imJoker

No content yet

imJoker

⚡️ Friends, since launching the buyback program in November, Orderly has been using 60% of its protocol revenue to repurchase $ORDER tokens, accumulating over 3.7 million tokens so far.

This is not a short-term move but a reflection of their long-term commitment to the community and the project. Making profits is not easy, but using revenue to buy back tokens shows the project team’s confidence in the future and their consideration for users’ long-term interests.

Buybacks themselves are a strong signal, indicating they are laying a foundation and planning for the long term rather than engagin

View OriginalThis is not a short-term move but a reflection of their long-term commitment to the community and the project. Making profits is not easy, but using revenue to buy back tokens shows the project team’s confidence in the future and their consideration for users’ long-term interests.

Buybacks themselves are a strong signal, indicating they are laying a foundation and planning for the long term rather than engagin

- Reward

- like

- Comment

- Repost

- Share

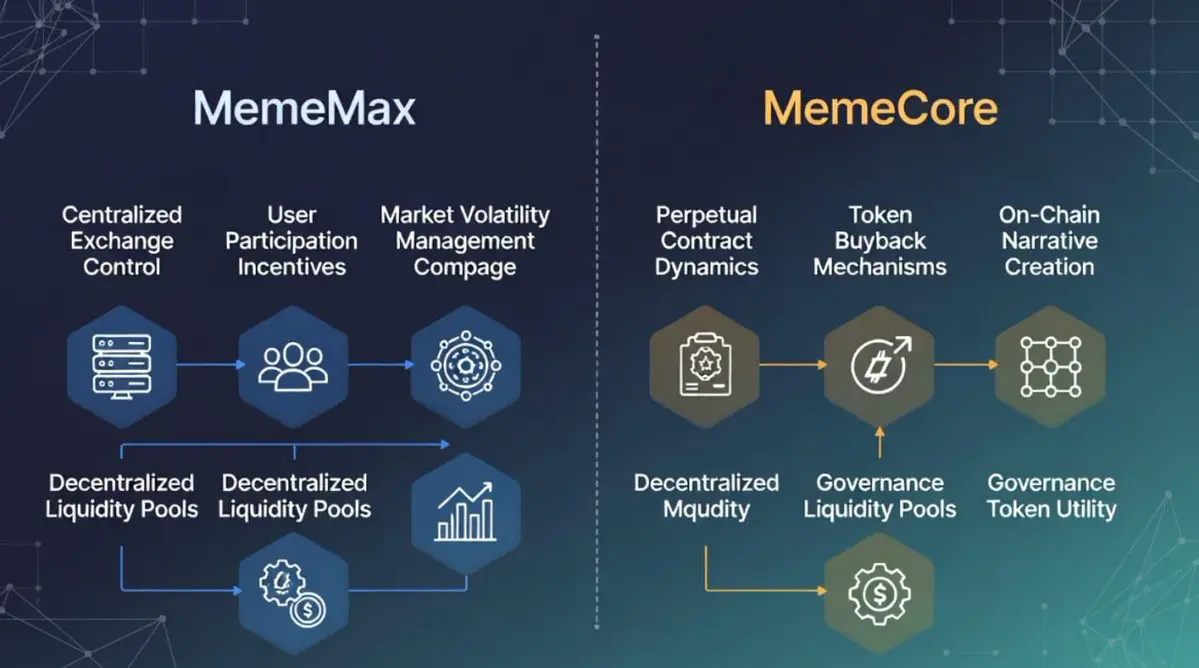

⚡️ Friends, after discussing MemeCore's recent annual AMA, it feels like their 2026 roadmap is no longer just a plan but more like a clear ecosystem integration network.

It's about truly merging DeFi and SocialFi, so that trading, socializing, and creation are no longer separate activities, but grow within the same system.

Next year, you'll see MemeMax go live on the mainnet, the POL mechanism implemented, PixelSwap integrated with a more mature DEX architecture, and Kaito bringing SocialFi attributes deeper into trading scenarios.

They are not content with just spinning in the current circle;

It's about truly merging DeFi and SocialFi, so that trading, socializing, and creation are no longer separate activities, but grow within the same system.

Next year, you'll see MemeMax go live on the mainnet, the POL mechanism implemented, PixelSwap integrated with a more mature DEX architecture, and Kaito bringing SocialFi attributes deeper into trading scenarios.

They are not content with just spinning in the current circle;

M3,26%

- Reward

- like

- Comment

- Repost

- Share

⚡️ Friends, the new year always makes people instinctively look back on the past and look forward to the future. The summary of 2025 reminds me of some fundamental truths, especially about the value of persistence and effort.

Seeing @ferra_protocol's summary, my first impression is not one of bragging, but of honesty. Over the past year, Ferra, regardless of how the external environment changes, has not stopped moving forward.

From the external signals, this may not seem like some eye-catching big news, and at times, many people might feel that it has no fresh breakthroughs. However, what trul

View OriginalSeeing @ferra_protocol's summary, my first impression is not one of bragging, but of honesty. Over the past year, Ferra, regardless of how the external environment changes, has not stopped moving forward.

From the external signals, this may not seem like some eye-catching big news, and at times, many people might feel that it has no fresh breakthroughs. However, what trul

- Reward

- 1

- Comment

- Repost

- Share

⚡️ Friends, currently decentralized exchanges may seem to offer a variety of choices, but in reality, they are largely similar. Whether it’s MEME coins, mainstream assets, or obscure tokens, they are all placed into the same liquidity model.

The CPMM model is simple but inefficient; for stablecoins, it may cause slippage; for assets with low liquidity, it exacerbates volatility. The market is constrained by a one-size-fits-all mold, ignoring the unique characteristics of each asset.

Ferra Protocol’s core insight lies here: different assets should inherently exist within different liquidity env

The CPMM model is simple but inefficient; for stablecoins, it may cause slippage; for assets with low liquidity, it exacerbates volatility. The market is constrained by a one-size-fits-all mold, ignoring the unique characteristics of each asset.

Ferra Protocol’s core insight lies here: different assets should inherently exist within different liquidity env

MEME-0,65%

- Reward

- 4

- 1

- 1

- Share

NingxiFour :

:

New Year Wealth Explosion 🤑⚡️ Friends, from building hype to structuring the project, the most challenging phase is here. Currently, there is no shortage of new tokens or narratives; what’s missing is sustained volatility. Volatility is the key to attracting attention and capital.

In the past, this entry point was tightly controlled by centralized exchanges. Users participated in a game but had no influence over the rules. Volatility was treated as a one-way consumable, emotions came and went, leaving nothing behind.

MemeMax’s approach is very clear: it doesn’t aim to be all-encompassing, but focuses deeply on Meme—the

In the past, this entry point was tightly controlled by centralized exchanges. Users participated in a game but had no influence over the rules. Volatility was treated as a one-way consumable, emotions came and went, leaving nothing behind.

MemeMax’s approach is very clear: it doesn’t aim to be all-encompassing, but focuses deeply on Meme—the

M3,26%

- Reward

- like

- Comment

- Repost

- Share

🎆 Another year is coming to an end, and this time I won't say "Happy New Year." I only hope that we can all experience less hardship and more happiness, my dear friends.

During this end-of-year period, I discovered a new project and decided to make it a focus for ongoing follow-up and continuous development: Ferra Protocol.

Ferra's positioning is similar to an intelligent trading manager, rather than an ordinary DEX. It addresses two core issues: low slippage for traders, high capital efficiency for LPs, and minimal impermanent loss. The core idea is a dynamically matched market-making tool:

During this end-of-year period, I discovered a new project and decided to make it a focus for ongoing follow-up and continuous development: Ferra Protocol.

Ferra's positioning is similar to an intelligent trading manager, rather than an ordinary DEX. It addresses two core issues: low slippage for traders, high capital efficiency for LPs, and minimal impermanent loss. The core idea is a dynamically matched market-making tool:

SUI8,18%

- Reward

- like

- Comment

- Repost

- Share

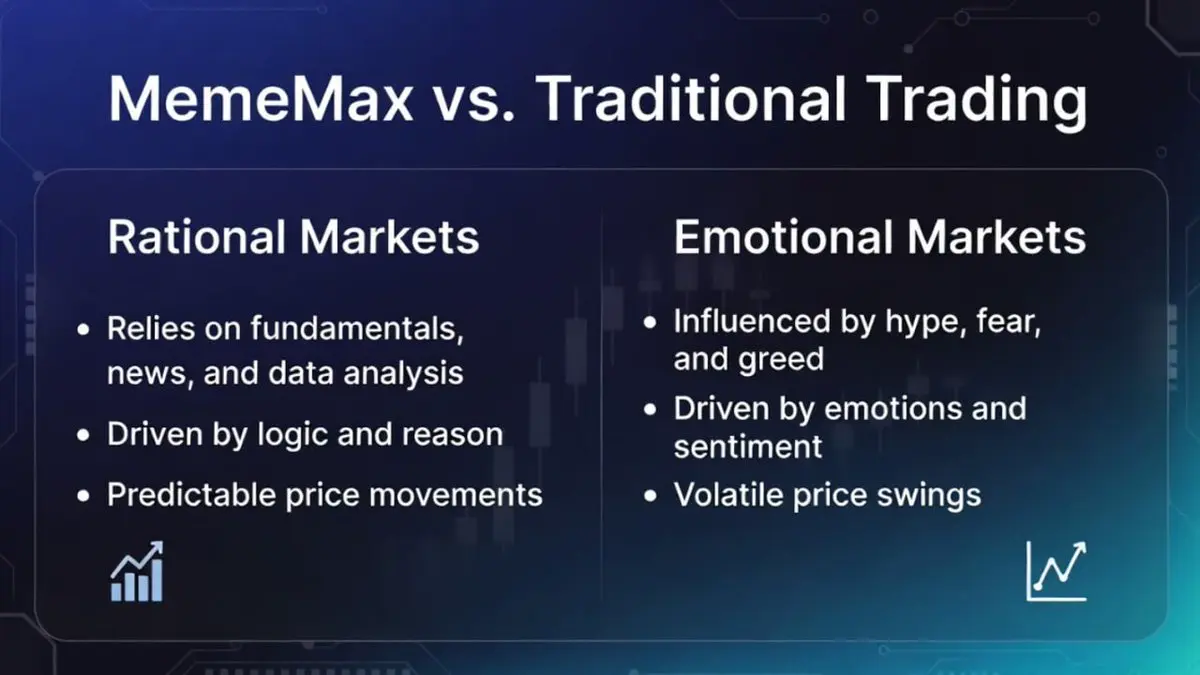

⚡️ Friends, my understanding of MemeMax is not about creating a better product, but about acknowledging something everyone has been pretending doesn't exist: meme trading has never been a rational market.

It’s about rhythm, emotional density, a resonance of a group of people simultaneously feeling the same urge. Spot trading pretends to have value, memes pretend to be jokes, but what truly drives prices is always who feels first, dares to bet, and can withstand the pressure.

So they call themselves The Perpetual DEX Playground, and I find that to be quite honest.

Playground is not utopia, but

It’s about rhythm, emotional density, a resonance of a group of people simultaneously feeling the same urge. Spot trading pretends to have value, memes pretend to be jokes, but what truly drives prices is always who feels first, dares to bet, and can withstand the pressure.

So they call themselves The Perpetual DEX Playground, and I find that to be quite honest.

Playground is not utopia, but

M3,26%

- Reward

- 1

- Comment

- Repost

- Share

⚡️ Friends, many projects talk about privacy, but what they are really discussing is attitude; whereas @BeldexCoin is more like discussing a methodology.

It’s not rushing to prove that we are right, but repeatedly answering a deeper question: if you cannot verify whether the rules have been changed, then why should you believe the system is neutral?

The issue is no longer just about censorship. It’s about whether the results you see are naturally distributed by algorithms or artificially manipulated. Are you being limited, downgraded, or treated differently? Is there any way to prove it yourse

It’s not rushing to prove that we are right, but repeatedly answering a deeper question: if you cannot verify whether the rules have been changed, then why should you believe the system is neutral?

The issue is no longer just about censorship. It’s about whether the results you see are naturally distributed by algorithms or artificially manipulated. Are you being limited, downgraded, or treated differently? Is there any way to prove it yourse

BDX0,47%

- Reward

- 3

- Comment

- Repost

- Share

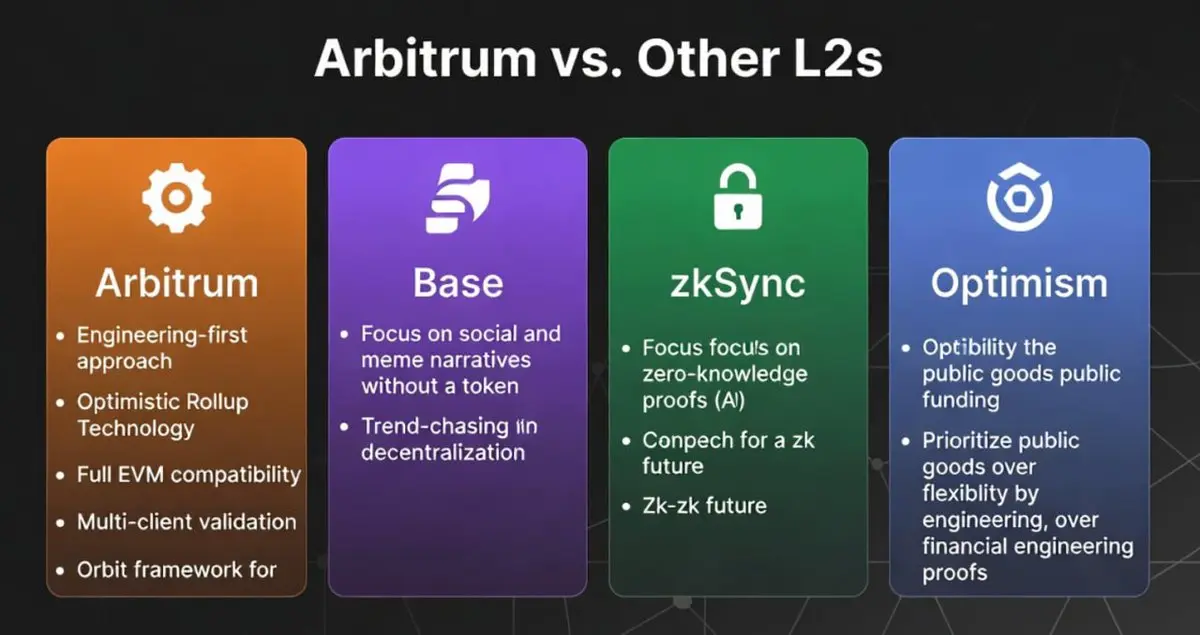

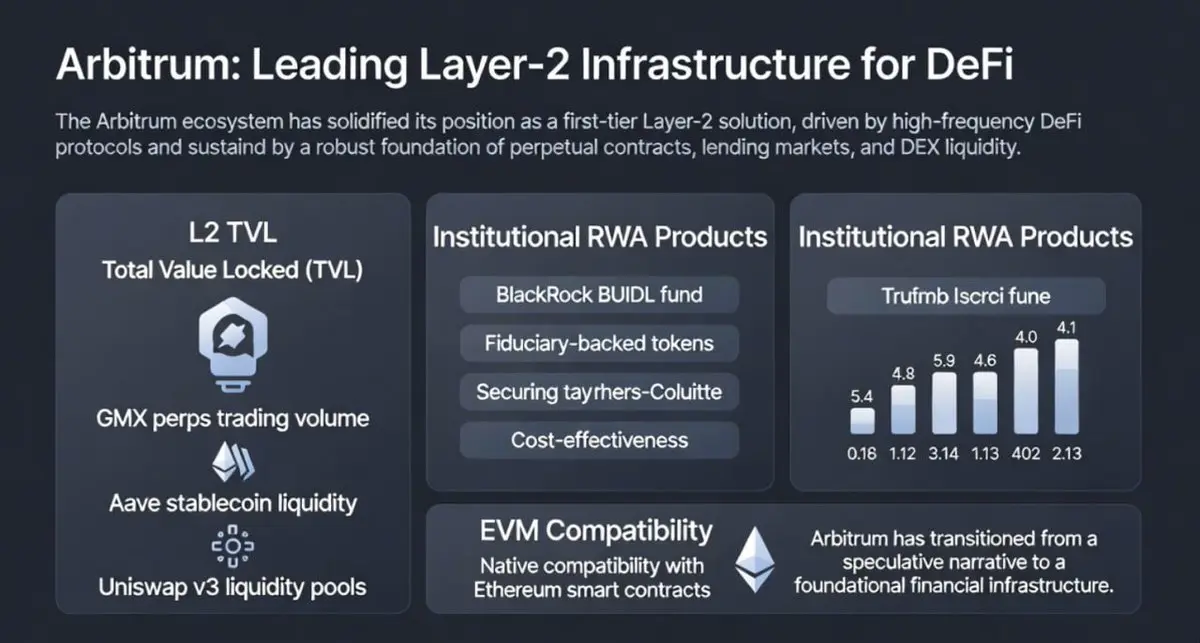

⚡️ Friends, the difference between Arbitrum and other L2s is not in the narrative but in positioning. Many people like to summarize a chain in one sentence: Base is social + Meme, zkSync is zk future, Optimism is public goods.

But Arbitrum is precisely the one that is hardest to summarize in a single sentence. The reason is simple: its positioning is not about storytelling but about infrastructure.

Arbitrum has chosen an engineering-first approach: Optimistic Rollup, full EVM compatibility, multi-client validation, Orbit framework. These may not sound glamorous, but they minimize migration cos

View OriginalBut Arbitrum is precisely the one that is hardest to summarize in a single sentence. The reason is simple: its positioning is not about storytelling but about infrastructure.

Arbitrum has chosen an engineering-first approach: Optimistic Rollup, full EVM compatibility, multi-client validation, Orbit framework. These may not sound glamorous, but they minimize migration cos

- Reward

- like

- Comment

- Repost

- Share

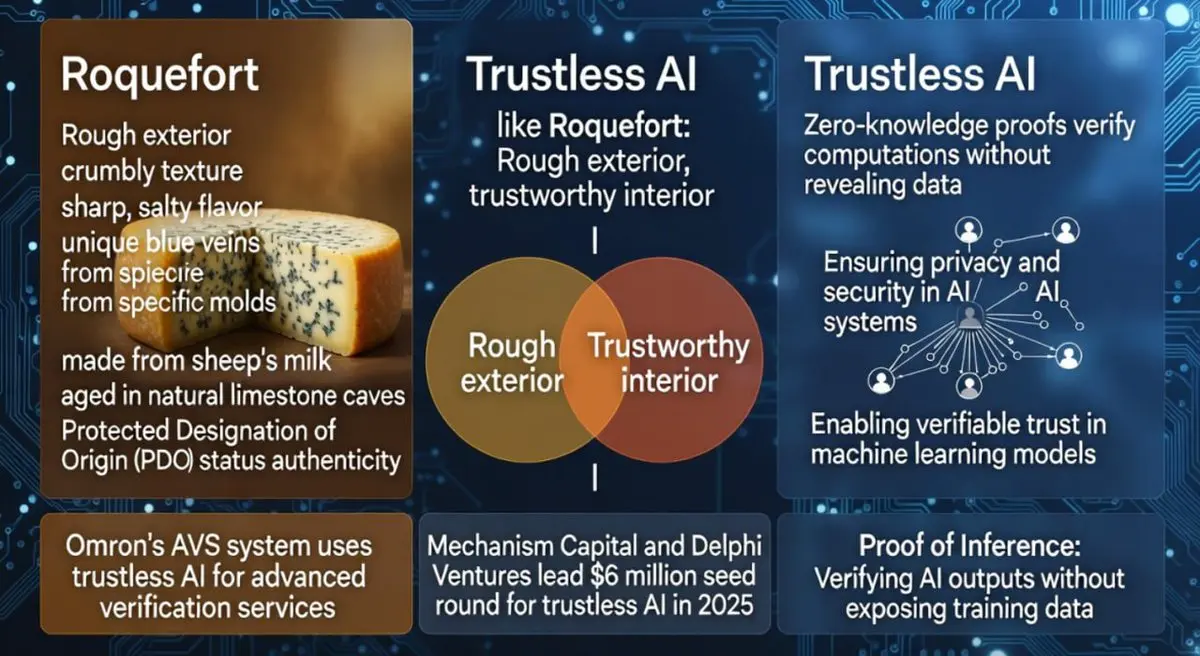

⚡️ Friends, when AI reasoning can be as trustworthy as top-quality cuisine, its value is no longer just superficial. French blue cheese (Roquefort) has a rough exterior, but when cut open, the moldy aroma and silky cheese melt slowly in the mouth, each bite filled with craftsmanship and time.

In the world of AI, Omron is like the shell of this cheese—appearing ordinary on the surface but hiding a rigorously verified computational process to ensure the results are genuine and reliable.

Whenever ChatGPT provides an answer, it's hard to tell whether it is the result of meticulous calculation or a

View OriginalIn the world of AI, Omron is like the shell of this cheese—appearing ordinary on the surface but hiding a rigorously verified computational process to ensure the results are genuine and reliable.

Whenever ChatGPT provides an answer, it's hard to tell whether it is the result of meticulous calculation or a

- Reward

- like

- Comment

- Repost

- Share

⚡️ Friends, Christmas Eve is a time for blessings and quiet reflection. In this world surrounded by data, algorithms, and surveillance, how much space do we still have that belongs to ourselves?

We often talk about smooth sailing and peace, but true safety is not just being physically unharmed; it also includes privacy unperturbed and a life free from intrusion.

Many have become accustomed to being seen—chat histories analyzed, browsing habits tracked, IP addresses exposed on public Wi-Fi. We think this is just the cost of convenience, but we overlook that the real power of choice is gradually

We often talk about smooth sailing and peace, but true safety is not just being physically unharmed; it also includes privacy unperturbed and a life free from intrusion.

Many have become accustomed to being seen—chat histories analyzed, browsing habits tracked, IP addresses exposed on public Wi-Fi. We think this is just the cost of convenience, but we overlook that the real power of choice is gradually

BDX0,47%

- Reward

- 3

- Comment

- Repost

- Share

⚡️ Friends, if we only look at the narrative rotation, many people may mistakenly believe that Arbitrum's highlights are already over.

But once you break down the data and the flow of funds, you will find that the core of Arbitrum has not wavered; it remains the king of Layer-2 infrastructure centered around DeFi.

By 2025, Arbitrum will firmly remain in the top tier of L2 TVL, supported not by short-term trends, but by a cluster of protocols that generate high-frequency and sustainable transaction fees, including perpetual contracts, lending, and DEXs. The trading volume of GMX's perps

View OriginalBut once you break down the data and the flow of funds, you will find that the core of Arbitrum has not wavered; it remains the king of Layer-2 infrastructure centered around DeFi.

By 2025, Arbitrum will firmly remain in the top tier of L2 TVL, supported not by short-term trends, but by a cluster of protocols that generate high-frequency and sustainable transaction fees, including perpetual contracts, lending, and DEXs. The trading volume of GMX's perps

- Reward

- like

- Comment

- Repost

- Share

⚡️ Friends, when the four major L2s emerged side by side back in the day, the market thought it was a long-term narrative battle. Looking back now, it was never about who had the louder voice from the very beginning, but rather about who could withstand real usage.

This week in Arbitrum, no grand vision was released, nor was the next round of stories discussed, but all the key data is speaking.

In terms of funds, there was a net inflow of $3.4B across the entire chain in a week, ranking first. This level of inflow is not speculative migration, but a choice of efficiency. Money will only remain

View OriginalThis week in Arbitrum, no grand vision was released, nor was the next round of stories discussed, but all the key data is speaking.

In terms of funds, there was a net inflow of $3.4B across the entire chain in a week, ranking first. This level of inflow is not speculative migration, but a choice of efficiency. Money will only remain

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More18.4K Popularity

4.39K Popularity

3.05K Popularity

2.07K Popularity

87.59K Popularity

Pin