Post content & earn content mining yield

placeholder

Crypto_Exper

📊 Institutional Bitcoin Strategy — Long‑Term Conviction or Tactical Adjustment?

In the latest market environment, data shows two very different behaviors between institutional investors and retail participants in Bitcoin (BTC):

1. Institutions Are Still Accumulating — Not Selling

Multiple on‑chain metrics and industry reports show that institutions continue to build Bitcoin exposure even as prices pull back:

Large holders and “whales” have been accumulating significant BTC amounts, reaching multi‑month highs in holdings.

Surveys indicate that about 80 % of institutions plan to buy more Bitco

In the latest market environment, data shows two very different behaviors between institutional investors and retail participants in Bitcoin (BTC):

1. Institutions Are Still Accumulating — Not Selling

Multiple on‑chain metrics and industry reports show that institutions continue to build Bitcoin exposure even as prices pull back:

Large holders and “whales” have been accumulating significant BTC amounts, reaching multi‑month highs in holdings.

Surveys indicate that about 80 % of institutions plan to buy more Bitco

BTC0,12%

- Reward

- 1

- Comment

- Repost

- Share

6 Iron Rules for Survival in the Crypto World

1. The essence of the sickle: All projects aim to drain your pockets; don't dream of being the "Chosen One."

2. Trust only the mainstream: Hold steady with BTC/ETH/SOL/BNB! The ecosystem is there, and even if you're trapped at high levels, there's a chance to recover. Don't gamble on the "next ETH."

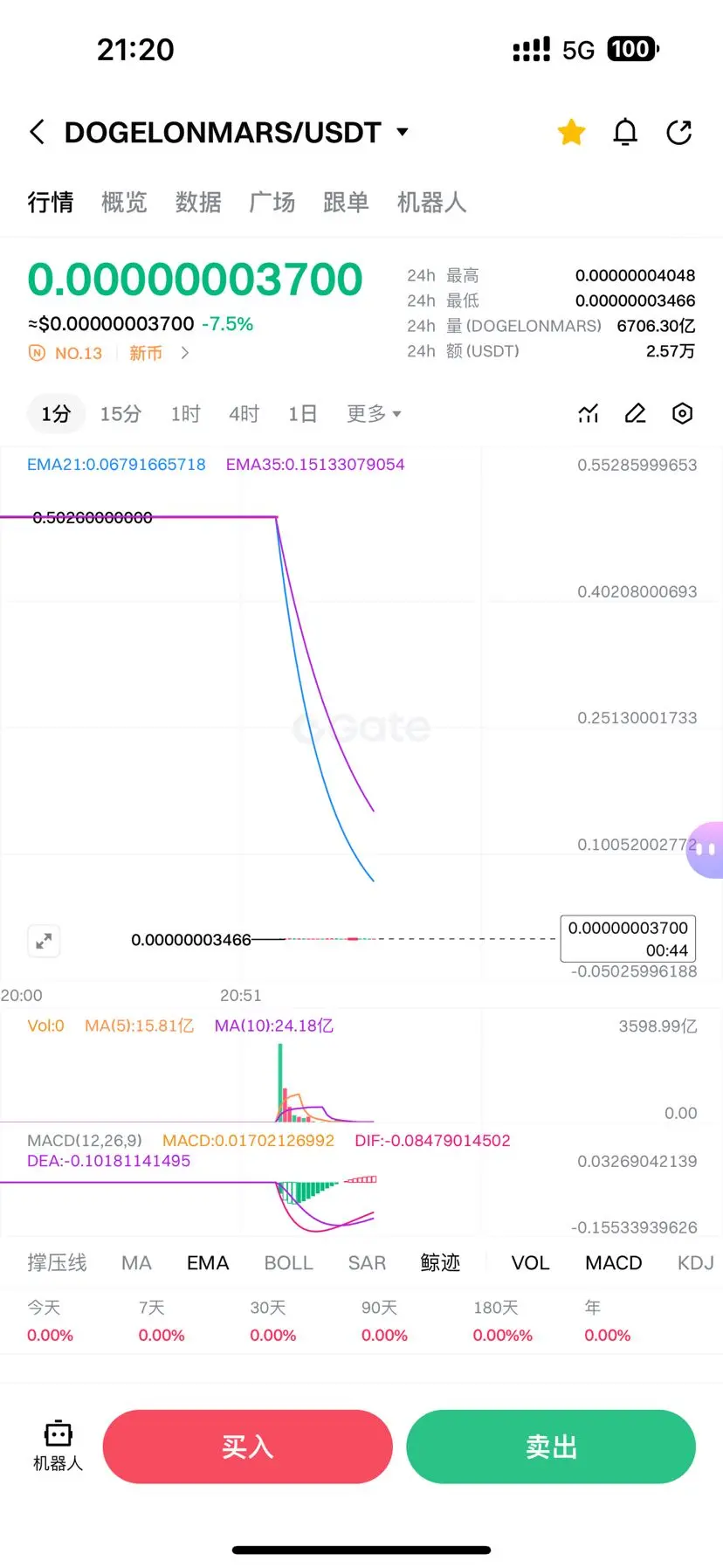

3. New coins are scams: 99% of new coins are scams packaged by Southeast Asia/Dubai operators. No ecosystem on-chain, all air; they harvest immediately upon launch.

4. Be cautious with contracts: 2x leverage can blow up; high leverage will definitely ge

View Original1. The essence of the sickle: All projects aim to drain your pockets; don't dream of being the "Chosen One."

2. Trust only the mainstream: Hold steady with BTC/ETH/SOL/BNB! The ecosystem is there, and even if you're trapped at high levels, there's a chance to recover. Don't gamble on the "next ETH."

3. New coins are scams: 99% of new coins are scams packaged by Southeast Asia/Dubai operators. No ecosystem on-chain, all air; they harvest immediately upon launch.

4. Be cautious with contracts: 2x leverage can blow up; high leverage will definitely ge

- Reward

- 1

- 3

- Repost

- Share

ChristmasEve :

:

2026 Go Go Go 👊View More

问你马

问你马

Created By@GateUser-8e1712fd

Listing Progress

0.00%

MC:

$0.1

Create My Token

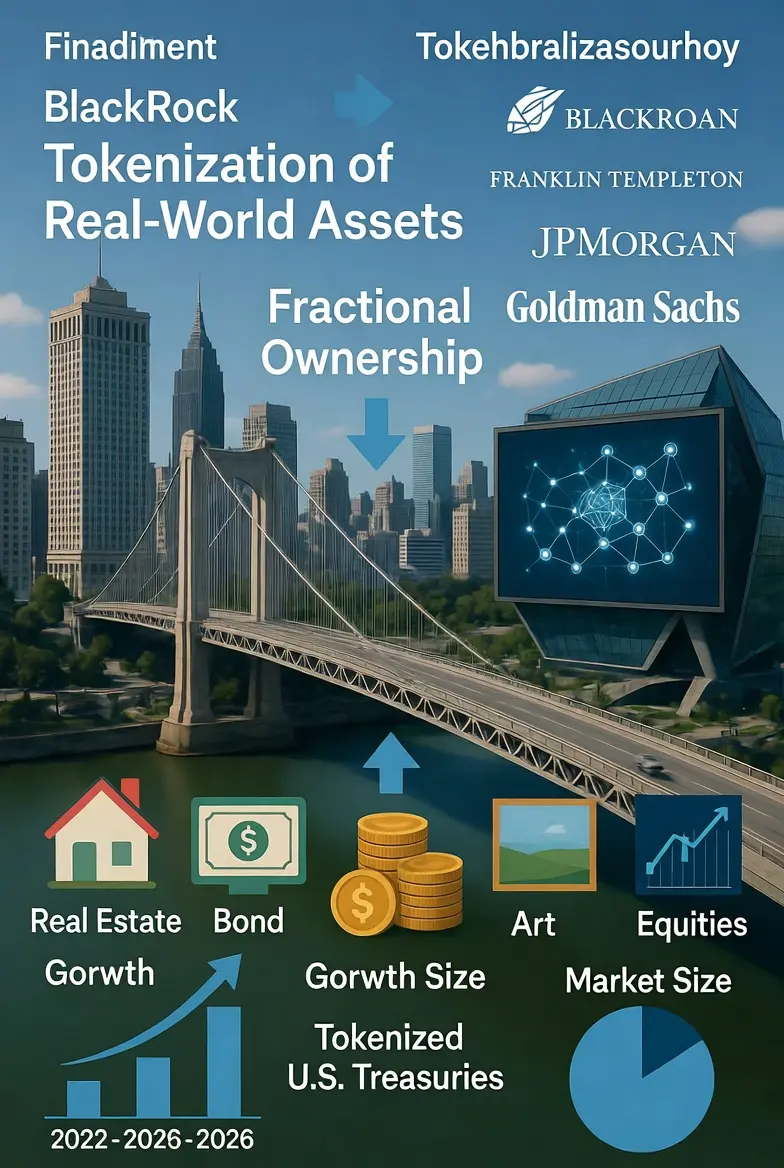

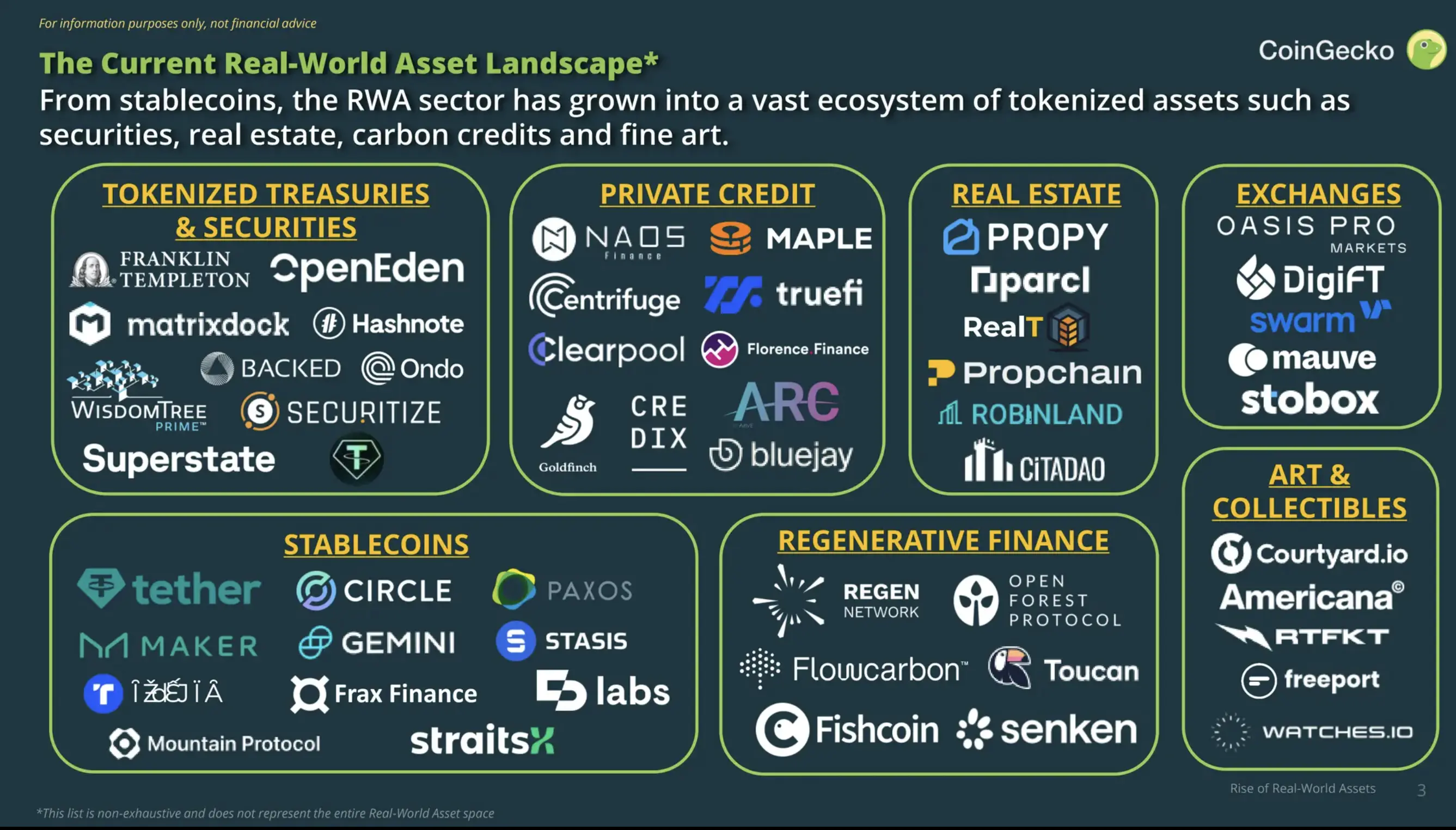

#TraditionalFinanceAcceleratesTokenization

Tokenization of real-world assets (RWAs) represents one of the most transformative trends bridging traditional finance (TradFi) and blockchain technology. It involves converting rights to physical or financial assets—such as real estate, bonds, treasuries, private credit, commodities, equities, or even art—into digital tokens on a blockchain. This process enables fractional ownership, faster settlement, enhanced transparency, and global accessibility while maintaining regulatory compliance through legal wrappers and off-chain structures.

As of early

Tokenization of real-world assets (RWAs) represents one of the most transformative trends bridging traditional finance (TradFi) and blockchain technology. It involves converting rights to physical or financial assets—such as real estate, bonds, treasuries, private credit, commodities, equities, or even art—into digital tokens on a blockchain. This process enables fractional ownership, faster settlement, enhanced transparency, and global accessibility while maintaining regulatory compliance through legal wrappers and off-chain structures.

As of early

- Reward

- 7

- 7

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

- Reward

- like

- Comment

- Repost

- Share

BTC Prediction and Market Analysis

- Reward

- 3

- 1

- Repost

- Share

MK_MEhEdI :

:

🎬A Beginner's Lesson: What Is a Single Candlestick Really Saying?- Reward

- like

- Comment

- Repost

- Share

#CapitalRotation 🌏🚀

Capital Rotation in Financial Markets: A Complete Deep-Dive Guide

Capital rotation is one of the most powerful yet often misunderstood forces driving financial markets. Whether you are trading stocks, cryptocurrencies, commodities, or global indices, understanding how and why capital rotates can give you a serious edge. Markets do not move randomly—money flows with purpose, responding to changing conditions, expectations, and risk appetite.

This extended guide explores capital rotation in depth, covering its mechanics, drivers, real-world examples, indicators, strategies,

Capital Rotation in Financial Markets: A Complete Deep-Dive Guide

Capital rotation is one of the most powerful yet often misunderstood forces driving financial markets. Whether you are trading stocks, cryptocurrencies, commodities, or global indices, understanding how and why capital rotates can give you a serious edge. Markets do not move randomly—money flows with purpose, responding to changing conditions, expectations, and risk appetite.

This extended guide explores capital rotation in depth, covering its mechanics, drivers, real-world examples, indicators, strategies,

- Reward

- 3

- 3

- Repost

- Share

HighAmbition :

:

Thanks for sharingView More

$BTCU.S. open in 2 hours!Still waiting for the pump.

- Reward

- like

- Comment

- Repost

- Share

🚀🏦 #MAJOR BANKS ARE #BULLISH ON GOLD FOR 2026! JPMorgan: $6,300-$6,900/ozUBS: $6,200/ozDeutsche Bank: $6,000/ozSocGen: $6,000/ozGoldman Sachs: $5,400/ozHSBC: $5,000/ozMorgan Stanley: $4,800/ozThey’re not betting on gold. They’re betting against the dollar.🔥#crypto

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/site-124?ref=UFRFAQ0M&ref_type=132

- Reward

- 10

- 10

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch 📉 Crypto Market Snapshot – Early February 2026

Bitcoin (BTC) is struggling below key support levels, trading near $75K–$78K after a major sell-off triggered wide liquidations across the market. The crash wiped out more than $2.5B in BTC positions and has dragged prices to multi-month lows.

Ethereum (ETH) also feels the heat, with prices dipping below $2,200–$2,100 amid market risk-off sentiment.

XRP faces heightened volatility; prediction markets expect it to remain under $2 in the near term.

Crypto stocks and related equities (e.g., Robinhood, Coinbase, MSTR) are underp

Bitcoin (BTC) is struggling below key support levels, trading near $75K–$78K after a major sell-off triggered wide liquidations across the market. The crash wiped out more than $2.5B in BTC positions and has dragged prices to multi-month lows.

Ethereum (ETH) also feels the heat, with prices dipping below $2,200–$2,100 amid market risk-off sentiment.

XRP faces heightened volatility; prediction markets expect it to remain under $2 in the near term.

Crypto stocks and related equities (e.g., Robinhood, Coinbase, MSTR) are underp

- Reward

- 1

- Comment

- Repost

- Share

MGO

MGO

Created By@GateUser-8e1712fd

Listing Progress

0.00%

MC:

$0.1

Create My Token

$ENA is currently trading inside a rising wedge on the 1H chart after a sharp sell-off and V-shaped recovery from the 0.1215 low. Price has stabilized and is now printing higher lows, showing short-term buyer presence — but the structure itself demands caution.

A rising wedge after a strong drop usually signals indeccision, not strength. Bulls are trying to push higher, but every push is getting absorbed near the upper boundary of the wedge. This tells us momentum is improving, but not decisive yet.

If buyers manage a clean breakout and hold above the wedge, we could see a continuation toward

A rising wedge after a strong drop usually signals indeccision, not strength. Bulls are trying to push higher, but every push is getting absorbed near the upper boundary of the wedge. This tells us momentum is improving, but not decisive yet.

If buyers manage a clean breakout and hold above the wedge, we could see a continuation toward

ENA-0,49%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

⚡ BULL–BEAR SHOWDOWN IMMINENT ⚡

• Bitcoin stands at a decisive battlefield

• Volatility coils… pressure building fast ⏳

• Bears confident, bulls quietly positioning

🚨 A single move can change everything

• $80,000 = the line that matters

• A clean reclaim flips market psychology

• Over $10 BILLION in short positions exposed

🔥 Forced liquidations could trigger a chain reaction

• Shorts scramble

• Momentum accelerates

• Price moves violently

This won’t be a normal rebound…

It’s a liquidity-driven breakout scenario

Markets reward patience —

And punish hesitation. 🚀#WhenWillBTCRebound? $BTC

• Bitcoin stands at a decisive battlefield

• Volatility coils… pressure building fast ⏳

• Bears confident, bulls quietly positioning

🚨 A single move can change everything

• $80,000 = the line that matters

• A clean reclaim flips market psychology

• Over $10 BILLION in short positions exposed

🔥 Forced liquidations could trigger a chain reaction

• Shorts scramble

• Momentum accelerates

• Price moves violently

This won’t be a normal rebound…

It’s a liquidity-driven breakout scenario

Markets reward patience —

And punish hesitation. 🚀#WhenWillBTCRebound? $BTC

BTC0,12%

- Reward

- 1

- Comment

- Repost

- Share

#WhenWillBTCRebound? Key Signals I’m Watching for Confirmation

Bitcoin is currently trading in a high-sensitivity zone, holding key support while repeatedly failing to reclaim major resistance. We’ve seen multiple short-term bounces, but none have shown the strength or follow-through needed to confirm a genuine trend reversal. This price behavior reflects a market that remains under pressure, with buyers still lacking conviction.

So the real question isn’t whether Bitcoin will rebound — it’s when that rebound becomes confirmed rather than speculative.

Current Market Structure

At present, BTC r

Bitcoin is currently trading in a high-sensitivity zone, holding key support while repeatedly failing to reclaim major resistance. We’ve seen multiple short-term bounces, but none have shown the strength or follow-through needed to confirm a genuine trend reversal. This price behavior reflects a market that remains under pressure, with buyers still lacking conviction.

So the real question isn’t whether Bitcoin will rebound — it’s when that rebound becomes confirmed rather than speculative.

Current Market Structure

At present, BTC r

BTC0,12%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#BTCKeyLevelBreak

Bitcoin is at one of those pivotal moments where technical structure and market psychology collide. The break of a key level is never just a number on a chart it represents a shift in conviction, liquidity, and trader behavior. Whether this break leads to a temporary shakeout or a sustained trend depends on how the market absorbs the move and where participants decide to position themselves next.

Recent sessions show that BTC has been compressing in a defined range, building tension beneath critical resistance and above major support. These levels are not arbitrary; they are

Bitcoin is at one of those pivotal moments where technical structure and market psychology collide. The break of a key level is never just a number on a chart it represents a shift in conviction, liquidity, and trader behavior. Whether this break leads to a temporary shakeout or a sustained trend depends on how the market absorbs the move and where participants decide to position themselves next.

Recent sessions show that BTC has been compressing in a defined range, building tension beneath critical resistance and above major support. These levels are not arbitrary; they are

BTC0,12%

- Reward

- 7

- 8

- Repost

- Share

HighAmbition :

:

Thanks for sharingView More

January Referral Rewards Special: Guaranteed Wins, Trending Tokens Up for Grabs https://www.gate.com/id/campaigns/3913?ref=VQUQVAXXVA&ref_type=132&utm_cmp=ApbojVO9

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

Join111 :

:

Bitcoin's attempt to stabilize as demand for put options used to hedge downside risk has eased somewhat, but the concentration of open interest at specific strike prices indicates that market tension has not fully dissipated. According to Deribit data, the highest concentration of put options shows that buyers are providing support around $75,000, making it a key support level. The token briefly dropped to $74,541 on Monday before rebounding. The next key support level is at $70,000.Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More11.68K Popularity

8.08K Popularity

5K Popularity

565 Popularity

2.9K Popularity

Hot Gate Fun

View More- MC:$2.79KHolders:10.00%

- MC:$2.79KHolders:10.00%

- MC:$2.8KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreYi Lihua: The expectation for a future bull market has not changed. Now is the best time to buy spot assets.

15 m

BitMine bought 20,000 ETH through FalconX 20 minutes ago, approximately worth $46.04 million

16 m

Spot silver surges 11.00% intraday, currently at $87.84 per ounce

34 m

Bitcoin mining company Cipher Mining plans to issue $2 billion in senior secured notes

39 m

Galaxy Digital Q4 2025 net loss of $482 million, exceeding analyst expectations

44 m

Pin