Search results for "AKI"

Is the Tom Lee team still trustworthy despite aggressively promoting ETH externally while being bearish internally?

Author: Aki, Wu talks about Blockchain

If we had to choose the most representative figure for the Ethereum bull narrative in 2025, Tom Lee, the chairman of BitMine and co-founder and chief investment officer of Fundstrat, would often be placed in the most prominent position. He has repeatedly emphasized in several public speeches that ETH is undervalued, and during the Binance Blockchain Week on December 4, he stated that Ethereum at $3000 is "seriously undervalued," and has given a high target price judgment of "ETH at $15,000 by the end of 2025." As a Wall Street veteran known as the "Wall Street Oracle" and a strategist actively involved in media and institutional roadshows, Tom Lee's views are often regarded by the market as a sentiment barometer.

However, when the market shifts its focus from the front of the lens to internal documents, the situation reverses: in To

ETH1,88%

金色财经_·2025-12-23 03:37

The Black Money Behind the Cuban Cigar Empire: Unveiling Chen Zhi's "Spider Web Capitalism 2.0"

Author: Aki Wu said Blockchain

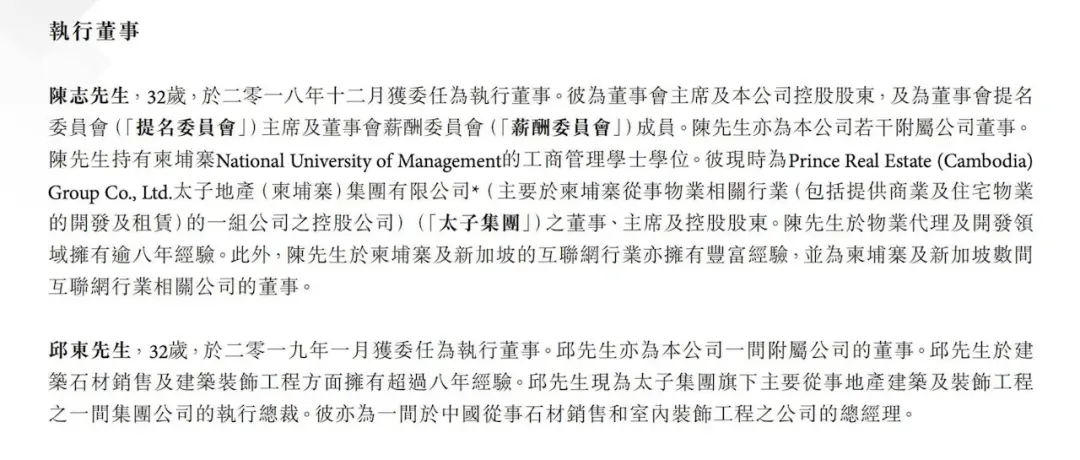

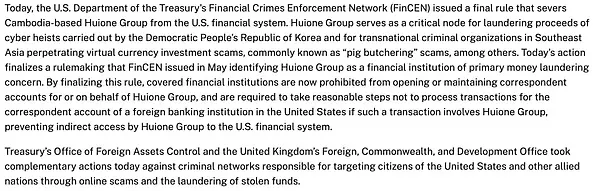

As the transnational criminal empire controlled by Chen Zhi, the actual controller of the Prince Group of Cambodia, is exposed and attacked by the British and American governments, the tangled global business network behind it has also come to light. Shockingly, this notorious gang, infamous for telecom fraud resembling the "pig butchering" scheme, human trafficking, and forced labor, has managed to control 50% of the global top Cuban cigar company Habanos through a complex offshore structure, with China being the largest consumer market for Habanos cigars. This unexpected connection reveals that in the digital age, the illegal economy and legitimate businesses are intertwined through blockchain and offshore financial networks, forming a new "capital spider web." This article attempts to analyze the operational logic of so-called "Spider Web Capitalism 2.0" — an upgrade of traditional offshore capitalism completed under the blockchain technology and the unique environment of Southeast Asia, presenting a new perspective.

BTC1,09%

PANews·2025-11-24 10:06

NVIDIA's market capitalization surpasses 5 trillion: A look back at its brief honeymoon period with Crypto Assets.

Author: Aki Wu said Blockchain

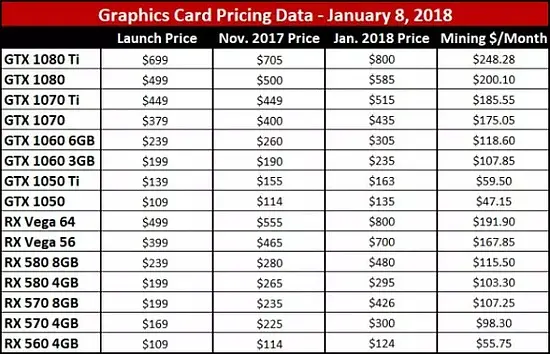

At the end of October 2025, Nvidia's stock price reached a historic high, with a market value exceeding $5 trillion, becoming the first company in the world to cross this market value threshold. Since the emergence of ChatGPT at the end of 2022, Nvidia's stock price has risen more than 12 times, with the AI revolution not only pushing the S&P 500 index to new heights but also sparking discussions about a technology valuation bubble. Today, Nvidia's market value even surpasses the total size of the entire cryptocurrency market, ranking just below the United States and China in terms of global GDP. It is remarkable that this superstar of the AI era once had a "honeymoon period" in the cryptocurrency field. This article will review Nvidia's tumultuous history with the cryptocurrency mining industry and why it chose to pivot towards AI.

金色财经_·2025-11-02 09:05

NVIDIA's market capitalization surpasses 5 trillion: A look back at its former honeymoon period with Crypto Assets

Author | Aki Wu said Blockchain

At the end of October 2025, Nvidia's stock price reached a new historical high, with a market capitalization surpassing the $5 trillion mark, becoming the first company in the world to cross this valuation threshold. Since the emergence of ChatGPT at the end of 2022, Nvidia's stock price has increased by more than 12 times, and the AI revolution has not only pushed the S&P 500 index to new heights but has also sparked discussions about a technology valuation bubble. Today, Nvidia's market capitalization has even exceeded the total size of the entire cryptocurrency market, and in terms of global GDP rankings, Nvidia's market value is only second to that of the United States and China. It is remarkable that this super star of the AI era once had a "honeymoon period" in the cryptocurrency field. This article will review the ups and downs of Nvidia's past with the cryptocurrency mining industry and why it chose to withdraw and turn towards A.

WuSaidBlockchainW·2025-11-02 00:36

How did Duke of Cambodia, who had 120,000 Bitcoins confiscated by the United States, get started?

Author: Aki Wu on Blockchain

Chen Zhi (alias Vincent) is a Chinese-born businessman, currently 37 years old. He is the founder and chairman of Prince Holding Group, a major enterprise in Cambodia, and one of the most influential wealthy businessmen in the country. Reports indicate that Chen Zhi holds dual citizenship in the UK and Cambodia. He has served as an advisor to Cambodia's two former Prime Ministers, Hun Sen and Hun Manet, and has been awarded the honorary title of "Duke" by the government, making him a prominent figure in both political and business circles locally. Recently, the US and UK governments imposed joint sanctions on Chen Zhi and his Prince Group. The U.S. Department of Justice charged him with telecommunications fraud and money laundering, and confiscated over $15 billion worth of Bitcoin, calling it "one of the largest financial scams in history." This article will reveal, based on public reports and US-UK judicial documents, how Chen Zhi became the "Godfather" of Cambodia's underworld.

BTC1,09%

PANews·2025-10-21 08:09

How the 120,000 Bitcoins of the Pig-butchering scams pro in Cambodia were confiscated by the US government

Author: Aki Wu said Blockchain

On October 14, 2025, a federal court in Brooklyn, New York unsealed an indictment revealing that the U.S. Department of Justice recently undertook the largest cryptocurrency seizure in history, confiscating approximately 127,000 Bitcoins, valued at over $15 billion. The seized Bitcoin assets originated from the fraudulent funds of the "Prince Group" in Cambodia, masterminded by Chen Zhi, who claims to be the "kingpin of pig butchering". The founder of the Cambodian Prince Group is accused of using forced labor to perpetrate cryptocurrency investment fraud, commonly known as "pig butchering" scams, with illegal daily profits reaching up to tens of millions of dollars. Currently, the massive Bitcoin funds are held by the U.S. government. This article will detail the background of the indictment, the source of the assets, and the law enforcement efforts behind this international cryptocurrency enforcement saga.

The Fraud Empire Beneath the Golden Coating

Chen Zhi is the "Prince Group Holdings" in Cambodia.

金色财经_·2025-10-18 04:47

Arthur Hayes: We are now in the mid-cycle; DAT may experience a collapse similar to FTX.

Author: Kyle Chasse, Translated by: Aki

In this interview, BitMEX co-founder Arthur Hayes discusses macro policies, liquidity, and the pricing of crypto assets. He analyzes and predicts that the United States will enter a phase of simultaneous interest rate cuts and fiscal expansion; stablecoins will weaken the Federal Reserve's power as a "price-insensitive buyer" of U.S. Treasuries; funds will be transmitted to the blockchain through stablecoins, favoring DeFi protocols with repo, dividends, and verifiable cash flows. Bitcoin is viewed as the core asset to hedge against fiat currency depreciation, and he also expresses views on the growth path and token unlock risks of Hyperliquid, as well as the capital operations of "digital asset treasury stocks."

Federal Reserve interest rate decision: cut by 25 basis points

Arthur Hayes: I haven't looked at the latest position of the 2-year U.S. Treasury bond today, but in the past week and a half to two weeks, in non

BTC1,09%

金色财经_·2025-09-22 04:21

Analysis of Nasdaq Proposal: How Tokenization of Securities is Reshaping the US Stock Trading Ecosystem?

Author: Aki Wu said Blockchain

On September 8, 2025, Nasdaq submitted a landmark proposal to the U.S. Securities and Exchange Commission (SEC), seeking to amend exchange rules to allow the trading of tokenized securities on its market. This means that U.S. stocks listed on Nasdaq, such as Apple and Amazon, are expected to be settled in the future in the form of blockchain tokens. If the proposal is approved, it will be the first case of a major U.S. securities exchange allowing the trading of tokenized stocks, marking the first large-scale introduction of blockchain technology into Wall Street's core market. This article will systematically outline the key points of the Nasdaq proposal, the motivations behind it, and the potential market upheavals it may bring, as well as its impact on the "U.S. stocks on-chain" sector and related segments, and forecast the potential development path of this innovative initiative.

Proposal Highlights: Detailed Explanation of Nasdaq Trading Rule Amendments

PANews·2025-09-18 05:11

After attacking Monero, who is the "famous" Qubic targeting DOGE?

Author: Aki Wu on Blockchain

This article does not constitute any investment advice. Readers are advised to strictly comply with the laws and regulations of their location and not to participate in illegal financial activities.

In mid-August, the Monero (XMR) network experienced a 51% hash power attack led by Sergey Ivancheglo, the former co-founder of IOTA, on the Qubic project. Qubic controlled more than 50% of Monero's total hash power, meaning it had the ability to reorganize blocks, censor transactions, and potentially implement double spending. This incident sparked widespread attention and discussion in the crypto industry, particularly regarding whether the network security of Monero, as a privacy coin, would be threatened. In response to this, the crypto exchange Kraken announced that it would suspend Monero deposits as a security precaution, with plans to resume deposit functionality after confirming network security. And this week, according to Cointele

PANews·2025-08-22 04:09

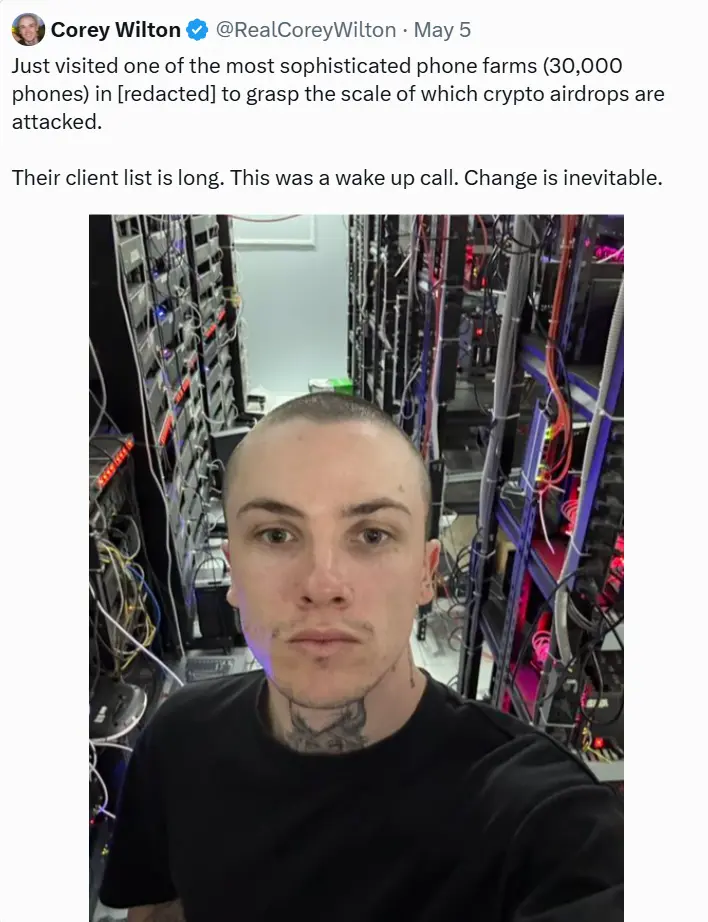

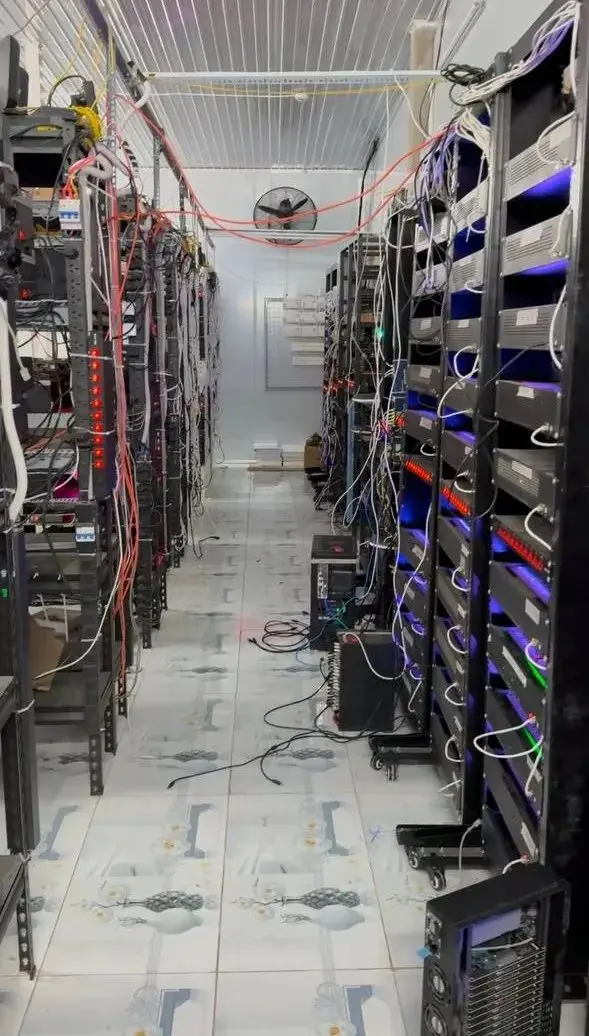

30,000 mobile phones in Vietnam are "running in full swing," and the airdrop farm is overcrowded with iron sheds.

Author|Felix Ng

Compilation | Wu Talks Blockchain Aki Chen

Original Title: Vietnam's Mobile Farm Crazy Harvests Crypto Airdrops, 30,000 Devices Overwhelm the Tin Shed

---

The full text is as follows:

In a "tin shed" with a refrigeration system just a 40-minute drive from Ho Chi Minh City, Mirai Labs CEO Corey Wilton first truly realized the enormous scale of the abuse of cryptocurrency airdrops. "It's really chilling," Wilton said in an interview. He had just visited a "phone farm" located in southern Vietnam, where he estimated that at least 30,000 smartphones were piled up in a space no larger than a single apartment.

For the past four years, Wilton has hoped to witness in person the kind of collapse that took place in 2021, which he had been focusing on.

FARM2,04%

GateUser-6bbdc2fc·2025-08-15 07:57

Vietnamese mobile phone farms crazy harvesting Airdrop, thirty thousand devices packed in iron sheds.

Author|Felix Ng

Compilation | Wu Says Blockchain Aki Chen

The full text is as follows:

In a "tin shed" with a refrigeration system located just 40 minutes from Ho Chi Minh City, Mirai Labs CEO Corey Wilton first truly realized the vast scale of abuse surrounding crypto airdrops. "It's really chilling," Wilton said in an interview. He had just visited a "mobile farm" in southern Vietnam, where he estimated that at least 30,000 smartphones were piled up in a space no larger than a single apartment.

For the past four years, Wilton has hoped to witness firsthand the kind of NFT horse racing game that collapsed in 2021.

FARM2,04%

PANews·2025-08-15 07:03

Hong Kong stablecoin bill released: Real-name registration for coin holders sparks controversy, relatively conservative towards Decentralized Finance.

Author | Aki Chen Wu said Blockchain

This article is organized with the participation of GPT, and is intended for information sharing only. It does not constitute any investment advice. Readers are advised to strictly comply with the laws and regulations of their location and to refrain from participating in illegal financial activities.

Introduction

On August 1, 2025, Hong Kong's "Stablecoin Regulation" officially took effect. The regulation clearly states that any institution issuing or offering fiat-pegged stablecoins to local retail in Hong Kong must apply for a license issued by the Monetary Authority, strictly adhere to reserve mechanisms, AML/KYC obligations, and requirements for transparency. The Hong Kong Monetary Authority also announced the launch of stablecoin license applications, with the first round of applications closing on September 30, and the first batch of licenses expected to be issued in early 2026. This series of actions is seen by the industry as "an important milestone in the global compliance of stablecoins," but due to its strong real-name system (KYC) requirements and high barriers to entry, it is also criticized.

DEFI1,55%

PANews·2025-08-05 01:10

Airwallex Founder Sparks Debate on Crypto Stablecoins: Revolution or Dream?

Authors: awxjack; kkone0x; EarningArtist; alexzuo4; BroLeonAus; bonnazhu; 0xHY2049; codeboymadif

Compiled by: Wu Says Blockchain Aki\_Chen

This article aims to accurately present various viewpoints. Whether in support or opposition, they reflect the market's different thoughts on the competition between stablecoins and traditional cross-border payments and do not constitute any investment advice.

Introduction

In June 2025, Jack Zhang, co-founder and CEO of Airwallex, tweeted consecutively on social media, openly questioning the actual value of stablecoins in B2B settlements within G10 developed economies, sparking discussions in the traditional finance and crypto communities around cost efficiency, financial freedom in emerging markets, and stablecoin regulation.

TechubNews·2025-06-10 06:52

Full text of SEC stablecoin regulation in the United States: What kind of stablecoin is not a security?

Written by: U.S. Securities and Exchange Commission, Corporate Finance Division

Compiler: Aki Chen Wu said blockchain

introduction

To further clarify the scope of the U.S. federal securities laws in the cryptoasset space [1], the Division of Corporation Finance has issued an opinion [2] on certain types of cryptoassets, commonly referred to as "stablecoins." This statement is only for stablecoins that meet the following types:

1. Design the mechanism to ensure that it is pegged to the US dollar (USD) at a ratio of 1:1,

2. Support the redemption of USD at a 1:1 ratio (i.e. 1 stablecoin can be exchanged for 1 USD),

3. Backed by a low-risk, highly liquid reserve asset whose USD valuation always covers the redemption needs of stablecoins in circulation.

As explained below, we cover this statement

AKI-1,53%

DeepFlowTech·2025-04-17 10:43

Full text of SEC stablecoin regulation in the United States: What kind of stablecoin is not a security?

> Buyers of compliant stablecoins are motivated by their stability and need to be used as a means of payment or store of value in commercial transactions.

Written by: U.S. Securities and Exchange Commission, Corporate Finance Division

Compiler: Aki Chen Wu said blockchain

> Original link:

>

introduction

To further clarify the scope of the U.S. federal securities laws in the cryptoasset space [1], the Division of Corporation Finance has issued an opinion [2] on certain types of cryptoassets, commonly referred to as "stablecoins." This statement is only for stablecoins that meet the following types:

1. Design the mechanism to ensure that it is pegged to the US dollar (USD) at a ratio of 1:1,

2. Support the redemption of USD at a 1:1 ratio (

AKI-1,53%

ForesightNews·2025-04-16 14:38

Full text of the US SEC stablecoin regulation: What kind of stablecoin is not a security?

Author: SEC Corporate Finance Division

Compiled by: Aki Chen Wu said blockchain

Introduction

To further clarify the applicability of U.S. federal securities laws in the field of crypto assets [1], the Division of Corporation Finance has provided relevant opinions on specific types of crypto assets (commonly referred to as "stablecoins") [2]. This statement is only applicable to stablecoins that meet the following types:

The design mechanism ensures a 1:1 peg with the US Dollar (USD),

Support redeeming US dollars at a 1:1 ratio (i.e., 1 stablecoin can be exchanged for 1 dollar),

Backed by low-risk and highly liquid reserve assets, its dollar valuation always covers the redemption demand of the circulating stablecoins.

As elaborated in the following text, we will include the contents of this statement.

AKI-1,53%

TechubNews·2025-04-16 05:37

Top Crypto Performers of the Week Across Leading Blockchain Ecosystems

Significant growth seen across various blockchains with top performers like $ZETA, $CARV, $AKI, and $CRV. Data shared by Phoenix Group on social media highlights their strong weekly performance in different ecosystems.

BlockchainReporter·2025-03-29 13:14

Load More