Berserker_09

No content yet

Berserker_09

Is Solana headed to $50? These charts show a textbook bear pattern

Solana’s SOL ( $SOL ) has dropped 38% over the last 30 days, falling to a two-year low of $67 on Friday. Multiple analysts believe that the downside is not over for the seventh-placed cryptocurrency, with downward targets extending as low as $30.

Key takeaways:

Solana’s head-and-shoulders pattern targets a SOL price of $50 or lower.

MVRV bands point to a potential bottom, but support at $75 must hold.

Solana targets $42 after bearish confirmation

SOL price has already lost over 72% of its value since a cycle top of around $295

Solana’s SOL ( $SOL ) has dropped 38% over the last 30 days, falling to a two-year low of $67 on Friday. Multiple analysts believe that the downside is not over for the seventh-placed cryptocurrency, with downward targets extending as low as $30.

Key takeaways:

Solana’s head-and-shoulders pattern targets a SOL price of $50 or lower.

MVRV bands point to a potential bottom, but support at $75 must hold.

Solana targets $42 after bearish confirmation

SOL price has already lost over 72% of its value since a cycle top of around $295

SOL0,32%

- Reward

- 1

- Comment

- Repost

- Share

Ethereum price confirms inverted H&S as staking queue soars

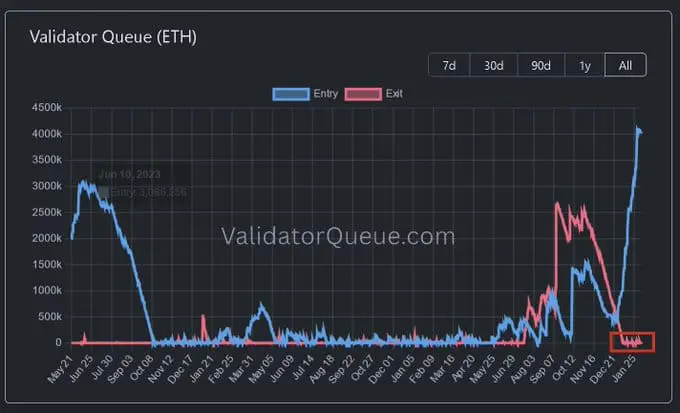

Ethereum price could be preparing a strong rebound after forming a giant hammer candle and confirming the inverted head-and-shoulders chart pattern as the staking queue jumps to a record high.

Ethereum ( $ETH ) token was trading at $2,080, up sharply from last week’s low of $1,738. This price is much lower than the all-time high of nearly $5,000.

The ongoing Ethereum crash is notable as it is happening when the token has some of the best fundamentals ever. For example, more investors are delegating their coins to staking. Data shows

Ethereum price could be preparing a strong rebound after forming a giant hammer candle and confirming the inverted head-and-shoulders chart pattern as the staking queue jumps to a record high.

Ethereum ( $ETH ) token was trading at $2,080, up sharply from last week’s low of $1,738. This price is much lower than the all-time high of nearly $5,000.

The ongoing Ethereum crash is notable as it is happening when the token has some of the best fundamentals ever. For example, more investors are delegating their coins to staking. Data shows

ETH0,73%

- Reward

- 2

- Comment

- Repost

- Share

BlackRock’s Bitcoin ETF Sees $231.6M Inflows After Two Days of Record Outflows

Why Did IBIT See Inflows After Heavy Redemptions?

BlackRock’s spot Bitcoin ( $BTC ) exchange-traded fund recorded $231.6 million in inflows on Friday, reversing part of the damage from earlier in the week as Bitcoin prices swung sharply. The rebound followed two consecutive sessions of large redemptions, when the iShares Bitcoin Trust ETF shed a combined $548.7 million on Wednesday and Thursday, according to the data.

Those outflows coincided with a sharp sell-off across crypto markets. Bitcoin briefly fell to $60,0

Why Did IBIT See Inflows After Heavy Redemptions?

BlackRock’s spot Bitcoin ( $BTC ) exchange-traded fund recorded $231.6 million in inflows on Friday, reversing part of the damage from earlier in the week as Bitcoin prices swung sharply. The rebound followed two consecutive sessions of large redemptions, when the iShares Bitcoin Trust ETF shed a combined $548.7 million on Wednesday and Thursday, according to the data.

Those outflows coincided with a sharp sell-off across crypto markets. Bitcoin briefly fell to $60,0

BTC-0,53%

- Reward

- 1

- Comment

- Repost

- Share

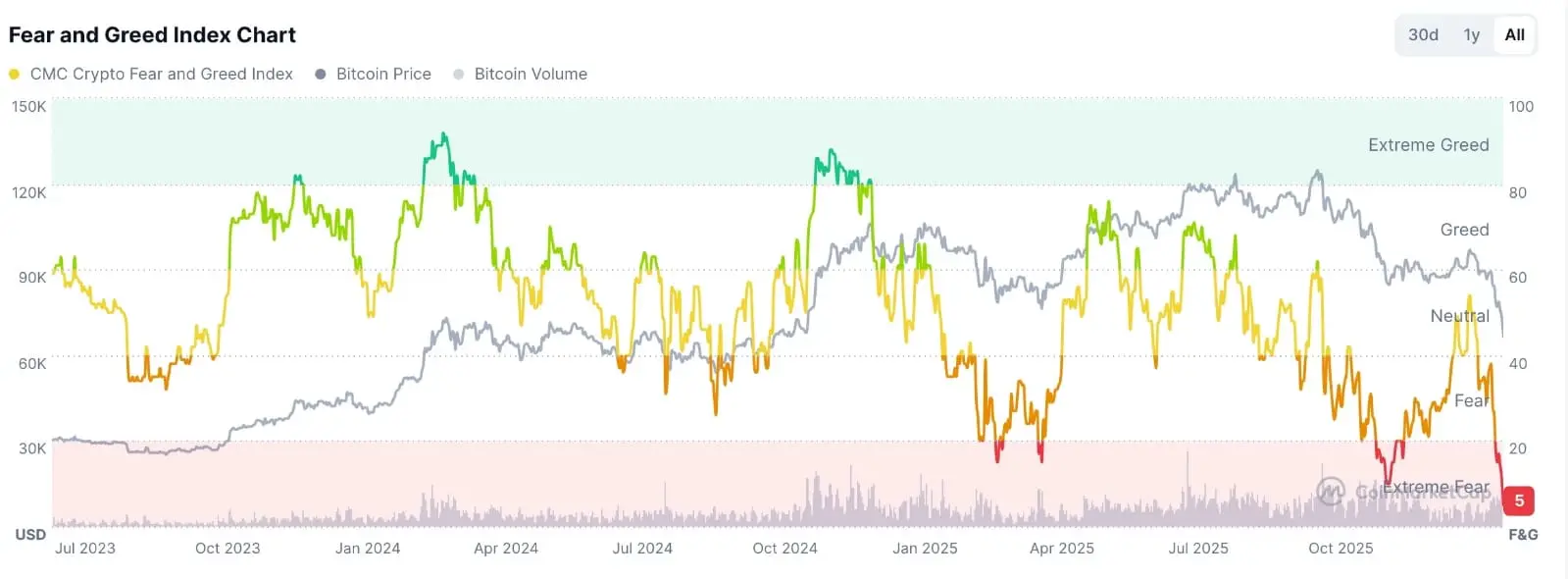

Crypto crash to end soon? Recovery possible, key indicators show

The crypto crash accelerated this week, with Bitcoin ( $BTC ) price plunging to $60,500, its lowest level since October 2024, and the market capitalization of all coins moving to $2.2 trillion.

Why the crypto crash is happening

The ongoing crypto market retreat is influenced by a mix of global economic concerns and investor sentiment. Rising tensions between the U.S. and Iran have added uncertainty, with both sides issuing warnings that any escalation could impact the region and potentially affect oil prices. However, there are n

The crypto crash accelerated this week, with Bitcoin ( $BTC ) price plunging to $60,500, its lowest level since October 2024, and the market capitalization of all coins moving to $2.2 trillion.

Why the crypto crash is happening

The ongoing crypto market retreat is influenced by a mix of global economic concerns and investor sentiment. Rising tensions between the U.S. and Iran have added uncertainty, with both sides issuing warnings that any escalation could impact the region and potentially affect oil prices. However, there are n

BTC-0,53%

- Reward

- 2

- Comment

- Repost

- Share

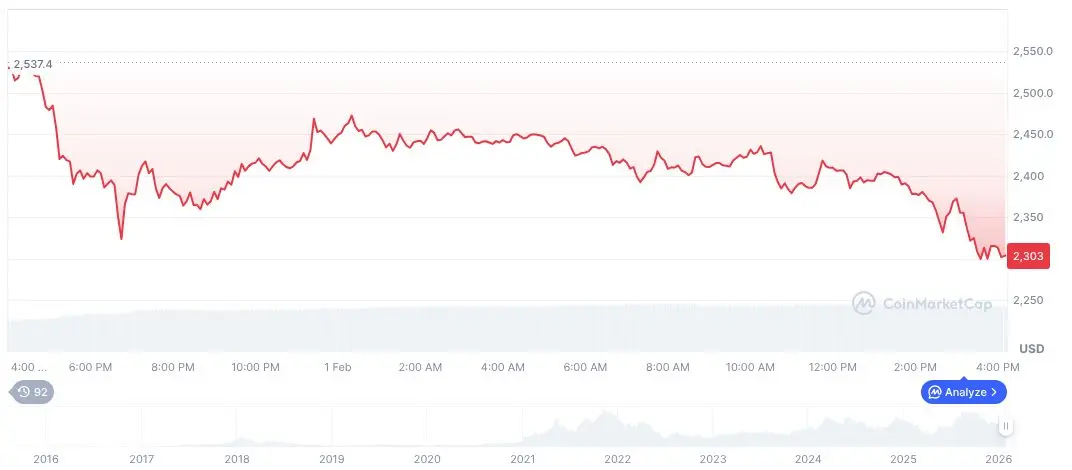

Ethereum price crash: What can investors expect in February 2026?

Ethereum’s price crash leaves $ETH stuck in a firm downtrend, with negative flows and weak momentum making a sustained reclaim of $3,000 in February increasingly unlikely.

Ethereum’s price and latest selloff has left investors nursing losses and staring down a February defined more by damage control than euphoria. The core message from market structure and on‑chain signals is blunt: a swift return to $3,000 is, for now, fantasy rather than base case.

Structure of the crash

Ethereum rebounded toward $2,300 after one of its sharpe

Ethereum’s price crash leaves $ETH stuck in a firm downtrend, with negative flows and weak momentum making a sustained reclaim of $3,000 in February increasingly unlikely.

Ethereum’s price and latest selloff has left investors nursing losses and staring down a February defined more by damage control than euphoria. The core message from market structure and on‑chain signals is blunt: a swift return to $3,000 is, for now, fantasy rather than base case.

Structure of the crash

Ethereum rebounded toward $2,300 after one of its sharpe

ETH0,73%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin price faces bearish breakdown: Is $54,860 the next big test?

Bitcoin price has deteriorated over recent weeks, with repeated bearish daily closes below key support increasing downside risk toward $54,860.

Bitcoin ( $BTC ) price has entered a vulnerable phase after failing to hold several critical technical levels that previously supported price action. Over the past few weeks, the market has shifted from consolidation into sustained weakness, with sellers gaining control across multiple timeframes. This transition has been reinforced by consecutive bearish daily candle closes, signalin

Bitcoin price has deteriorated over recent weeks, with repeated bearish daily closes below key support increasing downside risk toward $54,860.

Bitcoin ( $BTC ) price has entered a vulnerable phase after failing to hold several critical technical levels that previously supported price action. Over the past few weeks, the market has shifted from consolidation into sustained weakness, with sellers gaining control across multiple timeframes. This transition has been reinforced by consecutive bearish daily candle closes, signalin

BTC-0,53%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin price prediction: How low can BTC go in the first week of February?

Geopolitical risks, fears of a U.S. government shutdown, and slow-moving crypto regulations are weighing on market sentiment, keeping speculative bets muted.

Despite a brief lift, the path ahead for Bitcoin ( $BTC ) remains volatile, with key technical levels likely to dictate its next move in early February 2026.

In this Bitcoin price prediction, we look at where the market stands right now, the main downside levels to watch, and where BTC could go next if buyers step in.

Current market scenario

At the time of writing

Geopolitical risks, fears of a U.S. government shutdown, and slow-moving crypto regulations are weighing on market sentiment, keeping speculative bets muted.

Despite a brief lift, the path ahead for Bitcoin ( $BTC ) remains volatile, with key technical levels likely to dictate its next move in early February 2026.

In this Bitcoin price prediction, we look at where the market stands right now, the main downside levels to watch, and where BTC could go next if buyers step in.

Current market scenario

At the time of writing

BTC-0,53%

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

GreatBitcoin insiders face Epstein-era email fallout over Ripple

Leaked Epstein court files show a 2014 Austin Hill email pressuring investors tied to Ripple and Stellar, reviving scrutiny of Epstein’s Bitcoin funding, MIT links and $XRP long SEC fight.

Leaked court documents have revealed email communications between convicted financier Jeffrey Epstein and prominent figures in the cryptocurrency and technology sectors, according to records reviewed by multiple outlets.

The documents show that in 2014, Austin Hill sent emails to an address associated with Epstein, with MIT Media Lab director Joichi

Leaked Epstein court files show a 2014 Austin Hill email pressuring investors tied to Ripple and Stellar, reviving scrutiny of Epstein’s Bitcoin funding, MIT links and $XRP long SEC fight.

Leaked court documents have revealed email communications between convicted financier Jeffrey Epstein and prominent figures in the cryptocurrency and technology sectors, according to records reviewed by multiple outlets.

The documents show that in 2014, Austin Hill sent emails to an address associated with Epstein, with MIT Media Lab director Joichi

- Reward

- 3

- Comment

- Repost

- Share

Ethereum Holdings Decline as Supply Lockup Increases

Key Points:

45% of Ethereum is now locked, impacting trade ease.

Over 6.1 million ETH held by publicly listed companies.

Exchange-traded funds account for about 10% of Ethereum supply.

Sygnum's Q1 2026 investment outlook highlights ETH supply dynamics with 45% locked and a 14.5% decrease in exchange-held $ETH , potentially affecting market volatility if demand increases.

Reduced ETH supply against potential demand rises could trigger price fluctuations, impacting investor strategies and market behavior in the cryptocurrency sector.

Key Devel

Key Points:

45% of Ethereum is now locked, impacting trade ease.

Over 6.1 million ETH held by publicly listed companies.

Exchange-traded funds account for about 10% of Ethereum supply.

Sygnum's Q1 2026 investment outlook highlights ETH supply dynamics with 45% locked and a 14.5% decrease in exchange-held $ETH , potentially affecting market volatility if demand increases.

Reduced ETH supply against potential demand rises could trigger price fluctuations, impacting investor strategies and market behavior in the cryptocurrency sector.

Key Devel

ETH0,73%

- Reward

- 1

- Comment

- Repost

- Share

Here’s why Bitcoin price is crashing today (Jan. 31)

Bitcoin price continued its strong downward trend as ETF outflows accelerated, geopolitical risks rose, and the government shutdown continued.

Bitcoin ( $BTC ) dropped below the key support level at $81,000 and hit its lowest level since October last year. It has moved into a bear market by falling by 35% from its highest point in 2025.

BTC dropped as third-party data shows that ETF outflows continued. It shed over $509 million in assets last Friday, after losing $817 million on Thursday. They have shed assets in the last four consecutive da

Bitcoin price continued its strong downward trend as ETF outflows accelerated, geopolitical risks rose, and the government shutdown continued.

Bitcoin ( $BTC ) dropped below the key support level at $81,000 and hit its lowest level since October last year. It has moved into a bear market by falling by 35% from its highest point in 2025.

BTC dropped as third-party data shows that ETF outflows continued. It shed over $509 million in assets last Friday, after losing $817 million on Thursday. They have shed assets in the last four consecutive da

BTC-0,53%

- Reward

- 2

- 1

- Repost

- Share

WilliamEth :

:

all cc how co v it to eat like NC FL awh my foot slang xi lamb ze kk wow you can us out small W Emma see up it's seems#the cc and😆😅😂😄The One-Hour Crash That Wiped Out $5 Trillion Across Global Markets

The session opened calmly, with markets showing no clear stress before U.S. trading began. Momentum felt stable across risk assets, and positioning looked balanced. Then Bitcoin — $BTC , rolled over without warning. Selling accelerated within minutes, pulling liquidity from the market. What followed was not a routine dip, but a violent reset that erased trillions before traders could react. Within one hour, losses cascaded across every major asset class. Screens turned red across desks worldwide, catching both retail and insti

The session opened calmly, with markets showing no clear stress before U.S. trading began. Momentum felt stable across risk assets, and positioning looked balanced. Then Bitcoin — $BTC , rolled over without warning. Selling accelerated within minutes, pulling liquidity from the market. What followed was not a routine dip, but a violent reset that erased trillions before traders could react. Within one hour, losses cascaded across every major asset class. Screens turned red across desks worldwide, catching both retail and insti

BTC-0,53%

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin short-term holders need liquidity reset as 22% of BTC supply sits in loss

Bitcoin’s next uptrend hinges on fresh liquidity, with Glassnode saying BTC’s profit/loss ratio must rise well above 5 as 22% of supply sits in loss and selling risk lingers.

On-chain analytics firm Glassnode has identified key metrics that will determine the next phase of Bitcoin ( $BTC ) price growth, according to a recent analysis published by the company.

Bitcoin has experienced a downward trend, with price increases proving unsustainable due to insufficient buying liquidity, according to market data. After B

Bitcoin’s next uptrend hinges on fresh liquidity, with Glassnode saying BTC’s profit/loss ratio must rise well above 5 as 22% of supply sits in loss and selling risk lingers.

On-chain analytics firm Glassnode has identified key metrics that will determine the next phase of Bitcoin ( $BTC ) price growth, according to a recent analysis published by the company.

Bitcoin has experienced a downward trend, with price increases proving unsustainable due to insufficient buying liquidity, according to market data. After B

BTC-0,53%

- Reward

- 1

- Comment

- Repost

- Share

Hyperliquid price gains another 23% — what’s driving the surge?

Hyperliquid price is gaining momentum as increased commodity trading and token burn mechanics drive renewed interest and market activity.

Hyperliquid has maintained its recent momentum, rising an additional 23% in the last day to approximately $33.46 at the time of writing. After breaking out of a tight trading range and moving toward the top of its weekly levels, the token has gained more than 50%, capping a strong seven-day run.

Even with the sharp rebound, Hyperliquid ( $HYPE ) remains well below its September 2025 peak near $5

Hyperliquid price is gaining momentum as increased commodity trading and token burn mechanics drive renewed interest and market activity.

Hyperliquid has maintained its recent momentum, rising an additional 23% in the last day to approximately $33.46 at the time of writing. After breaking out of a tight trading range and moving toward the top of its weekly levels, the token has gained more than 50%, capping a strong seven-day run.

Even with the sharp rebound, Hyperliquid ( $HYPE ) remains well below its September 2025 peak near $5

HYPE-3,21%

- Reward

- 2

- Comment

- Repost

- Share

Fed rate decision: What to expect in crypto market tomorrow?

Crypto markets are entering a sensitive phase as interest in Fed rate expectations and liquidity conditions dominates sentiment, setting the stage for heightened volatility.

The broader cryptocurrency market is approaching a pivotal moment as macroeconomic forces increasingly shape short-term price behavior. After a period of consolidation and uneven rebounds, digital assets are showing signs of hesitation as traders await clearer guidance on the direction of U.S. monetary policy.

Rather than moving on to asset-specific narratives, t

Crypto markets are entering a sensitive phase as interest in Fed rate expectations and liquidity conditions dominates sentiment, setting the stage for heightened volatility.

The broader cryptocurrency market is approaching a pivotal moment as macroeconomic forces increasingly shape short-term price behavior. After a period of consolidation and uneven rebounds, digital assets are showing signs of hesitation as traders await clearer guidance on the direction of U.S. monetary policy.

Rather than moving on to asset-specific narratives, t

- Reward

- 8

- 1

- Repost

- Share

Dogecoin price continues to struggle beneath key resistance levels

Dogecoin price remains trapped below key resistance inside a descending channel, and sustained weakness increases the risk of a downside move toward $0.09 support.

The current Dogecoin ( $DOGE ) continues to struggle beneath key resistance levels. After an extended period of consolidation, DOGE remains positioned within a higher-time-frame descending channel, a structure that typically favors downside continuation unless reclaimed decisively.

Despite multiple attempts, price has failed to regain acceptance above the channel mid

Dogecoin price remains trapped below key resistance inside a descending channel, and sustained weakness increases the risk of a downside move toward $0.09 support.

The current Dogecoin ( $DOGE ) continues to struggle beneath key resistance levels. After an extended period of consolidation, DOGE remains positioned within a higher-time-frame descending channel, a structure that typically favors downside continuation unless reclaimed decisively.

Despite multiple attempts, price has failed to regain acceptance above the channel mid

DOGE-0,45%

- Reward

- 4

- 3

- Repost

- Share

Pot :

:

BTC has risen slightly, but I believe it will continue to go up.View More

Bitcoin Price Plummets: BTC Falls Below Critical $88,000 Threshold Amid Market Uncertainty

Global cryptocurrency markets witnessed a significant correction on Tuesday, as the flagship digital asset, Bitcoin ( $BTC ), decisively fell below the psychologically important $88,000 level. According to real-time data from Bitcoin World market monitoring, BTC is currently trading at $87,983.3 on the Binance USDT perpetual futures market. This move represents a notable shift in short-term sentiment and prompts a deeper examination of underlying market forces.

Bitcoin Price Drop: Analyzing the Immediate

Global cryptocurrency markets witnessed a significant correction on Tuesday, as the flagship digital asset, Bitcoin ( $BTC ), decisively fell below the psychologically important $88,000 level. According to real-time data from Bitcoin World market monitoring, BTC is currently trading at $87,983.3 on the Binance USDT perpetual futures market. This move represents a notable shift in short-term sentiment and prompts a deeper examination of underlying market forces.

Bitcoin Price Drop: Analyzing the Immediate

BTC-0,53%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin Struggles as Gold Hits Record Levels

Key Points:

Bitcoin lags as gold's value increases, impacting market dynamics.

Gold's 12.6% rise contrasts Bitcoin's 0.3% increase.

Bitcoin's speculative nature contrasts gold's stability amid uncertainty.

Bitcoin ( $BTC ) Struggles as Gold ( $XAUT ) Hits Record Levels

Bitcoin's price has markedly declined against gold's surge as of January 24, 2026, reflecting broader market volatility amid global economic uncertainties.

The contrasting performance stresses Bitcoin's speculative nature, with investors shifting towards gold as a stable refuge, influ

Key Points:

Bitcoin lags as gold's value increases, impacting market dynamics.

Gold's 12.6% rise contrasts Bitcoin's 0.3% increase.

Bitcoin's speculative nature contrasts gold's stability amid uncertainty.

Bitcoin ( $BTC ) Struggles as Gold ( $XAUT ) Hits Record Levels

Bitcoin's price has markedly declined against gold's surge as of January 24, 2026, reflecting broader market volatility amid global economic uncertainties.

The contrasting performance stresses Bitcoin's speculative nature, with investors shifting towards gold as a stable refuge, influ

- Reward

- 2

- Comment

- Repost

- Share

ROSE Price Jumps 15.6% as Weekly Falling Wedge Tightens Near Critical Resistance

Oasis ( $ROSE ) recorded a steep weekly movement with buyers propelling the prices upwards since the lows and the new market demanded interest. ROSE was trading at $0.01923 at the point of reporting, which is a 15.6% price increase in the last 24 hours.

The shift came with the price action still tightening in a falling wedge formation on the weekly chart, which can be observed all throughout the overarching decline. Remarkably, the recent recovery was developed around the long-term support, which resulted in the

Oasis ( $ROSE ) recorded a steep weekly movement with buyers propelling the prices upwards since the lows and the new market demanded interest. ROSE was trading at $0.01923 at the point of reporting, which is a 15.6% price increase in the last 24 hours.

The shift came with the price action still tightening in a falling wedge formation on the weekly chart, which can be observed all throughout the overarching decline. Remarkably, the recent recovery was developed around the long-term support, which resulted in the

ROSE-8,11%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin price at risk, Fed rate cut odds fall after strong US GDP data

Bitcoin’s price remained in a tight range today, January 22, as investors reacted to new developments on Greenland and to ongoing ETF outflows.

Bitcoin ( $BTC ) was trading at $89,400, a few points above this week’s low of $87,200. Still, there is a risk that the coin will continue to fall now that the odds of Federal Reserve interest rate cuts have fallen after the U.S. released strong economic data.

A report released by the Bureau of Economic Analysis showed that the economy did better than expected in the third quarter.

Bitcoin’s price remained in a tight range today, January 22, as investors reacted to new developments on Greenland and to ongoing ETF outflows.

Bitcoin ( $BTC ) was trading at $89,400, a few points above this week’s low of $87,200. Still, there is a risk that the coin will continue to fall now that the odds of Federal Reserve interest rate cuts have fallen after the U.S. released strong economic data.

A report released by the Bureau of Economic Analysis showed that the economy did better than expected in the third quarter.

BTC-0,53%

- Reward

- 1

- Comment

- Repost

- Share

Why is XRP price at risk of falling to December lows?

XRP price extended its losing streak to a sixth day on Wednesday as waning institutional appetite and a sector-wide sell-off pushed prices below the critical $2.00 support level.

According to data, $XRP price lost its key psychological support at $2 earlier this week, mirroring the general performance of the crypto market in general. The fifth-largest crypto asset is down 11.2% over the last seven days, a decline that extends to 20% when measured from its highest point this month.

XRP’s recent weakness largely stems from ongoing jitters in

XRP price extended its losing streak to a sixth day on Wednesday as waning institutional appetite and a sector-wide sell-off pushed prices below the critical $2.00 support level.

According to data, $XRP price lost its key psychological support at $2 earlier this week, mirroring the general performance of the crypto market in general. The fifth-largest crypto asset is down 11.2% over the last seven days, a decline that extends to 20% when measured from its highest point this month.

XRP’s recent weakness largely stems from ongoing jitters in

XRP1,18%

- Reward

- 1

- 6

- Repost

- Share

GateUser-48a338c3 :

:

Buy To Earn 💎View More

Trending Topics

View More193.22K Popularity

50.38K Popularity

19.76K Popularity

8.39K Popularity

3.83K Popularity

Pin