币莹莹6

No content yet

This week's market has been as thrilling as a roller coaster ride. The upward breakout you expected suddenly turned into a sharp decline. When the market moved downward, there was an unexpected reversal and a rally. It seemed like a break below, but in fact, it was just maintaining a wide-range consolidation at a low level.

Recently, after a sharp drop, Bitcoin's Asian session has remained weak and consolidating. The European and American sessions have gradually risen without any pullbacks. After the US stocks surged, they faced resistance and plunged. Whether bullish or bearish, the rapid swi

Recently, after a sharp drop, Bitcoin's Asian session has remained weak and consolidating. The European and American sessions have gradually risen without any pullbacks. After the US stocks surged, they faced resistance and plunged. Whether bullish or bearish, the rapid swi

BTC1.06%

- Reward

- 1

- Comment

- Repost

- Share

The long-awaited support at 85,000 has finally been broken, but it's not a substantial break. Don't worry, let Yingqing continue to brew...

Big rises and falls are just waiting for opportunities. Many people think I only do KONG, but actually, for me personally, leading everyone in KONG gives me more confidence and pride because each wave of KONGs maximizes our profits. The key is whether everyone can hold on.

Apart from doing KONG, I will also go long at key supports, such as the lowest point of the day before. However, I can never hold onto long positions for 😃. Look, early this morning I a

Big rises and falls are just waiting for opportunities. Many people think I only do KONG, but actually, for me personally, leading everyone in KONG gives me more confidence and pride because each wave of KONGs maximizes our profits. The key is whether everyone can hold on.

Apart from doing KONG, I will also go long at key supports, such as the lowest point of the day before. However, I can never hold onto long positions for 😃. Look, early this morning I a

BTC1.06%

- Reward

- like

- Comment

- Repost

- Share

Recent market conditions are simply "door closing and slaughtering sheep," with repeated washouts by the bears, ultimately leading to direct liquidation and panic selling.

The Federal Reserve cut interest rates, non-farm payrolls beat expectations, CPI data was positive, and the overall trend was mainly a one-sided surge. However, it was followed by pressure, sharp declines, and a plunge.

Throughout the process, fortunately Sister Ying has坚持 high-level thinking, even if there were losses along the way, she still坚持 the strategy to the end. After all, I am optimistic about the bear market, and t

The Federal Reserve cut interest rates, non-farm payrolls beat expectations, CPI data was positive, and the overall trend was mainly a one-sided surge. However, it was followed by pressure, sharp declines, and a plunge.

Throughout the process, fortunately Sister Ying has坚持 high-level thinking, even if there were losses along the way, she still坚持 the strategy to the end. After all, I am optimistic about the bear market, and t

BTC1.06%

- Reward

- like

- Comment

- Repost

- Share

I don't accept it, I don't accept it, I don't accept it. Tonight, Duotou will make me kneel and submit.

CPI Duotou, Bitcoin's strong rebound, then as expected, it faced pressure and plunged again, just like Wednesday's market.

Although tonight's first liquidation was out, which many people didn't understand, the subsequent continuation of the liquidation brought it back, and a big plunge directly convinced all of you...

After all, with such a clear strategy, only I am leading the winning team silently forward... $BTC

CPI Duotou, Bitcoin's strong rebound, then as expected, it faced pressure and plunged again, just like Wednesday's market.

Although tonight's first liquidation was out, which many people didn't understand, the subsequent continuation of the liquidation brought it back, and a big plunge directly convinced all of you...

After all, with such a clear strategy, only I am leading the winning team silently forward... $BTC

BTC1.06%

- Reward

- 4

- 1

- Repost

- Share

TigerArmy :

:

Just go for it💪The market rebounded after a day of clear weather, then randomly plummeted. Top-tier cryptocurrencies successfully gained nearly 5000/200 in the space. The lower side also tested the 85,000 support multiple times and showed weak rebound, then quickly bought at low levels to gain nearly 1500/41 in the space.

Although tonight's CPI data release is approaching, the overall trend remains bearish. In the short term, Bitcoin's resistance continues to focus on the 87,500-88,000 area, with support still at 85,000.

Bitcoin: Range of 87,400-87,900, with a downside target of 85,000. Breakout holds, and a

Although tonight's CPI data release is approaching, the overall trend remains bearish. In the short term, Bitcoin's resistance continues to focus on the 87,500-88,000 area, with support still at 85,000.

Bitcoin: Range of 87,400-87,900, with a downside target of 85,000. Breakout holds, and a

BTC1.06%

- Reward

- like

- Comment

- Repost

- Share

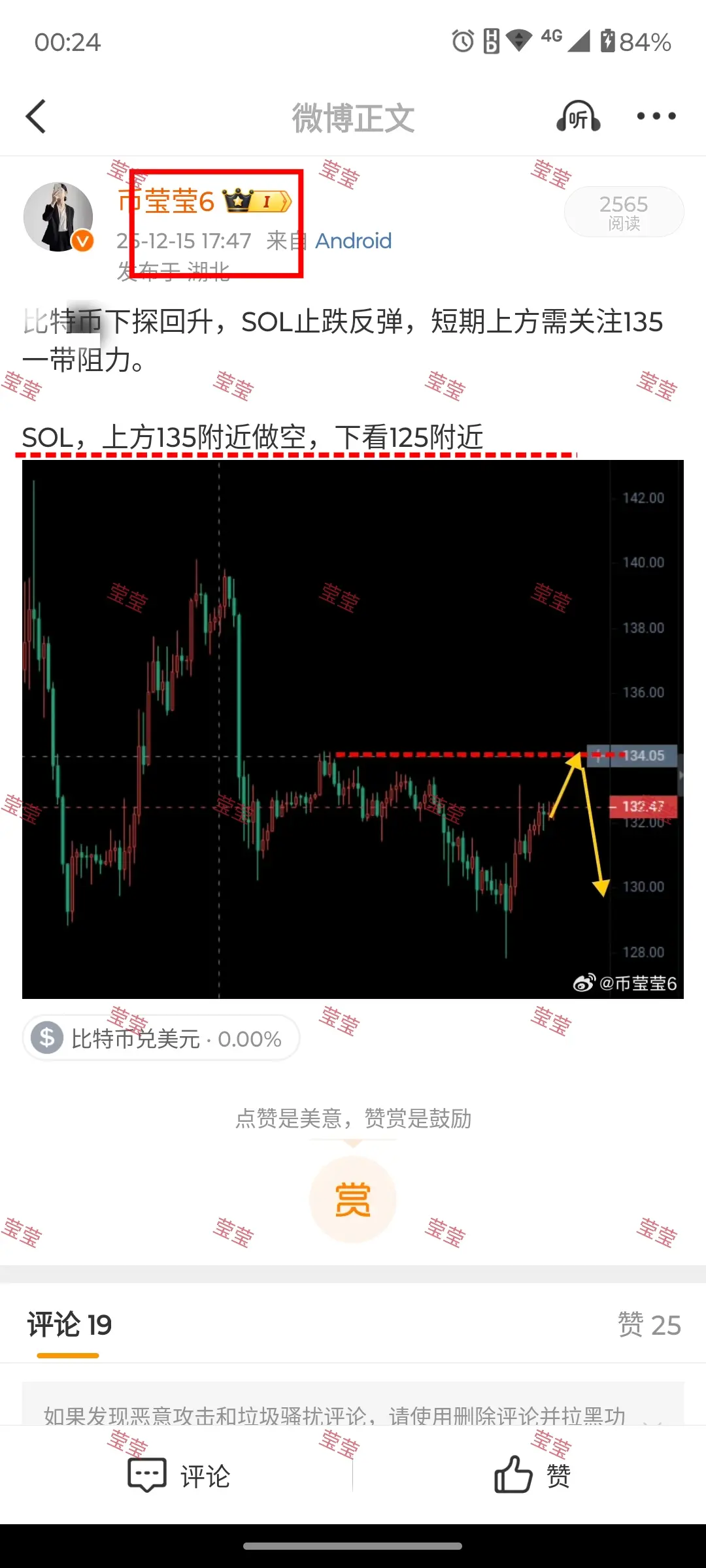

Kongtou continues to decline, with the 85,000 level dropping again. Breaking below is only a matter of time.

Two points to emphasize: the market is focused on Thursday’s CPI data. What if the CPI data is favorable to Kong? Wouldn't that be a double boost for Kong, leading to a direct break below the 85,000 level?

If it's bullish, Bitcoin wouldn't rebound much; on the contrary, it would give you a shorting opportunity. After all, without stabilizing above 90,000, I dare to boldly Kong.

Why? If Japan's interest rate hike on Friday materializes, there will definitely be another deep decline.

Abov

Two points to emphasize: the market is focused on Thursday’s CPI data. What if the CPI data is favorable to Kong? Wouldn't that be a double boost for Kong, leading to a direct break below the 85,000 level?

If it's bullish, Bitcoin wouldn't rebound much; on the contrary, it would give you a shorting opportunity. After all, without stabilizing above 90,000, I dare to boldly Kong.

Why? If Japan's interest rate hike on Friday materializes, there will definitely be another deep decline.

Abov

BTC1.06%

- Reward

- 1

- Comment

- Repost

- Share

The Federal Reserve's dovish rate cut implementation pushes Bitcoin higher before pulling back

Non-farm payroll data boosts confidence, Bitcoin surges again before pulling back

Overall trend remains cautious, especially with pressure below 90,000

Currently, market focus shifts to CPI data and whether Japan will raise interest rates.

Today, Wednesday, may serve as a transition period for market adjustments, with key attention on the 85,000 support level.

Non-farm payroll data boosts confidence, Bitcoin surges again before pulling back

Overall trend remains cautious, especially with pressure below 90,000

Currently, market focus shifts to CPI data and whether Japan will raise interest rates.

Today, Wednesday, may serve as a transition period for market adjustments, with key attention on the 85,000 support level.

BTC1.06%

- Reward

- like

- 1

- Repost

- Share

CoinEasy :

:

Interest rate hikes are certain, and the market may decline in a volatile manner, then test the lows before regaining upward momentum🤭Non-farm payrolls, an unexpectedly "volatile" surprise. After all, this round of Federal Reserve rate cuts came first, followed by the release of data, forming a stark reversal. Coupled with the sharp decline on Monday, even if the data is favorable, the entire market has already digested it in advance.

No matter how loud the thunder, the raindrops are small. Bitcoin rebounded from around 85,000, with a short-term slow push towards the 88,000 level, which also perfectly reached our target.

Currently, in the short term, Bitcoin is under pressure in the 88,000-88,500 range, with key support belo

No matter how loud the thunder, the raindrops are small. Bitcoin rebounded from around 85,000, with a short-term slow push towards the 88,000 level, which also perfectly reached our target.

Currently, in the short term, Bitcoin is under pressure in the 88,000-88,500 range, with key support belo

BTC1.06%

- Reward

- 1

- Comment

- Repost

- Share

Consolidating your position, you want to see a rally, a decline, you still want to see a rally, a breakout, you are even more eager to see a rally. Blindly going long while holding onto a lucky mindset, deep entrapment is inevitable...

In the entire market, above 90,000 for Bitcoin and above 3200 for Ethereum, there are countless short positions, some even above 9.4/3500. Even more terrifying, many friends hold positions above 11/4000...

Enduring the hardship, when will it end?

After the non-farm payroll report, there are also CPI data and Japan's interest rate cuts. Daily fluctuations tug at

In the entire market, above 90,000 for Bitcoin and above 3200 for Ethereum, there are countless short positions, some even above 9.4/3500. Even more terrifying, many friends hold positions above 11/4000...

Enduring the hardship, when will it end?

After the non-farm payroll report, there are also CPI data and Japan's interest rate cuts. Daily fluctuations tug at

BTC1.06%

- Reward

- like

- 1

- Repost

- Share

CoinEasy :

:

Just go for it💪No need to dwell on the past whether it's more or less, right or wrong. Tonight's Non-Farm Payrolls will determine whether the streak continues or reverses against the wind. Whether in the wind and rain or amidst the ups and downs, you're waiting...

Previous value: 11.9, forecast: 5, actual release: ?

Relatively speaking:

Actual > 5 indicates a bullish trend, > 11.9 indicates a significant bullish trend.

Actual < 5 indicates a bullish trend, and if it's negative, that means a significant bullish trend.

Currently, around 85,000 has some support. Since the day before yesterday, it has tested twi

Previous value: 11.9, forecast: 5, actual release: ?

Relatively speaking:

Actual > 5 indicates a bullish trend, > 11.9 indicates a significant bullish trend.

Actual < 5 indicates a bullish trend, and if it's negative, that means a significant bullish trend.

Currently, around 85,000 has some support. Since the day before yesterday, it has tested twi

BTC1.06%

- Reward

- like

- Comment

- Repost

- Share

Looking at Kong, doing Kong is mainstream. During key support levels, going long is just a transition. Always thinking of covering everything with more Kong, but there will always be some disappointments in the market. However, the overall operations remain quite rewarding.

Starting from the Federal Reserve interest rate decision, we predicted a rise followed by a fall. For Bitcoin, our top-level orders are located around the 9.38-9.43 region for Kong, then around the phase top at 9.27 by Friday, and until the next day Monday near 90,000. No matter which level is hit, the precision is impeccab

Starting from the Federal Reserve interest rate decision, we predicted a rise followed by a fall. For Bitcoin, our top-level orders are located around the 9.38-9.43 region for Kong, then around the phase top at 9.27 by Friday, and until the next day Monday near 90,000. No matter which level is hit, the precision is impeccab

BTC1.06%

- Reward

- like

- Comment

- Repost

- Share

The past few Mondays have shown a continuous downward trend

Gradual rise the day after, pressured at the 90,000 level, with a single-sided sharp decline testing the 85,000 support

The promised three tests arrived as scheduled. Although a large bearish candle did not break below the 85,000 support, the consecutive large bearish candles reached the 85,000 support.

Good news: Recently, every Tuesday has seen a reversal and a big rally

Testing period: Today’s big non-farm payrolls release, combined with two months of data, unexpectedly, Tuesday’s big non-farm payrolls are historically rare……

Awake

Gradual rise the day after, pressured at the 90,000 level, with a single-sided sharp decline testing the 85,000 support

The promised three tests arrived as scheduled. Although a large bearish candle did not break below the 85,000 support, the consecutive large bearish candles reached the 85,000 support.

Good news: Recently, every Tuesday has seen a reversal and a big rally

Testing period: Today’s big non-farm payrolls release, combined with two months of data, unexpectedly, Tuesday’s big non-farm payrolls are historically rare……

Awake

BTC1.06%

- Reward

- 2

- 1

- Repost

- Share

$GlobalVillage$ :

:

Hop on board!🚗Continuous downward pressure, directly testing the 85,000 support. Earlier this morning, it was said that breaking below 85,000 only requires a large bearish candle, but unexpectedly, the momentum remained weak.

Bitcoin around 8.52-8.57/2920-2950 with light positions, aiming for around 88,000, with synchronized posture. $BTC

Bitcoin around 8.52-8.57/2920-2950 with light positions, aiming for around 88,000, with synchronized posture. $BTC

BTC1.06%

- Reward

- like

- 3

- Repost

- Share

StableEarnings :

:

Is it broken and still connected?View More

Following the big profit from the short positions, currently buying around 8.78/3038 at the current price. Looking ahead to a potential rise of 800-1500 points.

View Original

- Reward

- like

- Comment

- Repost

- Share

Ethereum, consistently strong and holding strong, consistently weak and holding weak. The 3000 support level remains strong, and attention should be on the 3200 resistance area.

Look for opportunities around the 3180-3210 range for Ethereum, with a target of 3100-3120. #BTC行情分析

View OriginalLook for opportunities around the 3180-3210 range for Ethereum, with a target of 3100-3120. #BTC行情分析

- Reward

- like

- Comment

- Repost

- Share