PARON

No content yet

Pin

PARON

0

0

Capital Expenditures (CAPEX) in 2026:

Amazon $200 billion

Meta $185 billion

Microsoft $110 billion

The trio will spend approximately $600 billion, compared to their spending of $350 billion in 2025 and $250 billion in 2024.

The AI frenzy is one of the main reasons for this massive spending!

Amazon $200 billion

Meta $185 billion

Microsoft $110 billion

The trio will spend approximately $600 billion, compared to their spending of $350 billion in 2025 and $250 billion in 2024.

The AI frenzy is one of the main reasons for this massive spending!

USDG0,02%

MC:$2.48KHolders:2

0.01%

- Reward

- like

- Comment

- Repost

- Share

Do you know why I don't waste my time with traditional media?

Because they sell fear and greed, not knowledge.

You won't find facts or evidence with them, just emotional hype.

And now The Financial Times says Bitcoin is worthless!

If you still believe these myths in 2026, the problem is with you, not Bitcoin.

Bitcoin has "died" hundreds of times on newspaper pages,

But have you ever seen it affected even for a second? Never.

View OriginalBecause they sell fear and greed, not knowledge.

You won't find facts or evidence with them, just emotional hype.

And now The Financial Times says Bitcoin is worthless!

If you still believe these myths in 2026, the problem is with you, not Bitcoin.

Bitcoin has "died" hundreds of times on newspaper pages,

But have you ever seen it affected even for a second? Never.

MC:$7.78KHolders:2

29.35%

- Reward

- like

- Comment

- Repost

- Share

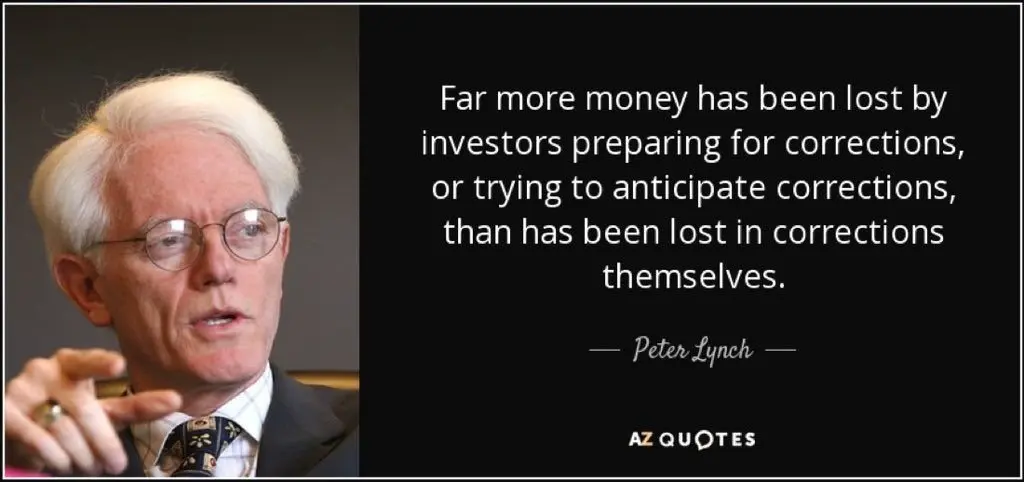

Peter Lynch says, "The money investors lose in preparing for corrections, or trying to predict them, far exceeds what is lost in the corrections themselves."

This is the dilemma of "waiting for the bottom"; while some stand on the sidelines waiting for market crashes, they miss out on upward waves that may not recur.

Successful investing doesn't require genius in predicting the unseen, but rather discipline and the ability to stay in the market for as long as possible.

Fear of "potential loss" is often the real reason behind losing "certain wealth."

Always remember:

Time in the market is more

View OriginalThis is the dilemma of "waiting for the bottom"; while some stand on the sidelines waiting for market crashes, they miss out on upward waves that may not recur.

Successful investing doesn't require genius in predicting the unseen, but rather discipline and the ability to stay in the market for as long as possible.

Fear of "potential loss" is often the real reason behind losing "certain wealth."

Always remember:

Time in the market is more

MC:$15.16KHolders:10

56.35%

- Reward

- like

- Comment

- Repost

- Share

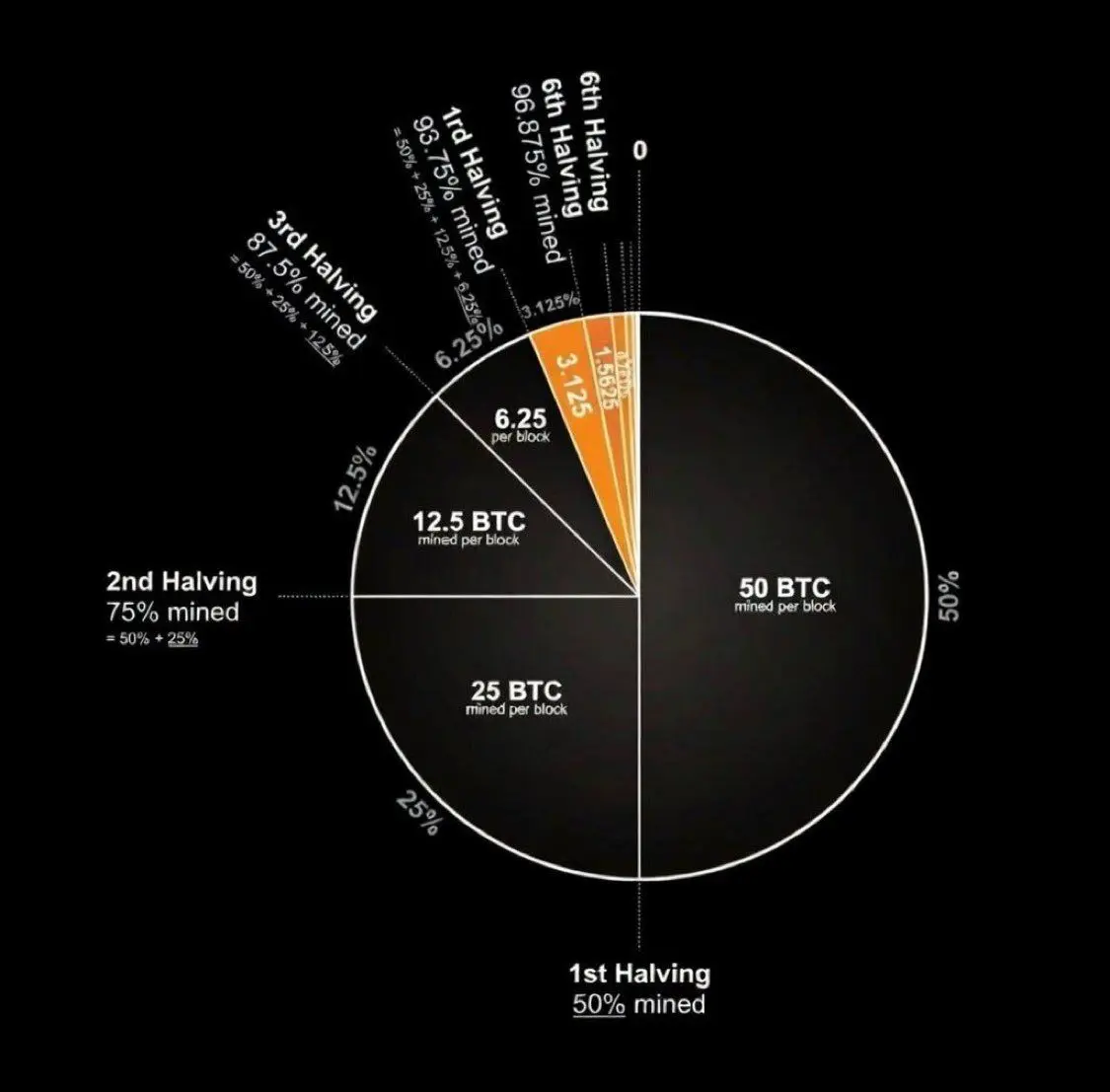

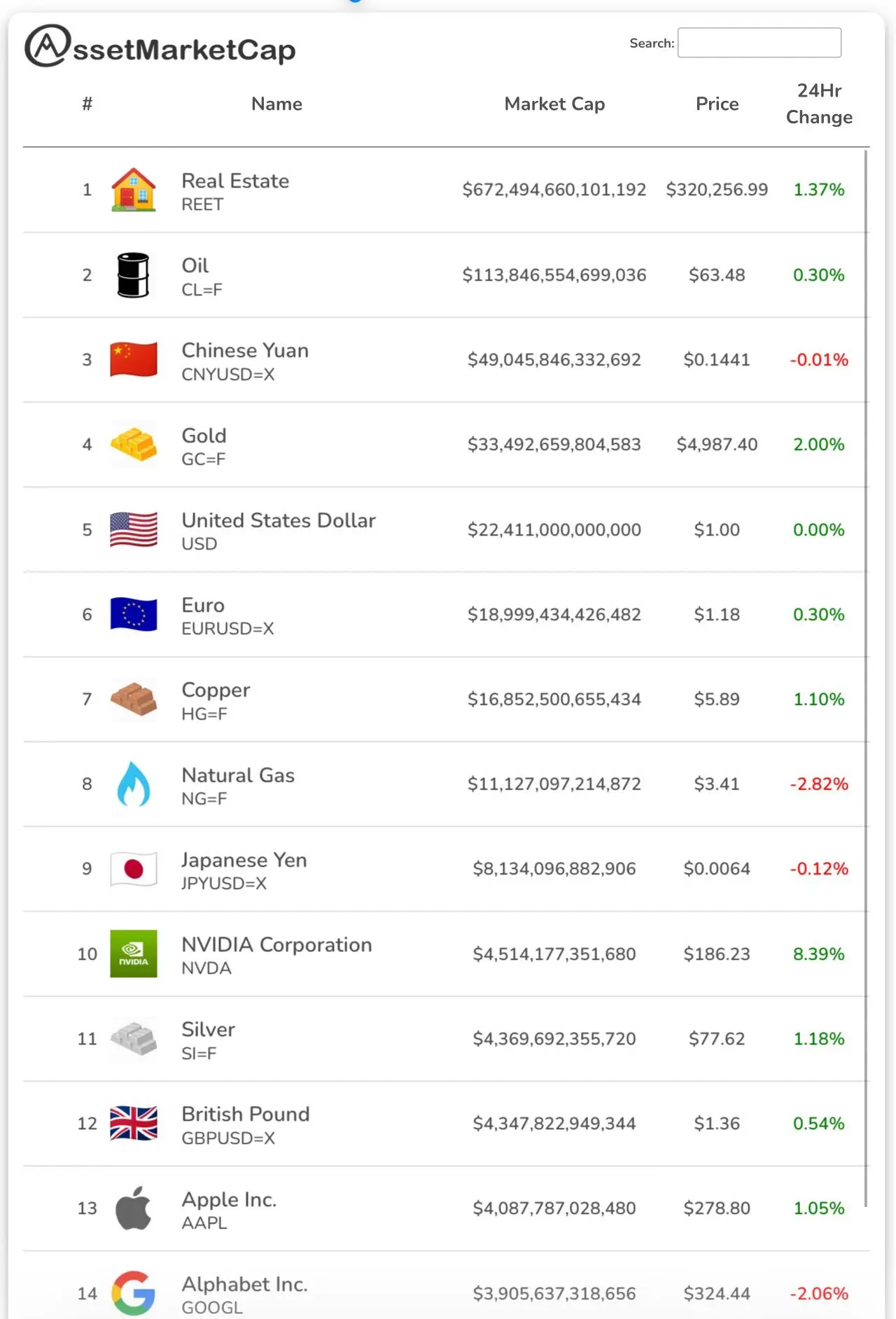

Do you know what the total assets of the world amount to? Now tell me, is Bitcoin expensive 📊

Total global assets = 1.1 quadrillion dollars

Bitcoin = less than 1.5 trillion ( less than 0.14% )

If Bitcoin were to capture just 1% of the global assets = 11 trillion

That’s more than 7 times the current price

And yet you hear: "Bitcoin is expensive"

The problem isn’t the price, the problem is understanding

$US30 $USDG $USDG #

#BuyTheDipOrWaitNow? #BitcoinBouncesBack #CelebratingNewYearOnGateSquare #YiLihuaExitsPositions #U.S.–IranNuclearTalksTurmoil

Total global assets = 1.1 quadrillion dollars

Bitcoin = less than 1.5 trillion ( less than 0.14% )

If Bitcoin were to capture just 1% of the global assets = 11 trillion

That’s more than 7 times the current price

And yet you hear: "Bitcoin is expensive"

The problem isn’t the price, the problem is understanding

$US30 $USDG $USDG #

#BuyTheDipOrWaitNow? #BitcoinBouncesBack #CelebratingNewYearOnGateSquare #YiLihuaExitsPositions #U.S.–IranNuclearTalksTurmoil

USDG0,02%

MC:$10.85KHolders:3

42.15%

- Reward

- like

- Comment

- Repost

- Share

Jim Cramer stated that he received information that Trump might take advantage of the recent dip and buy Bitcoin to support the US strategic reserve, potentially filling the reserve near the $60,000 level.

#Bitcoin

#BTC

#CryptoNews

#USBitcoinReserve

#CryptoMarket

View Original#Bitcoin

#BTC

#CryptoNews

#USBitcoinReserve

#CryptoMarket

MC:$10.85KHolders:3

42.15%

- Reward

- 3

- Comment

- Repost

- Share

"Hidden Million Dollar Opportunity in Front of Everyone"

Change your evaluation metric:

Pricing Bitcoin in fiat currency like the dollar is a losing game with a negative yield.

You are comparing two completely conflicting monetary protocols at their core. However, most market participants still measure Bitcoin’s “value” in US dollars because it is still considered the global reserve currency.

The current market narrative is that Bitcoin is just a “crypto Nasdaq” related to stock movements, and this narrative heavily dominates traders and Wall Street. Those who understand markets realize that

View OriginalChange your evaluation metric:

Pricing Bitcoin in fiat currency like the dollar is a losing game with a negative yield.

You are comparing two completely conflicting monetary protocols at their core. However, most market participants still measure Bitcoin’s “value” in US dollars because it is still considered the global reserve currency.

The current market narrative is that Bitcoin is just a “crypto Nasdaq” related to stock movements, and this narrative heavily dominates traders and Wall Street. Those who understand markets realize that

MC:$10.85KHolders:3

42.15%

- Reward

- like

- Comment

- Repost

- Share

Share moments and earn commissions easily!https://www.gate.com/live/video/8aaf04ff1e4b4401bcf87c190c278092?type=live&ref=VLUXV1XCUQ&ref_type=105

View Original

- Reward

- 1

- Comment

- Repost

- Share

$ETH $XRP

Is silver witnessing a new bullish market? Are the recent lows around $70 turning into the "new bottom" for the white metal? Especially after eliminating the excessive leverage that caused forced sell-offs and sharp crashes recently.

Karel Merks, an investment strategy analyst at "Beleggers Belangen," confirmed that the collapse of silver prices from $121 to $64 was not the end of the bull market, but a "forced cleansing" of reckless traders.

Merks identified several reasons indicating that a bullish market for silver is ahead, most notably:

- Traders exiting the market: The recen

View OriginalIs silver witnessing a new bullish market? Are the recent lows around $70 turning into the "new bottom" for the white metal? Especially after eliminating the excessive leverage that caused forced sell-offs and sharp crashes recently.

Karel Merks, an investment strategy analyst at "Beleggers Belangen," confirmed that the collapse of silver prices from $121 to $64 was not the end of the bull market, but a "forced cleansing" of reckless traders.

Merks identified several reasons indicating that a bullish market for silver is ahead, most notably:

- Traders exiting the market: The recen

MC:$10.85KHolders:3

42.15%

- Reward

- like

- Comment

- Repost

- Share

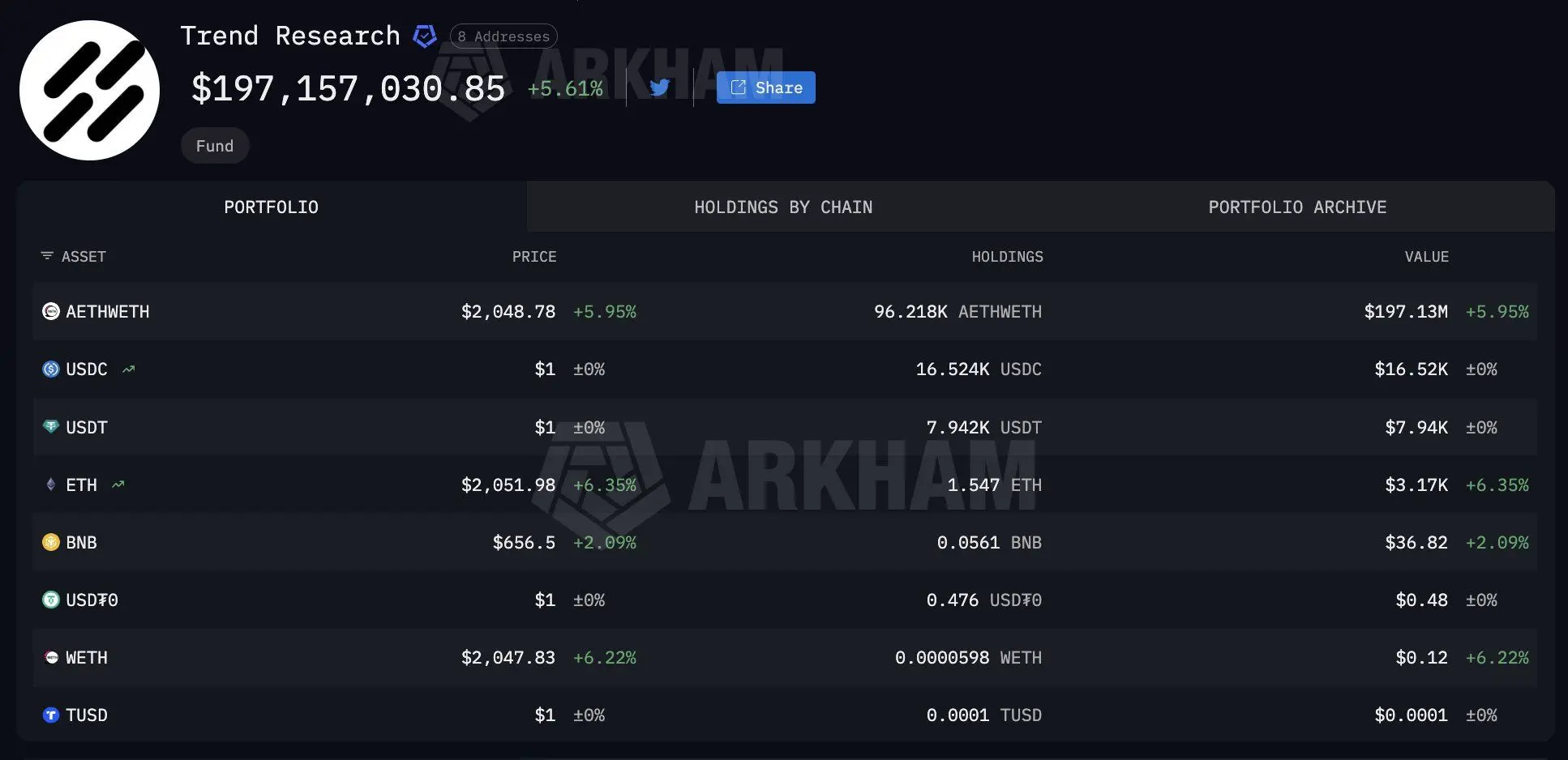

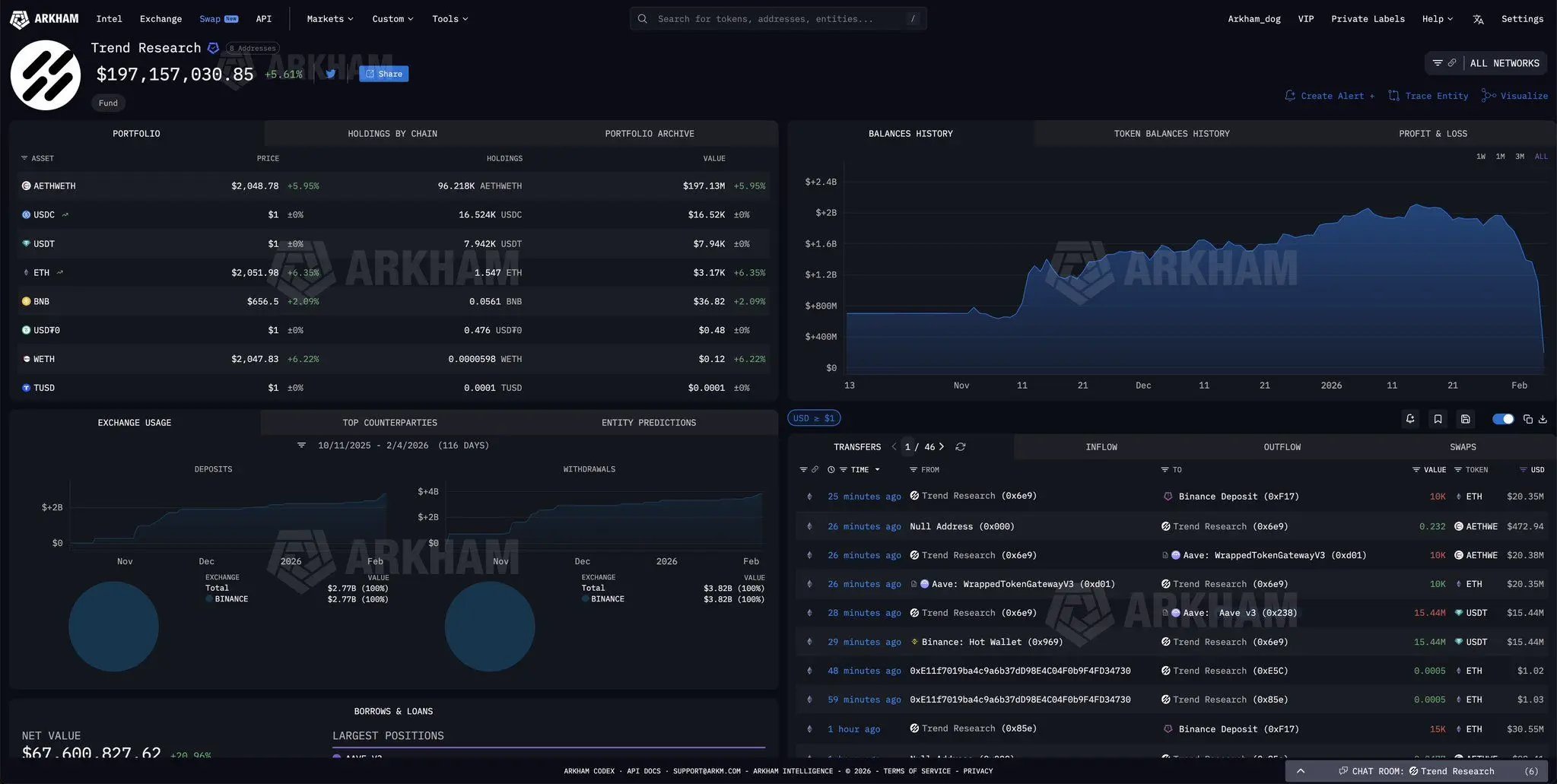

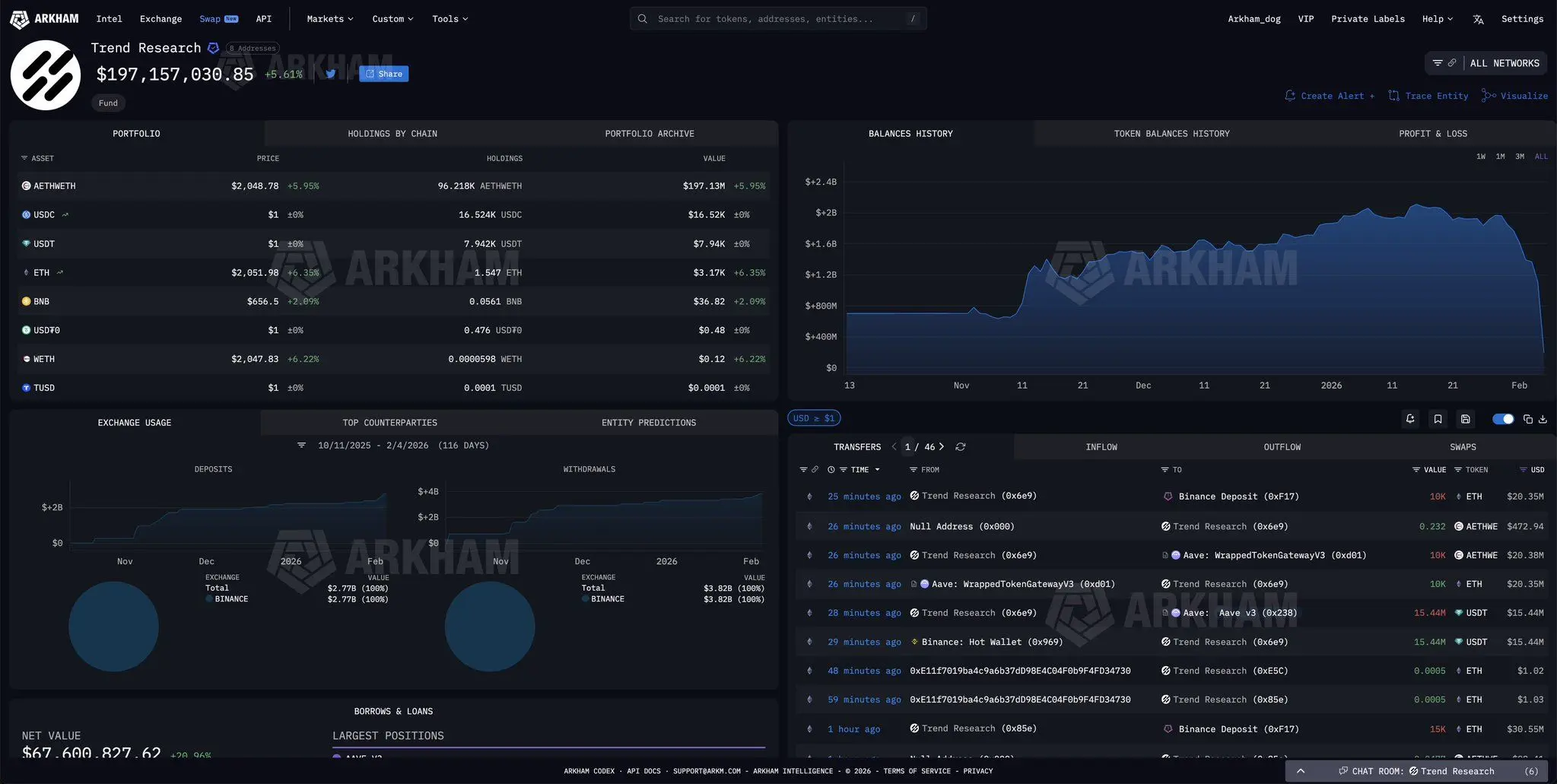

Trend Research suffered a massive loss of $686 million due to the recent crash, and decided to liquidate all its Ethereum holdings.

Just 8 days ago, the company was betting on ETH's rise with positions worth nearly $2 billion, but today it has closed them all after nearly being forcibly liquidated.

$BTC $GT

$USDG #BuyTheDipOrWaitNow? #InstitutionalCapitalImpactsMarketStructure #CryptoMarketPullback

View OriginalJust 8 days ago, the company was betting on ETH's rise with positions worth nearly $2 billion, but today it has closed them all after nearly being forcibly liquidated.

$BTC $GT

$USDG #BuyTheDipOrWaitNow? #InstitutionalCapitalImpactsMarketStructure #CryptoMarketPullback

MC:$5.5KHolders:4

0.05%

- Reward

- like

- Comment

- Repost

- Share

Trend Research suffered a massive loss of $686 million due to the recent collapse and decided to liquidate all its Ethereum holdings.

Just 8 days ago, the company was betting on ETH's rise with positions worth nearly $2 billion, but today it has closed them all after nearly being forcibly liquidated.

$BTC $GT

$USDG #BuyTheDipOrWaitNow? #InstitutionalCapitalImpactsMarketStructure #CryptoMarketPullback

View OriginalJust 8 days ago, the company was betting on ETH's rise with positions worth nearly $2 billion, but today it has closed them all after nearly being forcibly liquidated.

$BTC $GT

$USDG #BuyTheDipOrWaitNow? #InstitutionalCapitalImpactsMarketStructure #CryptoMarketPullback

MC:$5.5KHolders:4

0.05%

- Reward

- like

- Comment

- Repost

- Share

In 2021, trader Mark Minervini achieved one of the most significant accomplishments in modern trading history by winning the U.S. Stock Investment Championship with a portfolio exceeding one million USD, achieving a documented annual return of 334%. While this remarkable figure garnered worldwide attention, the true story behind this achievement lies not in bold speculation but in disciplined risk management executed with precision and consistency. What are the key lessons behind this success?

The U.S. Investment Championship is not a "simulation," but trading with real money and meticulous ac

The U.S. Investment Championship is not a "simulation," but trading with real money and meticulous ac

ETH1,38%

MC:$10.85KHolders:3

42.15%

- Reward

- like

- Comment

- Repost

- Share

$BTC $USDG

Bitcoin drops from $126,000 to $60,000 without a single "disaster news"...

So what’s really happening behind the scenes?

Some think the story is just economic pressures or geopolitical tensions,

but the truth is much deeper. We are witnessing a fundamental shift in "pricing genetics."

The traditional Bitcoin model was based on a simple principle:

Absolute scarcity of (21 million units).

Price moves based on real supply and demand in the "spot market" (Spot).

But today, the weight has shifted to "derivative and artificial markets."

Through futures, ETFs, and options contracts, major

View OriginalBitcoin drops from $126,000 to $60,000 without a single "disaster news"...

So what’s really happening behind the scenes?

Some think the story is just economic pressures or geopolitical tensions,

but the truth is much deeper. We are witnessing a fundamental shift in "pricing genetics."

The traditional Bitcoin model was based on a simple principle:

Absolute scarcity of (21 million units).

Price moves based on real supply and demand in the "spot market" (Spot).

But today, the weight has shifted to "derivative and artificial markets."

Through futures, ETFs, and options contracts, major

MC:$10.85KHolders:3

42.15%

- Reward

- 1

- Comment

- Repost

- Share

$BTC $USDG

Bitcoin drops from $126,000 to $60,000 without a single "disaster news"...

So what’s really happening behind the scenes?

Some think the story is just economic pressures or geopolitical tensions,

but the truth is much deeper. We are witnessing a fundamental shift in "pricing genetics."

The traditional Bitcoin model was based on a simple principle:

Absolute scarcity of (21 million units).

Price moves based on real supply and demand in the "spot market" (Spot).

But today, the focus has shifted to "derivative and synthetic markets."

Through futures, ETFs, and options contracts, major i

View OriginalBitcoin drops from $126,000 to $60,000 without a single "disaster news"...

So what’s really happening behind the scenes?

Some think the story is just economic pressures or geopolitical tensions,

but the truth is much deeper. We are witnessing a fundamental shift in "pricing genetics."

The traditional Bitcoin model was based on a simple principle:

Absolute scarcity of (21 million units).

Price moves based on real supply and demand in the "spot market" (Spot).

But today, the focus has shifted to "derivative and synthetic markets."

Through futures, ETFs, and options contracts, major i

MC:$10.85KHolders:3

42.15%

- Reward

- like

- Comment

- Repost

- Share

$ETH $XRP

Emerging Markets.. Awakening from the "Sleep" of the Lost Decade $EEM

The historical bet has always favored U.S. stocks, but 2026 seems to be writing a new chapter.

The chart in front of us speaks a strict technical language that leaves no room for interpretation:

Emerging markets have officially begun to outperform the giants.

Pattern analysis before the numbers:

What we see is not just a random rise,

but a (Inverse Head & Shoulders) pattern or "Inverted Head and Shoulders."

Technically,

This is one of the strongest patterns signaling the end of a downtrend and the beginning of a n

View OriginalEmerging Markets.. Awakening from the "Sleep" of the Lost Decade $EEM

The historical bet has always favored U.S. stocks, but 2026 seems to be writing a new chapter.

The chart in front of us speaks a strict technical language that leaves no room for interpretation:

Emerging markets have officially begun to outperform the giants.

Pattern analysis before the numbers:

What we see is not just a random rise,

but a (Inverse Head & Shoulders) pattern or "Inverted Head and Shoulders."

Technically,

This is one of the strongest patterns signaling the end of a downtrend and the beginning of a n

MC:$6.44KHolders:6919

23.73%

- Reward

- like

- Comment

- Repost

- Share

Kathy Wood: We Bought Bitcoin at $250 in 2015... and Many Mocked Us Back Then

Famous investor Kathy Wood, CEO of Ark Invest, revealed that her first Bitcoin purchase was in 2015 when the price of one coin was around $250.

Wood said during her appearance on The Diary of a CEO Podcast that her first Bitcoin was bought in the summer of 2015, explaining: "We entered the market at around $250 per coin, and today the price has risen significantly, which confirms that we entered very early and were convinced we were heading in the right direction."

She added that many people mocked her investment in

View OriginalFamous investor Kathy Wood, CEO of Ark Invest, revealed that her first Bitcoin purchase was in 2015 when the price of one coin was around $250.

Wood said during her appearance on The Diary of a CEO Podcast that her first Bitcoin was bought in the summer of 2015, explaining: "We entered the market at around $250 per coin, and today the price has risen significantly, which confirms that we entered very early and were convinced we were heading in the right direction."

She added that many people mocked her investment in

MC:$15.16KHolders:10

56.35%

- Reward

- like

- 1

- Repost

- Share

Sniper1h :

:

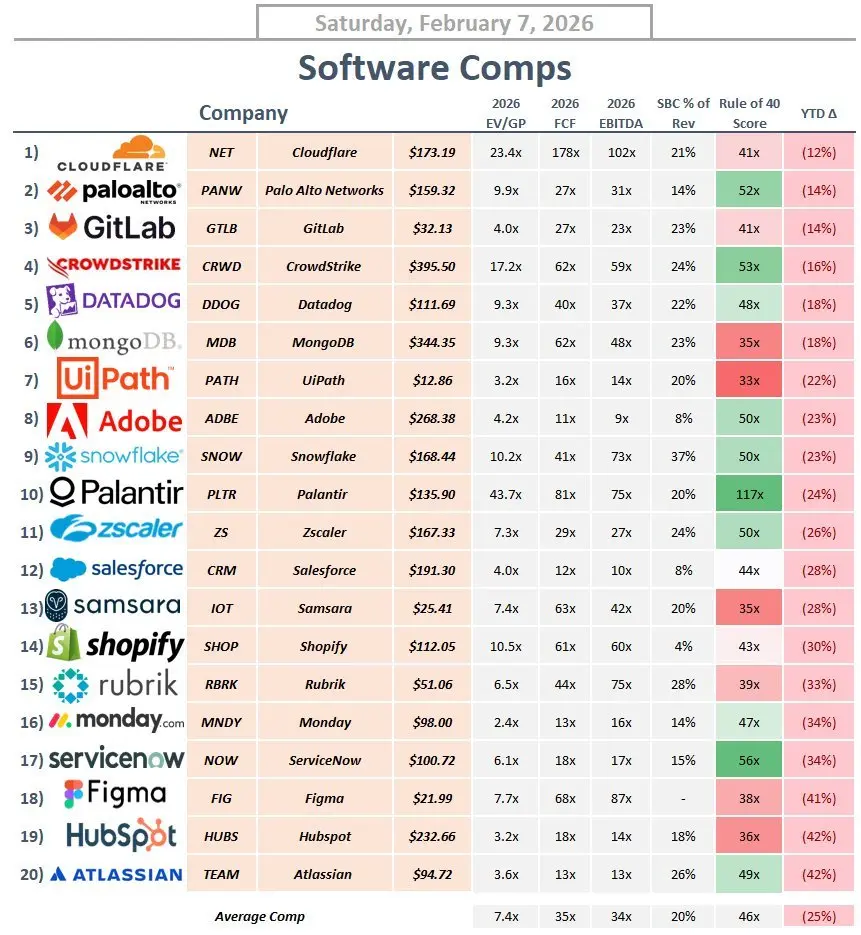

Bullish market at its peak 🐂The 40 Rule: The Investor's Compass in the Turbulent Sea of Software

In the world of investing in (SaaS) companies,

there's always a question professionals ask:

Do we prefer a company that grows at lightning speed even if it's losing money,

or a stable company that makes profits with slow growth?

This is where the "40 Rule" (Rule of 40) comes in to give us the answer.

Simply put, it's an equation that combines (revenue growth rate + profit margin).

If the result is 40% or more, the company is considered healthy and balances expansion with value creation skillfully.

If it exceeds 50% or 60%

View OriginalIn the world of investing in (SaaS) companies,

there's always a question professionals ask:

Do we prefer a company that grows at lightning speed even if it's losing money,

or a stable company that makes profits with slow growth?

This is where the "40 Rule" (Rule of 40) comes in to give us the answer.

Simply put, it's an equation that combines (revenue growth rate + profit margin).

If the result is 40% or more, the company is considered healthy and balances expansion with value creation skillfully.

If it exceeds 50% or 60%

- Reward

- 1

- Comment

- Repost

- Share

Mark Cuban: Artificial Intelligence Could Enable One Person to Start a Giant Company from Home

Mark Cuban said that AI is still in its early stages, but it has the potential to generate enormous wealth and possibly produce the world's first trillionaire. He believes that what we see today is only a small part of what this technology can offer in the future.

He pointed out that AI could allow a single individual to establish a giant company from their home, just as major companies like Apple and Amazon did in the past. He cited the example of OpenAI, which was founded in Greg Brockman's home in

Mark Cuban said that AI is still in its early stages, but it has the potential to generate enormous wealth and possibly produce the world's first trillionaire. He believes that what we see today is only a small part of what this technology can offer in the future.

He pointed out that AI could allow a single individual to establish a giant company from their home, just as major companies like Apple and Amazon did in the past. He cited the example of OpenAI, which was founded in Greg Brockman's home in

USDG0,02%

MC:$15.16KHolders:10

56.35%

- Reward

- like

- Comment

- Repost

- Share