# TrumpWithdrawsEUTariffThreats

40.74K

Amid ongoing trade tensions, Trump cancels tariffs on several European countries originally set for Feb 1. Do you think this easing signal will meaningfully impact market trends?

LittleQueen

#TrumpWithdrawsEUTariffThreats

Trump Withdraws EU Tariff Threats — Will This Easing Signal Meaningfully Move Markets?

Context & What Happened

• On January 21–22, 2026, U.S. President Donald Trump cancelled planned tariffs on eight major European allies that had been scheduled to take effect on Feb 1 — originally set at 10% and rising to 25% unless negotiations over Greenland progressed.

• The reversal followed a “framework” agreement reached at the World Economic Forum in Davos with NATO leadership on future Arctic cooperation and de‑escalation of the Greenland dispute.

Immediate Market React

Trump Withdraws EU Tariff Threats — Will This Easing Signal Meaningfully Move Markets?

Context & What Happened

• On January 21–22, 2026, U.S. President Donald Trump cancelled planned tariffs on eight major European allies that had been scheduled to take effect on Feb 1 — originally set at 10% and rising to 25% unless negotiations over Greenland progressed.

• The reversal followed a “framework” agreement reached at the World Economic Forum in Davos with NATO leadership on future Arctic cooperation and de‑escalation of the Greenland dispute.

Immediate Market React

- Reward

- 3

- 72

- Repost

- Share

GateUser-2e9a4942 :

:

hello everyone,nice to meet youView More

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The opening weeks of 2026 reminded global markets just how powerful political signals can be. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately priced in a renewed trade war. The move was linked to resistance against Washington’s Arctic strategy and the controversial Greenland acquisition proposal.

Risk sentiment collapsed almost overnight. Equities weakened

The opening weeks of 2026 reminded global markets just how powerful political signals can be. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately priced in a renewed trade war. The move was linked to resistance against Washington’s Arctic strategy and the controversial Greenland acquisition proposal.

Risk sentiment collapsed almost overnight. Equities weakened

- Reward

- 17

- 56

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats 📊 From Confrontation to Calculation: A Strategic Reset in 2026

The opening weeks of 2026 reminded global markets just how powerful political signals can be. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately priced in a renewed trade war. The move was linked to resistance against Washington’s Arctic strategy and the controversial Greenland acquisition proposal.

Risk sentiment collapsed almost overnight. Equities weake

The opening weeks of 2026 reminded global markets just how powerful political signals can be. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately priced in a renewed trade war. The move was linked to resistance against Washington’s Arctic strategy and the controversial Greenland acquisition proposal.

Risk sentiment collapsed almost overnight. Equities weake

- Reward

- 18

- 20

- Repost

- Share

Unoshi :

:

Thanks for informationView More

#TrumpWithdrawsEUTariffThreats

🌈In a major market-moving decision, President Trump announced the withdrawal of EU tariff threats, citing a “Framework of a future deal” involving Greenland and the Arctic region. For traders, this is a key event that resets market sentiment and creates opportunities across traditional and crypto markets. Let’s break it down step by step.

1. The NATO Factor – From Coercion to Diplomatic Flow

The withdrawal followed a meeting with NATO Secretary-General Mark Rutte, signaling a move from Economic Coercion to Diplomatic Negotiation.

Trader Insight: When uncertaint

🌈In a major market-moving decision, President Trump announced the withdrawal of EU tariff threats, citing a “Framework of a future deal” involving Greenland and the Arctic region. For traders, this is a key event that resets market sentiment and creates opportunities across traditional and crypto markets. Let’s break it down step by step.

1. The NATO Factor – From Coercion to Diplomatic Flow

The withdrawal followed a meeting with NATO Secretary-General Mark Rutte, signaling a move from Economic Coercion to Diplomatic Negotiation.

Trader Insight: When uncertaint

- Reward

- 11

- 24

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats Trump Withdraws EU Tariff Threats, Markets React with Relief

The decision by former US President Donald Trump to withdraw tariff threats against the European Union has injected a wave of relief into global financial markets. After weeks of heightened uncertainty surrounding potential trade escalation, this move signals a temporary easing of transatlantic trade tensions. Investors interpreted the announcement as a step toward stabilizing global trade flows at a time when markets are already dealing with slowing growth and geopolitical risks.

Background of the Tari

The decision by former US President Donald Trump to withdraw tariff threats against the European Union has injected a wave of relief into global financial markets. After weeks of heightened uncertainty surrounding potential trade escalation, this move signals a temporary easing of transatlantic trade tensions. Investors interpreted the announcement as a step toward stabilizing global trade flows at a time when markets are already dealing with slowing growth and geopolitical risks.

Background of the Tari

- Reward

- 8

- 11

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The first weeks of 2026 vividly illustrated how swiftly political signals can ripple through global markets. When U.S. President Donald Trump announced the possibility of imposing customs tariffs ranging from 10% to 25% on eight European nations—including Germany, France, the United Kingdom, and the Nordic bloc—investors immediately braced for a renewed trade war. This provocative move, tied to European resistance against Washington’s Arctic strategy and the highly debated Greenland acquisition proposal

The first weeks of 2026 vividly illustrated how swiftly political signals can ripple through global markets. When U.S. President Donald Trump announced the possibility of imposing customs tariffs ranging from 10% to 25% on eight European nations—including Germany, France, the United Kingdom, and the Nordic bloc—investors immediately braced for a renewed trade war. This provocative move, tied to European resistance against Washington’s Arctic strategy and the highly debated Greenland acquisition proposal

- Reward

- 4

- 6

- Repost

- Share

GateUser-ca826628 :

:

zh gs. ua ua. ua ua. ua ua. ua ú r rcarcy a ua u aView More

#TrumpWithdrawsEUTariffThreats #TrumpWithdrawsEUTariffThreats

Markets React and What Lies Ahead

Markets don’t move on noise—they move on signals. And today, the signal is unmistakable.

Former President Donald Trump’s decision to withdraw his tariff threats against the European Union is more than just a political headline. It’s a calculated, tactical move with global implications, signaling a pause rather than a permanent shift.

For months, investors and companies had been pricing in the risks of renewed U.S.–EU trade tensions: higher costs, disrupted supply chains, inflationary pressure, and

Markets React and What Lies Ahead

Markets don’t move on noise—they move on signals. And today, the signal is unmistakable.

Former President Donald Trump’s decision to withdraw his tariff threats against the European Union is more than just a political headline. It’s a calculated, tactical move with global implications, signaling a pause rather than a permanent shift.

For months, investors and companies had been pricing in the risks of renewed U.S.–EU trade tensions: higher costs, disrupted supply chains, inflationary pressure, and

- Reward

- 7

- 15

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats

Over the past few days, global markets were once again under pressure after signals emerged that Donald Trump could impose new tariffs on the European Union and the UK. For many investors, it immediately brought back memories of past trade wars — higher costs, market volatility, and uncertainty.

Now comes a moment of relief.

🕊️ Trump has withdrawn the tariff threat against the EU and the UK.

The decision followed diplomatic talks at the NATO level, linked to broader geopolitical discussions around Greenland and the Arctic region.

📈 Markets reacted quickly and c

Over the past few days, global markets were once again under pressure after signals emerged that Donald Trump could impose new tariffs on the European Union and the UK. For many investors, it immediately brought back memories of past trade wars — higher costs, market volatility, and uncertainty.

Now comes a moment of relief.

🕊️ Trump has withdrawn the tariff threat against the EU and the UK.

The decision followed diplomatic talks at the NATO level, linked to broader geopolitical discussions around Greenland and the Arctic region.

📈 Markets reacted quickly and c

- Reward

- 8

- 10

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

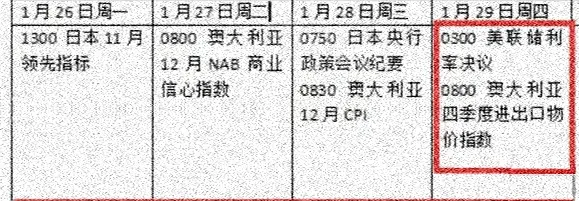

Bitcoin - Ethereum Next Week Focus

The Federal Reserve decision is approaching, and Trump has revoked the threat of tariffs on Europe over Greenland!

The key level for Bitcoin at 90,000 and the main trend for Ethereum at 3000—will the market bring new declines?

Similarly, after three consecutive rate cuts, the pause appears to be temporary. According to LSEG data, the money market is now fully considering future rate cut points. In reality, these are just gimmicks. The volatility that should occur in crypto won't be affected by the current situation. Excluding certainty (positive or negative),

View OriginalThe Federal Reserve decision is approaching, and Trump has revoked the threat of tariffs on Europe over Greenland!

The key level for Bitcoin at 90,000 and the main trend for Ethereum at 3000—will the market bring new declines?

Similarly, after three consecutive rate cuts, the pause appears to be temporary. According to LSEG data, the money market is now fully considering future rate cut points. In reality, these are just gimmicks. The volatility that should occur in crypto won't be affected by the current situation. Excluding certainty (positive or negative),

- Reward

- 4

- 4

- Repost

- Share

Ryakpanda :

:

Just go for it💪View More

#TrumpWithdrawsEUTariffThreats with context, background, reactions, and implications:

European shares rebound as Trump withdraws tariff threats over Greenland

Trump’s Greenland ‘framework’ deal: What we know about it, what we don’t

What Happened

U.S. President Donald Trump abruptly withdrew his threat to impose new tariffs on several European countries after intense diplomatic pushback and negotiations at the World Economic Forum in Davos, Switzerland. Trump had linked the tariff threat to Europe’s opposition to his controversial bid to exert influence over Greenland, an autonomous territory o

European shares rebound as Trump withdraws tariff threats over Greenland

Trump’s Greenland ‘framework’ deal: What we know about it, what we don’t

What Happened

U.S. President Donald Trump abruptly withdrew his threat to impose new tariffs on several European countries after intense diplomatic pushback and negotiations at the World Economic Forum in Davos, Switzerland. Trump had linked the tariff threat to Europe’s opposition to his controversial bid to exert influence over Greenland, an autonomous territory o

- Reward

- 10

- 13

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

66.7K Popularity

40.74K Popularity

34.01K Popularity

13.3K Popularity

28.16K Popularity

19.06K Popularity

16.41K Popularity

84.61K Popularity

45.42K Popularity

25.99K Popularity

16.1K Popularity

5.1K Popularity

261.89K Popularity

26.05K Popularity

184.12K Popularity

News

View MoreSolana's privacy coin GHOST surged 60% after announcing a new cross-chain swap solution.

7 m

Bloomberg Analyst: Silver ETF Returns Are "Exaggerated" but Limited Capital Inflows, IBIT Wind Resistance Attracts Funds, Sending Long-term Bullish Signals for BTC

21 m

Data: If BTC breaks through $92,927, the total liquidation strength of short positions on mainstream CEXs will reach $905 million.

1 h

Data: If ETH breaks through $3,088, the total liquidation strength of long positions on mainstream CEXs will reach $637 million.

1 h

Data: 1,799,900 PENDLE transferred from an anonymous address, worth approximately $3,582,000

1 h

Pin