PaiCrypto

No content yet

PaiCrypto

⚠️ DXY: The "mother of all" global assets that most people overlook

Main text:

After 23 days, the US Dollar Index (DXY) is about to close a crucial monthly candle

Currently, DXY is in a very long-term upward channel spanning over 5086 days

As shown in the chart, after testing and consolidating in February, a bullish close this month is highly probable. This not only reaffirms the channel support but also indicates that bullish momentum is building a base intensively in this area

As the pricing anchor for global liquidity, this movement of DXY will directly determine the next directio

View OriginalMain text:

After 23 days, the US Dollar Index (DXY) is about to close a crucial monthly candle

Currently, DXY is in a very long-term upward channel spanning over 5086 days

As shown in the chart, after testing and consolidating in February, a bullish close this month is highly probable. This not only reaffirms the channel support but also indicates that bullish momentum is building a base intensively in this area

As the pricing anchor for global liquidity, this movement of DXY will directly determine the next directio

- Reward

- 1

- Comment

- Repost

- Share

Is it possible that someday in the future, AI will replace my existence?

View Original- Reward

- 1

- Comment

- Repost

- Share

I heard Elys is very popular. This is my AI clone, feel free to add me.

The New Year holiday has ended. Starting next week, I will return to the market analysis.

View OriginalThe New Year holiday has ended. Starting next week, I will return to the market analysis.

- Reward

- like

- Comment

- Repost

- Share

【BTC enters a correction phase, how to position for the next asset rotation?】

1/ [🛰️] Many brothers have been asking recently: if BTC truly enters the "centripetal force" contraction zone I predicted earlier ($56.8K - $44K), how should we get through this long period of decline or sideways movement?

2/ Excellent traders never let their funds sit idle. Recently, I experienced @Matrixport_CN @Matrixport_EN's US stock trading features in depth. Honestly, this might be the smoothest "Crypto to US Stocks" direct access solution on the market today.

3/ Core advantages (these are experiences other e

View Original1/ [🛰️] Many brothers have been asking recently: if BTC truly enters the "centripetal force" contraction zone I predicted earlier ($56.8K - $44K), how should we get through this long period of decline or sideways movement?

2/ Excellent traders never let their funds sit idle. Recently, I experienced @Matrixport_CN @Matrixport_EN's US stock trading features in depth. Honestly, this might be the smoothest "Crypto to US Stocks" direct access solution on the market today.

3/ Core advantages (these are experiences other e

- Reward

- like

- Comment

- Repost

- Share

After waking up, there's only 10K left to the lower edge of the monthly K channel. The price continues to decline along the channel, with the slope steadily decreasing. As a result, a grid short position was opened, giving a feeling of missing out on earning 100 million…

View Original- Reward

- like

- Comment

- Repost

- Share

Breaking news: The U.S. government shutdown exceeded expectations💥 US stocks, NAS100 continued to decline, dragging BTC down significantly. Currently, if BTC breaks below the 76K support on the daily chart, the next target will be 70K, and subsequent targets could see BTC heading towards the lower band of the monthly K channel mentioned earlier, potentially reaching a figure starting with 6.

BTC-1,79%

- Reward

- like

- Comment

- Repost

- Share

"Guide to Living Correctly in the Crypto World": 1. Don't chase rebounds, be careful of getting buried. Can't trade during a bear market rebound? It's said to be like licking blood off a knife. 2. Don't chase breakouts, be careful of a pullback. Can't trade during a bull market breakout? It's said that if there's a pullback, it might not be in the right place yet. 3. Don't keep savings in financial products, beware of sudden crashes. Stablecoin investments are risky? It's said that if there's a crash, you can't afford to bear it. As long as I don't enter the market, I will never lose; as long

View Original- Reward

- like

- Comment

- Repost

- Share

SOL Technical Review: Arc Top Concerns vs Key Support Defense Battle1️⃣ Pattern Warning: The weekly K-line level arc top prototype has emerged. The neckline area is the "life and death line"; once broken, the support vacuum zone below may trigger a sharp pullback2️⃣ Bullish Defense Line: Currently, the daily chart shows a valid rebound at the $100 level3️⃣ Resistance Observation: Short-term resistance focuses on $105 / $113 / around $120💡 Core Logic: SOL's trend needs to be anchored to BTC movements; as long as the neckline is not broken, the outlook remains cautiously optimistic

View Original

- Reward

- like

- Comment

- Repost

- Share

ETH Weekly Observation: The "Life and Death Test" of a Two-Year Uptrend Channel 🚀1️⃣ Long-term Trend: Since April 2022, ETH has maintained a clear weekly K-level gradual upward channel. The price has consistently been constrained by the upper boundary, middle line, and lower boundary of the channel, exhibiting strong volatility patterns. 2️⃣ Core Resistance: The biggest current challenge is the horizontal zone near the previous high. Multiple failed attempts to break through have turned it into a "ceiling" level resistance for the next cycle. 3️⃣ Short-term Key Levels: Support: Around 2.2K. T

ETH-4,12%

- Reward

- like

- Comment

- Repost

- Share

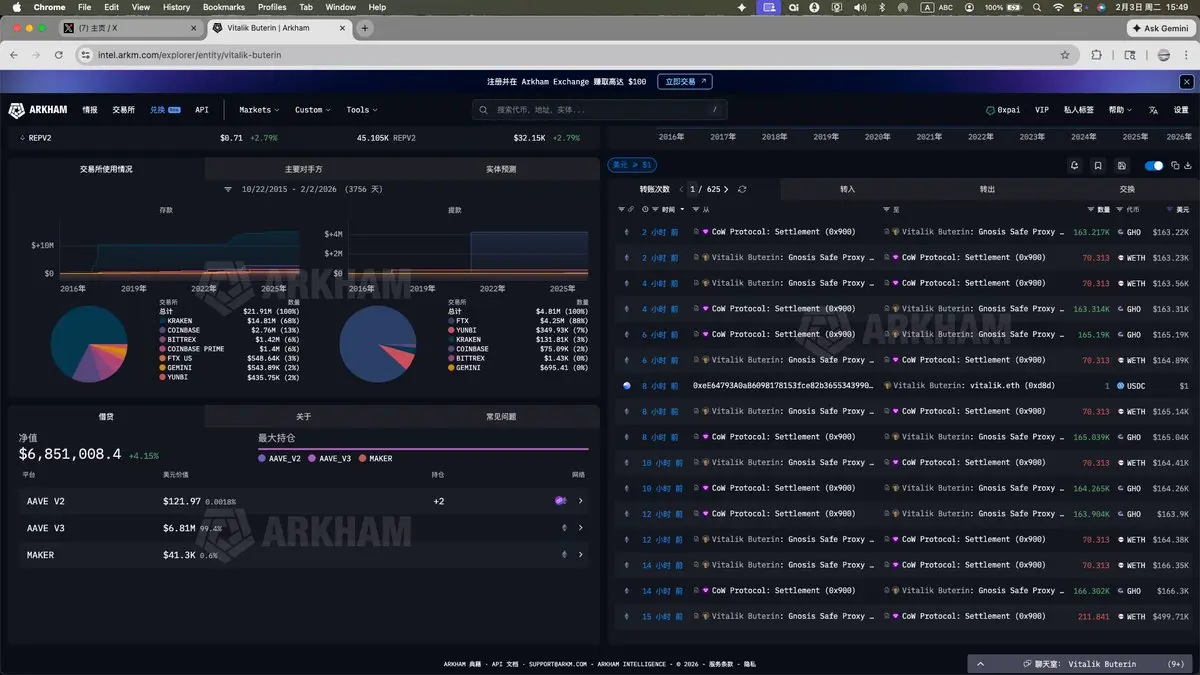

V神, this old guy, could he be head over heels in love again? By the way, "E Guards," your master is leading the way in selling off at critical moments, starting to backstab everyone's ETH faith regularly😂 I will do a technical structural review later, specifically discussing the technical trend, but everyone, don't panic first. This is part of his routine operation, and in the short term, it's more of an emotional impact with limited actual significance.

ETH-4,12%

- Reward

- like

- Comment

- Repost

- Share

"DXY 5086 Days Upward Channel Showdown: US Dollar Index Touches 'Life and Death Line', Liquidity Reversal Imminent?" 1/6 🛰️ Macro Coordinates: After 5086 days of watchfulness, we notice that the #DXY US Dollar Index monthly K-line has experienced a super-long cycle of an upward channel lasting 5086 days. It is now at a critical moment of touching the lower boundary of the channel. This is not just a line, but the "mother line" that has priced global liquidity over the past decade. 2/6 ⚖️ Crossroads: Rebound or Breakout? From a technical perspective, DXY is currently in an extremely sensitive

BTC-1,79%

- Reward

- like

- Comment

- Repost

- Share

I found that Gemini in Chrome seems to not only monitor auxiliary Chrome web browsing, but also appears to be able to monitor the content I just entered during use. Since all these contents are on a desktop window, when I let it assist in writing some content in the Chrome browser, it read my content. I don't know if that's the case.

View Original- Reward

- like

- Comment

- Repost

- Share

Understand the current market position status

View Original- Reward

- like

- Comment

- Repost

- Share

Continuous alerts🚨 woke me up. I was planning to catch a rebound from the oversold condition, but instead I got a weekend flood. If I had known that hanging on the mountain would have allowed me to catch this wave and possibly break through, it wouldn't be a bad thing. Retracing the daily chart to 80K, there could still be a decent rebound. If it continues to fall and there is no rebound, with persistent downward decline, then this is an extremely dangerous signal, indicating that a bigger crisis is brewing. But for now, it has already been broken through; it all depends on the rebound streng

View Original- Reward

- like

- Comment

- Repost

- Share

Come on! Are you going to wipe out the bears (shorts) or the bulls (longs)? Who will ultimately dominate the market?

View Original- Reward

- like

- Comment

- Repost

- Share

It's time to execute a wave of mid-term short positions.

View Original- Reward

- like

- Comment

- Repost

- Share

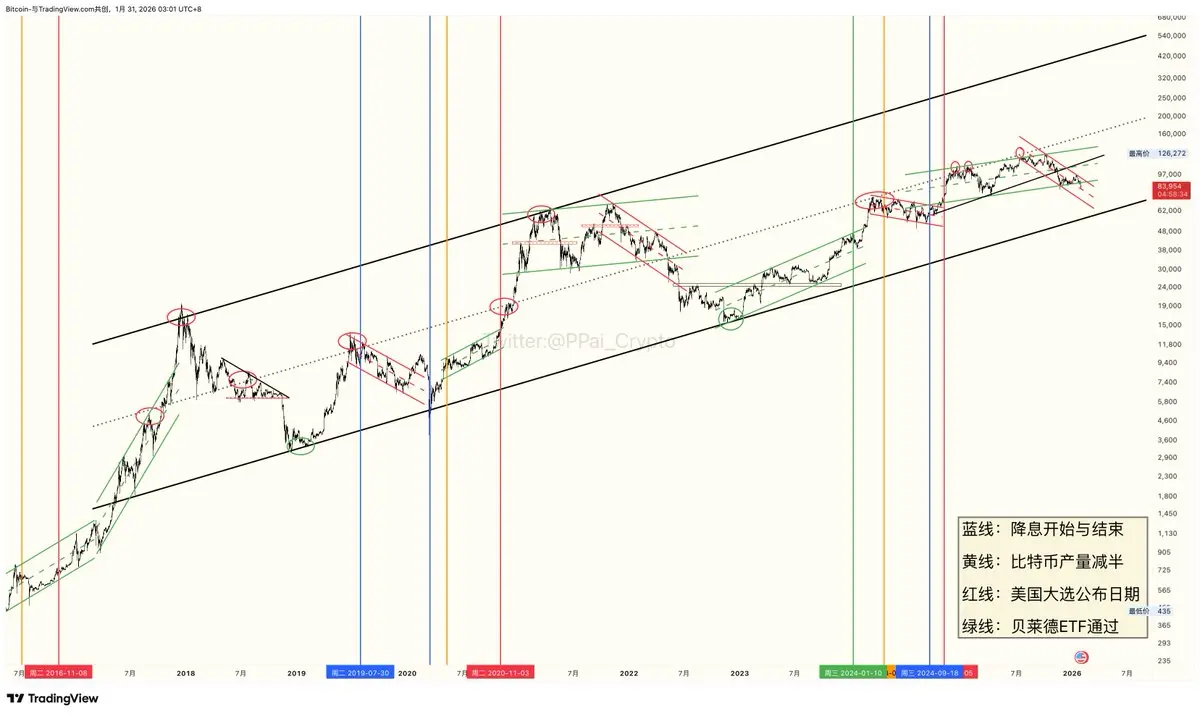

#BTC I am willing to call this chart 🚢 the "Bitcoin Navigation Map," which has been my "Golden Bible" for many years. The price fluctuation pattern essentially represents a journey of "channel switching": the channel is the trend: each upward or downward channel is a specific current breakthrough, crossing over: we transition from one price channel to a higher one through guidance from "lighthouses" such as interest rate cut cycles and halving nodes. Waves are fluctuations: no matter how turbulent the middle, the ship will ultimately follow the pattern, sailing from low-latitude waters (the b

BTC-1,79%

- Reward

- 1

- Comment

- Repost

- Share

Gemini in Chrome Now it's good, real-time AI assistance during Chrome browsing, very efficient to use.

View Original- Reward

- like

- Comment

- Repost

- Share