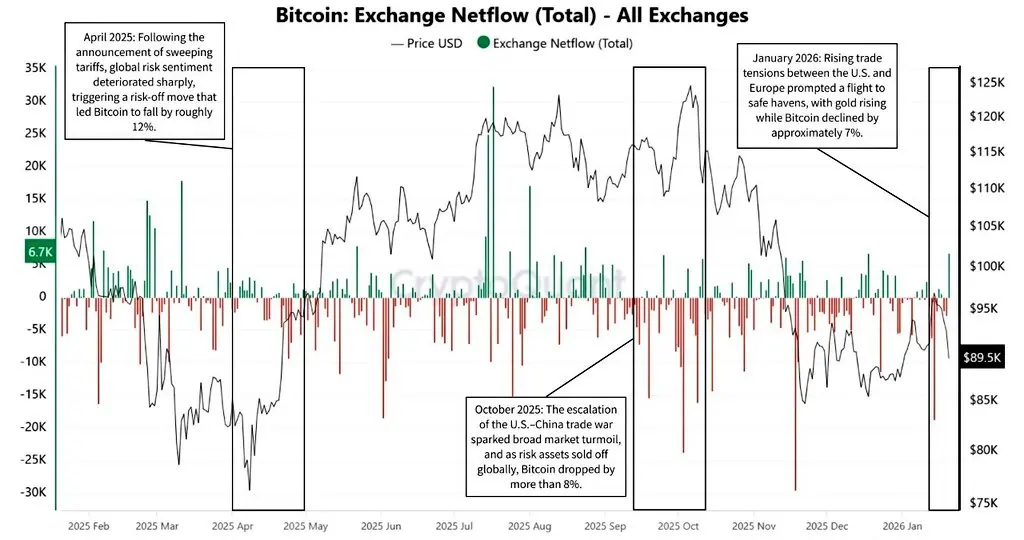

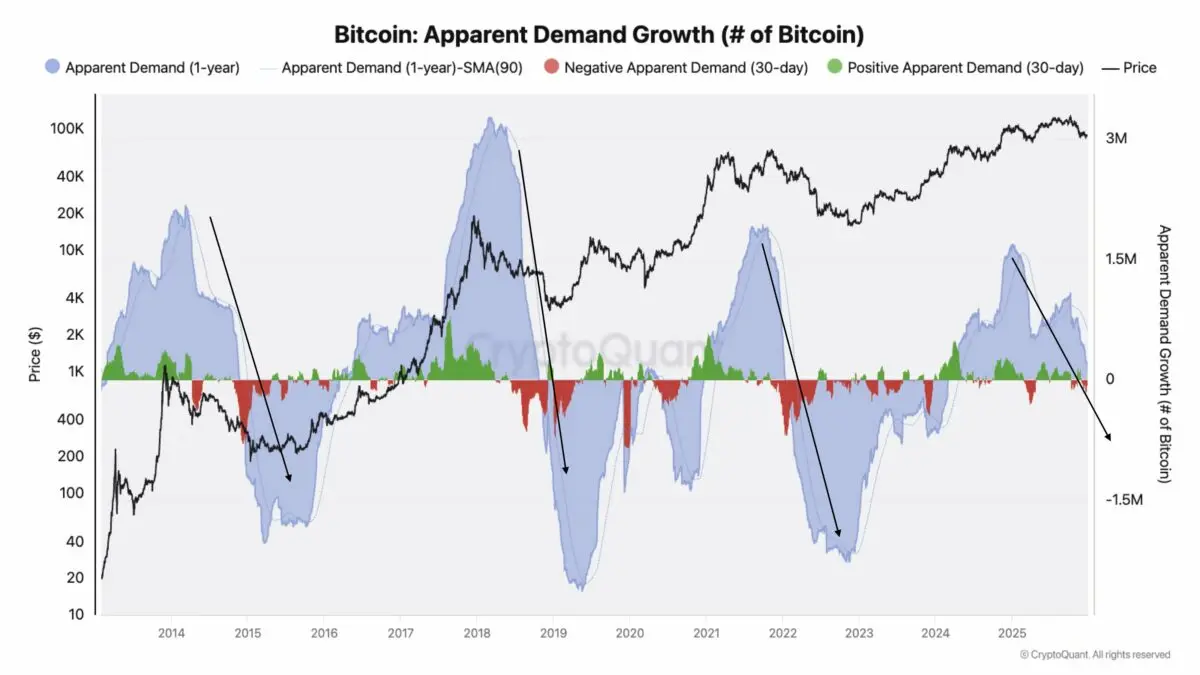

BlackRock isn’t “dumping.”

These are ETF redemptions, investors exiting after the January flush.

Coins move on-chain, fear spreads, but it’s just weak hands leaving.

Capitulation resets the market.

But all eyes on the Trump announcement.

These are ETF redemptions, investors exiting after the January flush.

Coins move on-chain, fear spreads, but it’s just weak hands leaving.

Capitulation resets the market.

But all eyes on the Trump announcement.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

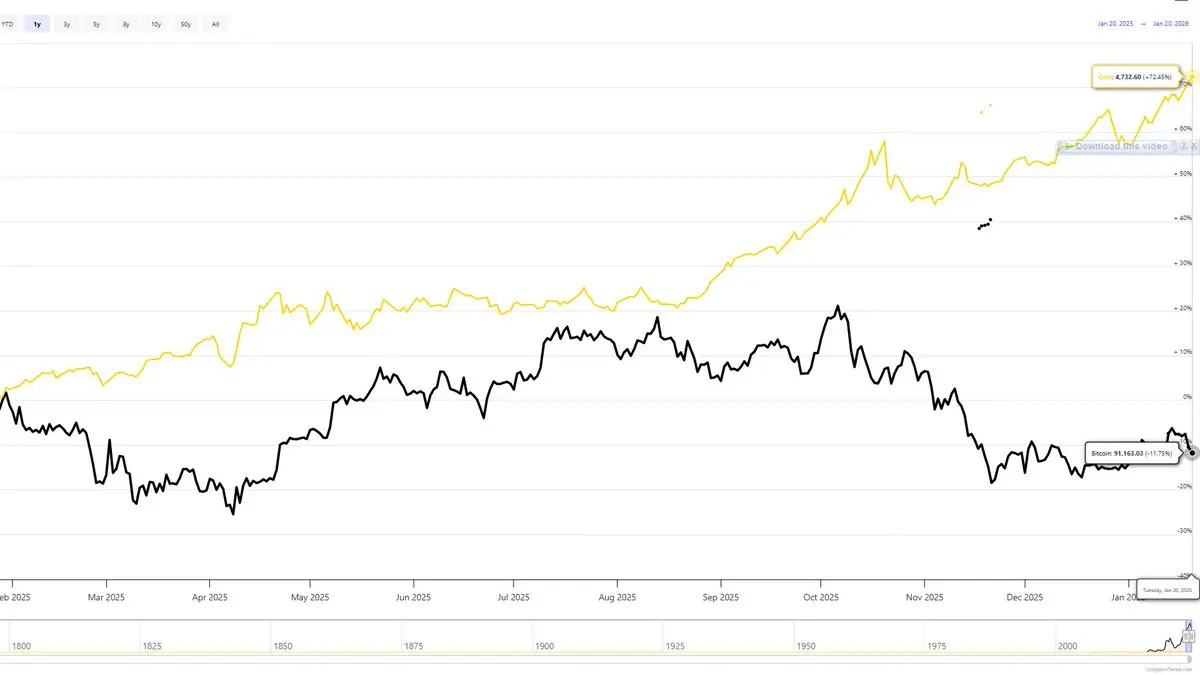

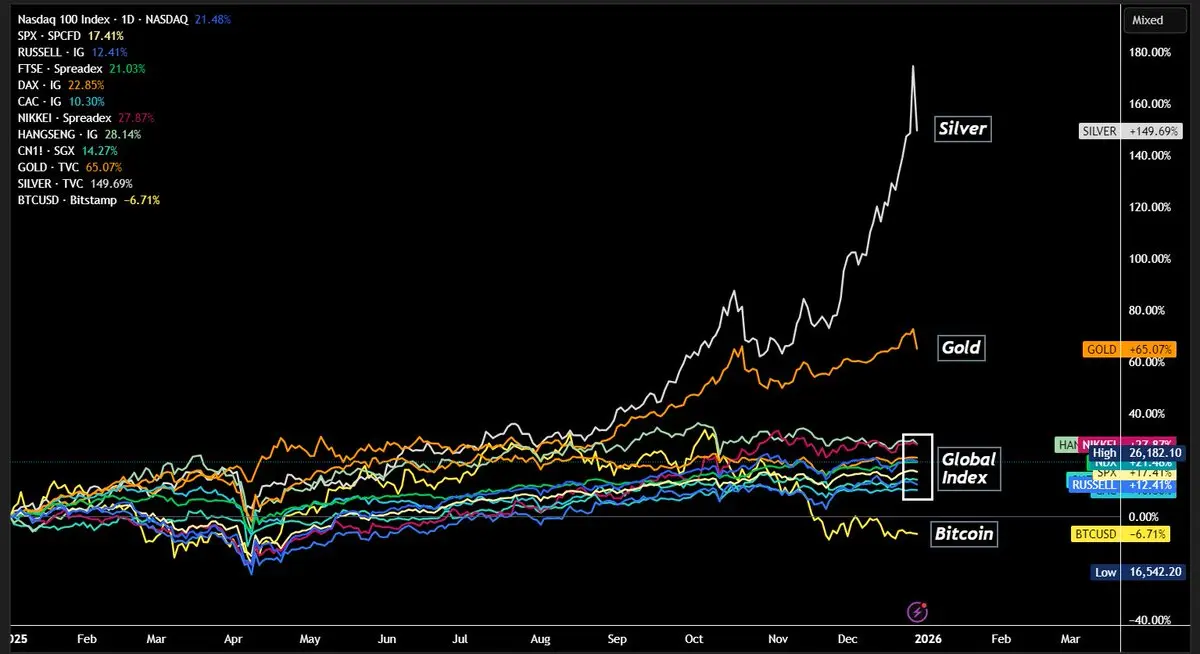

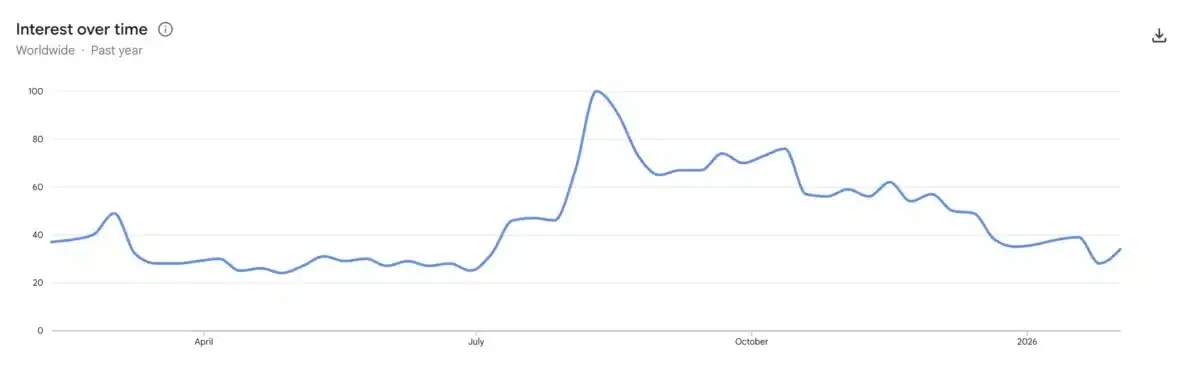

After the recent dump, crypto interest has crashed and fear is extreme.

Google searches are at a 1-year low and the Fear Index is at 9, showing panic. But this usually happens after big sell-offs.

This looks more like a reset phase than the end of the cycle.

Google searches are at a 1-year low and the Fear Index is at 9, showing panic. But this usually happens after big sell-offs.

This looks more like a reset phase than the end of the cycle.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

MarkAlvin :

:

Bears are clearly running out of ammo at this level.Prediction markets are growing fast.\n\nWeekly volume just hit $5.7B and 2025 crossed $40B. People are using money instead of opinions to predict real events. \n\nWith crypto making them easy and global, this is becoming one of the most useful trends in Web3.

- Reward

- 2

- 2

- Repost

- Share

DragonFlyOfficial :

:

🔥 Great post! 💯 This kind of sharing really helps the community — curious to know your next move or thoughts on this! 👀🚀View More

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

GateUser-99e9ba4f :

:

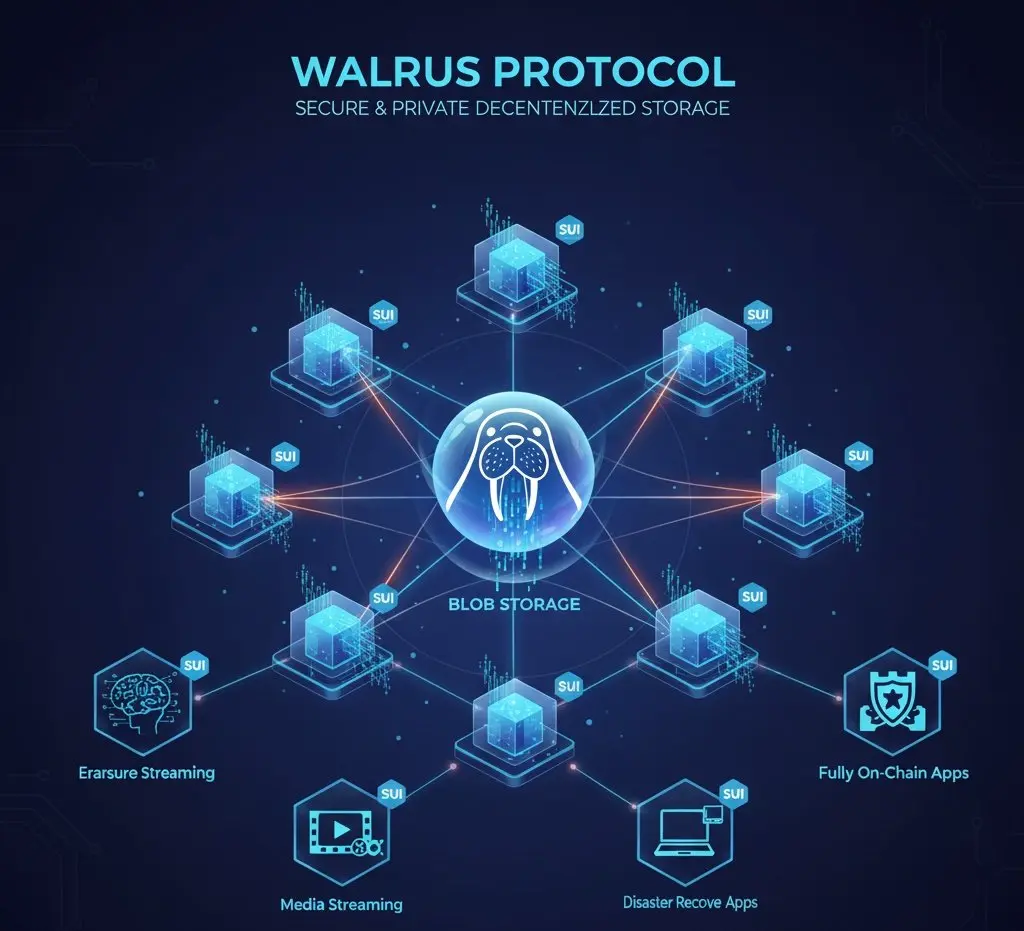

Very interesting information, thank you ♥️Walrus Protocol is making decentralized storage practical, not niche.

Built on Sui, it offers fast, low-cost, privacy-focused storage for enterprises, media, and dApps.

This feels less like a crypto experiment and more like real infrastructure for a decentralized web.

@WalrusProtocol #walrus $WAL

Built on Sui, it offers fast, low-cost, privacy-focused storage for enterprises, media, and dApps.

This feels less like a crypto experiment and more like real infrastructure for a decentralized web.

@WalrusProtocol #walrus $WAL

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Stablecoin inflows are finally ticking up.

Weekly exchange inflows jumped from $51B to $81B, breaking the downtrend. Growth is still modest, but this suggests early demand returning.

A real bull move needs these stablecoins to be deployed, not just parked.

Weekly exchange inflows jumped from $51B to $81B, breaking the downtrend. Growth is still modest, but this suggests early demand returning.

A real bull move needs these stablecoins to be deployed, not just parked.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More33.17K Popularity

42.26K Popularity

15.05K Popularity

41.38K Popularity

250.59K Popularity

Pin