Search results for "PAIN"

Is Gate Leverage Worry-Free worth participating in? Liquidation prevention mechanism, new user subsidies, and common questions explained

Gate Leverage Worry-Free solves what problems

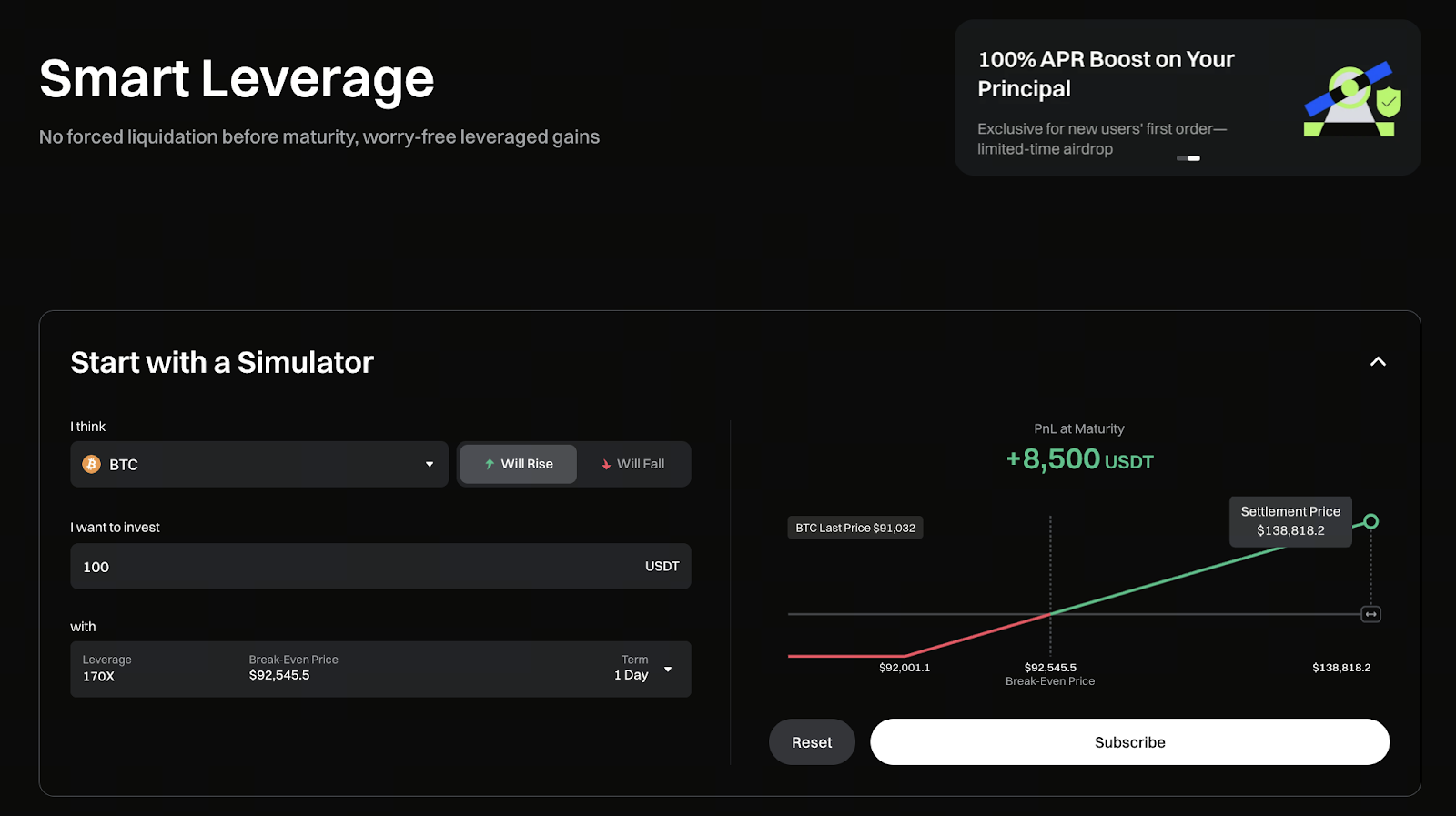

Figure: [https://www.gate.com/smart-leverage](https://www.gate.com/smart-leverage)

In the crypto market, many traders do not lose money because of incorrect direction judgment, but are "liquidated" early due to short-term sharp fluctuations. The forced liquidation mechanism in traditional leverage or perpetual contracts is the core source of this issue.

The launch of Gate Leverage Worry-Free directly addresses this pain point. This product uses a structured approach, allowing users to avoid worrying about forced liquidation during the holding period, thereby focusing more on market trend judgment.

Is Leverage Worry-Free really "not going to liquidate"

It should be clarified that Gate Leverage Worry-Free does not trigger forced liquidation during the holding period, but this does not mean there is no risk.

Product

GT0,56%

GateLearn·01-04 02:05

SkyBridge’s Scaramucci bets on Solana, Avalanche and TON as 2026 altcoin winners

Scaramucci names Solana, Avalanche and TON as top altcoins, citing 2025 whale selling, 2026 rate cuts and U.S. crypto regulation as key drivers.

Summary

Scaramucci blames 2025 altcoin pain on whale selling into ETF demand and an October deleveraging-driven liquidity crunch that dragged

Cryptonews·01-01 15:06

[Editorial] The "Linux Moment" of Cryptocurrency: The End of Ideology and the Victory of Pragmatism

The huge foundation supporting the internet world is "Linux." Most servers worldwide run on Linux, and the core of the Android smartphones we use every day is also Linux. However, ordinary users may not even realize they are using Linux. They don't need to know. As long as the network speed is fast and applications run smoothly, that's enough.

The turning point currently facing the cryptocurrency market is precisely this "Linux path." In the past few years, the cryptocurrency industry misjudged the public's willingness to follow their values. They believed that concepts like decentralization, self-sovereign identity, and radical transparency would change the world.

But this assumption is wrong. As previously diagnosed in this publication through editorials, the pain and initial state of the cryptocurrency market integrating into the mainstream financial system are not driven by grand ideals. The public has chosen pure "pragmatism."

Recently, institutions and mainstream applications have introduced crypto into the market.

TechubNews·2025-12-29 15:23

Pantera, Sequoia, and Samsung team up to bet, is FIN aiming to take over traditional banks' jobs?

Writing by: KarenZ, Foresight News

In the current global financial system, large-scale cross-border transfers are still plagued by "slow arrival, high fees, and complicated procedures." A startup called FIN is directly addressing this pain point with stablecoins, attempting to rewrite the industry landscape.

As a project founded by two former Citadel employees, FIN is not just making small moves on the fringes but is building a large-scale payment track using stablecoin technology, dedicated to providing instant and efficient cross-border transfer experiences for enterprises and high-net-worth individuals.

In early December 2025, FIN announced the completion of a $17 million funding round, led by Pantera Capital, with Sequoia and Samsung

TechubNews·2025-12-28 01:17

Pantera, Sequoia, and Samsung team up to bet, is FIN aiming to take over the traditional banking industry?

When quantitative elites start payments, what makes FIN, built by Citadel veterans, able to attract top-tier venture capital? Upgrading from TipLink to a payment platform focused on large-scale cross-border transfers, FIN is challenging the traditional banking global payment system with stablecoin technology.

(Background: Stablecoins won't drain banks! Cornell study: Deposit stickiness is extremely strong, forcing banks to upgrade)

(Additional context: United Stables launched $U stablecoin deployed on BNB and Ethereum, emphasizing "unified liquidity" and AI payment economy)

Contents

Core positioning of FIN

Core team: Quantitative DNA + Pain point-driven

Funding history

From TipLink to FIN: How does the project operate?

Summary

In the current global financial system, large-scale cross-border transfers are still plagued by

動區BlockTempo·2025-12-26 12:55

Secondary Market Daily Report 20251226

Market Trends

The cryptocurrency market overall shows a downward trend today, with BTC falling below $87,000 and SOL losing the key level of $120. The low liquidity during Christmas week has amplified market concerns over regulatory risks and economic uncertainties. The current market is on the eve of the "largest options expiration day in history," with massive expiring positions causing volatility to reach extreme levels. Short-term operations should remain highly cautious.

Mainstream Coins

BTC

Is facing a dramatic impact from $23 billion in options expiring (the largest in history). Currently, the biggest pain point for shorts is around $96,000, but the put pressure at $85,000 should not be underestimated. In the short term, prices may experience frequent "needle-like" movements before expiration. Looking long-term, Japan's Metaplanet Board has approved a plan to increase holdings of 210,000 BTC by the end of 2027, providing a solid

Biteye·2025-12-26 09:33

The Largest Crypto Options Expiration in History: How Will the $27 Billion Bitcoin and Ethereum Options Expiration Define the Start of 2026?

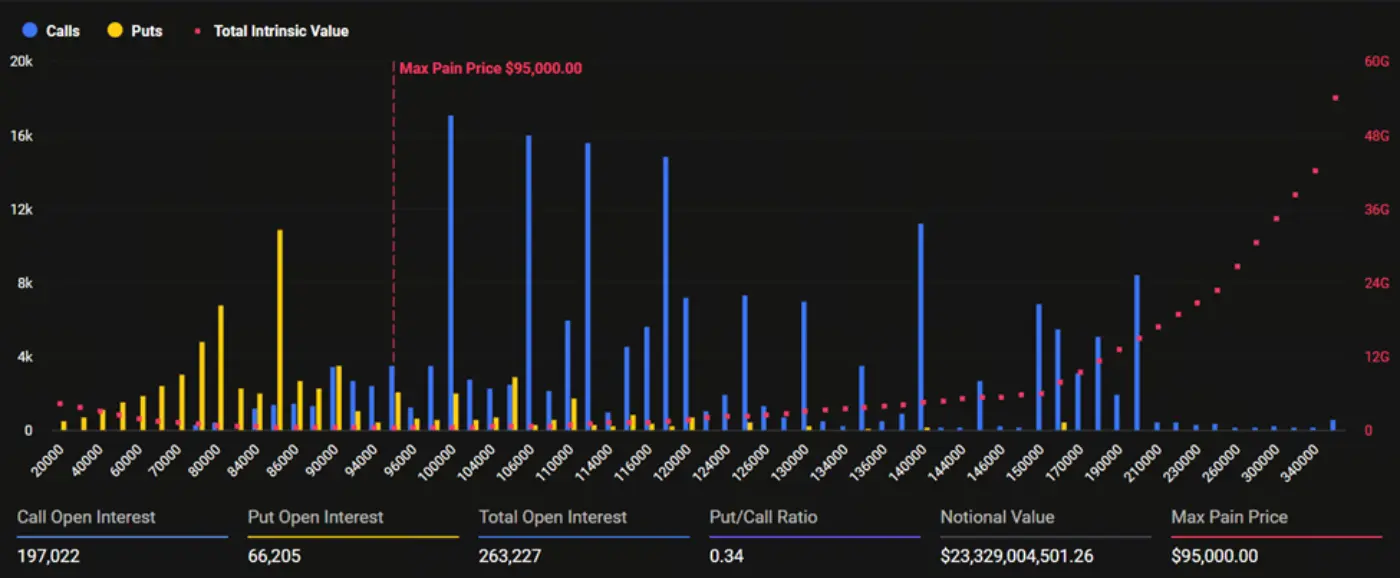

On December 26th, Beijing time, the world's largest cryptocurrency derivatives exchange Deribit is about to experience an unprecedented "Ultimate Settlement." Bitcoin and Ethereum options contracts worth up to $27 billion are set to expire, with Bitcoin options accounting for $23.6 billion and Ethereum options for $3.8 billion, representing over 50% of the exchange's total open interest. This expiration coincides with the overlap of quarterly and monthly contracts, with the "maximum pain" prices located around $95,000 and $3,000 respectively. Although implied market volatility has retreated from high levels, this historic scale of expiration is not merely a risk release; it is more likely to reshape the flow of funds after expiration, laying a new structural direction for the cryptocurrency market in early 2026.

MarketWhisper·2025-12-26 05:56

Ethereum 6 billion options expire! $3,100 pain point determines long and short life and death

On December 26, approximately $6 billion worth of Ethereum options contracts will expire, with Deribit holding about $3.8 billion. This is the biggest derivatives event of the week. The number of call options is 2.2 times that of put options, but the $3,100 "pain point" price has become a key level for bulls and bears. If Ethereum fails to effectively break through this level, a large number of call options will become worthless. The current price remains above $2,900, but the market structure is fragile.

MarketWhisper·2025-12-26 05:23

Holding XRP Got Painful: Treasury Data Shows Heavy Losses

XRP holders have had another rough stretch, and the latest on-chain view makes that pain easy to see. XRP is down around 3% this week and still trades below $1.90. Price action has stayed heavy, and every bounce has struggled to stick.

A CryptoQuant chart tracking Evernorth’s unrealized PnL adds

XRP12,03%

CaptainAltcoin·2025-12-24 16:35

$27 billion in cryptocurrency options will expire on Christmas Day! Traders are betting on a "Christmas Rebound," can BTC rise to $96,000?

As the year-end approaches, the crypto derivatives market is undergoing an unprecedented "structural reset." On December 26 (Boxing Day), the world's largest crypto assets options exchange Deribit will have Bitcoin and Ether options contracts with a total value of up to $27 billion expiring, with Bitcoin options accounting for $23.6 billion and Ether options for $3.8 billion. This expiration involves more than 50% of Deribit's total open contract volume, and the market shows a clear bullish bias, with the put-to-call ratio dropping to as low as 0.38.

At the same time, data from institutions like Matrixport shows that the sentiment among options traders has shifted from extreme bearishness to "slightly bullish" for the first time since the sharp drop in October, with the key indicator 25-Delta skew starting to rebound. This series of signs, combined with the characteristics of thin liquidity at year-end, sets the stage for the long-awaited "Santa Claus rally" in the market, while the $96,000 "maximum pain point" price for Bitcoin will become the focus of today's long and short battle.

MarketWhisper·2025-12-23 03:07

Gate Vault Multi-chain Safe: A controllable and recoverable asset security foundation for Web3 users.

When Web3 is to go mainstream, security must come first.

The speed of development of on-chain applications has already surpassed most users' understanding of security risks. Loss of private keys, phishing attacks, and platform failures are not isolated incidents, but rather recurring real-world tests during the popularization of Web3. Once assets go wrong, it is difficult to recover, and users will naturally keep their distance from the decentralized world.

The emergence of Gate Vault addresses this core pain point by not merely enhancing wallet functions, but by fundamentally redesigning a security architecture that is more aligned with real usage scenarios, starting from the essential questions of who can control assets and how to reduce single point risks.

No longer relying on a single private key security model

Traditional wallets concentrate all permissions in a single private key, which is convenient but extremely vulnerable. Gate Vault employs MPC (Multi-Party Computation) technology to split the complete private key.

GateLearn·2025-12-22 01:38

Crypto market cap falls to 8-month low, analysts see more pain ahead

The total crypto market capitalization has fallen to an eight-month low, erasing much of this year’s gains, as analysts remain bearish in the short term.

Total market capitalization fell to $2.93 trillion in late trading on Thursday, its lowest level since April, according to CoinGecko.

The total

MORE-3,71%

Cointelegraph·2025-12-19 11:54

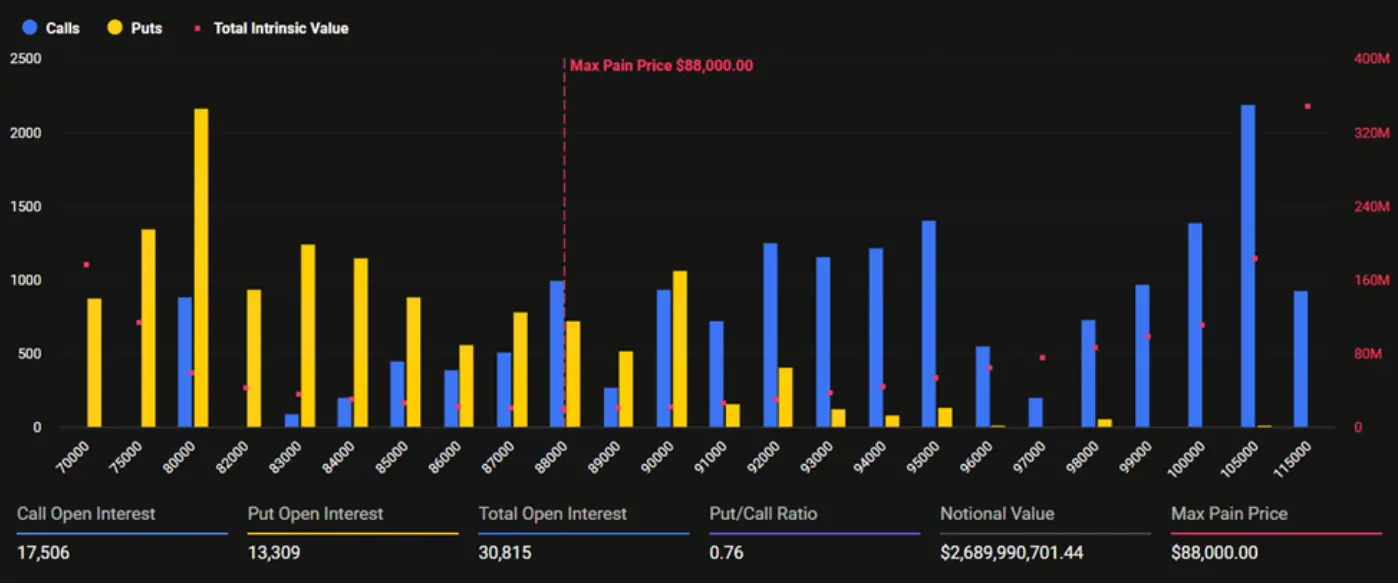

$3.16 billion in crypto options to be settled before Christmas. How will Bitcoin and Ethereum prices move?

The cryptocurrency derivatives market is facing a critical year-end test. On December 19th at 08:00 UTC, approximately $3.16 billion worth of Bitcoin and Ethereum options will expire simultaneously on the Deribit exchange. This is the last major derivatives settlement before Christmas. Among them, Bitcoin options dominate with a notional value of up to $2.69 billion, with the current price close to the "maximum pain point" of $88,000; Ethereum options are valued at $473 million, with their "maximum pain point" at $3,100, which is significantly different from the current price. In the context of holiday liquidity being thin, this "annual report card" is testing the market's short-term balance and could serve as a trigger for pre-holiday volatility. Traders are holding their breath, waiting for the next clear market catalyst.

MarketWhisper·2025-12-19 05:50

United Stables launches the new generation stablecoin U: nearly $60 million attracted within 24 hours, targeting the fragmented liquidity dilemma

The stablecoin market welcomes a heavyweight new player built by United Stables. On December 18, the next-generation stablecoin $U , aimed at creating a unified liquidity layer, officially launched on the BNB Chain and Ethereum mainnet. Its innovative "Stablecoin Inclusive Reserve" model consolidates mainstream stablecoins such as USDT, USDC, USD1, and others as reserve assets, attempting to end the market pain point of liquidity fragmentation. The launch performance has been remarkable: in less than 24 hours, its circulating supply rapidly rose to 58.9 million tokens, and it quickly gained full integration with leading DeFi protocols like PancakeSwap, Lista DAO, and major exchanges. This is not just the birth of a new asset but may also signal a strategic shift for stablecoins from "fiefdoms" to a "unified foundational layer."

MarketWhisper·2025-12-19 05:44

Web3 AI Security Track Newcomer AgentLISA Raises $12 Million, LISA Token Launches Airdrop

The Web3 AI security track receives a major announcement. The world's first AI agent security operating system AgentLISA recently announced the completion of a $12 million funding round and plans to launch its token LISA on platforms such as Binance Alpha on December 18. The project aims to leverage its proprietary TrustLLM large model to revolutionize the industry pain points of high costs and long cycles in smart contract auditing, reducing audit times from several weeks to just a few minutes. This token generation event (TGE) and launch mark a high level of recognition from capital and the market for the "AI + blockchain security" integrated track, which is expected to build a new security foundation for decentralized applications.

MarketWhisper·2025-12-19 05:25

Synthetix returns to the Ethereum mainnet every three years: All DEXs will come back

Gas fees plummet dramatically, coupled with the mainnet's liquidity and security advantages. After three years away, Synthetix returns to Ethereum, injecting a key variable into the 2025 DeFi landscape.

(Background recap: The insider story of RWA protocol Ondo Finance's explosion in popularity: BlackRock and Morgan Stanley entering the real-world asset space)

(Additional background: The US SEC terminates the investigation into Ondo Finance with "no charges"! $ONDO surges and breaks through $0.5)

Table of Contents

Gas fees plummet dramatically, costs are no longer a pain point

Deep liquidity, institutional funds locking in on the mainnet

Chain reaction: Layer 2 positioning reshuffle

Conclusion: The next step for the mainnet financial hub

Derivative protocol Synthetix announced on December 17

動區BlockTempo·2025-12-19 02:00

Bitcoin in Focus as Stock and Options Contracts Expire on Friday

In brief

The "triple witching" of stock derivatives can impact crypto indirectly by shifting equity market risk appetite, which then flows into high-beta assets like Bitcoin.

A larger, direct crypto event is the December 26 expiry of over $13.3B in Bitcoin options, where the "max pain" price is

Decrypt·2025-12-17 10:54

CZ Urges Crypto Holders to Stay Steady Amid Market Dip – "Smart Money Buys Low and Endures"

CZ encouraged cryptocurrency investors during the ongoing market downturn, reminding them to focus on long-term discipline rather than short-term pain.

CryptopulseElite·2025-12-17 07:07

Why has the UAE, which was built on oil, become a new hotspot for the cryptocurrency industry?

The recent crypto market has experienced extreme fluctuations, with Bitcoin retracing over 30% from its all-time high on one side, and the UAE bustling with various crypto conferences on the other, attracting top institutions and industry veterans.

It's hard to imagine that this oil-rich region has now become a new hotspot for the crypto industry. Why exactly are major institutions gathering here and even establishing headquarters?

Looking back to 2024, the UAE incorporated the crypto industry into its "2031 National Investment Strategy" and launched the "Tokenization Regulatory Sandbox Guide" in 2025, forming a layered regulatory model with federal and local cooperation.

Currently, the Dubai Virtual Assets Regulatory Authority (VARA) has issued licenses to 36 companies, while the Abu Dhabi Global Market explicitly classifies crypto assets as regulated financial products, effectively resolving the industry's "regulatory uncertainty" pain point and contrasting sharply with regulatory deadlocks in some other regions.

It is precisely due to regulatory

金色财经_·2025-12-17 06:36

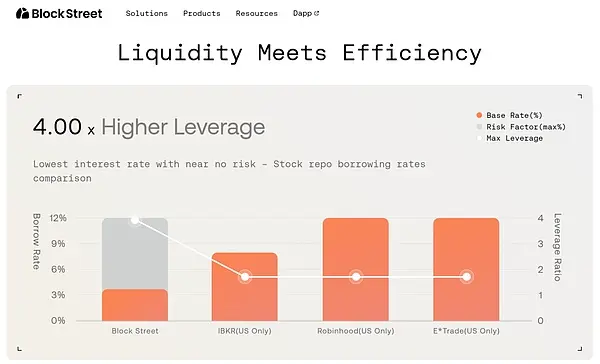

Talking with Blockstreet Hedy about US stocks: RWA tokenization is not the end point

By 2025, people will have fully recognized the transformative potential of blockchain and stablecoins, as well as their potential power in the monetary field. It can be said that we already have a tokenized blueprint that enables assets to achieve permissionless access worldwide and supports peer-to-peer transfers.

Since stablecoins—the tokenized form of fiat currency—can operate efficiently in the real world, what about the tokenization of stocks?

In the stock market, the current pain points are particularly prominent: the existing stock securities market is fragmented by region, cumbersome, and slow. Almost every region has its own Central Securities Depository (CSD)—the US has DTCC, Europe has Euroclear and Clearstream, and Asia has numerous others. Transferring stocks through brokers from one CSD to another can take several days or even weeks. Similarly, there are many frictions in the settlement of securities and the corresponding funds.

RWA3,72%

金色财经_·2025-12-16 08:50

Gold near previous high, Bitcoin undergoes deep correction: Grayscale predicts a new high in the first half of 2026

Recently, traditional safe-haven assets like gold and digital assets like Bitcoin have exhibited a rare and extreme divergence. Gold prices have climbed to $4,305 per ounce, just one step away from the all-time high, with an annual increase of up to 64%; meanwhile, Bitcoin hovers around $86,000, roughly 30% below its October peak. Renowned asset management firm Grayscale, in its latest "Digital Asset Outlook 2026," interprets the current market as the pain point of the "institutionalization era," and predicts that Bitcoin will hit a new all-time high in the first half of 2026. This judgment is based on structural changes such as global debt expansion, clearer regulatory frameworks, and continuous institutional capital inflows.

BTC0,68%

MarketWhisper·2025-12-16 05:52

Solana’s Metaplex Launches Genesis SDK for Open Fair-Launch Platforms

Solana just unlocked a new tool for builders. Metaplex has released the first public version of its Genesis SDK. This gives developers a plug-and-play way to build fair-launch platforms and access real-time token data. The upgrade aims to fix one of the ecosystem’s biggest pain points: chaotic and o

Coinfomania·2025-12-12 09:43

Bitcoin bulls face deeper pain as Fed’s third rate cut fails to spark bid

Bitcoin extends weakness after the Fed's third rate cut as on-chain data show realized losses at -18%, still far from the -37% capitulation zone seen at past bottoms.

Summary

The Fed delivered a third straight 25 bps cut to 3.5%--3.75%, with one Trump-appointed official pushing for a

BTC0,68%

Cryptonews·2025-12-12 09:42

$4.5 billion Bitcoin and Ethereum options expire today: markets remain fragile in the "liquidity desert" by the end of 2025

Bitcoin and Ethereum options contracts worth approximately $4.5 billion will expire on December 12th at 8:00 UTC. This large-scale expiration coincides with the end-of-year market liquidity being thin, and despite macroeconomic support such as the Federal Reserve's rate cuts, trader sentiment remains generally cautious. Data shows that Bitcoin's "maximum pain point" is around $90,000, while Ethereum is at $3,100. Put options slightly dominate, reflecting the market's attempt to hedge against potential downside risks. Analysts believe that in the absence of clear new catalysts, the volatility triggered by this expiration may be relatively limited, but the "structural risks" at year-end still warrant caution.

MarketWhisper·2025-12-12 06:11

Cross-chain track welcomes new developments: LI.FI completes $29 million financing to build the "Google Maps" of the crypto world

Cross-Chain Infrastructure Protocol LI.FI recently announced the completion of a new funding round of $29 million, led jointly by Multicoin Capital and CoinFund. This round brings LI.FI's total funding to approximately $52 million. It is positioned to provide enterprises with price comparison and optimal path execution services for cross-chain transactions, with monthly transaction volume surpassing $8 billion. This article will delve into multiple aspects including funding details, business model, security incident reflections, and future development, to analyze how LI.FI addresses the industry’s core pain point of blockchain ecosystem fragmentation, and to examine its market opportunities under the trend of integration between DeFi and mainstream finance.

USDC-0,02%

MarketWhisper·2025-12-12 01:19

The payment giant finally makes a move! Stripe partners with Paradigm to launch Tempo, aiming to become the ultimate solution for stablecoin payments

Tempo, a dedicated payment blockchain jointly developed by global payment giant Stripe and top crypto venture firm Paradigm, officially launched its public testnet on December 10, opening access to any company interested in building real-world stablecoin payment applications. This release also welcomes heavyweight new "design partners," including UBS Group, Mastercard, and prediction market platform Kalshi, joining the already impressive ecosystem lineup of Deutsche Bank, OpenAI, Shopify, and others.

Tempo aims to fundamentally solve the pain points of skyrocketing fees and settlement delays caused by transaction congestion on traditional blockchains by reserving dedicated block space for payments at the protocol layer and offering a fixed rate of $0.001 per transaction. Its target is the trillion-dollar daily payment and microtransaction market.

MarketWhisper·2025-12-10 01:52

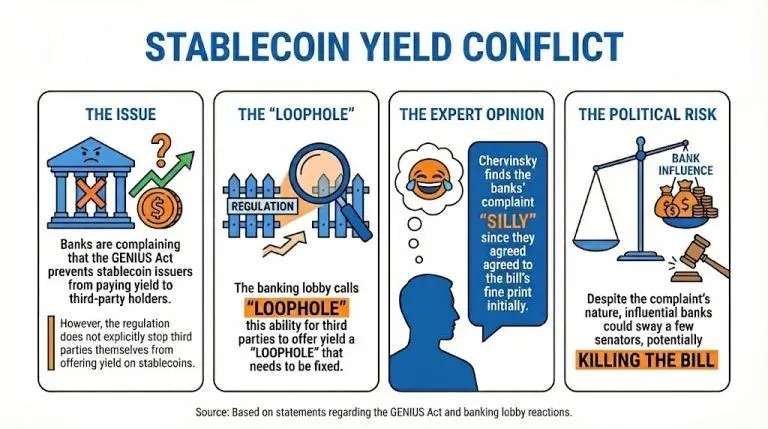

State of Senate's Crypto Market Bill: Stablecoins, Trump's Involvement and DeFi Pain Points Examined

The discussion happening in the Senate about the so-called crypto market structure bill has slowed down as the debate has reached key issues. According to Variant CLO Jake Chervinsky, it is unlikely for this bill to be approved before February.

Crypto Market Structure Bill Slows Down in Senate,

Coinpedia·2025-12-06 14:37

Bitcoin Price to $60K? Veteran Crypto Trader Warns of Months of Pain Ahead

A well-known crypto veteran Alex Wacz has issued a stark warning: Bitcoin may not be done falling. In a new post, the analyst said BTC still targets $60,000 over the next six months, even though the market could see a short-term relief bounce first. His view comes with a detailed weekly chart that o

BTC0,68%

CaptainAltcoin·2025-12-03 16:25

Aster (ASTER) News Sparks FOMO As LivLive ($LIVE) Dominates Presales and Becomes the Best Crypto ...

How many people ignore the hot opportunity to invest in crypto at the right time? That gut-punch feeling of watching a tiny token multiply a thousand times, knowing you scrolled right past the news, is a universal crypto pain. You saw the price shoot up, you read the viral success stories, but you s

CaptainAltcoin·2025-12-03 13:36

Analysis of the First RWA "Default" Case: What Risks Are Worth Noting?

In mid-to-late November 2025, an RWA project based on the accounts receivable of US small and medium-sized enterprises (SME)) collapsed due to a large-scale default of its underlying assets, causing the value of its on-chain tokens to plummet. In the past, the market viewed “asset tokenization” as a solution to the pain points of traditional asset investment due to the blockchain’s transparency and efficiency, which enhanced credibility. However, investment risk does not disappear; essentially, it is also “risk on-chain.” It instantaneously injects the slowly brewing credit risk of the off-chain world—without attenuation—into the 24/7 operating on-chain financial world.

Today, the Sa Sister team will not discuss asset innovation with our old friends, but will instead focus solely on risk governance. Through this project, which marks the industry's first major “blow-up,” we will thoroughly analyze the complete transmission path of risk from off-chain to on-chain, as well as the RWA risk management framework.

II. The Illusion of Blockchain Transparency: Compliance Is the Ultimate Line of Defense

The high transparency of blockchain is one of the main advantages of RWA.

金色财经_·2025-12-03 10:20

Bitcoin traders hit peak unrealized pain as ETFs start to turn positive

Bitcoin may be nearing a make-or-break point as short-term traders sit on the steepest unrealized losses of the current bull cycle.

Short-term Bitcoin (BTC) traders who have held BTC between one to three months have been sitting on losses ranging from 20% to 25% for over two weeks, marking the

Cointelegraph·2025-12-03 09:50

With the Bitcoin flywheel failing, what are some strategies for getting out of a losing position?

Author: Chloe, ChainCatcher

Since October, MSTR has dropped about 50%. After once soaring to a highlight of $457 last year, it has retraced significantly, far underperforming the market. MarketBeat data shows a 12-month low of about $155.61 and a high of over $450. It is now at a relatively undervalued low level with extremely high volatility.

So why has MSTR's stock price remained sluggish for months, not only far underperforming the market but even doing worse than Bitcoin itself? This has led the market to question whether the Bitcoin flywheel effect has already failed.

Enjoying double the happiness in a bull market means enduring double the pain in a bear market.

The plunge in Bitcoin's price is the most direct trigger. Since its peak on October 6, Bitcoin has dropped about 31%, and holding about 650,000 Bitcoins (accounting for a total of...

MarsBitNews·2025-12-03 07:55

Pump.Fun Rally Has a Real Reason – Here’s Why PUMP Price Suddenly Took Off

Yesterday the crypto market dropped more than 5%, and most traders expected more pain today. But instead, the market flipped green, climbing more than 1% at writing. And right now, Pump.Fun is one of the biggest beneficiaries of that shift.

The Pump.fun (PUMP) price is up more than 10% and

CaptainAltcoin·2025-12-02 15:04

Metrics Show Why Shiba Inu (SHIB) Surge Could Be Near and Its Possible Timeline

Shiba Inu (SHIB) price has faced heavy pressure since mid-September, falling by over 40% in just a few months. This sharp decline may raise doubts about whether the Shiba Inu token has bottomed or if there’s more pain ahead

TheCryptoBasic page on X shared insights suggesting that this might be a ra

CaptainAltcoin·2025-12-02 14:04

Data: BTC Options Delivery 143,000 contracts maximum pain point $98,000, ETH Options Delivery 572,000 contracts maximum pain point $3,400

According to Mars Finance, the cryptocurrency market is迎来重要期权交割日. Data shows that 143,000 BTC options are expiring, with a Put Call Ratio of 0.51 and a maximum pain point of $98,000, with a notional value of $13 billion; 572,000 ETH options are expiring, with a Put Call Ratio of 0.48 and a maximum pain point of $3,400, with a notional value of $1.71 billion. After experiencing significant跌 in Bitcoin and Ethereum prices earlier this month, the market stabilized and反弹 at the end of the month. Currently, BTC has firmly maintained the $90,000 integer level, while ETH has shown a three consecutive月线阴, fluctuating around $3,000. Market sentiment has clearly improved compared to last week. Options data indicates that implied波动率 has全面回升 compared to last month, with BTC主要期限.

MarsBitNews·2025-11-28 08:15

The new token IRYS from Irys experienced significant fluctuations upon launch; will the early rise be sustainable?

Layer 1 data chain Irys has officially launched, and the token IRYS has shown a wide fluctuation pattern in its initial trading, with prices fiercely oscillating between 0.009 USD and 0.052 USD. Technical indicators show that while the volume-weighted average price (VWAP) has formed short-term support, the On-Balance Volume (OBV) is still in the negative zone, reflecting that buying momentum has not yet been fully confirmed.

As one of the most anticipated infrastructure projects of this cycle, Irys attempts to address the pain points of blockchain data availability through its innovative design that combines on-chain data storage and smart contract execution. However, the potential airdrop unlocking pressure in its Token economic model still brings uncertainty to the short-term price trend.

MarketWhisper·2025-11-28 02:56

Digital Bank Revolut: The "Gravedigger" of Traditional Banks?

Author: Zhang Feng

Revolut is a UK fintech company founded in London in 2015 by Nikolay Storonsky and Vlad Yatsenko, focusing on digital banking services, with business covering cryptocurrency trading, securities investment, cross-border payments, and more. By 2025, it had over 65 million global users and was valued at 330 billion RMB, ranking 10th on the Hurun Global Unicorn List. In 2024, it launched the independent wealth management application Revolut Invest, managing a scale of 8.5 billion euros, and obtained a restricted banking license in the UK in July of the same year.

How did this financial technology "new wave" transform from a simple currency exchange tool into a global financial super app in just a few years? What traditional rules did it disrupt? What is the core of its business model?

1. Born from "pain points", growing with the times.

金色财经_·2025-11-28 00:26

This Crypto Expert Predicts Where the Kaspa Price Is Headed Next

Kaspa’s price is finally giving its community something to smile about. After months of grinding lower, the KAS price has exploded more than 40% this week and is now trading around $0.06. It is one of the best performers in the market right now, and for a project that has eaten nothing but pain

BTC0,68%

CaptainAltcoin·2025-11-27 07:06

Scilex completes a $583 million Bitcoin strategic investment in Datavault AI

Deep Tide TechFlow news, on November 26, Scilex Holding Company ( Nasdaq: SCLX ) announced the completion of its second strategic investment in Datavault AI Inc. ( Nasdaq: DVLT ), purchasing prepaid warrants through Bitcoin payments, which have all been exercised to acquire approximately 264 million shares of Datavault AI common stock, based on yesterday's closing price of $2.21 per share, totaling approximately $583 million. This transaction has been approved by the Datavault AI shareholders' meeting, and both parties will strengthen cooperation to jointly promote the growth of real-world asset tokenization business in 2026 and beyond. Scilex is an innovative pharmaceutical company focused on non-opioid pain management products, while Datavault AI is dedicated to AI-driven data.

BTC0,68%

DeepFlowTech·2025-11-26 11:50

Bitcoin Faces $13.3 Billion Options Expiry This Friday — Price Remains Far Below Max Pain Level

Bitcoin's recent sell-off has left it trading below the critical "max pain" level ahead of a major options expiry, raising concerns about future volatility. With increased demand for put options, market sentiment remains fragile as traders brace for potential turbulence.

BTC0,68%

Moon5labs·2025-11-26 00:01

Privacy Correction

The reason why Crypto Assets make everything open and transparent is quite simple.

If everyone can see all the information, then no one can lie and get away with it. A public ledger means that exchanges cannot falsify reserves, decentralized autonomous organizations (DAOs) cannot quietly misappropriate funds, and whales cannot pretend they have never sold any assets.

These are precisely the pain points in traditional markets, and they are the problems that Crypto Assets aim to solve. It does indeed address some of those issues. But as Byron Gilliam from Blockworks quoted Kevin Kelly this week: "Most of the problems we encounter today are caused by the solutions we had in the past." The solution of Crypto Assets is complete transparency, but in a market based on anonymous addresses, this solution rarely fully resolves the issues.

For institutions with standardized and audited trading, this design

金色财经_·2025-11-25 14:15

Bitcoin faces a monthly options expiry of $13.3 billion as trading remains well below the Max pain level

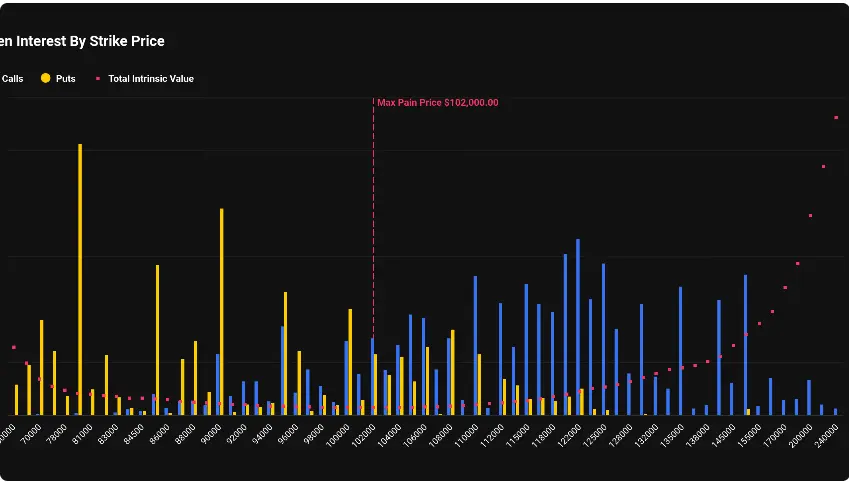

Bitcoin faced a strong 35% decline, dropping to $81,000 before recovering to $87,000. The options market sees heightened defensive strategies as 153,778 BTC options approach expiration, with a max-pain level at $102,000, indicating potential volatility ahead.

BTC0,68%

TapChiBitcoin·2025-11-25 11:30

QCP: Fed's dovish remarks boost the market, with December rate cut expectations rising to 75%.

According to Deep Tide TechFlow news, on November 24, QCP released a brief indicating that after dovish comments from Fed officials Williams and Miran on Friday, Bitcoin (BTC) showed initial signs of recovery. The market's expectations for a rate cut in December have significantly risen from 30-40% last Thursday to 75%. Despite BTC recently falling over 30% and breaking through several key support levels, the technical aspect still appears weak, but the derivatives market shows that traders are betting on both sides: hedging against further declines while keeping exposure for a potential year-end rebound. The maximum pain point price for options contracts at the end of the year is 104K, with open interest reaching an all-time high. In the perpetual futures market, leveraged long positions have mostly been cleared, and the funding rate has turned negative, which may alleviate further oversold risk. This week, during Thanksgiving, will test whether the BTC rebound is sustainable, and the market is also closely watching whether ETF capital flows will.

BTC0,68%

DeepFlowTech·2025-11-24 09:53

Crypto Pain Peaks: Cardano, Ethereum, and Bitcoin Show Massive Losses—Is It Time to Buy?

Santiment data shows Cardano, Chainlink, and Ethereum in extreme buy zones.

DOGE exhibits repeated cycles of consolidation forming rounded bases that historically precede rapid upward movements.

Bitcoin and XRP continue short-term declines, with ETFs recording significant outflows and total

CryptoNewsLand·2025-11-22 19:36

HBAR drops 8%: Is more pain ahead or will the bulls make a comeback?

HBAR is trading around $0.134, down nearly 8% today, underperforming the overall cryptocurrency market, which has dropped about 6%. The overall outlook remains bleak, as HBAR’s price has lost nearly half its value over the past three months.

Currently, this coin is at an important support level that c

HBAR3,6%

TapChiBitcoin·2025-11-21 13:34

Interpreting Ethereum Interoperability Layer (EIL): Bridging L2 Fragmentation and Building Seamless Cross-Chain Experiences

Author: Pan Zhixiong

Ethereum has successfully addressed scalability issues in recent years by deploying multiple Layer 2 solutions such as Arbitrum, Optimism, Base, and others, which have reduced transaction costs and increased efficiency. However, a resulting problem is the fragmentation of user experience: each L2 network is like an isolated island, and users face cumbersome steps, different bridging protocols, as well as complex asset and gas management when cross-chain. To solve this pain point, the Ethereum core team recently proposed the Ethereum Interop Layer (EIL).

To understand EIL, it is first necessary to review its foundation—ERC-4337.

ERC-4337 is a proposed account abstraction standard for Ethereum.

PANews·2025-11-21 06:12

Bitcoin Enters Death Cross—And Ethereum Isn’t Far Behind: Analysis

In brief

Both Bitcoin and Ethereum are falling hard, notching lows not seen in months.

Prediction market traders on Myriad now lean strongly bearish, projecting lower lows to come.

And the charts? Indicators suggest the pain isn't over. Here's why.

Decrypt's Art, Fashion, and

Decrypt·2025-11-19 21:39

1inch Gives Developers Early Access to New Shared Liquidity Protocol Aqua

In brief

DeFi ecosystem 1inch has unveiled Aqua, a new shared liquidity protocol.

Aqua enables different strategies to access the same tokens, in a bid to eliminate pain points facing liquidity providers, such as the need to split or lock funds across pools.

Devs can access Aqua's software

1INCH2,39%

Decrypt·2025-11-19 16:18

XRP Price Slips Into the “Pain Zone” As This Indicator Signals a Rare Buying Window

Ripple’s XRP price has been struggling as the crypto market keeps moving lower. The Bitcoin price dropped below $90,000 earlier today, and that move dragged most altcoins down with it.

XRP is still holding above the $2 support level, but it has fallen about 3% in the last day and 13% over the

CaptainAltcoin·2025-11-18 21:34

Load More