Post content & earn content mining yield

placeholder

自信且优雅

#Trading Bot#我正在 Gate uses HYPEUSDT contract grid bot, with a total return since creation of +54.12%

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AwBFBl5c

- Reward

- 1

- 1

- Repost

- Share

User_any :

:

To The Moon 🌕Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4097?ref=UVhNB1EM&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

HI

Hi

Created By@EndTime

Listing Progress

0.00%

MC:

$0.1

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VlAWVA0O

View Original

- Reward

- like

- Comment

- Repost

- Share

Start the Year of the Horse with a win! Gate Plaza's $50,000 Red Envelope Rain is waiting for you to post and smash https://www.gate.com/campaigns/4044?ref=VLRFAV5WVA&ref_type=132

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQIXB1oL

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQAWAQ0K

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain every day, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVdEBg1b

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=XwBFB1td

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLJBA19FUQ

View Original

- Reward

- like

- Comment

- Repost

- Share

From 5,000 to 100,000, currently 88,227

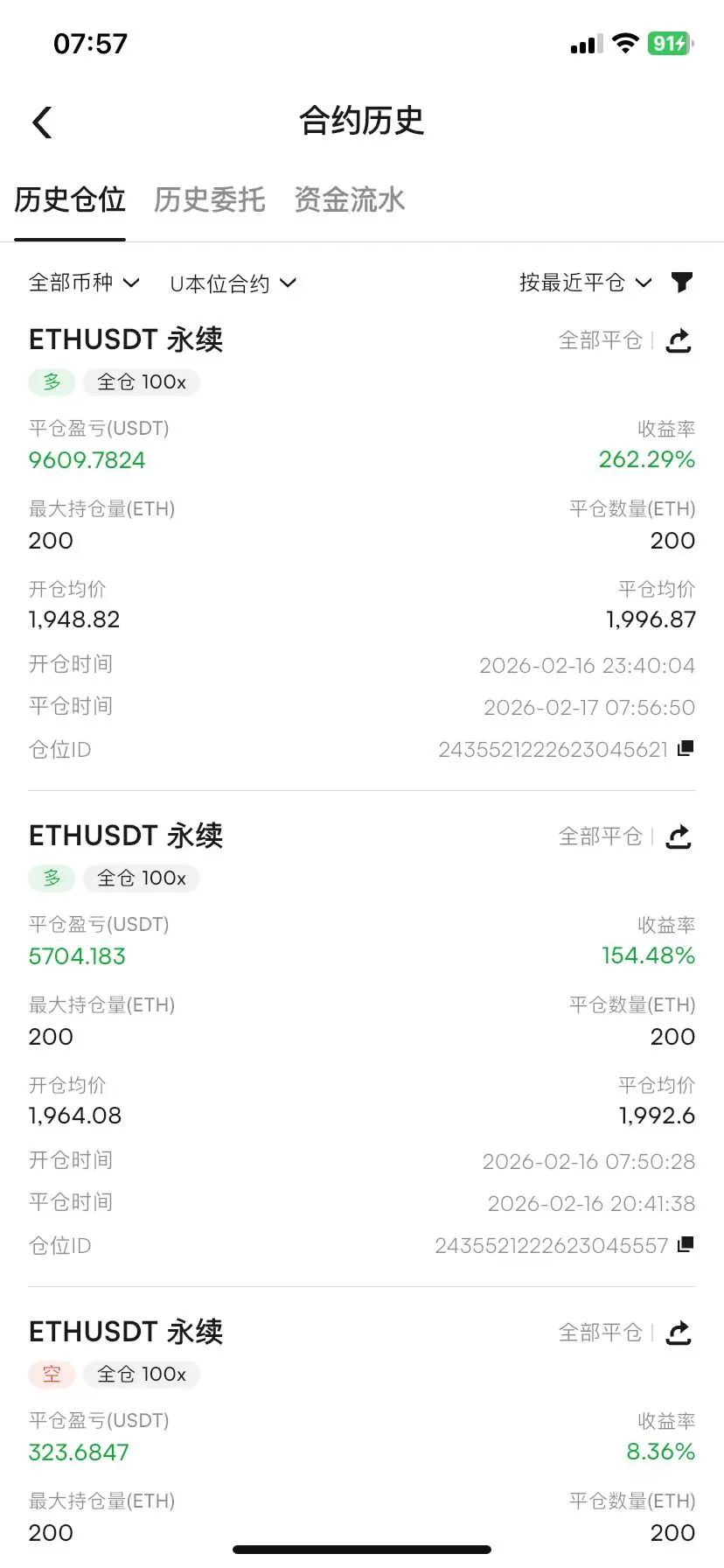

The mistress's long position has closed again. On the first day of the new year, waking up and feeling the joy of eating meat is still very nice. #Gate广场发帖领五万美金红包 #美国核心CPI创四年新低 #比特币下一步怎么走?

View OriginalThe mistress's long position has closed again. On the first day of the new year, waking up and feeling the joy of eating meat is still very nice. #Gate广场发帖领五万美金红包 #美国核心CPI创四年新低 #比特币下一步怎么走?

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQNCXFGJBG

View Original

- Reward

- like

- Comment

- Repost

- Share

D777

Dimzon777

Created By@Dimzon777

Listing Progress

0.00%

MC:

$2.5K

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVLFAWHXBG

View Original

- Reward

- like

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AlERV18M

View Original

- Reward

- like

- Comment

- Repost

- Share

Wish Everyone CroFam a happy Lunar New Year!

- Reward

- like

- Comment

- Repost

- Share

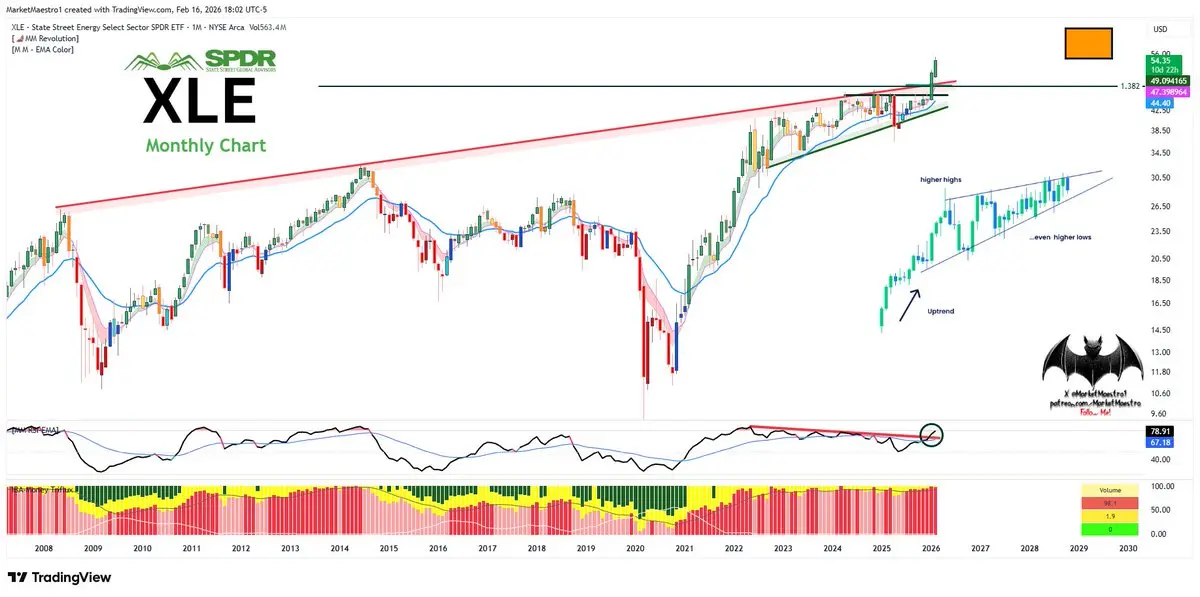

$XLE

Right now the setup is quite bullish. It broke out and keeps going without slowing down.

There are rumors in the background about a comprehensive deal between the U.S. and Russia, and if this ends with sanctions being loosened, XLE can face near term selling pressure.

Right now, energy markets are expecting a supply surplus for 2026. If a deal happens and sanctions on Russian oil/gas are lifted, Russia can supply global markets (especially Western markets) much more easily and in higher volumes. Extra Russian supply entering a market that’s already expected to be well supplied can push Br

Right now the setup is quite bullish. It broke out and keeps going without slowing down.

There are rumors in the background about a comprehensive deal between the U.S. and Russia, and if this ends with sanctions being loosened, XLE can face near term selling pressure.

Right now, energy markets are expecting a supply surplus for 2026. If a deal happens and sanctions on Russian oil/gas are lifted, Russia can supply global markets (especially Western markets) much more easily and in higher volumes. Extra Russian supply entering a market that’s already expected to be well supplied can push Br

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLRHAFTABQ

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVZBUVBZCA

View Original

- Reward

- like

- Comment

- Repost

- Share

Alpha Score Speedrun Graduation Day Welcome

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More160.03K Popularity

31.33K Popularity

27.83K Popularity

73.77K Popularity

13.73K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.53KHolders:20.00%

- MC:$2.5KHolders:10.00%

- MC:$0.1Holders:00.00%

- MC:$0.1Holders:10.00%

News

View MoreThe probability that the Federal Reserve will keep interest rates unchanged in March is 92.2%.

6 m

Harvard University established its first Ethereum ETF position in Q4 2025 and reduced its Bitcoin ETF holdings by approximately 21%.

10 m

Wintermute launches institutional-grade tokenized gold trading, with an expected market size of $15 billion by 2026

46 m

The Crypto Fear and Greed Index drops to its lowest point in history, and market sentiment remains bearish.

47 m

ETH Breaks Through 2000 USDT

2 h

Pin