# FOLKSFundingRateAndDelistingConcerns

5.07K

Yunna

#FOLKSFundingRateAndDelistingConcerns Market Alert: $FOLKS Funding Rates & Delisting FUD — What You Need to Know

The $FOLKS (Folks Finance) community has been buzzing over the last 48 hours with concerns regarding extreme funding rates and circulating rumors about potential delistings. Before you react, let’s break down the data and the reality of the situation.

📉 The Funding Rate Situation

Currently, we are seeing highly unconventional funding rates for $FOLKS perpetual contracts.

The Trend: Rates have spiked significantly into the negative/positive [Insert Current %], indicating a massi

The $FOLKS (Folks Finance) community has been buzzing over the last 48 hours with concerns regarding extreme funding rates and circulating rumors about potential delistings. Before you react, let’s break down the data and the reality of the situation.

📉 The Funding Rate Situation

Currently, we are seeing highly unconventional funding rates for $FOLKS perpetual contracts.

The Trend: Rates have spiked significantly into the negative/positive [Insert Current %], indicating a massi

- Reward

- 2

- Comment

- Repost

- Share

#FOLKSFundingRateAndDelistingConcerns Market Sentiment and Risk Overview

FOLKS has recently drawn heightened attention due to abnormal funding rate behavior combined with growing delisting concerns, creating a fragile and reactive market environment. When these dynamics converge, price movements are often driven more by emotion and positioning than by underlying fundamentals.

Funding Rates Signal Market Imbalance

Funding rates offer insight into derivatives positioning. In FOLKS’ case, persistently negative or unstable funding suggests that bearish positions are crowded, with traders paying to

FOLKS has recently drawn heightened attention due to abnormal funding rate behavior combined with growing delisting concerns, creating a fragile and reactive market environment. When these dynamics converge, price movements are often driven more by emotion and positioning than by underlying fundamentals.

Funding Rates Signal Market Imbalance

Funding rates offer insight into derivatives positioning. In FOLKS’ case, persistently negative or unstable funding suggests that bearish positions are crowded, with traders paying to

- Reward

- 6

- 1

- Repost

- Share

Discovery :

:

Watching Closely 🔍#FOLKSFundingRateAndDelistingConcerns

FOLKS | Forward Outlook and Market Structure

FOLKS is entering a decisive phase where future price action will be shaped less by speculation and more by how quickly uncertainty is resolved. The market is currently operating under stress, but periods like this often define the next major directional move.

Short-Term Outlook

In the near term, volatility is expected to remain elevated. Funding imbalances and positioning pressure suggest that price movements may continue to be sharp and reactionary. Any rallies without improvement in liquidity or funding stab

FOLKS | Forward Outlook and Market Structure

FOLKS is entering a decisive phase where future price action will be shaped less by speculation and more by how quickly uncertainty is resolved. The market is currently operating under stress, but periods like this often define the next major directional move.

Short-Term Outlook

In the near term, volatility is expected to remain elevated. Funding imbalances and positioning pressure suggest that price movements may continue to be sharp and reactionary. Any rallies without improvement in liquidity or funding stab

- Reward

- 1

- Comment

- Repost

- Share

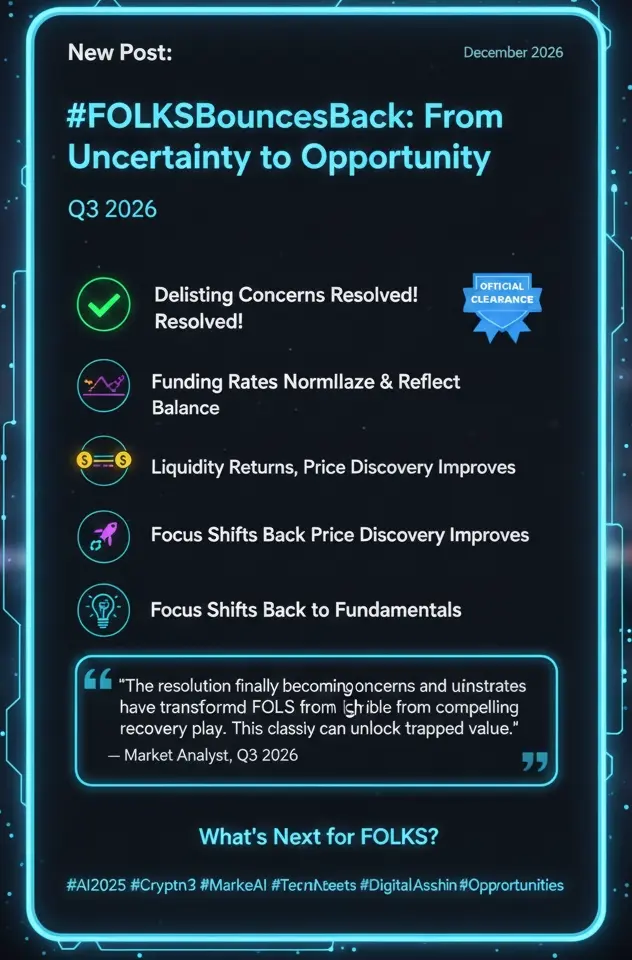

#FOLKSFundingRateAndDelistingConcerns #FOLKSBouncesBack: From Uncertainty to Opportunity

It's been a turbulent few months for FOLKS, but the tides are finally turning. After grappling with abnormal funding rates and persistent delisting concerns, the asset is showing strong signs of a comeback, driven by renewed confidence and strategic clarity.

✅ Delisting Concerns Resolved!

The biggest overhang has been lifted. Official statements from major exchanges have unequivocally confirmed FOLKS's continued listing, dispelling rumors and restoring much-needed certainty to the market. This clarity

It's been a turbulent few months for FOLKS, but the tides are finally turning. After grappling with abnormal funding rates and persistent delisting concerns, the asset is showing strong signs of a comeback, driven by renewed confidence and strategic clarity.

✅ Delisting Concerns Resolved!

The biggest overhang has been lifted. Official statements from major exchanges have unequivocally confirmed FOLKS's continued listing, dispelling rumors and restoring much-needed certainty to the market. This clarity

- Reward

- 8

- 1

- Repost

- Share

#FOLKSFundingRateAndDelistingConcerns Navigating Fragile Market Conditions

FOLKS has recently come under the spotlight as abnormal funding rates and growing delisting concerns weigh heavily on market sentiment. When these factors converge, price movements often reflect emotion and positioning rather than fundamentals, creating a reactive and fragile market environment.

Funding Rates Signal Positioning Imbalance

Derivatives funding rates offer insight into market positioning. In FOLKS’ case, persistently negative or unstable funding indicates crowded bearish positions, where traders are willin

FOLKS has recently come under the spotlight as abnormal funding rates and growing delisting concerns weigh heavily on market sentiment. When these factors converge, price movements often reflect emotion and positioning rather than fundamentals, creating a reactive and fragile market environment.

Funding Rates Signal Positioning Imbalance

Derivatives funding rates offer insight into market positioning. In FOLKS’ case, persistently negative or unstable funding indicates crowded bearish positions, where traders are willin

- Reward

- 8

- 2

- Repost

- Share

Discovery :

:

Watching Closely 🔍View More

#FOLKSFundingRateAndDelistingConcerns

FOLKS is drawing increased attention as abnormal funding rate behavior and growing delisting concerns begin to weigh heavily on market sentiment. When these two dynamics converge, price action often becomes driven by emotion and positioning rather than fundamentals, making the market more reactive and fragile.

Funding rates provide a clear window into derivatives positioning, and in FOLKS’ case they reflect sustained imbalance. Unstable or persistently negative funding suggests that bearish positions are crowded, with traders willing to pay to maintain sh

FOLKS is drawing increased attention as abnormal funding rate behavior and growing delisting concerns begin to weigh heavily on market sentiment. When these two dynamics converge, price action often becomes driven by emotion and positioning rather than fundamentals, making the market more reactive and fragile.

Funding rates provide a clear window into derivatives positioning, and in FOLKS’ case they reflect sustained imbalance. Unstable or persistently negative funding suggests that bearish positions are crowded, with traders willing to pay to maintain sh

- Reward

- 11

- 5

- Repost

- Share

June :

:

Come on, come on, come on, keep oiling, refuel again, refuel renewableView More

#FOLKSFundingRateAndDelistingConcerns

#FOLKSFundingRateAndDelistingConcerns

FOLKS has recently gained strong attention across spot and derivatives markets. While price momentum and market narratives remain active, two major risk signals are becoming increasingly important for traders and investors to monitor: elevated funding rates and delisting-related concerns.

🔹 Understanding High Funding Rates in FOLKS

Funding rates in perpetual futures rise when the majority of traders are positioned on the long side. In the case of FOLKS, funding rates have stayed at unusually high levels, which shows

#FOLKSFundingRateAndDelistingConcerns

FOLKS has recently gained strong attention across spot and derivatives markets. While price momentum and market narratives remain active, two major risk signals are becoming increasingly important for traders and investors to monitor: elevated funding rates and delisting-related concerns.

🔹 Understanding High Funding Rates in FOLKS

Funding rates in perpetual futures rise when the majority of traders are positioned on the long side. In the case of FOLKS, funding rates have stayed at unusually high levels, which shows

- Reward

- 21

- 11

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Watching Closely 🔍View More

#FOLKSFundingRateAndDelistingConcerns

FOLKS has recently come under increased scrutiny as funding rate behavior and delisting concerns begin to shape market sentiment. These two factors, when combined, often create an environment where price action becomes more emotional than rational, making it important to separate signal from noise.

The funding rate is one of the clearest indicators of positioning in the derivatives market. Persistent negative or unstable funding rates suggest that short positions are dominant, meaning traders are paying a premium to stay bearish. This typically reflects w

FOLKS has recently come under increased scrutiny as funding rate behavior and delisting concerns begin to shape market sentiment. These two factors, when combined, often create an environment where price action becomes more emotional than rational, making it important to separate signal from noise.

The funding rate is one of the clearest indicators of positioning in the derivatives market. Persistent negative or unstable funding rates suggest that short positions are dominant, meaning traders are paying a premium to stay bearish. This typically reflects w

- Reward

- 10

- 2

- Repost

- Share

Falcon_Official :

:

well-doneView More

BREAKING: Michael Saylor's 'Strategy' $MSTR buys 10,645 Bitcoin worth around $1B

This is 2nd time in a week saylor bought of that amount.

$BTC 🔥

#BEATTokenRisksIntensify #FOLKSFundingRateAndDelistingConcerns

This is 2nd time in a week saylor bought of that amount.

$BTC 🔥

#BEATTokenRisksIntensify #FOLKSFundingRateAndDelistingConcerns

BTC-2,18%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

127.48K Popularity

22.42K Popularity

19.87K Popularity

64.89K Popularity

9.41K Popularity

272.1K Popularity

308.03K Popularity

21.85K Popularity

11.57K Popularity

9.43K Popularity

9.88K Popularity

10.06K Popularity

8.68K Popularity

36.96K Popularity

News

View MoreThis week's unlock data overview: ZRO, ARB, KAITO, and others will undergo a one-time large token unlock.

33 m

Matrixport: Is a significant decline within 30 days a more frequent indicator of a bear market?

52 m

The Hong Kong Securities and Futures Commission issues a virtual asset trading platform license to VDX, bringing the total number of licensed platforms to 12.

1 h

"Maqi" increased HYPE long positions, with the account showing a floating loss of $330,000.

1 h

RootData: SOON will unlock tokens worth approximately $4.02 million in one week

1 h

Pin