Search results for "USD1"

WLFI Partners with MMA.INC to Build Web3 Economy with USD1 and Utility Tokens

Mixed Martial Arts Group Limited (NYSE American: MMA, hereinafter MMA.INC) announced today that it has signed a strategic memorandum of understanding (MOU) with World Liberty Financial (WLFI), the Trump family-backed decentralized finance platform.

CryptopulseElite·01-04 09:30

USD1 Season officially kicks off: WLFI activates strategic fund to promote ecosystem

The USD1 era has officially begun, marked by significant growth in market capitalization and trading volume. WLFI is launching a strategic reserve fund to support developers and innovative tokens, aiming to enhance the USD1 ecosystem and promote sustainable growth. The initiative also highlights outstanding individuals and projects.

TapChiBitcoin·01-03 04:49

Trump family enters the fighting sports! WLFI partners with MMA to develop practical tokens, integrating USD1 to create a sports Web3 economy

MMA.INC announces a strategic partnership with decentralized finance platform World Liberty Financial, planning to introduce stablecoins and utility token mechanisms, officially bringing blockchain technology into the global combat sports industry.

(Background recap: Trump’s crypto project WLFI buys meme coin $1 as strategic reserve! Rumors say it will make USD1 dominate Solana)

(Additional background: Trump’s $120 million gamble: WLFI allocates 5% of treasury tokens to expand USD1 stablecoin market share)

Table of Contents

USD1 becomes a core payment and incentive tool

Utility token model centered on “achievement”

Multi-platform integration and global promotion

Advisory-level cooperation to strengthen compliance and long-term development

New York Stock Exchange listed company Mixed Martial

動區BlockTempo·2025-12-30 14:40

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-29 20:26

Bitcoin crashes to $24,111! Former Chinese billionaire CZ reveals the liquidity trap

On December 24th, Christmas Eve, the Binance BTC/USD1 trading pair price plummeted from $87,000 to $24,111 within seconds, a 70% drop, and then quickly rebounded, triggering market panic and questions about manipulation. Former Chinese billionaire CZ quickly responded: this was not a systemic crash, only a liquidity shortage in a single trading pair, with no liquidation or forced liquidation. Arbitrageurs have corrected the price, and this trading pair is not part of the index system, so no chain liquidation was triggered.

MarketWhisper·2025-12-29 03:57

World Liberty Financial's USD1 Stablecoin Reaches $3 Billion Market Cap Milestone

World Liberty Financial (WLFI), the Trump family-linked crypto project, announced that its USD1 stablecoin has surpassed a $3 billion market cap—describing the achievement as an early milestone rather than the final target.

CryptopulseElite·2025-12-29 03:13

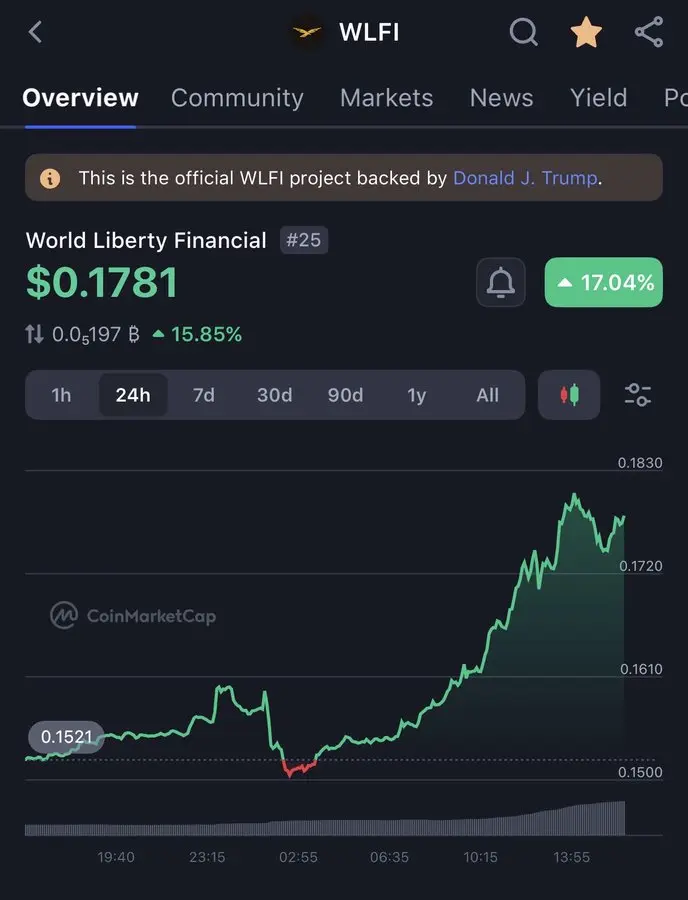

WLFI's $3 billion treasury proposal faces community resistance! USD1 soars, but WLFI drops 56% this year

DeFi project World Liberty Financial (WLFI) supported by the Trump family background is currently embroiled in a fierce internal struggle. On December 28, the project proposed a controversial governance proposal to use no more than 5% of the unlocked WLFI token treasury to subsidize and incentivize the adoption of its stablecoin USD1, aiming to catch up with giants like USDT and USDC. However, the proposal faced strong opposition during the community voting phase, with over 67% of voters casting against it. Dramatically, almost simultaneously, the circulating market cap of USD1 broke through the $3 billion mark for the first time, ranking as the seventh-largest stablecoin globally. Meanwhile, the WLFI governance token price has fallen 56% from its peak. Amid scrutiny due to political connections and fierce market competition, the project's development path remains full of uncertainties.

MarketWhisper·2025-12-29 02:51

Trump WLFI proposal faces opposition! Burning 5% of token treasury to incentivize USD1 stablecoin sparks controversy

Trump Family Crypto Project WLFI Announces New Governance Vote, which will authorize the use of less than 5% of the unlocked WLFI token supply for treasury funds, accelerating the adoption of the USD1 stablecoin through targeted incentives. However, the initiative faced strong opposition early on, with preliminary data showing that 46.1% of voters oppose the measure. Since its launch six months ago, USD1 has grown to a market cap of $3.2 billion.

MarketWhisper·2025-12-29 01:05

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-28 20:25

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-27 20:21

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-26 20:21

CZ Responds After Bitcoin 'Crashes' To $24,000 On Binance

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Changpeng “CZ” Zhao pushed back after a screenshot showing bitcoin at roughly $24,111 on Binance went viral on X, arguing the move was a microstructure glitch on a thin, newly listed BTC/USD1 pair r

Bitcoinistcom·2025-12-26 08:09

Stablecoin News: Trump endorsement pushes USD1 into the top five, who will dominate the stablecoin arena in 2025?

2025 is a milestone year in the stablecoin industry. Driven by macroeconomic positive factors such as the passing of the GENIUS Act and Circle's successful IPO, the total global supply of USD stablecoins surged by over $100 billion, reaching $314 billion. However, market growth is not evenly distributed. According to the key metric of "circulation velocity," a fierce reshuffle is underway. USDT leads with an absolute advantage, boasting a circulation velocity of 166. Ripple's RLUSD has emerged as a dark horse in second place, while USD1, endorsed by the Trump family, entered the top five just months after its launch, demonstrating remarkable market penetration and topicality. This ranking not only reveals the activity levels of trading but also reflects the deeper trend of the stablecoin sector evolving towards compliance, differentiation, and politicization.

MarketWhisper·2025-12-26 05:33

USD1 annualized 20% quota sold out! Binance cashes out 2 billion, see Trump's money-printing harvesting technique in one go

Christmas Eve Binance launches USD1 financial management with an annualized rate of 20% for instant purchase. This is a stablecoin issued by the Trump family through World Liberty Financial. Binance invested 2 billion in March, but the tokens were only issued on March 25, making it a "white note investment." On the night of the event, major investors bought BTC aggressively, and after the quota was sold out, an emergency increase to 30 billion USD was made. This article will analyze the process and actions of this money-printing and harvesting scheme.

MarketWhisper·2025-12-26 03:45

Bitcoin's "24,000 USD" fake fall: an in-depth analysis of the liquidity trap in the new USD1 trading pair

During the Christmas holiday, the BTC/USD1 trading pair on mainstream cryptocurrency exchanges experienced a shocking flash crash. The price of Bitcoin instantly dropped to $24,111 on the chart, then quickly rebounded to above $87,000 within seconds. This extreme volatility did not affect the prices of major trading pairs like BTC/USDT. The root cause was the newly launched stablecoin USD1 issued by World Liberty Financial, which has Trump as a background, with extremely scarce liquidity.

This incident coincided with the platform launching a high-yield promotion offering 20% annualized interest for USD1, leading to a surge of arbitrage funds. During the holiday's low trading volume, a simple sell order triggered a price collapse. This serves as a warning to all traders: operating in emerging or low-liquidity trading pairs may face slippage and risks far beyond expectations.

MarketWhisper·2025-12-26 02:46

Christmas Eve Horror, Binance BTC/USD1 dips to 24K

While most traders around the world are immersed in the peaceful holiday atmosphere of Christmas, the cryptocurrency market staged a heart-stopping "flash crash" on Christmas Eve. On the evening of December 24th, a specific trading pair on Binance—BTC/USD1—plummeted from 87K to 24K within seconds, a decline of 72%, sparking widespread discussion in the community and heightened concern over the liquidity of emerging stablecoins.

Binance BTC/USD1 Mysterious "Single Needle Drop"

According to on-chain data and exchange K-line charts, while most traders worldwide are enjoying the Christmas holiday tranquility, the price of BTC/USD1 on Binance fell like a guillotine. Interestingly, at the same time, in the mainstream markets of BTC/USDT or

ChainNewsAbmedia·2025-12-26 02:43

Stablecoin USD1 linked to Mr. Trump surpasses a market value of 3 billion dollars

World Liberty Financial's stablecoin USD1, co-founded by Donald Trump Jr., surpassed a $3 billion market cap and gained traction through partnerships with major platforms. However, a recent flash crash in BTC/USD1 on Binance raised concerns about liquidity risks despite USD1's rapid growth.

TapChiBitcoin·2025-12-26 01:27

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-25 20:15

VELO Expands PayFi Infrastructure With USD1 as Asia-Focused Adoption Comes Into View

For the USD1 integration, Velo has got the backing from Thailand’s CP Group, which has a strong retail and telecom footprint across Asia.

Analysts note that combining CP Group’s regional distribution and WLFI’s USD1 stablecoin liquidity will boost merchant and consumer adoption across Asia.

CryptoNewsFlash·2025-12-25 14:01

BONK Price Prediction for 2026: Trump Stablecoin Gains $150M on Yield News as DeepSnitch AI Outperforms Memes for 2026

The crypto market is witnessing a decisive shift in capital allocation, moving away from pure speculation toward assets that offer tangible yield and utility. This trend was shown this week by the massive inflows into the World Liberty Financial USD (USD1) stablecoin, due to a lucrative new yield p

CaptainAltcoin·2025-12-25 12:40

Bitcoin suddenly "dipped" to $24,000. What exactly happened?

Late Tuesday night, Bitcoin staged a terrifying moment on the Binance BTC/USD1 trading pair, with the price suddenly plunging in a needle-like drop to $24,111, but quickly rebounding within seconds to above $87,000. This 72% instantaneous drop only occurred on the USD1 stablecoin trading pair launched by World Liberty Financial, which is supported by the Trump family; other mainstream trading pairs were unaffected.

MarketWhisper·2025-12-25 06:58

BTC/USD1 "Price crash" occurs suddenly on Binance, Bitcoin drops to $24,111 and then bounces back

On December 25, a sudden dip in the BTC/USD1 trading pair saw Bitcoin drop to $24,111.22 before quickly recovering. This volatility is linked to the new USD1 stablecoin from World Liberty Financial, raising concerns due to its low liquidity.

TapChiBitcoin·2025-12-25 03:43

VELO Expands PayFi Infrastructure With USD1 as Asia-Focused Adoption Comes Into View

For the USD1 integration, Velo has got the backing from Thailand’s CP Group, which has a strong retail and telecom footprint across Asia.

Analysts note that combining CP Group’s regional distribution and WLFI’s USD1 stablecoin liquidity will boost merchant and consumer adoption across Asia.

CryptoNewsFlash·2025-12-24 14:00

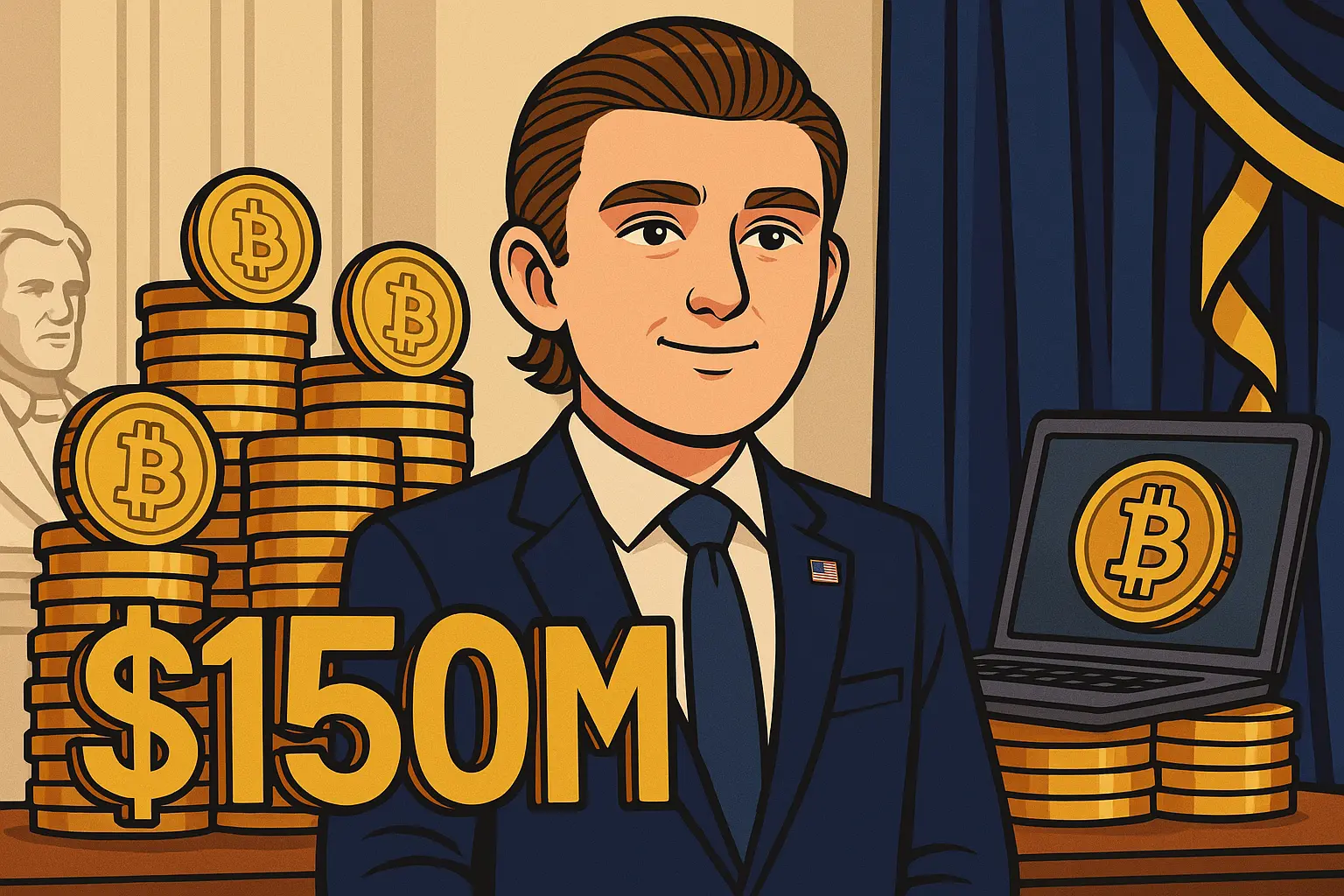

Trump family-linked USD1 supply up $150M as Binance rolls out yield program

The USD1 stablecoin, linked to Donald Trump's family, gained $150 million in market cap after Binance launched a yield program offering up to 20% APR. The stablecoin's market cap rose to $2.89 billion, positioning it as the seventh-largest stablecoin globally.

Cointelegraph·2025-12-24 13:25

The trillion-dollar stablecoin battle, Binance decides to join the fight again

Title: "Trillion-Dollar Stablecoin Battle, Binance Decides to Join Again"

Author: Lin Wanwan, Dongcha Beating

In 2024, the total on-chain transfer volume of stablecoins reached $27.6 trillion, surpassing the combined total of Visa and Mastercard for the first time.

This figure was $300 billion five years ago and was nearly zero ten years ago.

On December 18, a project called United Stables launched a new stablecoin, $U, in Dubai. Its reserves are not in cash or government bonds but a combination of USDC, USDT, and USD1 stablecoins. Collateralizing stablecoins with stablecoins is industry slang called "matryoshka."

Binance Wallet immediately integrated, BNB Chain

PANews·2025-12-24 13:07

USD1 Supply Jumps $45M After Binance 20% APY Promotion

The circulating supply of USD1 rose sharply on December 24 after Binance rolled out a high-yield promotion. Data from CoinGecko shows that more than 45.6 million USD1 tokens entered circulation within a few hours of the announcement. The sudden increase pushed USD1’s total market capitalization

USD1-0,04%

Coinfomania·2025-12-24 07:07

VELO Expands PayFi Infrastructure With USD1 as Asia-Focused Adoption Comes Into View

For the USD1 integration, Velo has got the backing from Thailand’s CP Group, which has a strong retail and telecom footprint across Asia.

Analysts note that combining CP Group’s regional distribution and WLFI’s USD1 stablecoin liquidity will boost merchant and consumer adoption across Asia.

CryptoNewsFlash·2025-12-23 13:55

Gate Research Institute: LazAI Alpha Mainnet officially launched|Velo partners with WLFI to bring USD1 into the ecosystem

crypto market panorama

BTC (-0.73% | Current Price 88,500 USDT): Currently, Bitcoin is still in a stage of fluctuating rebound. The 4-hour chart shows that BTC began a mild rebound after stabilizing around 84,000 USD, but after briefly breaking through the 90,000 USD mark on Monday, it fell back again. The MACD green bars continue to converge and form a death cross around 88,000 USD, indicating that buying momentum is still insufficient. From the daily structure, Bitcoin has not effectively broken away from the bottom range formed since late November, and is currently still operating within the stabilization range of 84,000–94,000 USD, mainly focusing on fluctuating repair.

ETH (-0.84% | Current Price 2,994 USDT): In the past 24 hours, the price of Ethereum has oscillated around the $3,000 threshold, with low trading volume.

GateResearch·2025-12-23 06:38

Velo Integrates USD1 With WLF to Empower PayFi Infrastructure Across Asia

Velo Protocol has partnered with USD1 to enhance Payment Finance in Asia, facilitating seamless payments and institutional settlements. This collaboration aims to empower users with advanced financial infrastructure and stablecoin liquidity.

BlockChainReporter·2025-12-23 03:04

Velo Partners With World Liberty Financial to Integrate USD1 Stablecoin

Velo, a PayFi infrastructure protocol focused on real-world financial adoption, has announced a strategic collaboration with World Liberty Financial to integrate USD1, a regulated U.S. dollar–backed stablecoin, into its ecosystem. The announcement was made on December 22, 2025, in Singapore.

USD1

ICOHOIDER·2025-12-22 14:29

United Stables launches the new generation stablecoin U: nearly $60 million attracted within 24 hours, targeting the fragmented liquidity dilemma

The stablecoin market welcomes a heavyweight new player built by United Stables. On December 18, the next-generation stablecoin $U , aimed at creating a unified liquidity layer, officially launched on the BNB Chain and Ethereum mainnet. Its innovative "Stablecoin Inclusive Reserve" model consolidates mainstream stablecoins such as USDT, USDC, USD1, and others as reserve assets, attempting to end the market pain point of liquidity fragmentation. The launch performance has been remarkable: in less than 24 hours, its circulating supply rapidly rose to 58.9 million tokens, and it quickly gained full integration with leading DeFi protocols like PancakeSwap, Lista DAO, and major exchanges. This is not just the birth of a new asset but may also signal a strategic shift for stablecoins from "fiefdoms" to a "unified foundational layer."

MarketWhisper·2025-12-19 05:44

Trump advances into clean energy! TMTG announces a full stock merger with TAE Technologies to create a "nuclear fusion power plant," DJT jumps 22%

Trump Media & Technology Group and fusion energy company TAE Technologies announced today (18th) that they have signed a definitive merger agreement to combine through a all-stock transaction, with a valuation exceeding $6 billion.

(Background recap: Musk comments on "Trump's nationwide spending spree": In the future, there will be no poverty, so no need to save money)

(Additional background: Trump bets $120 million: WLFI allocates 5% of national treasury tokens to expand USD1 stablecoin market share)

Table of Contents

Agreement Details

What is TAE Technologies?

DJT Stock Price Soars

Trump Media & Technology Group (Trump Media & Technology Group Corp., stock code: DJT.O) and fusion energy company TAE

動區BlockTempo·2025-12-18 12:45

World Liberty Proposes Using Treasury Funds to Expand USD1 Stablecoin Supply Across Markets

World Liberty Financial governance vote could release up to 5% of treasury funds to expand USD1 adoption across crypto markets.

USD1 has reached nearly $3 billion in value locked within six months despite intense stablecoin competition.

World Liberty aims to boost partnerships liquidity a

CryptoNewsLand·2025-12-18 11:36

World Liberty Financial proposes using 5% of WLFI treasury to support USD1

World Liberty Financial plans to use 5% of its treasury to enhance the adoption of its USD1 stablecoin, which ranks seventh among USD-pegged stablecoins, by forming strategic partnerships and increasing supply to gain a competitive edge.

Cryptonews·2025-12-18 07:36

WLFI USD1 Adoption Could Rise as Community Offers Incentives

The WLFI community aims to boost USD1 stablecoin adoption by using treasury funds for incentives like staking bonuses and transaction rewards, fostering growth and real-world use in the crypto ecosystem.

Coinfomania·2025-12-18 06:52

WLFI Dual-Engine Launch: Tens of Millions of Dollars Buyback and Technology Foundation Building, Is a Turnaround in Sight?

World Liberty Financial (WLFI) community recently launched a key governance proposal, planning to utilize unlocked treasury funds to incentivize the adoption of its stablecoin USD1, aiming to accelerate ecosystem expansion. Fundamental positive signals are frequent: the project team has used USD1 to complete a $10 million WLFI token buyback in the past 3 weeks and has listed core trading pairs on mainstream CEXs. Meanwhile, technical analysis shows that WLFI's price has completed a classic market auction theory rotation and found support near the value zone low coinciding with Fibonacci key retracement levels, suggesting selling pressure may be waning. The resonance between fundamental catalysts and technical bottoming signals provides a new perspective for WLFI's future trajectory.

MarketWhisper·2025-12-18 03:48

Trump invests 120 million USD in a big gamble: WLFI allocates 5% of national treasury tokens to expand USD1 stablecoin market share

Trump family-supported World Liberty Financial (WLFI) proposes to allocate 5% of the national treasury funds (about $120 million) to promote its own stablecoin USD1 in response to fierce market competition. However, community voting results are divided, with opposition voices prevailing. WLFI hopes to attract liquidity through subsidy strategies, but concerns about its long-term effectiveness and regulatory risks still exist. This proposal will test its political influence and trustworthiness.

動區BlockTempo·2025-12-18 03:10

Trump Family WLFI Unlocks the Treasury! $10 Million Buyback USD1 Promotion Voting

Trump Family Crypto Project WLFI (World Liberty Financial) announced that a new proposal suggests "using partially unlocked WLFI treasury funds as incentives to promote the adoption of USD1," and community voting is now open. In the past 3 weeks, WLFI has used USD1 to repurchase approximately $10 million worth of WLFI tokens and has launched major spot trading pairs on Binance.

MarketWhisper·2025-12-18 01:58

Dogecoin Price Prediction: Binance Adds Zero-Trading Pairs for Trump Family Stablecoin, DeepSnitc...

Binance included additional trading pairs for the WLFI’s USD1 stablecoin. In addition to introducing fee-free trading pairs for tokens such as SOL, BNB, BTC, and ETH, the exchange also plans to convert collateral assets backing the BUSD stablecoin into USD1

As traders search for affordable tokens,

CaptainAltcoin·2025-12-13 06:26

Binance Boosts Trash-Linked USD1 Stablecoin Partnerships for Wider Adoption

Binance Expands Support for Trump-Backed USD1 Stablecoin and Promotes Ecosystem Integration

The world’s largest cryptocurrency exchange, Binance, has announced a significant expansion of its support for the USD1 stablecoin issued by World Liberty Financial. This move aims to enhance liquidity and f

USD1-0,04%

CryptoBreaking·2025-12-12 04:11

Binance expands the role of USD1 stablecoin in the trading ecosystem

Binance has integrated the USD1 stablecoin by allowing trading of assets like BNB, ETH, and SOL against it. This move enhances USD1's role in Binance's collateral structure, with approximately $2.8 billion in circulation, largely from Abu Dhabi's MGX fund. Donald Trump and his sons are co-founders of World Liberty Financial, which launched USD1 in March 2024.

TapChiBitcoin·2025-12-12 02:04

Binance Deepens Ties to Trump-Backed Stablecoin Following Founder’s Pardon

The Trump-backed USD1 stablecoin is now traded on Binance against BNB, Solana, and Ethereum, enhancing accessibility. This follows a deepening partnership between World Liberty and Binance after Changpeng Zhao's pardon.

TRUMP1,87%

Decrypt·2025-12-11 18:27

World Liberty Financial Confirms January Rollout for Its New Line of Crypto and RWA Products

World Liberty Financial plans a January launch for new crypto products backed by its USD1 stablecoin.

WLFI token rises on product plans but faces lower trading activity and mixed market signals.

Aster DEX partnership aims to expand USD1 use across decentralized platforms and boost adoption.

World

CryptoNewsLand·2025-12-04 10:14

Barron Trump Net Worth 2025: Youngest Trump's $150M Crypto Fortune

Barron Trump is worth an estimated $150 million at 19, primarily from crypto ventures. As World Liberty Financial co-founder, Barron Trump holds 10% of the family's $1.5B crypto empire through WLFI token sales, USD1 stablecoin stake, Alt5 Sigma deal, and locked tokens.

TRUMP1,87%

MarketWhisper·2025-12-03 05:55

WLFI Spends $7.8M in Massive Token Buyback

WLFI executed a $7.79M token buyback to reinforce confidence in its ecosystem, using structured on-chain swaps to stabilize market activity.

WLFI’s portfolio shows diversification, holding billions in crypto assets, major USD1 reserves, and multiple AETH-based derivatives.

Security steps

CryptoFrontNews·2025-11-26 14:04

BNB Hack Abu Dhabi Highlights Web3 Growth as WLFI and USD1 Ecosystem

The recent post of BNB Chain is advertising a Twitter Space titled The Regional Impact of Web3 + Luxury and Tourism. The event is an extension of the larger BNB Hack Abu Dhabi that gathers developers to have workshops, ideation, and a significant, in-person hackathon. Abu Dhabi still maintains an

Coinfomania·2025-11-25 13:21

Peter Schiff’s Old Joke Becomes 2025’s New Hype

An X post of May 2017 by the BoltzCrypto returned attention to $USACOIN saying that it was the latest entry to his USD1 folio. The trader applauded the story of the coin, associating it with the Trump and Elon Musk memes in addition to the symbolic origins of the token in the one-year-old satire of

Coinfomania·2025-11-25 10:10

WLFI Deploys USD1 Stablecoin on AB Chain as Partnership Expands DeFi Capabilities

World Liberty Financial (WLFI) and AB Chain have announced a new strategic collaboration that brings USD1, WLFI’s dollar-pegged stablecoin, onto the AB Chain network. By integrating with AB Chain’s high-performance infrastructure, USD1 now benefits from faster transaction speeds and a more

ICOHOIDER·2025-11-14 10:57

WLFI Expands USD1 Stablecoin with AB Chain Integration for Faster Transactions

WLFI has expanded the reach of its USD1 stablecoin by deploying it on the AB Chain, a move designed to accelerate settlement speed and enhance liquidity within decentralized finance (DeFi). This latest integration, announced on November 13, allows users to transact with USD1 using AB Chain’s high-th

CryptoBreaking·2025-11-14 09:07

Lorenzo Protocol Launches USD1+ OTF: Triple-Yield Stablecoin Fund Goes Live on BNB Chain Mainnet

Lorenzo Protocol has officially launched its flagship USD1+ On-Chain Traded Fund (OTF) on BNB Chain mainnet, accepting deposits for a stable, non-rebasing, yield-bearing product targeting up to 40% 7-day APR.

CryptopulseElite·2025-11-14 07:28

Load More