EyeOnChain

No content yet

EyeOnChain

Bitmine Keeps Swinging, Even While the Red Gets Deeper😁.

#Bitmine didn’t slow down last week -- if anything, they leaned in harder. Another 40,613 ETH quietly grabbed up, about $82.8M worth, just added to the pile. That brings their total stash to a massive 4.32 million $ETH … yeah, billions on billions when you zoom out.

The catch? Their average entry sits way up around $3,847. At today’s prices, that mountain of ETH is staring at a drawdown north of $7.8 billion. Not a typo.

Still, no panic moves, no sudden exits showing up. Just a giant position, sitting heavy, absorbing the pain. Whether

#Bitmine didn’t slow down last week -- if anything, they leaned in harder. Another 40,613 ETH quietly grabbed up, about $82.8M worth, just added to the pile. That brings their total stash to a massive 4.32 million $ETH … yeah, billions on billions when you zoom out.

The catch? Their average entry sits way up around $3,847. At today’s prices, that mountain of ETH is staring at a drawdown north of $7.8 billion. Not a typo.

Still, no panic moves, no sudden exits showing up. Just a giant position, sitting heavy, absorbing the pain. Whether

ETH-1,07%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

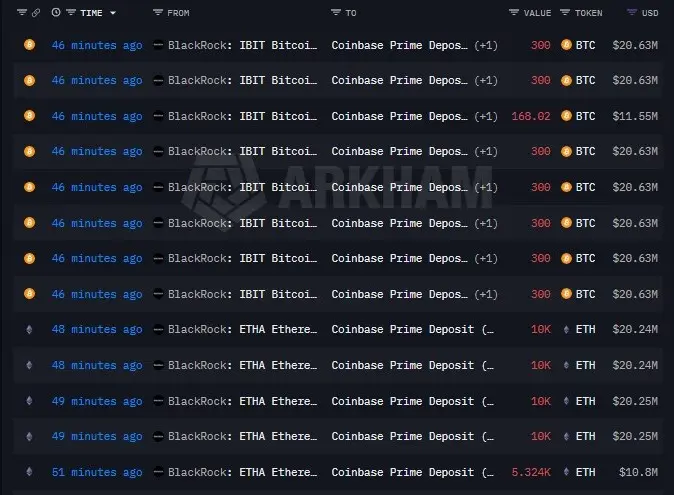

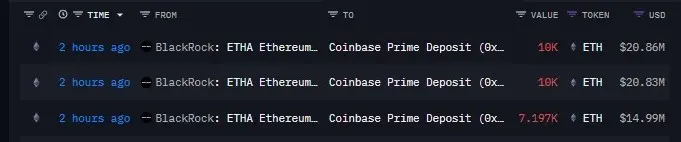

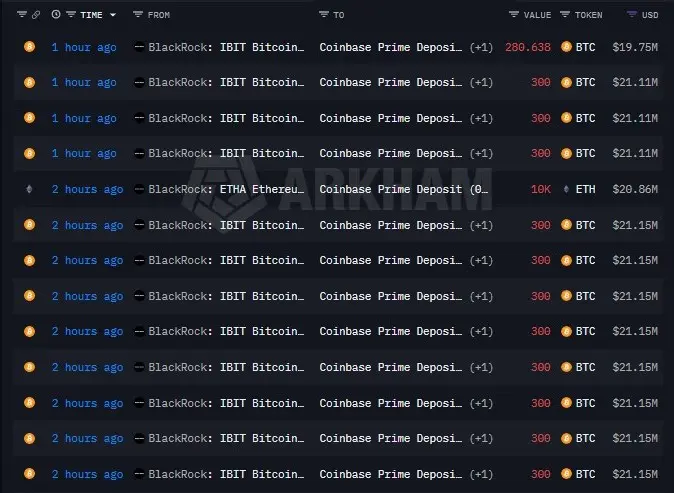

#blackRock Just Did Another Shuffle🥶. yup, it happened. In the last couple of hours, BlackRock slid 5,081 BTC and 27,197 ETH into Coinbase Prime.WHAT it\'s Mean 👇!Could be housekeeping, could be setting things up for later… hard to say. But whenever BlackRock moves this much crypto around and doesn’t bother explaining, people usually start paying attention anyway.Address: $BTC $ETH

- Reward

- like

- Comment

- Repost

- Share