Bhutan Executes Periodic Bitcoin Sales Amid Ongoing Market Volatility

Key Takeaways

-

Bhutan sold ~$22.4M BTC last week (incl. 184 BTC ≈ $14M) — part of regular ~$50M sales, not panic.

-

Hydro-powered mining since 2019: >$765M profits, low costs, peaked pre-2024 halving.

-

Still holds reserves; pledged 10,000 BTC ($1B) as collateral for Gelephu City project.

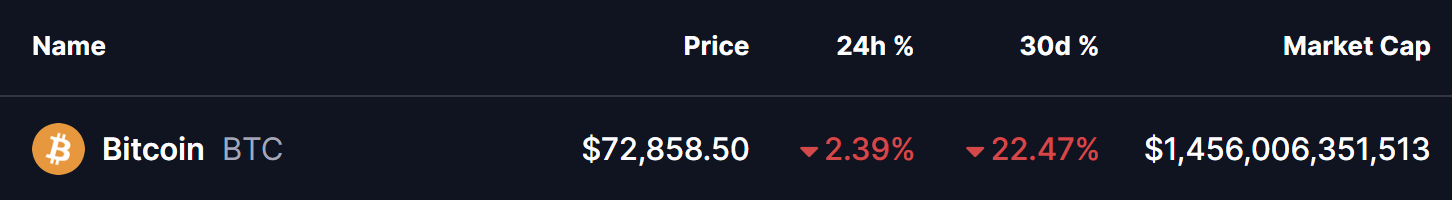

The Royal Government of Bhutan has transferred approximately $22.4 million worth of Bitcoin from its sovereign wallets over the past week, according to on-chain analytics. This follows the kingdom’s established pattern of strategic, incremental Bitcoin disposals, occurring as Bitcoin trades around $72,858—down 2.39% in the last 24 hours and 22.47% over the past 30 days.

Source: Coinmarketcap

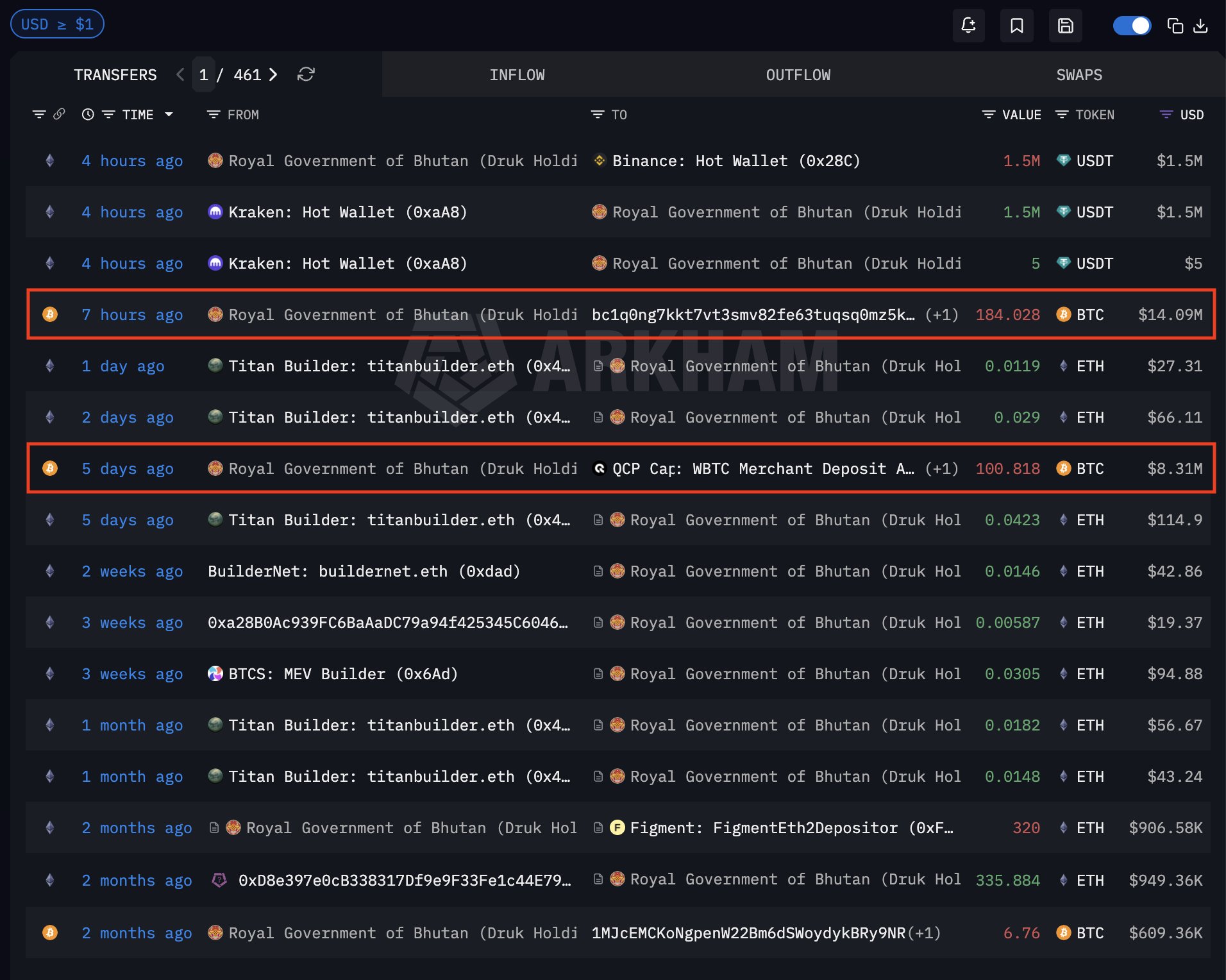

This latest activity includes a transfer of 184 BTC, valued at roughly $14 million. One transfer, executed approximately five days ago, was directed to addresses associated with institutional market maker QCP Capital. Analytics indicate that Bhutan typically executes sales in tranches of roughly $50 million, with periods of heightened activity observed in prior months, including mid-to-late September 2025.

Source: Arkham (X)

Sovereign Mining and Disciplined Treasury Management

Bhutan’s Bitcoin program began in 2019, utilizing the nation’s abundant hydroelectric resources to power efficient mining operations. This strategy has produced substantial long-term value, with low operational costs supported by renewable energy infrastructure. Peak production occurred in 2023, contributing to holdings that once exceeded 13,000 BTC and positioned Bhutan among the leading government custodians worldwide.

The recent transfers reflect a measured approach to treasury management. Proceeds from such sales have historically supported national development objectives, including infrastructure projects and public sector priorities, while allowing the government to maintain a core reserve of digital assets.

Integrating Bitcoin into Long-Term Economic Strategy

Bhutan continues to demonstrate a forward-looking integration of cryptocurrency into sovereign finance. In late 2025, the government committed up to 10,000 BTC—valued at approximately $1 billion at the time—as collateral to support the development of Gelephu Mindfulness City, a sustainable economic zone focused on innovation and long-term growth. This initiative emphasizes mechanisms such as collateralized financing and yield generation to advance infrastructure goals without depleting principal holdings.

Current holdings remain meaningful, with ongoing mining activities through established partnerships. These periodic transfers align with broader market conditions but appear consistent with proactive portfolio adjustments rather than reactive liquidation.

As institutions and governments worldwide assess digital asset strategies, Bhutan’s model highlights the potential for resource-endowed nations to leverage clean-energy mining for economic diversification and resilience. Market observers are encouraged to track relevant on-chain addresses for continued activity, though patterns suggest these movements form part of a deliberate, non-panic-driven framework.

Cryptocurrency assets carry significant volatility and risk; independent research and professional advice are recommended prior to any investment decisions.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

Harvard Sells 21% of Bitcoin, Makes $86.8M Ethereum Bet

Top Crypto to Buy Now: BlockDAG, Stellar, Bitcoin Cash, and Chainlink Offer 300x Potential

Data: Over the past 24 hours, the entire network has been liquidated for $296 million, mainly long positions.

BTC short-term decline of -1.17%: Panic spreading and long-term holders selling dominate downward pressure

2026 Shaping Up to Be Unprecedentedly Bearish for BTC - U.Today