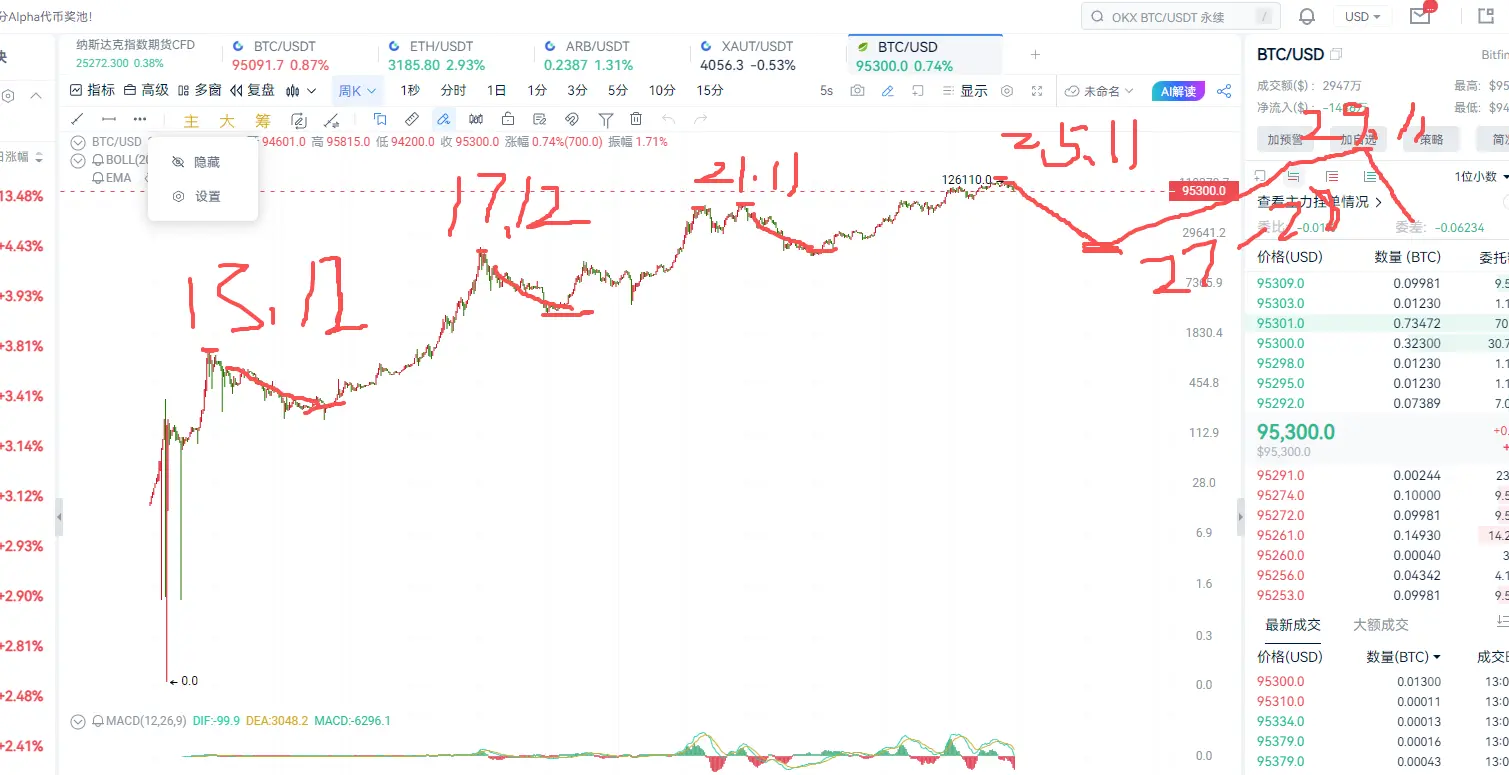

Oracle has invested heavily in AI and even borrowed funds. Some institutions estimate that Oracle may be unable to meet its debt obligations this year. As a result, many quantitative firms might assess that the rise in AI is hard to sustain. They may reduce their holdings in US stocks. If US stocks can't hold up, it would be even more futile for Bitcoin. Therefore, today's market trend continues to be bearish.

BTC-0.1%