RenderWithMe

No content yet

RenderWithMe

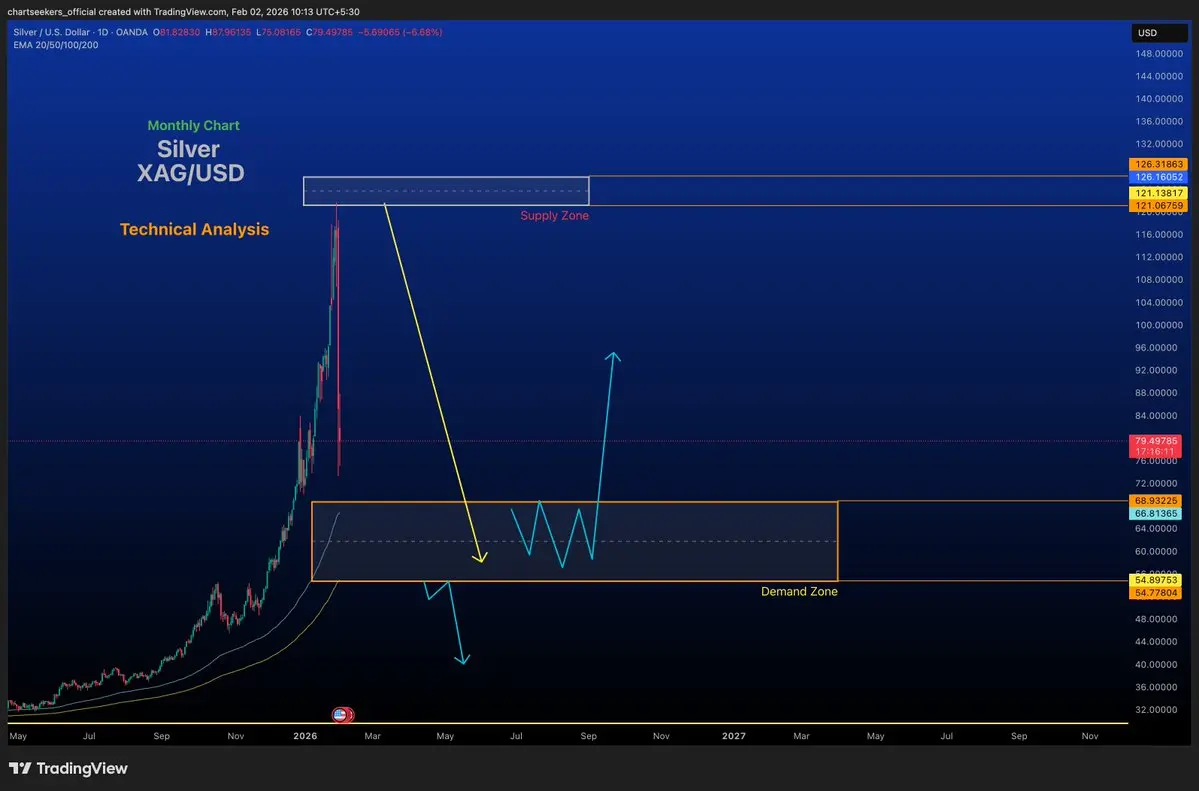

$XAGUSD$SILVERFinally Hit the demand Zone

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$USDT.D Approaching supply zone

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#others dominancecompleted ABC Correction getting ready for Z wave

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$COAIFinally Corrected himself after a long time

- Reward

- like

- Comment

- Repost

- Share

$BNBPrice is currently reacting inside the first demand zone, but MACD momentum suggests weakness isn’t done yet. A deeper pullback toward the second demand zone remains a strong possibility.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

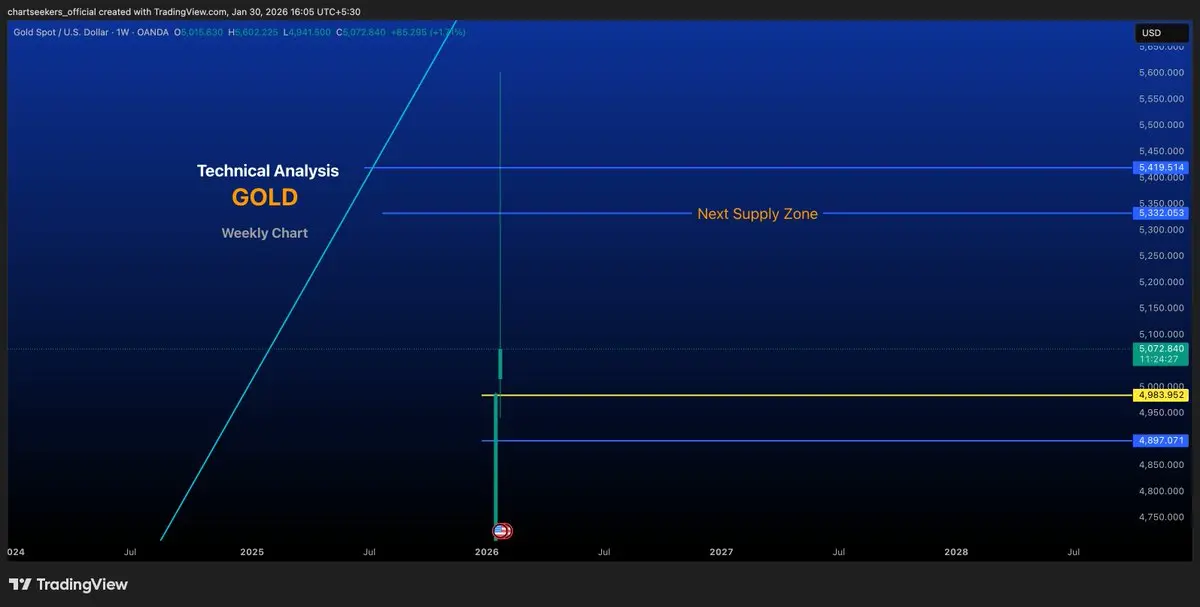

$XAUUSD$GOLD Supply zone = strict teacher ❌ Demand zone = my house 🏠

View Original

- Reward

- like

- Comment

- Repost

- Share

$XAG$SILVER🤪😱😵😲

- Reward

- like

- Comment

- Repost

- Share

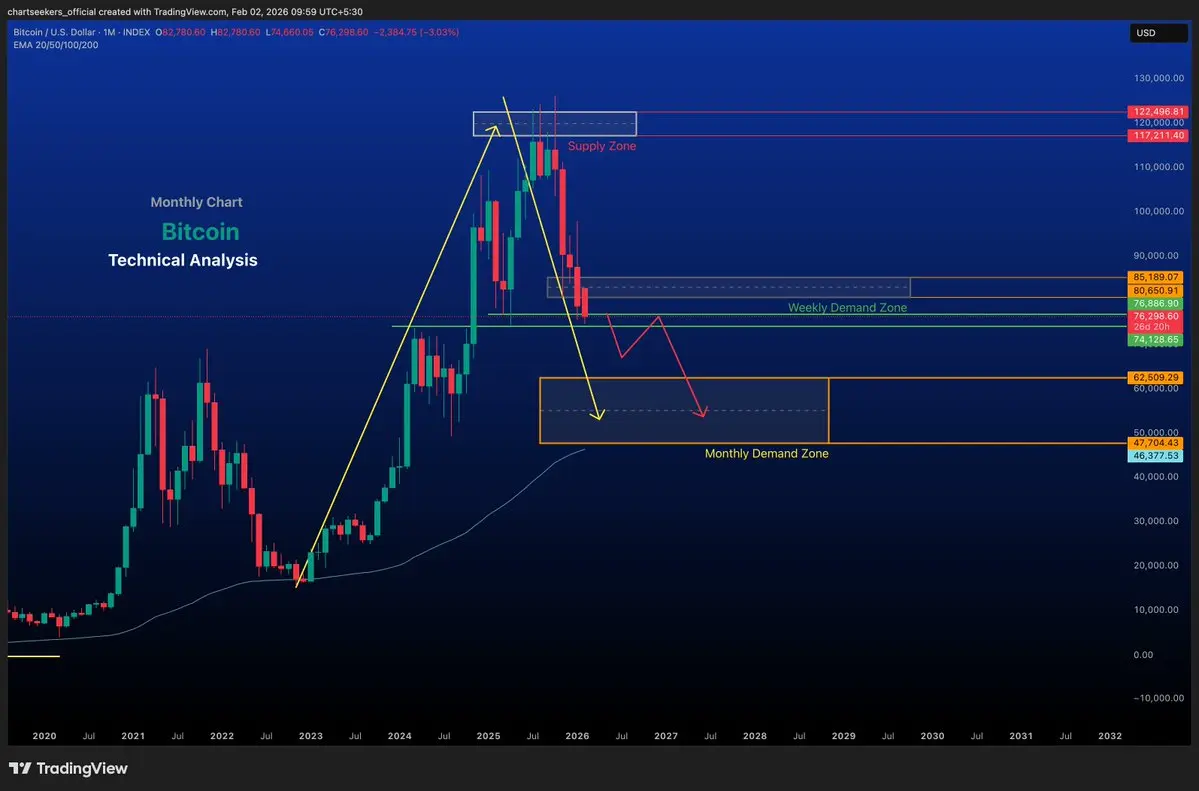

$BTCGet your self ready for Monthly demand zone

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊- Reward

- like

- Comment

- Repost

- Share

#CryptoNews

- Reward

- like

- Comment

- Repost

- Share

$ROSEbroken first resistance and moving towards 2nd resistance

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$PYTHFrom panic to patience… this chart tells a story only long-term believers understand.

- Reward

- like

- Comment

- Repost

- Share