MarketMaestro

No content yet

MarketMaestro

$SPY

OI-based Net Gamma Exposure: negative

Volume-based Net Gamma Exposure: clearly negative

Directionalized Volume: negative

This combination means a negative gamma regime. In a negative gamma regime, Market Makers are forced to trade in the direction of the price move. If the market falls, dealers SELL to hedge and accelerate the drop. If the market rises, dealers BUY to hedge, creating a squeeze.

There is a massive pile-up at the 680 strike level. We are currently at 681.06, meaning we are right on top of this big wall. The heavy open interest at this level acts like a magnet that pulls pri

OI-based Net Gamma Exposure: negative

Volume-based Net Gamma Exposure: clearly negative

Directionalized Volume: negative

This combination means a negative gamma regime. In a negative gamma regime, Market Makers are forced to trade in the direction of the price move. If the market falls, dealers SELL to hedge and accelerate the drop. If the market rises, dealers BUY to hedge, creating a squeeze.

There is a massive pile-up at the 680 strike level. We are currently at 681.06, meaning we are right on top of this big wall. The heavy open interest at this level acts like a magnet that pulls pri

- Reward

- like

- Comment

- Repost

- Share

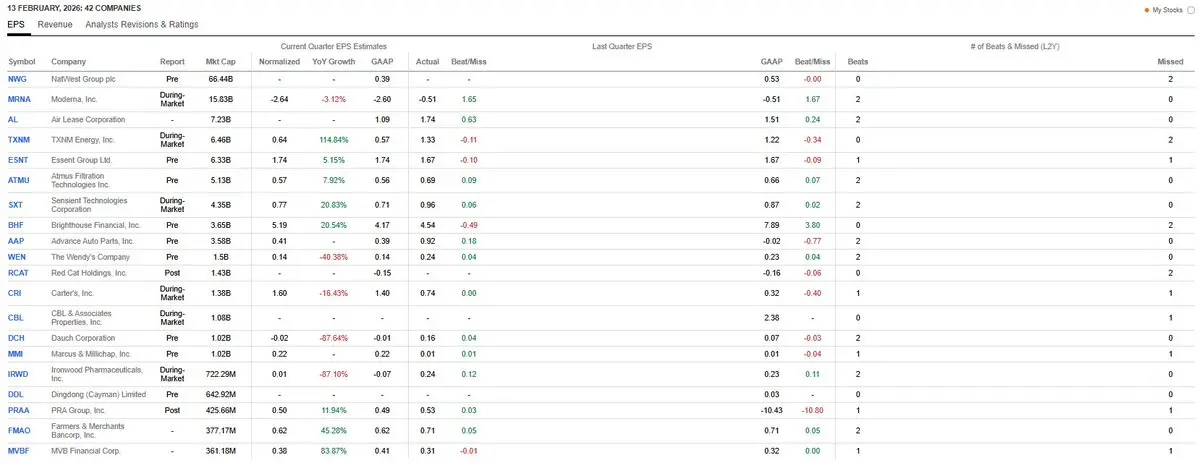

Today's ERs

$RCAT

$RCAT

- Reward

- like

- Comment

- Repost

- Share

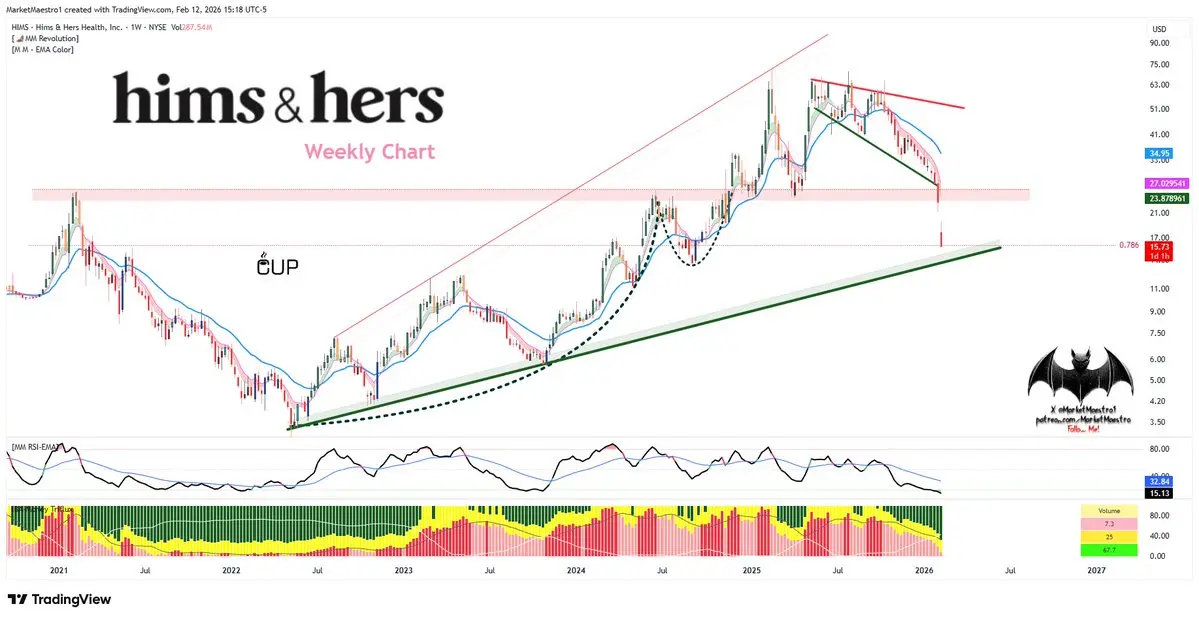

$HIMS

The wind has turned against HIMS. Compounded GLP-1 products, which sit at the center of the company’s growth story, are no longer just a gray-area debate, they are now facing a concrete regulatory barrier. Especially with the FDA hardening its tone and bringing the Department of Justice (DoJ) into the process, the risk parameters have completely changed.

Novo Nordisk’s legal moves, and especially the fact that oral formulations are being treated as a red line, have increased the pressure on the company. The fact that HIMS had to stop oral GLP-1 sales is also operational proof of this pre

The wind has turned against HIMS. Compounded GLP-1 products, which sit at the center of the company’s growth story, are no longer just a gray-area debate, they are now facing a concrete regulatory barrier. Especially with the FDA hardening its tone and bringing the Department of Justice (DoJ) into the process, the risk parameters have completely changed.

Novo Nordisk’s legal moves, and especially the fact that oral formulations are being treated as a red line, have increased the pressure on the company. The fact that HIMS had to stop oral GLP-1 sales is also operational proof of this pre

- Reward

- like

- Comment

- Repost

- Share

$VNQ

It broke the red diagonal resistance 💥 It got stuck at fibo88. It looks extremely bullish.

It broke the red diagonal resistance 💥 It got stuck at fibo88. It looks extremely bullish.

- Reward

- like

- Comment

- Repost

- Share

$VZ

BULL's EYE! 🎯

It broke the neckline very strongly. got stuck at fibo127

VZ beat expectations on both revenue and EPS in Q4. The new CEO’s cost-saving measures and growth strategies worked; the company posted its biggest mobile and broadband subscriber gains in the past six years. Management announced a massive $25B share buyback program that pleased investors. For 2026, the company guides for 4%–5% EPS growth and 7% free cash flow growth. While the Frontier acquisition increases total debt, Verizon continues to have the lowest leverage ratio in the industry

BULL's EYE! 🎯

It broke the neckline very strongly. got stuck at fibo127

VZ beat expectations on both revenue and EPS in Q4. The new CEO’s cost-saving measures and growth strategies worked; the company posted its biggest mobile and broadband subscriber gains in the past six years. Management announced a massive $25B share buyback program that pleased investors. For 2026, the company guides for 4%–5% EPS growth and 7% free cash flow growth. While the Frontier acquisition increases total debt, Verizon continues to have the lowest leverage ratio in the industry

- Reward

- like

- Comment

- Repost

- Share

$VOLT

The ETF’s holdings align with Trump policies. From a technical perspective, the chart is also signaling a steep uptrend is possible

Industrials – 35%–40% Weight

These companies generally focus on electric infrastructure, power management, and grid construction.

$POWL: Produces equipment for electricity distribution and control.

$PWR: Provides infrastructure and construction engineering services for electric grids. HUBB: Manufactures electrical and electronic products/components.

$GEV: A spin-off from General Electric, a giant focused on energy generation (turbines, wind) and electrif

The ETF’s holdings align with Trump policies. From a technical perspective, the chart is also signaling a steep uptrend is possible

Industrials – 35%–40% Weight

These companies generally focus on electric infrastructure, power management, and grid construction.

$POWL: Produces equipment for electricity distribution and control.

$PWR: Provides infrastructure and construction engineering services for electric grids. HUBB: Manufactures electrical and electronic products/components.

$GEV: A spin-off from General Electric, a giant focused on energy generation (turbines, wind) and electrif

VOLT1,9%

- Reward

- like

- 4

- Repost

- Share

GateUser-c886be29 :

:

Ape In 🚀View More

$XLU might change its long standing bad luck dating back to 1999 this year. The ETF’s biggest weight is $NEE, and is extremely bullish

- Reward

- like

- Comment

- Repost

- Share

$AMZN ’s setup has now become risky ❗️ On the 3 month, monthly, and weekly timeframes, the charts have all broken down. This technical setup is a rising wedge. If it breaks down, the picture can deteriorate further

- Reward

- like

- Comment

- Repost

- Share

$TE

For now, the first target looks like support band. If it drops into that area, it still has room to correct further, so the index situation is very critical. If we can see a reversal in the index, the first zone could be enough, but if selling continues in the index, second band comes into play

For now, the first target looks like support band. If it drops into that area, it still has room to correct further, so the index situation is very critical. If we can see a reversal in the index, the first zone could be enough, but if selling continues in the index, second band comes into play

- Reward

- like

- Comment

- Repost

- Share

$WMT

Strong! 🦾

Strong! 🦾

- Reward

- like

- Comment

- Repost

- Share

$SHOP

I think it's at the darkest point of the night. Dawn time. As you know, it’s also the moment closest to the sun.

$105 is an important support. ı still haven’t seen a hold, but I think the rebound will be very strong. I see the green zone, the worst case scenario

I think it's at the darkest point of the night. Dawn time. As you know, it’s also the moment closest to the sun.

$105 is an important support. ı still haven’t seen a hold, but I think the rebound will be very strong. I see the green zone, the worst case scenario

- Reward

- like

- Comment

- Repost

- Share

$WULF

In an environment like this, what a strong! It reached the main fibo78 zone. That may be one of the toughest zones. $16.73 is both fibo78 and the RSI band. With the index in this condition, this area probably needs a catalyst+god candle to clear. For a rally, it needs to break small green line!

In an environment like this, what a strong! It reached the main fibo78 zone. That may be one of the toughest zones. $16.73 is both fibo78 and the RSI band. With the index in this condition, this area probably needs a catalyst+god candle to clear. For a rally, it needs to break small green line!

- Reward

- like

- Comment

- Repost

- Share

$RKLB Gifted Link! 🎁 You can read it for free 👇💯

- Reward

- like

- 4

- Repost

- Share

GateUser-37f4a2e7 :

:

2026 GOGOGO 👊View More

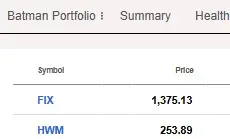

Portfolio top 2! 🤑

🥇 $FIX

🥈 $HWM

🥇 $FIX

🥈 $HWM

- Reward

- like

- Comment

- Repost

- Share

$IONQ

I don’t know if MM ran the algorithms and went out for a cigarette. It got what it wanted in a lot of stocks, but it wants more. There’s no sign of holding yet. If $32.66 breaks, it may want green zone. Right now it’s in the same spot as the April tariff crash. It still looks like it’s searching for a bottom

I don’t know if MM ran the algorithms and went out for a cigarette. It got what it wanted in a lot of stocks, but it wants more. There’s no sign of holding yet. If $32.66 breaks, it may want green zone. Right now it’s in the same spot as the April tariff crash. It still looks like it’s searching for a bottom

- Reward

- like

- Comment

- Repost

- Share

$SMR

NuScale Power to Collaborate with Oak Ridge National Laboratory to Explore Artificial Intelligence-Guided Nuclear Fuel Management

NuScale Power to Collaborate with Oak Ridge National Laboratory to Explore Artificial Intelligence-Guided Nuclear Fuel Management

- Reward

- like

- Comment

- Repost

- Share

$DNN

It’s very strong across all timeframes. It’s one of Canada’s leading #Uranium players. Uranium demand is very large.

STRONG!

It’s very strong across all timeframes. It’s one of Canada’s leading #Uranium players. Uranium demand is very large.

STRONG!

- Reward

- like

- Comment

- Repost

- Share

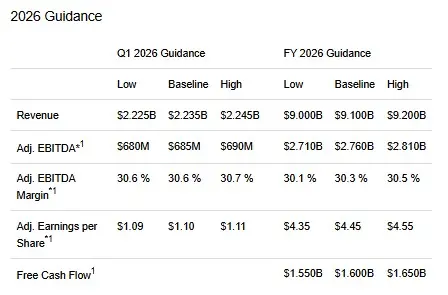

$HWM my no 🥇

Howmet Aerospace Non-GAAP EPS of $1.05 beats by $0.08, revenue of $2.2B beats by $70M

Feb. 12, 2026

Howmet Aerospace press release (HWM): Q4 Non-GAAP EPS of $1.05 beats by $0.08.

Revenue of $2.2B (+15.8% Y/Y) beats by $70M.

Revenue of $2.2 billion, up 15% year over year (YoY), driven by Commercial Aerospace, up 13%

1Q26 revenue consensus of $2.17B, EPS consensus of $1.02, FY26 revenue consensus of $9.14B, EPS consensus of $4.47

Howmet Aerospace Non-GAAP EPS of $1.05 beats by $0.08, revenue of $2.2B beats by $70M

Feb. 12, 2026

Howmet Aerospace press release (HWM): Q4 Non-GAAP EPS of $1.05 beats by $0.08.

Revenue of $2.2B (+15.8% Y/Y) beats by $70M.

Revenue of $2.2 billion, up 15% year over year (YoY), driven by Commercial Aerospace, up 13%

1Q26 revenue consensus of $2.17B, EPS consensus of $1.02, FY26 revenue consensus of $9.14B, EPS consensus of $4.47

- Reward

- like

- Comment

- Repost

- Share

$COPX

#Copper broke above the resistance that’s been in place since 2006. I think the road is long

#Copper broke above the resistance that’s been in place since 2006. I think the road is long

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More37.92K Popularity

70.27K Popularity

15.95K Popularity

42.16K Popularity

252.04K Popularity

Pin