Search results for "PENDLE"

Arthur Hayes Liquidates $5.53 Million in ETH! DeFi Token Bets Revealed

Legendary trader Arthur Hayes sold 1,871 ETH (5.53 million USD) within two weeks, reallocating to DeFi tokens such as PENDLE, LDO, ENA, and ETHFI. PENDLE accounts for 48.9% of his portfolio. Hayes believes that the crypto market liquidity has bottomed out in November, and improved fiat liquidity will benefit DeFi tokens beyond ETH.

MarketWhisper·2025-12-31 07:51

Pendle Moved $58B in Fixed Yield – So Why Is the PENDLE Price Still Down 64%?

Pendle (PENDLE) is pulling attention from both sides of the market. On one hand, Arthur Hayes rotated $3M into PENDLE and other DeFi yield plays, signaling growing interest in fixed-yield infrastructure.

On the other, Polychain Capital exited its entire position, pushing price lower and shaking

CaptainAltcoin·2025-12-23 16:05

PENDLE Slides After Polychain Sell-Off: Will Buyers Defend $2?

Price Trend: Pendle remains in a strong downtrend after months of sustained selling pressure.

Whale Exit: Polychain Capital sold PENDLE at a loss, signaling weakened institutional conviction.

Key Level: Buyers must defend $2 support to prevent a deeper move toward $1.80.

Pendle — PENDLE,

PENDLE5,21%

CryptoNewsLand·2025-12-20 07:41

Altcoin Patterns Repeat: 2021’s Invalidation Reappears As Analysts Point to a Fresh Parabolic Cyc...

Analysts observe a repeating 2021 pattern in the altcoin market, indicating a potential new parabolic cycle. Notable assets AAVE, PENDLE, CRV, ENS, and AERO exhibit stable structures amidst recent compressions, suggesting readiness for significant price movements.

CryptoNewsLand·2025-12-11 02:34

Pendle Leads DeFi Innovation: Joins ETHGas Open Gas Initiative to Slash User Fees on Ethereum

As decentralized finance (DeFi) continues to evolve in 2025, Pendle has emerged as a frontrunner in yield trading and tokenization, now integrating with the newly launched Open Gas Initiative by ETHGas to subsidize transaction costs for users. Announced on December 3, 2025, this code-free program enables protocols like Pendle to cover a portion of gas fees on the Ethereum mainnet, enhancing accessibility and reducing barriers for everyday interactions in blockchain ecosystems.

CryptopulseElite·2025-12-04 06:05

Strong Fundamentals! Pendle TVL Surpasses $8.7 Billion, Setting a Record and Gaining Inclusion in Bloomberg Index

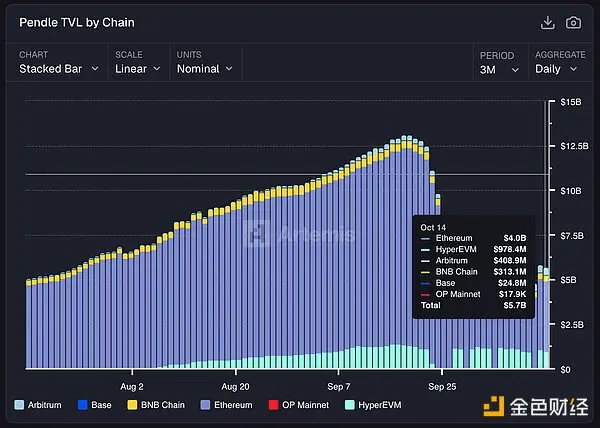

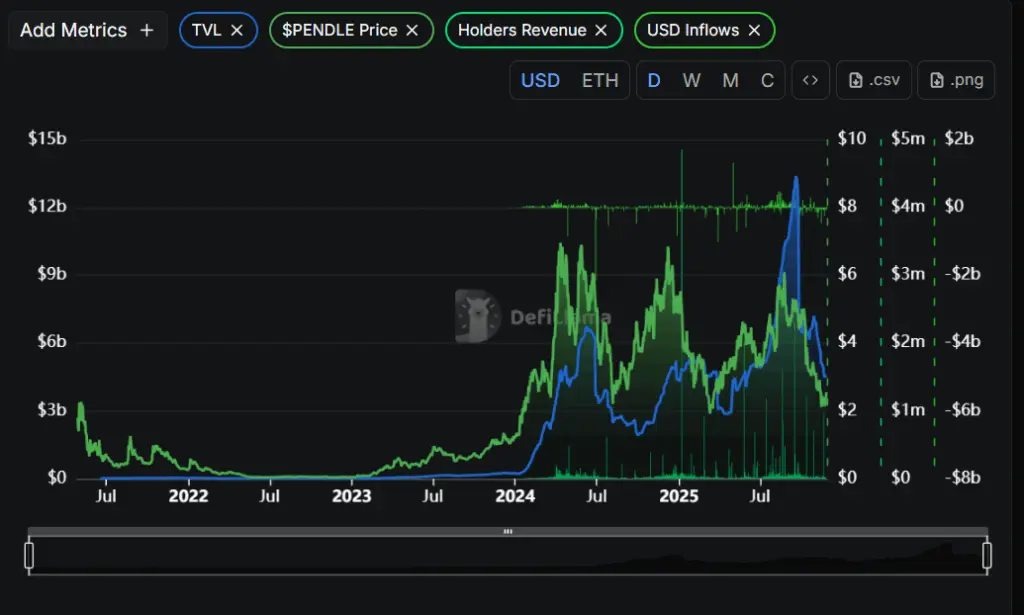

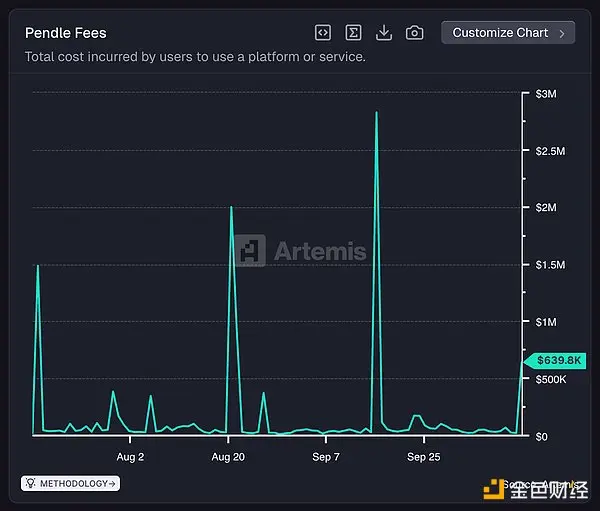

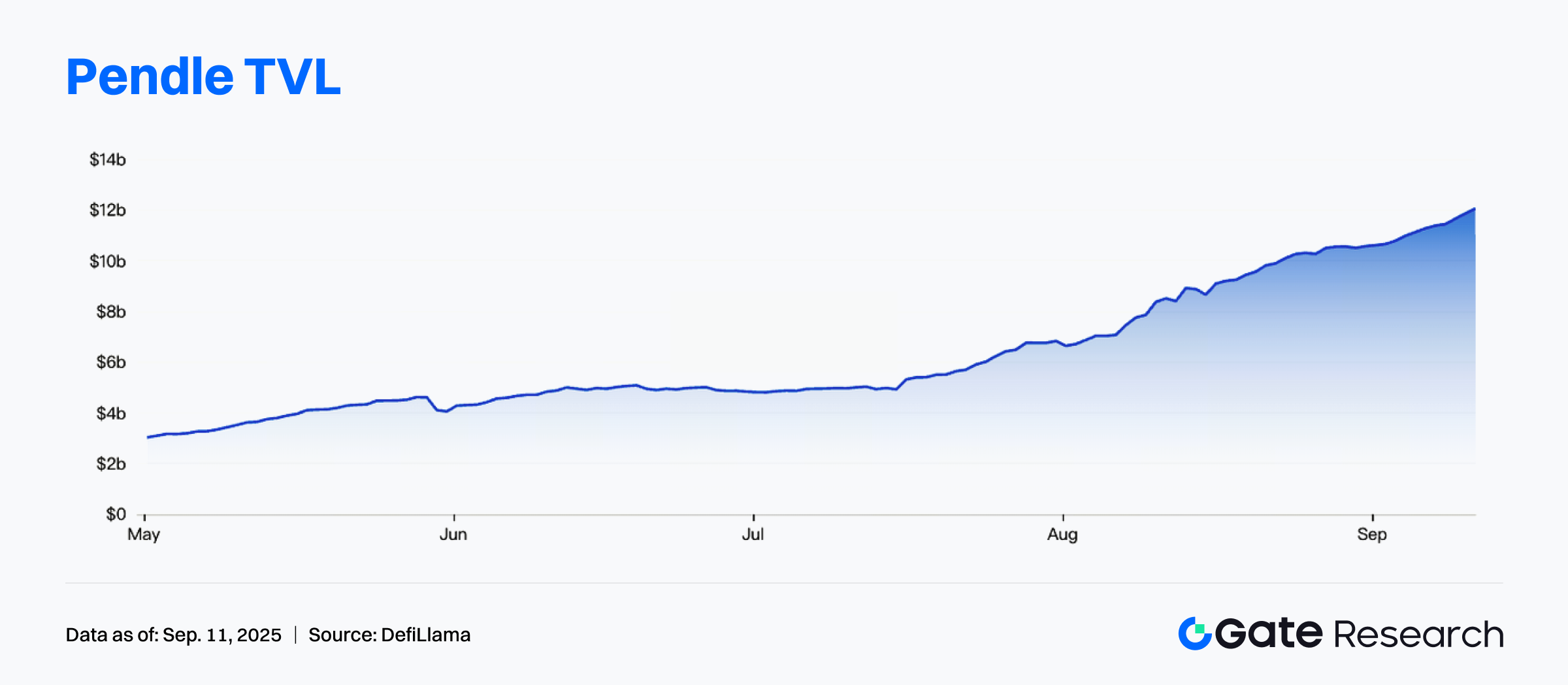

Currently, the native token PENDLE of the DeFi yield derivatives protocol Pendle is at a critical technical juncture. Its price is around $2.7, and in the short term, it has risen above the 20-day moving average with a single-day increase of 10.75%, indicating strong buying pressure. However, significant resistance is present at the 50-day and 200-day moving averages above, with technical indicators showing severe divergence and market sentiment stuck in a "tug-of-war" between bulls and bears. Meanwhile, Pendle's fundamentals are exceptionally strong, with total value locked soaring to $8.75 billion in Q3, monthly trading volume hitting a record high of $11 billion, and its successful inclusion in the Bloomberg Galaxy DeFi Index. The stark contrast between technical indecision and robust fundamentals highlights the market's anticipation for the next clear driving signal.

MarketWhisper·2025-12-04 03:29

Buy-the-dip Value Tokens? In-depth Analysis of "Real Yield" DeFi Tokens

We examined DeFi star projects with "real yield"—Ethena (ENA), Pendle (PENDLE), and Hyperliquid (HYPE)—and raised a core question: as their token prices decline, do their fundamentals remain strong, or is the yield itself under pressure?

The answer is mixed:

ENA generates massive fees, but almost all fees are recycled as subsidies to maintain TVL, so the protocol's actual "surplus" is minimal.

PENDLE's fundamentals have deteriorated along with its price. As TVL has plunged to around $3.6 billion, the current sell-off is not a divergence between price and value, but rather a rational market response to a shrinking business.

HYPE is a huge money printer, generating over $1.2 billion in annualized revenue, almost all of which is used for token buybacks—but

PANews·2025-12-03 06:10

Exclusive Interview with the Founder of Pendle: The Road to the Empire of Yield Trading

Author: Jonathan Ma, founder of Artemis; Translated by: Golden Finance xiaozou

Recently, we interviewed Pendle founder TN Lee. Pendle has become one of the fastest-growing fixed income and yield trading protocols in the DeFi space, with a total locked value (TVL) surpassing billions of dollars, and stablecoins accounting for over 80% of the liquidity. By splitting assets into principal tokens (PT) and yield tokens (YT), Pendle has created a bilateral market that satisfies both risk-averse investors seeking predictable returns and risk-seeking traders chasing points and excess returns.

This article will delve into the development history of Pendle, future opportunities, and the strategic layout for seizing the $140 trillion global fixed income market.

1. Hello TN! Pendle was founded in 2020. Could you share your entrepreneurial story with us? You founded Pend

金色财经_·2025-12-02 00:06

Hayes Dumped Pendle and Ethena At a Loss… Then Bought Back Cheaper: Here’s the Crypto Whale Playbook

A sharp move from BitMEX co-founder Arthur Hayes has triggered new debate across the market about how whales trade during fear-driven selloffs. Two weeks ago, Hayes sold Pendle, Ethena (ENA) and EthFi at a 20% loss, only to buy back over $3 million worth of the same assets 30–40% cheaper after the m

CaptainAltcoin·2025-11-29 16:03

PENDLE Tests Critical Weekly Support as Arthur Hayes Adds $814K Tokens

PENDLE sits on the $2.00–$2.35 weekly support zone, maintaining stability while buyers aim for momentum toward $3.00 and higher resistance levels.

Price action shows strong absorption at the support midpoint, indicating active buyer defense and potential for a sustained upward move toward

PENDLE5,21%

CryptoFrontNews·2025-11-28 09:01

Arthur Hayes' $1.9 Million Altcoin Buying Spree: Has the Market Rhythm Changed?

Arthur Hayes, co-founder of BitMEX and a prominent crypto influencer, has sparked market speculation after accumulating over $1.9 million in altcoins like ENA, ETHFI, and PENDLE within the past 24 hours.

CryptopulseElite·2025-11-28 06:36

Arthur Hayes Again on a Buying Spree

Key Notes

Arthur Hayes aggressively accumulated ENA, ETHFI, and PENDLE.

His wallet shows multiple rapid transfers from FalconX and Cumberland.

Hayes believes Bitcoin has already printed its cycle bottom.

Arthur Hayes, the former BitMEX CEO and one of crypto’s most influential analysts, has res

ON-0,64%

Coinspeaker·2025-11-27 13:32

Arthur Hayes bought $536,000 worth of PENDLE amid positive market sentiment.

Arthur Hayes, co-founder of BitMEX and a prominent KOL in the cryptocurrency field, just made a notable purchase of the utility token of

TapChiBitcoin·2025-11-27 09:03

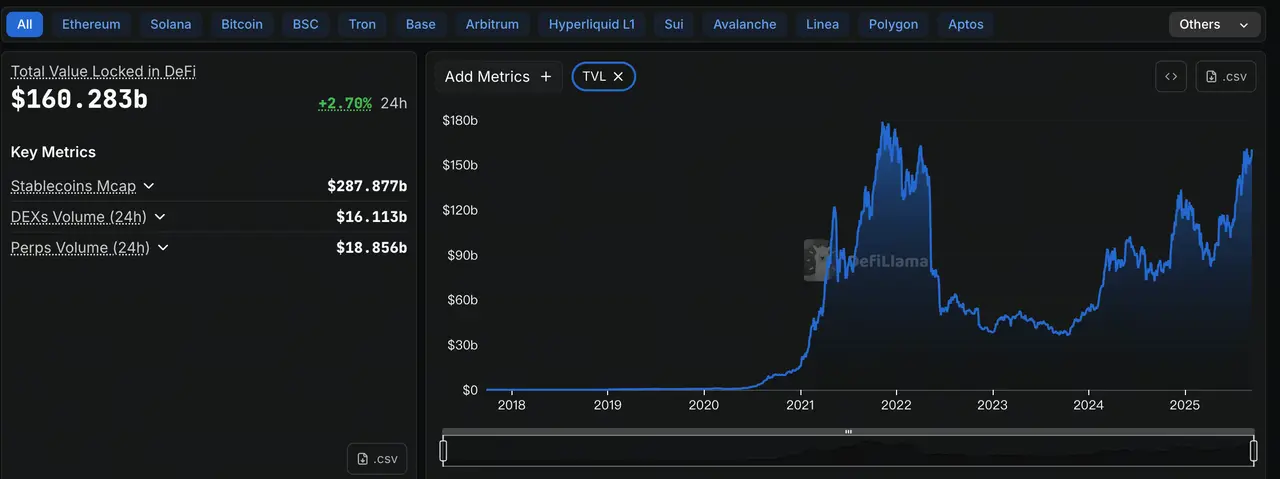

Pendle released its third quarter report: TVL averaged $8.75 billion, a quarter-on-quarter increase of 118.8%.

Pendle released its third-quarter report, with a Total Value Locked of ( TVL reaching 8.75 billion USD, significantly rising compared to the second quarter, with stablecoins accounting for 80%. The nominal volume was 23.39 billion USD, with revenue of 9.14 million USD and 292,000 monthly active users, showing a comprehensive improvement in key metrics.

PENDLE5,21%

MarsBitNews·2025-11-18 03:14

Data: A certain Whale continues to inject various assets such as UNI and LINK into Binance while incurring significant unrealized losses.

According to Mars Finance, a Whale deposited 1.19 million UNI (approximately 10.54 million USD) to Binance, and then continued to deposit multiple assets while being in a significant loss state: 74,281 LINK is currently worth about 1.07 million USD, with a loss of 752,000 USD compared to the purchase price; 764,376 PENDLE is currently worth about 1.85 million USD, with a loss of 1.77 million USD; 8,936 AAVE is currently worth about 1.66 million USD, with a loss of 570,000 USD. The Address also sold 220,351 AERO for 186,000 USDC and still holds 150,000 AERO.

UNI5,94%

MarsBitNews·2025-11-14 10:21

Pendle has launched a new pool, and Boros has introduced a new expiration date for the Hyperliquid BTC funding rate market.

Pendle has recently added 11 new DeFi funding yield pools, and its Borob trading platform has launched a new expiration date for the BTCUSD funding rate market, supporting BTC and USDT trading, aimed at providing investors with a new way to hedge against funding rate fluctuations.

MarsBitNews·2025-11-10 12:33

Elixir: deUSD is officially invalidated, and the USDC compensation process will be initiated for all DeUSD and its derivations holders.

According to Mars Finance, Elixir's official Twitter announced that the stablecoin deUSD has officially been retired and no longer holds any value. The platform will initiate a USDC compensation process for all holders of deUSD and its derivations (such as sdeUSD). The affected range includes collateralizers on lending platforms, AMM LPs, Pendle LPs, etc. Elixir also warns users not to purchase or invest in deUSD through AMM or other channels.

MarsBitNews·2025-11-07 05:13

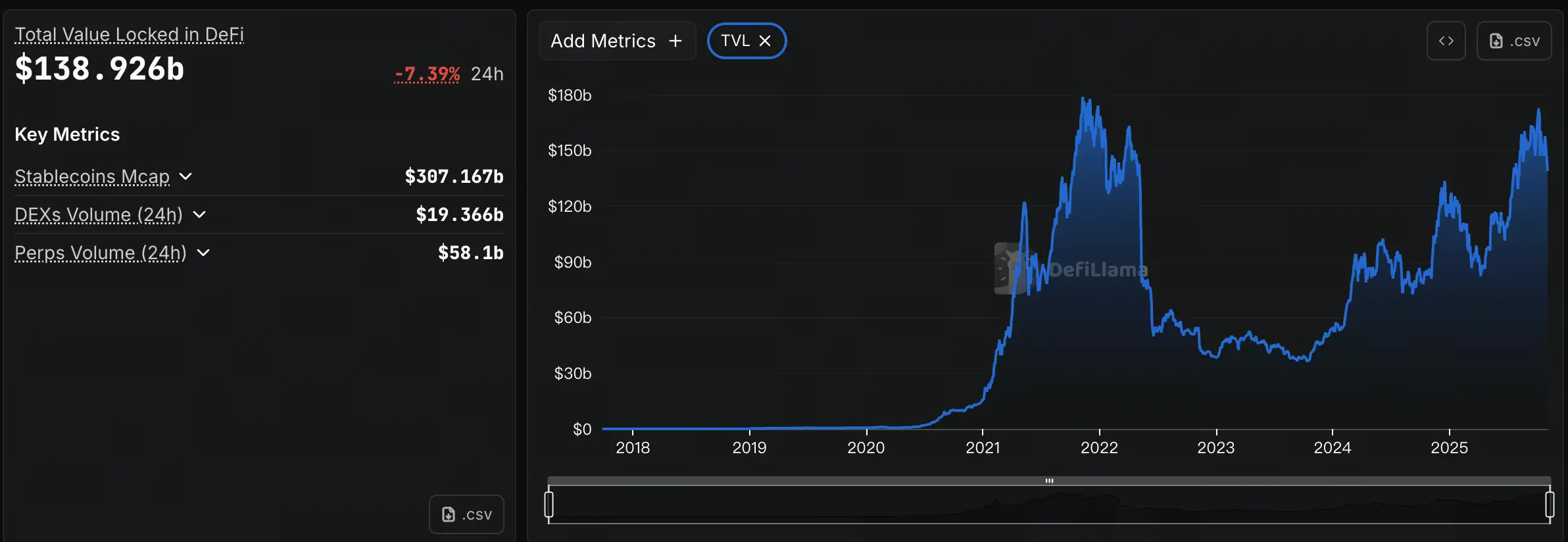

Gate Decentralized Finance Daily ( November 4: Total TVL plummets by 7.39%; Moonwell and Stream Finance encounter issues one after another.

On November 4, the crypto market continued its downward trend, with BTC falling below 104,000 USD and ETH dropping below 3,500 USD. The total value locked (TVL) in the DeFi sector fell below 140 billion USD, down 7.39% for the day. Market risk events occurred frequently, with Moonwell suffering over 1 million USD in losses from an offline Oracle Machine attack, and Stream Finance experiencing 93 million USD in losses due to fund management errors. The stablecoin XUSD was severely unpegged. Meanwhile, ZKsync announced a staking rewards program, and Pendle set records for the highest income and trading volume, demonstrating the resilience of leading protocols. Overall, the market is facing challenges in fluctuation and trust, with liquidity concentrating towards high-quality assets.

MarketWhisper·2025-11-04 09:40

Dialogue Pendle Co-Founder TN LEE: V2 Stability, Boros Sets Sail, Creating the "Apple" of the Decentralized Finance Marketplace

Editing: J.A.E

From Kyber to Pendle, TN LEE's entrepreneurial journey over ten years of industry experience has nearly spanned the key cycles of the Decentralized Finance (DeFi) market. As an early participant in the DeFi ecosystem, he not only accumulated extensive business experience but also keenly captured the enormous potential of the interest rate marketplace during the DeFi Summer. In the DeFi world, interest rates have always been the core variable driving capital flows and user decisions. Based on a deep understanding and practical experience in the interest rate marketplace, he assembled a team and founded Pendle, gradually building a complex and innovative product system centered around "interest rates."

Recently, Pendle co-founder TN LEE gave an exclusive interview to PANews, revealing that Pendle will not offer any spot or perpetual futures trading, but will instead focus more on interest rates to create the best interest rate solutions for DeFi and even broader fields.

PANews·2025-10-29 07:58

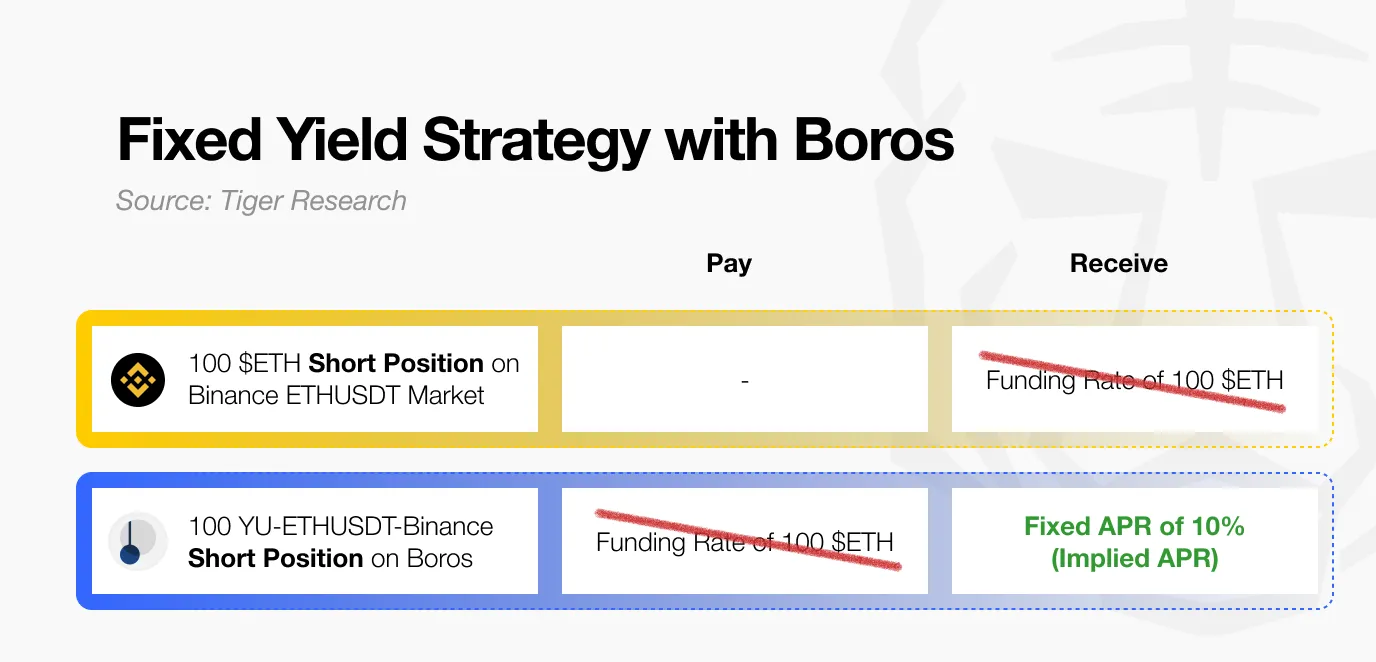

Can the funding rate be traded? Unlock Pendle's next hundredfold growth engine "Boros"

Boros takes the funding rate as a breakthrough point, creating a new field of tradable yield assets and becoming an important driving force in the Pendle ecosystem. (Background: Understanding Pendle and Boros: Turning funding rates into DeFi derivations) (Supplementary Background: Pendle is hard to understand, but not understanding it is your loss) If you had to nominate the most innovative DeFi protocol, who would you nominate? Surely Pendle would be on the list. In 2021, Pendle became the first DeFi protocol to focus on the "interest rate swap" market, single-handedly opening a yield trading market worth tens of billions, becoming the absolute leader in yield trading. And in August 2025, Pendle's innovative core of "daring to be the first" continues, launching Boros and opening up the on-chain yield blind spot of "funding rate."

PENDLE5,21%

動區BlockTempo·2025-10-26 08:27

Gate Decentralized Finance Daily ( October 24 ): Aster launches Rocket Launch; Spark allocates 100 million USD to Superstate fund.

On October 24, BTC broke through $111,000 and ETH returned to $3,900, driving a strong rebound in the DeFi market, with the total TVL across the network reaching $152.461 billion. Aster launched a brand new Rocket Launch mechanism, sparking heated discussions in the community; Pendle was approved to list ETP in Switzerland, furthering its institutionalization process; Spark invested $100 million in the Superstate fund, demonstrating the increasingly diversified yield structures of DeFi protocols.

MarketWhisper·2025-10-24 10:32

21Shares has launched the Pendle ETP (APEN) on the Swiss Stock Exchange.

According to Mars Finance, on October 24, 21Shares has launched the Pendle exchange-traded product (ETP, code APEN) on the SIX Swiss Exchange, providing European investors with a Compliance investment channel $PENDLE . This move not only benefits Pendle

PENDLE5,21%

MarsBitNews·2025-10-24 07:37

5 Must-Read Articles Tonight | Bitcoin Retirement Era

Funding for crypto assets and blockchain startups has significantly declined, raising only $1.97 billion in the second quarter of 2025, marking the lowest level in nearly two years. Pendle innovates in yield trading through asset splitting, while the recent crypto market experienced a flash crash, affecting investor sentiment.

金色财经_·2025-10-20 13:04

Exclusive Interview with Pendle Founder: The Road to the Empire of Yield Trading

Author: Jonathan Ma, Founder of Artemis; Translator: Jinse Finance xiaozou

Recently, we interviewed TN Lee, the founder of Pendle. Pendle has become one of the fastest-growing fixed income and yield trading protocols in the DeFi space, with a total locked value (TVL) surpassing several billion dollars, and stablecoins accounting for over 80% of liquidity. By splitting assets into principal tokens (PT) and yield tokens (YT), Pendle has created a bilateral market that satisfies both risk-averse investors seeking certain returns and risk-seeking traders chasing points and excess returns.

This article will delve into the development history of Pendle, future opportunities, and the strategic layout for seizing the 140 trillion US dollar global fixed income market.

1. Hello TN! Pendle was established in 2020. Could you share with us the story of how you started Pendle?

PENDLE5,21%

金色财经_·2025-10-20 04:52

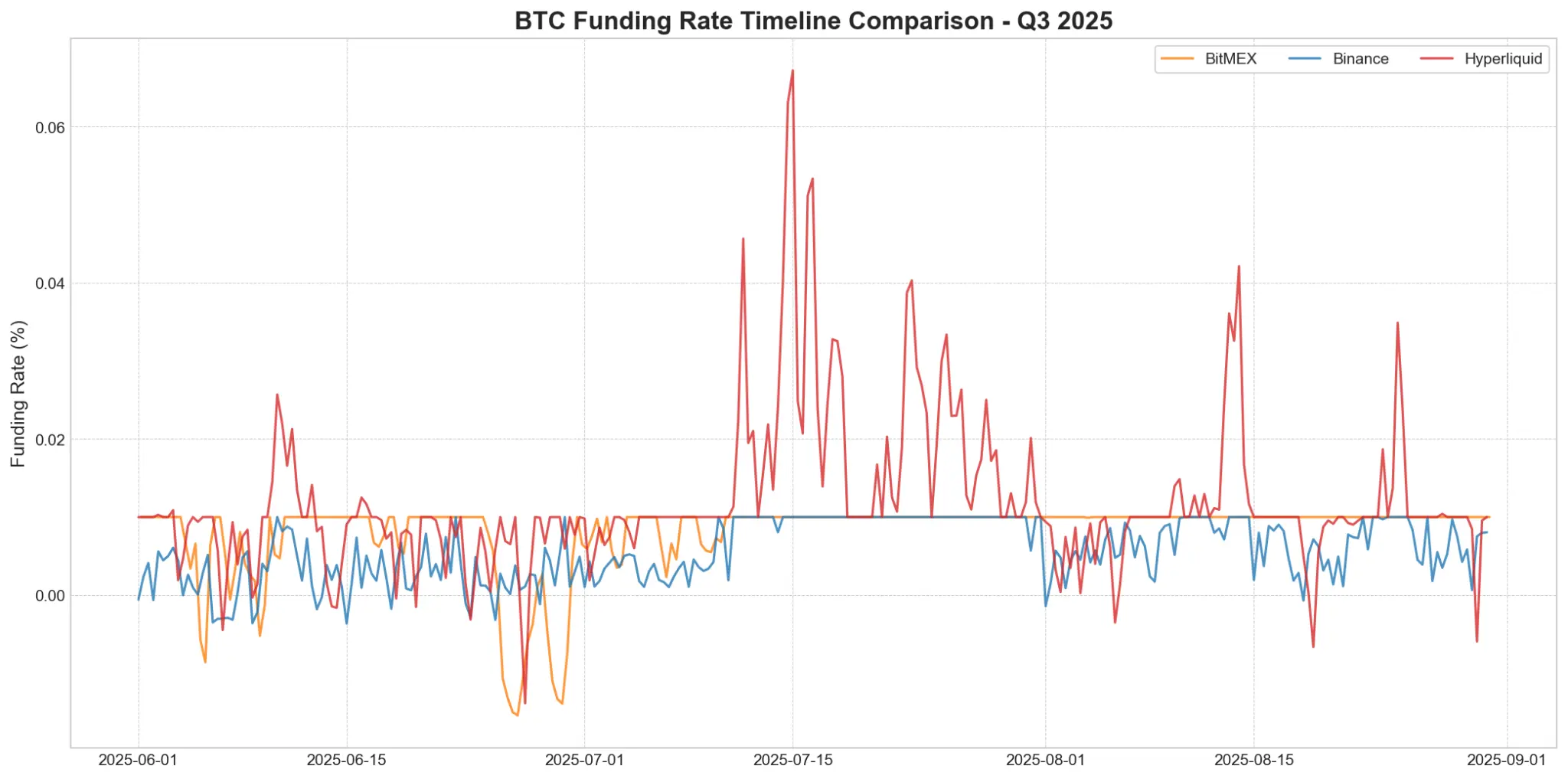

Q3 Derivation Report: Anchors and Limits, Understanding the Structure of Funding Rate

To make a long story short:

With the explosive growth of decentralized derivatives platforms like Hyperliquid and the introduction of Pendle funding rate trading, the cryptocurrency funding rate market is continually evolving. Specifically, two structural forces can be attributed to the dynamics of the funding rate market, thus creating predictable trading opportunities:

1. The anchor point of the formula (lower limit): The perpetual swap contract formula embeds an interest rate component that forces the interest rates to cluster around 0.01% (positive deviation). Data shows that over 92% of the funding rates in the third quarter of 2025 are positive.

Trader Action: Do not bet on sustained negative interest rates. The formula is actively pushing interest rates up.

2. Arbitrage Capital (Upper Limit): Includes billions of dollars in institutional capital from participants such as Ethena, which immediately shorts high premium contracts when interest rates soar.

Trader Actions:

PANews·2025-10-15 02:07

Comprehensive Analysis of Pendle Yield Strategies: The New Normalization of Pulse's AgentFi

This article analyzes Pendle's strategy applications under different market cycles, focusing on fixed income, speculation, and arbitrage. Pendle has established a secondary market for encryption assets through yield splitting and trading mechanisms, significantly enhancing trading flexibility and pricing accuracy. Additionally, the Boros module capitalizes on funding rate assets, expanding the application scenarios of Decentralized Finance and providing investors with new yield strategies.

動區BlockTempo·2025-10-03 09:32

Pendle, Arbitrum, and Polkadot Underrated Coins That Will Do Well in October 2025

Pendle shows early signs of momentum as RSI and MACD signal room for further growth despite modest trading strength.

Arbitrum maintains balanced momentum, recovering from intraday weakness and positioning for steady upside if volume improves.

Polkadot leads the rally, posting the strongest gains w

CryptoNewsLand·2025-10-02 22:54

Slow Fog Cosine: Losses exceed $1.3 million as Pendle Large Investors are stolen, possibly due to their contract allowing anyone to call.

Mars Finance reported that Slow Fog's Yu Xian explained the Pendle Large Investors theft incident on the X platform, with officials confirming the protocol's security. The contract created by the Large Investors was exploited by a Hacker, ultimately leading to losses exceeding $1.3 million.

MarsBitNews·2025-10-02 03:54

Pendle is suspected of being attacked by a token minting dumping, the official: the protocol is safe and not hacked.

The decentralized yield tokenization protocol Pendle has reported that an on-chain wallet has been cleared out, with someone suspected of minting and dumping a large amount of PT/YT tokens, causing the price of PENDLE to experience a big dump. However, the officials emphasized that the protocol itself has not been hacked, and funds are still safe.

Suspected vulnerability behavior exposed: attackers are minting and dumping coins on a large scale.

Pendle announced on September 30th (Monday) via X that an on-chain Wallet had been emptied, and the attacker is suspected of continually minting Principal Tokens (PT) and Yield Tokens (YT) in the Pendle protocol, quickly dumping these Tokens for profit.

This behavior has raised market alertness, with users questioning whether there are minting vulnerabilities in the protocol or if there has been some kind of internal operation.

Official clarification: The protocol has not been hacked, and the funds are safe.

Facing community panic, Pen

PENDLE5,21%

ChainNewsAbmedia·2025-10-01 01:45

In-depth analysis of Pendle and Boros: How can investors enter the funding rate market?

This report is written by Tiger Research and analyzes how Pendle transforms fluctuating funding rates into stable and predictable returns for institutional investors through Boros, thereby changing the DeFi derivation space.

Summary of Key Points

Core problem solved: Institutions need stable returns but the funding rate fluctuates wildly - Boros converts volatility into fixed returns.

Market Opportunity: Having a first-mover advantage in the DeFi derivation space, becoming an indispensable infrastructure for Delta-neutral strategies like Ethena.

Expanded Vision: Extend from the funding rate of crypto assets to traditional finance (bonds, stocks), leading the on-chain derivation market.

1. The undeveloped areas behind the success of Decentralized Finance

Despite the emergence of many narratives in the crypto market, Decentralized Finance (DeFi) and derivation trading.

PENDLE5,21%

PANews·2025-09-22 04:07

A whale withdrew 1 million PENDLE and staked it in a lock-up position for six months.

According to Mars Finance news on September 20, monitoring by Yu Jin revealed that an address withdrew 1 million PENDLE from Binance 10 minutes ago, worth 10 million USD, to on-chain, and then deposited it into Pendle for a six-month Lock-up Position stake.

PENDLE5,21%

MarsBitNews·2025-09-20 15:43

Understanding Pendle and Boros: Turning funding rate into DeFi derivation

This article discusses the collaboration between Pendle and Boros, transforming the fluctuation of funding rates into stable returns, and changing the strategies of institutional investors in DeFi derivations. Pendle introduces a yield splitting mechanism to enhance capital efficiency, while Boros provides stable yield units to help institutions drop the risk of funding rate fluctuations and promote the growth of the DeFi market.

動區BlockTempo·2025-09-20 10:57

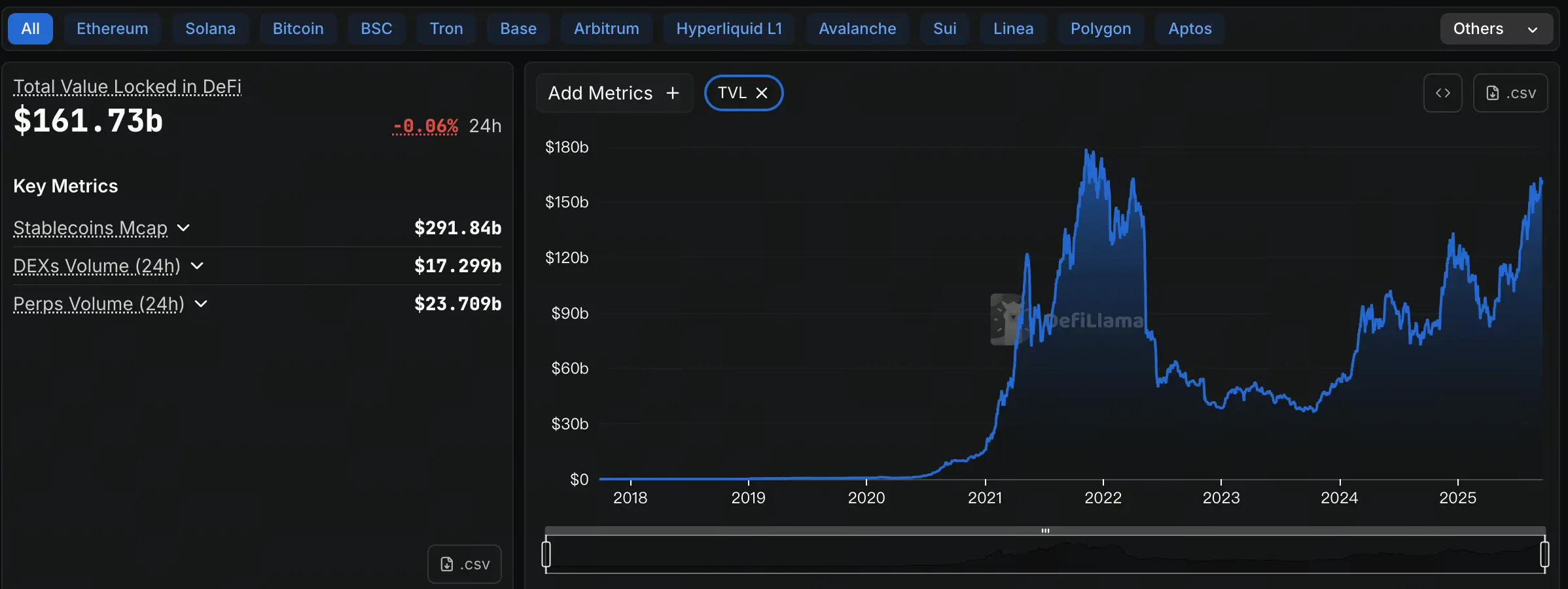

Gate Decentralized Finance Daily ( September 19, ): MetaMask confirms issue coin; Plasma announces TGE date, Aave V4 to launch in Q4.

On September 19, following the Fed's interest rate cut, the DeFi market entered a phase of consolidation. The total TVL across the network slightly decreased to $161.73 billion, down by 0.06% over the last 24 hours. The total trading volume of DEXs fell back to $17.299 billion, a decrease of 8.7% compared to the previous period. In terms of on-chain dynamics, Ethereum DEX regained the top position with a daily trading volume of $3.861 billion, surpassing Solana; Meteora, Fluid, and Pendle remain active. Overall, the DeFi zone tokens showed mixed performance, with CRV and MORPHO rising against the trend, while MYX experienced a rollercoaster, falling nearly 25%.

MarketWhisper·2025-09-19 09:10

Pendle Multi-signature Wallet has transferred 1.2 million PENDLE to Binance again, worth approximately 6.44 million USD.

According to Mars Finance, Pendle's Multi-signature Wallet (Address: 0x811) has transferred 1.2 million PENDLE Tokens to Binance again, worth approximately 6.44 million USD.

PENDLE5,21%

MarsBitNews·2025-09-19 01:23

Is This Where Pendle Price Bottoms Out Before the Next Rally?

The article discusses the potential for Pendle (PENDLE) to rally if it dips to $4.70, a significant support level based on a chart by analyst Ali. It outlines why this price point is important and possible price movement towards $7.60 if the bounce occurs successfully.

CaptainAltcoin·2025-09-17 13:03

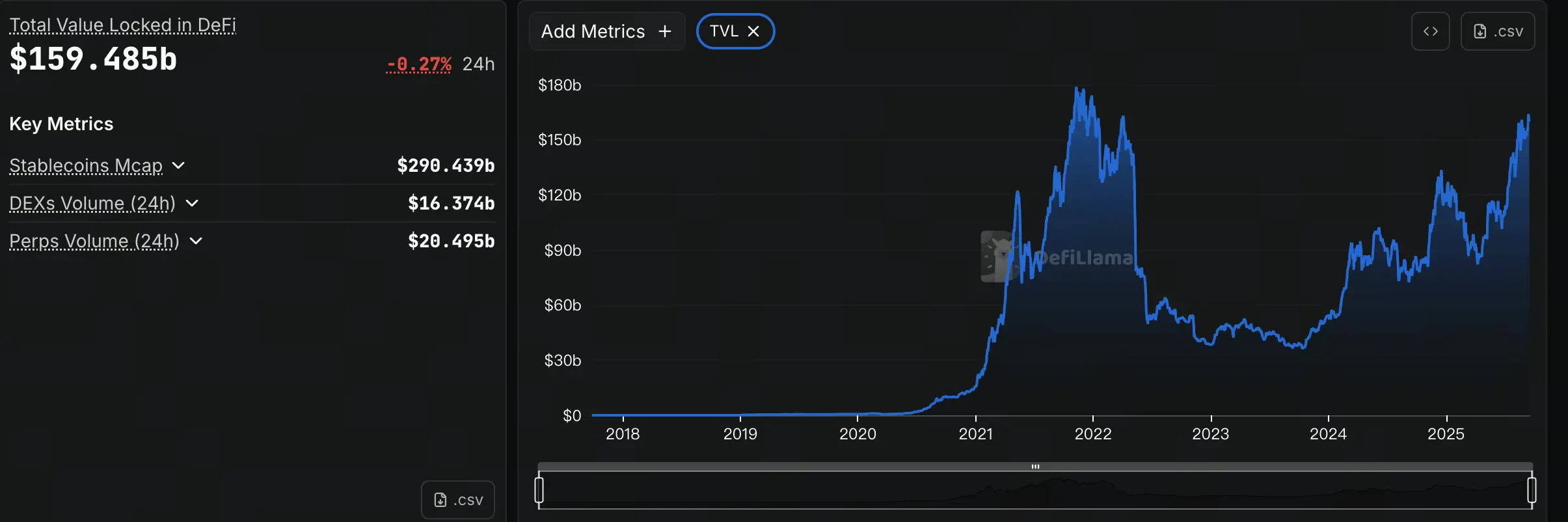

Gate Decentralized Finance Daily (, September 17: TVL once again falls below $160 billion, MYX big pump 45% leading the zone.

As of September 17, the total DeFi TVL across the network slightly decreased to $159.485 billion, falling below the $160 billion mark, with the overall market funds remaining cautious. DEX volume shrank to $16.374 billion, showing a nearly 19% day-on-day decline, indicating weakened short-term activity. On the protocol level, Pump protocol fees remain high, with leading projects like Pendle and Ethena maintaining steady growth. Notably, in the Token market, MYX experienced a big pump of over 45%, becoming the biggest highlight of the day, indicating that funds are still seeking high-yield opportunities in specific emerging sectors.

MarketWhisper·2025-09-17 08:44

Gate Decentralized Finance Daily ( September 16 ): Base "Exploring Issue Coin" Ignites Market Enthusiasm; DEX volume increases by 25%

As of September 16, the total DeFi TVL across the network remains firmly above $160 billion, with DEX trading volume exceeding $19.4 billion, a significant increase of 25% compared to the previous day. The trading activity of Solana and Ethereum has significantly increased, while the DEX trading volume within the Base ecosystem has also surged due to the potential Favourable Information from "exploring issue coin". On the other hand, the Pump protocol fees have soared to the second highest across the network, Pendle has launched cross-chain PT, and Ethena is preparing to switch fees, all indicating that core protocols are continuously iterating in terms of functional expansion and revenue models. The overall market is experiencing a turbulent consolidation, with some DeFi blue-chip tokens strengthening.

MarketWhisper·2025-09-16 09:28

Gate Decentralized Finance Daily ( September 12, ): Meteora October TGE; Ethena daily fees exceed 13 million USD.

On September 12, the DeFi market overall warmed up, with the total TVL returning above 160 billion USD, and DEX trading volume maintained at 16.1 billion USD. Meteora continues to lead the Solana ecosystem with expectations for TGE and Airdrop, with daily trading volume exceeding 1 billion USD; WLFI announced a buyback and burn proposal, strengthening the long-term value narrative. Meanwhile, protocols such as Ethena and Pendle have performed outstandingly in terms of revenue and TVL rise, showing that funds are concentrating towards yield-generating protocols.

MarketWhisper·2025-09-12 10:03

ONDO, AERO, and PENDLE lead the pump in the Decentralized Finance market! Technical signals release recovery momentum.

Decentralized Finance (DeFi) tokens experienced a significant Rebound this week, with Ondo Finance (ONDO), Aerodrome Finance (AERO), and Pendle (PENDLE) becoming the market focus. On-chain and derivation data show that traders' interest in these three major tokens is rapidly heating up, with Open Interest (OI) increasing by 20%, 16%, and 12% respectively on September 12, indicating that capital inflows are betting on the continuation of the recovery trend.

MarketWhisper·2025-09-12 05:30

Pendle breaks through the $5 mark, with TVL reaching an all-time high: the next target aims for the historical high point of $7.50.

Against the backdrop of a significant surge in volume, the price of Pendle (PENDLE) rose over 5%, breaking the $5 mark. Meanwhile, its Total Value Locked (TVL) in the Decentralized Finance (DeFi) ecosystem reached an all-time high. This rise momentum is driven by multiple factors, including the macroeconomic environment and the strong fundamental growth of the Pendle platform itself.

PENDLE5,21%

MarketWhisper·2025-09-12 02:45

Pendle rolls out an autonomous yield agent for 24/7 portfolio growth

Pendle, the protocol that facilitates trading and tokenisation of future yield, has made a strategic move in its mission by launching autonomous agent Pulse, which optimises fixed yield portfolios 24/7 throughout the year.

Pendle has collaborated with Giza to release an agent that makes yield

BitcoinInsider·2025-09-11 10:21

Gate Decentralized Finance Daily (, September 11, ): Linea introduces a dual Burn Mechanism; Meteora plans to have its TGE in October.

On September 11, the DeFi market continued its warming trend, with TVL breaking through 15.67 billion USD. The leading protocols showed steady growth, and Solana's trading activity once again led the way. The announcement of Linea's token mechanism strengthened long-term value expectations, while the ongoing expansions of Pendle and Ethena highlighted the demand for stable returns and innovative mechanisms. The Meteora TGE ignited community enthusiasm, but the Nemo attack incident reminded the market that security remains a core issue that cannot be ignored in DeFi. In the short term, the market may remain active due to concentrated liquidity and incentive mechanisms, but risk management will still be a key focus for investors.

MarketWhisper·2025-09-11 09:30

Pendle Yield Strategy Overview: Pulse's AgentFi New Paradigm

Written by: 0xjacobzhao

Undoubtedly, Pendle is one of the most successful DeFi protocols in this round of the crypto cycle. While many protocols have stagnated due to liquidity depletion and a retreat of narratives, Pendle has successfully become the "price discovery venue" for yield-bearing assets with its unique yield splitting and trading mechanism. Through deep integration with stablecoins, LST/LRT, and other yield assets, it has established a distinctive positioning as the "DeFi yield infrastructure."

In "The Smart Evolution of DeFi: From Automation to

PENDLE5,21%

TechubNews·2025-09-11 09:19

Gate Research Institute: Gate launches coin staking feature|OpenSea Foundation plans to announce SEA Token TGE in early October

Abstract

1. This week BTC rose by 2.43%, ETH rose by 1.72%, and mainstream altcoins continued to rise overall.

2. MYX token is currently priced at 18.34 USD, with a 24-hour increase of up to 18.1%, and a cumulative surge of 1533.7% over 7 days.

3. Gate introduces a staking feature, supporting mainstream assets.

4. Pendle's TVL has increased by over 10% in the last 7 days, reaching a new high.

5. The OpenSea Foundation plans to announce the SEA token TGE in early October.

6. The altcoin index is rising rapidly, with obvious signs of capital rotation.

Market Interpretation

Market Commentary

- BTC Market —— This week BTC rose by 2.43%. After undergoing previous fluctuations and consolidation, BTC has continued to rise recently, reaching a peak of 124,400 USD.

GateResearch·2025-09-11 06:59

Pendle: Building the Blueprint for DeFi Fixed Income in the Era of Yield Splitting and Restaking

Pendle has evolved from a niche experiment into a DeFi blue chip, using PT/YT yield-splitting to bring fixed income markets on-chain and driving its TVL from millions to billions.

LSDfi and LRTfi turned Pendle into a yield hub, where users hedge or leverage staking and restaking rewards, with

CoinRank·2025-09-10 10:23

Here’s Why PENDLE Might Be the Best Crypto to Buy Now; Research

The CaptainAltcoin Research team on X has highlighted Pendle ($PENDLE) as one of the most promising assets in today’s DeFi market. The thread argues that Pendle has the numbers, the adoption, and the upcoming catalysts that could make it the backbone of DeFi yield.

At under $10, they suggest it

CaptainAltcoin·2025-09-08 20:04

Pendle Battles Key $4.40 Support for Next Big Move

Pendle is currently at $4.67, facing critical support at $4.40, which if maintained, could lead to a recovery towards $7. Key resistance levels are at $4.79 and $5.40. The near-term direction depends on buyer support, with a breakdown risking a bearish shift.

CryptoFrontNews·2025-09-07 12:32

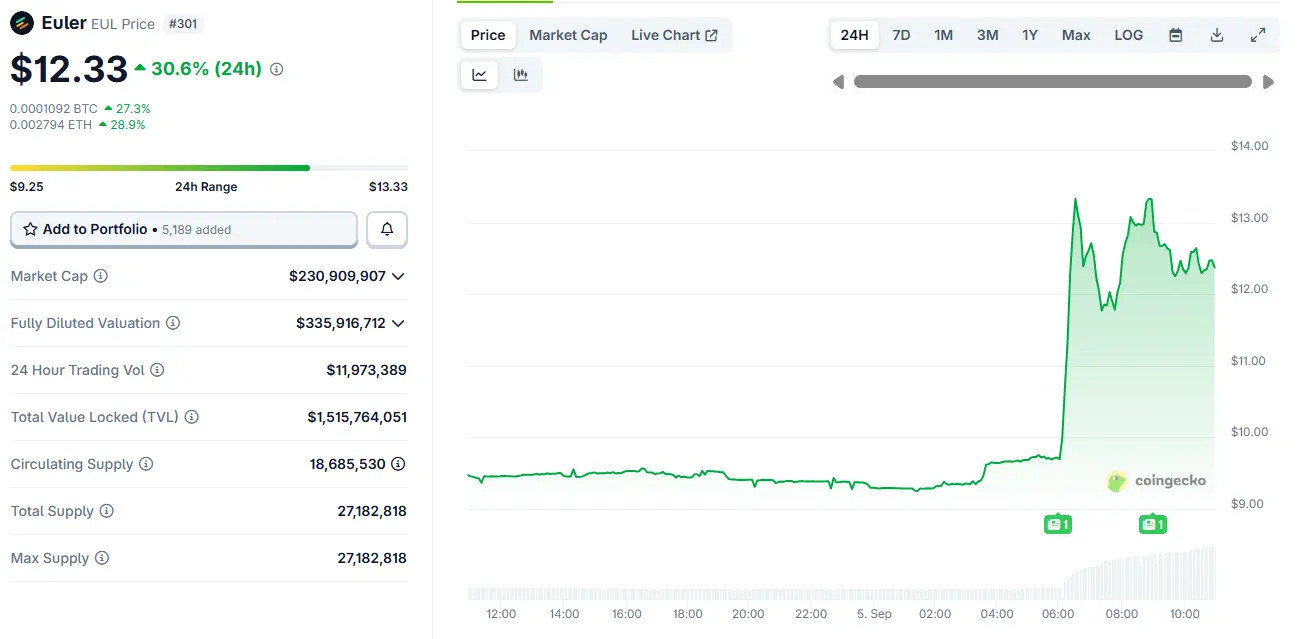

Bithumb listing sends the price of Euler (EUL) price flying

The Euler (EUL) price has surged over 30% after Bithumb confirmed KRW trading.

Euler’s TVL hit $1.52B, marking rapid DeFi growth in 2025.

Coinbase and Pendle integrations have boosted Euler’s ecosystem momentum.

Bithumb, South Korea’s second-largest cryptocurrency exchange, has announced that tr

EUL10,24%

BitcoinInsider·2025-09-05 10:46

Crypto for Advisors: The Mechanics of Generating Yield On-Chain

How does decentralized finance (DeFi) work? In today&39;s Crypto for Advisors newsletter, Elisabeth Phizackerley and Ilan Solot and from Marex Solutions co-authored this piece about the mechanics of a DeFi transaction using Ethena, Pendle and Aave and how they all work together to create

YahooFinance·2025-09-04 17:45

Load More