#WhenisBestTimetoEntertheMarket

Hello Gate Square community! 🌟 Grinding the charts late into the night . Bitcoin is hovering in the 67,500–68,000 USDT range — mild +1% 24h recovery after testing ~66,400 lows, but still deep in a -24%+ 30-day correction from January highs ~89k–92k.

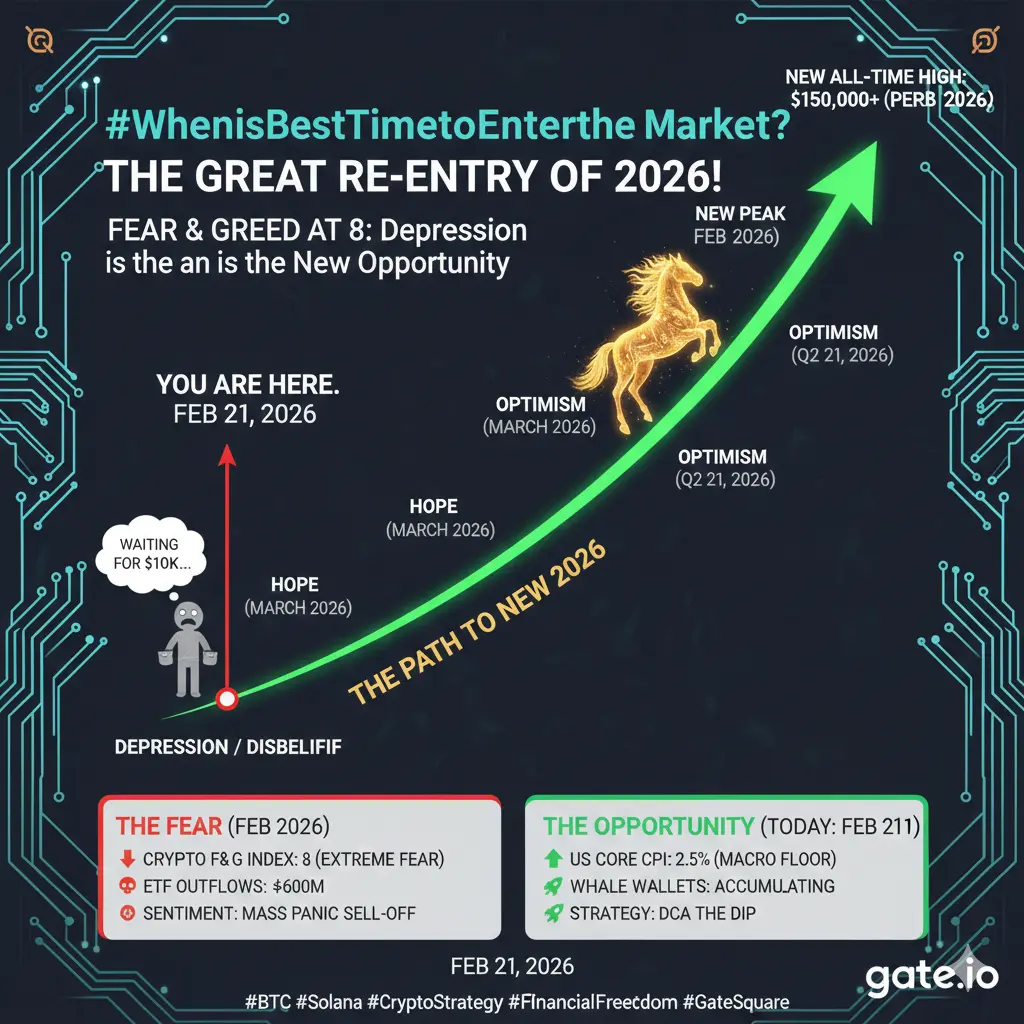

The core question: When is the best time to enter the market?

No single perfect moment exists — timing bottoms perfectly is rare even for pros. The winning edge is a disciplined process: risk management, gradual entry, and contrarian thinking during fear.

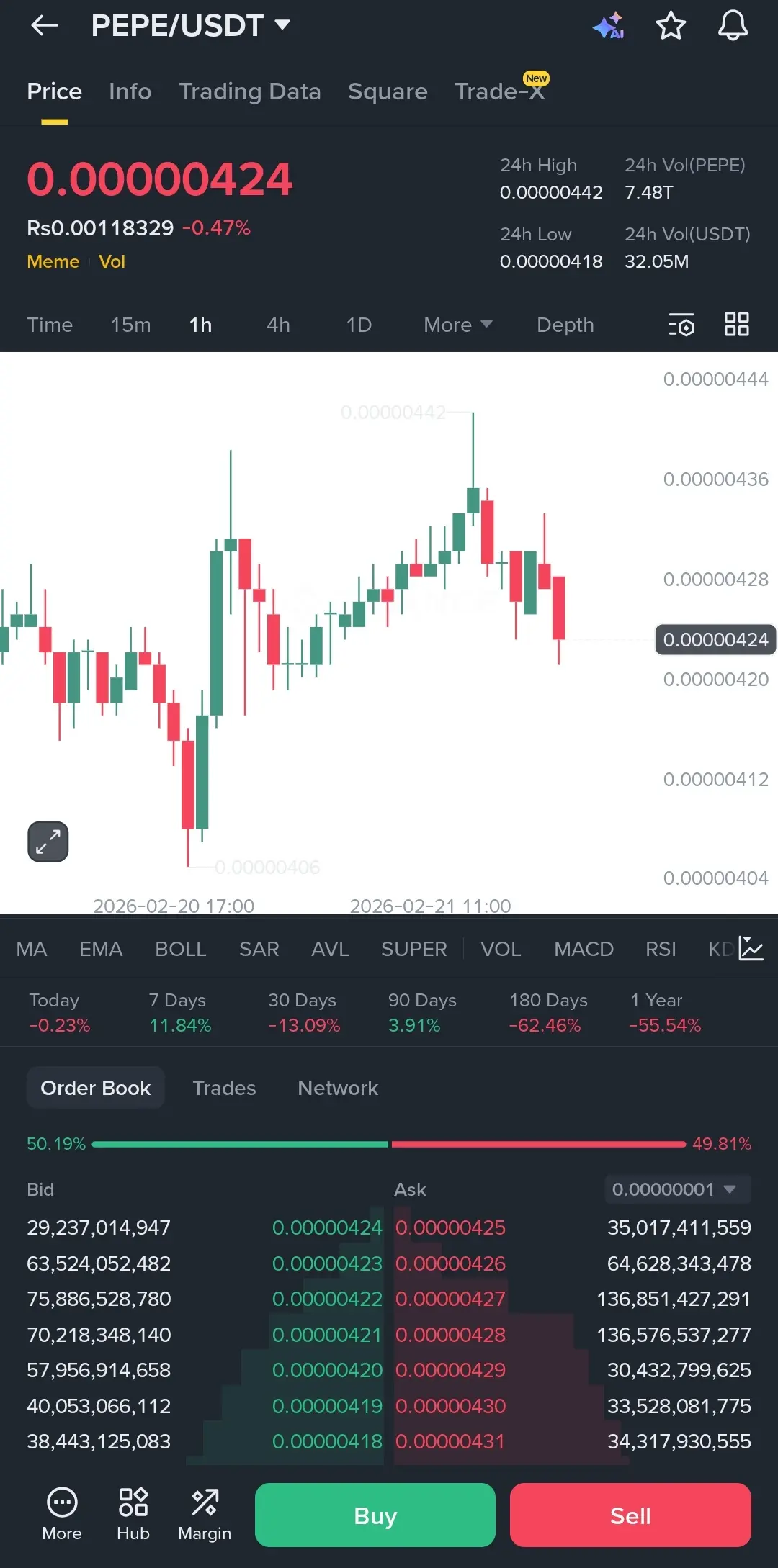

1️⃣ Current Live Market Snapshot

Price: ~67,700 USDT (range 66,500–68,300 on major exchanges)

24h Change: +0.8% to +1.4% (green bounce from recent lows)

24h Volume: 47B–52B+ USD (strong inflow showing real interest)

7-Day: -3% to -4%

30-Day: -24%+ (correction mode)

Fear & Greed Index: ~7–12 (Extreme Fear — capitulation signal, historically prime for long-term buys)

Social Sentiment: ~57% positive but low volume — cautious hope, no FOMO

Explanation: Extreme Fear often marks oversold conditions where selling exhausts and buyers quietly accumulate.

2️⃣ Whale & Institutional Activity (Strong Bullish Signal)

MicroStrategy (Strategy) added 2,486 BTC (~$168M) recently → total holdings now 717,131 BTC (avg cost ~$66k–$76k range, committed long-term).

Corporate treasuries and big players accumulating despite dip.

ETF flows mixed but overall institutional demand persists.

Explanation: Retail fear sells → institutions buy → reduced supply over time supports future rallies.

3️⃣ Technical Breakdown – All Timeframes

🔹 Long-Term (Weekly/Monthly)

Correction after 2025 ATH (>120k).

Weekly death cross active.

Fib 0.618 support ~65k–66k.

🔹 Medium-Term (Daily/4H)

Bearish MA stack (MA7 < MA30 < MA120).

RSI ~35–40 (oversold).

MACD flattening (divergence possible).

Bollinger squeeze (volatility breakout soon).

Resistance 68.5k–69k.

Support 65.5k–66.5k.

🔹 Short-Term (1H/15m)

Bullish flip (MA7 > MA30 > MA120).

Volume + MACD/RSI momentum building.

Explanation: Short-term recovery possible, but broader trend remains corrective until key resistance breaks.

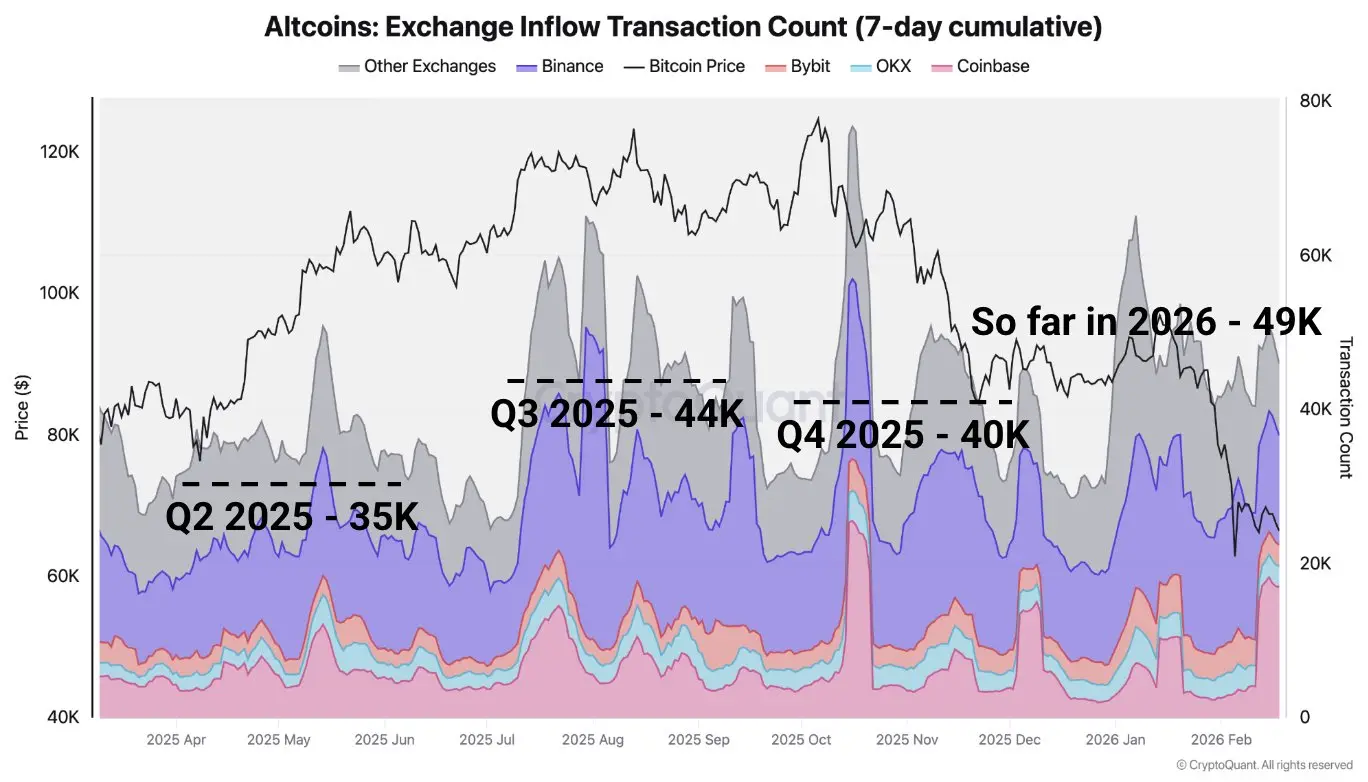

4️⃣ On-Chain & Macro Insights

Exchange reserves declining (less sell pressure).

Long-term holders strong (HODL mode).

Macro: Tariff news shrugged off; potential weak GDP = rate-cut hopes → risk-on boost.

Explanation: On-chain conviction + macro catalysts can flip sentiment fast.

5️⃣ Best Entry Process – DCA Wins Over Timing

Dollar-Cost Averaging (DCA) in fear zones historically beats lump-sum timing (~80%+ cycles).

Example DCA Plan ($10,000 total):

25% now (~67,700)

25% dip 65,500–66,500

20% 62k–63k

15% 58k–60k (extreme)

15% breakout >72k

Avg cost ~65k–66k → positioned for upside.

Explanation: Spreads risk, averages in weakness, reduces regret if lower.

6️⃣ 2026 Price Forecasts (Analyst Range)

Conservative: $75k–$150k

Balanced: $120k–$170k

Bullish: $175k–$225k+ (institutional + macro tailwinds)

Explanation: Expect chop then potential rally — many see new highs if adoption continues.

7️⃣ Full Risk Assessment

Downtrend extension: High (possible -20–40% more).

Volatility/fakeouts: High.

Macro shocks: Medium.

Psychology: Fear creates doubt — contrarian edge.

Explanation: Size small (<1–2% risk per entry), use stops.

8️⃣ Historical Cycle Parallels

Post-halving corrections: 30–50%+ drawdowns → explosive legs (2016/2020).

Mirrors 2022 fear bottom structure.

Explanation: Patterns suggest late-stage correction behavior.

9️⃣ Psychological Edge + Horse Motivation

Extreme Fear feels scary — that’s often where opportunity hides.

Discipline > emotion.

Year of the Wood Horse 2026 = speed, courage, momentum — channel it with consistent process! 🐎🔥

🔥 Community Questions Answered

DCA now in Extreme Fear or wait sub-65k?

→ Start DCA gradually now (25–30% allocation). Fear at 7–12 historically strong; add more on dips for better average. Waiting for “perfect” often misses rallies.

BTC EOY 2026 target?

→ Balanced view: $120k–$170k realistic. Bullish stretch $175k–$225k if macro cooperates.

Portfolio % in BTC currently?

→ ~15–25% diversified allocation example — adjust to your own tolerance; never all-in.

717k BTC corporate stack – genius or risky?

→ Long-term conviction strategy; short-term volatility risk. Signals strong belief in BTC as treasury reserve.

Fear & Greed ~7–12: Buy signal or trap?

→ Strong contrarian buy signal historically — not a trap if you size properly and DCA.

Next move: Dip buy or breakout wait?

→ Dip buy via DCA for long-term; breakout wait (>69k) for active trades.

Tariffs/GDP macro – pump or dump?

→ Weak data could trigger rate-cut expectations → bullish reaction, though short-term volatility possible.

Share your chart, your plan, and your risk strategy.

Watching 65k–66k support closely with structured DCA approach.

Tag friends, drop your thoughts, and let’s keep this discussion going!

Hello Gate Square community! 🌟 Grinding the charts late into the night . Bitcoin is hovering in the 67,500–68,000 USDT range — mild +1% 24h recovery after testing ~66,400 lows, but still deep in a -24%+ 30-day correction from January highs ~89k–92k.

The core question: When is the best time to enter the market?

No single perfect moment exists — timing bottoms perfectly is rare even for pros. The winning edge is a disciplined process: risk management, gradual entry, and contrarian thinking during fear.

1️⃣ Current Live Market Snapshot

Price: ~67,700 USDT (range 66,500–68,300 on major exchanges)

24h Change: +0.8% to +1.4% (green bounce from recent lows)

24h Volume: 47B–52B+ USD (strong inflow showing real interest)

7-Day: -3% to -4%

30-Day: -24%+ (correction mode)

Fear & Greed Index: ~7–12 (Extreme Fear — capitulation signal, historically prime for long-term buys)

Social Sentiment: ~57% positive but low volume — cautious hope, no FOMO

Explanation: Extreme Fear often marks oversold conditions where selling exhausts and buyers quietly accumulate.

2️⃣ Whale & Institutional Activity (Strong Bullish Signal)

MicroStrategy (Strategy) added 2,486 BTC (~$168M) recently → total holdings now 717,131 BTC (avg cost ~$66k–$76k range, committed long-term).

Corporate treasuries and big players accumulating despite dip.

ETF flows mixed but overall institutional demand persists.

Explanation: Retail fear sells → institutions buy → reduced supply over time supports future rallies.

3️⃣ Technical Breakdown – All Timeframes

🔹 Long-Term (Weekly/Monthly)

Correction after 2025 ATH (>120k).

Weekly death cross active.

Fib 0.618 support ~65k–66k.

🔹 Medium-Term (Daily/4H)

Bearish MA stack (MA7 < MA30 < MA120).

RSI ~35–40 (oversold).

MACD flattening (divergence possible).

Bollinger squeeze (volatility breakout soon).

Resistance 68.5k–69k.

Support 65.5k–66.5k.

🔹 Short-Term (1H/15m)

Bullish flip (MA7 > MA30 > MA120).

Volume + MACD/RSI momentum building.

Explanation: Short-term recovery possible, but broader trend remains corrective until key resistance breaks.

4️⃣ On-Chain & Macro Insights

Exchange reserves declining (less sell pressure).

Long-term holders strong (HODL mode).

Macro: Tariff news shrugged off; potential weak GDP = rate-cut hopes → risk-on boost.

Explanation: On-chain conviction + macro catalysts can flip sentiment fast.

5️⃣ Best Entry Process – DCA Wins Over Timing

Dollar-Cost Averaging (DCA) in fear zones historically beats lump-sum timing (~80%+ cycles).

Example DCA Plan ($10,000 total):

25% now (~67,700)

25% dip 65,500–66,500

20% 62k–63k

15% 58k–60k (extreme)

15% breakout >72k

Avg cost ~65k–66k → positioned for upside.

Explanation: Spreads risk, averages in weakness, reduces regret if lower.

6️⃣ 2026 Price Forecasts (Analyst Range)

Conservative: $75k–$150k

Balanced: $120k–$170k

Bullish: $175k–$225k+ (institutional + macro tailwinds)

Explanation: Expect chop then potential rally — many see new highs if adoption continues.

7️⃣ Full Risk Assessment

Downtrend extension: High (possible -20–40% more).

Volatility/fakeouts: High.

Macro shocks: Medium.

Psychology: Fear creates doubt — contrarian edge.

Explanation: Size small (<1–2% risk per entry), use stops.

8️⃣ Historical Cycle Parallels

Post-halving corrections: 30–50%+ drawdowns → explosive legs (2016/2020).

Mirrors 2022 fear bottom structure.

Explanation: Patterns suggest late-stage correction behavior.

9️⃣ Psychological Edge + Horse Motivation

Extreme Fear feels scary — that’s often where opportunity hides.

Discipline > emotion.

Year of the Wood Horse 2026 = speed, courage, momentum — channel it with consistent process! 🐎🔥

🔥 Community Questions Answered

DCA now in Extreme Fear or wait sub-65k?

→ Start DCA gradually now (25–30% allocation). Fear at 7–12 historically strong; add more on dips for better average. Waiting for “perfect” often misses rallies.

BTC EOY 2026 target?

→ Balanced view: $120k–$170k realistic. Bullish stretch $175k–$225k if macro cooperates.

Portfolio % in BTC currently?

→ ~15–25% diversified allocation example — adjust to your own tolerance; never all-in.

717k BTC corporate stack – genius or risky?

→ Long-term conviction strategy; short-term volatility risk. Signals strong belief in BTC as treasury reserve.

Fear & Greed ~7–12: Buy signal or trap?

→ Strong contrarian buy signal historically — not a trap if you size properly and DCA.

Next move: Dip buy or breakout wait?

→ Dip buy via DCA for long-term; breakout wait (>69k) for active trades.

Tariffs/GDP macro – pump or dump?

→ Weak data could trigger rate-cut expectations → bullish reaction, though short-term volatility possible.

Share your chart, your plan, and your risk strategy.

Watching 65k–66k support closely with structured DCA approach.

Tag friends, drop your thoughts, and let’s keep this discussion going!