Search results for "VC"

Crypto VC Outlook 2026: A Shift in the Winds! Funds Will Flow Into These Three "Certain" Tracks

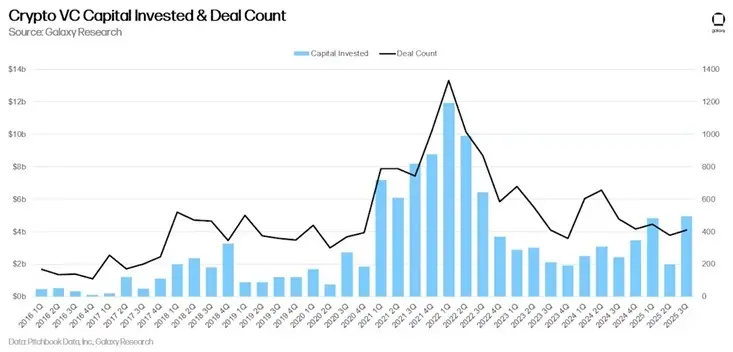

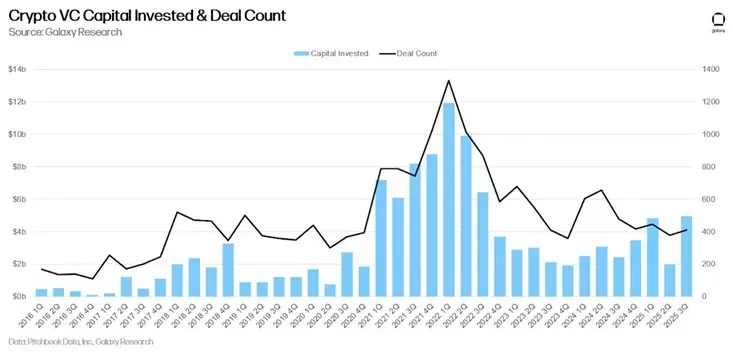

After experiencing the rollercoaster of 2025, the crypto venture capital market is standing at a critical crossroads. Although the total traditional VC investment has rebounded to $18.9 billion, the number of deals has plummeted by approximately 60% year-over-year, with funds highly concentrated in later-stage projects and DAT companies. Looking ahead to 2026, top investors generally expect the market to continue its rationality and discipline, with early-stage investments only experiencing a mild recovery, and token sales serving as a supplementary fundraising method. This article will delve into the underlying logic behind capital flows and reveal the certainty tracks and potential risks that institutions see in the coming year.

MarketWhisper·4h ago

Paradigm's Moment of Stagnation: When "Research-Driven" Meets Reality Test

Article by: Gu Yu, ChainCatcher

For a long time, Paradigm has been a flagship venture capital firm in the crypto industry, representing top-tier investment style and aesthetics in the field. Research-driven crypto VC firms are highly praised. However, due to industry cyclical influences, Paradigm has not been immune during the current downturn in VC, one of the manifestations being an unprecedented wave of executive departures. Since April this year, at least 7 employees have left, including several partners.

In December, Paradigm's first employee and general partner Charlie Noyes, along with Paradigm's Head of Market Development Nick Martitsch, announced their departures successively.

In September, Paradigm's Chief Legal Officer Gina Moon, among others, also left.

TechubNews·2025-12-30 08:04

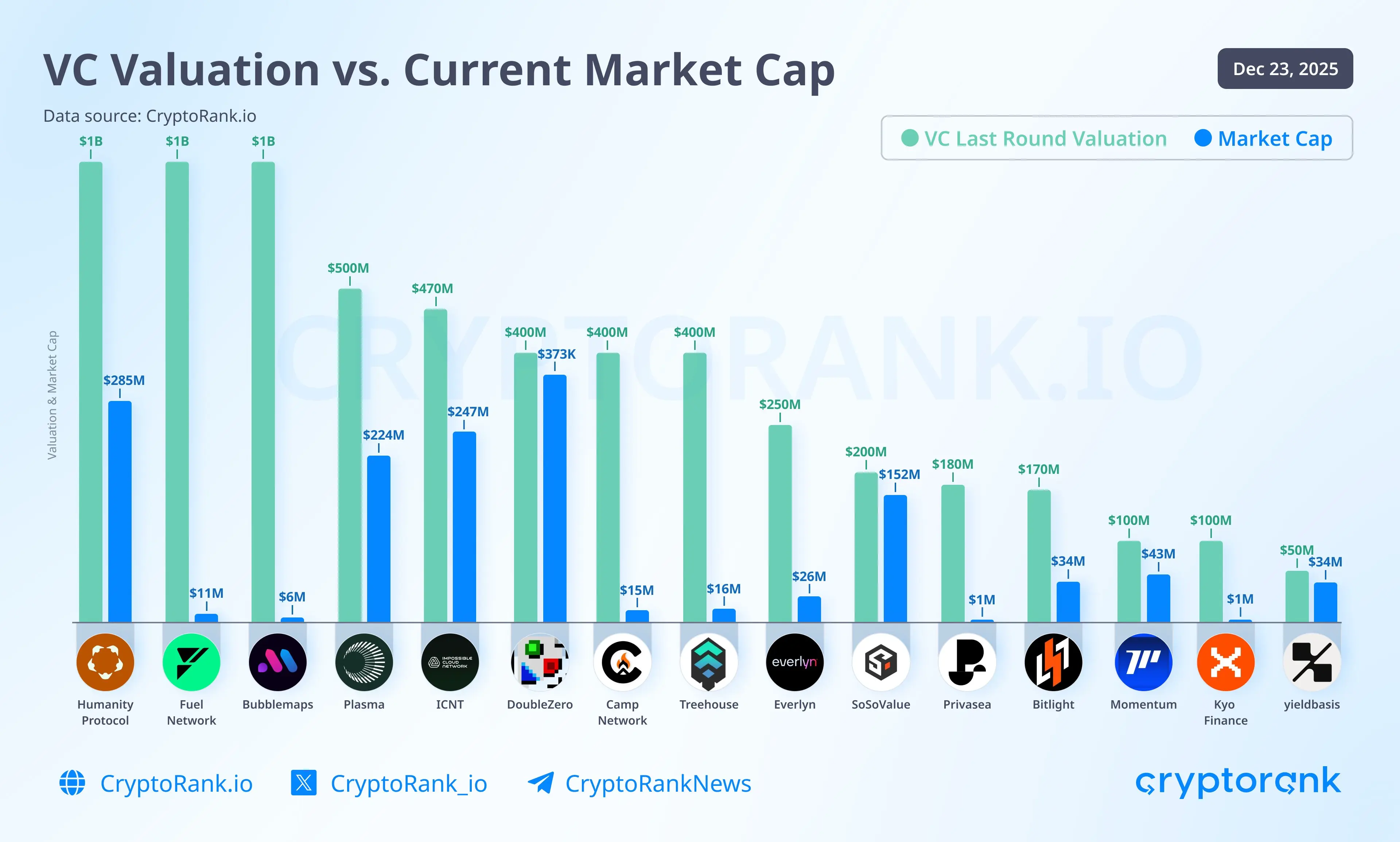

Hype VC bubble bursts as crypto projects in 2025 plummet disastrously

Crypto venture capital funds have poured billions of USD into early-stage tokens during the 2025 "risk-on" recovery. However, many of these bets are now trading significantly below the notable valuation levels seen in private funding rounds.

The widening gap between the figures

TapChiBitcoin·2025-12-30 00:24

Most Searched Crypto Presales of Late 2025: IPO Genie ($IPO) Climbs the Rankings

The AI-powered crypto presale democratizing pre-IPO investing and capturing global investor attention in late 2025

Finding upcoming crypto presales with low prices that aren’t overhyped, VC-controlled, or already priced for perfection

In a market flooded with short-lived narratives and insider-he

BlockChainReporter·2025-12-29 13:35

Crypto VC Funding: HashKey Group bags $250m, Architect raises $35m

The week of December 21-27, 2025, closed the year with $316.2 million in crypto funding across 8 visible projects.

Summary

Crypto projects raised $316.2M in the final week of 2025 across eight deals.

HashKey Group dominated funding with a massive $250M year-end raise.

Finance and trading

VC2,46%

Cryptonews·2025-12-27 13:36

V God is optimistic about the development of the prediction market but is contradicted by the founder: it's just an illusion supported by VC subsidies

Ethereum co-founder Vitalik Buterin believes that prediction markets can stabilize sentiment and approach the truth, but founder Leo Zhang points out that reality relies on VC subsidies, creating a false impression. The liquidity of prediction markets is mainly concentrated in easily quantifiable areas, lacking autonomous awareness of events, indicating unhealthy market behavior. Both perspectives reveal the gap between reality and ideals.

ETH0,86%

CryptoCity·2025-12-27 05:00

Which blockchain will win in the tokenization narrative? Dragonfly VC: The answer is not a binary choice.

Dragonfly partner Rob Hadick believes that in the future of asset tokenization, there will not be just one blockchain winning, but multiple chains coexisting and developing independently. Ethereum will dominate the financial sector, while Solana focuses on high-speed transactions. Market demand will drive the division of labor and collaboration among different blockchains, promoting overall development rather than simple competition.

ChainNewsAbmedia·2025-12-26 07:05

Ethereum Price Prediction: Rob Hadick Believes Both Ethereum and Solana Can Thrive in the Tokenization Space, DeepSnitch AI’s Surge To $890K Strengthens 100x Narrative

Rob Hadick of Dragonfly VC believes that Solana and Ethereum can coexist in the growing tokenization space. Moreover, he claims that no single blockchain can establish a monopoly as no network can “scale large enough” to cover all the sectors and use cases.

Meanwhile, the Ethereum price

CaptainAltcoin·2025-12-25 10:45

2025 EOY Report: VC of the Year

After a bruising multi-year downturn, 2025 marked a decisive comeback for crypto venture capital, led by a small group of firms shaping regulation, infrastructure, and consumer adoption.

Capital flowed again, but more selectively, and the firms that rose to the top were those with long-term

VC2,46%

Coinpedia·2025-12-24 17:09

Crypto downturn reveals gap between VC valuations and market cap

Several blockchain startups once valued near $1 billion now have market capitalizations that are only a fraction of those figures, as tighter liquidity forces valuation resets.

This is evident across several high profile projects, according to data compiled by CryptoRank.

Humanity Protocol,

VC2,46%

Cointelegraph·2025-12-24 10:15

Lighter Airdrop is coming: Is a valuation of 3.7 billion reasonable? Is now a chance to get in or catch a falling knife?

The on-chain Perpetual Futures exchange Lighter has opened its Airdrop registration. The current premarket price is around 3.75, corresponding to a FDV of 3.75 billion USD, while the latest valuation in the last round was 1.5 billion USD. The author has organized Hyperliquid's market capitalization to revenue ratio (PS Ratio), as well as the Lighter PS Ratio calculated using VC valuation and premarket valuation, suggesting that the current Lighter premarket price may not be a good entry point. On the other hand, the trading volume of Lighter divided by the open interest ratio is far higher than that of Hyperliquid, indicating that there may be some wash trading involved.

Lighter has opened the Airdrop submission page

Click on Points in Lighter, then proceed to

HYPE5,78%

ChainNewsAbmedia·2025-12-22 04:24

Adam Back Criticizes Bitcoiner VC for Ignoring Quantum Threat

Bitcoin Community Responds to Quantum Computing Threats and Industry Investment

Recent debates within the cryptocurrency sector have spotlighted concerns about the emerging threat of quantum computing to Bitcoin’s security. While some industry leaders advocate caution, others suggest the

BTC1,38%

CryptoDaily·2025-12-21 06:00

Adam Back slams Bitcoiner VC for ‘uninformed noise’ about quantum risk

Blockstream CEO Adam Back has criticized Castle Island Ventures founding partner Nic Carter for amplifying concerns about quantum computing threats to Bitcoin.

“You make uninformed noise and try to move the market or something. You’re not helping,” Back said in an X post on Friday, after Carter

BTC1,38%

Cointelegraph·2025-12-21 05:25

Arthur Hayes: The alt season has already arrived, you just refuse to admit it, HYPE and SOL are the undeniable proof.

BitMEX founder Arthur Hayes reveals the new market norm for 2025: ETF fund stickiness breaks the old rotation rules, alt season is still here but only belongs to a few high-quality assets.

(Previous Summary: Arthur Hayes warns that Monad could plummet 99%: high valuation and low circulation VC coin)

(Background information: Monad is officially launched! $MON opening price performance, token economics, Coinbase public sale results.. all organized)

Table of Contents

Spot ETF builds high walls, capital no longer seeps in arbitrarily.

Selective Bull Market: The Victory of Elite Assets

2026 Outlook: Market Logic Enters the Era of Stock Pickers

In the two months since Bitcoin's fluctuation down to $126,000, the alt season index has also continued to decline, and many retail investors are struggling.

動區BlockTempo·2025-12-21 04:55

Crypto VC Funding: RedotPay leads with $107m, Fuse bags $70m

During the week of December 14-20, 2025, crypto VC funding reached $335.1 million across 18 projects. Key highlights include RedotPay's $107 million Series B, Fuse's $70 million Series B, and METYA's $50 million funding, reflecting a growing trend in digital finance investment.

XDC2,2%

Cryptonews·2025-12-20 13:06

SBI VC Trade Launches Recruitment for Rent Coin Lending Service

SBI VC Trade is launching a recruitment round for its Rent Coin lending service, allowing users to lend cryptocurrencies for interest payments. This initiative caters to the growing demand for passive income options in the crypto space.

CryptoDaily·2025-12-20 10:50

Adam Back Criticizes Bitcoiner VC for Ignoring Quantum Threat

Bitcoin Community Responds to Quantum Computing Threats and Industry Investment

Recent debates within the cryptocurrency sector have spotlighted concerns about the emerging threat of quantum computing to Bitcoin’s security. While some industry leaders advocate caution, others suggest the

BTC1,38%

CryptoDaily·2025-12-20 05:55

Adam Back slams Bitcoiner VC for ‘uninformed noise’ about quantum risk

Blockstream CEO Adam Back has criticized Castle Island Ventures founding partner Nic Carter for amplifying concerns about quantum computing threats to Bitcoin.

“You make uninformed noise and try to move the market or something. You’re not helping,” Back said in an X post on Friday, after Carter

BTC1,38%

Cointelegraph·2025-12-20 05:25

Binance Isn’t Rushing to List Kaspa (KAS), and This Interview Explains Why

Kaspa has never followed the usual crypto playbook. No presale. No VC allocations. No quiet deals happening behind closed doors. That difference matters more now than ever, especially as questions keep circling around why Binance has not rushed to list Kaspa token on its spot market.

A recent

CaptainAltcoin·2025-12-19 14:05

SBI VC Trade Launches Recruitment for Rent Coin Lending Service

SBI VC Trade, a leading cryptocurrency exchange and subsidiary of SBI Holdings, has announced the opening of a new recruitment round for its Rent Coin lending service. The recruitment period is set to begin on December 18, 2025, at 20:00 JST. This service allows users to lend their

CryptoDaily·2025-12-19 10:45

Pantera Partner: Crypto VC Returns to Professionalism and Rationality, Where is the Next Investment Hotspot?

Pantera Capital

Compiled & Edited by Yuliya, PANews

Recently, two partners of the top venture capital firm Pantera Capital, Paul Veradittakit and Franklin Bi, analyzed the current state and changes in the crypto investment market in their first podcast episode. They reviewed the speculative wave of altcoins over the past few years, analyzed the "ice and fire" phenomenon of this year’s record-high funding coupled with a significant decline in transaction volume, and debated topics such as project investment strategies, exit paths, DAT, tokenization, and zero-knowledge proofs. PANews has organized and compiled this blog post.

Crypto investment is returning to professionalism and rationality; team execution and asset appreciation are key to DAT competitiveness

Host: Today, we are going to discuss the current state of crypto venture capital. Data shows that

PANews·2025-12-19 07:19

Bear market venture capital cooling: Changes in crypto VC investment logic, where is the turning point in 2026?

As the cryptocurrency market enters a downtrend cycle, the movements of venture capital (VC) become a barometer for the industry. Since Bitcoin hit a record high of $126,000 in October 2025, its price has retraced approximately 25%, with the ripple effect quickly spreading to the primary market. This article delves into three major trends currently shaping the crypto VC market: downward revisions in startup valuation expectations, investment transactions concentrating on leading projects, and liquidity challenges following token generation events (TGE). Industry experts point out that the market downturn is prompting investors to shift from chasing short-term momentum to focusing on project fundamentals and long-term utility. The integration of artificial intelligence with blockchain, as well as the fusion of real-world assets (RWA) and blockchain, are seen as the most promising growth tracks for 2026.

MarketWhisper·2025-12-19 06:05

Say goodbye to building towers on sand, the transformative moment for crypto VC

Author: Nancy, PANews

From the former "investment barometer" to today's "VC fears," crypto venture capital is undergoing a necessary disillusionment and cleanup.

The darkest hour is also a moment of rebirth. This brutal de-bubbling process is forcing the crypto market to establish healthier and more sustainable valuation logic, and is also driving the industry back to rationality and maturity.

The star VC falls, the disillusionment of the elite halo

Another crypto venture capital firm has fallen. On December 17, Shima

PANews·2025-12-18 12:02

The brutal liquidation of the public chain market in 2025: thriving casinos, fake ghost towns, and VC's harvest game

Author: BlockWeeks Weekly

In the cryptocurrency market, if you only look at market cap, you'll see a thriving, flourishing digital utopia. Valuations in the hundreds of billions of dollars, grand technical whitepapers, the halo of Turing Award winners... everything seems to be the dawn of the next-generation internet.

But if you change your perspective — viewing only the “on-chain real revenue (Fees)” — you'll see a completely different, even chilling scene: in this so-called trillion-dollar market, the vast majority of “unicorns” are actually zombie companies that have long since ceased to breathe.

Recently, BlockWeeks conducted a detailed analysis of the “Fees” data from DeFiLlama's public chains, and we discovered an unavoidable structural problem: crypto public chains have entered a phase of “extreme profit concentration and long tail collective zombification.”

PANews·2025-12-18 04:04

VC "dead"? No, the industry is undergoing a brutal reshuffle

As a former VC investor, what are your thoughts on the current "VC is dead" rhetoric on Crypto Twitter?

Regarding the paid question, I’ll give a serious answer. I also have quite a few thoughts on this rhetoric.

First, the conclusion -

1. The fact that some VCs are already dead is undeniable.

2. Overall, VCs will not die; they will continue to exist and push the industry forward.

3. VCs are actually similar to projects and talent—they are entering a phase of "clearing out" and "big waves washing away the sand," somewhat like during the internet bubble of 2000. This is the "debt" from the last crazy bull run. After a few years of repayment, a new phase of healthy growth will begin, but the threshold will be much higher than before.

Now, let me elaborate on each point.

1. Some VCs are already dead

Asian VCs are probably the hardest hit in this round. Starting from this year, most of the top players have shut down or disbanded. The remaining few might not even make a deal once every few months, focusing on...

PANews·2025-12-18 03:07

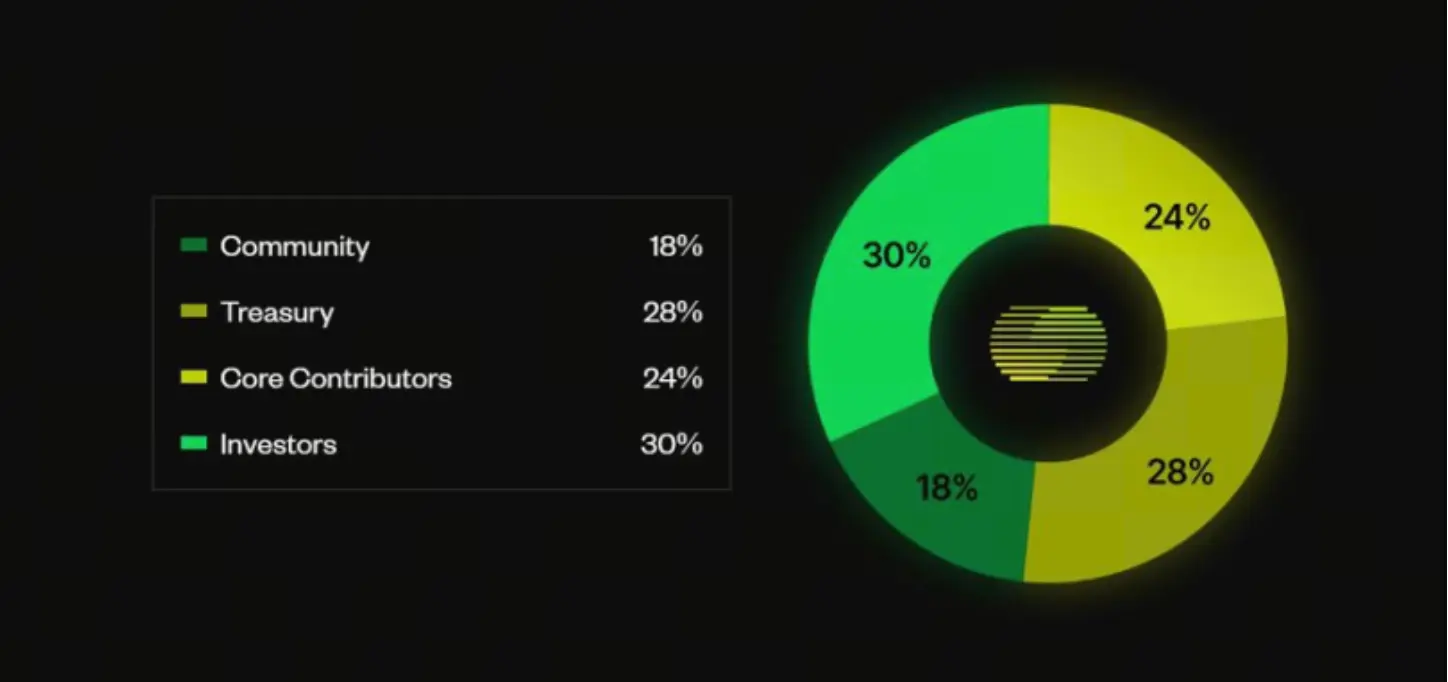

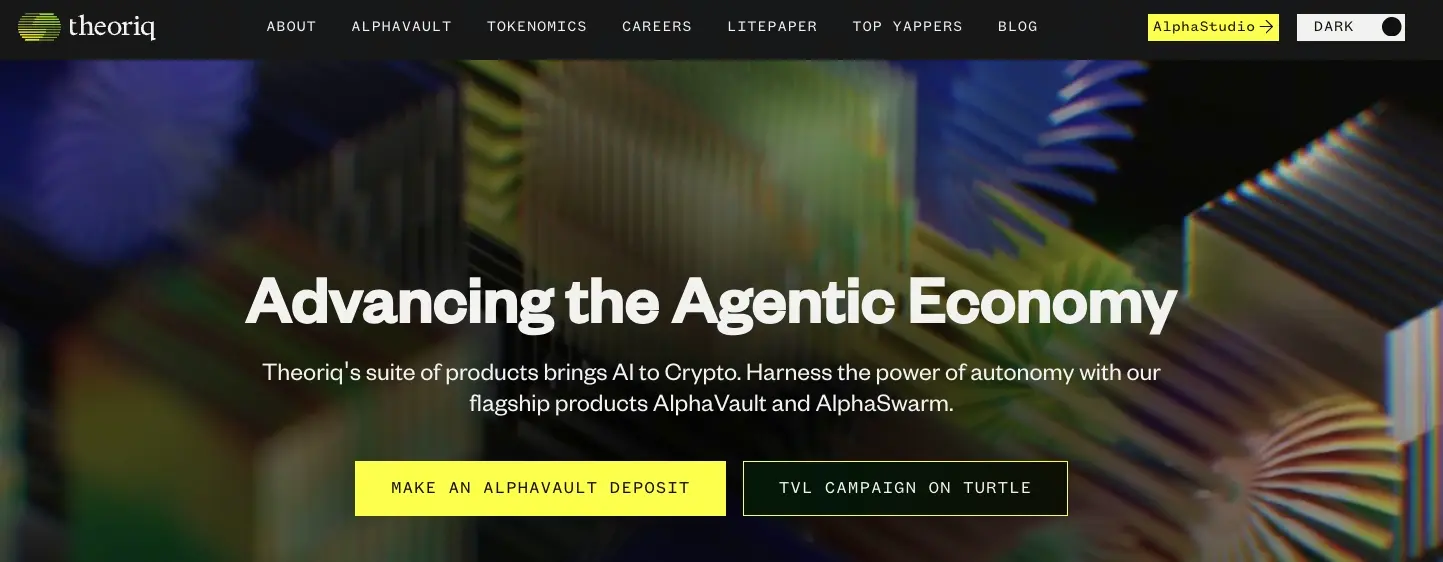

Modular AI Agent Base Layer Theoriq Mainnet Launch: Secures Tens of Millions in Funding, THQ Simultaneously Listed on Two Major Exchanges

In December 2025, the modular AI agent infrastructure project Theoriq reached a key milestone: its mainnet officially launched, marking the activation of the first complete tech stack built for AI-native finance. At the same time, its native token THQ has been confirmed to be listed on the two major mainstream exchanges Binance Alpha and Coinbase. Previously, Theoriq had secured over $10 million in funding led by Hack VC, and its early product AlphaVault's total locked value exceeded $21 million within four days of launch, demonstrating strong market demand for on-chain AI agent-managed funds.

THQ-2%

MarketWhisper·2025-12-17 03:34

What is Theoriq? Decentralized AI Agent Collaboration Platform raises millions of dollars in funding

Theoriq is a decentralized protocol that combines AI and blockchain, designed as a platform for multi-agent system collaboration. In simple terms, Theoriq is an infrastructure that enables AI Agents to interact with each other on the blockchain and autonomously execute DeFi tasks. Theoriq's testnet has attracted over 23 million interactions and received $10.4 million in funding from organizations such as Hack VC.

MarketWhisper·2025-12-17 02:26

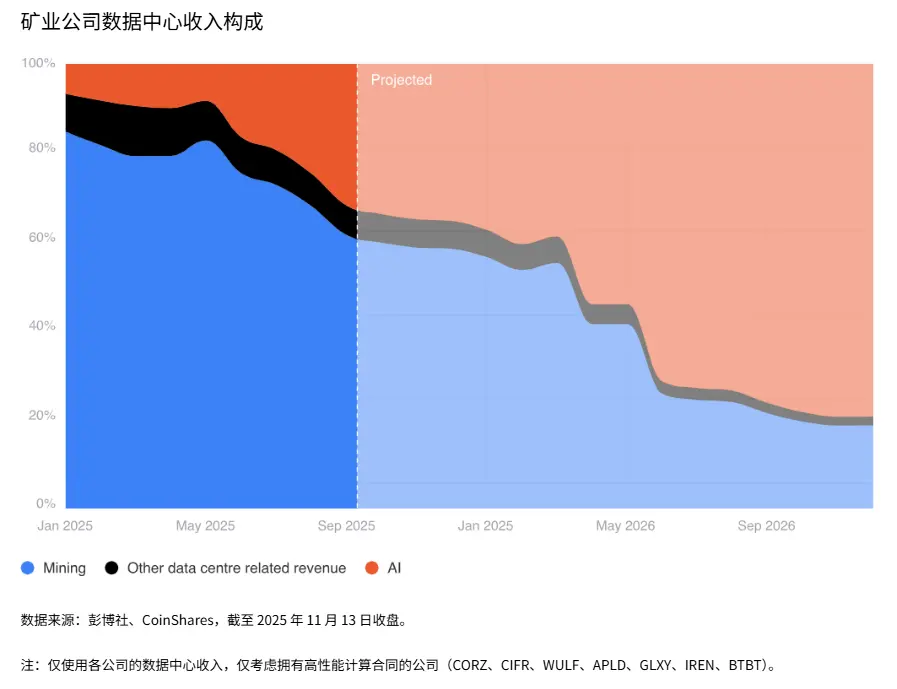

CoinShares' 2026 Cryptocurrency Predictions: Mining Model Differentiation, Investment Track Focus, and the Rise of Prediction Markets

This article does not constitute investment advice. Readers should strictly comply with local laws and regulations.

CoinShares has released its annual digital asset outlook report. The following are several key points in the "Conclusion: Emerging Trends and New Frontiers" section worth noting:

1. Strong Recovery of Crypto VC Financing: In 2025, crypto VC financing has surpassed last year, confirming that crypto investments exhibit a "high beta" performance relative to macro liquidity. In a broadly accommodative macro environment, capital inflows are expected to continue, supporting growth in 2026.

2. VC Investment Focus on "Large Deals" and Utility: Investment styles are shifting from diversification to concentration on "large deals," with capital favoring a few leading projects. There is also increased emphasis on actual utility and cash flow rather than hollow hype or meme coins.

3. Four Major Investment Tracks in 2026: Looking ahead to next year, VC is focusing on RWA (with stablecoins as the core), AI integration with crypto, and the emergence of...

PANews·2025-12-16 08:02

a16z Leaves the US: The Dusk of the VC Empire and the Rise of a New King

Author: Anita

On December 10, 2025, a16z Crypto announced the opening of an office in Seoul. The press release described it as an "offensive," but upon closer inspection, seeing a16z's heavy reliance on liquidity exits and the surge in regulatory liabilities, it becomes clear that this might be a form of "escape" for a16z.

U.S. long-arm jurisdiction has cornered the Crypto industry.

PANews·2025-12-15 11:10

A16z Investor Partner: By 2026, venture capital will merge with private equity, mainly because AI has achieved cost reduction and efficiency gains

A16z investor Troy Kirwin believes that venture capital and private equity have long been distinctly different, but the rapid development of AI is driving their integration. PE firms are starting to invest in AI startups, and VC-backed AI platforms are also integrating traditional businesses to achieve profitability. AI is redefining the mid-market, fostering collaboration and transformation between VC and PE.

PANews·2025-12-12 03:50

Paradigm makes its first investment in Brazil! $13.5 million bet on stablecoin Crown with a $90 million valuation

Top cryptocurrency venture capital firm Paradigm has announced a $13.5 million investment in the Series A funding round of Brazilian stablecoin startup Crown, bringing the company's valuation to $90 million. This marks Paradigm's first investment in Brazil, signifying the entry of this top VC—known for investing billions of dollars in blockchain startups—into the South American market, which is seen as having huge potential for digital asset adoption.

MarketWhisper·2025-12-09 02:30

Crypto venture capital winter! November trading volume drops to yearly low, with only 57 major financing deals supporting the market

In November, the cryptocurrency venture capital market continued its sluggish trend. According to RootData, only 57 funding rounds were disclosed during the month, marking one of the lowest records this year. However, the total funding amount remained relatively stable due to large transactions such as Revolut's $1 billion and CEX's $800 million, highlighting the polarization in the crypto VC market of "large sums of money, few deals."

MarketWhisper·2025-12-08 03:23

Crypto VC Funding Dips Despite Major November Investment Surges

Cryptocurrency Venture Capital Slows in 2025 Amid Fewer Deals

Venture capital investment in the cryptocurrency sector continues to decline through late 2025, with a noticeable reduction in deal activity. Despite several high-profile fundraisings, the number of funding rounds remains subdued

CryptoBreaking·2025-12-07 17:11

VC Roundup: Big money, few deals as crypto venture funding dries up

Venture capital funding in the cryptocurrency sector remained muted in November, continuing a broader slowdown that has persisted through late 2025. Deal activity was once again concentrated in a small number of large raises by established companies.

As Cointelegraph previously reported, the

VC2,46%

Cointelegraph·2025-12-07 16:59

Crypto VC Funding: Paribu acquires CoinMENA for $240m, N3XT bags $72m

The week of November 30 to December 6, 2025, recorded $478.9 million in crypto VC funding across 18 projects.

Summary

Weekly crypto VC funding hit $478.9M across 18 projects.

Paribu's $240M CoinMENA acquisition dominated this week's deals.

N3XT, Canton Network, and Portal secured major

VC2,46%

Cryptonews·2025-12-06 16:54

The so-called "building L2 ecosystems" has already been disproven.

Author: GodotGodot; Source: @GodotSancho

Recently, I've seen a lot of discussions about Monad $MON and the moat of public chains. As a contributor to L2, I genuinely feel that the so-called "building an ecosystem" has already been debunked.

If you build a public chain or L2 from scratch with complete sincerity, wanting to create a great project, the first thing you need to consider is where the users and on-chain funds will come from.

When you reach out everywhere for cooperation, you'll find that no one pays attention to you; even if you pay KOLs for promotion, you might still be rejected.

At this point, you realize that the most basic need for everyone is to be sure you won't rug, not to care about your public chain's performance or technology. You need strong VC funding to serve as brand endorsement.

The problem is, what do VCs look for when investing? You need to have a background from a prestigious university or a big tech company, and ideally a background in cryptography, or at least a partner with such a background.

Suppose you happen to have all of these, and you also found a cryptographer...

金色财经_·2025-12-04 02:29

Wu said November VC Monthly Report: Naver's $10.3 billion acquisition of Upbit, Kalshi raised $1 billion in financing, etc.

Author | Wu Says Blockchain

According to RootData statistics, in November 2025, there were a total of 57 venture capital projects publicly disclosed by Crypto VC, representing a month-on-month decrease of 28% (compared to 79 projects in October 2025) and a year-on-year decrease of 41% (compared to 96 projects in November 2024). Note: Since not all financing is disclosed in the same month, the above statistics may increase in the future. The number of projects in each sector is as follows:

Among them, CeFi accounts for about 12.5%, DeFi accounts for about 30.4%, NFT/GameFi accounts for about 1.8%, L1/L2 accounts for about 1.8%, RWA/DePIN accounts for about 7.1%, Tool/Wallet accounts for about

VC2,46%

WuSaidBlockchainW·2025-12-02 23:39

After shorting ETH and making a profit of 580,000 USD, why do I still feel optimistic about the market?

Taiki Maeda closed his position after earning $578,000 by shorting Ether within two months. He believes that the market is in the second month of a 3 to 6 month Bear Market and advises investors to prioritize preserving their principal while focusing on stablecoin Mining and Airdrop strategies. This article is sourced from Taiki Maeda's podcast, organized, translated, and written by Deep Tide TechFlow. (Background: Analyst: Ether is severely undervalued, with most models determining its value should be above $4,000) (Background info: How did Korea's largest Crypto VC conclude that Ether is worth $4,700?) Key Summary: In just two months of Bear Market trading, Taiki Maeda earned $578,000 by shorting. In this episode of the podcast, he provides an in-depth analysis of the potential trends in the cryptocurrency market over the next few months and advises investors.

ETH0,86%

動區BlockTempo·2025-12-02 14:15

A well-known KOL in the crypto world is embroiled in a "donation fraud" scandal, with Elizabeth being accused of forging donation receipts for the Hong Kong fire.

After the fire at Wangfuk Court in Tai Po, Hong Kong, crypto world KOL Elizabeth claimed to donate 200,000 HKD but was questioned about the authenticity of the certificate. The community discovered several doubts, and the response from the person involved failed to quell the controversy, instead sparking a bigger uproar. (Background summary: When the voice of KOL is louder than VC: A wealth experiment kidnapped by traffic) (Background supplement: A candid account from a crypto KOL: Our era has already come to an end) The serious fire at Wangfuk Court in Tai Po, Hong Kong, resulted in hundreds of casualties and property losses. Charitable organizations such as Yan Chai Hospital immediately established emergency aid funds to support the affected citizens. The crypto assets industry also saw many businesses and individuals providing support, including several industry giants like Binance and Matrixport donating millions of HKD. However, on December 1, the well-known KOL @Elizabethofyou( from the crypto assets community...

VC2,46%

動區BlockTempo·2025-12-02 12:50

“It Could Drop 99%”: Arthur Hayes vs. Monad Founder in Explosive Public Debate

Arthur Hayes, the outspoken founder of a major crypto derivatives platform, ignited a firestorm by declaring that Monad (MON) — a Layer-1 blockchain that had been live for only six days — could “drop 99%” and labeled it “just another high-FDV, low-float VC coin.”

CryptopulseElite·2025-12-02 06:02

Exchange and VC coin contradiction: industry pricing mechanism and value discovery function failure.

The Zerebro project party has revealed the high listing fees and利益纠葛 between exchanges and market makers, showing the truth and contradictions of the encryption industry. This revelation may reflect the end of the VC coin era, while also pointing out the failure of pricing mechanisms within the industry. Although the exposure may not immediately change the status quo, it brings hope for more project parties to speak out.

VC2,46%

金色财经_·2025-12-02 00:10

Kamirai launches VC-free Web3 “dual-engine” ecosystem

Kamalai has launched a VC-free, community-governed ecosystem combining the Kamirex DEX for Asian markets and a dark fantasy RPG, ensuring players maintain ownership of on-chain assets and giving users governance over the platform.

Cryptonews·2025-12-01 11:06

A statement "may fall by 99%": Arthur Hayes and Monad start a public opinion showdown across the internet.

Original Title: "The Great Argument Showcase between Monad Founder and Arthur Hayes"

Original author: jk

Source of the original text:

Reprint: Mars Finance

On November 29, BitMEX founder Arthur Hayes publicly expressed his pessimism about Monad, which had just launched its mainnet 6 days earlier, during an interview with Altcoin Daily, claiming it "could drop by 99%" and characterizing it as "another high market cap, low circulation VC coin." This statement quickly escalated, leading Monad co-founder Keone Hon to respond directly on X, resulting in a fierce public confrontation between the two.

The following is the complete record of the dialogue between the two parties.

Full text of the conversation

· Keone Hon, Founder of Monad

Dear

MON-1,05%

MarsBitNews·2025-12-01 05:15

Monad big dump 99% alert! Arthur Hayes names high FDV venture coin trap

Arthur Hayes, a veteran in the Crypto Assets space, issued a warning about Monad, stating that this recently launched Layer 1 Blockchain could experience a big dump of 99%, ultimately becoming another failed experiment driven by VC hype rather than real applications. Arthur described the project as "another high FDV, low Circulating Supply VC coin," and pointed out that its Token structure itself puts retail investors at risk.

MarketWhisper·2025-12-01 00:58

PA Daily | Aster announces S3 Airdrop schedule; Arthur Hayes criticizes MON coin price, Monad founder retaliates

Today's news highlights:

1. Macroeconomic Outlook for Next Week: Federal Reserve's Guidance Week, Data Flood Coming

2. Beijing Business Today: The chaos of cryptocurrency speculation has infiltrated platforms such as Xiaohongshu, Taobao, and Xianyu.

3. Arthur Hayes said "MON is a high-risk VC coin or could drop by 99%", Monad founder suggests experiencing the mainnet.

4.Santiment: The market shows signs of fatigue, and we need to wait for clearer signals.

5. Aster announces S3 airdrop schedule: Inspector opens on December 1, tokens can be claimed on December 15.

6. Sahara AI responds to unusual market fluctuations: an internal investigation has been launched, and there are no security risks or product issues.

Macro

Beijing Business Daily: The chaos of cryptocurrency speculation has infiltrated platforms such as Xiaohongshu, Taobao, and Xianyu.

The Beijing Business Daily's financial investigation team published an article titled "The Surge of Cryptocurrency Speculators Entering Social Platforms," which points out the chaotic flow of cryptocurrency speculation.

PANews·2025-11-30 09:23

Arthur Hayes mocked Monad's 99% fall with a quote from Do Kwon, sarcastically asking: "If it's so strong, why isn't the Token fully unlocked?"

The top-tier public chain Monad has been continuously falling since its issuance, and Arthur Hayes stated on the show that Monad is another high FDV, low Circulating Supply VC coin. This kind of public chain, which only has speculation without application, will ultimately end up falling just like Berachain.

Arthur Hayes cites Do

MON-1,05%

ChainNewsAbmedia·2025-11-30 07:03

Arthur Hayes warns that Monad could big dump 99%: overvalued with low Circulating Supply VC coin

The highly anticipated Layer 1 public chain Monad Mainnet officially launched this week, but Arthur Hayes warned that the VC supported Monad may face a big dump due to high FDV and low Circulating Supply. (Background: Monad officially launched! $MON opening coin price performance, tokenomics, Coinbase public sale results... all summarized) (Supplementary background: Monad raised only 70% of its target in 2 days of public sale! Coinbase Launchpad's first launch failure?) The L1 public chain Monad, which just officially launched this week, has garnered market attention due to $225 million in funding from Paradigm and support from Coinbase's public sale. However, BitMEX founder Arthur Hayes earlier expressed concerns.

動區BlockTempo·2025-11-30 05:59

Load More