亮哥日进斗金

Many fans and friends often ask me: how to get started with short-term trading? Honestly, short-term trading is definitely not something you can do by just clicking a few times—it's more about rhythm, reaction, and discipline.

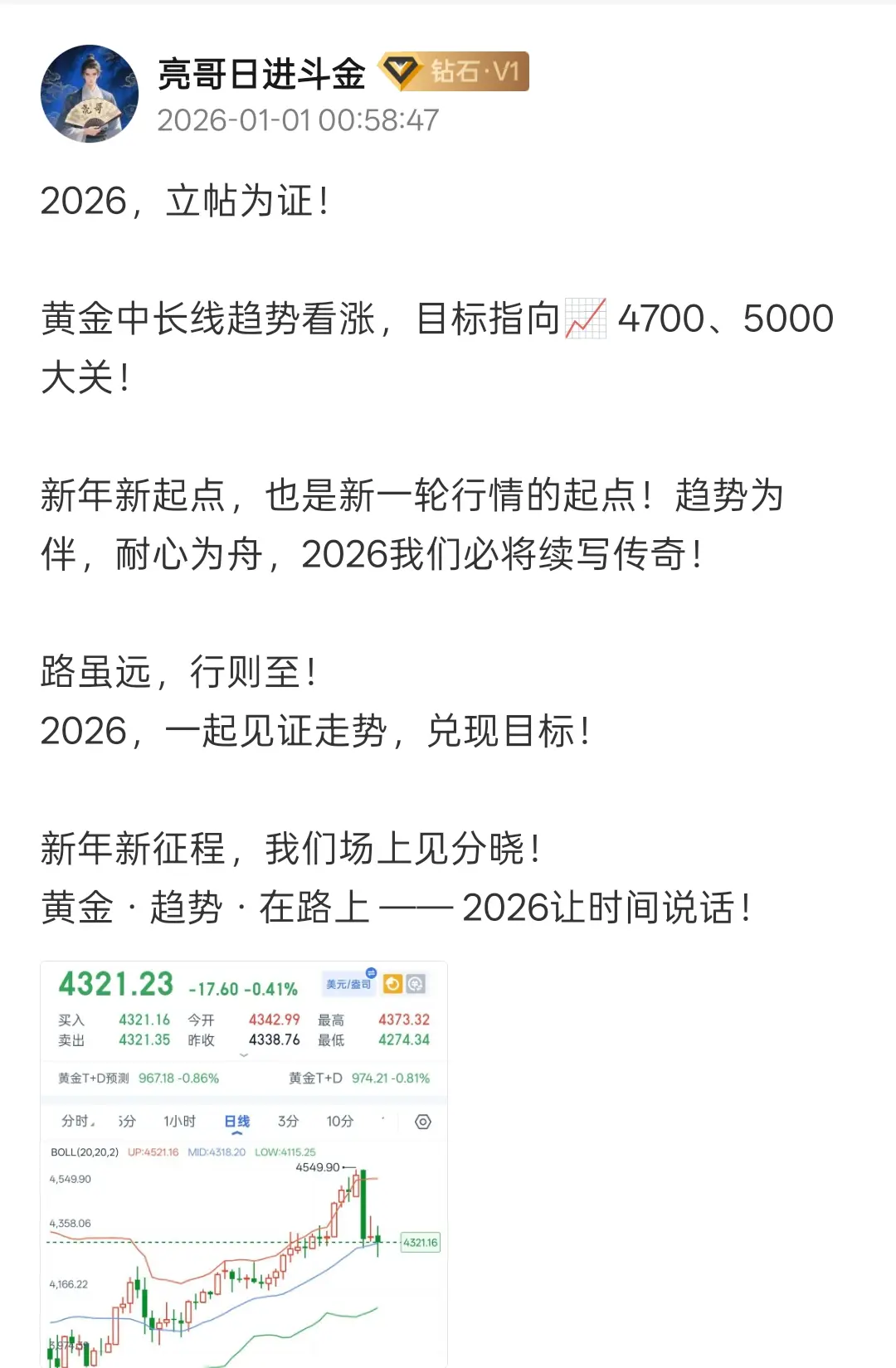

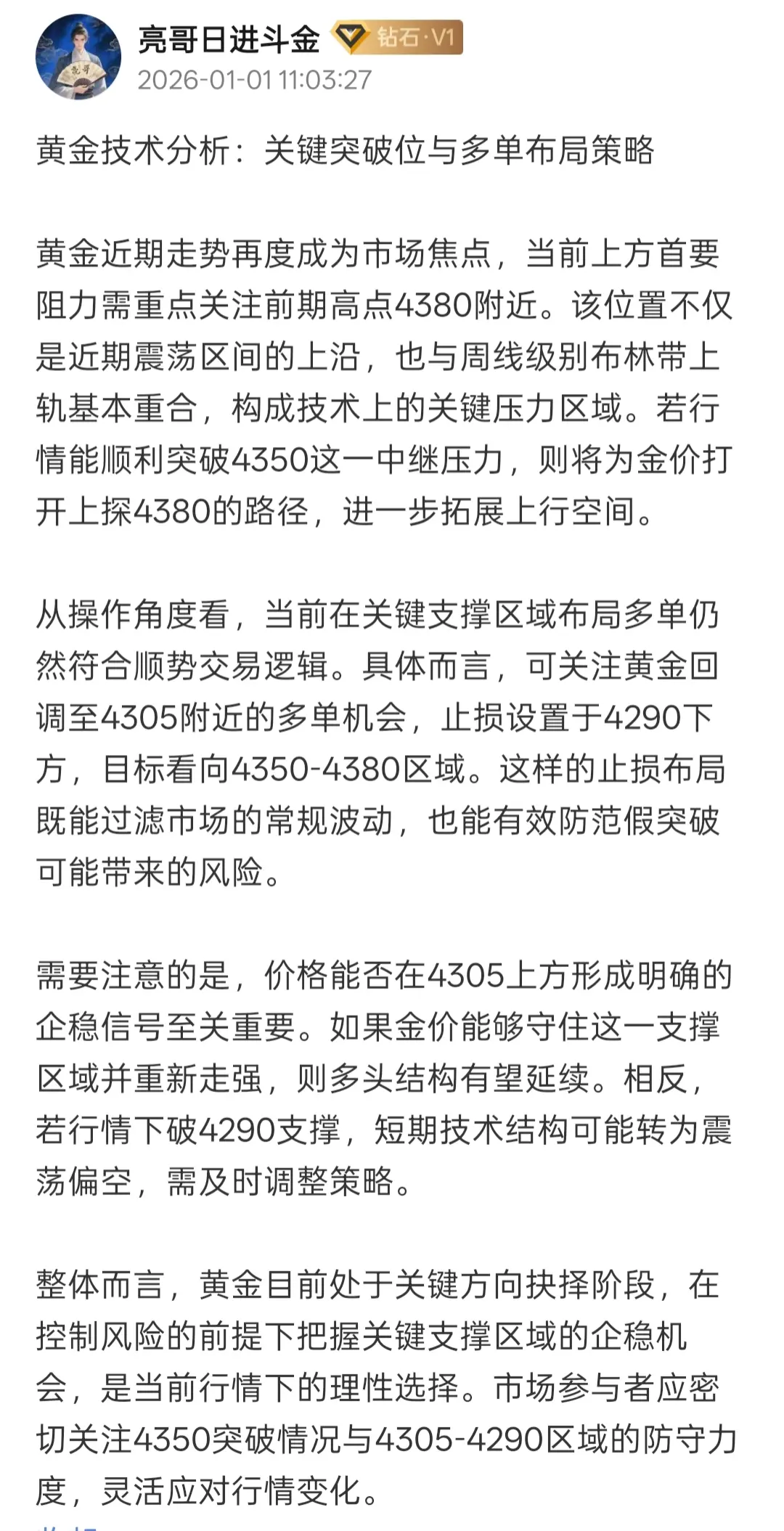

First, you need to look at the chart. Where has the price moved? Where might be resistance, and where is it likely to bounce? Support, resistance, moving averages—these are not just memorized concepts but important references for judging whether "this move is worth doing."

Second, you need to be able to read news, but don't wait for news to come out before acting. It's b

View OriginalFirst, you need to look at the chart. Where has the price moved? Where might be resistance, and where is it likely to bounce? Support, resistance, moving averages—these are not just memorized concepts but important references for judging whether "this move is worth doing."

Second, you need to be able to read news, but don't wait for news to come out before acting. It's b