📊 BitMine Acquires 20,000 ETH — Market Implications

Dragon Fly Official Market View

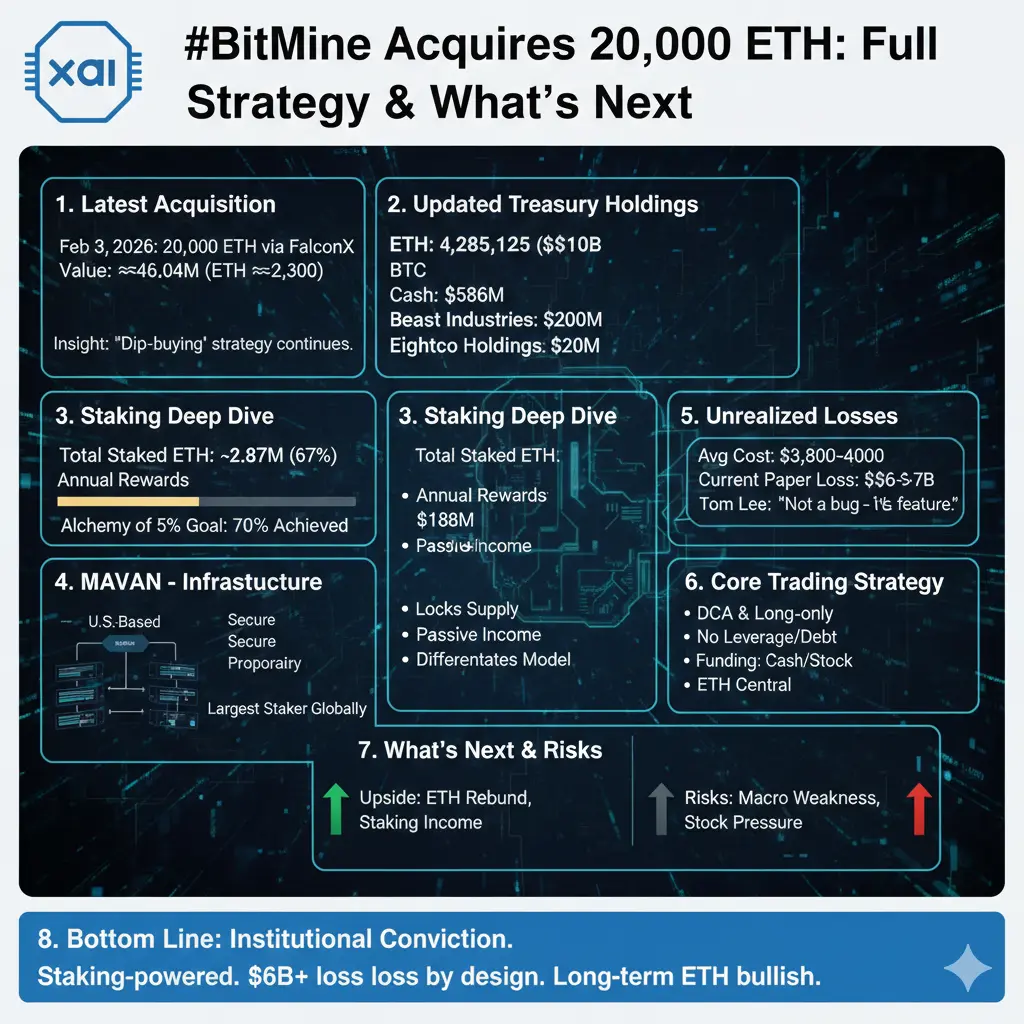

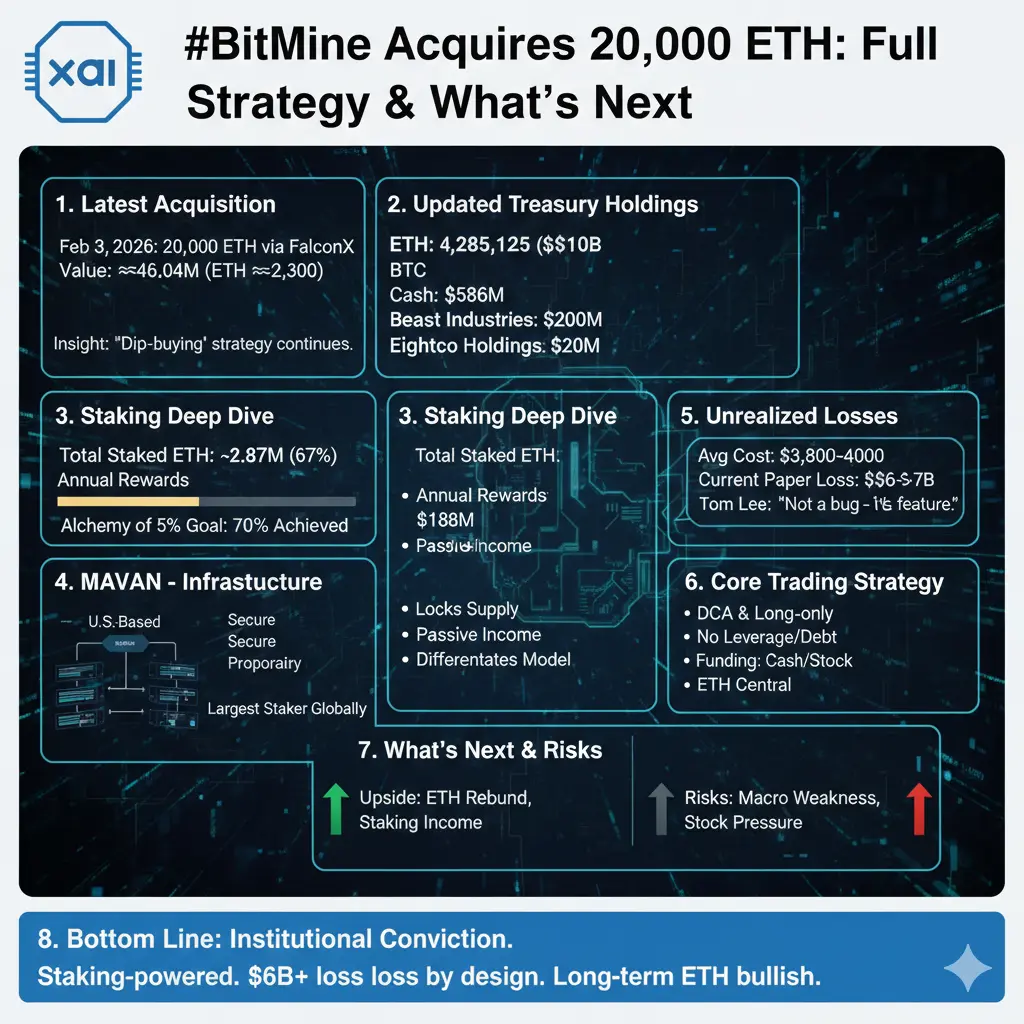

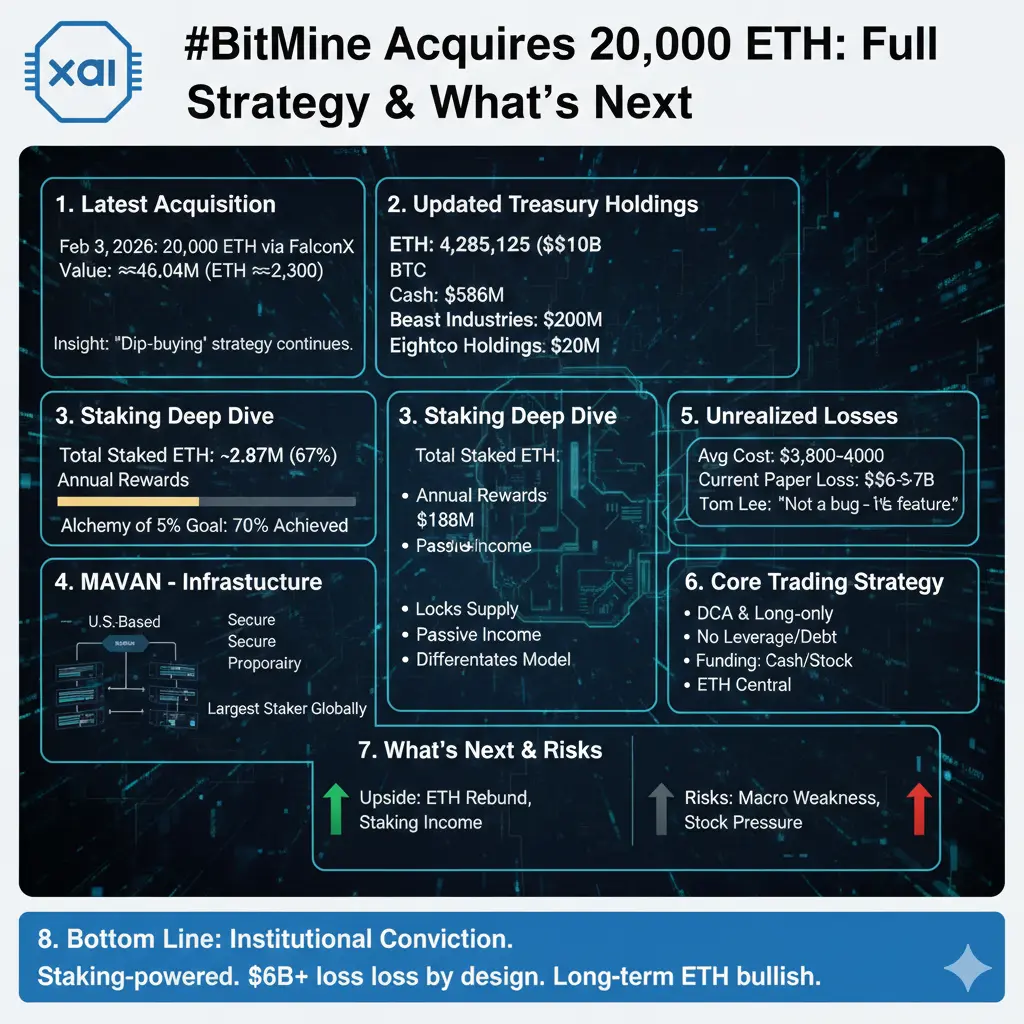

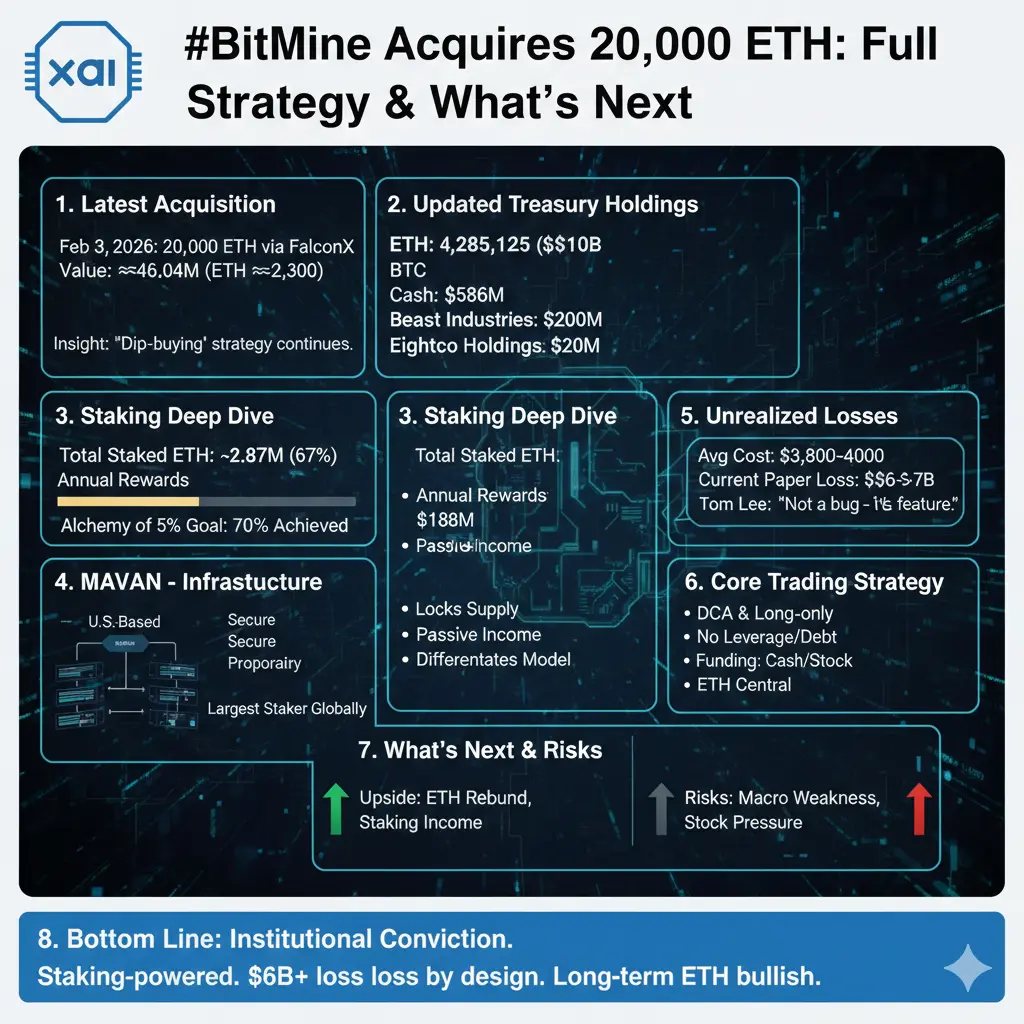

BitMine’s acquisition of 20,000 ETH marks a significant institutional move in the crypto space. Large purchases like this indicate confidence in Ethereum’s long-term potential and can influence market sentiment across both spot and derivative markets.

🔍 Key Market Considerations

• Market sentiment: Large institutional buys often trigger renewed interest from other investors

• Price impact: Significant accumulation can create short-term upward pressure while strengthening support zones

• Structural signal: Indicates confidence in ETH fundamentals, staking, and Layer-2 adoption

Dragon Fly Official view:

“Acquisitions at this scale are structural signals. They show conviction, not speculation.”

📈 Outlook for Traders

Short-term trading: Watch for price absorption at support and resistance levels

Medium-term positioning: Institutional accumulation can create smoother upward trends

Risk management: Despite strong buying, volatility can spike — manage exposure carefully

Dragon Fly Official insight:

“Follow the trend set by strong hands. Timing and risk discipline matter more than hype.”

🧭 Key Takeaway

BitMine’s ETH acquisition is a strong positive signal for market confidence. Traders should align positions with structural momentum rather than short-term fluctuations.

#BitMineAcquires20,000ETH

Dragon Fly Official Market View

BitMine’s acquisition of 20,000 ETH marks a significant institutional move in the crypto space. Large purchases like this indicate confidence in Ethereum’s long-term potential and can influence market sentiment across both spot and derivative markets.

🔍 Key Market Considerations

• Market sentiment: Large institutional buys often trigger renewed interest from other investors

• Price impact: Significant accumulation can create short-term upward pressure while strengthening support zones

• Structural signal: Indicates confidence in ETH fundamentals, staking, and Layer-2 adoption

Dragon Fly Official view:

“Acquisitions at this scale are structural signals. They show conviction, not speculation.”

📈 Outlook for Traders

Short-term trading: Watch for price absorption at support and resistance levels

Medium-term positioning: Institutional accumulation can create smoother upward trends

Risk management: Despite strong buying, volatility can spike — manage exposure carefully

Dragon Fly Official insight:

“Follow the trend set by strong hands. Timing and risk discipline matter more than hype.”

🧭 Key Takeaway

BitMine’s ETH acquisition is a strong positive signal for market confidence. Traders should align positions with structural momentum rather than short-term fluctuations.

#BitMineAcquires20,000ETH