GateAI: An AI Market Understanding Assistant Centered on Real Data

8h ago

Gate Residual Coin Treasure USDT Financial Management Limited-Time Additional Investment | Register to Receive Higher Interest, Newcomers Can Enjoy Up to 100% Annualized Return

01-08 01:49

Trending Topics

View More964 Popularity

22.76K Popularity

1.84K Popularity

1.59K Popularity

62.73K Popularity

Hot Gate Fun

View More- MC:$3.52KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$3.66KHolders:20.95%

- MC:$0.1Holders:10.00%

Pin

Gate Research Institute: Blue-chip Non-fungible Token series Floor Price rebound, Telegram founder's arrest hits TON chain ecosystem

Market Review

According to gate market data, as of 3:00 on August 26 (UTC+0):

BTC - BTC price fell by 0.14% in the past 24 hours, currently trading at around $64,032.10, with a highest price of $65,098 and a lowest price of $63,788 in the past 24 hours. After a short-term breakthrough of $65,000, BTC pulled back to near the 4-hour MA5 moving average ($64,109), and the price oscillated between $64,000 and $65,000 during the day.

ETH - The price of ETH has fallen by 0.78% in the past 24 hours, currently priced at approximately $2,741.46. The highest price in the past 24 hours was $2,792, and the lowest price was $2,720. The price of ETH has been fluctuating between $2,740 and $2,800. Currently, there is short-term support at the $2,730 level.

SOL— The SOL price has increased by 0.11% in the past 24 hours, and is currently priced at approximately $158.72, with a 24-hour high of $161.92 and a low of $155.22. The SOL price has shown strong performance, quickly rebounding after falling below the 4-hour MA10 moving average ($156), forming a strong support. The current support below is at $156, and the resistance level above is at $163.

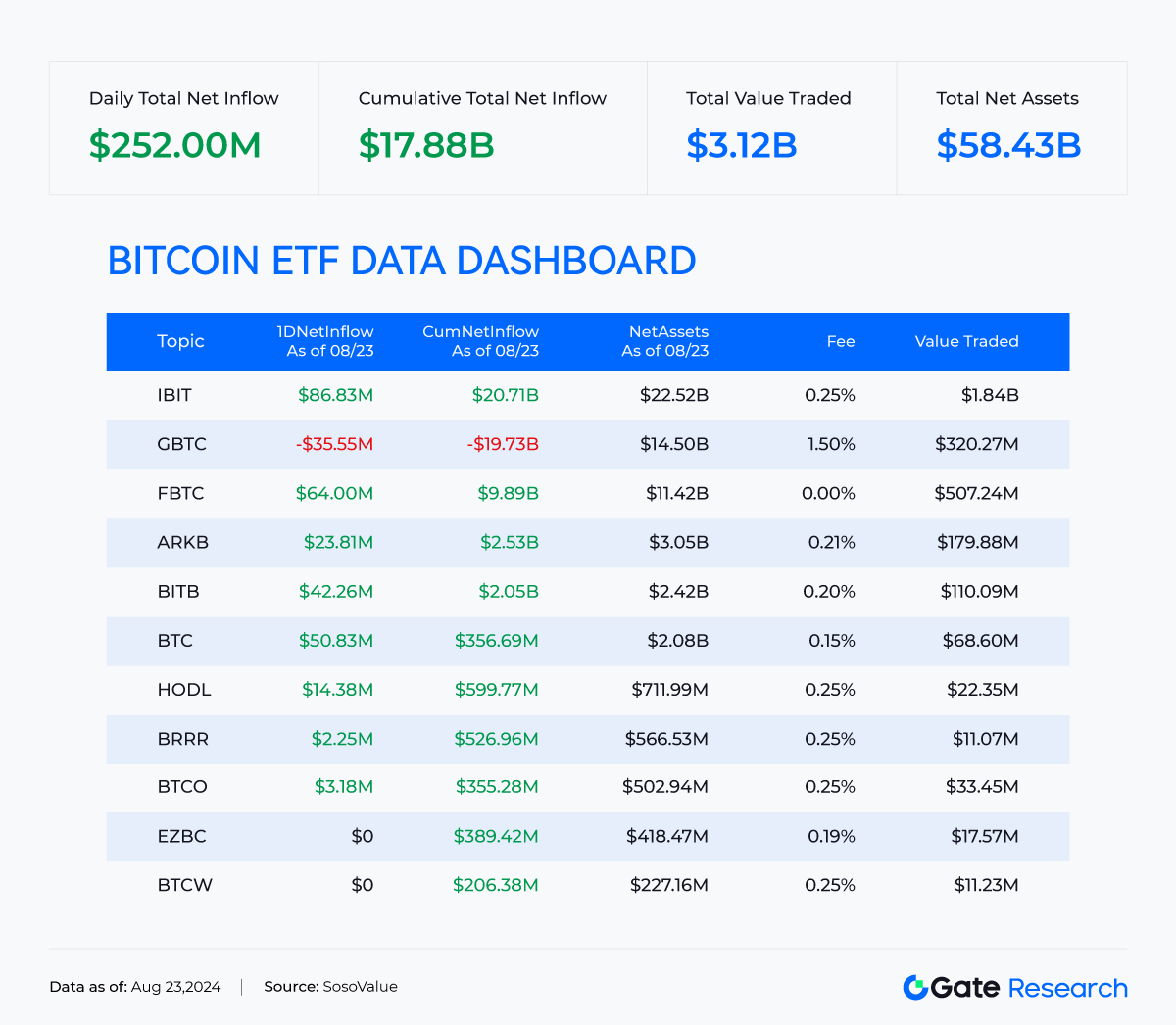

SpotETF - According to Soso Value and Coinglass data, BTC Spot ETF had a net inflow of $252 million and ETH Spot ETF had a net outflow of $5.7 million last Friday.

Non-fungible Token— As of 6:00 on August 26th (UTC+0), according to the Blur market data, the blue-chip Non-fungible Token series Floor Price has shown varying degrees of recovery. Among them: BAYC Floor Price is 13.8 ETH, with a 7-day increase of 12.77%; Pudgy Penguins Floor Price is 10.9 ETH, with a 7-day increase of 19.91%; Azuki Floor Price is 4.77 ETH, with a 7-day increase of 7.35%; MAYC Floor Price is 2.15 ETH, with a 7-day increase of 8.1%.

Fear and Greed Index - As of 6:00 on August 26th (UTC+0), the Fear and Greed Index is 55, indicating that the market sentiment is more greedy, and investors may increase or decrease their assets, leading to significant Fluctuation in market prices at current levels.

Hot Token

According to the gate market data, as of 3 a.m. on August 26th (UTC+0), combined with the volume and price performance in the past 24 hours, the following popular altcoins are as follows:

Highlights Data

BSC on-chain volume has increased by 39.82% in the past 7 days As of 2 am on August 26th (UTC+0), according to DeFiLlama data, the volume on BSC in the past 24 hours is close to that on the Solana chain, with the volume on BSC at about $7.25 billion and the volume on Solana at about $7.29 billion. In the past week, the volume on BSC has increased by 39.82%, approaching Solana’s overall volume, which may indicate that market participants are beginning to follow the rise of the BSC ecosystem.

The reason for the surge in BSC chain volume may be related to the rise of a meme launch platform similar to Pump.fun on BSC on-chain. Four.meme is a leading meme fair launch platform on BSC, providing a seamless and low-cost way to issuance meme Tokens. They have a relatively strong marketing team, and through the viral spread of platforms such as Twitter, both Newbies and experienced cryptocurrency enthusiasts can create or learn about the hottest meme Tokens for the first time and profit from them.

BTCSpot ETF net inflows of $252 million According to Soso Value and Coinglass data, last Friday, BTCSpot ETF saw a net inflow of 252 million USD, while ETHSpot ETF saw a net outflow of 5.7 million USD. Most of the BTC ETF realized a net inflow, with only GBTC seeing a net outflow of 35.5 million USD. This may be related to the macro Favourable Information in the public speech of Federal Reserve Chairman Powell. Last Friday, ETH ETF experienced a net outflow, possibly influenced by the 9.8 million USD outflow from the Grayscale ETHE target, with zero net inflow for Blackrock ETHA and Franklin EZET.

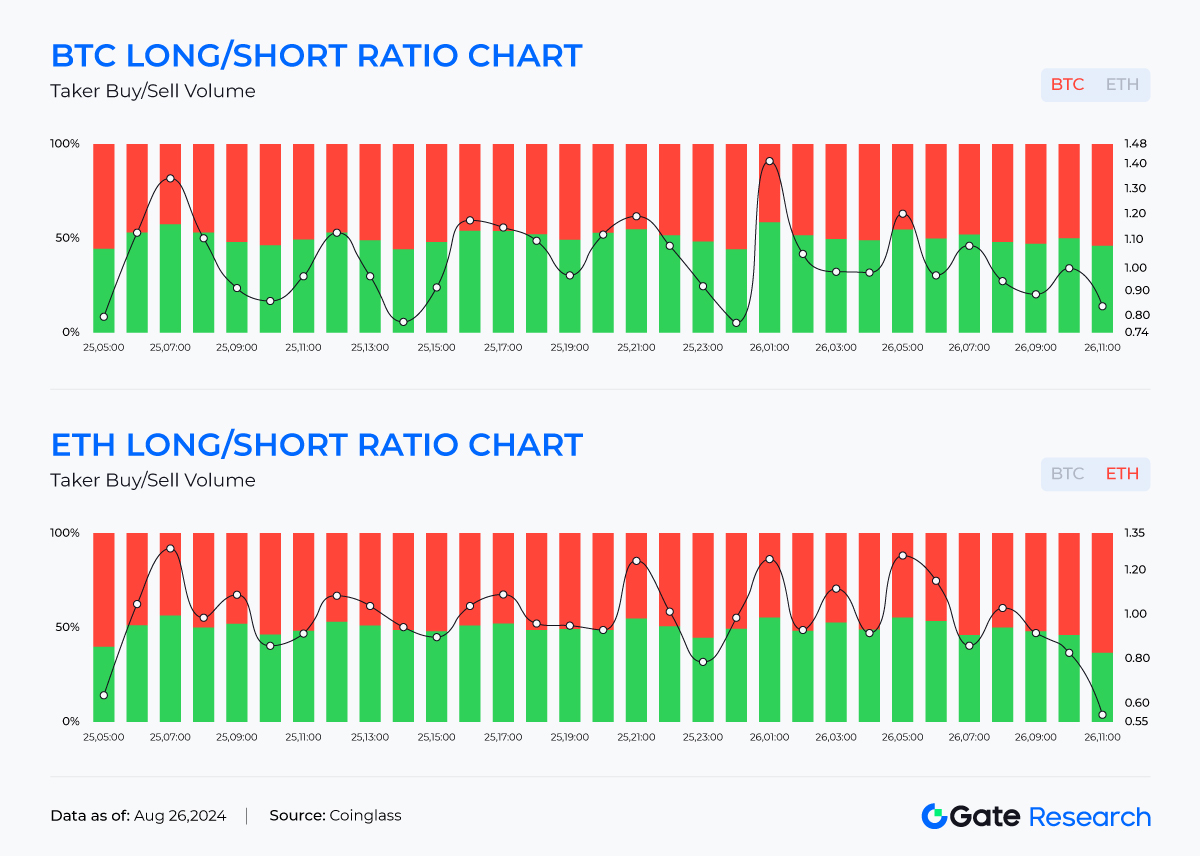

Contract Long/Short Ratio According to Coinglass data, as of 2:00 on August 26th (UTC+0), the BTCHoldings weighted funding rate is 0.0001%, and the ETHHoldings weighted funding rate is 0.0011%. In the past 24 hours, the BTC contract long/short ratio and the ETH contract long/short ratio have both been dominated by long positions. In addition, as of 4:00 on August 26th (UTC+0), the total liquidation amount of contracts on the entire network in the past 24 hours is approximately $79 million, of which the liquidation amount of long contracts exceeds $53.14 million. The BTC buy/sell ratio is 0.8235, indicating that market participants have a wait-and-see attitude towards BTC short-term price action.

Powell is more confident in inflation returning to 2% and explicitly expresses willingness to cut interest rates in September On August 23rd, Federal Reserve Chairman Powell delivered a speech on the economic outlook at the Jackson Hole Symposium, indicating that the time for policy adjustment has come and explicitly expressing the Fed’s willingness to cut interest rates in September. After Powell’s expression of an imminent policy change, the CME ‘Fed Watch’ data showed a positive change, with a 43% probability of a cumulative 50 basis point rate cut by November, a 45.2% probability of a cumulative 75 basis point rate cut, and an 11.8% probability of a cumulative 100 basis point rate cut. Overall, Powell’s speech provided some Favourable Information for the encryption market, but also brought some uncertainties. The specific magnitude of the rate cut and policy direction at the Fed’s September meeting will be key factors affecting the direction of the encryption market.

Hotspot Review

Telegram founder arrested, significant Fluctuation in Ton ecosystem Token price and TVL On August 24th, Pavel Durov, the founder and CEO of Telegram, was arrested at a French airport and may face multiple criminal charges. Durov is accused of failing to effectively address issues related to criminal activities on the Telegram platform and failing to cooperate with the French law enforcement. The Telegram Open Network (TON) was initially developed by the Telegram team and later taken over by the community due to legal issues. However, Ton has established a partnership with Telegram, and Telegram has integrated an encryption wallet based on TON into its ecosystem, providing the possibility for nearly a billion Telegram users to easily make encryption payments. Many Ton ecosystem DApps exist in the form of Telegram Mini Apps.

According to the gate market data, the price of Toncoin (TON) has fallen to some extent under the influence of the news of the arrest of Telegram founder Pavel Durov. In the early morning of August 26, the price of $TON fell by more than 20%, reaching a minimum of 5.2 US dollars. As of 4:00 on August 26 (UTC+0), the TON price has rebounded to around 5.8 US dollars. The TON ecosystem project Token NOT also fell, with a maximum fall of 25%, and other related Tokens also experienced different degrees of decline.

In addition, according to DeFiLlama data, as of 0:00 on August 26 (UTC+0), the TVL of the TON chain has dropped significantly to $3.37 billion, a 34% decrease in 24 hours, and a drop of over 56% from the peak TVL in July. Among them, the Liquid Staking projects on TON such as Tonstakers and Bemo, and other stake projects, have all experienced a TVL decrease of over 15% due to the drop in TON price. According to Staking Reward data, in the past two weeks, the stake amount of TON has been fluctuating between 600m and 630m, and has not been significantly affected. However, there has been a certain degree of withdrawal of DEX Liquidity. As shown in the data from the chart below, multiple DEXs have experienced a TVL loss of over 20%, most likely due to the withdrawal of Liquidity. According to DeFILlama data, the TVL of TON’s two major DEXs, DeDust and Ston.Fi, has both dropped by over 30%.

The price drop of Ton this time is similar to the BNB drop caused by the arrest of BNB Chain founder Zhao Changpeng, which has affected market confidence. Due to the strong partnership between Telegram and Ton, Ton is seen as a huge traffic entrance of Web3. Although Pavel Durov’s arrest did not explicitly mention his relationship with Ton, many Ton developers and entrepreneurs have gradually started to pay attention to potential compliance and legal risks. At the same time, although the relevant charges may not necessarily lead to the rectification or shutdown of Telegram, the associated advantages of Ton may be weakened as a result. Currently, according to Ton Stat data, the on-chain volume, fee situation, and the number of active accounts in the past few days have returned to the level before the incident. Due to the undisclosed details of this arrest and the long-term nature of the subsequent legal proceedings, the impact of Durov’s arrest on the TON ecosystem still needs further observation, and Gate Research Institute will continue to follow this event.

Mt.Gox WalletAddressBTC holdings have decreased by about 68.3% According to Arkham monitoring, since the beginning of 2021, the Mt. Gox wallet has held a total of 141,690 BTC, and the Market Cap peaked at $10.12 billion in March 2024. At 9:00 on August 24th (UTC+0), the Mt.Gox wallet held 32,900 BTC (approximately $21.1 billion), and as of 6:00 on August 26th (UTC+0), the wallet held 44,899 BTC (approximately $28.7 billion), accounting for about 31.7% of the holdings at the beginning of 2021, a decrease of about 68.3%.

Gate Research Institute mentioned in a previous daily report that the ongoing repayment of Mt.Gox may cause some potential impact on the market. From the recent repayment situation and BTC PA, the market has not been significantly affected by the influx of these BTC into the market, especially since the two large transactions that occurred on August 21. The BTC price has not experienced a decline. On August 23, it rose from around $60,000 to around $64,000 and has remained at that level for more than two days.

Financing News

According to RootData, from August 24th to August 26th, 2024, only projects in the DePin field received funding. The specific financing situation is as follows:

ATT, a platform that integrates DePin and RWA technologies, announced that it has received institutional investment from Waterdrip Capital. The financing will be used for international market expansion, thereby enhancing ATT’s strategic position in the DePin and RWA fields. ATT adopts a unique DA-AIOT-P (Decentralization Asset-Artificial Intelligence Internet of Things-Payment) mechanism, which builds a new digital advertising ecosystem that integrates physical advertising assets, e-commerce merchants, user resources, and digital technology. Currently, the ecosystem is centered around the LED screens in Lan Kwai Fong, Hong Kong, and is expanding to major business areas in Southeast Asia, Japan, Korea, and Europe.

Airdrop Opportunity

Orderly Network - the full-chain Derivatives Liquidity layer, will begin Airdrop registration on August 26th. 13.3% of the total supply will be used for Airdrop, and users can claim the full Airdrop on the same day. Orderly Network completed a $20 million financing round in June 2022, with support from investors such as Pantera Capital, Dragonfly Capital, Sequoia China, Jump Crypto, and Seven X. In March 2023, Orderly Network completed a strategic financing round with a valuation of $200 million. On August 16th, 2024, Orderly Network completed a $5 million strategic financing round with participation from OKX Ventures, among others.

Corn - Corn is an Ethereum L2 that uses BTC as gas, completed a $6.7 million financing on August 19, with Polychain Capital, Binance Labs, Framework Ventures, OKX Ventures, HTX Ventures, and Relayer Capital as co-investors. Corn announced the start of an Airdrop activity on August 23, announcing the distribution of retrospective reward points Kernel (representing the proportional share in the $CORN Airdrop) to eligible users. The AirdropSnapshot for this batch is set at 4:20 on July 13, 2024 (UTC+8).

In addition to the retrospective Airdrop, Corn’s ongoing Airdrop activities include the Galxe points Airdrop and the deposit to earn points activity.