Uniswap (UNI) News Today

Latest crypto news and price forecasts for UNI: Gate News brings together the latest updates, market analysis, and in-depth insights.

Uniswap Fee Switch Fallout: Is UNI Ready to Bounce or Break?

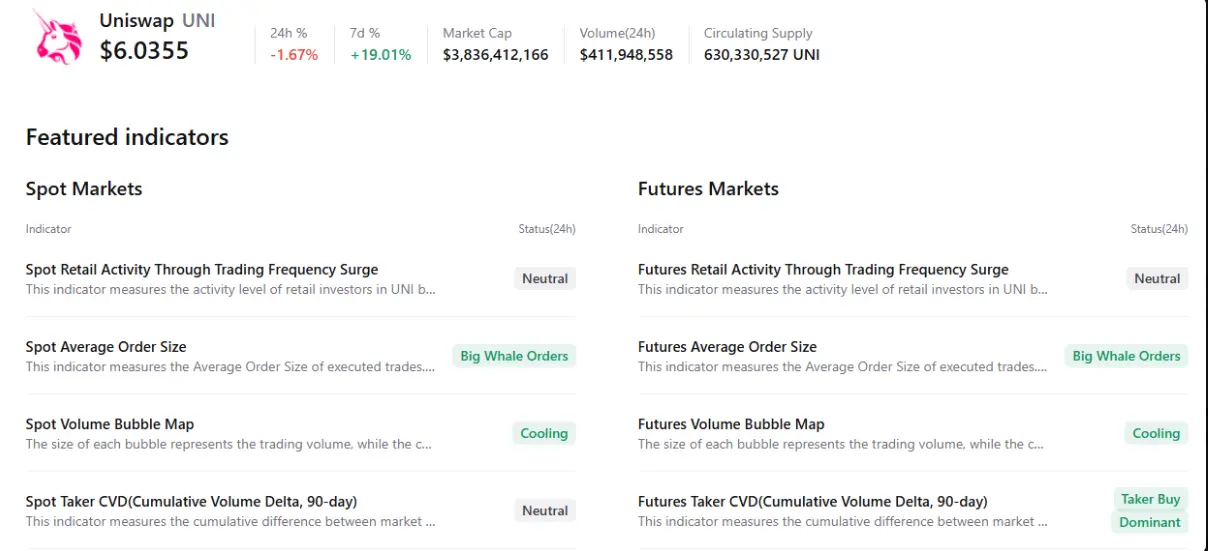

UNI Support: Bulls defend $5.50 demand zone, showing short-term resilience despite weak volume.

Protocol Upgrade: Fee switch and UNI burn strengthen fundamentals and boost market confidence.

Resistance Levels: $6.25-$6.55 and $6.65-$8.25 zones may limit gains; drop below $5.30 risks

CryptoNewsLand·7h ago

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history.

UNI-0,83%

CoinsProbe·01-03 06:26

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history.

UNI-0,83%

CoinsProbe·01-02 06:25

Bitwise Targets AAVE, UNI, SUI and More in New Wave of Crypto ETF Filings

Bitwise files with the SEC for 11 new crypto ETFs, providing exposure to tokens like AAVE, TRX, UNI, and others.

The proposed ETFs use a hybrid structure with up to 60% in underlying crypto assets and 40% in derivatives and ETPs.

Crypto asset manager Bitwise has filed applications with the U

CryptoNewsFlash·01-01 13:46

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history.

UNI-0,83%

CoinsProbe·01-01 06:20

Bitwise Targets AAVE, UNI, SUI and More in New Wave of Crypto ETF Filings

Bitwise files with the SEC for 11 new crypto ETFs, providing exposure to tokens like AAVE, TRX, UNI, and others.

The proposed ETFs use a hybrid structure with up to 60% in underlying crypto assets and 40% in derivatives and ETPs.

Crypto asset manager Bitwise has filed applications with the U

CryptoNewsFlash·2025-12-31 13:45

Uniswap Burns 100M UNI and Launches Ongoing Protocol Burn

Uniswap has burned 100 million UNI tokens, reducing the supply by 16%. This move, part of the UNIfication proposal, introduces a continuous burn model funded by transaction fees, aimed at enhancing long-term value appreciation.

CryptoNewsFlash·2025-12-30 10:30

Uniswap Burns $596M in UNI Following Fee Switch Vote—What’s Next?

Uniswap Executes Historic Token Burn Following Governance Approval

Uniswap has carried out a significant token burn, removing 100 million UNI tokens valued at approximately $596 million from its treasury. This move follows the recent approval of its long-anticipated fee burning proposal, marking a

UNI-0,83%

CryptoBreaking·2025-12-29 07:55

Gate Research Institute: Structural Recovery During Holiday Window | UNI Deflation Mechanism Implementation

Cryptocurrency Asset Overview

BTC (+0.69% | Current Price: 88,358 USDT)

After two days of sideways movement over the weekend, BTC experienced a slight increase to around $88,300, returning above the MA5, MA10, and MA30 moving averages. The short-term structure has shifted from weak to stable, with the moving averages showing a recovery from bearish to bullish. From a key price level perspective, the $88,800–$89,500 range above is a zone of short-term previous highs with dense trading activity and resistance from long upper shadows, which may require repeated digestion in the near term. It is important to note that we are currently in the Christmas holiday period overlapping with the New Year’s Day, during which participation from European, American, and Asian institutions has decreased, and overall liquidity is relatively weak. Prices are more susceptible to amplified fluctuations under low trading volume conditions. However, the credibility of a trend breakout remains limited, so short-term movements are more likely to oscillate within a range.

GateResearch·2025-12-29 07:09

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history.

UNI-0,83%

CoinsProbe·2025-12-29 06:15

Uniswap enters the deflationary era! $600 million token burn mechanism permanently activated

Uniswap Labs executed the largest token burn in history on December 27, permanently removing 100 million UNI tokens, with a market value of approximately $600 million at the time. This move implements the core mechanism of the UNIfication governance proposal, shifting the protocol from a fee accumulation model to a deflationary-driven framework. Protocol fees generated by Uniswap v2 and v3 will continue to be used for market repurchases and burning of UNI, gradually reducing the circulating supply.

UNI-0,83%

MarketWhisper·2025-12-29 01:45

UNI rallies after Uniswap removes $596M worth of tokens from supply

Uniswap recently executed a 100 million UNI token burn, permanently removing approximately $596 million worth of tokens from circulation.

Summary

Uniswap permanently burned 100M UNI after a 99.9% governance vote passed UNIfication.

Protocol fees are now live while interface fees remain zero

U

Cryptonews·2025-12-28 14:54

Uniswap Burns 100M UNI Worth $591M After Fee Proposal

Uniswap’s “UNIfication” burn removes 100M UNI, transforming the token from governance-only to value-accruing asset.

Over 125M votes supported fee burns, now directly tying protocol usage to token supply reduction.

UNI wallet holds $1.7B, mainly in UNI; smaller transfers of ETH, USDC,

CryptoFrontNews·2025-12-28 14:41

Uniswap Burns 100M UNI Worth $596M After Fee-Burn Approval

_Uniswap executes historic UNI burn after governance approval, reducing supply, activating protocol fees, and strengthening the token’s deflationary model._

Uniswap has completed a landmark token burn that reshapes its economic structure. The protocol burned 100m UNI. The value was almost $596 m

UNI-0,83%

LiveBTCNews·2025-12-28 12:50

Uniswap Burns $596M in UNI Following Fee Switch Vote—What’s Next?

Uniswap Executes Historic Token Burn Following Governance Approval

Uniswap has carried out a significant token burn, removing 100 million UNI tokens valued at approximately $596 million from its treasury. This move follows the recent approval of its long-anticipated fee burning proposal, marking a

UNI-0,83%

CryptoBreaking·2025-12-28 07:50

UNI at a Crossroads After Uniswap Fee Switch Goes Live

Uniswap activated protocol fees and burned UNI, strengthening long-term token economics.

Market reaction stayed cautious despite strong governance consensus and DEX volume leadership.

Technical signals suggest UNI faces consolidation or downside risk near key liquidity zones.

Uniswap — U

CryptoNewsLand·2025-12-28 06:36

Uniswap Executes Major UNI Token Burn — Could This Bullish Pattern Signal Further Gains?

Date: Sun, Dec 28, 2025 | 05:58 AM GMT

Uniswap is back in the spotlight after executing one of the largest token burn events in its history.

UNI-0,83%

CoinsProbe·2025-12-28 06:10

Uniswap burns 100 million UNI worth nearly $600 million after approving the fee burn mechanism

Uniswap has burned 100 million UNI tokens, worth approximately $596 million USD, after the community approved the burn fee proposal. This action aims to reduce the token supply, create deflationary pressure, and increase the value of UNI in the future.

UNI-0,83%

TapChiBitcoin·2025-12-28 02:48

UNIfication Greenlights 100M UNI Burn and Switches On Protocol Fees

Key Takeaways:

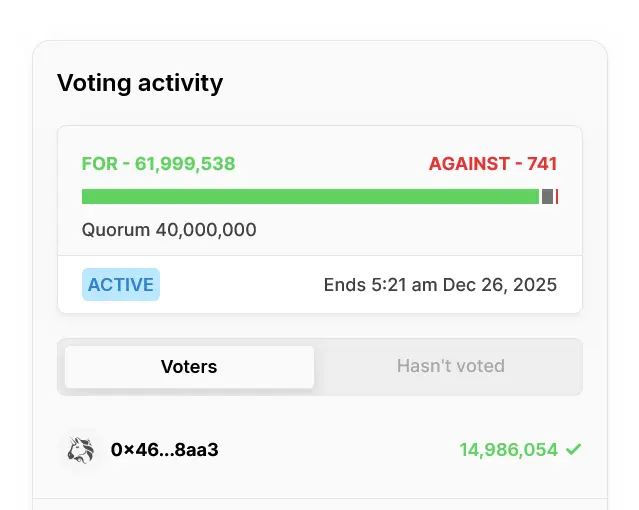

The proposal of UNIfication has been passed by more than 125 million UNI votes by Uniswap governance, which was well above the expected quorum.

This choice opens a one-time burn of 100 million UNI of the treasury and protocol-level trading fees following a brief timelock.

The

UNI-0,83%

CryptoNinjas·2025-12-27 15:01

UNIfication Proposal Passes, Turning UNI Into a Value-Accruing Asset

Uniswap Labs and the Uniswap Foundation have gained strong community support for the UNIfication proposal, linking UNI token value to platform activity through fee activation and significant burns. This governance shift aligns UNI with protocol revenue, enhancing its value.

UNI-0,83%

ICOHOIDER·2025-12-26 14:00

Uniswap Governance Approves UNIfication Proposal With Near Unanimous Support

Uniswap activated a fee system that burns UNI tokens as trading activity across the protocol continues to grow.

Governance approval shows strong holder alignment around linking protocol usage directly to long term UNI supply reduction.

Operational changes centralize Uniswap governance

UNI-0,83%

CryptoNewsLand·2025-12-26 11:36

“How do tokens reflect returns”… Uniswap redraws the new landscape of DeFi governance with “UNIfication”

Exilist (엑시리스트) recently focused its research report on the lack of actual value in governance tokens within DeFi and the fundamental policy shift of Uniswap (유니스왑). The study defines Uniswap's "UNIfication" proposal as an event that goes beyond a simple token burn, fundamentally restructuring the protocol's profit model and capital distribution structure.

So far, governance tokens have struggled to provide a practical narrative beyond "voting rights." Although Uniswap has generated revenue and expanded its ecosystem, criticism persists that UNI holders perceive minimal value. In response, the "UNIfication" governance vote held in December 2025 was overwhelmingly approved with 125,342,017 UNI in favor and 742 UNI against. The core of the proposal is: ▲ from the treasury

UNI-0,83%

TechubNews·2025-12-26 10:43

UNI Surges on Governance Vote While Broader Market Stalls

Table of Contents

2. Uniswap Eyes Resistance Amid Price Struggles

4. Conclusion

A governance decision has sparked a significant rally for UNI, capturing the spotlight in a sluggish market. This sudden surge creates a buzz, overshadowing the stagnation seen in many other

CryptoDaily·2025-12-25 13:46

Uniswap (UNI) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

Date: Thu, Dec 18, 2025 | 09:55 AM GMT

The broader cryptocurrency market has been experiencing choppy price action over the past several weeks, a

CoinsProbe·2025-12-25 10:26

4 Altcoins Face Pivotal Events Before Christmas: UNI, HYPE, ASTER, and HUMA

As the crypto market heads into the final week before Christmas, several major altcoins are on the brink of significant governance votes and tokenomics changes that could reshape their long-term supply dynamics.

CryptopulseElite·2025-12-25 08:42

Uniswap (UNI) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

The broader cryptocurrency market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10. That correction dragged Ethereum (ETH)

CoinsProbe·2025-12-24 10:11

Uniswap Fee Switch Proposal Nears Approval as 99% of UNI Voters Support Token Burn

Uniswap’s UNIfication proposal has received over 69 million votes from UNI holders, with only 700 voting against it as the Dec. 25 deadline nears.

UNIfication proposes a fee model switch where Uniswap will now collect the fees previously going to LPs to buy and burn UNI tokens.

Uniswap is ed

UNI-0,83%

CryptoNewsFlash·2025-12-24 09:10

The price of Uniswap (UNI) is aiming for a breakthrough as the market awaits the results of the UNIfication vote.

The price of Uniswap (UNI) continues to hold steady above the 6 USD mark at the time of writing on Tuesday, after finishing the previous week with a strong close above the key resistance zone. Traders' attention is currently focused on the long-awaited UNIfication proposal, which is expected to close on Thursday and

UNI-0,83%

TapChiBitcoin·2025-12-23 13:08

UNI Surges on Governance Vote While Broader Market Stalls

Uniswap's UNI token has surged following a governance decision, contrasting with a stagnant market. Currently priced between $5.14 and $6.80, it faces resistance at $7.48. Its future remains cautiously optimistic amid mixed short-term indicators.

CryptoDaily·2025-12-23 12:03

Uniswap (UNI) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

Date: Thu, Dec 18, 2025 | 09:55 AM GMT

The broader cryptocurrency market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10. That correction dragged Ethereum

CoinsProbe·2025-12-23 10:08

Uniswap Fee Switch Proposal Nears Approval as 99% of UNI Voters Support Token Burn

Uniswap’s UNIfication proposal has received over 69 million votes from UNI holders, with only 700 voting against it as the Dec. 25 deadline nears.

UNIfication proposes a fee model switch where Uniswap will now collect the fees previously going to LPs to buy and burn UNI tokens.

Uniswap is ed

UNI-0,83%

CryptoNewsFlash·2025-12-23 09:10

3 notable altcoins in the Christmas week of 2025

The Christmas week is known to be a volatile period in the market. However, this volatility does not always equate to a rise to the sky in the prices of cryptocurrency tokens. To transform volatility into a bullish trend, cryptocurrencies need to rely on supportive factors.

TapChiBitcoin·2025-12-23 07:03

Here’s Why Uniswap Fee Switch Vote Could Change UNI Value Overnight

Uniswap (UNI) processes around $80 billion in trading volume every month. Yet UNI holders receive nothing from that activity. No protocol fees. No revenue share. Just price speculation. That disconnect is now at the center of a governance vote that could redefine what the UNI token actually

CaptainAltcoin·2025-12-22 12:05

Uniswap (UNI) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

Date: Thu, Dec 18, 2025 | 09:55 AM GMT

The broader cryptocurrency market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10. That correction dragged Ethereum

CoinsProbe·2025-12-22 10:07

Uniswap to burn 100M UNI tokens as community backs “UNIfication” proposal

The Uniswap community has overwhelmingly approved the "UNIfication" proposal, which will implement token burns funded by trading fees, transfer responsibilities to Uniswap Labs, and establish a growth budget. UNI price has increased by over 25% amid the voting.

UNI-0,83%

Cryptonews·2025-12-22 08:18

Uniswap Token Sale by Vitalik Buterin Fails to Shake UNI

UNI remained stable despite Vitalik Buterin’s token sale and heavy short liquidity.

Price Compression signaled hesitation, not panic, as support near $4.81 held.

Traders watch the $5.6 liquidity band for potential breakout or continued downside risk.

UNI trading recently drew attention a

CryptoNewsLand·2025-12-22 07:43

Uniswap historic upgrade! 100 million tokens burned, UNI big pump 25%

The most significant protocol upgrade in Uniswap's seven-year history is about to take place. The fee switch proposal, known as "UNIfication," has received support from over 62 million votes, with voting ending on Thursday. This proposal will burn 100 million UNI tokens from the Uniswap Foundation treasury. Since the voting began, the price of UNI has experienced a big pump of about 25%.

UNI-0,83%

MarketWhisper·2025-12-22 02:08

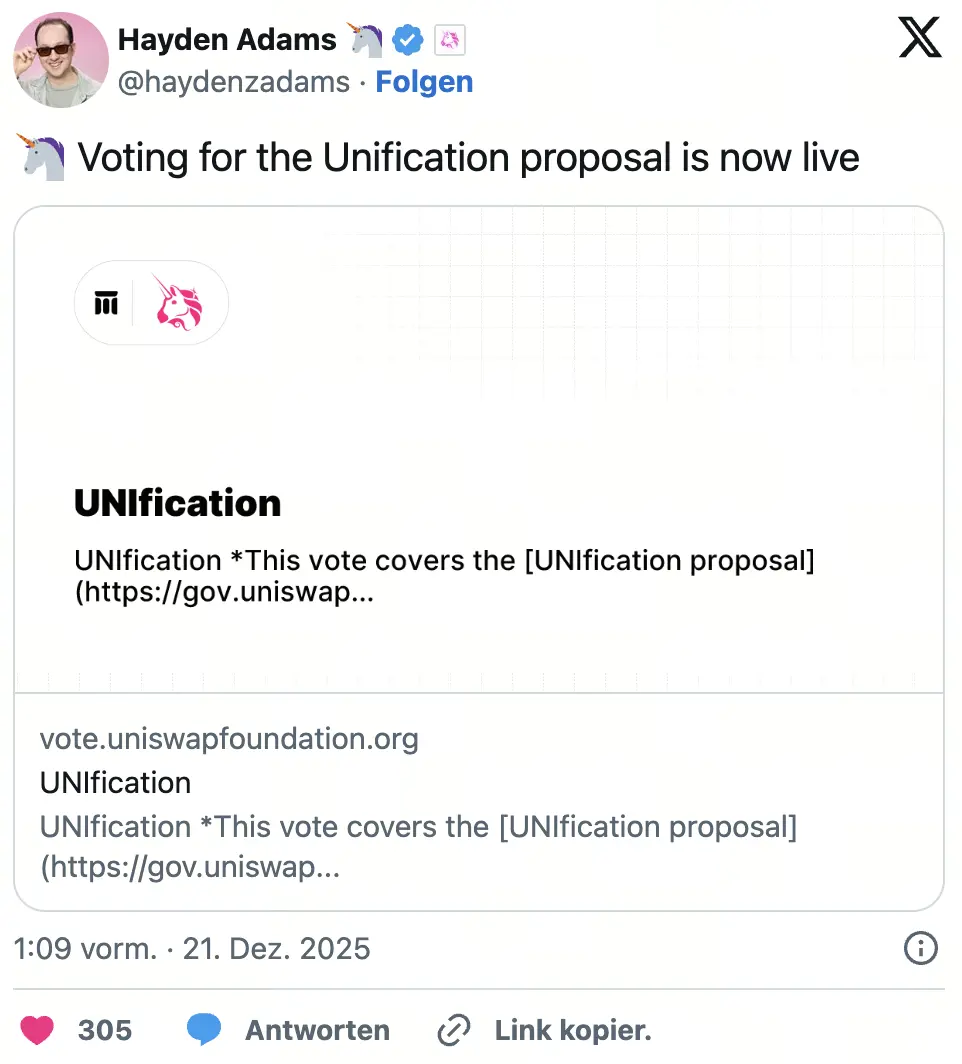

Uniswap fee switch to go live as community vote set to pass

The highly-anticipated Uniswap protocol fee switch, dubbed “UNIfication,” is set to pass and go live later this week, having reached the 40 million vote threshold needed to trigger one of the biggest upgrades in the decentralized exchange protocol’s seven-year history.

As of early Monday,

Cointelegraph·2025-12-22 00:35

Uniswap initiates protocol fee governance vote, UNI surges 19% in a single day.

As the overall performance of the crypto assets market remains relatively subdued, the governance dynamics of the decentralized exchange Unification have become the focus of funding attention. An important governance proposal regarding protocol fees and the introduction of a token burning mechanism has officially entered the on-chain voting phase, with the native token UNI of Uniswap experiencing a significant price increase of about 19% within 24 hours, outperforming major market assets.

UNI price skyrocketed, with a daily pump of about 19%.

According to the data from the Uniswap governance platform, this vote officially started at 03:50 UTC on December 20. Shortly after the voting began, the price of UNI showed a significant pump. From the daily chart of UNI against the US dollar on TradingView, the strongest price surge concentrated in the first few hours after the voting window opened, with the price quickly breaking through the previous level of about 5.4.

ChainNewsAbmedia·2025-12-21 10:56

Uniswap (UNI) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

Date: Thu, Dec 18, 2025 | 09:55 AM GMT

The broader cryptocurrency market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10. That correction dragged Ethereum

CoinsProbe·2025-12-21 10:03

Uniswap (UNI) Price Spikes as $626M Burn Proposal Gains Support, Yet Downtrend Holds

The Uniswap (UNI) price surged higher in the latest session, pushing roughly 17% above prior levels as aggressive spot buying entered the market. Large individual purchases dominated order flow, with close to $1.25 million in buys representing a sizable share of total daily volume.

The rally

UNI-0,83%

CaptainAltcoin·2025-12-21 09:35

Vitalik has sold off many tokens including UNI and BNB

Vitalik Buterin, co-founder of Ethereum, recently sold various cryptocurrencies like UNI and BNB, transferring around $80,364 using privacy-focused RAILGUN, indicating a trend towards privacy in large transactions. His past sales often support charitable causes rather than signal market negativity.

TapChiBitcoin·2025-12-21 02:27

Uniswap (UNI) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

Date: Thu, Dec 18, 2025 | 09:55 AM GMT

The broader cryptocurrency market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10. That correction dragged Ethereum

CoinsProbe·2025-12-20 10:01

Uniswap (UNI) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

Date: Thu, Dec 18, 2025 | 09:55 AM GMT

The broader cryptocurrency market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10. That correction dragged Ethereum

CoinsProbe·2025-12-19 10:01

Load More