KyleChassé

No content yet

KyleChassé

Prediction markets are coming for sportsbooks.

Novig raised $75M at a $500M valuation, led by Pantera Capital.

P2P model. No retail commissions. Institutions pay.

They’re operating via sweepstakes while seeking approval from the U.S. Commodity Futures Trading Commission.

If regulators approve it, betting starts looking like an exchange.

But that's still an IF.

And if it happens...the house always wins.

Not a bad place to look.

Novig raised $75M at a $500M valuation, led by Pantera Capital.

P2P model. No retail commissions. Institutions pay.

They’re operating via sweepstakes while seeking approval from the U.S. Commodity Futures Trading Commission.

If regulators approve it, betting starts looking like an exchange.

But that's still an IF.

And if it happens...the house always wins.

Not a bad place to look.

- Reward

- like

- Comment

- Repost

- Share

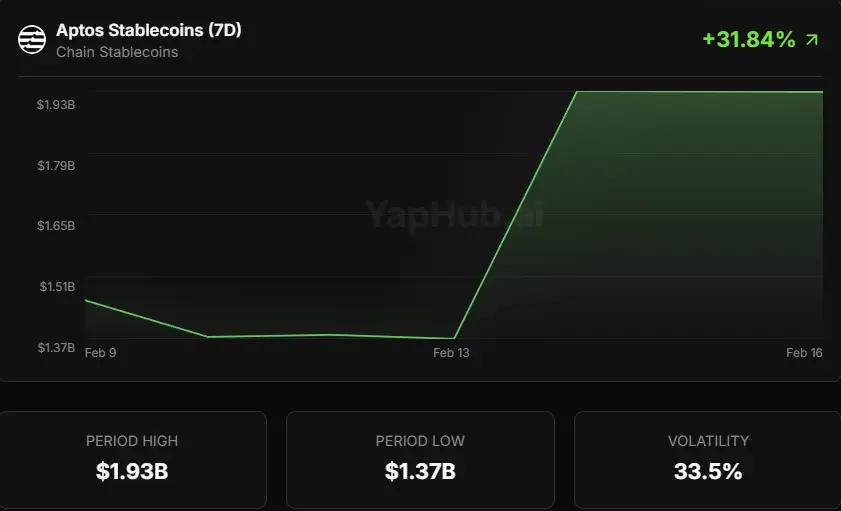

Three signals. One direction.

Balaji says stablecoins win because they run 24/7.

The ECB plans a digital euro pilot in 2027, issuance by 2029.

Italy’s largest bank just disclosed $96M in Bitcoin ETFs.

Private rails scaling.

Public money going programmable.

Banks buying the hedge.

Stablecoins pressure banks.

CBDCs protect state control.

Bitcoin sits outside both.

If you still think crypto is “fringe,” you’re not watching close enough.

Balaji says stablecoins win because they run 24/7.

The ECB plans a digital euro pilot in 2027, issuance by 2029.

Italy’s largest bank just disclosed $96M in Bitcoin ETFs.

Private rails scaling.

Public money going programmable.

Banks buying the hedge.

Stablecoins pressure banks.

CBDCs protect state control.

Bitcoin sits outside both.

If you still think crypto is “fringe,” you’re not watching close enough.

BTC-1,94%

- Reward

- 2

- Comment

- Repost

- Share

The International Monetary Fund just issued a triple warning to Japan.

Protect the independence of the Bank of Japan.

Avoid fiscal expansion.

Don’t cut consumption taxes.

This lands as Sanae Takaichi pushes zero food tax and questions more rate hikes.

The IMF wants tightening toward neutral by 2027.

And it's not like any country has gone against the IMF before...

🇸🇻

Protect the independence of the Bank of Japan.

Avoid fiscal expansion.

Don’t cut consumption taxes.

This lands as Sanae Takaichi pushes zero food tax and questions more rate hikes.

The IMF wants tightening toward neutral by 2027.

And it's not like any country has gone against the IMF before...

🇸🇻

- Reward

- 1

- Comment

- Repost

- Share

2026 is going to be HUGE for SUI.

Privacy turned on by default.

Gas-free stablecoin transfers.

Native USDsui.

Bitcoin finance.

Gaming as the trojan horse.

DeepBook margin.

$1B+ TVL.

ETF filings in motion.

Sui isn’t JUST chasing narratives.

It’s building a financial operating system.

Privacy turned on by default.

Gas-free stablecoin transfers.

Native USDsui.

Bitcoin finance.

Gaming as the trojan horse.

DeepBook margin.

$1B+ TVL.

ETF filings in motion.

Sui isn’t JUST chasing narratives.

It’s building a financial operating system.

SUI-4,72%

- Reward

- like

- Comment

- Repost

- Share

🚨 The strong hands are starting to bend

For the first time since the 2023 bear market, Bitcoin’s long term holder SOPR just dropped below 1 to 0.88, which means seasoned holders are beginning to sell at a loss.

That is not full capitulation yet because the monthly SOPR is still above 1, but it is the first real crack in the armor.

At the same time, the Crypto Fear Index is stuck in its longest extreme fear stretch in years, with BTC and ETH both bleeding through 2026.

Historically, this kind of fear has marked major turning points.

Right now we are in the transition phase where conviction get

For the first time since the 2023 bear market, Bitcoin’s long term holder SOPR just dropped below 1 to 0.88, which means seasoned holders are beginning to sell at a loss.

That is not full capitulation yet because the monthly SOPR is still above 1, but it is the first real crack in the armor.

At the same time, the Crypto Fear Index is stuck in its longest extreme fear stretch in years, with BTC and ETH both bleeding through 2026.

Historically, this kind of fear has marked major turning points.

Right now we are in the transition phase where conviction get

- Reward

- like

- Comment

- Repost

- Share

The market is screaming “QE.”

It isn’t... yet.

The Federal Reserve Bank of New York is buying $16B in short-term T-bills this week, starting Tuesday at 9 a.m. ET.

These operations have been scheduled since Dec 12, 2025. They are routine reserve management.

The goal is to keep bank reserves stable during tax season and rising cash demand.

Liquidity added? Yes.

Policy pivot? No.

All this while people like Kiyosaki are excited for a crash.

It isn’t... yet.

The Federal Reserve Bank of New York is buying $16B in short-term T-bills this week, starting Tuesday at 9 a.m. ET.

These operations have been scheduled since Dec 12, 2025. They are routine reserve management.

The goal is to keep bank reserves stable during tax season and rising cash demand.

Liquidity added? Yes.

Policy pivot? No.

All this while people like Kiyosaki are excited for a crash.

- Reward

- like

- Comment

- Repost

- Share

Three pressure points. One market.

BTC Open Interest: -55% from ATH.

Biggest flush since April 2023.

Leverage wiped.

Mining 1 BTC costs $80K+.

Price < $70K.

Miners underwater.

When cost > price, something adjusts.

India’s reserves just fell $6.7B to $717B after a record high, per the Reserve Bank of India.

Gold marked sharply lower.

Leverage down.

Miners stressed.

Reserves swinging.

Compression like this rarely lasts.

BTC Open Interest: -55% from ATH.

Biggest flush since April 2023.

Leverage wiped.

Mining 1 BTC costs $80K+.

Price < $70K.

Miners underwater.

When cost > price, something adjusts.

India’s reserves just fell $6.7B to $717B after a record high, per the Reserve Bank of India.

Gold marked sharply lower.

Leverage down.

Miners stressed.

Reserves swinging.

Compression like this rarely lasts.

BTC-1,94%

- Reward

- like

- Comment

- Repost

- Share

There's a lot of fake news going around.

The cashtags misunderstanding.

Exaggerated Fed activity.

Now people think Burry is bearish again.

Is the market that desperate for a move?

Always do your own research.

The cashtags misunderstanding.

Exaggerated Fed activity.

Now people think Burry is bearish again.

Is the market that desperate for a move?

Always do your own research.

- Reward

- like

- Comment

- Repost

- Share

Grayscale just moved $SUI one step closer to Wall Street.

On Feb 15, 2026, Grayscale amended its S-1 to convert its Sui trust into a spot ETF, ticker GSUI, with Coinbase as prime broker and custodian.

SUI jumped 7% to ~$0.95.

Volume up 45%.

Futures OI hit $524M.

Are you positioning before approval.

On Feb 15, 2026, Grayscale amended its S-1 to convert its Sui trust into a spot ETF, ticker GSUI, with Coinbase as prime broker and custodian.

SUI jumped 7% to ~$0.95.

Volume up 45%.

Futures OI hit $524M.

Are you positioning before approval.

SUI-4,72%

- Reward

- 3

- 2

- 1

- Share

Karik254 :

:

I do business, I deal on deals if you have a good deal you get it to me if I like it i buy your deal if you have money to buy my own i give you my deal you pay that's business 😂View More

Fund managers just flipped to max bearish on the dollar.

A Bank of America survey shows the biggest short in 14 years. DXY near 97. Down 9% in 2025.

The DXY is now at 2022 levels.

Cuts expected from the Federal Reserve.

Crowded trade.

If it squeezes, risk dumps. If it falls, crypto flies.

A Bank of America survey shows the biggest short in 14 years. DXY near 97. Down 9% in 2025.

The DXY is now at 2022 levels.

Cuts expected from the Federal Reserve.

Crowded trade.

If it squeezes, risk dumps. If it falls, crypto flies.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

I've seen a lot of posts getting it wrong.

Yes, X is building rails for timeline trading.

No, X is not handling those trades themselves.

They're just making it easier for others provide that service.

That's huge.

Yes, X is building rails for timeline trading.

No, X is not handling those trades themselves.

They're just making it easier for others provide that service.

That's huge.

- Reward

- 1

- Comment

- Repost

- Share

Saylor is going to do what???

With BTC at $68,417 below his ~$76K average, Michael Saylor plans to equitize $6B in convertible debt and keep buying.

714,644 BTC. ~$49B assets. ~$6B debt.

He’s extending the bet and shifting risk to shareholders.

If BTC runs, genius.

If it drops, leverage bites...

With BTC at $68,417 below his ~$76K average, Michael Saylor plans to equitize $6B in convertible debt and keep buying.

714,644 BTC. ~$49B assets. ~$6B debt.

He’s extending the bet and shifting risk to shareholders.

If BTC runs, genius.

If it drops, leverage bites...

BTC-1,94%

- Reward

- like

- Comment

- Repost

- Share

CZ just said the quiet part out loud.

On-chain transparency is powerful for auditability.

But it’s a nightmare for payroll.

If every salary, bonus, and vendor payment is publicly traceable, crypto struggles to function as everyday money. Companies will not expose internal compensation structures to the world.

This is the core tension:

Transparency strengthens compliance and fraud detection.

Privacy enables real economic activity.

Until that balance is solved at the protocol level, crypto payments remain a niche tool, not a global standard.

The next adoption will be driven by usable privacy.

On-chain transparency is powerful for auditability.

But it’s a nightmare for payroll.

If every salary, bonus, and vendor payment is publicly traceable, crypto struggles to function as everyday money. Companies will not expose internal compensation structures to the world.

This is the core tension:

Transparency strengthens compliance and fraud detection.

Privacy enables real economic activity.

Until that balance is solved at the protocol level, crypto payments remain a niche tool, not a global standard.

The next adoption will be driven by usable privacy.

- Reward

- like

- Comment

- Repost

- Share

I’m watching Sui because it’s built for speed, not ideology.

Its object-based parallel execution removes bottlenecks and makes onchain feel instant.

When retail comes back, performance is what they’ll notice first.

Its object-based parallel execution removes bottlenecks and makes onchain feel instant.

When retail comes back, performance is what they’ll notice first.

SUI-4,72%

- Reward

- 2

- Comment

- Repost

- Share

This is INSANE!!!

$9.6T of U.S. debt is about to hit the market and this rollover alone could reshape the entire macro cycle.

A third of outstanding bonds are refinancing at 3.5 to 4%, pushing net interest toward $1T in 2026 and forcing policymakers into a corner between higher yields or easier money.

This is the pressure point that will determine whether liquidity tightens further or the easing pivot arrives sooner than expected.

Be ready.

$9.6T of U.S. debt is about to hit the market and this rollover alone could reshape the entire macro cycle.

A third of outstanding bonds are refinancing at 3.5 to 4%, pushing net interest toward $1T in 2026 and forcing policymakers into a corner between higher yields or easier money.

This is the pressure point that will determine whether liquidity tightens further or the easing pivot arrives sooner than expected.

Be ready.

- Reward

- like

- Comment

- Repost

- Share

Fear & Greed just hit 8 while whales quietly accumulated.

That just so happens to be the exact divergence that has marked every major Bitcoin bottom before.

Some whales are accumulating loudly.

Saylor wants more.

Tom Lee says he'd buy $ETH if it crashed.

ARK bought more Crypto stocks.

We're not dead yet.

That just so happens to be the exact divergence that has marked every major Bitcoin bottom before.

Some whales are accumulating loudly.

Saylor wants more.

Tom Lee says he'd buy $ETH if it crashed.

ARK bought more Crypto stocks.

We're not dead yet.

- Reward

- 2

- Comment

- Repost

- Share