Post content & earn content mining yield

placeholder

SHOLEH0X

TON’s DeFi Is Designed for Scale

Scaling DeFi is not just about handling more transactions per second. It is about maintaining quality as usage grows.

Many networks can process transactions quickly, but struggle when:

Liquidity becomes fragmented

Slippage increases

Execution becomes unreliable

Infrastructure breaks under demand

User experience deteriorates

TON approaches scaling differently.

It combines:

A high-performance blockchain with low fees and fast finality

Native distribution through Telegram

Invisible UX design

Aggregated liquidity routing

And professional liquidity infrastructure

Th

Scaling DeFi is not just about handling more transactions per second. It is about maintaining quality as usage grows.

Many networks can process transactions quickly, but struggle when:

Liquidity becomes fragmented

Slippage increases

Execution becomes unreliable

Infrastructure breaks under demand

User experience deteriorates

TON approaches scaling differently.

It combines:

A high-performance blockchain with low fees and fast finality

Native distribution through Telegram

Invisible UX design

Aggregated liquidity routing

And professional liquidity infrastructure

Th

TON-0,58%

- Reward

- like

- Comment

- Repost

- Share

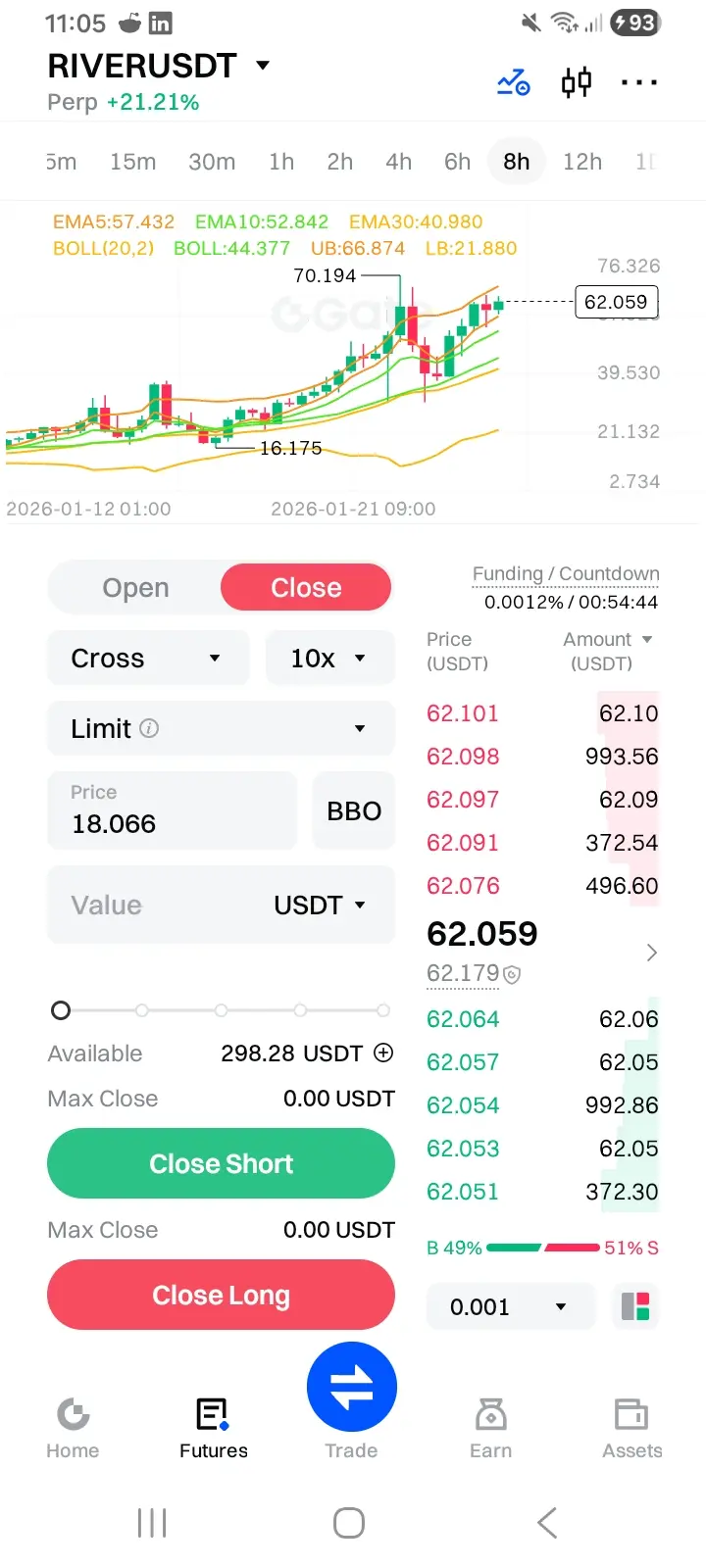

【$CLANKER Signal】Long | Healthy Reset After Volume Breakout

$CLANKER After a 21.64% volume-driven surge, the price is currently cooling and consolidating at high levels. The price action indicates healthy profit-taking rather than top distribution, with buying pressure continuously absorbing selling in the key support zone.

🎯 Direction: Long

🎯 Entry: 32.50 - 33.00

🛑 Stop Loss: 30.80 ( Rigid stop loss, invalidates structure if broken )

🚀 Target 1: 36.50

🚀 Target 2: 40.00

Market logic is hardcore: after a massive rally, there was no panic selling, but instead sideways consolidation replac

$CLANKER After a 21.64% volume-driven surge, the price is currently cooling and consolidating at high levels. The price action indicates healthy profit-taking rather than top distribution, with buying pressure continuously absorbing selling in the key support zone.

🎯 Direction: Long

🎯 Entry: 32.50 - 33.00

🛑 Stop Loss: 30.80 ( Rigid stop loss, invalidates structure if broken )

🚀 Target 1: 36.50

🚀 Target 2: 40.00

Market logic is hardcore: after a massive rally, there was no panic selling, but instead sideways consolidation replac

CLANKER12,87%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$30.16K

Create My Token

- Reward

- like

- Comment

- Repost

- Share

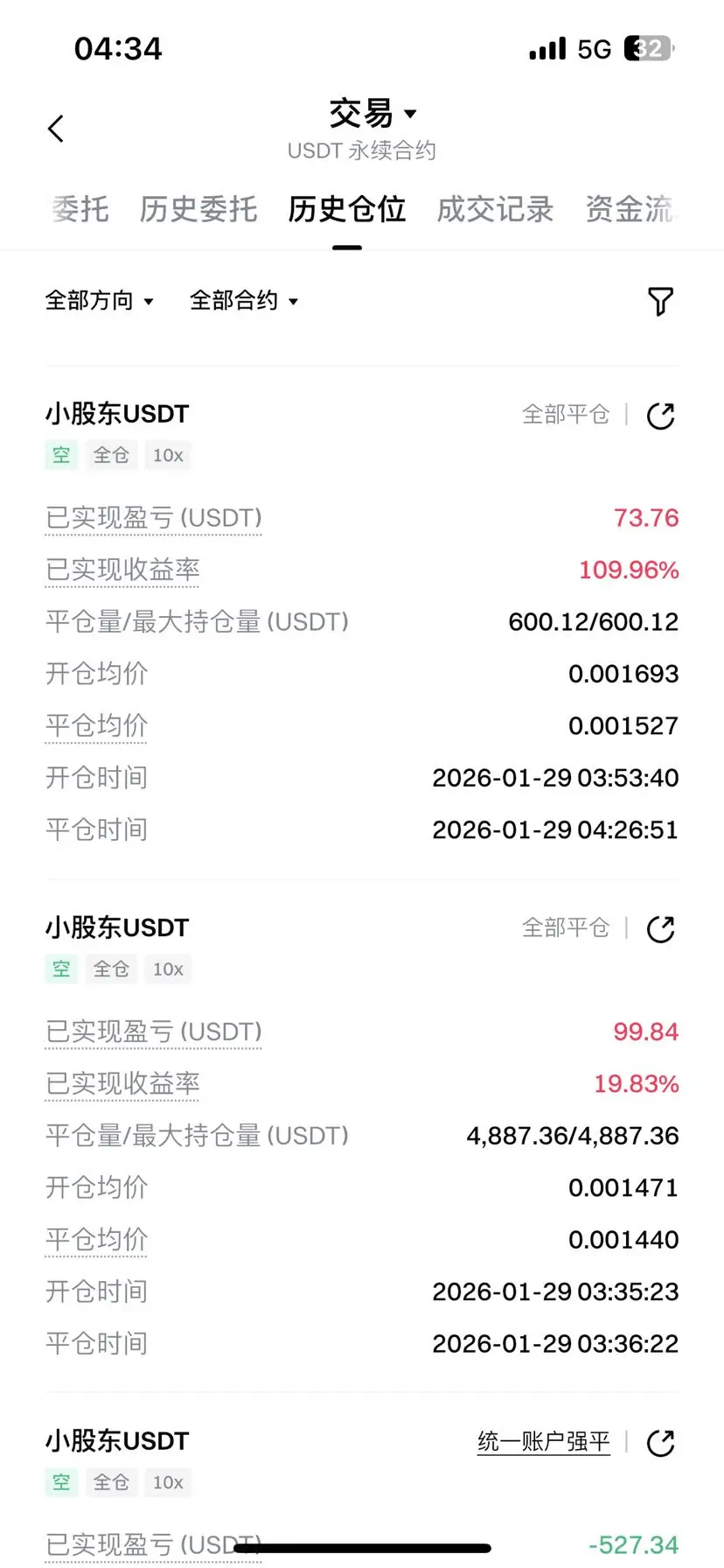

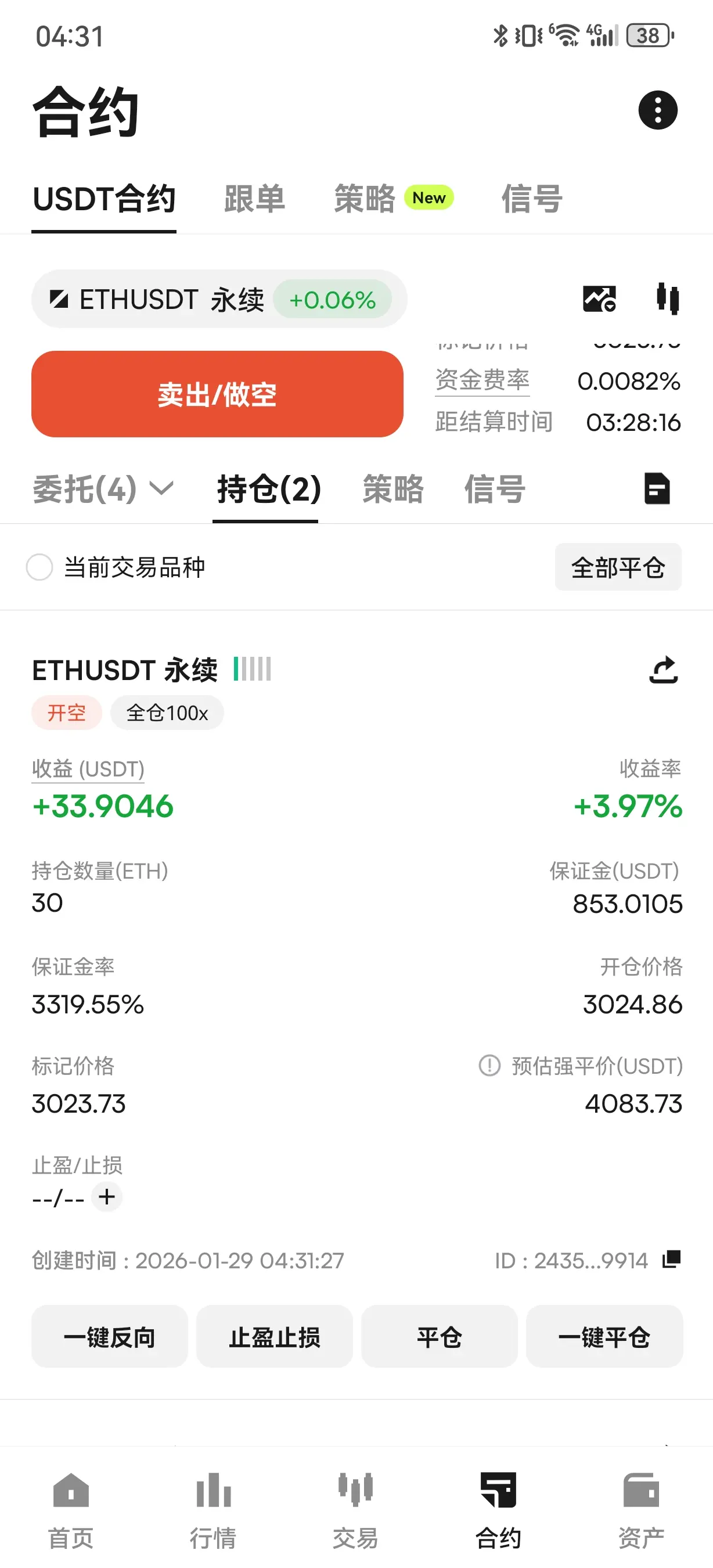

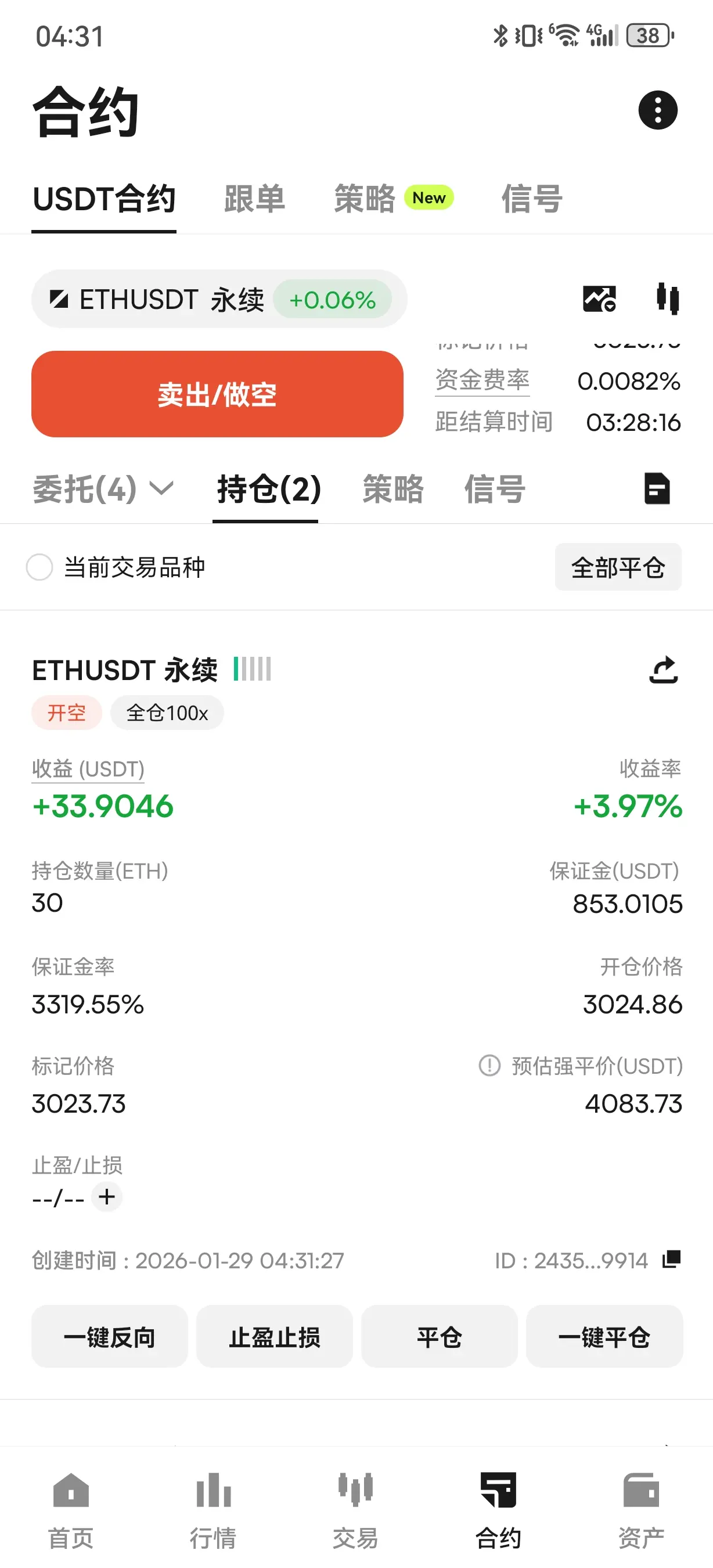

#晒出带单成就##速来!跟我赚钱##稳健带单长线收益#K-line's red and green fluctuations will eventually return to the规律, don't let temporary震荡绑架 your emotions, don't let greed and恐惧牵着 your rhythm. Use闲钱 to enter the market,守住止损止盈的底线, avoid追涨 and盲从, slow down and稳一点, you can走得更远. After the low rebound from 87267, the current high has reached 90592; similarly, after the low rebound from 2784, the current high has reached 3045. The回踩需求 is明确! Changsheng daily intraday布局大饼一空两多, gaining over 3267 points of space! Simultaneously,布局以太, gaining over 119 points of space!

Today’s market continues its强势格局, Bitcoin successfully突破关

View OriginalToday’s market continues its强势格局, Bitcoin successfully突破关

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 WHITE HOUSE JUST ANNOUNCED TO GATHER BANKING AND CRYPTO INDUSTRY EXECUTIVES TO ADVANCE CRYPTO MARKET STRUCTURE BILLIT’S FINALLY HAPPENING

- Reward

- like

- Comment

- Repost

- Share

It\'s dumptime Jerome Powell. Wrap it up

- Reward

- like

- Comment

- Repost

- Share

Strategy vs. The Mag 7 vs. Bitcoin in the Bitcoin Standard Era

NVIDIA (NVDA): 17.38×, 1,637.5%

Strategy (MSTR): 11.73×, 1,073.2%

Bitcoin (BTC): 7.74×, 674.1%

Tesla (TSLA): 4.70×, 370.3%

Alphabet (GOOGL): 4.52×, 352.0%

Meta (META): 2.63×, 162.8%

Apple (AAPL): 2.36×, 136.1%

Microsoft (MSFT): 2.36×, 136.3%

Amazon (AMZN): 1.59×, 58.9%

NVIDIA (NVDA): 17.38×, 1,637.5%

Strategy (MSTR): 11.73×, 1,073.2%

Bitcoin (BTC): 7.74×, 674.1%

Tesla (TSLA): 4.70×, 370.3%

Alphabet (GOOGL): 4.52×, 352.0%

Meta (META): 2.63×, 162.8%

Apple (AAPL): 2.36×, 136.1%

Microsoft (MSFT): 2.36×, 136.3%

Amazon (AMZN): 1.59×, 58.9%

BTC-0,17%

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4-gold-lucky-draw?ref=VVIRUVLWUG&ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

坐庄开始

过年坐庄

Created By@Cy168

Subscription Progress

0.00%

MC:

$0

Create My Token

Check in to Stream, Sprint for VIP+1 and Monthly Bonus https://www.gate.com/campaigns/3899?ref=BVIRBA8M&ref_type=132

- Reward

- 12

- 12

- Repost

- Share

MGİ :

:

2026 GOGOGO 👊View More

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

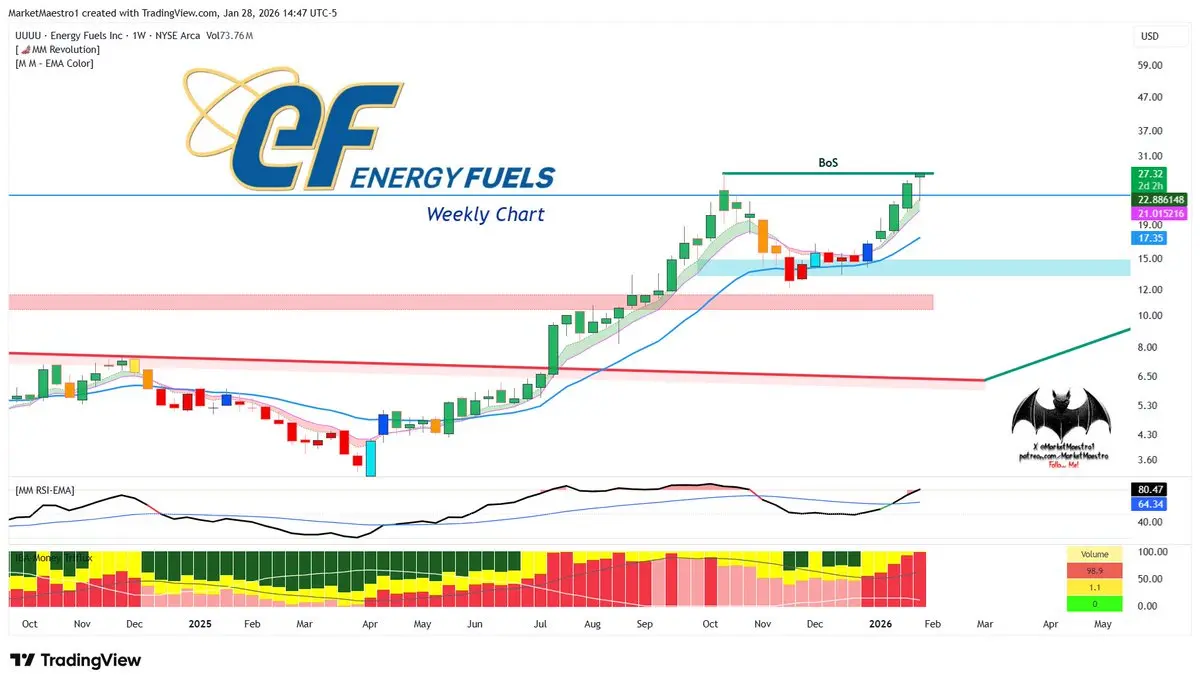

$UUUUI see a higher probability of a BoS breakout 🤞

- Reward

- like

- Comment

- Repost

- Share

SMCI STOCK 🚨 JAN 28

- Reward

- like

- Comment

- Repost

- Share

View Original

- Reward

- like

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 1

- 13

- Repost

- Share

ox_Alan :

:

join the live and claim the redpocket 🧧🧧🧧 fastView More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More17.53K Popularity

80.63K Popularity

33.42K Popularity

11.35K Popularity

12.17K Popularity

Hot Gate Fun

View More- MC:$3.43KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.5KHolders:20.19%

- MC:$3.43KHolders:10.00%

- MC:$3.43KHolders:10.00%

News

View MoreChris Grisanti: Federal Reserve statement leans hawkish, inflation becomes the primary concern

10 m

Spot gold breaks through $5350/oz, reaching a new all-time high

20 m

The probability of the Federal Reserve cutting interest rates by 25 basis points in March has decreased to 11.9%, while the probability of holding rates steady has increased to 88.1%.

24 m

Powell: We need to closely monitor inflation

32 m

Powell: Cannot prematurely declare victory on inflation

32 m

Pin