# What’sNextforBitcoin?

46.26K

Peacefulheart

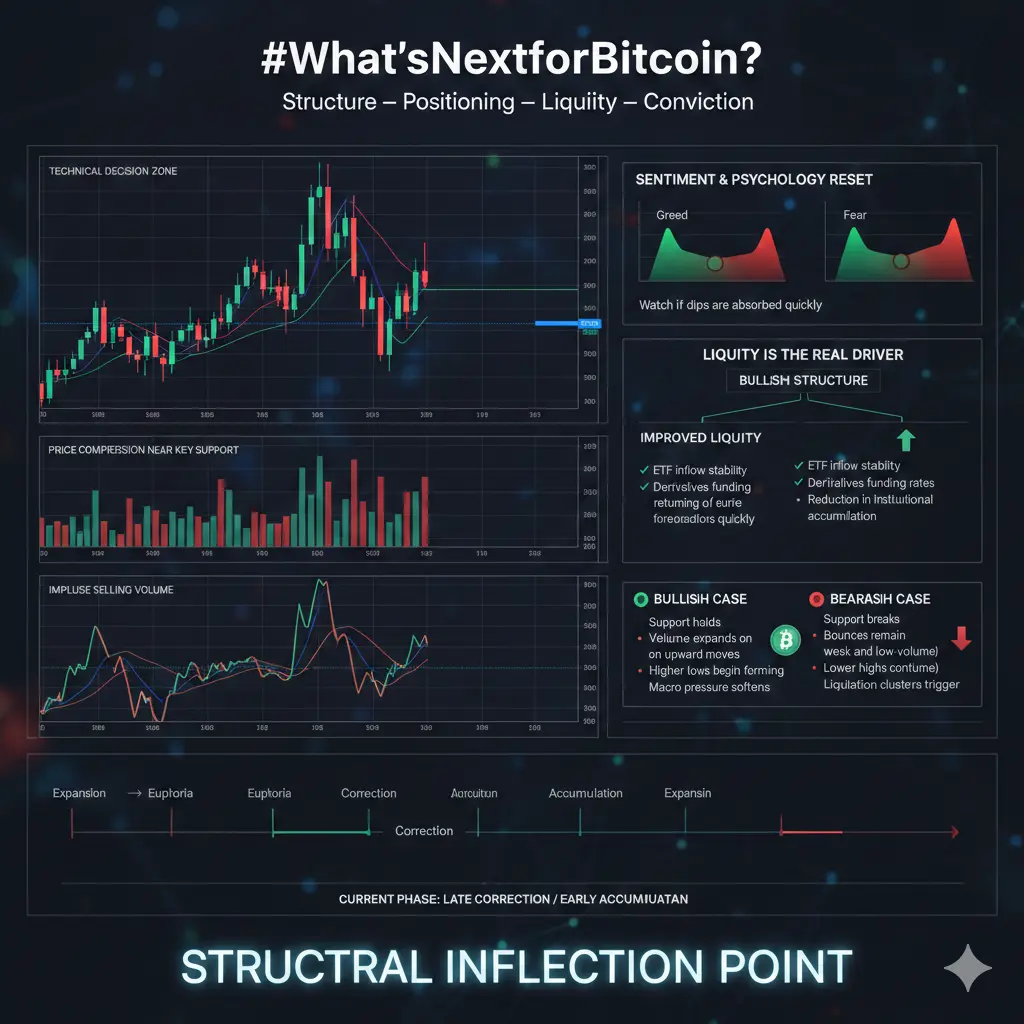

#What’sNextforBitcoin? Let’s pause the headlines and look at structure — because Bitcoin doesn’t move on emotion, it moves on positioning, liquidity, and conviction. 📊

Right now, BTC is sitting in a technical decision zone. After recent volatility, price is compressing near key support. When markets compress after expansion, they prepare for expansion again — the only question is direction. This phase is less about prediction and more about confirmation.

📉 1️⃣ Short-Term Outlook: Relief Rally or Continuation?

If major support levels continue to hold, a technical relief rally becomes likely.

Right now, BTC is sitting in a technical decision zone. After recent volatility, price is compressing near key support. When markets compress after expansion, they prepare for expansion again — the only question is direction. This phase is less about prediction and more about confirmation.

📉 1️⃣ Short-Term Outlook: Relief Rally or Continuation?

If major support levels continue to hold, a technical relief rally becomes likely.

BTC-0,65%

- Reward

- 5

- 11

- Repost

- Share

StylishKuri :

:

To The Moon 🌕View More

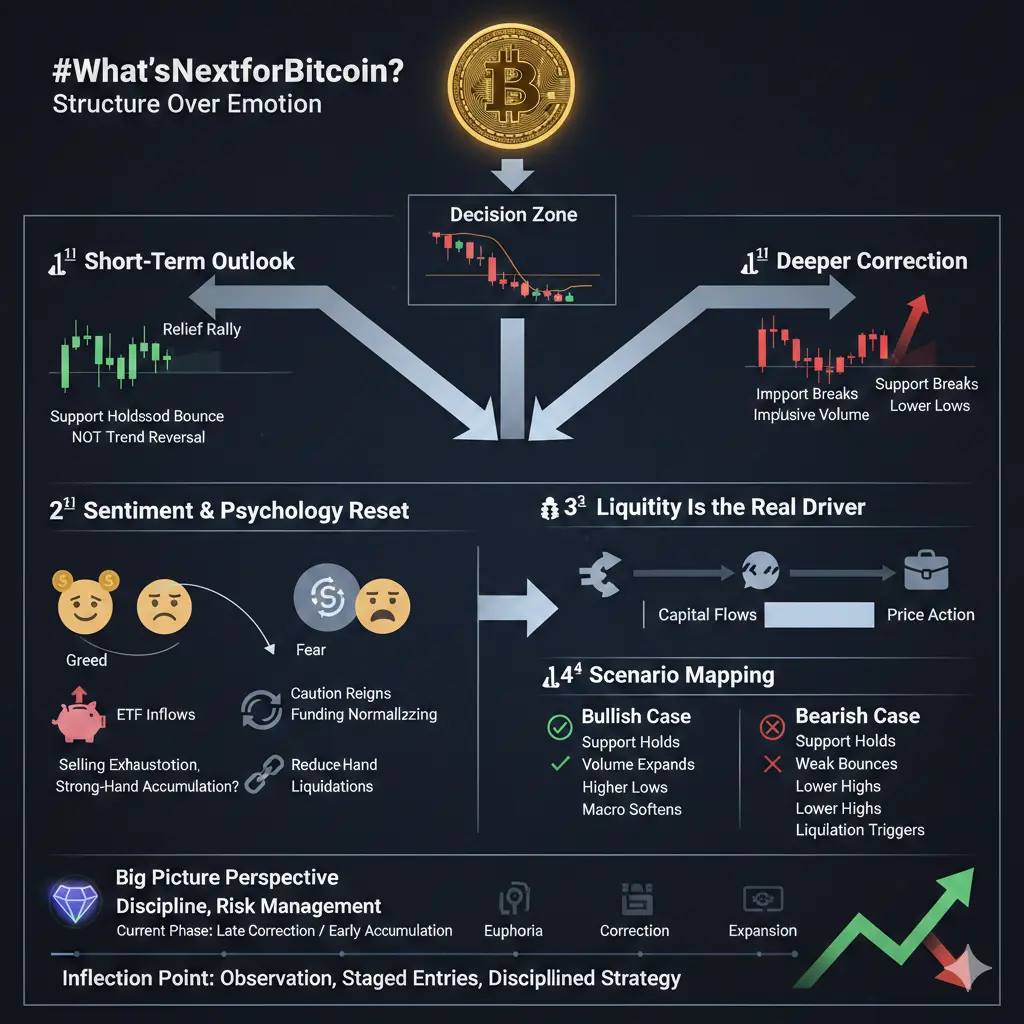

#What’sNextforBitcoin? Let’s step back from the noise and focus on structure over emotion. Bitcoin doesn’t move on headlines or hype — it moves on positioning, liquidity, and conviction. Currently, BTC is compressing near key support, a classic decision zone where the next major move is determined by how buyers and sellers react, not by speculation.

📉 1️⃣ Short-Term Outlook: Relief Rally or Continuation?

If major support levels hold, a technical relief rally becomes likely. Oversold conditions often produce short-term bounces as short sellers take profit and sidelined buyers test entries. But

📉 1️⃣ Short-Term Outlook: Relief Rally or Continuation?

If major support levels hold, a technical relief rally becomes likely. Oversold conditions often produce short-term bounces as short sellers take profit and sidelined buyers test entries. But

BTC-0,65%

- Reward

- 7

- 9

- Repost

- Share

MrFlower_XingChen :

:

Buy To Earn 💰️View More

#What’sNextforBitcoin? What’sNextforBitcoin? Structural Crossroads for BTC

Bitcoin is currently at a critical juncture. Headlines, social chatter, or sudden macro developments may sway short-term sentiment, but true directional moves are determined by positioning, liquidity, and conviction. BTC is compressing near key support zones—a classic inflection point where the next major move will be dictated by how buyers and sellers interact rather than speculation or emotion.

📉 1️⃣ Short-Term Technical Outlook

If support levels hold, BTC may see a technical relief rally. Oversold conditions often t

Bitcoin is currently at a critical juncture. Headlines, social chatter, or sudden macro developments may sway short-term sentiment, but true directional moves are determined by positioning, liquidity, and conviction. BTC is compressing near key support zones—a classic inflection point where the next major move will be dictated by how buyers and sellers interact rather than speculation or emotion.

📉 1️⃣ Short-Term Technical Outlook

If support levels hold, BTC may see a technical relief rally. Oversold conditions often t

BTC-0,65%

- Reward

- 2

- Comment

- Repost

- Share

#What’sNextforBitcoin? Bitcoin (BTC) is at a structural crossroads. Headlines, social media hype, or sudden macro news may sway short-term sentiment, but true market direction is dictated by positioning, liquidity, and conviction. Currently, BTC is compressing near key support zones, a classic decision point where the next major move will be defined by how buyers and sellers interact — not by speculation or emotional reactions.

📉 1️⃣ Short-Term Technical Outlook

If major support levels hold, we can expect a technical relief rally. Oversold conditions often trigger short-term bounces as short

📉 1️⃣ Short-Term Technical Outlook

If major support levels hold, we can expect a technical relief rally. Oversold conditions often trigger short-term bounces as short

BTC-0,65%

- Reward

- 3

- 1

- Repost

- Share

MingDragonX :

:

To The Moon 🌕#What’sNextforBitcoin?

#What’sNextforBitcoin? 🚀

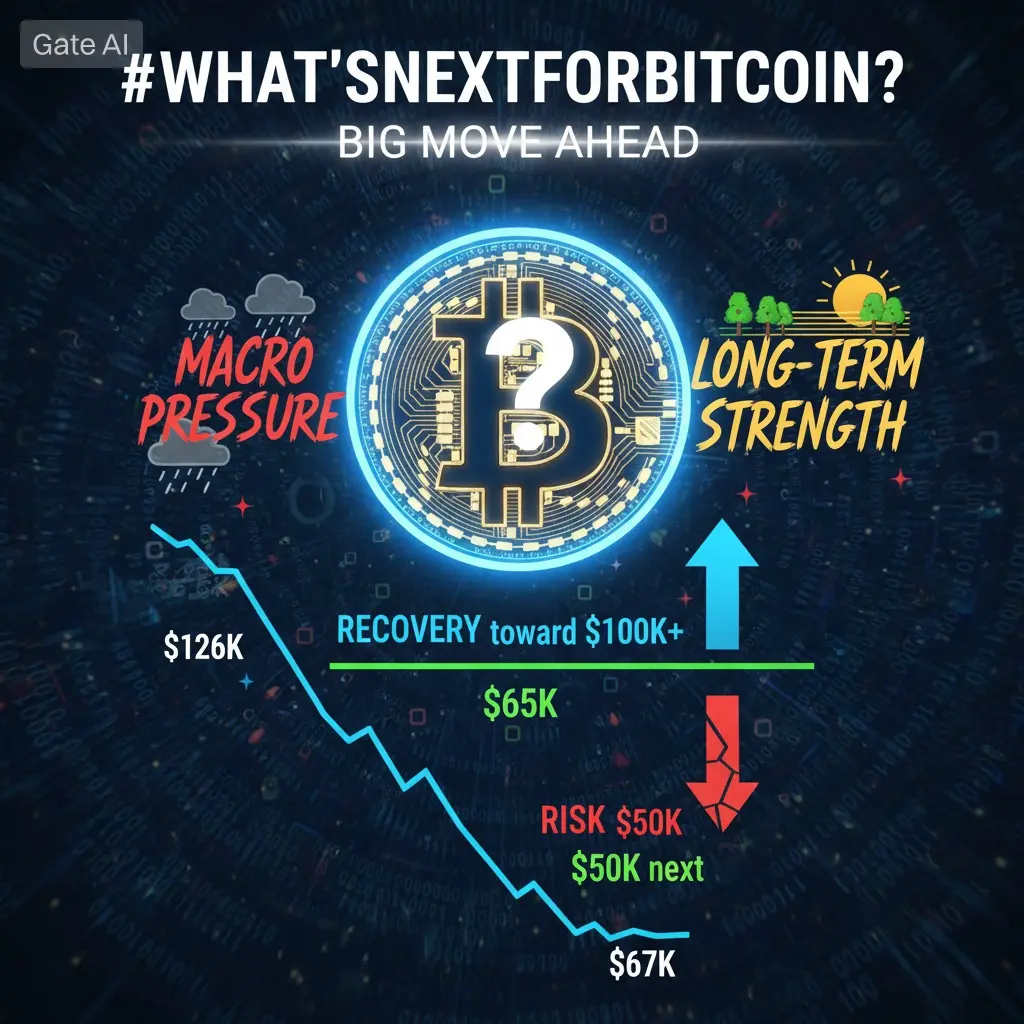

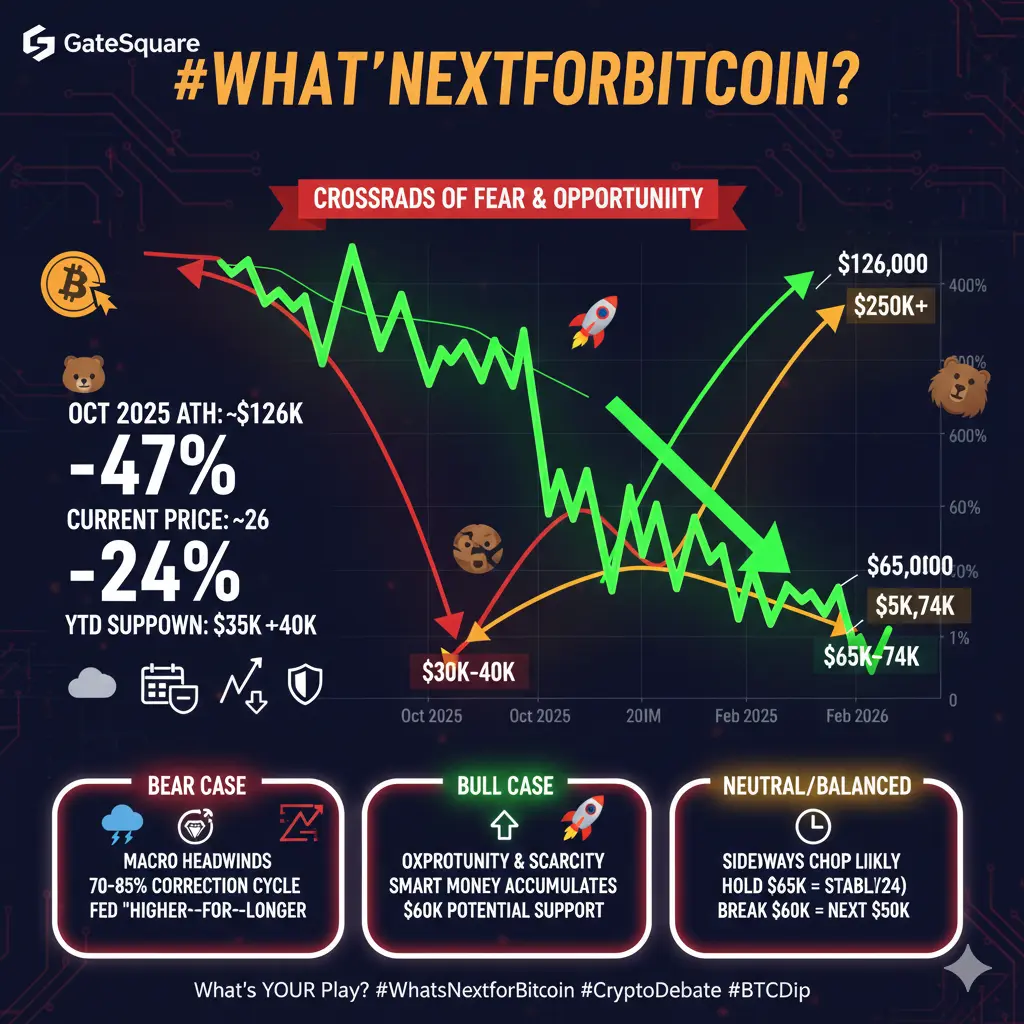

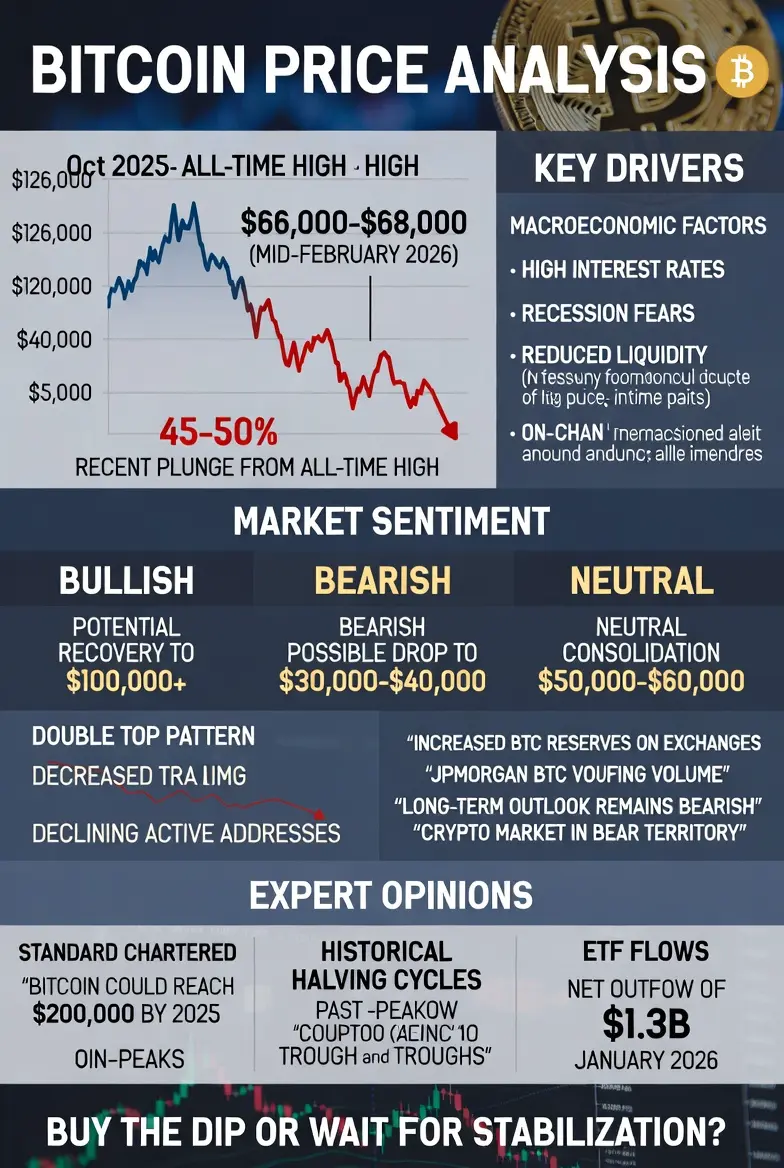

Right now, Bitcoin is trading around $66K–$68K after falling from its October 2025 all-time high above $126K. That’s almost a 50% drop. The big difference this time? There’s no major exchange collapse or disaster. The pressure is mostly coming from high interest rates, recession fears, and less money flowing into risk assets.

Let’s understand the situation in simple language.

📊 Current Market Condition

• Bitcoin is down about 24% so far in 2026.

• January and February both negative — rare for BTC.

• Price stuck between $65K–$72K.

• Strong sup

#What’sNextforBitcoin? 🚀

Right now, Bitcoin is trading around $66K–$68K after falling from its October 2025 all-time high above $126K. That’s almost a 50% drop. The big difference this time? There’s no major exchange collapse or disaster. The pressure is mostly coming from high interest rates, recession fears, and less money flowing into risk assets.

Let’s understand the situation in simple language.

📊 Current Market Condition

• Bitcoin is down about 24% so far in 2026.

• January and February both negative — rare for BTC.

• Price stuck between $65K–$72K.

• Strong sup

BTC-0,65%

- Reward

- 8

- 5

- Repost

- Share

repanzal :

:

thanks for the outstanding information sharing with us its realy informative.View More

BTC Technical Outlook: Bitcoin Consolidates Near Macro Base After Breakdown Below 0.236

Bitcoin remains in a corrective phase after failing to sustain acceptance above the $85,000–$93,000 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement zone.

Repeated rejection from this supply cluster, combined with the breakdown below the ascending support structure, confirmed a transition from bullish continuation into a broader corrective trend.

Price is currently consolidating near the $66,000–$70,000 region, forming a short-term base after an extended decline from the $100K+ highs

Bitcoin remains in a corrective phase after failing to sustain acceptance above the $85,000–$93,000 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement zone.

Repeated rejection from this supply cluster, combined with the breakdown below the ascending support structure, confirmed a transition from bullish continuation into a broader corrective trend.

Price is currently consolidating near the $66,000–$70,000 region, forming a short-term base after an extended decline from the $100K+ highs

BTC-0,65%

- Reward

- 6

- 2

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

BTC Technical Outlook: Bitcoin Consolidates Near Macro Base After Breakdown Below 0.236

Bitcoin remains in a corrective phase after failing to sustain acceptance above the $85,000–$93,000 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement zone.

Repeated rejection from this supply cluster, combined with the breakdown below the ascending support structure, confirmed a transition from bullish continuation into a broader corrective trend.

Price is currently consolidating near the $66,000–$70,000 region, forming a short-term base after an extended decline from the $100K+ highs

Bitcoin remains in a corrective phase after failing to sustain acceptance above the $85,000–$93,000 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement zone.

Repeated rejection from this supply cluster, combined with the breakdown below the ascending support structure, confirmed a transition from bullish continuation into a broader corrective trend.

Price is currently consolidating near the $66,000–$70,000 region, forming a short-term base after an extended decline from the $100K+ highs

BTC-0,65%

- Reward

- 3

- 3

- Repost

- Share

apollo123 :

:

Join the horse racing prediction, complete tasks to receive race tickets, enjoy daily Coin Gift giveaways worth millions, and share prizes worth 100,000 USDT — all happening at the Spring Festival Gate 2026 https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLBGVFTEBGView More

#我在Gate广场过新年

#What’sNextforBitcoin?

In 2026, Bitcoin has transitioned from a speculative "tech play" into a mature, institutionalized macro asset. The market is currently navigating a period of post-peak consolidation, following a significant rally in 2025 that saw prices reach as high as $126,000.

As of mid-February 2026, here is the breakdown of the trends shaping Bitcoin’s immediate future:

1. The 2026 Market Climate

After the "halving fever" of 2024 and the subsequent bull run of 2025, the market has cooled.

Current Range: Bitcoin is currently trading between $69,000 and $71,000. This

#What’sNextforBitcoin?

In 2026, Bitcoin has transitioned from a speculative "tech play" into a mature, institutionalized macro asset. The market is currently navigating a period of post-peak consolidation, following a significant rally in 2025 that saw prices reach as high as $126,000.

As of mid-February 2026, here is the breakdown of the trends shaping Bitcoin’s immediate future:

1. The 2026 Market Climate

After the "halving fever" of 2024 and the subsequent bull run of 2025, the market has cooled.

Current Range: Bitcoin is currently trading between $69,000 and $71,000. This

- Reward

- 3

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

📊 #What’sNextForBitcoin? 🤔

Bitcoin is moving inside a tight range between support and resistance ⚖️

Momentum is slightly negative 📉

RSI is neutral 🟡

EMA acting as a decision zone 🔄

So what’s next? 👇

🟢 Break above resistance with strong volume → Bullish continuation 🚀

🔴 Break below support with strong selling → Bearish extension 📉

🟡 Stay inside range → More consolidation before big move ⏳

Right now, the market is preparing…

A breakout or breakdown is loading. 🔥

Smart traders are not predicting —

They are waiting for confirmation. 🎯

Are you bullish or bearish for the next move? Drop

Bitcoin is moving inside a tight range between support and resistance ⚖️

Momentum is slightly negative 📉

RSI is neutral 🟡

EMA acting as a decision zone 🔄

So what’s next? 👇

🟢 Break above resistance with strong volume → Bullish continuation 🚀

🔴 Break below support with strong selling → Bearish extension 📉

🟡 Stay inside range → More consolidation before big move ⏳

Right now, the market is preparing…

A breakout or breakdown is loading. 🔥

Smart traders are not predicting —

They are waiting for confirmation. 🎯

Are you bullish or bearish for the next move? Drop

BTC-0,65%

- Reward

- 1

- Comment

- Repost

- Share

Over 95% of Bitcoin’s 21 million supply is already mined.

That leaves roughly 1,009,606 BTC still to be issued — and the emission rate keeps declining every halving.

This isn’t just scarcity in theory. It’s a supply curve that tightens by design, regardless of demand cycles, politics, or macro shifts.

Fixed cap. Predictable issuance.

Digital scarcity operating exactly as coded.

$BTC

#What’sNextforBitcoin?

That leaves roughly 1,009,606 BTC still to be issued — and the emission rate keeps declining every halving.

This isn’t just scarcity in theory. It’s a supply curve that tightens by design, regardless of demand cycles, politics, or macro shifts.

Fixed cap. Predictable issuance.

Digital scarcity operating exactly as coded.

$BTC

#What’sNextforBitcoin?

BTC-0,65%

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

211.14K Popularity

13.56K Popularity

46.26K Popularity

86.75K Popularity

851.12K Popularity

287.89K Popularity

448.82K Popularity

33.9K Popularity

22.56K Popularity

20.88K Popularity

21.21K Popularity

18.97K Popularity

20.52K Popularity

48.31K Popularity

News

View MoreMachi Closes Multiple Positions with $275K Loss, Total Losses Exceed $28.15M

10 m

Whale 0xF4EE Resumes ETH Sales After Month-Long Hiatus

29 m

Tom Lee's Bitmine Purchases 35,000 ETH Worth $69.37M in Single Day

34 m

Li Feifei's AI startup World Labs completes $1 billion funding round, with participation from NVIDIA and others

35 m

Data: US XRP spot ETF experienced a total net outflow of $220,620 in one day

43 m

Pin